UNITED STATES

SECURITIES AND EXCHANGE

COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

Proxy Statement Pursuant to Section 14(a) of

the

Securities Exchange Act of 1934

Filed

by the Registrant ¨

Filed

by a Party other than the Registrant x

Check the appropriate box:

| x |

Preliminary Proxy Statement |

| |

|

| ¨ |

Confidential, for Use of the Commission

Only (as permitted by Rule 14a-6(e)(2)) |

| |

|

| ¨ |

Definitive Proxy Statement |

| |

|

| ¨ |

Definitive Additional Materials |

| |

|

| ¨ |

Soliciting Material Pursuant to §240.14a-12 |

Carver Bancorp, Inc.

(Name of Registrant as Specified in Its Charter)

Dream Chasers Capital Group LLC

Gregory Lewis

Shawn Herrera

Kevin Winters

Jeffrey Bailey

Jeffrey Anderson

(Name of Person(s) Filing Proxy Statement if

other than the Registrant)

Payment of Filing Fee (Check all boxes that apply):

| x |

No fee required. |

| |

|

| ¨ |

Fee paid previously with preliminary

materials. |

| |

|

| ¨ |

Fee computed on table in exhibit required

by Item 25(b) per Exchange Act Rules 14a6(i)(1) and 0-11. |

PRELIMINARY COPY SUBJECT TO COMPLETION

2024 ANNUAL MEETING OF SHAREHOLDERS

OF

CARVER BANCORP, INC.

PROXY STATEMENT

OF

DREAM CHASERS CAPITAL GROUP LLC

GREGORY LEWIS

SHAWN HERRERA

KEVIN WINTERS

JEFFREY BAILEY

JEFFREY ANDERSON

PLEASE VOTE THE ENCLOSED BLUE UNIVERSAL

PROXY CARD FROM DREAM CHASERS TODAY—BY PHONE, BY

INTERNET OR BY SIGNING, DATING AND RETURNING

IT IN THE POSTAGE-PAID ENVELOPE PROVIDED

IMPORTANT

[●], 2024

To Our Fellow Carver Shareholders:

This Proxy Statement (this “Proxy

Statement”) and the enclosed BLUE universal proxy card are being furnished to shareholders of Carver Bancorp, Inc.

(“Carver” or the “Company”) in connection with the solicitation of proxies by Dream Chasers

Capital Group LLC (“Dream Chasers”), Gregory Lewis, a citizen of the United States of America, Shawn Herrera, a citizen

of the United States of America, Kevin Winters, a citizen of the United States of America, and Jeffrey Bailey, a citizen of the United

States of America (all of the foregoing, collectively, the “Dream Chasers Beneficial Owners”), and Jeff Anderson, a

citizen of the United States (collectively together with the Dream Chasers Beneficial Owners, the “Dream Chasers Group”

or the “Participants”), to be used at the 2024 annual meeting of shareholders of Carver, including any adjournments

or postponements thereof and any special meeting held in lieu thereof (the “2024 Annual Meeting”).

The Company has not yet publicly disclosed the date, time

and location of the 2024 Annual Meeting.

Once the Company publicly discloses such date, time and location,

the Participants intend to supplement this Proxy Statement with such information and file revised definitive materials with the

Securities and Exchange Commission (the “SEC”). This Proxy Statement and the enclosed BLUE

universal proxy card are first being furnished to shareholders on or about [●], 2024.

THIS SOLICITATION IS BEING MADE BY THE DREAM

CHASERS GROUP AND NOT ON BEHALF OF THE BOARD OF DIRECTORS OF THE COMPANY.

We are soliciting your proxy for the 2024 Annual Meeting

in respect of the following matters:

| 1. | Election of Jeffrey Bailey (“Jeffrey Bailey,” or “Mr. Bailey”) and Jeffrey Anderson (“Jeff

Anderson” or “Mr. Anderson” and with Jeffrey Bailey, each a “Dream Chasers Nominee”

and together the “Dream Chasers Nominees”) to serve as a director of the Company for a term of three years (“Proposal

1”); |

| 2. | Approval of the Carver Bancorp, Inc. Equity Incentive Plan (“Proposal 2”); |

| 3. | Ratification of the appointment of BDO USA, LLP as the Company’s independent auditors for fiscal year ending March 31,

2025 (“Proposal 3”); and |

| 4. | Advisory (non-binding) resolution to approve the compensation of the Named Executive Officers as described in the Company’s

proxy statement (“Proposal 4”). |

Except as set forth in this Proxy Statement, the

Dream Chasers Group is not aware of any other matter to be considered at the 2024 Annual Meeting. However, if the Dream Chasers Group

learns of any other proposals made at a reasonable time before the 2024 Annual Meeting, the Dream Chasers Group will either supplement

this Proxy Statement and provide shareholders with an opportunity to vote by proxy directly on such matters or will not exercise discretionary

authority with respect thereto. If other proposals are made thereafter, the persons named as proxies on the BLUE universal

proxy card solicited by the Dream Chasers Group will vote such proxies in their discretion with respect to such matters.

The Company has not yet disclosed the record date

for determining shareholders entitled to notice of and to vote at the 2024 Annual Meeting (the “Record Date”) nor has

Carver disclosed the number of outstanding shares of capital stock of the Company entitled to vote at the 2024 Annual Meeting as of the

Record Date. Once the Company publicly discloses such Record Date and the number of shares of capital stock of the Company outstanding

as of the Record Date, the Dream Chasers Group intends to supplement this Proxy Statement with such information and file revised definitive

materials with the SEC. Shareholders of record at the close of business on the Record Date will be entitled to vote at the 2024 Annual

Meeting. According to the Company’s Quarterly Report on Form 10-Q, filed on August 14, 2024 (the “Company’s

Form 10-Q”), as of August 13, 2024, there were 5,105,306 shares of common stock, par value $0.01 (the “Shares”)

outstanding. Each Share has one vote.

As of the date of this Proxy Statement, the Participant’s

beneficially own an aggregate of 497,774 Shares, representing approximately 9.8% of the Company’s outstanding Shares (based on information

disclosed in the Company’s Form 10-Q regarding the number of outstanding Shares).

The Dream Chasers Group is seeking your proxy to

vote “FOR” the election of Jeffrey Bailey and Jeff Anderson, to “WITHHOLD” on Kenneth J. Knuckles and Jillian

E. Joseph (the “Opposed Company Nominees”) and to vote “AGAINST” the Company’s “say-on-pay”

advisory (non-binding) resolution to approve the compensation of the Named Executive Officers as described in the Company’s Proxy

Statement in Proposal 4. The Dream Chasers Beneficial Owners intend to vote all of their Shares “FOR” the election of the

Dream Chasers Nominees, “WITHHOLD” on the Opposed Company Nominees, and “AGAINST” the Company’s “say-on-pay”

advisory (non-binding) resolution to approve the compensation of the Named Executive Officers as described in the Company’s Proxy

Statement in Proposal 4. The Dream Chasers Group makes no recommendation with respect to Proposals 2 and 3 and it will exercise its discretion

to cause your proxy to abstain from voting on Proposals 2 and 3 to the extent you have not indicated your vote on such Proposals. Otherwise,

the Dream Chasers Group will vote in accordance with your instructions provided on the BLUE universal proxy card that is

signed and returned, subject to the conditions discussed below.

3/30

The Dream Chasers Group and the Company will each

be using a universal proxy card for voting on the election of directors at the 2024 Annual Meeting, which will include the names of all

nominees for election to the Board.

Shareholders will have the ability to vote for

up to two nominees on the Dream Chasers Group’s enclosed BLUE universal proxy card. If you receive a BLUE

universal proxy card or voting instruction form, there is no need to use the Company’s White Proxy card or voting instruction form,

regardless of how you wish to vote. If you do vote on the White Proxy card or voting instruction form, we urge you to vote “FOR”

the Dream Chasers Group Nominees and “WITHHOLD” on the Opposed Company Nominees.

Shareholders are permitted to vote for any combination

of (up to two total) the Dream Chasers Nominees, Jeffrey Bailey and Jeff Anderson, and the Company’s nominees on the BLUE

universal proxy card. However, if shareholders choose to vote on any of the Company’s nominees, we recommend that shareholders “WITHHOLD”

on the Opposed Company Nominees. We believe the best opportunity for Jeffrey Bailey and Jeff Anderson to be elected is by voting “FOR”

Jeffrey Bailey and Jeff Anderson, and to “WITHHOLD” on the Opposed Company Nominees, on the BLUE universal proxy

card.

