UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 13D

(Rule 13d-101)

INFORMATION TO BE INCLUDED IN STATEMENTS FILED

PURSUANT

TO RULE 13d-1(a) AND AMENDMENTS THERETO FILED

PURSUANT TO RULE 13d-2(a)

Carver Bancorp, Inc.

(Name of Issuer)

Common Stock, par value $0.01 per share

(Title of Class of Securities)

146875604

(CUSIP Number)

Gregory Lewis

Dream Chasers Capital Group LLC

26 Broadway, 8th Floor

New York, New York 10004

917-969-2814

With a copy to:

Drew G.L. Chapman

Hamilton Clarke LLP

48 Wall Street

New York, New York 10005

(Name, Address and Telephone Number of Person

Authorized to Receive Notices and Communications)

October 18, 2024

(Date of Event Which Requires Filing of This

Statement)

If the filing person has previously filed a statement on Schedule 13G

to report the acquisition that is the subject of this Schedule 13D, and is filing this schedule because of Rule 13d-1(e), 13d-1(f) or

13d-1(g), check the following box. ¨

Note: Schedules filed in paper format shall include a signed

original and five copies of the schedule, including all exhibits. See Rule 13d-7 for other parties to whom copies are to be sent.

| * |

The remainder of this cover page shall be filled out for a reporting person’s initial filing on this form with respect to the subject class of securities, and for any subsequent amendment containing information which would alter disclosures provided in a prior cover page. |

The information required on the remainder of this cover page shall

not be deemed to be “filed” for the purpose of section 18 of the Securities Exchange Act of 1934 (“Act”) or otherwise

subject to the liabilities of that section of the Act but shall be subject to all other provisions of the Act (however, see the Notes).

| 1 |

NAME OF REPORTING PERSON

Dream Chasers Capital Group LLC |

| 2 |

CHECK THE APPROPRIATE BOX IF A MEMBER OF A GROUP

(a) x (b) ¨ |

| 3 |

SEC USE ONLY |

| 4 |

SOURCE OF FUNDS

WC (See Item 3) |

| 5 |

CHECK BOX IF DISCLOSURE OF LEGAL PROCEEDINGS IS REQUIRED PURSUANT TO

ITEMS 2(d) OR 2(e)

¨ |

| 6 |

CITIZENSHIP OR PLACE OF ORGANIZATION

New York |

Number of

shares

beneficially

owned by

each

reporting

person

with |

7 |

SOLE VOTING POWER

0 |

| 8 |

SHARED VOTING POWER

238,300 |

| 9 |

SOLE DISPOSITIVE POWER

0 |

| 10 |

SHARED DISPOSITIVE POWER

200 |

| 11 |

AGGREGATE AMOUNT BENEFICIALLY OWNED BY EACH REPORTING PERSON

238,300 |

| 12 |

CHECK BOX IF THE AGGREGATE AMOUNT IN ROW (11) EXCLUDES CERTAIN SHARES

¨ |

| 13 |

PERCENT OF CLASS REPRESENTED BY AMOUNT IN ROW (11)

4.7%* |

| 14 |

TYPE OF REPORTING PERSON

CO |

* All percentage calculations set forth

herein are based upon the aggregate of 5,105,306 shares of Common Stock outstanding as of August 13, 2024, as reported in the Issuer’s

Quarterly Report on Form 10-Q filed with the Securities and Exchange Commission (the “SEC”) on August 14, 2024.

| CUSIP No. 146875604 | Page 2 |

| 1 |

NAME OF REPORTING PERSON

Gregory Antonius Lewis |

| 2 |

CHECK THE APPROPRIATE BOX IF A MEMBER OF A GROUP

(a) x (b) ¨ |

| 3 |

SEC USE ONLY |

| 4 |

SOURCE OF FUNDS

OO (See Item 3) |

| 5 |

CHECK BOX IF DISCLOSURE OF LEGAL PROCEEDINGS IS REQUIRED PURSUANT TO

ITEMS 2(d) OR 2(e)

¨ |

| 6 |

CITIZENSHIP OR PLACE OF ORGANIZATION

United States of America |

Number of

shares

beneficially

owned by

each

reporting

person

with |

7 |

SOLE VOTING POWER

0 |

| 8 |

SHARED VOTING POWER

238,300 |

| 9 |

SOLE DISPOSITIVE POWER

0 |

| 10 |

SHARED DISPOSITIVE POWER

200 |

| 11 |

AGGREGATE AMOUNT BENEFICIALLY OWNED BY EACH REPORTING PERSON

238,300 |

| 12 |

CHECK BOX IF THE AGGREGATE AMOUNT IN ROW (11) EXCLUDES CERTAIN SHARES

¨ |

| 13 |

PERCENT OF CLASS REPRESENTED BY AMOUNT IN ROW (11)

4.7%* |

| 14 |

TYPE OF REPORTING PERSON

IN |

* All percentage calculations set forth herein

are based upon the aggregate of 5,105,306 shares of Common Stock outstanding as of August 13, 2024, as reported in the Issuer’s

Quarterly Report on Form 10-Q filed with the SEC on August 14, 2024.

| CUSIP No. 146875604 | Page 3 |

| 1 |

NAME OF REPORTING PERSON

Shawn Paul Herrera |

| 2 |

CHECK THE APPROPRIATE BOX IF A MEMBER OF A GROUP

(a) x (b) ¨ |

| 3 |

SEC USE ONLY |

| 4 |

SOURCE OF FUNDS

PF (See Item 3) |

| 5 |

CHECK BOX IF DISCLOSURE OF LEGAL PROCEEDINGS IS REQUIRED PURSUANT TO

ITEMS 2(d) OR 2(e)

¨ |

| 6 |

CITIZENSHIP OR PLACE OF ORGANIZATION

United States of America |

Number of

shares

beneficially

owned by

each

reporting

person

with |

7 |

SOLE VOTING POWER

0 |

| 8 |

SHARED VOTING POWER

0 |

| 9 |

SOLE DISPOSITIVE POWER

81,100 |

| 10 |

SHARED DISPOSITIVE POWER

0 |

| 11 |

AGGREGATE AMOUNT BENEFICIALLY OWNED BY EACH REPORTING PERSON

81,100 |

| 12 |

CHECK BOX IF THE AGGREGATE AMOUNT IN ROW (11) EXCLUDES CERTAIN SHARES

¨ |

| 13 |

PERCENT OF CLASS REPRESENTED BY AMOUNT IN ROW (11)

1.6%* |

| 14 |

TYPE OF REPORTING PERSON

IN |

* All percentage calculations set forth herein

are based upon the aggregate of 5,105,306 shares of Common Stock outstanding as of August 13, 2024, as reported in the Issuer’s

