Form S-3 - Registration statement under Securities Act of 1933

18 October 2024 - 7:37AM

Edgar (US Regulatory)

As filed with the U.S. Securities and Exchange Commission on October 17, 2024

Registration No. 333-

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM S-3

REGISTRATION STATEMENT

UNDER

THE SECURITIES ACT OF 1933

BIO-PATH HOLDINGS, INC.

(Exact name of Registrant as specified in its charter)

| |

Delaware

|

|

|

87-0652870

|

|

| |

(State or other jurisdiction of

incorporation or organization)

|

|

|

(I.R.S. Employer

Identification Number)

|

|

4710 Bellaire Boulevard, Suite 210

Bellaire, Texas 77401

(832) 742-1357

(Address, including zip code, and telephone number, including area code, of registrant’s principal executive offices)

Peter H. Nielsen

President and Chief Executive Officer

4710 Bellaire Boulevard, Suite 210

Bellaire, Texas 77401

(832) 742-1357

(Name, address, including zip code, and telephone number, including area code, of agent for service)

Copies to:

William R. Rohrlich, II

Winstead PC

600 Travis Street

Suite 5200

Houston, Texas 77002

Tel. (281) 681-5912

Fax (281) 681-5901

Approximate date of commencement of proposed sale to the public: From time to time, after the effective date of this registration statement.

If the only securities being registered on this Form are being offered pursuant to dividend or interest reinvestment plans, please check the following box. ☐

If any of the securities being registered on this Form are to be offered on a delayed or continuous basis pursuant to Rule 415 under the Securities Act of 1933, other than securities offered only in connection with dividend or interest reinvestment plans, check the following box. ☒

If this Form is filed to register additional securities for an offering pursuant to Rule 462(b) under the Securities Act, please check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ☐

If this Form is a post-effective amendment filed pursuant to Rule 462(c) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ☐

If this Form is a registration statement pursuant to General Instruction I.D. or a post-effective amendment thereto that shall become effective upon filing with the Commission pursuant to Rule 462(e) under the Securities Act, check the following box. ☐

If this Form is a post-effective amendment to a registration statement filed pursuant to General Instruction I.D. filed to register additional securities or additional classes of securities pursuant to Rule 413(b) under the Securities Act, check the following box. ☐

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting company or an emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer,” “smaller reporting company,” and “emerging growth company” in Rule 12b-2 of the Exchange Act.

| |

Large accelerated filer

☐

|

|

|

Accelerated filer

☐

|

|

| |

Non-accelerated filer

☒

|

|

|

Smaller reporting company

☒

|

|

| |

Emerging growth company

☐

|

|

|

|

|

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 7(a)(2)(B) of Securities Act. ☐

The Registrant hereby amends this Registration Statement on such date or dates as may be necessary to delay its effective date until the Registrant shall file a further amendment that specifically states that this Registration Statement shall thereafter become effective in accordance with Section 8(a) of the Securities Act or until this Registration Statement shall become effective on such date as the Commission, acting pursuant to said Section 8(a), may determine.

The information in this prospectus is not complete and may be changed. The selling stockholders listed herein may not sell these securities until the registration statement filed with the U.S. Securities and Exchange Commission becomes effective. This prospectus is not an offer to sell the securities and it is not soliciting an offer to buy the securities in any state where offers or sales are not permitted.

PRELIMINARY PROSPECTUS

Subject to completion, dated October 17, 2024

17,757,844 Shares of Common Stock

The selling stockholders named in this prospectus may use this prospectus to offer and resell from time to time up to 17,757,844 shares of our common stock, par value $0.001 per share, which are comprised of (i) 4,597,702 shares (the “Pre-Funded Warrant Shares”) of our common stock issuable upon the exercise of pre-funded warrants (the “Pre-Funded Warrants”) to purchase up to 4,597,702 shares of our common stock at an exercise price of $0.001 per share issued in a private placement on October 8, 2024 (the “Private Placement”), pursuant to that certain Securities Purchase Agreement by and among us and an investor, dated as of October 8, 2024 (the “Securities Purchase Agreement”), (ii) 6,407,657 shares (the “Series A Warrant Shares”) of our common stock issuable upon exercise of series A warrants (the “Series A Warrants”) to purchase up to 6,407,657 shares of our common stock at an exercise price of $1.00 per share issued in the Private Placement, (iii) 6,407,657 (the “Series B Warrant Shares” and collectively with the Pre-Funded Warrant Shares and the Series A Warrant Shares, the “Warrant Shares”) of our common stock issuable upon exercise of series B warrants (the “Series B Warrants” and together with the Series A Warrants, the “Common Stock Warrants” and the Common Stock Warrants together with the Pre-Funded Warrants, the “Warrants”) to purchase up to 6,407,657 shares of our common stock at an exercise price of $1.00 per share issued in the Private Placement and (iv) 344,828 shares (the “Placement Agent Warrant Shares”) of our common stock issuable upon the exercise of placement agent warrants (the “Placement Agent Warrants”) to purchase up to 344,828 shares of our common stock at an exercise price of $1.0875 per share issued in connection with the Private Placement.

The Warrants and the Warrant Shares were or will be issued to the investors in reliance upon the exemption from the registration requirements in Section 4(a)(2) of the Securities Act of 1933, as amended (the “Securities Act”), and Rule 506 of Regulation D promulgated thereunder. The Placement Agent Warrants and the Placement Agent Warrant Shares were or will be issued to the placement agent in reliance upon the exemption from the registration requirements in Section 4(a)(2) of the Securities Act. We are registering the offer and resale of the Warrant Shares to satisfy the provisions of that certain registration rights agreement, dated October 8, 2024 (the “Registration Rights Agreement”), pursuant to which we agreed to register the resale of the Warrant Shares.

We are not selling any common stock under this prospectus and will not receive any of the proceeds from the sale of shares by the selling stockholders. We will, however, receive the net proceeds of any Warrants or Placement Agent Warrants exercised for cash.

The selling stockholders identified in this prospectus may offer the shares of common stock from time to time through public or private transactions at fixed prices, at prevailing market prices at the time of sale, at prices related to the prevailing market price, at varying prices determined at the time of sale, or at negotiated prices. The registration of the shares of common stock on behalf of the selling stockholders, however, does not necessarily mean that any of the selling stockholders will offer or sell their shares under this registration statement or at any time in the near future. We provide more information about how the selling stockholders may sell their shares of common stock in the section entitled “Plan of Distribution” on page 18.

The selling stockholders will bear all commissions and discounts, if any, attributable to the sale or disposition of the shares of common stock, or interests therein and all costs, expenses and fees in connection with the registration of the shares. We will not be paying any underwriting discounts or commissions in this offering or costs, expenses, and fees in connection with the registration of the shares of common stock described in this prospectus. We will pay the expenses of registering the shares.

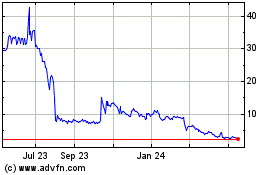

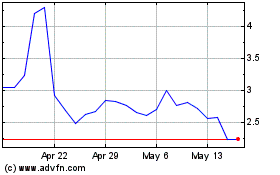

Our common stock is traded on The Nasdaq Capital Market under the symbol “BPTH.” On October 14, 2024, the last reported sale price of our common stock was $1.13 per share.

We may amend or supplement this prospectus from time to time by filing amendments or supplements as required. You should read the entire prospectus and any amendments or supplements carefully before you make your investment decision.

An investment in our common stock involves a high degree of risk. See “Risk Factors” on page 8 of this prospectus for more information on these risks.

Neither the U.S. Securities and Exchange Commission nor any state securities commission has approved or disapproved of these securities, or passed upon the adequacy or accuracy of this prospectus. Any representation to the contrary is a criminal offense.