YOU

MAY VOTE “FOR” UP TO TWO NOMINEES IN TOTAL. IF YOU VOTE ON AT LEAST ONE NOMINEE BUT FEWER THAN TWO

NOMINEES IN PROPOSAL 1, YOUR SHARES WILL ONLY BE VOTED “FOR” THOSE NOMINEES YOU HAVE SO MARKED. IF YOU VOTE

“FOR” MORE THAN TWO NOMINEES ON PROPOSAL 1 ON EITHER THE BLUE PROXY CARD OR THE BLUE VOTING INSTRUCTION FORM, YOUR VOTES

ON PROPOSAL 1 WILL BECOME INVALID AND NOT BE COUNTED.

The Dream Chasers Group reserves the right to withdraw

the nomination of either of the Dream Chasers Nominees. In any such case, the Dream Chasers Group will give prompt notice to the Company

of any such withdrawal and the Dream Chasers Group will file and disclose to shareholders the relevant information. The Dream Chasers

Group has no reason to believe that Jeffrey Bailey and Jeff Anderson will be unable or unwilling to serve as director.

The

Dream Chasers Group Urges Shareholders to “WITHHOLD” on the Opposed Company Nominees

Due in part, to the nature of the SEC’s newly-adopted

universal proxy rules and the manner in which votes will be tabulated, to help ensure the election of Jeffrey Bailey and Jeff Anderson,

we recommend that shareholders vote “FOR” Jeffrey Bailey and Jeff Anderson and “WITHHOLD” on the

Opposed Company Nominee.

WE BELIEVE JEFFREY BAILEY

AND JEFF ANDERSON’S SIGNIFICANT EXPERTISE AND LONG TRACK RECORD OF BUSINESS EXPERIENCE WILL BE INVALUABLE TO THE COMPANY AS IT WORKS

TO OVERCOME ITS CHALLENGES. ACCORDINGLY, THE DREAM CHASERS GROUP URGES YOU TO VOTE YOUR BLUE UNIVERSAL PROXY CARD “FOR”

THE DREAM CHASERS NOMINEES, TO “WITHHOLD” ON THE OPPOSED COMPANY NOMINEES, AND TO VOTE “AGAINST” PROPOSAL

4. THE DREAM CHASERS GROUP MAKES NO RECOMMENDATION WITH RESPECT TO PROPOSALS 2 AND 3.

Other

Disclosures and Voting Information

The Participants represent that (i) they intend

to, or are part of a group which intends to, deliver a proxy statement and form of proxy to holders of at least the percentage of the

Company’s outstanding capital stock required to elect the Dream Chasers Nominees at the 2024 Annual Meeting, and (ii) they

intend to, or are part of a group which intends to, solicit the holders of shares representing at least 67% of the voting power of shares

entitled to vote on the election of directors in support of the Dream Chasers Nominees.

You may vote in person by attending the 2024 Annual

Meeting. Written ballots will be distributed to shareholders who wish to vote in person at the 2024 Annual Meeting. If you hold your Shares

through a bank, broker or other custodian, you must obtain a legal proxy from such bank, broker or other custodian in order to vote in

person at the meeting. In addition, as explained in the detailed instructions on your BLUE universal proxy card, there are

three other ways you may vote:

| 1. | Vote via the Internet by following the voting instructions on the BLUE universal proxy card or the voting instructions

provided by your broker, bank or other holder of record. Internet voting procedures are designed to authenticate your identity, allow

you to vote your Shares and confirm that your instructions have been properly recorded. Your Internet vote authorizes the named proxies

to vote your Shares in the same manner as if you had signed and returned a proxy card. If you submit your vote by Internet, you may incur

costs associated with electronic access, such as usage charges from Internet access providers and telephone companies; |

| 2. | Vote by telephone by following the voting instructions on the BLUE universal proxy card or the instructions provided

by your broker, bank or other holder of record. Your telephone vote authorizes the named proxies to vote your Shares in the same manner

as if you had signed and returned a proxy card; or |

| 3. | Sign, date and return the enclosed BLUE universal proxy card in the enclosed postage-paid envelope. We recommend that

you vote on the BLUE universal proxy card even if you plan to attend the 2024 Annual Meeting. |

IF YOU HAVE ALREADY VOTED USING THE COMPANY’S WHITE

PROXY CARD, YOU MAY REVOKE YOUR PREVIOUSLY SIGNED WHITE PROXY BY SIGNING AND RETURNING A LATER-DATED BLUE UNIVERSAL

PROXY CARD IN THE ENCLOSED POSTAGE-PAID ENVELOPE, BY DELIVERING A WRITTEN NOTICE OF REVOCATION TO THE DREAM CHASERS GROUP OR TO THE

SECRETARY OF THE COMPANY, OR BY INSTRUCTING US BY TELEPHONE OR VIA THE INTERNET AS TO HOW YOU WOULD LIKE YOUR SHARES VOTED

(INSTRUCTIONS ARE ON YOUR BLUE UNIVERSAL PROXY CARD). ONLY THE LATEST VALIDLY EXECUTED PROXY THAT YOU SUBMIT WILL BE

COUNTED.

HOLDERS OF SHARES AS OF

THE RECORD DATE ARE URGED TO SUBMIT A BLUE UNIVERSAL PROXY CARD EVEN IF YOUR SHARES WERE SOLD AFTER THE RECORD DATE.

IF YOUR SHARES ARE HELD IN THE

NAME OF A BROKERAGE FIRM, BANK, BANK NOMINEE OR OTHER INSTITUTION ON THE RECORD DATE, ONLY THAT INSTITUTION CAN VOTE THOSE SHARES

AND ONLY UPON RECEIPT OF YOUR SPECIFIC INSTRUCTIONS.

5/30

ACCORDINGLY, PLEASE CONTACT THE PERSON RESPONSIBLE

FOR YOUR ACCOUNT AND INSTRUCT THAT PERSON TO SIGN AND RETURN ON YOUR BEHALF THE BLUE UNIVERSAL PROXY CARD AS SOON AS POSSIBLE.

Dream Chasers has retained Okapi Partners LLC to

assist in communicating with shareholders in connection with the proxy solicitation and to assist in efforts to obtain proxies. If you

have any questions concerning this Proxy Statement, would like to request additional copies of this Proxy Statement or need help voting

your Shares, please contact:

Okapi Partners LLC

1212 Avenue of the Americas, 17th Floor

New York, New York 10036

Shareholders Call Toll-Free: +1 (877) 629-6356

Banks and Brokers Call Collect: +1 (212) 297-0720

Email: info@okapipartners.com

REASONS TO VOTE FOR THE DREAM CHASERS NOMINEES

The Dream Chasers Group believes it is crucially important to Make

Carver Great Again.

About nominee #1: Jeffrey (Jeff) Anderson

Jeffrey (Jeff) Anderson is 64 years old and recently retired after

spending over thirty years in banking and financial services. In his various roles, Mr. Anderson has proven to be a results-driven

and accomplished senior financial management executive and corporate officer with extensive experience in insurance, consumer banking,

expense management governance and execution, project management, budgeting, risk management, centers of excellence operations, asset management,

and compliance. Mr. Anderson possesses a successful track record of increasing corporate profitability and shareholder value by leading

the execution of competitive business strategies that increase revenues and reduce expenses on a global scale.

Most recently, Mr. Anderson was an executive director at J.P.

Morgan Chase, where he was responsible for global expense management initiatives to drive and track nearly $2 billion in cost reductions,

and was senior vice president for corporate planning at Bank of America.

Mr. Anderson served in a variety of senior roles at AIG for over

eight years, first as CFO of the company’s asset management support functions where he implemented expense management programs that

reduced spending by 15% in the unit and were replicated across AIG. He later served as Global Head of Expense Management, where

he created governance, policies and procedures, and spend and compliance reporting across all businesses, and developed a diversity council

and talent development initiatives. Finally, he served in Chief of Staff roles for the Chief Administrative Officer and the CEO

of the Global Consumer Insurance Business.

Prior to AIG, Mr. Anderson served in several CFO roles at JP Morgan

Chase, including for the Investment Banking Operations and Technology group and Treasury and Security Services Technology group.

He was also CFO for the Northeast Region Retail Banking organization, which included over 800 tri-state area banking centers and at the

time comprised an income statement with $3.7 billion in revenue, $1.7 billion in pretax earnings, a balance sheet of $100 billion in deposits

and investments, and $15 billion in loans.

Mr. Anderson was born and raised in Harlem. He currently

serves the Board of Directors of three Harlem-based non-profit organizations: The Mama Foundation for the Arts, the Harlem Goju Association

and YES Inc. He also serves on the Board of the Bergen Community College Foundation.

Mr. Anderson is a graduate of Baruch College, where he studied

accounting, and received his M.B.A. from the University of Michigan’s Ross School of Business.

About Nominee #2: Jeffrey John Bailey

Jeffrey John Bailey is Carver’s largest

individual shareholder.

