Capital City Bank Group, Inc. (NASDAQ: CCBG) today reported net

income attributable to common shareowners of $14.2 million, or

$0.83 per diluted share, for the second quarter of 2024 compared to

$12.6 million, or $0.74 per diluted share, for the first quarter of

2024, and $14.2 million, or $0.83 per diluted share, for the second

quarter of 2023.

QUARTER HIGHLIGHTS

(2nd Quarter 2024 versus

1st Quarter 2024)

Income Statement

- Tax-equivalent net interest income totaled $39.3 million

compared to $38.4 million for the prior quarter - total deposit

cost increased 10 basis points to 95 basis points – net interest

margin increased one basis point to 4.02%

- Stable credit quality metrics and credit loss provision - net

loan charge-offs were 18 basis points (annualized) of average loans

– allowance coverage ratio increased 2 basis points to 1.09% at

June 30, 2024

- Noninterest income increased $1.5 million, or 8.3%, due to

higher mortgage banking revenues

- Noninterest expense was well-controlled with a $0.3 million, or

0.7%, increase for the quarter

- Reduction in effective tax rate reflected a new investment in a

solar tax credit fund

Balance Sheet

- Loan balances decreased $1.9 million, or 0.1% (average), and

declined $40.9 million, or 1.5% (end of period)

- Deposit balances increased by $64.5 million, or 1.8% (average),

and decreased $46.2 million, or 1.3% (end of period)

- Tangible book value per diluted share (non-GAAP financial

measure) increased $0.72, or 3.4%

Commenting on the company's results, William G. Smith, Jr.,

Capital City Bank Group Chairman, President, and CEO, said, "I am

pleased with the quarter and how the year is progressing. Our

disciplined approach resulted in tangible book value growth of 3.4%

for the quarter, driven by margin expansion and stable credit

quality. We are poised for a successful year and remain focused on

initiatives that drive sustained core profitability."

Discussion of Operating Results

Net Interest Income/Net Interest Margin

Tax-equivalent net interest income for the second quarter of

2024 totaled $39.3 million, compared to $38.4 million for the first

quarter of 2024, and $40.2 million for the second quarter of 2023.

Compared to the first quarter of 2024, the increase was primarily

due to higher overnight funds and loan interest income that was

partially offset by higher deposit interest expense. The increase

in overnight funds interest income reflected higher average deposit

balances and the increase in loan interest income reflected

existing loans re-pricing at higher rates and new loan volume at

higher rates. The increase in deposit interest expense was

attributable to higher average money market account (“MMA”)

balances and to a lesser extent certificates of deposit (“CD”)

balances and reflected a combination of re-mix from other deposit

categories and higher rates for certain products.

Compared to the second quarter of 2023, the $0.9 million

decrease was generally driven by higher deposit interest expense

and lower overnight funds and investment interest income, which

outpaced an increase in loan interest income. For the first six

months of 2024, tax-equivalent net interest income totaled $77.8

million compared to $80.7 million for the same period of 2023. The

decrease was primarily driven by the same aforementioned

trends.

Our net interest margin for the second quarter of 2024 was

4.02%, an increase of one basis point over the first quarter of

2024 and a decrease of four basis points from the second quarter of

2023. For the month of June 2024, our net interest margin was

4.04%. For the first six months of 2024, our net interest margin

was 4.01% compared to 4.05% for the same period of 2023. Compared

to the first quarter of 2024, the slight increase was primarily due

to the favorable loan repricing that was partially offset by higher

deposit cost. The decrease from both prior year periods reflected

higher deposit cost related to re-mix within the deposit base and

higher rates paid on deposits, partially offset by higher yields

from new loan volume and existing loans repricing at higher

rates. For the second quarter of 2024, our cost of

funds was 97 basis points, an increase of nine basis points over

the first quarter of 2024 and an increase of 46 basis points over

the second quarter of 2023. Our cost of deposits (including

noninterest bearing accounts) was 95 basis points, 85 basis points,

and 43 basis points, respectively, for the same

periods.

Provision for Credit Losses

We recorded a provision for credit losses of $1.2

million for the second quarter of 2024 compared to $0.9 million for

the first quarter of 2024 and $2.2 million for the second quarter

of 2023. Compared to the first quarter of 2024, the increase in the

provision was primarily due to loan grade migration and slightly

higher loss rates partially offset by lower loan balances. For the

first six months of 2024, we recorded a provision for credit losses

of $2.1 million compared to $5.3 million for the same period of

2023 with the decrease driven primarily by lower new loan volume in

2024. We discuss the allowance for credit losses

further below.

Noninterest Income and Noninterest Expense

Noninterest income for the second quarter of 2024

totaled $19.6 million compared to $18.1 million for the first

quarter of 2024 and $20.0 million for the second quarter of 2023.