The date of this prospectus is , 2024

TABLE OF CONTENTS

| |

|

|

Page

|

|

|

|

|

|

|

|

1 |

|

|

|

|

|

|

|

|

2 |

|

|

|

|

|

|

|

|

7 |

|

|

|

|

|

|

|

|

8 |

|

|

|

|

|

|

|

|

9 |

|

|

|

|

|

|

|

|

11 |

|

|

|

|

|

|

|

|

12 |

|

|

|

|

|

|

|

|

13 |

|

|

|

|

|

|

|

|

15 |

|

|

|

|

|

|

|

|

18 |

|

|

|

|

|

|

|

|

20 |

|

|

|

|

|

|

|

|

20 |

|

|

|

|

|

|

|

|

20 |

|

|

|

|

|

|

|

|

20

|

|

|

ABOUT THIS PROSPECTUS

This prospectus relates to the resale from time to time of up to 17,757,844 shares of our common stock, par value $0.001 per share, which consists of (i) 4,597,702 shares (the “Pre-Funded Warrant Shares”) of our common stock issuable upon the exercise of pre-funded warrants (the “Pre-Funded Warrants”) to purchase up to 4,597,702 shares of our common stock at an exercise price of $0.001 per share issued in a private placement on October 8, 2024 (the “Private Placement”), pursuant to that certain Securities Purchase Agreement by and among us and an investor, dated as of October 8, 2024 (the “Securities Purchase Agreement”), (ii) 6,407,657 shares (the “Series A Warrant Shares”) of our common stock issuable upon exercise of series A warrants (the “Series A Warrants”) to purchase up to 6,407,657 shares of our common stock at an exercise price of $1.00 per share issued in the Private Placement, (iii) 6,407,657 (the “Series B Warrant Shares” and together with the Series A Warrant Shares, the “Common Stock Warrant Shares” and the Common Stock Warrant Shares together with the Pre-Funded Warrant Shares, the “Warrant Shares”) of our common stock issuable upon exercise of series B warrants (the “Series B Warrants” and together with the Series A Warrants, the “Common Stock Warrants” and the Common Stock Warrants together with the Pre-Funded Warrants, the “Warrants”) to purchase up to 6,407,657 shares of our common stock at an exercise price of $1.00 per share issued in the Private Placement and (iv) 344,828 shares (the “Placement Agent Warrant Shares”) of our common stock issuable upon the exercise of placement agent warrants (the “Placement Agent Warrants”) to purchase up to 344,828 shares of our common stock at an exercise price of $1.0875 per share issued in connection with the Private Placement. Before buying any of the common stock that the selling stockholders are offering, we urge you to carefully read this prospectus, together with the information incorporated by reference as described under the headings “Where You Can Find More Information” and “Information Incorporated By Reference” in this prospectus. These documents contain important information that you should consider when making your investment decision.

You should rely only on the information we have provided or incorporated by reference in this prospectus. Neither we nor the selling stockholders have authorized anyone to provide you with different information. No dealer, salesperson or other person is authorized to give any information or to represent anything not contained in this prospectus. You must not rely on any unauthorized information or representation. You should assume that the information in this prospectus is accurate only as of the dates on the front of this document and that any information we have incorporated by reference is accurate only as of the date of the document incorporated by reference. Our business, financial condition, results of operations and prospects may have changed since those dates.

You should read this prospectus and the documents incorporated by reference in this prospectus when making your investment decision.

Unless the context requires otherwise, references in this prospectus to “we,” “our,” “us,” “the Company” and “Bio-Path” refer to Bio-Path Holdings, Inc. and its wholly-owned subsidiary. Bio-Path Holdings, Inc.’s wholly-owned subsidiary, Bio-Path, Inc., is sometimes referred to herein as “Bio-Path Subsidiary.”

PROSPECTUS SUMMARY

The following summary highlights some information from this prospectus. It is not complete and does not contain all of the information that you should consider before making an investment decision. You should read this entire prospectus, including the “Risk Factors” section on page 8, the financial statements and related notes and the other more detailed information appearing elsewhere or incorporated by reference into this prospectus and any applicable prospectus supplement.

Overview

We are a clinical and preclinical stage oncology-focused RNAi nanoparticle drug development company utilizing a novel technology that achieves systemic delivery for target-specific protein inhibition for any gene product that is over-expressed in disease. Our drug delivery and antisense technology, called DNAbilize®, is a platform that uses P-ethoxy, which is a deoxyribonucleic acid (DNA) backbone modification that is intended to protect the DNA from destruction by the body’s enzymes when circulating in vivo, incorporated inside of a lipid bilayer having neutral charge. We believe this combination allows for high efficiency loading of antisense DNA into non-toxic, cell-membrane-like structures for delivery of the antisense drug substance into cells. In vivo, the DNAbilize® delivered antisense drug substances are systemically distributed throughout the body to allow for reduction or elimination of target proteins in blood diseases and solid tumors. Through testing in numerous animal studies and dosing in clinical trials, our DNAbilize® drug candidates have demonstrated an excellent safety profile. DNAbilize® is a registered trademark of the Company.

Using DNAbilize® as a platform for drug development and manufacturing, we currently have four drug candidates in development to treat at least five different cancer disease indications. Our lead drug candidate, prexigebersen (pronounced prex” i je ber’ sen), which targets growth factor receptor-bound protein 2 (“Grb2”), initially started the efficacy portion of a Phase 2 clinical trial for untreated acute myeloid leukemia (“AML”) patients in combination with low-dose cytarabine (“LDAC”). The interim data presented in the 2018 American Society of Hematology (“ASH”) Annual Meeting showed that 11 (65%) of the 17 evaluable patients had a response, including five (29%) who achieved complete remission (“CR”), inclusive of one CR with incomplete hematologic recovery (“CRi”) and one morphologic leukemia-free state, and six (35%) stable disease responses, including two patients who had greater than a 50% reduction in bone marrow blasts. However, DNA hypomethylating agents are now the most frequently used agents in the treatment of elderly AML patients in the U.S. and Europe. As a result, Stage 2 of the Phase 2 trial in AML was amended to remove the combination treatment of prexigebersen and LDAC and replace it with the combination treatment of prexigebersen and decitabine, a DNA hypomethylating agent, for treatment of a second cohort of untreated AML patients. Since decitabine is also used as a treatment for relapsed/refractory AML patients, a cohort of relapsed/refractory AML patients was also added to the study.

The U.S. Food and Drug Administration (“FDA”) granted approval of venetoclax in combination with LDAC, decitabine or azacytidine (the latter two drugs are DNA hypomethylating agents) as frontline therapy for newly diagnosed AML in adults who are 75 years or older, or who have comorbidities precluding intensive induction chemotherapy. We believe this approval of the frontline venetoclax and decitabine combination therapy provides an opportunity for combining prexigebersen with the combination therapy for the treatment of newly diagnosed AML patients. Preclinical efficacy studies for the triple combination treatment of prexigebersen, decitabine and venetoclax in AML have been successfully completed. In the preclinical efficacy studies, four AML cancer cell lines were treated with three different combinations of decitabine, venetoclax and prexigebersen. Decrease in AML cell viability was the primary measure of efficacy. The triple combination of decitabine, venetoclax and prexigebersen showed significant improvement in efficacy in three of the four AML cell lines. Based on these results, we believe that adding prexigebersen to the treatment combination of decitabine and venetoclax could lead to improved efficacy in AML patients. Accordingly, we further amended Stage 2 of this Phase 2 clinical trial to add the triple combination treatment comprised of prexigebersen, decitabine and venetoclax.