Mr. Bailey is 58 years old and the CEO of Dunham Metal Processing

in Orange, California, a provider of specialized metal parts and components. The company was founded by Mr. Bailey’s grandfather

in 1962 and focused in its first two decades on manufacturing metal components for the bath and shower category, largely for customers

located in Southern California.

7/30

Mr. Bailey joined the company on a full-time basis in 1988, working

on the factory floor and assisting his grandfather in running the business. Facing challenging economic and market conditions, Mr. Bailey

immediately focused on sales, marketing and product development to diversify the business and ensure its long-term viability.

When Mr. Bailey joined the company, it had six employees working

one shift. Today, Dunham has 90 employees across three shifts. Mr. Bailey steadily added capabilities to meet additional needs for

customers, and today supplies a wide range of anodized, coated, plated and laser-engraved metal components for the automotive, maritime,

aerospace and medical equipment industries. The company now serves customers nationwide, and Mr. Bailey has presided over a 25x increase

in sales over the course of his tenure.

Mr. Bailey is also responsible for managing the company’s

banking relationships. He has deep experience establishing and managing a range of corporate and business banking accounts, including

lines of credit.

In addition to his role with Dunham, Bailey manages his family’s

extensive portfolio of real estate and investment holdings.

BACKGROUND TO THE SOLICITATION

The following is a chronology of material events leading up to this

proxy solicitation:

| · | On July 29, 2022, Dream Chasers Capital Group sent the Company a letter asking it to consider a potential

business combination with an innovative financial technology company. |

| · | On September 14, 2022, Carver acknowledged receipt of the July 29 letter and requested information

about Dream Chasers’ advisors on the proposal. |

| · | On November 11, 2022, Dream Chasers responded to the Company to provide the names of its legal and

banking advisors and suggest a meeting to discuss the proposal |

| · | On December 19, 2022, the Company responded to Dream Chasers and proposed a meeting after the Christmas

holiday. |

| · | On December 30, 2022, Dream Chasers responded and offered availability for a meeting in late January. |

| · | On May 12, 2023, Dream Chasers again responded to the Company to provide updated information on its

advisors and to suggest dates in June for a meeting. |

| · | In late May and early June of 2022, Dream Chasers and the Company corresponded on several occasions

to agree on a date for a meeting. |

| · | On June 12, 2023, Mr. Greg Lewis of Dream Chasers met with members of the Carver management

team, including then-CEO Michael Pugh, and members of the Board to discuss Dream Chasers’ proposal for a business combination to

drive growth and returns. |

| · | On June 23, 2023, responding to a request from the Company during the June 12 meeting, Dream

Chasers sent the Company a written summary of the business combination proposal that was discussed in the meeting. |

| · | On July 10, 2023, Dream Chasers sent the Company a follow-up email to ask about the status of the

proposal. |

| · | On July 10, 2023, Michael Pugh, the then-CEO of Carver, responded, indicating that a Board meeting

would be held in July during which the proposal would be discussed. |

| · | On August 7, 2023, Mr. Jeffrey Bailey emailed members of the Carver Board, including then-CEO

Michael Pugh, about his concerns over sales of Carver shares to the National Community Investment Fund and to Board members that diluted

existing shareholders. Mr. Bailey received no reply to his concerns. |

| · | On August 14, 2023, Dream Chasers sent the Company a letter, offering to purchase 35% of the common

stock of the Company for $2.75 - $3.00 per share. |

| · | On August 18, 2023, the Company sent Dream Chasers a letter rejecting the offer to purchase 35% of

the common stock of Carver. |

| · | On August 31, 2023, Dream Chasers issued a press release announcing its offer to purchase 35% of

the common stock of Carver. |

9/30

| · | On October 27, 2023, Dream Chasers sent the Company an email reiterating its offer to purchase 35%

of the common stock of Carver. |

| · | On November 20, 2023, Dream Chasers issued a press release announcing it had increased its offer

from $3.00 per share to $3.25 per share to acquire 35% of the common stock of Carver. |

| · | In November and December of 2023, and early January 2024, Dream Chasers followed up with

the Company several times about the offer to acquire up to 35% of the common stock of Carver, requested a meeting to discuss the offer,

and corresponded with the Company’s outside counsel to arrange a mutually agreeable time for a meeting. |

| · | On January 24, 2024, Mr. Greg Lewis of Dream Chasers met with certain members of the Board of Carver to discuss the proposal to purchase

up to 35% of the shares of common stock of Carver. At the meeting, Mr. Lewis also handed the Board a letter from Mr. Bailey to the Board,

expressing his support of Dream Chasers’ bid to acquire 35% of Carver. After the meeting, Dream Chasers followed up by email with

a list of action items and requests. |

| · | On January 25, 2024, Dream Chasers issued a press release announcing it had met with members of Carver’s

Board on January 24, 2024. |

| · | On January 31, 2024, Dream Chasers followed up with the Board to request a decision on the offer to purchase up to 35% of the

shares of the common stock of Carver. Later that day, the Company issued a press release and letter to shareholders rejecting the Dream

Chasers offer to purchase up to 35% of the shares of the common stock of Carver. |

| · | On July 12, 2024, Dream Chasers privately submitted to the Company its notice of director nomination to nominate the Dream Chasers

Nominees for election to the Board at the 2024 Annual Meeting (including any adjournments or postponements thereof or any special meeting

that may be called in lieu thereof). |

| · | On July 18, 2024, the Company sent Dream Chasers a letter confirming receipt of the nominations. |

| · | On July 23, 2024, Dream Chasers issued a press release announcing its nomination of the Dream Chasers

Nominees. |

| · | In August, September and early October of 2024, Dream Chasers’ outside counsel followed

up on several occasions to request a response to the nominations, and corresponded with the Company to determine a date for interviews

of the nominees. |

| · | On October 17, 2024, each of the Dream Chasers Nominees were interviewed by members of the Issuer’s

Nomination and Governance Committee. |

| · | On October 18, 2024, the Company filed a preliminary proxy statement for the 2024 Annual Meeting,

including opposing the election of the two Dream Chasers Nominees. |

| · | On October 24, 2024, the Dream Chasers Group filed this preliminary proxy statement with the SEC. |

PROPOSAL 1: ELECTION OF DIRECTORS

Based on the Company’s Proxy Statement, along

with other public filings and material contained on the Company’s website, two directors are to be elected to the Board at the 2024

Annual Meeting. The Dream Chasers Group recommends that shareholders elect Jeffrey Bailey and Jeff Anderson as directors of the Company

at the 2024 Annual Meeting. We therefore urge shareholders to vote “FOR” Jeffrey Bailey and Jeff Anderson and to “WITHHOLD”

on the Opposed Company Nominees.

Jeffrey Bailey and Jeff Anderson have consented

to being named in a Proxy Statement relating to the 2024 Annual Meeting as a nominee and to serving as a director of the Company if elected.

If elected, the initial term of Jeffrey Bailey and Jeff Anderson will be to serve until the annual meeting of stockholders held three

years next following and until his successor shall have been duly elected and qualified in accordance with the Bylaws. We have no knowledge

of any facts that would prevent a final determination by the Board that each of Jeffrey Bailey and Jeff Anderson is independent in accordance

with the corporate governance standards of the Company, the pertinent listing standards of NASDAQ and under paragraph (a)(1) of Item

407 of Regulation S-K. Jeffrey Bailey and Jeff Anderson satisfies all qualifications required by the Delaware General Corporation Law

(the “DGCL”) to be a director of the Company.

The Dream Chasers Group believes that Jeffrey Bailey

and Jeff Anderson’s significant expertise and long track record and successful business experience will be invaluable to Carver

as it works to overcome its challenges. Furthermore, because we believe that many of these challenges relate to the Company’s corporate

governance practices and lack of accountability, we believe that the addition of motivated independent directors, including Mr. Bailey

having a significant ownership stake, would help to bring an ownership mentality to the boardroom and increase transparency and accountability.

As members of the Board, Jeffrey Bailey and Jeff Anderson would seek to help the Company improve performance by enhancing corporate governance

practices, fixing operations and strategy and improving capital allocation.

The Dream Chasers Beneficial Owners intend to vote

all of their Shares “FOR” Jeffrey Bailey and Jeff Anderson and to “WITHHOLD” on the Opposed Company Nominees.

If both Jeffrey Bailey and Jeff Anderson are elected they will only represent two out of seven members of the Board, and if only one is

elected he will represent one out of seven members of the Board, and therefore there can be no assurance that either Jeffrey Bailey or

Jeff Anderson individually can implement the actions that they believe are necessary to enhance shareholder value.