Quarterly Report on Form 10-Q filed with the SEC on August 14, 2024.

| CUSIP No. 146875604 | Page 4 |

| 1 |

NAME OF REPORTING PERSON

Kevin Scott Winters |

| 2 |

CHECK THE APPROPRIATE BOX IF A MEMBER OF A GROUP

(a) x (b) ¨ |

| 3 |

SEC USE ONLY |

| 4 |

SOURCE OF FUNDS

PF (See Item 3) |

| 5 |

CHECK BOX IF DISCLOSURE OF LEGAL PROCEEDINGS IS REQUIRED PURSUANT TO

ITEMS 2(d) OR 2(e)

¨ |

| 6 |

CITIZENSHIP OR PLACE OF ORGANIZATION

United States of America |

Number of

shares

beneficially

owned by

each

reporting

person

with |

7 |

SOLE VOTING POWER

0 |

| 8 |

SHARED VOTING POWER

0 |

| 9 |

SOLE DISPOSITIVE POWER

157,000 |

| 10 |

SHARED DISPOSITIVE POWER

0 |

| 11 |

AGGREGATE AMOUNT BENEFICIALLY OWNED BY EACH REPORTING PERSON

157,000 |

| 12 |

CHECK BOX IF THE AGGREGATE AMOUNT IN ROW (11) EXCLUDES CERTAIN SHARES

¨ |

| 13 |

PERCENT OF CLASS REPRESENTED BY AMOUNT IN ROW (11)

3.1%* |

| 14 |

TYPE OF REPORTING PERSON

IN |

* All percentage calculations set forth herein

are based upon the aggregate of 5,105,306 shares of Common Stock outstanding as of August 13, 2024, as reported in the Issuer’s

Quarterly Report on Form 10-Q filed with the SEC on August 14, 2024.

| CUSIP No. 146875604 | Page 5 |

| 1 |

NAME OF REPORTING PERSON

Jeffrey John Bailey |

| 2 |

CHECK THE APPROPRIATE BOX IF A MEMBER OF A GROUP

(a) x (b) ¨ |

| 3 |

SEC USE ONLY |

| 4 |

SOURCE OF FUNDS

PF (See Item 3) |

| 5 |

CHECK BOX IF DISCLOSURE OF LEGAL PROCEEDINGS IS REQUIRED PURSUANT TO

ITEMS 2(d) OR 2(e)

¨ |

| 6 |

CITIZENSHIP OR PLACE OF ORGANIZATION

United States of America |

Number of

shares

beneficially

owned by

each

reporting

person

with |

7 |

SOLE VOTING POWER

98,274 |

| 8 |

SHARED VOTING POWER

161,2001 |

| 9 |

SOLE DISPOSITIVE POWER

98,274 |

| 10 |

SHARED DISPOSITIVE POWER

161,200 |

| 11 |

AGGREGATE AMOUNT BENEFICIALLY OWNED BY EACH REPORTING PERSON

259,4742 |

| 12 |

CHECK BOX IF THE AGGREGATE AMOUNT IN ROW (11) EXCLUDES CERTAIN SHARES

¨ |

| 13 |

PERCENT OF CLASS REPRESENTED BY AMOUNT IN ROW (11)

5.1%* |

| 14 |

TYPE OF REPORTING PERSON

IN |

* All percentage calculations set forth herein

are based upon the aggregate of 5,105,306 shares of Common Stock outstanding as of August 13, 2024, as reported in the Issuer’s

Quarterly Report on Form 10-Q filed with the SEC on August 14, 2024.

1 Jointly owned with

wife, Michelle Bailey.

2 Includes 161,200 shares owned jointly with wife, Michelle

Bailey.

| CUSIP No. 146875604 | Page 6 |

ITEM 1. SECURITY AND

ISSUER

This statement on Schedule

13D (“Schedule 13D”) relates to the common stock, par value $0.01 per share (the “Common Stock”),

of Carver Bancorp, Inc., a Delaware corporation (the “Issuer”). The principal executive offices of the Issuer are located

at 75 West 125th Street, New York, NY 10027. This Schedule 13D amends, supersedes and replaces entirely any and all Schedule

13Ds previously filed by any of the Reporting Persons with respect to the Issuer.

The Reporting Persons (as

defined below) each beneficially owns an aggregate of 497,774 shares of Common Stock. These shares represent approximately 9.8% of the

outstanding shares of Common Stock.

ITEM 2. IDENTITY AND BACKGROUND

| (a) | This statement is filed by: |

| i. | Dream Chasers Capital Group LLC, a New York limited liability company (“Dream Chasers”); |

| ii. | Gregory Antonius Lewis (“Lewis”), an individual resident in the state of New York; |

| iii. | Shawn Paul Herrera (“Herrera”), an individual resident in the state of California; |

| iv. | Kevin Scott Winters (“Winters”), an individual resident in the state of California; and |

| v. | Jeffrey John Bailey (“Bailey”), an individual resident in the state of California. |

Each of the foregoing is referred to as a “Reporting Person”

and collectively as the “Reporting Persons.” Each of the Reporting Persons is party to that certain Joint Filing Agreement,

as further described in Item 6. Accordingly, the Reporting Persons are hereby filing a joint Schedule 13D.

| |

(b) |

The residential or business addresses of the Reporting Persons are as follows: |

| i. | The address of the principal business and principal office of Dream Chasers is 26 Broadway, 8th Floor, New York, New

York 10004; |

| ii. | The address of Lewis is c/o Dream Chaser Capital Group LLC, 26 Broadway, 8th Floor, New York, New York 10004; |

| iii. | The address of Herrera is 500 Los Viboras Road, Hollister, CA 95023; |

| iv. | The address of Winters is 6452 Acacia Lane, Yorba Linda, CA 92886; and |

| v. | The address of Bailey is 936 N. Parker Street, Orange, CA 92867. |

| CUSIP No. 146875604 | Page 7 |

| (c) | Information about the present principal occupation or employment of each of the Reporting Persons and the name, principal business

and address of any corporation or other organization in which such employment is conducted is set forth below: |

| i. | Dream Chasers principal business is that of an investment vehicle, located at 26 Broadway, 8th Floor, New York, New York

10004; |

| ii. | Lewis’s principal occupation is to serve as the Chief Executive Officer and manager of Dream Chasers, located at 26 Broadway,

8th Floor, New York, New York 10004; |

| iii. | Herrera is the Chief Executive Officer of Mazda Computing, which is a computer equipment and peripherals company, located at 2526

Qume Dr. Ste 22, San Jose, CA, 95131; |

| iv. | Winters is a Business Development Executive at Isat - Tamaro, which is a commercial construction and engineering company, located

at 14848 Northam St, La Mirada, CA 90638; and |

| v. | Bailey is the Chief Executive Officer at Dunham Metal Processing, which is a metal processing company, located at 936 N. Parker Street,

Orange, CA 92867. |

(d), (e) During the last five years, none of the reporting persons has been (i) convicted in any criminal proceeding (excluding traffic

violations and other similar misdemeanors) and (ii) has been a party to any civil proceeding of a judicial or administrative body

of competent jurisdiction as a result of which such person was or is subject to any judgment, decree or final order enjoining future violations

of, or prohibiting or mandating activities subject to, federal or state securities laws or finding any violation with respect to such

laws.