Our approved amended Stage 2 for this Phase 2 clinical trial currently has three cohorts of patients. The first two cohorts will treat patients with the triple combination of prexigebersen, decitabine and venetoclax. The first cohort will include newly diagnosed AML patients, and the second cohort will include relapsed/refractory AML patients. Finally, the third cohort will treat relapsed/refractory AML patients,

who are venetoclax-resistant or -intolerant, with the two-drug combination of prexigebersen and decitabine. The full trial design plans have approximately 98 evaluable patients for the first cohort having newly diagnosed AML patients with a preliminary review performed after 19 evaluable patients and a formal interim analysis after 38 evaluable patients. The full trial design plans have approximately 54 evaluable patients for each of the second cohort, having relapsed/refractory AML patients, and the third cohort, having AML patients who are venetoclax-resistant or -intolerant, in each case with a review performed after 19 evaluable patients. The study is anticipated to be conducted at up to ten clinical sites in the U.S., and Gail J. Roboz, MD, is the national coordinating Principal Investigator for the Phase 2 trial. Dr. Roboz is a professor of medicine and director of the Clinical and Translational Leukemia Program at the Weill Medical College of Cornell University (the “Weill Medical College”) and the New York-Presbyterian Hospital in New York City. On August 13, 2020, we announced the enrollment and dosing of the first patient in this approved amended Stage 2 of the Phase 2 clinical trial.

The safety run-in of Stage 2 of the Phase 2 clinical study was successfully completed, and the preliminary data was presented at the 2021 ASH Annual Meeting. In the safety run-in of the triple combination, six evaluable patients were treated with the combination of prexigebersen, decitabine and venetoclax. These patients included four relapsed/refractory AML patients, and two newly diagnosed AML patients. Five patients (83%) responded to treatment, including four (67%) achieving CR/CRi/MLFS and one (17%) achieving partial remission (“PR”). Recent publications provide that response (CR + CRi) rates to combination treatment with decitabine and venetoclax (but without prexigebersen) are 12 to 52% for relapsed/refractory AML patients, depending on the length of treatment (12% for patients treated with venetoclax in combination with decitabine for five days and 42% to 52% for patients treated with venetoclax in combination with decitabine for 10 days), and 0 to 39% for relapsed/refractory secondary AML patients. Response rates to frontline treatment with decitabine and venetoclax (but without prexigebersen) are 54 to 74% for newly diagnosed AML patients. These preliminary data showed the treatment was well-tolerated and there were no dose limiting toxicities attributed to prexigebersen. Three patients remained on treatment for more than one cycle.

On August 1, 2023, we announced interim data for the first two cohorts of the amended Stage 2 of the Phase 2 clinical trial. Fourteen newly diagnosed patients were evaluable in the first cohort and treated with at least one cycle of the prexigebersen, decitabine and venetoclax combination therapy. All patients in the first cohort (median age 75) were adverse risk by 2017 European LeukemiaNet (“ELN”) guidelines (n=10) or secondary AML (n=4). Prexigebersen was well-tolerated, and adverse events (“AEs”) were generally consistent with decitabine and venetoclax treatment and/or for AML. Twelve of the 14 evaluable patients (86%) achieved CR/CRi and two (14%) achieved PR. In total, 100% of the evaluable patients had a response to treatment. The CR/CRi rate of 86% for the evaluable patients in the first cohort is significantly higher than the range of CR/CRi rates of 54 to 74% for newly diagnosed patients treated with the frontline combination treatment of decitabine and venetoclax from the publications described above. Fourteen refractory/relapsed evaluable AML patients in the second cohort were treated with at least one cycle of the prexigebersen, decitabine and venetoclax combination therapy. Substantially all of the patients in the second cohort (median age 56.5) were adverse risk by 2017 ELN guidelines (n=11) or secondary AML (n=2). Prexigebersen was well-tolerated, and AEs were generally consistent with decitabine and venetoclax treatment and/or for AML. Eight of the 14 evaluable refractory/relapsed patients (57%) achieved CR/CRi, two (14%) achieved PR and two (22%) achieved stable disease. In total, 93% of the evaluable patients in the second cohort had a response to treatment. The CR/CRi rate of 57% for the evaluable refractory and relapsed patients in the second cohort is significantly higher than the range of CR/CRi rates of 12 to 52% for refractory/relapsed patients treated with the combination treatment of decitabine and venetoclax from the publications described above.

On June 3, 2024, we announced additional interim data for the first two cohorts of the amended Stage 2 of the Phase 2 clinical trial. In Cohort 1, 31 newly diagnosed patients were enrolled; 20 evaluable patients with a median age of 75 years, treated with at least one cycle of prexigebersen, decitabine and venetoclax, had adverse-risk or secondary AML evolved from myelodysplastic syndromes, chronic myelomonocytic leukemia or treatment-related AML. Fifteen patients (75%) achieved complete remission, CR with partial recovery of peripheral blood counts (“CRh”), or CRi. Two patients achieved PR and two patients achieved stable disease. In Cohort 2, 38 relapsed/refractory patients were enrolled; 23 evaluable patients with a median age of 63 years, treated with at least one cycle of prexigebersen, decitabine and venetoclax, had adverse-risk or secondary AML. Twelve patients (55%) achieved CR/CRi/CRh, one patient

achieved PR, eight patients achieved stable disease and one patient had treatment failure. Among the evaluable patients of both cohorts, adverse events were consistent with those expected with decitabine and venetoclax and/or AML, including fatigue (72%), anemia (60%) and neutropenia (49%), while the most frequent severe adverse events were febrile neutropenia (26%) and sepsis (5%). The interim analysis data was selected as an oral presentation in the 2024 American Society of Clinical Oncology (“ASCO”) Annual Meeting and as a poster presentation in the 2024 European Hematology Association (“EHA”) Annual Meeting. Based on this interim data, we expect to continue enrollment of up to 98 and 54 evaluable patients for Cohorts 1 and 2, respectively and plan to pursue FDA expedited programs for Fast Track designation. We are evaluating whether to seek to expand Stage 2 of the Phase 2 clinical trial in Europe.

On July 8, 2024, we announced that the study is currently paused for an interim analysis, amendment preparation and FDA review. We expect to complete enrollment in cohorts 1 and 2 in 2026.

Our second drug candidate, Liposomal Bcl-2 (“BP1002”), targets the protein Bcl-2, which is responsible for driving cell survival in up to 60% of all cancers. A Phase 1 clinical trial to evaluate the ability of BP1002 to treat refractory/relapsed lymphoma and refractory/relapsed chronic lymphocytic leukemia (“CLL”) patients has been initiated. The Phase 1 clinical trial is being conducted at the Georgia Cancer Center, The University of Texas Southwestern and New York Medical College. On January 10, 2024, we announced the successful completion of the first dose cohort in the Phase 1 clinical trial. A total of six evaluable patients are scheduled to be treated over two dose levels with BP1002 monotherapy in a standard 3+3 design, unless there is a dose limiting toxicity which would require an additional three patients to be tested. There were no dose limiting toxicities in the first dose cohort (20 mg/m2). Enrollment has continued for patients in the second BP1002 dose cohort of 40 mg/m2 and we expect to complete enrollment and to review this data by year-end

Additionally, preclinical studies suggest that the combination of BP1002 with decitabine is efficacious in venetoclax-resistant leukemia and lymphoma cells. An abstract of the preclinical study was presented at the 2021 American Association for Cancer Research (“AACR”) Annual Meeting. A Phase 1/1b clinical trial to investigate the ability of BP1002 to treat refractory/relapsed AML patients, including venetoclax-resistant patients, is being studied. A recent study found that AML patients who had relapsed from frontline venetoclax-based treatment had a very poor prognosis, with a median survival of less than three months. Since venetoclax and BP1002 utilize different mechanisms of action, we believe that BP1002 may be a potential treatment for venetoclax-relapsed AML patients. The Phase 1/1b clinical trial is being conducted at several leading cancer centers in the United States, including the Weill Medical College, The University of Texas MD Anderson Cancer Center (“MD Anderson”), Scripps Health and The University of California at Los Angeles Cancer Center. On December 14, 2023, we announced the successful completion of the first dose cohort of the dose escalation portion of the Phase 1/1b clinical trial of BP1002; and on April 18, 2024, we announced the successful completion of the second dose cohort. On October 7, 2024, we announced that the FDA had completed its review of PK/PD data from the first two dosing cohorts and that the enrollment for the third dosing cohort (60 mg/m2) is now complete. We expect to advance to the next planned higher dose of 90 mg/m2 in the fourth quarter of 2024. The approved treatment cycle is two doses per week over four weeks, resulting in eight doses administered over twenty-eight days. The Phase 1b portion of the study is expected to commence after completion of BP1002 monotherapy cohorts and will assess the safety and efficacy of BP1002 in combination with decitabine in refractory/relapsed AML patients.

