LOS ANGELES, April 26 /PRNewswire-FirstCall/ -- Cathay General

Bancorp (the "Company"), (NASDAQ:CATY), the holding company for

Cathay Bank (the "Bank"), today announced results for the first

quarter of 2007. STRONG FINANCIAL PERFORMANCE First Quarter 2007

First Quarter 2006 Net income $30.0 million $27.3 million Basic

earnings per share $0.58 $0.54 Diluted earnings per share $0.57

$0.54 Return on average assets 1.45% 1.67% Return on average

stockholders' equity 12.87% 14.06% Efficiency ratio 38.44% 36.07%

FIRST QUARTER HIGHLIGHTS * First quarter earnings increased $2.7

million, or 9.6%, compared to the same quarter a year ago. * Fully

diluted earnings per share reached $0.57, increasing 5.6% compared

to the same quarter a year ago. * Return on average assets was

1.45% for the quarter ended March 31, 2007, compared to 1.54% for

the quarter ended December 31, 2006 and compared to 1.67% for the

same quarter a year ago. * Return on average stockholders' equity

was 12.87% for the quarter ended March 31, 2007, compared to 13.03%

for the quarter ended December 31, 2006, and compared to 14.06% for

the same quarter a year ago. * Gross loans, excluding the loans

acquired through United Heritage Bank, increased by $110.6 million,

or 1.92% for the quarter to $5.9 billion at March 31, 2007. * The

Company completed the acquisition of United Heritage Bank at the

close of business on March 30, 2007. "We are pleased to report

solid earnings for the first quarter of 2007 despite a challenging

economic environment. Strong net interest income and an improvement

in the efficiency ratio were the main factors that contributed to

the solid first quarter results," commented Dunson Cheng, Chairman

of the Board, Chief Executive Officer, and President of the

Company. "We received the necessary regulatory approvals for our

new Hong Kong branch as of April 4, 2007 and expect the office to

open by the end of the second quarter. Our new Bellevue, Washington

branch is expected to open in May, 2007, followed by our new

Dallas, Texas, and Ontario, California branches early in the third

quarter," said Peter Wu, Executive Vice Chairman and Chief

Operating Officer. "In March, 2007, the Company's Board of

Directors approved a new stock repurchase program for the

repurchase of one million shares of its common stock, demonstrating

the Company's continuing commitment to effective capital management

and stockholder value. While loan growth has slowed, we are still

optimistic that 2007 should be another record year for Cathay

General Bancorp," concluded Dunson Cheng. INCOME STATEMENT REVIEW

The comparability of financial information is affected by our

acquisitions. Operating results include the operations of acquired

entities from the date of acquisition. Net interest income before

provision for loan losses Net interest income before provision for

loan losses increased to $72.8 million during the first quarter of

2007, or 11.7% higher than the $65.1 million during the same

quarter a year ago. The increase was due primarily to the increases

in loans and securities and higher loan prepayment fees of $0.9

million. The net interest margin, on a fully taxable-equivalent

basis, was 3.83% for the first quarter of 2007. The net interest

margin decreased 18-basis points from 4.01% in the fourth quarter

of 2006 and decreased 50-basis points from 4.33% in the first

quarter of 2006. The decrease in the net interest margin was

primarily as a result of the increases in investment securities

that had lower yields than loans, repricing of time deposits to

reflect higher market interest rates, and increased reliance on

more expensive wholesale borrowings. For the first quarter of 2007,

the yield on average interest-earning assets was 7.44% on a fully

taxable-equivalent basis, and the cost of funds on average

interest-bearing liabilities equaled 4.27%. In comparison, for the

first quarter of 2006, the yield on average interest-earning assets

was 6.94% and cost of funds on average interest-bearing liabilities

equaled 3.18%. The interest spread, defined as the difference

between the yield on average interest-earning assets and the cost

of funds on average interest-bearing liabilities, decreased