(f) The individual Reporting Persons are

each citizens of the United States.

ITEM 3. SOURCE AND AMOUNT OF FUNDS OR OTHER

CONSIDERATION

The responses to Item 4, 5

and 6 of this Schedule 13D are incorporated herein by reference.

| i. | The Shares listed as being beneficially owned by Dream Chasers were purchased with capital from Dream Chasers. Dream Chasers acquired

200 Shares for a total purchase price of approximately $838. Dream Chasers paid an average price of approximately $4.19 per Share; |

| ii. | Herrera acquired 81,100 Shares with personal funds in open market transactions for a total investment of approximately $877,502. Herrera

paid an average price of approximately $10.82 per Share; |

| iii. | Winters acquired 157,000 Shares with personal funds in open market transactions for a total investment of approximately $1,890,280.

Winters paid an average price of approximately $12.04 per Share; and |

| iv. | Bailey acquired 358,274 Shares with personal funds in open market transactions for a total investment of $3,729,767.39. Bailey paid

an average price of approximately $10.41 per Share. Bailey shares beneficial ownership over 161,200 Shares with his wife. Bailey has entered

into a Proxy and Power of Attorney that grants full voting and investment discretion over 98,800 Shares to Garrett Kyle Bailey, and beneficially

owns 259,474 Shares. |

ITEM 4. PURPOSE OF TRANSACTION

The Reporting Persons acquired

beneficial ownership of the Shares in the belief that the Shares were undervalued and an attractive investment opportunity.

The Reporting Persons intend

to engage in conversations, meetings and other communications with certain members of the Issuer’s board of directors and management

team, stockholders, industry analysts, and other interested parties, in each case to discuss the Issuer’s business, operations,

financial condition, strategic plans, governance, the composition of the executive suite and board and possibilities for changes thereto,

as well as other matters related to the Issuer.

The Reporting Persons

may take or engage in various plans, actions or transactions in seeking to bring about changes to increase stockholder value, and

may discuss such plans, actions or transactions with the Issuer and the board of directors and management team of the Issuer,

stockholders, industry analysts, and other interested parties. The Reporting Persons may change their intentions with respect to any

and all matters referred to in Item 4 of Schedule 13D, and may also take steps to explore and prepare for various plans and actions,

and propose transactions, before forming an intention to engage in such plans or actions or proceed with such plans, actions or

transactions.

| CUSIP No. 146875604 | Page 8 |

The

Reporting Persons may review their investments in the Issuer on a continuing basis. Depending on various factors, including, without limitation,

the outcome of any discussions referenced above, the Issuer’s financial position and strategic direction, actions taken by the Issuer’s

management and board of directors, price levels of the Shares, other investment opportunities available to the Reporting Persons, conditions

in the securities markets and general economic and industry conditions, the Reporting Persons may from time to time and at any time in

the future take or engage in various plans, actions or transactions with respect to the investment in the Issuer as they deem appropriate,

including, without limitation, purchasing additional Shares, disposing of Shares, acquiring

other financial instruments that are based upon or relate to the value of the Shares, selling or obtaining financing on some or all of

their beneficial or economic holdings, and engaging in hedging or similar transactions with respect to securities that are based upon

or relate to the value of the Shares.

On July 10, 2024, Dream Chasers,

in compliance with the Bylaws of the Issuer, submitted to the Issuer its notice of director nomination (the “2024 Notice”)

to nominate two candidates for election to the Board, in each case, at the 2024 annual meeting of stockholders of the Issuer (including

any adjournments or postponements thereof or any special meeting that may be called in lieu thereof, the “2024 Annual Meeting”).

The 2024 Notice stated that

at the 2024 Annual Meeting, Dream Chasers, in its capacity as the “Record Stockholder”, intends to nominate Jeffrey

Bailey and Jeffrey Anderson (each a “2024 Nominee” and collectively, the “2024 Nominees”) for election

as directors of the Issuer.

The Reporting Persons and

the other participants named in the 2024 Notice intend to file a preliminary proxy statement with the SEC in due course in connection

with the solicitation of proxies in favor of the election of the 2024 Nominees and approval of the 2024 Bylaw Proposal at the 2024 Annual

Meeting.

On October 17, 2024, each

of the 2024 Nominees were interviewed by members of the Issuer’s Nomination and Governance Committee.

On October 18, 2024, the Issuer

filed its Preliminary Proxy Statement with the SEC, indicating that the Issuer intends to place the 2024 Nominees on the ballot for the

Issuer’s 2024 Annual Meeting.

ITEM 5. INTEREST IN SECURITIES OF

THE ISSUER

The aggregate percentage of

Shares reported as beneficially owned by each person named herein is based upon 5,105,306 Shares issued and outstanding as of August 13,

2024, which is the total number of Shares outstanding as reported in the Issuer’s quarterly report on Form 10-Q filed with the Securities

and Exchange Commission on August 14, 2024.

| |

(a) |

Dream Chasers beneficially owns 238,300 Shares. |

Percentage: Approximately

4.7%

| |

(b) |

1. |

Sole power to vote or direct vote: 0 |

| |

2. |

Shared power to vote or direct vote: 238,300 |

| |

3. |

Sole power to dispose or direct the disposition: 0 |

| |

4. |

Shared power to dispose or direct the disposition: 200 |

| CUSIP No. 146875604 | Page 9 |

| |

(c) |

Dream Chasers has not entered into any transactions in Shares during the past 60 days. |

Mr. Lewis, as the sole manager of Dream Chasers, may be deemed to have

the shared power to vote or direct the vote of all of the Shares of Dream Chasers, Mr. Herrera and Mr. Winters.

| |

(a) |

Herrera beneficially owns 81,100 Shares. |

Percentage: Approximately

1.6%

| |

(b) |

1. |

Sole power to vote or direct vote: 0 |

| |

2. |

Shared power to vote or direct vote: 0 |

| |

3. |

Sole power to dispose or direct the disposition: 81,100 |

| |

4. |

Shared power to dispose or direct the disposition: 0 |

| |

(c) |

Herrera purchased 4,000 in open market transactions during the past 60 days on September 11, 2024 for an average price per Share of $1.09. |

| |

(a) |

Winters beneficially owns 157,000 Shares. |

Percentage: Approximately

3.1%

| |

(b) |

1. |

Sole power to vote or direct vote: 0 |

| |

2. |

Shared power to vote or direct vote: 0 |

| |

3. |

Sole power to dispose or direct the disposition: 157,000 |

| |

4. |

Shared power to dispose or direct the disposition: 0 |

| |

(c) |

Winters has not entered into any transactions in Shares during the past 60 days. |

| |

(a) |

Bailey beneficially owns 259,474 Shares3, of which 161,200 Shares are jointly owned with his wife. |