Biographical Information of the Dream Chasers

Nominees

Set forth above in the section entitled Reasons

to Vote for the Dream Chasers Nominees is background information about each of Jeffrey Bailey and Jeff Anderson, including their name,

age, principal occupation and employment and public company directorships held during the past five years, as well as a description of

the qualifications, attributes and skills that especially qualify Jeffrey Bailey and Jeff Anderson to serve as a director of the Company.

That information has been furnished to us by the Dream Chasers Nominees. Each of the Dream Chasers Nominees is a citizen of the United

States of America. The nomination was made in a timely manner and in compliance with applicable provisions of the Company’s governing

instruments. Please see the section of this Proxy Statement titled “Information About the Participants” for additional information

about each of the Dream Chasers Nominees, including information about their beneficial ownership of Shares.

None of the organizations or corporations referenced

in the biographies of each of the Dream Chasers Nominees is a parent, subsidiary or other affiliate of the Company. Each of Jeffrey Bailey

and Jeff Anderson have consented to being named as a nominee in this Proxy Statement and to serving as a director of the Company, if elected.

The Dream Chasers Group reserves the right to withdraw the nomination of either of the Dream Chasers Nominees or any additional or substitute

nominee at any time, if applicable. In any such case, the Dream Chasers Group will give prompt notice to the Company of any such withdrawal

and the Dream Chasers Group will disclose to shareholders the relevant information.

11/30

Interests in the Solicitation

The Dream Chasers Nominees may be deemed to have

an interest in their nominations for election to the Board by virtue of the compensation that the Dream Chasers Nominees will receive

from the Company as a director, if elected to the Board, and as described below. We expect that the Dream Chasers Nominees, if elected,

will be indemnified for their service as directors of the Company to the same extent indemnification is provided to the current directors

of the Company under the Bylaws and the Company’s Amended and Restated Certificate of Incorporation and be covered by the policy

of insurance which insures the Company’s directors and officers (See the section entitled “Director Nominee Consent and Indemnification”

below).

The Participants could be considered to have an

indirect interest in this Proposal 1 (Election of the Dream Chasers Nominees as Directors), as described in further detail herein. Other

than as set forth in this Proxy Statement, no Participant, or any associate of any Participant, has any substantial interest, direct or

indirect, by security holdings or otherwise, in any matter to be acted upon at the 2024 Annual Meeting.

Mr. Lewis is the Manager and Chief Executive

Officer of Dream Chasers, and controls the investment and voting decisions of Dream Chasers with respect to any securities held by Dream

Chasers, including any interests in Shares held by it. Mr. Lewis is entitled to an incentive allocation from Dream Chasers, which

is customary in the investment management industry and is based on a percentage of the increase or decrease in the value of the investment

portfolio of Dream Chasers, of which interests in Shares form a part as of the date hereof. Mr. Lewis is also entitled to a management

fee based on a percentage of the total value of the investment portfolio of Dream Chasers.

Arrangements Between Dream Chasers Group and

the Dream Chasers Nominees

There are no arrangements or other agreements

that have been entered into between the Dream Chasers Group and any of the Dream Chasers Nominees with respect to any securities of

the Company.

Each of the Dream Chasers Nominees has executed

a written consent to being named in this Proxy Statement and to serving as a director, if elected.

Except as set forth in this subsection or elsewhere

in this Proxy Statement, (i) the Dream Chasers Nominees will not receive any compensation from any member of the Dream Chasers Group

to serve as nominees for election or as a director, if elected, of the Company, and (ii) there are no arrangements or understandings

between the Dream Chasers Nominees and any other party pursuant to which any such Dream Chasers Nominees were or are to be selected as

a director or nominee, as applicable.

You should refer to the Company’s definitive

Proxy Statement (the “Company’s Proxy Statement”) and form of proxy distributed by the Company

for the background, qualifications and other information concerning the Opposed Company Nominees. There is no assurance that any of the

Company’s other directors will continue to serve as directors if either of the Dream Chasers Group’s nominees are elected

to the Board. In the event that Jeffrey Bailey and /or Jeff Anderson is elected and that one or more of the Company’s directors

declines to serve with either of Jeffrey Bailey and Jeff Anderson, the Bylaws provide that the resulting vacancies may be filled by the

directors then in office, even if less than a quorum, or by a sole remaining director.

The Dream Chasers Group and the Company will each

be using a universal proxy card for voting on the election of directors at the 2024 Annual Meeting, which will include the names of all

nominees for election to the Board.

Shareholders will have the ability to vote for

up to two nominees on the Dream Chasers Group’s enclosed BLUE universal proxy card. There is no need to use the Company’s

white proxy card or voting instruction form, regardless of how you wish to vote.

Vote Required.

According to Article II of the Bylaws, in

contested elections such as this one, the affirmative vote of a plurality of the votes cast at the 2024 Annual Meeting is required for

the election of each director nominee (meaning that the two director nominees who receive the highest number of shares voted “FOR”

their election by the common shareholders will be elected to the Board). Because the directors will be elected by the affirmative vote

of a plurality of the votes, withhold votes will have no effect on the outcome of Proposal 1.

WE STRONGLY URGE YOU TO VOTE FOR THE

ELECTION OF JEFFREY BAILEY AND JEFF ANDERSON AND TO WITHHOLD ON THE OPPOSED COMPANY NOMINEES BY SIGNING, DATING AND RETURNING

YOUR BLUE UNIVERSAL PROXY CARD TODAY IN THE ENCLOSED POSTAGE-PAID ENVELOPE.

PROPOSAL 2: APPROVAL OF THE COMPANY’S

2024 EQUITY INCENTIVE PLAN

Vote Required

The approval of the Company’s 2024 Equity

Incentive Plan (the “Equity Incentive Plan”) requires the affirmative vote of the holders of a majority of the number of votes

cast at the Annual Meeting. Abstentions and broker non-votes will have no effect on the outcome of this proposal.

The Dream Chasers Group makes no recommendation

with respect to Proposal 2 and it will exercise its discretion to cause your proxy to abstain from voting on Proposal 2 to the extent

you have not indicated your vote on such Proposal.

PROPOSAL 3: RATIFICATION OF THE APPOINTMENT

OF AUDITORS

The ratification of the appointment of BDO USA,

LLP as the Company’s independent auditor requires the affirmative vote of the holders of a majority of the number of votes eligible

to be cast by the holders of shares entitled to vote at the 2024 Annual Meeting present, electronically or by proxy, and entitled to vote

at the Annual Meeting. Abstentions and broker non-votes will have no effect on the outcome of this proposal.

The Dream Chasers Group makes no recommendation

with respect to Proposal 3 and it will exercise its discretion to cause your proxy to abstain from voting on Proposal 3 to the extent

you have not indicated your vote on such Proposal.

13/30

PROPOSAL 4: ADVISORY VOTE TO APPROVE THE

COMPENSATION OF NAMED EXECUTIVE OFFICERS

According to the Company’s Proxy Statement,

the Board requests that the Stockholders approve the compensation of its Named Executive Officers (as described in the Company Proxy Statement)

pursuant to Section 14A of the Exchange Act. A discussion of this matter can be found in the Company’s Proxy Statement entitled

“Compensation of Directors and Executive Officers.” This vote is advisory and not binding on the Company, but the Company

Proxy Statement states that the Board and the Compensation Committee value the opinions of the Stockholders and will consider the outcome

of the vote in determining its executive compensation program.

“Say-on-Pay” Vote

The Company Proxy Statement provides that the Board

maintains a pay for performance philosophy that forms the foundation for all of the Compensation Committee’s decisions regarding

executive compensation.

The Company Proxy Statement states that the following

resolution is submitted for a Stockholder vote at the 2024 Annual Meeting:

RESOLVED, that the stockholders of Carver Bancorp, Inc.

(the “Company”) approve, on an advisory basis, the compensation of the Company’s Named Executive Officers disclosed

in this Proxy Statement, including the compensation tables and other narrative executive compensation disclosures set forth in this Proxy

Statement.

The Company Proxy Statement states that the advisory

vote, commonly referred to as a “Say-on-Pay” advisory vote, is non-binding on the Board of Directors.

Although non-binding, the Company’s Proxy Statement states that the Board of Directors and the Compensation Committee

value constructive dialogue on executive compensation and other important governance topics with our stockholders and encourages all stockholders

to vote their shares on this matter. It further states that the Board of Directors and the Compensation Committee will review the voting

results and take them into consideration when making future decisions regarding its executive compensation programs.

The Dream Chasers Group does not believe that the

Company’s performance justifies the executive officer compensation disclosed in the Company Proxy Statement. The Company’s

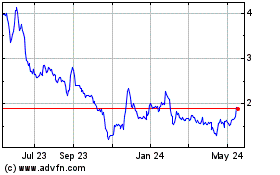

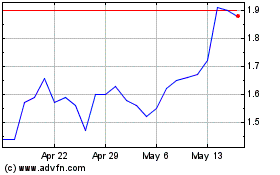

stock price reached an all-time low in October of 2023, and remains significantly depressed from historical levels. Total

shareholder returns over the last ten years do not justify the executive compensation that the Board has approved over that time.