Our third drug candidate, Liposomal STAT3 (“BP1003”), targets the STAT3 protein and is currently in IND enabling studies as a potential treatment of pancreatic cancer, non-small cell lung cancer (“NSCLC”) and AML. Preclinical models have shown BP1003 to inhibit cell viability and STAT3 protein expression in NSCLC and AML cell lines. Further, BP1003 successfully penetrated pancreatic tumors ex vivo and significantly enhanced the efficacy of gemcitabine, a treatment for patients with advanced pancreatic cancer, in a pancreatic cancer patient derived tumor model. An abstract of the preclinical study was presented at the 2019 AACR Annual Meeting. Our lead indication for BP1003 is pancreatic cancer due to the severity of this disease and the lack of effective, life-extending treatments. For example, pancreatic adenocarcinoma is projected to be the second most lethal cancer behind lung cancer by 2030. Typical survival for a metastatic pancreatic cancer patient is about three to six months from diagnosis. Additionally, an abstract of the preclinical study demonstrating that BP1003 enhanced the sensitivity of breast and ovarian cancer cells to chemotherapy was presented at the 2022 AACR Annual Meeting. On September 16, 2024, we announced a

publication in the peer-reviewed journal, Biomedicines, which highlights the therapeutic potential and broad anti-tumor effect of BP1003 in numerous preclinical solid tumor models, including breast, ovarian, and pancreatic cancer. We have successfully completed several IND enabling studies of BP1003 and have one additional IND enabling study to complete. Once the additional study is successfully completed, our goal is to file an IND application and initiate the first-in-humans Phase 1 study of BP1003 in patients with refractory, metastatic solid tumors, including pancreatic cancer and NSCLC.

In addition, a modified product named BP1001-A, our fourth drug candidate, has shown to enhance chemotherapy efficacy in preclinical solid tumor models. Results of the preclinical study were published in the scientific journal Oncotarget in July 2020. BP1001-A incorporates the same drug substance as prexigebersen but has a slightly modified formulation designed to enhance nanoparticle properties. A BP1001-A Phase 1/1b clinical trial in patients with advanced or recurrent solid tumors has been initiated. The Phase 1/1b clinical trial is being conducted at several leading cancer centers in the United States, including MD Anderson, Karmanos Cancer Institute, Mary Crowley Cancer Research and Holy Cross Hospital, Maryland. On July 17, 2023, we announced completion of the first cohort of the dose escalation portion of the Phase 1/1b clinical trial. A total of nine evaluable patients are scheduled to be treated with BP1001-A monotherapy over three dose levels in a standard 3+3 dose escalation design. The first dose cohort consisted of a starting dose of 60 mg/m2, and there were no dose limiting toxicities. Enrollment is now open for patients for the second dose cohort of 90 mg/m2 which we expect to be complete by the end of 2024 in order to advance to dose level 3. The Phase 1b portion of the study is expected to commence after successful completion of BP1001-A monotherapy cohorts and is intended to assess the safety and efficacy of BP1001-A in combination with paclitaxel in patients with recurrent ovarian or endometrial tumors. Phase 1b studies are also expected to be opened in combination with gemcitabine in Stage 4 pancreatic cancer and combination therapy in breast cancer.

Grb2 is involved in activating the RAS/ERK pathway for cell growth. By blocking the cell’s ability to produce Grb2, BP1001-A treatment may limit cell growth. In obesity, two such growth pathways are related to leptin and insulin. Activation of leptin or insulin receptors can stimulate the RAS/ERK pathway via Grb2. We believe development of BP1001-A for the treatment for obesity and obesity-related cancers could be accelerated given the large amount of safety data from BP1001-A treatment of patients with solid tumors and the continued unmet medical need. The Company is preparing for preclinical development evaluating BP1001-A for the treatment of obesity and will continue thereafter to conduct additional IND-enabling studies with an aim to advance BP1001-A into first-in-human studies in this indication.

Our DNAbilize® technology-based products are available for out-licensing or partnering. We intend to apply our drug technology template to new disease-causing protein targets to develop new liposomal antisense drug candidates for inclusion in our pipeline that meet scientific, preclinical and commercial criteria and file new patents on these targets. We expect that these efforts will include collaboration with key scientific opinion leaders in the field of study and include developing drug candidates for diseases other than cancer. As we expand our drug development programs, we will look at indications where a systemic delivery is needed and antisense RNAi nanoparticles can be used to slow, reverse or cure a disease, either alone or in combination with another drug.

We are developing a molecular biomarker package to accompany prexigebersen treatment, the goal of which is to identify patients with a genetic profile more likely to respond to treatment thereby improving probability of success for this program. The emerging role of biomarkers has been enhancing cancer development over the past decade and has become a more common companion to many cancer development programs. We expect to develop molecular biomarker packages to accompany our new programs.

We have certain intellectual property as the basis for our current drug products in clinical development, prexigebersen, BP1002, BP1003 and BP1001-A. We are developing RNAi antisense nanoparticle drug candidates based on our own patented technology to treat cancer and autoimmune disorders where targeting a single protein may be advantageous and result in reduced patient adverse effects as compared to small molecule inhibitors with off-target and non-specific effects. We have composition of matter and method of use intellectual property for the design and manufacture of antisense RNAi nanoparticle drug products.

Corporate Information

The Company was incorporated in May 2000 as a Utah corporation. In February 2008, Bio-Path Subsidiary completed a reverse merger with the Company, which at the time was traded over the counter and had no current operations. The prior name of the Company was changed to Bio-Path Holdings, Inc. and the directors and officers of Bio-Path Subsidiary became the directors and officers of Bio-Path Holdings, Inc. On March 10, 2014, our common stock ceased trading on the OTCQX and commenced trading on the Nasdaq Capital Market under the ticker symbol “BPTH.” Effective December 31, 2014, we changed our state of incorporation from Utah to Delaware through a statutory conversion pursuant to the Utah Revised Business Corporation Act and the Delaware General Corporation Law. Our principal executive offices are located at 4710 Bellaire Boulevard, Suite 210, Bellaire, Texas 77401, and our telephone number is (832) 742-1357.

On February 22, 2024, we effected a reverse stock split of our outstanding shares of common stock at a ratio of 1-for-20, and our common stock began trading on the split-adjusted basis on the Nasdaq Capital Market at the commencement of trading on February 23, 2024. All common stock share and per share amounts in this Registration Statement on Form S-3 have been adjusted to give effect to the 1-for-20 reverse stock split.

THE OFFERING

Common Stock Offered by the Selling Stockholders

Up to 17,757,844 shares of our common stock, par value $0.001 per share, all of which are issuable upon exercise of the Warrants and the Placement Agent Warrants.

We are not selling any common stock under this prospectus and will not receive any proceeds from the sale of shares listed in this prospectus. We will, however, receive the net proceeds of any Warrants or Placement Agent Warrants exercised for cash in the future. We currently expect to use such net proceeds, if any, for working capital and general corporate purposes.

Nasdaq Capital Market

Symbol

“BPTH”

An investment in our company involves a high degree of risk. Please refer to the sections titled “Risk Factors” and “Special Note Regarding Forward-Looking Statements” and other information included or incorporated by reference in this prospectus for a discussion of factors you should carefully consider before investing in our securities.