Percentage: Approximately

5.1%

3

Bailey has entered into a Proxy and Power of Attorney that grants full voting and investment discretion over 98,800 Shares to Garrett

Kyle Bailey. In total, Bailey owns an aggregate of 358,274 Shares, however beneficially owns for purposes of Section 13(d) 259,474 Shares.

| CUSIP No. 146875604 | Page 10 |

| |

(b) |

1. |

Sole power to vote or direct vote: 98,274 |

| |

2. |

Shared power to vote or direct vote: 161,200 |

| |

3. |

Sole power to dispose or direct the disposition: 98,274 |

| |

4. |

Shared power to dispose or direct the disposition: 161,200 |

| |

(c) |

Bailey has not entered into any transactions in Shares during the past 60 days. |

The

Reporting Persons, as members of a “group” for the purposes of Section 13(d)(3) of the Exchange Act, may be deemed the

beneficial owner of the Shares directly owned by the other Reporting Persons. Each Reporting Person disclaims beneficial ownership of

such Shares except to the extent of his or its pecuniary interest therein.

| |

(d) |

Other than as set forth in Item 3, no person other than the Reporting Persons is known to have the right to receive, or the power to direct the receipt of dividends from, or proceeds from the sale of, Shares. |

Each of the Reporting Persons specifically disclaims beneficial ownership

of the securities reported herein except to the extent of such Reporting Person’s pecuniary interest therein.

ITEM 6. CONTRACTS, ARRANGEMENTS, UNDERSTANDINGS

OR RELATIONSHIPS WITH RESPECT TO SECURITIES OF THE ISSUER

The Reporting Persons entered into a Joint Filing Agreement pursuant

to which they agreed to the joint filing on behalf of each of them of this Schedule 13D (and any amendments thereto) with respect to the

securities of the Issuer. Such Joint Filing Agreement is filed as Exhibit 99.1 hereto.

The Reporting Persons have granted Lewis a power of attorney to execute

this Schedule 13D and any amendments hereto. The power of attorney is filed as Exhibit 99.2 hereto.

Herrera and Winters have each granted Dream Chasers a power of attorney

to, among other things, vote their Shares pursuant to a Voting Agreement, a copy of which is attached hereto as Exhibit 99.3 and

incorporated herein by reference.

Bailey has granted to Garrett Kyle Bailey a proxy and power of attorney

to, among other things, vote and make investment decisions with respect to 98,800 of his Shares pursuant to a Proxy and Power of Attorney,

a copy of which is attached hereto as Exhibit 99.4.

Other than as described herein, there are no contracts, arrangements,

understandings or relationships among the Reporting Persons, or between the Reporting Persons and any other person, with respect to the

securities of the Issuer.

ITEM 7. MATERIAL TO BE FILED AS AN

EXHIBIT

| CUSIP No. 146875604 | Page 11 |

SIGNATURES

After reasonable inquiry and to the best of each

of the undersigned’s knowledge and belief, each of the undersigned certify that the information set forth in this statement is true,

complete and correct.

Date: October 22, 2024

| |

DREAM CHASERS CAPITAL GROUP LLC |

| |

|

|

| |

By: |

/s/

Gregory Antonius Lewis |

| |

|

Name: |

Gregory Lewis |

| |

|

Title: |

Managing Member |

| |

|

|

|

| |

GREGORY ANTONIUS LEWIS |

| |

|

| |

By: |

/s/

Gregory Antonius Lewis |

| |

Name: |

Gregory Antonius Lewis |

| |

|

|

| |

SHAWN PAUL HERRERA |

| |

|

| |

By: |

/s/

Shawn Paul Herrera |

| |

Name: |

Shawn Paul Herrera |

| |

|

|

| |

KEVIN SCOTT WINTERS |

| |

|

|

|

| |

By: |

/s/ Kevin Scott Winters |

| |

Name: |

Kevin Scott Winters |

| |

|

|

| |

JEFFREY JOHN BAILEY |

| |

|

| |

By: |

/s/ Jeffrey John Bailey |

| |

Name: |

Jeffrey John Bailey |

| CUSIP No. 146875604 | Page 12 |

| CUSIP No. 146875604 | Page 13 |

Exhibit

99.1

Joint

Filing Agreement

We,

the undersigned, hereby express our agreement that the attached Schedule 13D is, and any further amendments thereto signed by each of

the undersigned shall be, filed on behalf of each of us pursuant to and in accordance with the provisions of Rule 13d-1(k) under

the Securities Exchange Act of 1934. This agreement may be terminated with respect to the obligations to jointly file future amendments

to such statement on Schedule 13D as to any of the undersigned upon such person giving written notice thereof to each of the other persons

signatory hereto, at the principal office thereof. This agreement supercedes any prior joint filing agreements by and among any of the

undersigned with respect to the securities of Carver Bancorp, Inc.

[Signature

pages follow.]

[Signature

Page to Joint Filing Agreement]

| Dated: October 22,

2024 |

|

| |

|

| |

DREAM

CHASER’S CAPITAL GROUP LLC |

| |

|

| |

/s/

Gregory Lewis |

| |

Name: |

Gregory Lewis |

| |

Title: |

Sole Manager |

[Signature

Page to Joint Filing Agreement]

| Dated: October 22,

2024 |

|

| |

|

| |

/s/

Gregory Lewis |

| |

Gregory

Lewis |

[Signature

Page to Joint Filing Agreement]

| Dated: October 22,

2024 |

|

| |

|

| |

/s/

Shawn Herrera |

| |

Shawn

Herrera |

[Signature

Page to Joint Filing Agreement]

| Dated: October 22,

2024 |

|

| |

|

| |

/s/

Kevin Winters |

| |

Kevin

Winters |

[Signature

Page to Joint Filing Agreement]

| Dated: October 22,

2024 |

|

| |

|

| |

/s/

Jeffrey Bailey |

| |

Jeffrey

Bailey |

Exhibit 99.2

POWER OF ATTORNEY

The undersigned hereby appoints Gregory Lewis

his or her true and lawful attorney-in fact and agent to execute and file with the Securities and Exchange Commission any Schedule 13D

and any amendments to the foregoing and any related documentation which may be required to be filed in his or her individual capacity

as a result of the undersigned’s beneficial ownership of, or participation in a group with respect to, securities of Carver Bancorp, Inc.

directly or indirectly beneficially owned by him or her or any of his or her affiliates, and granting unto said attorney-in-fact and agent

full power and authority to do and perform each and every act and thing which he or she might or could do in person, hereby ratifying

and confirming all that said attorney-in-fact and agent may lawfully do or cause to be done by virtue hereof. The authority of Gregory

Lewis under this Power of Attorney shall continue with respect to the undersigned until the undersigned is no longer required to file

Schedules 13D or amendments thereto with respect to securities of Carver Bancorp, Inc. unless revoked earlier in writing. The undersigned

acknowledges that the attorney-in-fact appointed herein, in serving in this capacity at the undersigned’s request, is not assuming,

nor is Carver Bancorp, Inc. assuming, any of his or her responsibilities to comply with the Securities Exchange Act of 1934 or the

rules and regulations thereunder.