primarily due to the reasons discussed above. Provision for loan

losses The provision for loan losses was $1.0 million for the first

quarter of 2007 compared to $1.5 million for the first quarter of

2006 and to no provision for the fourth quarter of 2006. The

provision for loan losses was based on the review of the adequacy

of the allowance for loan losses at March 31, 2007. The provision

for loan losses represents the charge or credit against current

earnings that is determined by management, through a credit review

process, as the amount needed to establish an allowance that

management believes to be sufficient to absorb loan losses inherent

in the Company's loan portfolio. The following table summarizes the

charge-offs and recoveries for the quarters as indicated: For the

three months ended, March 31, March 31, December 31, (Dollars in

thousands) 2007 2006 2006 Charge-offs $3,281 $265 $1,185 Recoveries

2,477 241 342 Net Charge-offs (Recoveries) $804 $24 $843

Non-interest income Non-interest income, which includes revenues

from depository service fees, letters of credit commissions,

securities gains (losses), gains (losses) on loan sales, wire

transfer fees, and other sources of fee income, was $5.9 million

for the first quarter of 2007, an increase of $809,000, or 15.9%,

compared to the non-interest income of $5.1 million for the first

quarter of 2006. For the first quarter of 2007, the Company

recorded net securities gains of $191,000 compared to net

securities gains of $27,000 for the same quarter in 2006. Letters

of credit commissions increased $223,000, or 20.9%, to $1.3 million

in the first quarter of 2007 from $1.1 million in the same quarter

of 2006 due primarily to increases in export letters of credit

commissions and documentary collection commissions due in part to

the acquisition of Great Eastern Bank in April 2006. Depository

service fees increased $91,000, or 7.3%, from $1.26 million in the

first quarter of 2006 to $1.35 million in the first quarter of 2007

due primarily to the increases in overdraft and non-sufficient fund

charges. In addition, other operating income increased $331,000, or

12.2%, to $3.1 million in the first quarter of 2007 from $2.7

million in the same quarter a year ago primarily due to increases

in loan referral fees of $356,000, safe deposit box commissions of

$156,000, wealth management commissions of $138,000, wire transfer

fees of $121,000 and other miscellaneous income of $181,000 offset

by a decrease in warrant income of $883,000. Non-interest expense

Non-interest expense increased $4.9 million, or 19.4%, to $30.2

million in the first quarter of 2007 compared to the same quarter a

year ago primarily due to increases in salaries and employee

benefits expenses, occupancy expenses, and computer and equipment

expenses. The efficiency ratio was 38.44% for the first quarter of

2007 compared to 36.07% in the year ago quarter and 38.82% for the

fourth quarter of 2006. The increase of non-interest expense from

the first quarter a year ago to the first quarter of 2007 was

primarily due to the acquisitions of Great Eastern Bank and New

Asia Bancorp in 2006, and a combination of the following: *

Salaries and employee benefits increased $2.9 million, or 20.9%,

from $14.04 million in the first quarter of 2006 to $16.98 million

in the first quarter of 2007 due primarily to increases in

salaries, payroll taxes, and benefits of $2.5 million. * Occupancy

expenses increased $688,000, or 33.1%, due to increases in

depreciation expenses, property taxes, rent expenses, utility

expenses and repair and maintenance expenses due to acquisitions. *

Computer and equipment expenses increased $615,000, or 38.2%, due

to the increase in software license fees under a new data

processing contract and in depreciation expenses. * Marketing

expenses increased $206,000, or 29.6%, in the first quarter of 2007

compared to the same quarter a year ago due to increased donations,

sponsorships, and charitable contributions. * OREO expenses

increased $159,000 due to an additional writedown recorded in

connection with the sale of a property which closed on April 20,

2007. * Amortization of core deposit intangibles increased

$364,000, or 26.0%, due to the acquisitions completed during 2006.