Approval of this proposal requires the affirmative

vote of the holders of a majority of the number of votes eligible to be cast by the holders of shares present, electronically or by proxy,

and entitled to vote at the Annual Meeting. Abstentions and broker non-votes will have no effect on the outcome of this proposal. Your

vote is advisory and will not be binding upon the Board of Directors of the Company.

WE RECOMMEND A VOTE “AGAINST”

THIS PROPOSAL AND INTEND TO VOTE OUR DREAM CHASERS GROUP SHARES “AGAINST” THIS PROPOSAL.

ADDITIONAL PARTICIPANT INFORMATION

As described herein, the Participants in the proxy

solicitation are comprised of Dream Chasers Capital Group LLC, Gregory Lewis, Shawn Herrera, Kevin Winters, Jeffrey Bailey and Jeff Anderson.

Dream

Chasers is an investment vehicle with a business address of 26 Broadway, 8th Floor, New York, New York 10004. The

principal occupation of Mr. Lewis is serving as Chief Executive Officer and manager of Dream Chasers, with a business address c/o

Dream Chasers Capital Group, 26 Broadway, 8th Floor, New York, New York 10004. The principal occupation of Mr. Herrera

is the Chief Executive Officer of Mazda Computing, with a business address at 500 Los Viboras Road, Hollister, CA 95023. The principal

occupation of Mr. Winters is a business development executive at Isat-Tamaro, with a business address at 6452 Acacia Lane, Yorba

Linda, CA 92886. The principal occupation of Mr. Bailey is as Chief Executive Officer at Dunham Metal Processing, with a business

address at 936 N. Parker Street, Orange, CA 92867. The principal occupation of Mr. Anderson is a retired executive, with a business

address at 100 Park Avenue, Fort Lee, NJ 07430.

The Dream Chasers Beneficial Owners collectively

beneficially own an aggregate of 497,774 Shares, representing approximately 9.8% of the Company’s outstanding Shares (based on information

disclosed in the Company’s Form 10-Q regarding the number of outstanding Shares). Each member of the Dream Chasers Group is

a participant in this proxy solicitation. Of the Dream Chasers Group’s Shares, 100 are held by Dream Chasers as the Record Stockholder

in record name.

Applicable percentage ownership

is based on 5,105,306 Shares issued and outstanding as of August 13, 2024, which is the total number of Shares outstanding as reported

in the Issuer’s quarterly report on Form 10-Q filed with the Securities and Exchange Commission on August 14, 2024, adjusted

as required by rules promulgated by the SEC. These rules generally attribute beneficial ownership of securities to persons who

possess sole or shared voting power or investment power with respect to those securities.

For additional information about the Participants

and their beneficial ownership of Shares, as well as information regarding purchases and sales of securities of the Company during the

past two (2) years by the Participants in this solicitation, please see Annex A.

The Shares owned directly by each member of the

Dream Chasers Group were purchased with personal funds or, in the case of Dream Chasers, with its own capital.

Annex A shows the number of Shares that are beneficially

owned (within the meaning of Rule 13d-3 under the Exchange Act) by each Participant as of the date of this Proxy Statement.

Except as set forth in this subsection or in Annex A,

no Participant, and no associate of any Participant, owns beneficially, directly or indirectly, or of record but not beneficially,

any securities of the Company, or any parent or subsidiary of the Company, nor has any Participant purchased or sold any securities

of the Company within the last two years.

The

Dream Chasers Beneficial Owners, as members of a “group” for the purposes of Section 13(d)(3) of the Exchange Act,

may be deemed the beneficial owner of the Shares directly owned by the other Dream Chasers Beneficial Owners. Each Participant disclaims

beneficial ownership of such Shares except to the extent of his or its pecuniary interest therein.

Each of the Participants has an interest in the

election of directors at the 2024 Annual Meeting through the ownership of the Shares as described in this Proxy Statement or as a Dream

Chasers Nominee, as applicable.

15/30

Except as set forth in this Proxy Statement (including

the Annexes hereto), (i) during the past 10 years, no participant in this solicitation has been convicted in a criminal proceeding

(excluding traffic violations or similar misdemeanors); (ii) no participant in this solicitation directly or indirectly beneficially

owns any securities of the Company; (iii) no participant in this solicitation owns any securities of the Company which are owned

of record but not beneficially; (iv) no participant in this solicitation has purchased or sold any securities of the Company during

the past two years; (v) no part of the purchase price or market value of the securities of the Company owned by any participant

in this solicitation is represented by funds borrowed or otherwise obtained for the purpose of acquiring or holding such securities; (vi) no

participant in this solicitation is, or within the past year was, a party to any contract, arrangements or understandings with any person

with respect to any securities of the Company, including, but not limited to, joint ventures, loan or option arrangements, puts or calls,

guarantees against loss or guarantees of profit, division of losses or profits, or the giving or withholding of proxies; (vii) no

associate of any participant in this solicitation owns beneficially, directly or indirectly, any securities of the Company; (viii) no

participant in this solicitation owns beneficially, directly or indirectly, any securities of any parent or subsidiary of the Company;

(ix) no participant in this solicitation or any of his or its associates was a party to any transaction, or series of similar transactions,

since the beginning of the Company’s last fiscal year, or is a party to any currently proposed transaction, or series of similar

transactions, to which the Company or any of its subsidiaries was or is to be a party, in which the amount involved exceeds $120,000;

(x) no participant in this solicitation or any of his or its associates has any arrangement or understanding with any person with

respect to any future employment by the Company or its affiliates, or with respect to any future transactions to which the Company or

any of its affiliates will or may be a party; and (xi) no participant in this solicitation has a substantial interest, direct or

indirect, by securities holdings or otherwise, in any matter to be acted on at the Annual Meeting.

Legal Proceedings

To the knowledge of the Dream Chasers Group, there

are no material legal proceedings to which any Participant or the Dream Chasers Nominees or any of their respective associates are a party

adverse to the Company or any of its subsidiaries, or any material legal proceedings in which any of the Participants, or the Dream Chasers

Nominees or any of their respective associates have a material interest adverse to the Company or any of its subsidiaries.

PROXY INFORMATION

The enclosed BLUE universal proxy card

may be executed only by holders of record of Shares on the Record Date. If you were a shareholder of record on the Record Date, you

will retain your voting rights at the 2024 Annual Meeting even if you sell your Shares after the Record Date. Accordingly, it is

important that you vote the Shares held by you on the Record Date, or grant a proxy to vote your Shares on the BLUE

universal proxy card, even if you sell your Shares after the Record Date. The Shares represented by each BLUE

universal proxy card that is properly executed and returned to the Dream Chasers Group will be voted at the 2023 Annual Meeting in

accordance with the instructions marked thereon.

If you have signed the BLUE universal

proxy card and no marking is made, you will be deemed to have given a direction with respect to all of the Shares represented by the BLUE

universal proxy card (i) to vote “FOR” the election of Jeffrey Bailey and Jeff Anderson, and to “WITHHOLD”

on the Opposed Company Nominees and (ii) vote “AGAINST” Proposal 4. The Dream Chasers Group makes no recommendation with

respect to Proposals 2 and 3 and it will exercise its discretion to cause your proxy to abstain from voting on Proposals 2 and 3 to the

extent you have not indicated your vote on such Proposals. Otherwise, the Dream Chasers Group will vote in accordance with your instructions

provided on the BLUE universal proxy card that is signed and returned, subject to the conditions discussed below.

If you hold your Shares in the name of one or more

brokerage firms, banks or nominees, only they can vote your Shares and only upon receipt of your specific instructions. Accordingly, you

should contact the person responsible for your account and give instructions to them to sign and return a BLUE universal

proxy card representing your Shares. Note that any voting instruction form provided by Broadridge Financial Solutions may contain slightly

different formatting than any proxy card provided by the Dream Chasers Group.