RISK FACTORS

An investment in our company involves a high degree of risk. Before you make a decision to invest in our securities, you should consider carefully the risks described in or incorporated by reference in this prospectus, including the risks and uncertainties discussed under the section titled “Risk Factors” in our most recent Annual Report on Form 10-K and any subsequent Quarterly Reports on Form 10-Q or Current Reports on Form 8-K, and all other documents incorporated by reference into this prospectus, as updated by our subsequent filings under the Securities Exchange Act of 1934, as amended (the “Exchange Act”).

Any of these risks could have a material adverse effect on our business, prospects, financial condition and results of operations. In any such case, the trading price of our securities could decline and you could lose all or part of your investment. Additional risks not presently known to us or that we currently deem immaterial may also adversely affect our business operations. The risks described in or incorporated by reference in this prospectus also include forward-looking statements and our actual results may differ substantially from those discussed in these forward-looking statements. See “Special Note Regarding Forward-Looking Statements.”

Risks Related to this Offering

Failure to meet Nasdaq’s continued listing requirements could result in the delisting of our common stock, negatively impact the price of our common stock and negatively impact our ability to raise additional capital.

On March 12, 2024, the Company received a deficiency letter from the Listing Qualifications Department of The Nasdaq Stock Market LLC (“Nasdaq”) notifying the Company that it is not in compliance with the minimum stockholders’ equity requirement of at least $2,500,000 for continued inclusion on The Nasdaq Capital Market pursuant to Nasdaq Listing Rule 5550(b)(1) (the “Stockholders’ Equity Requirement”). On April 26, 2024, in accordance with Nasdaq Listing Rule 5810(c)(2)(A), the Company submitted a plan to Nasdaq to regain compliance (the “Compliance Plan”) with the Stockholders’ Equity Requirement and on June 12, 2024, the Company received a letter from Nasdaq granting an extension (the “Extension Letter”) until September 8, 2024 to demonstrate compliance with the Stockholders’ Equity Requirement.

On September 12, 2024, the Company received a delisting determination letter from Nasdaq advising the Company that the Company did not meet the terms of the Extension Letter. Specifically, the Company did not confirm or demonstrate compliance with the Stockholders’ Equity Requirement by completing its proposed transactions as set forth in the Extension Letter. On September 19, 2024, the Company submitted a hearing request to the Nasdaq Hearings Panel (the “Panel”), which request stayed suspension of the Company’s securities and the filing of the Form 25-NSE pending the Panel’s decision. On September 19, 2024, the Company received a letter from Nasdaq accepting the request for appeal and scheduling the hearing date for November 5, 2024. At the Panel hearing, the Company intends to present a plan to regain compliance with the Stockholders’ Equity Requirement. In the interim, the Company’s common stock will continue to trade on the Nasdaq Capital Market under the symbol “BPTH” pending the Panel’s decision. There can be no assurance that the Company’s appeal will be successful or that the Company will be able to regain compliance with the Stockholders’ Equity Requirement.

If our common stock is delisted, it could reduce the price of our common stock and the levels of liquidity available to our stockholders. In addition, the delisting of our common stock could materially adversely affect our access to the capital markets and any limitation on liquidity or reduction in the price of our common stock could materially adversely affect our ability to raise capital. Delisting from The Nasdaq Capital Market could also result in other negative consequences, including the potential loss of confidence by suppliers, customers and employees, the loss of institutional investor interest and fewer business development opportunities.

SPECIAL NOTE REGARDING FORWARD-LOOKING STATEMENTS

This prospectus and the documents incorporated by reference into this prospectus contain “forward- looking statements” within the meaning of Section 27A of the Securities Act of 1933, as amended (the “Securities Act”), and Section 21E of the Exchange Act. Forward-looking statements can be identified by words such as “anticipate,” “expect,” “intend,” “plan,” “believe,” “seek,” “estimate,” “project,” “goal,” “strategy,” “future,” “likely,” “may,” “should,” “will” and variations of these words and similar references to future periods, although not all forward-looking statements contain these identifying words. Forward- looking statements are neither historical facts nor assurances of future performance. Instead, they are based on our current beliefs, expectations and assumptions regarding the future of our business, future plans and strategies, projections, anticipated events and trends, the economy and other future conditions. Because forward-looking statements relate to the future, they are subject to inherent risks, uncertainties and changes in circumstances, including but not limited to risk factors contained in or incorporated by reference under the section titled “Item 1A. Risk Factors” to Part I of our Annual Report on Form 10-K as of and for the fiscal year ended December 31, 2023 other factors described elsewhere in this prospectus or in our current and future filings with the Securities and Exchange Commission (“SEC”). As a result, our actual results and financial condition may differ materially from those expressed or forecasted in the forward- looking statements, and you should not rely on such forward-looking statements. You should carefully read this prospectus, together with the information incorporated herein by reference described under the section titled “Where You Can Find More Information,” completely and with the understanding that our actual future results may be materially different from what we expect. We can give no assurances that any of the events anticipated by the forward-looking statements will occur or, if any of them do, what impact they will have on our results of operations and financial condition. Important factors that could cause our actual results and financial condition to differ materially from those indicated in the forward-looking statements include, among others, the following:

•

our lack of significant revenue to date, our history of recurring operating losses and our expectation of future operating losses;

•

our need for substantial additional capital and our need to delay, reduce or eliminate our drug development and commercialization efforts if we are unable to raise additional capital;

•

the highly-competitive nature of the pharmaceutical and biotechnology industry and our ability to compete effectively;

•

the success of our plans to use collaboration arrangements to leverage our capabilities;

•

our ability to retain and attract key personnel;

•

the risk of misconduct of our employees, agents, consultants and commercial partners;

•

disruptions to our operations due to expansions of our operations;

•

the costs we would incur if we acquire or license technologies, resources or drug candidates;

•

risks associated with product liability claims;

•

our reliance on information technology systems and the liability or interruption associated with cyber-attacks or other breaches of our systems;

•

our ability to use net operating loss carryforwards;

•

provisions in our charter documents and state law that may prevent a change in control;

•

work slowdown or stoppage at government agencies could negatively impact our business;

•

the impact, risks and uncertainties related to global pandemics, including the COVID-19 pandemic, and actions taken by governmental authorities or others in connection therewith;

•

our need to complete extensive clinical trials and the risk that we may not be able to demonstrate the safety and efficacy of our drug candidates;

•

risks that our clinical trials may be delayed or terminated;

•

our ability to obtain domestic and/or foreign regulatory approval for our drug candidates;

•

changes in existing laws and regulations affecting the healthcare industry;

•

our reliance on third parties to conduct clinical trials for our drug candidates;

•

our ability to maintain orphan drug exclusivity for our drug candidates;

•

our reliance on third parties for manufacturing our clinical drug supplies;

•

risks associated with the manufacture of our drug candidates;

•

our ability to establish sales and marketing capabilities relating to our drug candidates;

•

market acceptance of our drug candidates;

•

third-party payor reimbursement practices;

•

our ability to adequately protect the intellectual property of our drug candidates;

•

infringement on the intellectual property rights of third parties;

•

costs and time relating to litigation regarding intellectual property rights;

•

our ability to adequately prevent disclosure by our employees or others of trade secrets and other proprietary information;

•

our need to raise additional capital;

•

the volatility of the trading price of our common stock;

•

our common stock being thinly traded;

•

our ability to issue shares of common or preferred stock without approval from our stockholders;

•

our ability to pay cash dividends;

•

costs and expenses associated with being a public company;

•

our ability to maintain effective internal controls over financial reporting; and

•

our ability to regain and maintain compliance with the listing standards of the Nasdaq Capital Market.

Any forward-looking statement made by us in this prospectus and the documents incorporated by reference into this prospectus is based only on information currently available to us and speaks only as of the date on which it is made. We undertake no obligation to publicly update any forward-looking statement, whether as a result of new information, future developments or otherwise. However, you should carefully review the risk factors set forth in other reports or documents we file from time to time with the SEC.