* Other operating expenses increased $192,000, or 8.6%, primarily

due to increases in printing and supply expenses and higher

operating losses. Offsetting the above increases were a $355,000,

or 27.3%, decrease in operations of affordable housing investments

primarily due to a $500,000 cash distribution from a low income

housing partnership which had been fully amortized in previous

years. Income taxes The effective tax rate was 36.8% for the first

quarter of 2007, compared to 37.0% for the same quarter a year ago

and 36.4% for the full year 2006. The FASB issued Interpretation

No. 48 "Accounting for Uncertainty in Income Taxes" ("FIN 48")

which requires that the amount of recognized tax benefit should be

the maximum amount which is more-likely-than-not to be realized and

that amounts previously recorded that do not meet the requirements

of FIN 48 be charged against retained earnings. As of December 31,

2006, the Company reflected a $12.1 million net state tax

receivable related to payments it made in April 2004 under the

Voluntary Compliance Initiative program of the California Franchise

Tax Board for tax deductions related to its regulated investment

company for the years 2000, 2001, and 2002. The Company has

determined that its refund claim related to its regulated

investment company is not more-likely-than-not to be realized and

consequently, included the $7.9 million after tax amount related to

its refund claim in its $8.5 million total cumulative effect

adjustment for FIN 48 as an adjustment to the opening balance of

retained earnings as of the January 1, 2007, effective date of FIN

48. BALANCE SHEET REVIEW Total assets increased by $662.3 million,

or 8.3%, to $8.7 billion at March 31, 2007 from year-end 2006 of

$8.0 billion. The increase in total assets was represented

primarily by increases in investment securities, reverse repurchase

agreements and loans funded by increases in repurchase agreements

and FHLB borrowings. Securities purchased under agreements to

resell increased $150.0 million and long-term certificates of

deposit increased $50.0 million during the first quarter due to

attractive rates available on these investments. Investment

securities increased by $338.0 million during the first quarter due

to purchases of callable agency securities which provided

collateral for repurchase agreements. The growth of gross loans to

$5.9 billion as of March 31, 2007, from $5.7 billion as of December

31, 2006, represents an increase of $149.2 million, or 2.6%, of

which $38.6 million resulted from the acquisition of United

Heritage Bank on March 30, 2007. The changes in the loan

composition from December 31, 2006, are presented below: Type of

Loans: March 31, 2007 December 31, 2006 % Change (Dollars in

thousands) Commercial $1,258,234 $1,243,756 1 Residential mortgage

475,463 455,949 4 Commercial mortgage 3,341,377 3,226,658 4 Equity

lines 114,137 118,473 (4) Real estate construction 687,989 685,206

0 Installment 16,212 13,257 22 Other 3,303 4,247 (22) Gross loans

and leases $5,896,715 $5,747,546 3 Allowance for loan losses

(65,317) (64,689) 1 Unamortized deferred loan fees (11,354)

(11,984) (5) Total loans and leases, net $5,820,044 $5,670,873 3 At

March 31, 2007, total deposits increased $49.4 million, or 0.9%, to

$5.72 billion from December 31, 2006, of $5.68 billion, due

primarily to $54.2 million from the acquisition of United Heritage

Bank. The changes in the deposit composition from December 31,

2006, are presented below: Deposits March 31, 2007 December 31,

2006 % Change (Dollars in thousands) Non-interest-bearing demand

$778,965 $781,492 (0) NOW 236,601 239,589 (1) Money market 677,406

657,689 3 Savings 351,432 358,827 (2) Time deposits under $100,000

1,032,774 1,007,637 2 Time deposits of $100,000 or more 2,647,562

2,630,072 1 Total deposits $5,724,740 $5,675,306 1 At March 31,

2007, brokered deposits increased $21.1 million to $268.8 million

from $247.7 at December 31, 2006. Securities sold under agreement

to repurchase increased $338.3 million from $400.0 million at

December 31, 2006, to $738.3 million at March 31, 2007. Advances

from the Federal Home Loan Bank increased $260.0 million to $974.7

million at March 31, 2007, compared to $714.7 million at December

31, 2006. Federal funds purchased decreased $37.0 million to $13.0

million at March 31, 2007, from $50.0 million at December 31, 2006.