REVOCATION OF PROXIES

Any shareholder of record may revoke or change

his or her proxy instructions at any time prior to the vote at the 2024 Annual Meeting by:

| · | submitting a properly executed, subsequently dated proxy card that will revoke all prior proxy cards, including any proxy cards which

solicit a proxy in favor of all of the incumbent directors; |

| · | instructing the Dream Chasers Group by telephone or via the Internet as to how you would like your shares voted (instructions are

on your BLUE universal proxy card) or instructing the Company in accordance with the Company’s instructions as to

how you would like your shares voted; |

| · | attending the 2024 Annual Meeting and withdrawing his or her proxy by voting in person (although attendance at the 2024 Annual Meeting

will not in and of itself constitute revocation of a proxy); or |

| · | delivering written notice of revocation either to the Dream Chasers Group, c/o Okapi Partners LLC, 1212 Avenue of the Americas, 17th

Floor, New York, New York 10036-1600, or the Corporate Secretary’s Office, 75 West 125th Street, New York, New York 10027,

or any other address provided by the Company. |

Although

a revocation is effective if delivered to the Company, the Dream Chasers Group requests that either the original or a copy of any revocation

be mailed to Dream Chasers Capital Group c/o Okapi Partners LLC, 1212 Avenue of the Americas, 17th

Floor, New York, New York 10036-1600, so that the Dream Chasers Group will be aware of all revocations and can more accurately determine

if and when the requisite proxies for the election of the Dream Chasers Nominee as a director have been received. The Dream Chasers Group

may contact shareholders who have revoked their proxies.

IF YOU PREVIOUSLY SIGNED AND

RETURNED A WHITE PROXY CARD TO THE COMPANY, THE DREAM CHASERS GROUP URGES YOU TO REVOKE IT BY (1) SIGNING, DATING AND RETURNING

THE BLUE UNIVERSAL PROXY CARD IN THE ENCLOSED POSTAGE-PAID ENVELOPE, (2) INSTRUCTING US BY TELEPHONE OR VIA THE INTERNET

AS TO HOW YOU WOULD LIKE YOUR SHARES VOTED, (3) ATTENDING THE 2024 ANNUAL MEETING AND VOTING IN PERSON OR (4) DELIVERING A

WRITTEN NOTICE OF REVOCATION TO THE DREAM CHASERS GROUP OR TO THE SECRETARY OF THE COMPANY.

THE

DREAM CHASERS GROUP AND THE COMPANY WILL EACH BE USING A UNIVERSAL PROXY CARD FOR VOTING ON THE ELECTION OF DIRECTORS AT THE 2024 ANNUAL

MEETING, WHICH WILL INCLUDE THE NAMES OF ALL NOMINEES FOR ELECTION TO THE BOARD. SHAREHOLDERS WILL HAVE THE ABILITY TO VOTE FOR UP TO

TWO NOMINEES ON THE DREAM CHASERS GROUP’S ENCLOSED BLUE UNIVERSAL PROXY CARD. IF YOU RECEIVE A BLUE

PROXY CARD OR VOTING INSTRUCTION FORM, THERE IS NO NEED TO USE THE COMPANY’S WHITE PROXY CARD OR VOTING INSTRUCTION FORM, REGARDLESS

OF HOW YOU WISH TO VOTE. IF YOU DO VOTE ON THE WHITE PROXY CARD, WE URGE YOU TO VOTE “FOR” THE DREAM CHASER GROUP NOMINEES

AND “WITHHOLD” ON THE OPPOSED COMPANY NOMINEES.

17/30

VOTING

For Proposal 1, the election of directors, according

to the Bylaws, the holders of a majority in voting power of the capital stock issued and outstanding and entitled to vote thereat, present

in person or represented by proxy, shall constitute a quorum at the 2024 Annual Meeting. Abstentions will be counted as present for purposes

of determining whether a quorum is present at the 2024 Annual Meeting, however abstentions and broker non-votes will have no effect on

the outcome of Proposal 1.

In contested elections such as this one, the affirmative

vote of a plurality of the votes cast at the 2024 Annual Meeting is required for the election of each director nominee (meaning that the

two director nominees who receive the highest number of shares voted “FOR” their election by the common shareholders will

be elected to the Board).

The affirmative vote of a majority of the votes

cast by the shareholders entitled to vote is required for the approval of Proposal 2, 3 and 4. Abstentions and broker non-votes will not

be taken into account in determining the outcome of the election and the votes on Proposals 2, 3 and 4 because abstentions and broker

non-votes will have no effect on the election or these proposals since such actions do not represent votes cast.

Delaware law provides for the authorization of

proxies by electronic means. Accordingly, you may submit your proxy by telephone or the Internet. To submit a proxy with voting instructions

by telephone please call the telephone number listed on the BLUE universal proxy card. Proxies may also be submitted over

the Internet. Please refer to the BLUE universal proxy card for the website information. In each case shareholders will

be required to provide the unique control number which has been printed on each shareholder’s BLUE universal proxy

card. In addition to the instructions that appear on the BLUE universal proxy card, step-by-step instructions will be provided

by a recorded telephone message for those shareholders submitting proxies by telephone, or at the designated website for those shareholders

submitting proxies over the Internet. Shareholders submitting their proxies with voting instructions by telephone or over the Internet

will receive confirmation on the telephone that their vote by telephone was successfully submitted, and may provide an email address for

confirmation that their vote by Internet was successfully submitted.

Under the rules and interpretations of NASDAQ,

if you receive proxy materials from or on behalf of both the Dream Chasers Group and the Company, brokers, banks and other nominees will

not be permitted to exercise discretionary authority regarding any of the proposals to be voted on at the Annual Meeting, whether “routine”

or not. Because the Dream Chasers Group has initiated a contested proxy solicitation, there will be no “routine” matters at

the Annual Meeting for any broker accounts that are provided with proxy materials by the Dream Chasers Group. As a result, there will

be no broker non-votes by such banks, brokers or other nominees with respect to such accounts. If you do not submit any voting instructions

to your broker, bank or other nominee with respect to such accounts, your shares in such accounts will not be counted in determining the

outcome of any of the proposals at the Annual Meeting, nor will your shares be counted for purposes of determining whether a quorum exists.

Broker non-votes will not be counted for purposes of determining whether a quorum is present or for voting purposes with regards to any

of the Proposals.

YOUR VOTE IS EXTREMELY IMPORTANT. WE URGE

YOU TO SIGN, DATE AND RETURN THE ENCLOSED BLUE UNIVERSAL PROXY CARD TODAY OR INSTRUCT US BY TELEPHONE OR VIA THE INTERNET TO

VOTE FOR THE ELECTION OF JEFFREY BAILEY AND JEFF ANDERSON AND TO “WITHHOLD” ON THE OPPOSED COMPANY

NOMINEES, AND TO VOTE “AGAINST” PROPOSAL 4.

COST AND METHOD OF SOLICITATION

The solicitation of proxies pursuant to this Proxy

Statement is being made by the Dream Chasers Group.

Dream

Chasers has entered into an agreement with Okapi Partners for solicitation and advisory services in connection with this solicitation,

for which Okapi Partners will receive a fee not to exceed $[●], together with reimbursement for its reasonable out-of-pocket

expenses, and will be indemnified against certain liabilities and expenses, including certain liabilities under the federal securities

laws. Okapi Partners will solicit proxies from individuals, brokers, banks, bank nominees and other institutional holders. The Dream Chasers

Group has requested banks, brokerage houses and other custodians, nominees and fiduciaries to forward all solicitation materials to the

beneficial owners of the shares they hold of record. Dream Chasers will reimburse these record holders for their reasonable out-of-pocket

expenses in so doing. It is anticipated that Okapi Partners will employ approximately [●] persons to solicit stockholders for the

Annual Meeting.

The

entire expense of soliciting proxies is being borne by Dream Chasers. Costs of this solicitation of proxies are currently estimated to

be approximately $[●] (including, but not limited to, fees for attorneys, solicitors and other advisors, and other costs

incidental to the solicitation). Dream Chasers estimates that through the date hereof its expenses in furtherance of, or in connection

with, the solicitation are approximately $[●]. The actual amount could be higher or lower depending on the facts and circumstances

arising in connection with any solicitation. Dream Chasers may seek reimbursement from the Company of all expenses it incurs in connection

with this solicitation but does not intend to submit the question of such reimbursement to a vote of security holders of the Company.

The Board, which will consist of two of seven

directors of the Board if Jeffrey Bailey and Jeff Anderson are elected, would be required to evaluate the requested reimbursement consistent

with their fiduciary duties to the Company and its shareholders. Costs related to the solicitation of proxies include expenditures for

attorneys, public relations, and other advisors, solicitors, printing, advertising, postage, transportation, litigation and other costs

incidental to the solicitation.

OTHER MATTERS AND ADDITIONAL

INFORMATION

The SEC has adopted rules that permit companies

and intermediaries (such as brokers and banks) to satisfy the delivery requirements for proxy statements and annual reports with respect

to two or more shareholders sharing the same address by delivering a single proxy statement addressed to those shareholders.

Once you have received notice from your bank or

broker that it will be householding communication to your address, householding will continue until you are notified otherwise or until

you revoke your consent. If, at any time, you no longer wish to participate in householding and would prefer to receive a separate proxy

statement and annual report, please notify your bank or broker and direct your request to the Corporate Secretary’s Office, 75 West

125th Street, New York, New York 10027.

