Filing of Certain Prospectuses and Communications in Connection With Business Combination Transactions (425)

17 July 2021 - 6:01AM

Edgar (US Regulatory)

Filed by Brookfield Asset Management Inc. and Brookfield Property Partners L.P.

Pursuant to Rule 425 under the Securities Act of 1933,

as amended

Subject Company: Brookfield Property Partners L.P.

Registration No.: 333-255512

Dated: July 16, 2021

BROOKFIELD PROPERTY PARTNERS UNITHOLDERS APPROVE

PRIVATIZATION TRANSACTION

BROOKFIELD NEWS, July 16, 2021 –

Brookfield Property Partners L.P. (“BPY”) (Nasdaq: BPY; TSX: BPY.UN) announced today that it has received unitholder approval

for Brookfield Asset Management Inc.’s (“BAM”) acquisition of all of the limited partnership units of BPY (the “transaction”).

Approval was given at a special meeting of BPY unitholders held on July 16, 2021 (the “Meeting”).

At the Meeting, approximately 99.06% of the votes

cast by all BPY unitholders, and 97.79% of votes cast by minority BPY unitholders, were voted in favour of the transaction.

As previously announced, in connection with the

transaction and subject to pro-ration, BPY unitholders have the ability to elect to receive, per BPY unit, $18.17 in cash, 0.4006 of

a BAM class A limited voting share, or 0.7268 of a BPY preferred unit with a liquidation preference of $25.00 per unit and a fixed distribution

rate of 6.25% per annum, or $0.390625 per quarter.

The election deadline by which registered unitholders

are entitled to elect to receive their preferred form of consideration will be 5:00 p.m. (Toronto time) on July 20, 2021. Non-registered

or beneficial unitholders, those who have their units held with a broker or other intermediary, may have an earlier deadline as set forth

by said intermediary. Non-registered unitholders are advised to contact their broker or other intermediary to elect to receive their

preferred form of consideration prior to the deadline set forth by said intermediary.

The closing of the transaction is subject to

the satisfaction of certain other closing conditions customary in a transaction of this nature, including obtaining the final court order.

Assuming that these conditions are satisfied, it is expected that the closing of the transaction will occur prior to the end of July

2021.

IMPORTANT INFORMATION AND WHERE TO FIND IT

In connection with the transaction, BAM and BPY,

together with certain subsidiaries of BPY (collectively, the “Registrants”) have filed with the U.S. Securities and Exchange

Commission (“SEC”) a registration statement on Form F-4 (File No. 333-255512) (the “Registration Statement”)

that includes a circular of BPY that also constitutes a prospectus of the Registrants. On June 8, 2021, the SEC declared the Registration

Statement effective, and the Registrants mailed the circular/prospectus to BPY unitholders, holders of shares of class A stock, par value

$0.01 per share, of Brookfield Property REIT Inc. and holders of exchangeable limited partnership units of Brookfield Office Properties

Exchange LP on or about June 17, 2021. BAM and BPY also filed a Rule 13E-3 transaction statement on Schedule 13E-3 relating to the transaction.

Each of BAM and BPY also have filed and plan to file other relevant documents with the SEC regarding the transaction. INVESTORS ARE URGED

TO READ THE REGISTRATION STATEMENT, CIRCULAR/PROSPECTUS, THE RULE 13E-3 TRANSACTION STATEMENT AND OTHER RELEVANT DOCUMENTS FILED OR TO

BE FILED WITH THE SEC BECAUSE THEY CONTAIN OR WILL CONTAIN IMPORTANT INFORMATION.

No securities regulatory authority has either

approved or disapproved of the contents of this news release. This news release shall not constitute an offer to sell or the solicitation

of an offer to sell or the solicitation of an offer to buy any securities, nor shall there be any sale of securities in any jurisdiction

in which such offer, solicitation or sale would be unlawful prior to registration or qualification under the securities laws of any such

jurisdiction. No offer of securities shall be made except by means of a prospectus meeting the requirements of Section 10 of the Securities

Act of 1933, as amended. A free copy of the circular/prospectus, as well as other filings containing information about the Registrants,

may be obtained at the SEC’s Internet site (http://www.sec.gov). You may also obtain these documents, free of charge, from BPY

by accessing BPY’s website at bpy.brookfield.com or from BAM by accessing BAM’s website at bam.brookfield.com.

# # #

Brookfield Property Partners

Brookfield Property Partners, through Brookfield

Property Partners L.P. and its subsidiary Brookfield Property REIT Inc., is one of the world’s premier real estate companies, with

approximately $88 billion in total assets. We own and operate iconic properties in the world’s major markets, and our global portfolio

includes office, retail, multifamily, logistics, hospitality, triple net lease, manufactured housing and student housing. Further information

is available at bpy.brookfield.com.

Brookfield Property Partners is the flagship

listed real estate company of Brookfield Asset Management Inc., a leading global alternative asset manager with over $600 billion in

assets under management. More information is available at www.brookfield.com.

Brookfield Property Partners L.P. is listed on

the Nasdaq Stock Market and the Toronto Stock Exchange. Brookfield Property REIT Inc. is listed on the Nasdaq Stock Market.

Brookfield Contacts:

|

Communications & Media:

|

|

Investor Relations:

|

|

Kerrie McHugh

|

|

Matt Cherry

|

|

Tel: +1 (212) 618-3469

|

|

+1 (212) 417-7488

|

|

Email: kerrie.mchugh@brookfield.com

|

|

matthew.cherry@brookfield.com

|

FORWARD-LOOKING STATEMENTS

This news release contains “forward-looking

information” and “forward-looking statements” within the meaning of applicable Canadian and U.S. securities laws. The

word “will” and derivations thereof and other expressions that are predictions of or indicate future events, trends or prospects

and which do not relate to historical matters identify forward-looking statements.

Forward-looking statements in this news release

include statements with respect to the transaction. Although BAM and BPY believe that such forward-looking statements and information

are based upon reasonable assumptions and expectations, the reader should not place undue reliance on forward-looking statements and

information Except as required by law, BAM and BPY undertake no obligation to publicly update or revise any forward-looking statements

or information, whether written or oral, that may be as a result of new information, future events or otherwise.

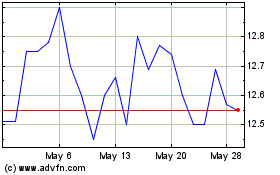

Brookfield Property Part... (NASDAQ:BPYPN)

Historical Stock Chart

From Oct 2024 to Nov 2024

Brookfield Property Part... (NASDAQ:BPYPN)

Historical Stock Chart

From Nov 2023 to Nov 2024