On March 30, 2007, Cathay General Bancorp issued $46.4 million of

junior subordinated debt which generated $45.0 million of Tier 1

capital. ASSET QUALITY REVIEW Non-performing assets to gross loans

and other real estate owned was 0.63% at March 31, 2007, compared

to 0.62% at December 31, 2006. Total non-performing assets

increased $1.6 million, or 4.6%, to $37.2 million at March 31,

2007, compared with $35.6 million at December 31, 2006, primarily

due to a $10.1 million increase in non-accrual loans, including

$0.6 million from the acquisition of United Heritage Bank, offset

by a $7.7 million decrease in accruing loans past due 90 days or

more and by a $748,000 decrease in OREO. Included in nonaccrual

loans at March 31, 2007 was one well-secured land loan for $12.0

million which was reduced by a $8.5 million payment received on

April 26, 2007 and the remaining $3.5 million is expected to be

repaid in full by early May, 2007. In addition, on April 20, 2007,

the sale of a $4.1 million OREO was completed at its recorded book

value as of March 31, 2007. The allowance for loan losses amounted

to $65.3 million at March 31, 2007, and represented the amount that

the Company believes to be sufficient to absorb loan losses

inherent in the Company's loan portfolio. The allowance for loan

losses represented 1.11% of period-end gross loans and 200% of

non-performing loans at March 31, 2007. The comparable ratios were

1.13% of gross loans and 213% of non-performing loans at December

31, 2006. Results of the changes to the Company's non-performing

assets and troubled debt restructurings are highlighted below:

(Dollars in thousands) March 31, 2007 December 31, 2006 % Change

Non-performing assets Accruing loans past due 90 days or more $262

$8,008 (97) Non-accrual loans 32,462 22,322 45 Total non-performing

loans 32,724 30,330 8 Other real estate owned 4,511 5,259 (14)

Total non-performing assets $37,235 $35,589 5 Troubled debt

restructurings $955 $955 -- CAPITAL ADEQUACY REVIEW At March 31,

2007, the Tier 1 risk-based capital ratio of 9.40%, total

risk-based capital ratio of 10.92%, and Tier 1 leverage capital

ratio of 8.78%, continue to place the Company in the "well

capitalized" category, which is defined as institutions with a Tier

1 risk-based capital ratio equal to or greater than 6%, a total

risk-based capital ratio equal to or greater than 10%, and a Tier 1

leverage capital ratio equal to or greater than 5%. At December 31,

2006, the Company's Tier 1 risk-based capital ratio was 9.40%, the

total risk-based capital ratio was 11.00%, and Tier 1 leverage

capital ratio was 8.98%. During the first quarter of 2007, the

Company repurchased 877,903 shares of its common stock for $29.9

million, or $34.11 average cost per share. No shares were

repurchased during 2006. On March 6, 2007, the Company completed

the March 18, 2005, repurchase program with 1.0 million shares of

its common stock repurchased for $33.9 million, or $33.91 average

cost per share. On March 7, 2007, the Company announced a new

program to repurchase an additional 1.0 million shares of its

common stock. At March 31, 2007, 573,800 shares remain under the

Company's March 7, 2007 repurchase program. ABOUT CATHAY GENERAL

BANCORP Cathay General Bancorp is the holding company for Cathay

Bank, a California state-chartered bank. Founded in 1962, Cathay

Bank offers a wide range of financial services. Cathay Bank

currently operates 30 branches in California, nine branches in New

York State, one in Massachusetts, one in Houston, Texas, two in

Washington State, three in Chicago, Illinois, one in New Jersey, a

loan production office in Dallas and representative offices in

Taipei, Hong Kong, and Shanghai. Cathay Bank's website is found at

http://www.cathaybank.com/. FORWARD-LOOKING STATEMENTS AND OTHER

NOTICES Statements made in this press release, other than

statements of historical fact, are forward-looking statements

within the meaning of the applicable provisions of the Private

Securities Litigation Reform Act of 1995 regarding management's

beliefs, projections, and assumptions concerning future results and

events. These forward-looking statements may include, but are not

limited to, such words as "believes," "expects," "anticipates,"

"intends," "plans," "estimates," "may," "will," "should," "could,"

"predicts," "potential," "continue," or the negative of such terms

and other comparable terminology or similar expressions.