Because Dream Chasers has initiated a contested

proxy solicitation, we understand that banks and brokers with account holders who are shareholders of the Company will not be householding

our proxy materials.

The SEC allows the “incorporation by reference”

of information into this Proxy Statement, which allows the disclosure of important information to you by referring you to another document

filed separately with the SEC. The information incorporated by reference is considered to be part of this Proxy Statement, except to the

extent that the information is superseded by information in this Proxy Statement.

19/30

Please refer to the Company’s Proxy Statement

and annual report for certain information and disclosure required by applicable law. Schedule II of this Proxy Statement contains information

regarding persons who beneficially own more than 5% of the shares and the ownership of the shares by the directors and management of the

Company.

Any statement contained in this Proxy Statement

or in a document incorporated or deemed to be incorporated by reference herein will be deemed to be modified or superseded for purposes

of this Proxy Statement to the extent that a statement contained herein or in any other subsequently filed document which also is or is

deemed to be incorporated by reference herein modifies or supersedes such statement. Any statement so modified or superseded will not

be deemed, except as so modified or superseded, to constitute a part of this Proxy Statement.

You should not assume that the information contained

in this Proxy Statement is accurate as of any date other than the date of this Proxy Statement, and the mailing of this Proxy Statement

to shareholders shall not create any implication to the contrary.

This Proxy Statement and all

other solicitation materials in connection with this Proxy Solicitation will be available on the internet, free of charge, on the SEC’s

website at https://www.sec.gov.

OTHER PROPOSALS

Except for those proposals set forth in this Proxy

Statement, we are not aware of any other matters to be considered at the 2024 Annual Meeting. If, however, the Dream Chasers Group learns

of any other proposals made at a reasonable time before the 2024 Annual Meeting, the Dream Chasers Group will either supplement this Proxy

Statement and provide shareholders with an opportunity to vote by proxy directly on such matters or will not exercise discretionary authority

with respect thereto. If other proposals are made thereafter, the persons named as proxies on the BLUE universal proxy card

solicited by the Dream Chasers Group will vote such proxies in their discretion with respect to such matters.

OTHER INFORMATION ABOUT THE COMPANY

Based upon documents publicly filed by the Company,

the mailing address of the principal executive offices of the Company is 75 West 125th Street, New York, New York 10027.

Certain information regarding the compensation

of directors and executive officers, certain shareholders’ beneficial ownership of more than 5% of the Company’s voting securities,

and certain other matters regarding the Company and its officers and directors is required to be contained in the Company’s Proxy

Statement. Certain other information regarding the 2024 Annual Meeting, as well as procedures for submitting proposals for consideration

at the 2024 annual meeting of shareholders of the Company, is also required to be contained in the Company’s Proxy Statement. Please

refer to the Company’s Proxy Statement to review this information. Please note that because the Dream Chasers Group was not involved

in the preparation of the Company’s Proxy Statement, the Dream Chasers Group cannot reasonably confirm the accuracy or completeness

of certain information contained in the Company’s Proxy Statement. As we may distribute our definitive proxy statement before the

Company files the Company’s Proxy Statement, we will provide any previously omitted information in a supplement filed as a revised

definitive proxy statement, including completing references to the date, time and location of the 2024 Annual Meeting, as well as information

relating to the Record Date. Dream Chasers anticipates that Additional information related to the foregoing information, as well as other

important information, will be available in the Company’s Proxy Statement, which should be available on the SEC’s website

at https://www.sec.gov.

The information concerning the Company and

the proposals referenced in the Company’s Proxy Statement contained in this Proxy Statement has been taken from, or is based

upon, publicly available documents on file with the SEC and other publicly available information. Although the Dream Chasers Group

has no knowledge that would indicate that statements relating to the Company contained in this Proxy Statement that are made in

reliance upon publicly available information are inaccurate or incomplete, to date we have not had access to the books and records

of the Company related to such information and statements, were not involved in the preparation of such information and statements

and are not in a position to verify such information and statements. All information relating to any person other than the

Participants is based only on the knowledge of the Dream Chasers Group.

WE HAVE OMITTED FROM THIS PROXY STATEMENT CERTAIN DISCLOSURE REQUIRED

BY APPLICABLE LAW THAT IS REQUIRED TO BE INCLUDED IN THE COMPANY PROXY STATEMENT RELATING TO THE 2024 ANNUAL MEETING BASED ON OUR RELIANCE

ON RULE 14A-5(C) UNDER THE EXCHANGE ACT. THIS DISCLOSURE INCLUDES, AMONG OTHER THINGS, CURRENT BIOGRAPHICAL INFORMATION ON THE COMPANY’S

DIRECTORS AND EXECUTIVE OFFICERS, INFORMATION CONCERNING EXECUTIVE COMPENSATION AND DIRECTOR COMPENSATION, INFORMATION CONCERNING

THE BOARD AND ITS COMMITTEES OF THE BOARD, INFORMATION CONCERNING CERTAIN RELATIONSHIPS AND RELATED PARTY TRANSACTIONS, INFORMATION

ABOUT THE COMPANY’S INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM, INFORMATION ON HOW TO ATTEND THE 2024 ANNUAL MEETING AND

VOTE IN PERSON, INFORMATION CONCERNING THE PROCEDURES FOR SUBMITTING STOCKHOLDER PROPOSALS AND DIRECTOR NOMINATIONS INTENDED FOR

CONSIDERATION AT THE 2025 ANNUAL MEETING AND FOR CONSIDERATION FOR INCLUSION IN THE COMPANY’S PROXY MATERIALS FOR THAT MEETING,

AND OTHER IMPORTANT INFORMATION. WE TAKE NO RESPONSIBILITY FOR THE ACCURACY OR COMPLETENESS OF ANY INFORMATION THAT WE EXPECT TO BE CONTAINED

IN THE PRELIMINARY OR DEFINITIVE COMPANY PROXY STATEMENT. EXCEPT AS OTHERWISE NOTED HEREIN, THE INFORMATION IN THIS PROXY STATEMENT CONCERNING

THE COMPANY HAS BEEN TAKEN FROM OR IS BASED UPON DOCUMENTS AND RECORDS ON FILE WITH THE SEC AND OTHER PUBLICLY AVAILABLE INFORMATION. STOCKHOLDERS

ARE DIRECTED TO REFER TO THE COMPANY PROXY STATEMENT FOR THE FOREGOING INFORMATION. STOCKHOLDERS CAN ACCESS THE COMPANY PROXY STATEMENT

AND ANY OTHER RELEVANT DOCUMENTS DISCLOSING THIS INFORMATION, WITHOUT COST, ON THE SEC’S WEBSITE AT WWW.SEC.GOV, OR BY WRITING TO

THE COMPANY’S CORPORATE SECRETARY, C/O CARVER BANCORP, INC., 75 WEST 125TH STREET, NEW YORK, NEW YORK 10027.

Dated:

[=], 2024

21/30

CAUTIONARY STATEMENT REGARDING FORWARD-LOOKING

STATEMENTS

This Proxy Statement contains forward-looking statements.

All statements contained in this Proxy Statement that are not clearly historical in nature or that necessarily depend on future events

are forward-looking, and the words “anticipate,” “believe,” “expect,” “potential,” “could,”

“opportunity,” “estimate,” “plan,” and similar expressions are generally intended to identify forward-looking

statements. The projected results and statements contained in this Proxy Statement that are not historical facts are based on current

expectations, speak only as of the date of this Proxy Statement and involve risks, uncertainties and other factors that may cause actual

results, performance or achievements to be materially different from any future results, performance or achievements expressed or implied

by such projected results and statements. Assumptions relating to the foregoing involve judgments with respect to, among other things,

future economic, competitive and market conditions and future business decisions, all of which are difficult or impossible to predict

accurately and many of which are beyond the control of the Dream Chasers Group. Although the Dream Chasers Group believes that the assumptions

underlying the projected results or forward-looking statements are reasonable as of the date of this Proxy Statement, any of the assumptions

could be inaccurate and therefore, there can be no assurance that the projected results or forward-looking statements included in this

Proxy Statement will prove to be accurate and therefore actual results could differ materially from those set forth in, contemplated by,

or underlying those forward looking statements. In light of the significant uncertainties inherent in the projected results and forward-looking

statements included in this Proxy Statement, the inclusion of such information should not be regarded as a representation as to future

results or that the objectives and strategic initiatives expressed or implied by such projected results and forward-looking statements

will be achieved. Except to the extent required by applicable law, the Dream Chasers Group will not undertake and specifically declines

any obligation to disclose the results of any revisions that may be made to any projected results or forward-looking statements in this

Proxy Statement to reflect events or circumstances after the date of such projected results or statements or to reflect the occurrence

of anticipated or unanticipated events.