[Signature pages follow.]

| |

/s/ Gregory Lewis |

| |

Gregory Lewis |

Dated: October 22, 2024

Signature Page to Power of Attorney

| |

DREAM CHASERS CAPITAL GROUP LLC |

| |

|

| |

By: |

/s/ Gregory Lewis |

| |

Name: |

Gregory Lewis |

| |

Title: |

Sole Manager |

Dated: October 22, 2024

Signature Page to Power of Attorney

| |

/s/ Shawn Herrera |

| |

Shawn Herrera |

Dated: October 22, 2024

Signature Page to Power of Attorney

| |

/s/ Kevin Winters |

| |

Kevin Winters |

Dated: October 22, 2024

Signature Page to Power of Attorney

| |

/s/

Jeffrey Bailey |

| |

Jeffrey Bailey |

Dated: October 22, 2024

Exhibit 99.3

VOTING AGREEMENT

This VOTING AGREEMENT (the “Agreement”) is made as of December

12, 2022 (the “Effective Date”), by and among Dream Chaser’s Capital Group LLC, a New York limited liability company

(“Dream Chaser’s”), and the following individuals: Shawn Paul Herrera (“Herrera”) and Kevin Scott Winters

(“Winters”), for the purpose of creating a group (the “Group”) with respect to a portion of their shares of common

stock of Carver Bancorp, Inc., a Delaware corporation (the “Company”), held by Dream Chaser’s, Herrera and Winters (collectively,

the “Stockholders”) as of the date hereof. The number of shares committed by each Stockholder to the Group is set forth in

Schedule 1 attached hereto and incorporated herein by this reference.

RECITALS

WHEREAS, the Stockholders represents that

they are the respective owners of the shares of common stock, par value $0.01 per share of Carver Bancorp, Inc. set forth in Schedule

1 (the “Shares”), and also below their names on the signature page of this Agreement; and

WHEREAS, the Stockholders believe that

it is in their respective best interests to enter into this Agreement to vote as a bloc with respect to the Shares.

AGREEMENT

NOW THEREFORE, in order to implement the

foregoing and in consideration of the premises and the mutual covenants and agreements contained herein, and for other good and valuable

consideration, the receipt and sufficiency of which are hereby acknowledged, the parties hereto agree as follows:

1. Creation of the Group.

a. Creation of the

Group. The Stockholders hereby create and establish the Group and appoint and authorize Lewis to vote their respective shares pursuant

to the terms and conditions of this Agreement.

b. Group Representative.

The Group’s initial Group Representative shall Dream Chaser’s (the “Group Representative”). If at any time the

Group Representative is unable to serve as a Group Representative hereunder by reason of death, incapacity or otherwise, such Group Representative

shall be removed and may be replaced with a successor Group Representative upon the majority vote of the holders of a majority of the

Shares. In addition, (a) the Group Representative may be removed and a successor Group Representative may be appointed, (b) a successor

Group Representative may be designated to take office automatically upon (1) the death of the Group Representative, or (2) the conviction

of the Group Representative of a felony or any crime involving fraud, and (c) the Group Representative may appoint an alternate Group

Representative as the Group Representative deems necessary, in each case, upon the majority vote of the holders of a majority of the

Shares. Within three (3) months of removing and/or replacing the Group Representative, or appointing any alternate Group Representative,

the new Group Representative shall send written notice to the Company of the person they have designated as the successor to such Group

Representative or any alternate Group Representative. As a condition to becoming a Group Representative, the successor Group Representative

must become a party to this Agreement by executing documentation reasonably satisfactory to the Stockholders (each successor Group Representative

appointed pursuant to the terms of this Section 1 is referred to as a “Successor Group Representative,” and, collectively

with the Initial Group Representative, are referred to as the “Group Representatives”). Each Group Representative hereby

accepts his or her appointment as such pursuant to the terms and conditions of this Agreement and agrees to administer the Group in accordance

with the terms and conditions of this Agreement, unless and until replaced by a Successor Group Representative as herein provided.

2. [Reserved]

3. Group Representative’s

Powers and Duties; Compensation.

a. Voting Powers.

For so long as this Agreement remains in effect and subject to the exclusions and limitations set forth Section b below, the Group Representative

shall vote, or cause the Shares subject to this Agreement to be voted (in person or by proxy), in the same proportion that the shares

of Common Stock that are not subject to hereto are actually and validly voted on such matter, excluding (for the purpose of determining

such proportion) all shares of Common Stock held by any Person or “Group” that has (or based upon its beneficial ownership

of Common stock should have) filed a Schedule 13D pursuant to Section 13(d) of the Exchange Act with respect to the Common Stock at the

time of the relevant vote, except that, if Section b below does apply to the matter upon which a vote is to be effected and the Group

Representative receives valid and timely written voting instructions from the Stockholders delivered in accordance with Section 9 that

have not been revoked, the Group Representative shall vote, or cause the Shares subject to such voting instructions to be voted (in person

or by proxy), in accordance therewith. Subject to the provisions of this Agreement, the Group Representative shall have the full, exclusive

and unqualified right and power to vote, to execute consents, to enter into voting agreements, and to grant proxies with respect to all

of the Shares subject to this Agreement, as well as in respect of any other securities with voting rights received in respect of the

Shares at any time hereafter by way of a stock dividend, distribution, conversion or exchange as provided in Section c below, with respect

to any lawful corporate action, whether or not in the ordinary course of business, and no Stockholder shall in such capacity have any

rights or powers to vote such Shares or to give consents with respect to or grant proxies in respect thereof or otherwise take part in

any corporate action. Without limiting the generality of the foregoing, the Stockholders (i) acknowledge that each Group Representative,

in his or her individual or representative capacity, is a holder of Shares and (ii) agrees that the Group Representative is entitled

to exercise the powers granted to such Group Representative in the preceding sentence in the Group Representative’s sole and absolute

discretion (including in his or her own interest as a holder of Shares) without fiduciary duty of any kind to the Stockholders with respect

to the exercise of such powers.

b. Extraordinary Transactions.