Forward-looking statements are not guarantees. They involve known

and unknown risks, uncertainties, and other factors that may cause

the actual results, performance, or achievements of Cathay General

Bancorp to be materially different from any future results,

performance, or achievements expressed or implied by such

forward-looking statements. Such risks and uncertainties and other

factors include, but are not limited to, adverse developments or

conditions related to or arising from: expansion into new market

areas; acquisitions of other banks, if any; fluctuations in

interest rates; demographic changes; earthquake or other natural

disasters; competitive pressures; deterioration in asset or credit

quality; changes in the availability of capital; legislative and

regulatory developments; changes in business strategy; and general

economic or business conditions in California and other regions

where Cathay Bank has operations. These and other factors are

further described in Cathay General Bancorp's Annual Report on Form

10-K for the year ended December 31, 2006, its reports and

registration statements filed with the Securities and Exchange

Commission ("SEC") and other filings it makes in the future with

the SEC from time to time. Cathay General Bancorp has no intention

and undertakes no obligation to update any forward-looking

statements or to publicly announce the results of any revision of

any forward-looking statement to reflect future developments or

events. Cathay General Bancorp's filings with the SEC are available

to the public from commercial document retrieval services and at

the website maintained by the SEC at http://www.sec.gov/, or by

request directed to Cathay General Bancorp, 777 N. Broadway, Los

Angeles, CA 90012, Attention: Investor Relations (213) 625-4749.

CATHAY GENERAL BANCORP CONSOLIDATED FINANCIAL HIGHLIGHTS

(Unaudited) Three months ended March 31, (Dollars in thousands,

except per share data) 2007 2006 % Change FINANCIAL PERFORMANCE Net

interest income before provision for loan losses $72,752 $65,141 12

Provision for loan losses 1,000 1,500 (33) Net interest income

after provision for loan losses 71,752 63,641 13 Non-interest

income 5,884 5,075 16 Non-interest expense 30,229 25,326 19 Income

before income tax expense 47,407 43,390 9 Income tax expense 17,441

16,054 9 Net income $29,966 $27,336 10 Net income per common share:

Basic $0.58 $0.54 7 Diluted $0.57 $0.54 6 Cash dividends paid per

common share $0.09 $0.09 -- SELECTED RATIOS Return on average

assets 1.45% 1.67% (13) Return on average stockholders' equity

12.87% 14.06% (8) Efficiency ratio 38.44% 36.07% 7 Dividend payout

ratio 15.60% 16.53% (6) YIELD ANALYSIS (Fully taxable equivalent)

Total interest-earning assets 7.44% 6.94% 7 Total interest-bearing

liabilities 4.27% 3.18% 34 Net interest spread 3.17% 3.76% (16) Net

interest margin 3.83% 4.33% (12) CAPITAL RATIOS March 31, March 31,

December 31, 2007 2006 2006 Tier 1 risk-based capital ratio 9.40%

10.26% 9.40% Total risk-based capital ratio 10.92% 11.31% 11.00%

Tier 1 leverage capital ratio 8.78% 9.61% 8.98% CATHAY GENERAL

BANCORP CONDENSED CONSOLIDATED BALANCE SHEETS (Unaudited) (In

thousands, except share and per share data) March 31, 2007 December

31, 2006 % change Assets Cash and due from banks $93,191 $114,798

(19) Federal funds sold 3,912 18,000 (78) Cash and cash equivalents

97,103 132,798 (27) Short-term investments 15,525 16,379 (5)

Securities purchased under agreements to resell 150,000 -- 100

Long-term certificates of deposit 50,000 -- 100 Securities

available-for-sale (amortized cost of $1,873,558 in 2007 and

$1,543,667 in 2006) 1,860,194 1,522,223 22 Trading securities 5,316

5,309 0 Loans 5,896,715 5,747,546 3 Less: Allowance for loan losses

(65,317) (64,689) 1 Unamortized deferred loan fees, net (11,354)