Annex A

INFORMATION CONCERNING PARTICIPANTS IN THE SOLICITATION

Below are the number of Shares that are beneficially owned (within

the meaning of Rule 13d-3 under the Exchange Act) by each Participant as of the date of this Proxy Statement.1

| |

|

Dream Chasers beneficially owns 238,300 Shares. |

Percentage: Approximately

4.7%

| |

|

Herrera beneficially owns 81,100 Shares. |

Percentage: Approximately

1.6%

| |

|

Winters beneficially owns 157,000 Shares. |

Percentage: Approximately

3.1%

| |

|

Bailey beneficially owns 259,474 Shares, of which 161,200 Shares are jointly owned with his wife.4 |

Percentage: Approximately

5.1%

| |

|

Anderson does not own any Shares in the Company. |

Percentage: Approximately

0%

1 All percentage calculations for each of the Participants

beneficial ownership set forth herein are based upon the aggregate of 5,105,306 shares of Common Stock outstanding as of August 13, 2024,

as reported in the Issuer’s Quarterly Report on Form 10-Q filed with the SEC on August 14, 2024.

2 Gregory Lewis is the sole manager of Dream Chasers and

thereby may be deemed to have shared voting power and/or shared dispositive power, as applicable, with regard to, and therefore may be

deemed to beneficially own (within the meaning of Rule 13d-3 under the Exchange Act), the Shares beneficially owned by Dream Chasers.

3 Herrera and Winters have each granted Dream Chasers a

power of attorney to, among other things, vote their Shares pursuant to a Voting Agreement dated as of December 12, 2022.

4 Bailey has entered into a Proxy and Power of Attorney

that grants full voting and investment discretion over 98,800 Shares to Garrett Kyle Bailey. In total, Bailey owns an aggregate of 358,274

Shares, however beneficially owns for purposes of Section 13(d) 259,474 Shares.

23/30

SCHEDULE I

TRANSACTIONS IN SECURITIES OF THE COMPANY DURING

THE PAST TWO YEARS

The Shares held by the Participants are or may

be held in the ordinary course with other investment securities owned by each of them in comingled margin accounts with a prime broker,

which prime broker may, from time to time, extend margin credit to such Participant, subject to applicable federal margin regulations,

stock exchange rules and credit policies. The Shares referenced below that were or are held by the Participants were not purchased

using margin credit.

The following transaction history shows all transactions

by the Participants in Shares during the past two years.

| Security |

Date of Purchase/

Sale |

Shares Purchased/ (Sold) |

| |

DREAM CHASERS |

|

| |

|

|

| Common Stock |

5/12/2023 |

200 |

| |

|

|

| |

KEVIN WINTERS |

|

| |

|

|

| Common Stock |

11/14/2022 |

(4100) |

| |

|

|

| |

SHAWN HERRERA |

|

| |

|

|

| Common Stock |

9/11/2024 |

4000 |

| |

|

|

| |

JEFFREY BAILEY |

|

| Common Stock |

9/8/2023 |

500 |

| |

|

|

| Common Stock |

11/22/2023 |

2750 |

| |

|

|

| Common Stock |

11/27/2023 |

10000 |

| |

|

|

| Common Stock |

11/29/2023 |

5000 |

| |

|

|

| Common Stock |

11/30/2023 |

5000 |

| |

|

|

| Common Stock |

11/30/2023 |

5000 |

| |

|

|

| Common Stock |

12/5/2023 |

2926 |

| |

|

|

| Common Stock |

12/5/2023 |

1 |

| |

|

|

| Common Stock |

12/5/2023 |

600 |

| |

|

|

| Common Stock |

12/5/2023 |

172 |

| |

|

|

| Common Stock |

12/5/2023 |

1301 |

| Common Stock |

12/6/2023 |

5000 |

| |

|

|

| Common Stock |

12/7/2023 |

1000 |

| |

|

|

| Common Stock |

12/8/2023 |

5000 |

| |

|

|

| Common Stock |

12/15/2023 |

2000 |

| |

|

|

| Common Stock |

1/4/2024 |

5000 |

| |

|

|

| Common Stock |

1/8/2024 |

3184 |

| |

|

|

| Common Stock |

1/8/2024 |

801 |

| |

|

|

| Common Stock |

1/8/2024 |

800 |

| |

|

|

| Common Stock |

1/8/2024 |

215 |

| |

|

|

| Common Stock |

1/12/2024 |

100 |

| |

|

|

| Common Stock |

1/12/2024 |

900 |

| |

|

|

| Common Stock |

1/12/2024 |

5000 |

| |

|

|

| Common Stock |

1/19/2024 |

1142 |

| |

|

|

| Common Stock |

1/19/2024 |

3781 |

| |

|

|

| Common Stock |

1/19/2024 |

77 |

| |

|

|

| Common Stock |

1/19/2024 |

200 |

| |

|

|

| Common Stock |

1/19/2024 |

4300 |

| |

|

|

| Common Stock |

1/19/2024 |

500 |

| |

|

|

| Common Stock |

1/24/2024 |

1000 |

25/30

SCHEDULE II

SECURITY OWNERSHIP OF CERTAIN

BENEFICIAL OWNERS AND MANAGEMENT

The following table is reprinted from the Company’s Proxy Statement and

contains information regarding persons who beneficially own more than 5% of the shares of Common Stock and the ownership of

the shares by the directors and executive officers of the Company.5

Stock Ownership of Certain Beneficial Owners

| Name and Address of Beneficial Owners | |

|

Amount

of Shares

Owned and Nature of

Beneficial Ownership |

|

|

Percent of

Shares

of Common

Stock

Outstanding | |

| 5% Beneficial Stockholders | |

|

|

|

|

| | |

National Community Investment Fund

135 South

LaSalle Street, Suite 3025

Chicago, IL 60603 | |

|

399,821 |

(1) |

|

| 7.78 | % |

| | |

|

|

|

|

| | |

Jeffrey John Bailey

936 N, Parker Street

Orange, CA 92867 | |

|

278,524 |

(2) |

|

| 5.42 | % |

| (1) | Based on a Schedule 13G filed on July 21, 2023. |

| (2) | Based on a Schedule 13D filed on December 20, 2022. |

Stock Ownership of Management

| Name | |

Title | |

Amount

and Nature of

Beneficial Ownership of

Common Stock (1) | | |

Percent of Common

Stock Outstanding | |

| Lewis P. Jones III | |

Chairperson of the Board | |

| 1,500 | | |

| * | |

| Pazel G. Jackson, Jr. | |

Director | |

| 6,326 | | |

| * | |

| Colvin W. Grannum | |

Director | |

| 2,740 | | |

| * | |

| Kenneth J. Knuckles | |

Director | |

| 2,000 | | |

| * | |

| Craig C. MacKay | |

Interim President and Chief Executive Officer, Director | |

| 6,000 | | |

| * | |

| Jillian E. Joseph | |

Director | |

| 1,667 | | |

| * | |

| Robin L. Nunn | |

Director | |

| 1,000 | | |

| * | |

| Christina L. Maier | |

First Senior Vice President and Chief Financial Officer | |

| 13,000 | | |

| * | |

| Marc S. Winkler | |

Senior Vice President and Chief Administrative Officer | |

| 6,000 | | |

| | |

All directors and other executive

officers as a group (10 persons) | |

| |

| 57,591 | | |

| 1.12 | % |

* Less than

1% of outstanding Common Stock.

| (1) | Amounts of equity securities shown include shares of common stock subject to options exercisable within

60 days as follows: Mr. Jones – 1,000; Mr. Grannum – 1,000; Mr. Knuckles – 1,000; Mr. McKay –

1,000; Ms. Joseph – 667; all officers and directors as a group – 4,667. |

5 The beneficial ownership percentages listed in the Company’s

Proxy Statement with respect to Mr. Bailey are listed as of December 2022. For the most up to date information on Mr. Bailey’s

beneficial ownership, see Information Concerning the Participants in Annex A.

SPECIAL INSTRUCTIONS

Please review this Proxy Statement and the enclosed

materials carefully. YOUR VOTE IS VERY IMPORTANT, no matter how many or how few Shares you own.

| 1. | If your Shares are registered in your own name, please sign, date and mail the enclosed BLUE universal proxy card today

to Dream Chasers Capital Group LLC, c/o Okapi Partners LLC, in the postage-paid envelope provided or instruct us by telephone or via the

Internet today as to how you would like your Shares voted (instructions are on your BLUE universal proxy card). |

| 2. | If your Shares are held in the name of a brokerage firm, bank nominee or other institution, only it can sign a BLUE universal proxy card with respect