Notwithstanding anything to the contrary elsewhere in this Agreement, a majority of the Stockholders may direct the Group Representative

in writing to exercise the voting rights with respect to the Shares regulated pursuant to this Agreement, and the Group Representative

shall vote in accordance with such direction, to vote: (i) against (1) any merger, consolidation, business combination, share exchange,

restructuring, recapitalization or acquisition involving the Company or any similar transaction involving all or a material portion of

the assets of the Company and its subsidiaries, taken as a whole, or (2) the sale, lease, exchange, pledge, mortgage or transfer (including

through any arrangement having substantially the same economic effect as a sale of assets) of all or a material portion of the assets

of the Company and its subsidiaries, taken as a whole, if, in each case of Section 3(b)(1) and Section 3(b)(2), (x) the Act requires

stockholder approval for such matter, (y) the NASDAQ Listing Rules require stockholder approval for such matter or (z) the Company’s

Board of Directors (the “Board”) voluntarily submits the matter for stockholder approval even though it is not required;

against any action that requires stockholder approval under Rule 5635(a)(1) of the NASDAQ rules; (ii) against the liquidation or dissolution

of the Company; (iii) against any amendment to the certificate of incorporation or bylaws of the Company (except for amendments to increase

the number of authorized shares of Common Stock); or (iv) against any transaction which requires stockholder approval under Rule 5635(b)

of the NASDAQ rules.

c. Notices, Dividends

and Distributions. In the event that the Group Representative receives any dividends or other distributions (other than additional

Shares or other voting securities of the Company) with respect to the Shares held by them hereunder, they shall promptly pay (or, in

the event that such dividends or distributions are not cash, distribute in kind) the amount thereof received by them to the Stockholders

pro rata; provided, however, that the Group Representative may, by notice to the Company, instruct the Company to pay such dividends

directly to the respective Stockholders. If the Group Representative receives any Shares or other voting securities of the Company as

a dividend or distribution upon, conversion of or in exchange for any Shares held by them hereunder, the Group Representative shall hold

such Shares or other voting securities of the Company in accordance with the terms of this Agreement and shall update the Stock Register

accordingly.

d. No Right to Sell

Shares. The Group Representative shall have no authority to sell, pledge, hypothecate or otherwise dispose of the Shares or any interest

therein.

e. Compensation of

Group Representative. No Group Representative shall receive any compensation for his or her services under this Agreement. This subsection

shall not, however, affect the right of the Group Representative to compensation from the Company for services performed by such person

in any other capacity (e.g., as an officer, director, employee or otherwise).

f. Group Representative’s

Liability and Indemnity. No Group Representative shall be liable for any error of judgment or mistake of fact or law, or for any

action or omission under this Agreement, except for such Group Representative’s fraud, bad faith, willful misconduct, or gross

negligence. No Group Representative shall be liable for acting on any notice, request or instruction or other document believed to be

genuine and to have been executed by or on behalf of the proper party or parties. The Stockholders shall be responsible for payment of

their proportionate share of all reasonable expenses of the Group Representative, including counsel fees, and shall discharge all liabilities

incurred by them in connection with the exercise of their powers and the performance of their duties under this Agreement. Any action

or omission undertaken by a Group Representative in good faith in accordance with the advice of legal counsel shall be binding and conclusive

on the parties to this Agreement. The Stockholders shall also defend, indemnify and hold the Group Representative harmless from and against

any and all claims and liabilities in connection with or arising out of the execution of its duties under this Agreement or the exercise

of any powers or the performance of any duties by them as herein provided or contemplated, except such as shall arise from the fraud,

bad faith or willful misconduct of the Group Representative.

g. Method of Voting

Shares. The Group Representative may in all matters act either at a meeting or by a writing or writings with or without a meeting.

The Stockholders shall provide the Group Representative with a proxy or other document necessary for the Group Representative to fulfill

its obligations hereunder.

4. Transfer of Shares; Increased Ownership

in Shares and Termination.

a. General. The

voting agreement created by this Agreement shall be irrevocable and shall terminate upon the written agreement of the holders of a majority

of the Shares. Except for Section 3.f, which will survive the termination of this Agreement, this Agreement shall have no further force

and effect (x) upon termination of this Agreement pursuant to its terms; or (y) with respect to each Stockholder, when such Stockholder

no longer Beneficially Owns any Shares or other voting securities of the Company which are subject to this Agreement.

b. Transfer/Purchase

of Shares. This Agreement shall not place any restrictions on any Stockholder from transferring its Shares; provided that prior to

any such transfer, such Stockholder will provide notice to the Group Representative of the date of such transfer and the number of Shares

being transferred. Any transferred Shares will no longer be subject to this Agreement unless agreed to in writing by the transferee of

such Shares. Each Stockholder herby agrees that if such Stockholder transfers its Shares or increases the number of shares of Carver

Bancorp, Inc. common stock it owns, it will provide the Group Representative on the day of such transfer or purchase, the information

necessary for the Group Representative to make any required amendments to the related Schedule 13D on file with the Securities and Exchange

Commission (the “SEC”) or make any other required filings with the SEC.

5. Amendments. This Agreement may be amended, modified

or supplemented at any time and from time to time by the written agreement of the holders of a majority of the Shares.

6. Governing Law. This Agreement, including its existence,

validity, construction, and operating effect, and the rights of the parties hereto, shall be governed by and construed in accordance

with the laws of the State of Delaware without regard to otherwise governing principles of conflicts of law.

7. Severability. If any one or more of the provisions

of this Agreement, as applied to any party or any circumstance, shall, for any reason, be held to be invalid, illegal or unenforceable

in any respect, such invalidity, illegality or unenforceability shall not affect any other provision of this Agreement, and this Agreement

shall be construed as if such invalid, illegal or unenforceable provision had never been contained herein. If any one or more of the

provisions of this Agreement shall, for any reason, be held to be unenforceable as to duration, scope, activity or subject, such provision

shall be construed by limiting and reducing it so as to make such provision enforceable to the extent compatible with the then existing

applicable law. Without limiting the generality of the foregoing, it is the express intent of the parties to cause the Shares to be voted

by the Group Representative as provided herein. Accordingly, in the event that this Agreement is rescinded or otherwise terminated other

than pursuant to its terms for any reason, the parties agree promptly to negotiate a successor voting agreement to accomplish this objective

and to otherwise replicate the provisions hereof to the extent possible.