USE OF PROCEEDS

We are not selling any common stock under this prospectus and will not receive any proceeds from the sale of shares listed in this prospectus. We will, however, receive the net proceeds of any Warrants or Placement Agent Warrants exercised for cash in the future. We currently expect to use such net proceeds, if any, for working capital and general corporate purposes. The selling stockholders will bear all commissions and discounts, if any, attributable to the sale or disposition of the shares. We will bear all costs, expenses and fees in connection with the registration of the shares.

PRIVATE PLACEMENT OF WARRANTS

On October 8, 2024, we entered into the Securities Purchase Agreement with an accredited investor pursuant to which we sold to such investor (i) 4,597,702 Pre-Funded Warrants with an exercise price of $0.001 per share, (ii) 6,407,657 Series A Warrants with an exercise price of $1.00, and (iii) 6,407,657 Series B Warrants with an exercise price of $1.00. The purchase price of each Pre-Funded Warrant and the associated Common Stock Warrants was $0.869 for aggregate gross proceeds of approximately $4.0 million, exclusive of placement agent commission and fees and other offering expenses (the “Offering”). For more information regarding the Warrants, see “Description of Capital Stock — Warrants — Pre-Funded Warrants and Common Stock Warrants”.

In connection with the Offering, we entered into a registration rights agreement dated October 8, 2024 (the “Registration Rights Agreement”) with the investor pursuant to which we agreed to prepare and file a registration statement covering the Registrable Securities on or prior to the date that is 10 calendar days following the date of the Registration Rights Agreement. We agreed to use our commercially reasonable efforts to cause the registration statement covering the Warrants to be declared effective as promptly as practicable after the filing thereof, but in any event no later the 30th calendar day following the date of the Registration Rights Agreement (or in the event of a full review by the SEC, the 60th calendar day following the date of the Registration Rights Agreement).

In addition, pursuant to the terms of the Engagement Letter dated as of September 26, 2024, between the Company and the Placement Agent, we issued to the Placement Agent’s designees 344,828 Placement Agent Warrant Shares issuable upon the exercise of the Placement Agent Warrants at an exercise price of $1.0875 per share issued in connection with the Private Placement. For more information regarding the Placement Agent Warrants, see “Description of Capital Stock — Warrants — Placement Agent Warrants”.

In connection with the Offering, the Company and the investor agreed to cancel such investor’s series A warrants to purchase 1,809,955 shares of common stock at an exercise price of $2.00 per share and series B warrants to purchase 1,809,955 shares of common stock at an exercise price of $2.00 per share issued to such investor on June 5, 2024, effective as of October 10, 2024.

SELLING STOCKHOLDERS

The common stock being offered by the selling stockholders are those issuable to the selling stockholders, upon exercise of the Warrants and Placement Agent Warrants. For additional information regarding the issuances of the Warrants and Placement Agent Warrants, see “Private Placement of Warrants” above. We are registering the shares of common stock in order to permit the selling stockholders to offer the shares for resale from time to time. Except for the ownership of the Warrants and Placement Agent Warrants, as applicable, or as otherwise set forth herein, the selling stockholders have not had any material relationship with us within the past three years.

The table below lists the selling stockholders and other information regarding the beneficial ownership of the shares of common stock by each of the selling stockholders. The second column lists the number of shares of common stock beneficially owned by each selling stockholder, based on its ownership of the shares of common stock and warrants, as of October 14, 2024, assuming exercise of the warrants held by the selling stockholders on that date, without regard to any limitations on exercises. The third column lists the shares of common stock being offered by this prospectus by the selling stockholders.

In accordance with the terms of the Registration Rights Agreement, this prospectus generally covers the resale of the maximum number of shares of common stock issuable upon exercise of the Warrants and Placement Agent Warrants, see “Private Placement of Warrants” above, determined as if the outstanding Warrants and Placement Agent Warrants were exercised in full as of the trading day immediately preceding the date this registration statement was initially filed with the SEC, each as of the trading day immediately preceding the applicable date of determination and all subject to adjustment as provided in the registration right agreement, without regard to any limitations on the exercise of the Warrants and Placement Agent Warrants. The fourth column assumes the sale of all of the shares offered by the selling stockholders pursuant to this prospectus.

Under the terms of the Warrants and Placement Agent Warrants, a selling stockholder may not exercise any such warrants to the extent such exercise would cause such selling stockholder, together with its affiliates and attribution parties, to beneficially own a number of shares of common stock which would exceed 4.99% or 9.99%, as applicable, of our then outstanding common stock following such exercise, excluding for purposes of such determination shares of common stock issuable upon exercise of the Warrants and Placement Agent Warrants which have not been exercised. The number of shares in the second and fourth columns do not reflect this limitation. The selling stockholders may sell all, some or none of their shares in this offering. See “Plan of Distribution.”

|

Name of Selling stockholder

|

|

|

Number of

shares of

Common Stock

Owned Prior

to Offering

|

|

|

Maximum

Number of shares

of Common Stock

to be Sold Pursuant

to this Prospectus(8)

|

|

|

Number of

shares of

Common Stock

Owned After

Offering(9)

|

|

|

Percent(9)

|

|

|

Armistice Capital, LLC(1)

|

|

|

|

|

17,572,016(2) |

|

|

|

|

|

17,413,016 |

|

|

|

|

|

159,000 |

|

|

|

|

|

*

|

|

|

|

Michael Vasinkevich(3)

|

|

|

|

|

331,375(4) |

|

|

|

|

|

221,121 |

|

|

|

|

|

110,254 |

|

|

|

|

|

*

|

|

|

|

Noam Rubinstein(3)

|

|

|

|

|

162,777(5) |

|

|

|

|

|

108,621 |

|

|

|

|

|

54,156 |

|

|

|

|

|

*

|

|

|

|

Craig Schwabe(3)

|

|

|

|

|

17,359(6) |

|

|

|

|

|

11,638 |

|

|

|

|

|

5,721 |

|

|

|

|

|

*

|

|

|

|

Charles Worthman(3)

|

|

|

|

|

5,167(7) |

|

|

|

|

|

3,448 |

|

|

|

|

|

1,719 |

|

|

|

|

|

*

|

|

|

|

TOTAL

|

|

|

|

|

|

|

|

|

|

|

17,757,844 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

*

Less than 1%

(1)

The securities are directly held by Armistice Capital Master Fund Ltd., a Cayman Islands exempted company (the “Master Fund”), and may be deemed to be beneficially owned by: (i) Armistice Capital, LLC (“Armistice Capital”), as the investment manager of the Master Fund; and (ii) Steven Boyd, as the Managing Member of Armistice Capital. The Common Stock Warrants and the Pre-Funded Warrants are subject to a beneficial ownership limitation of 4.99% and 9.99%, respectively, which such limitations restrict the selling stockholder from exercising that portion of the warrants that would result in the selling stockholder and its affiliates owning, after exercise, a number of shares of common

stock in excess of the beneficial ownership limitation. The address of Armistice Capital Master Fund Ltd. is c/o Armistice Capital, LLC, 510 Madison Avenue, 7th Floor, New York, NY 10022.

(2)

Consists of: (i) 4,597,702 Pre-Funded Warrant Shares, (iii) 6,407,657 Series A Warrant Shares, (iv) 6,407,657 Series B Warrant Shares and (v) 159,000 shares of common stock issuable upon exercise of warrants issued in prior offerings.

(3)

Each of the selling stockholders is affiliated with H.C. Wainwright & Co., LLC, a registered broker dealer with a registered address of c/o H.C. Wainwright & Co., 430 Park Ave, 3rd Floor, New York, NY 10022, and has sole voting and dispositive power over the securities held. The number of shares to be sold in this offering consists of shares of common stock issuable upon exercise of Placement Agent Warrants, which were received as compensation for our private placement. The selling stockholder acquired the Placement Agent Warrants in the ordinary course of business and, at the time the Placement Agent Warrants were acquired, the selling stockholder had no agreement or understanding, directly or indirectly, with any person to distribute such securities.