(11,984) (5) Loans, net 5,820,044 5,670,873 3 Federal Home Loan

Bank stock 50,094 34,348 46 Other real estate owned, net 4,511

5,259 (14) Affordable housing investments, net 85,623 87,289 (2)

Premises and equipment, net 75,352 72,934 3 Customers' liability on

acceptances 24,987 27,040 (8) Accrued interest receivable 44,605

39,267 14 Goodwill 320,500 316,752 1 Other intangible assets, net

41,610 42,987 (3) Other assets 43,315 53,050 (18) Total assets

$8,688,779 $8,026,508 8 Liabilities and Stockholders' Equity

Deposits Non-interest-bearing demand deposits $778,965 $781,492 (0)

Interest-bearing deposits: NOW deposits 236,601 239,589 (1) Money

market deposits 677,406 657,689 3 Savings deposits 351,432 358,827

(2) Time deposits under $100,000 1,032,774 1,007,637 2 Time

deposits of $100,000 or more 2,647,562 2,630,072 1 Total deposits

5,724,740 5,675,306 1 Federal funds purchased 13,000 50,000 (74)

Securities sold under agreement to repurchase 738,300 400,000 85

Advances from the Federal Home Loan Bank 974,680 714,680 36 Other

borrowings from financial institutions 10,000 10,000 -- Other

borrowings from affordable housing investments 19,777 19,981 (1)

Long-term debt 150,517 104,125 45 Acceptances outstanding 24,987

27,040 (8) Minority interest in consolidated subsidiaries 8,500

8,500 -- Other liabilities 85,640 73,802 16 Total liabilities

7,750,141 7,083,434 9 Commitments and contingencies -- -- -- Total

stockholders' equity 938,638 943,074 (0) Total liabilities and

stockholders' equity $8,688,779 $8,026,508 8 Book value per share

$18.35 $18.16 1 Number of common stock shares outstanding

51,154,356 51,930,955 (1) CATHAY GENERAL BANCORP CONDENSED

CONSOLIDATED STATEMENTS OF INCOME AND COMPREHENSIVE INCOME

(Unaudited) Three months ended March 31, (Dollars in thousands,

2007 2006 except per share data) INTEREST AND DIVIDEND INCOME Loan

receivable, including loan fees $114,179 $90,086 Securities

available-for-sale - taxable 21,815 13,146 Securities

available-for-sale - nontaxable 599 722 Federal Home Loan Bank

stock 509 348 Agency preferred stock 164 209 Federal funds sold and

securities purchased under agreements to resell 3,802 28 Deposits

with banks 786 67 Total interest and dividend income 141,854

104,606 INTEREST EXPENSE Time deposits of $100,000 or more 31,152

21,438 Other deposits 17,987 9,893 Securities sold under agreements

to repurchase 5,717 2,513 Advances from Federal Home Loan Bank

11,781 3,799 Long-term debt 1,976 1,041 Short-term borrowings 489

781 Total interest expense 69,102 39,465 Net interest income before

provision for loan losses 72,752 65,141 Provision for loan losses

1,000 1,500 Net interest income after provision for loan losses

71,752 63,641 NON-INTEREST INCOME Securities gains, net 191 27

Letters of credit commissions 1,292 1,069 Depository service fees

1,346 1,255 Other operating income 3,055 2,724 Total non-interest

income 5,884 5,075 NON-INTEREST EXPENSE Salaries and employee

benefits 16,977 14,040 Occupancy expense 2,768 2,080 Computer and

equipment expense 2,225 1,610 Professional services expense 1,728

1,641 FDIC and State assessments 259 249 Marketing expense 901 695

Other real estate owned expense 244 85 Operations of affordable

housing investments 944 1,299 Amortization of core deposit

intangibles 1,765 1,401 Other operating expense 2,418 2,226 Total

non-interest expense 30,229 25,326 Income before income tax expense

47,407 43,390 Income tax expense 17,441 16,054 Net income 29,966

27,336 Other comprehensive gain (loss), net of tax 4,683 (6,839)