8. Specific Performance. The parties agree that the failure

of any party to perform any obligation provided for by this Agreement could result in irreparable damage to the other parties, and that

monetary damages alone would not be adequate to compensate the non-defaulting party for its injury. Any party shall therefore be entitled,

in addition to any other remedy that may be available, including monetary damages, to obtain specific performance of the terms of this

Agreement. If any action is brought by any party to enforce this agreement, any party against which the action is brought shall waive

the defense that there is an adequate remedy at law.

9. Notices. All notices, consents, waivers, and other

communications under this Agreement must be in writing and will be deemed to have been duly given when (i) delivered by hand (with written

confirmation of receipt), (ii) upon receipt, if sent by electronic or digital transmission method (including e-mail), or (iii) on the

date of receipt or refusal indicated on the return receipt, if sent by registered or certified mail, return receipt requested, postage

and charges prepaid and properly addressed, in each case to the appropriate addresses and e-mail addresses s as a party may designate

by notice to the other parties from time to time.

10. Binding Effect. Except as otherwise expressly provided

herein, this Agreement shall be binding on and inure to the benefit of the parties hereto. No rights or obligations hereunder may be

assigned by any party hereto except as explicitly provided in this Agreement.

11. Benefit and Burden. Nothing express or implied in

this Agreement is intended or shall be construed to confer upon or to provide any Person other than the parties (and including specifically

any stockholder of the Company that is not a party to this Agreement) any rights or remedies hereunder or by reason hereof. This Agreement

and all its conditions and provisions are intended to be, and are, for the sole and exclusive benefit of the parties hereto and their

successors and permitted assigns and are not for the benefit of any other Person.

12. Certain Rules of Construction. To the fullest extent

permitted by law, the parties hereto intend that any ambiguities shall be resolved without reference to which party may have drafted

this Agreement. All Section or subsection titles or other captions in this Agreement are for convenience only, and they shall not be

deemed part of this Agreement and in no way define, limit, extend or describe the scope or intent of any provisions hereof. Unless the

context otherwise requires: (a) a term has the meaning assigned to it; (b) “or” is not exclusive; (c) words in the singular

include the plural, and words in the plural include the singular; (d) provisions apply to successive events and transactions; (e) “herein,”

“hereof” and other words of similar import refer to this Agreement as a whole and not to any particular Section, subsection

or other subdivision; (f) “include” or “including” shall be deemed to be followed by “without limitation”

or “but not limited to” whether or not they are followed by such phrases or words of like import; (g) all references to “Sections”

or “subsections” refer to Sections or subsections of this Agreement; and (h) any pronoun used in this Agreement shall include

the corresponding masculine, feminine or neuter forms.

13. Waiver. The failure of any party at any time to insist

upon strict performance of any condition, promise, agreement or understanding set forth in this Agreement shall not be construed as a

waiver or relinquishment of the right to insist upon strict performance of the same or any other condition, promise, agreement or understanding

at a future time.

14. Entire Agreement. This Agreement constitutes the

entire agreement between the parties hereto pertaining to the subject matter hereof and fully supersedes any and all prior or contemporaneous

agreements or understandings between the parties hereto pertaining to the subject matter hereof.

15. Counterparts. This Agreement may be executed in any

number of multiple counterparts, each of which shall be deemed to be an original copy and all of which shall constitute one agreement,

binding on all parties hereto.

16. Arbitration. It is understood

and agreed between the parties hereto that any and all claims, grievances, demands, controversies, causes of action or disputes of any

nature whatsoever (collectively, “Claims”), arising out of, in connection with, or in relation to this Agreement or the arbitrability

of any Claims under this Agreement, shall be resolved by final and binding arbitration administered by the New York City offices of JAMS

in accordance with the then-existing JAMS Arbitration Rules. The parties shall select a mutually acceptable neutral arbitrator from the

panel of arbitrators serving with any of JAMS’s offices, but in the event the parties cannot agree on an arbitrator, the Administrator

of JAMS shall appoint an arbitrator from such panel (the arbitrator so selected or appointed, the “Arbitrator”). The parties

expressly agree that the Arbitrator may provide all appropriate remedies (at law and equity) or judgments that could be awarded by a

court of law in Delaware, and that, upon good cause shown, the Arbitrator shall afford the parties adequate discovery, including deposition

discovery. Except as provided herein, the Federal Arbitration Act shall govern the interpretation, enforcement and all actions pursuant

to this Section 16. The Arbitrator shall be bound by and shall strictly enforce the terms of this Section 16 and may not limit, expand,

or otherwise modify its terms. The Arbitrator shall make a good faith effort to apply the substantive law (and the law of remedies, if

applicable) of the state of Delaware, or federal law, or both, as applicable, without reference to its conflicts of laws provisions.

The Arbitrator is without jurisdiction to apply any different substantive law. The Arbitrator shall be bound to honor claims of privilege

or work-product doctrine recognized at law, but the Arbitrator shall have the discretion to determine whether any such claim of privilege

or work product doctrine applies. The Arbitrator shall render an award and a written, reasoned opinion in support thereof. Subject to

the provisions of Section 7, the Arbitrator shall have power and authority to award any appropriate remedy (in law or equity) or judgment

that could be awarded by a court of law in Delaware, which may include reasonable attorneys’ fees to the prevailing party. The

award rendered by arbitration shall be final and binding upon the parties, and judgment upon the award may be entered in any court having

jurisdiction thereof. Neither a party nor the Arbitrator shall disclose the existence, content, or results of any arbitration hereunder

without the prior written consent of all parties. Adherence to this dispute resolution process shall not limit the parties’ right

to obtain any provisional remedy, including, without limitation, injunctive or similar relief, from any court of competent jurisdiction

as may be necessary to protect their rights and interests. Notwithstanding the foregoing sentence, this dispute resolution procedure

is intended to be the exclusive method of resolving any Claims arising out of or relating to this Agreement. Subject to the Arbitrator’s

award, each party shall bear its own fees and expenses with respect to this dispute resolution process and any action related thereto

and the parties shall share equally the fees and expenses of JAMS and the Arbitrator.

17. Definitions. Capitalized words and phrases used and

not otherwise defined elsewhere in this Agreement shall have the following meanings:

“Act”

means the General Corporation Law of the State of Delaware, as amended.

“Beneficial Owner”

is defined in Rule 13d-3(a) and (b) of the rules and regulations of the Securities Exchange Act of 1934, as amended. “Beneficially

Owned” shall have a correlative meaning.

“Encumbrance”

means a security interest, lien, charge, claim, community or other marital property interest, pledge, alienation, mortgage, option, hypothecation,

encumbrance or similar collateral assignment by any other means, whether for value or no value and whether voluntary or involuntary (including

by operation of law or by judgment, levy, attachment, garnishment, bankruptcy or other legal or equitable proceedings) or any other restriction

on use, voting (including any proxy), transfer (including any right of first refusal or similar right), receipt of income or exercise

of any other attribute of ownership.