(4)

Consists of (i) 221,121 Placement Agent Warrant Shares and (ii) 110,254 shares of common stock issuable upon exercise of warrants received as compensation for prior offerings.

(5)

Consists of (i) 108,621 Placement Agent Warrant Shares and (ii) 54,156 shares of common stock issuable upon exercise of warrants received as compensation for prior offerings.

(6)

Consists of (i) 11,638 Placement Agent Warrant Shares and (ii) 5,721 shares of common stock issuable upon exercise of warrants received as compensation for prior offerings.

(7)

Consists of (i) 3,448 Placement Agent Warrant Shares and (ii) 1,719 shares of common stock issuable upon exercise of warrants received as compensation for prior offerings.

(8)

Represents the maximum number of shares of common stock that may be offered by the selling stockholder based on the assumption that all of the outstanding Warrants or Placement Agent Warrants held by the selling stockholder will be exercised for cash, irrespective of limitations on exercise.

(9)

Represents the number of shares of common stock that will be beneficially owned by the selling stockholder after completion of this offering based on the assumptions that (i) all of the Warrants and Placement Agent Warrants held by all selling stockholders will be exercised; (ii) all of the shares of common stock registered for resale by the registration statement of which this prospectus is a part will be sold and (iii) no other shares of common stock will be acquired or sold by the selling stockholders before completion of this offering. Applicable percentage ownership following the offering is based on 21,468,034 shares of common stock that would be outstanding assuming the exercise of all of the Warrants and all shares registered by this prospectus are sold in the offering.

DESCRIPTION OF CAPITAL STOCK

The following description of our common stock and preferred stock is a summary. It is not complete and is subject to and qualified in its entirety by our certificate of incorporation and first amended and restated bylaws, as amended, each of which is incorporated by reference into this prospectus. See the sections titled “Where You Can Find More Information” and “Information Incorporated by Reference.” As of the date of this prospectus, our certificate of incorporation authorizes us to issue 200,000,000 shares of common stock, par value $0.001 per share, and 10,000,000 shares of preferred stock, par value $0.001 per share. As of October 14, 2024, there were 3,710,190 shares of common stock issued and outstanding and no shares of preferred stock issued and outstanding.

Common Stock

Holders of common stock are entitled to one vote for each share held in the election of directors and on all other matters submitted to a vote of stockholders. Cumulative voting of shares of common stock is prohibited. Accordingly, holders of a majority of the shares of common stock entitled to vote in any election of directors may elect all of the directors standing for election.

Subject to the prior rights of the holders of any outstanding preferred stock, holders of common stock are entitled to receive dividends when, as and if declared by our board of directors out of funds legally available therefor. Upon the liquidation, dissolution or winding up of our company, the holders of common stock are entitled to receive ratably the assets of our company remaining after payment of all liabilities and payment to holders of preferred stock if such preferred stock has an involuntary liquidation preference over the common stock. Holders of common stock have no preemptive, subscription, redemption or conversion rights. The outstanding shares of common stock are, and the shares offered by us in this offering will be, when issued and paid for, validly issued, fully paid and nonassessable.

As of October 14, 2024, there were approximately 187 holders of record of our common stock.

Preferred Stock

The board of directors is authorized, without any further notice to or action of the stockholders, to issue 10,000,000 shares of preferred stock in one or more series and to determine the relative rights, preferences and privileges of the shares of any such series.

Warrants

As of October 14, 2024, there are outstanding warrants to purchase an aggregate of 18,559,613 shares of our common stock at a weighted average exercise price of $0.94 per share.

Warrants Registered Pursuant to this Registration Statement

Pre-Funded Warrants

Each Pre-Funded Warrant is exercisable commencing on the issuance date until exercised in full at an exercise price of $0.001 per share and may be exercised by means of a cashless exercise. The Company is prohibited from effecting an exercise of the Pre-Funded Warrants to the extent that, as a result of such exercise, the holder together with the holder’s affiliates, would beneficially own more than 9.99% of the number of shares of common stock outstanding immediately after giving effect to the issuance of the Pre-Funded Warrant Shares upon exercise of the Pre-Funded Warrants.

Common Stock Warrants

The Company must seek approval from its stockholders (the “Stockholder Approval”) for the issuance of the shares issuable upon exercise of the Common Stock Warrants by January 8, 2025. In the event the Company does not obtain Stockholder Approval at an annual or special meeting held by January 8, 2025, the Company must call a stockholder meeting each 90 days thereafter to seek Stockholder Approval until the earlier of the date on which Stockholder Approval is obtained or the Common Stock Warrants are no longer outstanding. Each Series A Warrant is exercisable for a period of five years commencing on the date of

Stockholder Approval (the “Stockholder Approval Date”) and each Series B Warrant is exercisable for a period of two years commencing on the Stockholder Approval Date. Each Common Stock Warrant is exercisable at an exercise price of $1.00 per share, subject to adjustment. If at the time of exercise of the Common Stock Warrants a registration statement covering the resale of the Common Stock Warrant Shares is not effective, the holders may exercise the Common Stock Warrants by means of a cashless exercise. The Company is prohibited from effecting an exercise of the Common Stock Warrants to the extent that, as a result of such exercise, the holder together with the holder’s affiliates, would beneficially own more than 4.99% (or, at the election of the holder, 9.99%) of the number of shares of common stock outstanding immediately after giving effect to the issuance of the Common Stock Warrant Shares upon exercise of the Common Stock Warrant, which beneficial ownership limitation may be increased by the holder up to, but not exceeding, 9.99%.

Placement Agent Warrants

The Placement Agent Warrants are exercisable for a period of five years commencing on the Stockholder Approval Date at an exercise price of $1.0875 per share, subject to adjustment. If at the time of exercise of the Private Placement Warrants a registration statement covering the resale of the Placement Agent Warrant Shares is not effective, the holders may exercise the Placement Agent Warrants by means of a cashless exercise. The Company is prohibited from effecting an exercise of the Placement Agent Warrants to the extent that, as a result of exercise, the holder together with the holder’s affiliates, would beneficially own more than 4.99% of the number of shares of common stock outstanding immediately after giving effect to the issuance of the Placement Agent Warrant Shares upon exercise

Limitation on Liability and Indemnification of Officers and Directors

Our certificate of incorporation and first amended and restated bylaws, as amended, provide for indemnification of our officers and directors to the fullest extent permitted by Delaware law. Our certificate of incorporation and first amended and restated bylaws, as amended, limit the liability of our directors for monetary damages to the fullest extent permitted by Delaware law. We maintain directors and officers liability insurance.

Anti-Takeover Effects of Provisions of Our Certificate of Incorporation, Our Bylaws and Delaware Law

Some provisions of Delaware law and our certificate of incorporation and our first amended and restated bylaws, as amended, contain provisions that could have the effect of delaying, deterring or preventing another party from acquiring or seeking to acquire control of us. These provisions are intended to discourage certain types of coercive takeover practices and inadequate takeover bids and to encourage anyone seeking to acquire control of us to negotiate first with our board of directors. However, these provisions may also delay, deter or prevent a change in control or other takeover of our company that our stockholders might consider to be in their best interests, including transactions that might result in a premium being paid over the market price of our common stock and also may limit the price that investors are willing to pay in the future for our common stock. These provisions may also have the effect of preventing changes in our management.

Our certificate of incorporation and first amended and restated bylaws, as amended, include anti- takeover provisions that:

•

authorize our board of directors, without further action by the stockholders, to issue shares of preferred stock in one or more series, and with respect to each series, to fix the number of shares constituting that series and establish the rights and other terms of that series;

•

establish advance notice procedures for stockholders to submit nominations of candidates for election to our board of directors and other proposals to be brought before a stockholders meeting;

•

provide that our first amended and restated bylaws, as amended, may be amended by our board of directors without stockholder approval;

•

limit our stockholders’ ability to call special meetings of stockholders;

•

allow our directors to establish the size of the board of directors by action of the board, subject to a minimum of three members;

•

provide that vacancies on our board of directors or newly created directorships resulting from an increase in the number of our directors may be filled only by a majority of directors then in office, even though less than a quorum; and

•

do not give the holders of our common stock cumulative voting rights with respect to the election of directors.