Total comprehensive income $34,649 $20,497 Net income per common

share: Basic $0.58 $0.54 Diluted $0.57 $0.54 Cash dividends paid

per common share $0.09 $0.09 Basic average common shares

outstanding 51,684,754 50,226,768 Diluted average common shares

outstanding 52,295,229 50,797,859 CATHAY GENERAL BANCORP AVERAGE

BALANCES - SELECTED CONSOLIDATED FINANCIAL INFORMATION (Unaudited)

For the three months ended, (Dollars in thousands) March 31, 2007

March 31, 2006 December 31, 2006 Interest- earning Average Average

Average Average Average Average assets Balance Yield/Rate Balance

Yield/Rate Balance Yield/Rate (1)(2) (1)(2) (1)(2) Loans and leases

(1) $5,787,959 8.00% $4,838,651 7.55% $5,628,885 8.10% Taxable

securities 1,578,706 5.60% 1,161,798 4.59% 1,442,358 5.44%

Tax-exempt securities (2) 75,549 6.16% 86,755 6.54% 77,977 6.86%

FHLB & FRB stock 44,957 4.59% 29,756 4.74% 34,917 5.62% Federal

funds sold and securities purchased under agreements to resell

217,662 7.08% 2,622 4.33% 2,744 5.06% Deposits with banks 47,822

6.67% 19,340 1.41% 13,068 3.67% Total interest- earning assets

$7,752,655 7.44% $6,138,922 6.94% $7,199,949 7.53% Interest-bearing

liabilities Interest-bearing demand deposits $232,656 1.26%

$242,462 0.95% $231,415 1.27% Money market 666,454 3.08% 575,759

2.30% 636,143 2.94% Savings deposits 344,336 1.00% 357,795 0.77%

359,894 0.99% Time deposits 3,654,859 4.72% 3,095,301 3.51%

3,609,594 4.61% Total interest- bearing deposits $4,898,305 4.07%

$4,271,317 2.97% $4,837,046 3.96% Federal funds purchased 25,244

5.33% 45,028 4.53% 43,940 5.40% Securities sold under agreements to

repurchase 616,418 3.76% 280,000 3.64% 400,000 4.46% Other borrowed

funds 923,273 5.24% 384,913 4.30% 635,190 5.25% Long-term debt

105,156 7.62% 53,982 7.82% 104,125 7.64% Total interest- bearing

liabili- ties 6,568,396 4.27% 5,035,240 3.18% 6,020,301 4.20%

Non-interest- bearing demand deposits 772,268 717,599 786,132 Total

deposits and other borrowed funds $7,340,664 $5,752,839 $6,806,433

Total average assets $8,389,776 $6,628,833 $7,844,168 Total average

stockholders' equity $944,314 $788,565 $929,564 (1) Yields and

interest earned include net loan fees. Non-accrual loans are

included in the average balance. (2) The average yield has been

adjusted to a fully taxable-equivalent basis for certain securities

of states and political subdivisions and other securities held

using a statutory Federal income tax rate of 35%. DATASOURCE:

Cathay General Bancorp CONTACT: Heng W. Chen of Cathay General

Bancorp, +1-213-625-4752 Web site: http://www.cathaybank.com/

Copyright

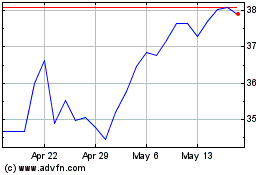

Cathay General Bancorp (NASDAQ:CATY)

Historical Stock Chart

From Jun 2024 to Jul 2024

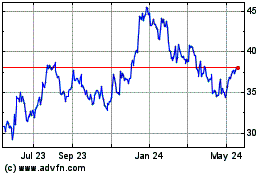

Cathay General Bancorp (NASDAQ:CATY)

Historical Stock Chart

From Jul 2023 to Jul 2024