“Person”

means and includes an individual, a general or limited partnership, a limited liability company, a joint venture, a corporation (including

any non-profit corporation), an estate, a trust, an unincorporated organization, an association, a government or any department or agency

thereof or any entity similar to any of the foregoing.

“Transfer”

means a sale, transfer, assignment, gift, bequest or disposition by any other means, whether for value or no value and whether voluntary

or involuntary (including, without limitation, by realization upon any Encumbrance or by operation of law or by judgment, levy, attachment,

garnishment, bankruptcy or other legal or equitable proceedings). The term “Transferred” shall have a correlative meaning.

[Signature page follows]

IN WITNESS WHEREOF, the parties hereto

have executed this Voting Agreement as of the date first above written.

| STOCKHOLDERS |

|

| |

|

| /s/

Shawn Paul Herrara |

|

| Shawn

Paul Herrara |

|

| |

|

| Holder

of 71,000 Shares |

|

| |

|

| /s/

Kevin Scott Winters |

|

| Kevin

Scott Winters |

|

| |

|

| Holder

of 162,000 Shares |

|

| |

|

| GROUP

REPRESENTATIVE: |

|

| |

|

| For:

DREAM CHASER’S CAPITAL GROUP LLC |

|

| |

|

| By: |

/s/ Gregory Antonius Lewis |

|

| Name: |

Gregory Antonius Lewis |

|

| Title: |

CEO/Managing Partner |

|

[Signature Page to

Voting Agreement]

Exhibit 99.4

PROXY AND POWER OF ATTORNEY

PROXY

AND POWER OF ATTORNEY (the "Proxy and Power of Attorney"), effective as of June 1, 2024, between Jeffrey Bailey (the “Stockholder”)

and Garrett Kyle Bailey (the “Grantee”).

WHEREAS,

the Stockholder is the owner of 98,800 shares (the “Covered Shares”) of Common Stock, par value $.01 (the "Common Stock"),

of Carver Bancorp, Inc. (the "Company");

WHEREAS,

the Stockholder desires to enter into this Agreement with Grantee with respect to the Covered Shares.

NOW,

THEREFORE, in consideration of the foregoing and the mutual covenants and agreements contained herein, and intending to be legally bound

hereby, the Parties agree as follows:

1.

The Stockholder hereby irrevocably constitutes, appoints, authorizes and empowers the Grantee, during the term of this Proxy and

Power of Attorney, as its sole and exclusive true and lawful proxy and attorney-in-fact, with full power of substitution, (i) to vote

and exercise all voting and related rights with respect to all of the Covered Shares (and any and all securities issued or issuable in

respect thereof), for and in the name, place and stead of the Stockholder, at any annual, special or other meeting of the stockholders

of the Company, and at any adjournment or adjournments thereof, or pursuant to any consent in lieu of a meeting or otherwise, with respect

to any matter that may be submitted for a vote of stockholders of the Company; and (ii) to sell, transfer, assign, pledge, hypothecate,

cause to be redeemed or otherwise dispose of, and make any and all investment decisions with respect to, the Covered shares and related

rights (and any and all securities issued or issuable in respect thereof). All power and authority hereby conferred is irrevocable except

as set forth in this Agreement, and the Stockholder shall not and cannot exercise any of the powers conferred and granted to the Grantee

under this Proxy and Power of Attorney with respect to the Covered Shares during its term.

2. The Stockholder represents and

warrants to the Grantee that, as of the date hereof, the Stockholder (i) owns all of the Covered Shares, (ii) owns all of the Covered

Shares free and clear of all liens, charges, claims, encumbrances and security interests of any nature whatsoever, and (iii) has not granted

any proxy to any Person (other than the Grantee) with respect to any Covered Shares or deposited such Covered Shares into a voting trust.

3. Any securities of the Company

to be issued or issuable to the Stockholder in respect of Covered Shares during the term of this Proxy and Power of Attorney shall be

deemed Covered Shares for purposes of this Proxy and Power of Attorney.

4. The term of this Proxy and Power

of Attorney shall continue until terminated in accordance with Section 7 below.

5. This Proxy and Power of Attorney

shall be governed by and construed in accordance with the laws of the State of Delaware.

6. This Proxy and Power of Attorney

shall be binding upon, inure to the benefit of, and be enforceable by the successors and permitted assigns of the Parties hereto.

7. This Proxy and Power of

Attorney shall terminate and have no further force or effect solely upon the earlier to occur of: (a) the sale of all of the Covered Shares

by the Grantee, and (b) receipt by the Grantee of not less than sixty one days’ written notice by the Stockholder of its intent

to terminate. Further, this Proxy and Power of Attorney may not be amended or modified in any manner whatsoever except by writing by the

parties hereto, and such amendment shall not become effective for a period of not less than sixty one days’ from the date of such

amendment.

8. The Stockholder agrees and represents

that this Proxy and Power of Attorney is coupled with an interest sufficient in law to support an irrevocable power and, except as set

forth in 7. above, shall not be terminated by any act of the Stockholder, by lack of appropriate power or authority or by the occurrence

of any other event or events.

9. The Stockholder will, upon request,

execute and deliver any additional documents and take such actions as may reasonably be deemed by the Grantee to be necessary or desirable

to complete the Proxy and Power of Attorney granted herein or to carry out the provisions hereof.

10. If any term, provision, covenant,

or restriction of this Proxy and Power of Attorney is held by a court of competent jurisdiction to be invalid, void or unenforceable,

the remainder of the terms, provisions, covenants and restrictions of this Proxy and Power of Attorney shall remain in full force and

effect and shall not in any way be affected, impaired or invalidated.

11. This Proxy and Power of Attorney

may be executed in any number of counterparts, each of which shall be deemed to be an original but both of which together shall constitute

one and the same instrument.

IN

WITNESS WHEREOF, the parties have caused this Proxy and Power of Attorney to be duly executed on the date first above written.

| |

/s/

Jeffrey Bailey |

| |

Jeffrey

Bailey |

| |

|

| |

/s/

Garrett Kyle Bailey |

| |

Garrett

Kyle Bailey |

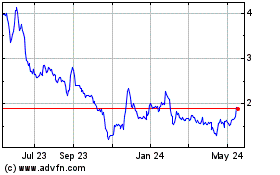

Carver Bancorp (NASDAQ:CARV)

Historical Stock Chart

From Jan 2025 to Feb 2025

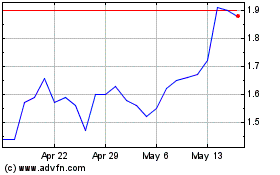

Carver Bancorp (NASDAQ:CARV)

Historical Stock Chart

From Feb 2024 to Feb 2025