Business Combinations

Section 203 of the Delaware General Corporation Law provides that we may not engage in certain “business combinations” with any “interested stockholder” for a three-year period following the time that the person became an interested stockholder, unless:

•

prior to the time that person became an interested stockholder, our board of directors approved either the business combination or the transaction which resulted in the person becoming an interested stockholder;

•

upon consummation of the transaction which resulted in the person becoming an interested stockholder, the interested stockholder owned at least 85% of the voting stock of the corporation outstanding at the time the transaction commenced, excluding certain shares; or

•

at or subsequent to the time the person became an interested stockholder, the business combination is approved by the board of directors and by the affirmative vote of at least 662∕3% of the outstanding voting stock which is not owned by the interested stockholder.

Generally, a business combination includes a merger, consolidation, asset or stock sale or other transaction resulting in a financial benefit to the interested stockholder. Subject to certain exceptions, an interested stockholder is a person who, together with that person’s affiliates and associates, owns, or within the previous three years owned, 15% or more of our voting stock. However, in the case of our company, the sponsors and any of their respective permitted transferees receiving 15% or more of our voting stock, such stockholders will not be deemed to be interested stockholders regardless of the percentage of our voting stock owned by them. The statute could prohibit or delay mergers or other takeover or change in control attempts with respect to us and, accordingly, may discourage attempts to acquire us.

Listing

Our common stock is listed for trading on The Nasdaq Capital Market under the symbol “BPTH.”

Transfer Agent and Registrar

The transfer agent and registrar for our common stock is Equiniti Trust Company, LLC, 6201 15th Avenue, Brooklyn, New York 11219. Its phone number is (800) 937-5449.

PLAN OF DISTRIBUTION

Each Selling Stockholder (the “Selling Stockholders”) of the securities and any of their pledgees, assignees and successors-in-interest may, from time to time, sell any or all of their securities covered hereby on the principal Trading Market or any other stock exchange, market or trading facility on which the securities are traded or in private transactions. These sales may be at fixed or negotiated prices. A Selling Stockholder may use any one or more of the following methods when selling securities:

•

ordinary brokerage transactions and transactions in which the broker-dealer solicits purchasers;

•

block trades in which the broker-dealer will attempt to sell the shares as agent but may position and resell a portion of the block as principal to facilitate the transaction;

•

purchases by a broker-dealer as principal and resale by the broker-dealer for its account;

•

an exchange distribution in accordance with the rules of the applicable exchange;

•

privately negotiated transactions;

•

settlement of short sales;

•

in transactions through broker-dealers that agree with the selling stockholders to sell a specified number of shares at a stipulated price per security;

•

through the writing or settlement of options or other hedging transactions, whether through an options exchange or otherwise;

•

a combination of any such methods of sale; or

•

any other method permitted pursuant to applicable law.

The Selling Stockholders may also sell securities under Rule 144 or any other exemption from registration under the Securities Act of 1933, as amended (the “Securities Act”), if available, rather than under this prospectus.

Broker-dealers engaged by the Selling Stockholders may arrange for other brokers-dealers to participate in sales. Broker-dealers may receive commissions or discounts from the Selling Stockholders (or, if any broker-dealer acts as agent for the purchaser of securities, from the purchaser) in amounts to be negotiated, but, except as set forth in a supplement to this Prospectus, in the case of an agency transaction not in excess of a customary brokerage commission in compliance with FINRA Rule 2121; and in the case of a principal transaction a markup or markdown in compliance with FINRA Rule 2121.

In connection with the sale of the securities or interests therein, the Selling Stockholders may enter into hedging transactions with broker-dealers or other financial institutions, which may in turn engage in short sales of the securities in the course of hedging the positions they assume. The Selling Stockholders may also sell securities short and deliver these securities to close out their short positions, or loan or pledge the securities to broker-dealers that in turn may sell these securities. The Selling Stockholders may also enter into option or other transactions with broker-dealers or other financial institutions or create one or more derivative securities which require the delivery to such broker-dealer or other financial institution of securities offered by this prospectus, which securities such broker-dealer or other financial institution may resell pursuant to this prospectus (as supplemented or amended to reflect such transaction).

The Selling Stockholders and any broker-dealers or agents that are involved in selling the securities may be deemed to be “underwriters” within the meaning of the Securities Act in connection with such sales. In such event, any commissions received by such broker-dealers or agents and any profit on the resale of the securities purchased by them may be deemed to be underwriting commissions or discounts under the Securities Act. Each Selling Stockholder has informed the Company that it does not have any written or oral agreement or understanding, directly or indirectly, with any person to distribute the securities.

The Company is required to pay certain fees and expenses incurred by the Company incident to the registration of the securities. The Company has agreed to indemnify the Selling Stockholders against certain losses, claims, damages and liabilities, including liabilities under the Securities Act.

We agreed to keep this prospectus effective until the earlier of (i) the date on which the securities may be resold by the Selling Stockholders without registration and without regard to any volume or manner-of- sale limitations by reason of Rule 144, without the requirement for the Company to be in compliance with the current public information under Rule 144 under the Securities Act or any other rule of similar effect or (ii) all of the securities have been sold pursuant to this prospectus or Rule 144 under the Securities Act or any other rule of similar effect. The resale securities will be sold only through registered or licensed brokers or dealers if required under applicable state securities laws. In addition, in certain states, the resale securities covered hereby may not be sold unless they have been registered or qualified for sale in the applicable state or an exemption from the registration or qualification requirement is available and is complied with.

Under applicable rules and regulations under the Exchange Act, any person engaged in the distribution of the resale securities may not simultaneously engage in market making activities with respect to the common stock for the applicable restricted period, as defined in Regulation M, prior to the commencement of the distribution. In addition, the Selling Stockholders will be subject to applicable provisions of the Exchange Act and the rules and regulations thereunder, including Regulation M, which may limit the timing of purchases and sales of the common stock by the Selling Stockholders or any other person. We will make copies of this prospectus available to the Selling Stockholders and have informed them of the need to deliver a copy of this prospectus to each purchaser at or prior to the time of the sale (including by compliance with Rule 172 under the Securities Act).

LEGAL MATTERS

The validity of the issuance of the securities offered hereby will be passed upon for us by Winstead PC, Houston, Texas.

EXPERTS

The consolidated financial statements of Bio-Path Holdings, Inc. appearing in Bio-Path Holdings, Inc’s Annual Report (Form 10-K) for the year ended December 31, 2023 have been audited by Ernst & Young LLP, independent registered public accounting firm, as set forth in their report thereon (which contains an explanatory paragraph describing conditions that raise substantial doubt about the Company’s ability to continue as a going concern as described in Note 2 to the consolidated financial statements), included therein, and incorporated herein by reference. Such consolidated financial statements are incorporated herein by reference in reliance upon such report given on the authority of such firm as experts in accounting and auditing.

WHERE YOU CAN FIND MORE INFORMATION

We have filed with the SEC a registration statement on Form S-3 under the Securities Act with respect to the securities being offered hereby. This prospectus, which constitutes a part of the registration statement, does not contain all of the information set forth in the registration statement or the exhibits and schedules filed therewith. For further information about us and the securities offered hereby, we refer you to the registration statement and the exhibits filed thereto. Statements contained in this prospectus regarding the contents of any contract or any other document that is filed as an exhibit to the registration statement are not necessarily complete, and each such statement is qualified in all respects by reference to the full text of such contract or other document filed as an exhibit to the registration statement.