The $1.5 million increase over the first quarter of 2024 was due to

an increase in mortgage banking revenues driven by higher

production. Compared to the second quarter of 2023, the $0.4

million decrease was primarily attributable to a $1.7 million

decrease in other income, which reflected a $1.4 million gain from

the sale of mortgage servicing rights in the second quarter of

2023, partially offset by a $1.0 million increase in mortgage

banking revenues driven by a higher gain on sale margin, and a $0.3

million increase in wealth management fees.

For the first six months of 2024, noninterest

income totaled $37.7 million, which is comparable to the same

period of 2023 and reflected a $2.0 million decrease in other

income that was partially offset by a $1.0 increase in wealth

management fees and a $1.0 million increase in mortgage banking

revenues. The decrease in other income was primarily attributable

to the aforementioned $1.4 million gain from the sale of mortgage

servicing rights in 2023. A decrease in vendor bonus

income and miscellaneous income also contributed to the decrease.

The increase in wealth management fees was primarily driven by

higher retail brokerage fees and to a lesser extent trust fees. The

increase in mortgage banking revenues was due to a higher gain on

sale margin.

Noninterest expense for the second quarter of 2024 totaled $40.4

million compared to $40.2 million for the first quarter of 2024 and

$40.3 million for the second quarter of 2024. The $0.2

million increase over the first quarter of 2024 reflected a $0.2

million increase in other expense which included the write-off of

obsolete assets from the remodeling of an office site and a core

system migration in the second quarter of 2024. Compared to the

second quarter of 2023, the $0.1 million increase reflected a $1.0

million increase in compensation expense and a $0.1 million

increase in occupancy expense that was partially offset by a $1.0

million decrease in other expense. The increase in

compensation expense reflected a $0.7 million increase in salary

expense and a $0.3 million increase in associate benefit expense.

The increase in salary expense was primarily due to lower realized

loan cost (credit offset to salary expense) of $0.5 million (lower

new loan volume) and higher base salary expense of $0.3 million.

The increase in associate benefit expense was attributable to

higher expense for associate insurance. The increase in occupancy

expense was due to higher expense for maintenance agreements

(security upgrades). The decrease in other expense was due to a

one-time payment for $0.8 million in the second quarter of 2023

related to a consulting engagement for the negotiation of a new

core processing agreement.

For the first six months of 2024, noninterest expense totaled

$80.6 million compared to $78.0 million for the same period of 2023

with the $2.6 million increase attributable to increases in

compensation expense of $1.8 million, occupancy expense of $0.4

million, and other expense of $0.4 million. The increase in

compensation expense was primarily due to a lower level of realized

loan cost (credit offset to salary expense) of $2.0 million (lower

new loan volume) and higher base salary expense of $0.8 million

(primarily annual merit raises), partially offset by lower

commission expense of $1.1 million. The increase in occupancy was

driven by an increase in expense for maintenance agreements

(security upgrades and addition of interactive teller machines).

The increase in other expense reflected a $1.8 million gain from

the sale of a banking office in the first quarter of 2023 that was

partially offset by lower pension plan expense of $0.6 million

(service cost) and the favorable impact of the aforementioned

one-time consulting expense of $0.8 million in

2023.

Income Taxes

We realized income tax expense of $3.2 million (effective rate

of 18.5%) for the second quarter of 2024 compared to $3.5 million

(effective rate of 23.0%) for the first quarter of 2024 and $3.4

million (effective rate of 19.4%) for the second quarter of 2023.

For the first six months of 2024, we realized income tax expense of

$6.7 million (effective rate of 20.6%) compared to $7.1 million

(effective rate of 20.4%) for the same period of 2023. The decrease

in our effective tax rate for the second quarter of 2024 was

primarily due to a higher level of tax benefit accrued from a new

investment in a solar tax credit equity fund. Absent discrete

items, we expect our annual effective tax rate to approximate

20-21% for 2024.

Discussion of Financial Condition

Earning Assets

Average earning assets totaled $3.935 billion for the second

quarter of 2024, an increase of $85.7 million, or 2.2%, over the

first quarter of 2024, and an increase of $111.3 million, or 2.9%,

over the fourth quarter of 2023. The variance for both prior period

comparisons was driven by an increase in deposit balances (see

below – Deposits), resulting in higher levels of overnight funds

sold. Compared to the fourth quarter of 2023, the change in the

earning asset mix reflected a $162.7 million increase in overnight

funds and a $15.5 million increase in loans held for investment

(“HFI”) that was partially offset by lower investment securities of

$43.4 million, and loans held for sale of $23.5 million.

Average loans HFI decreased $1.9 million, or 0.1%, from the

first quarter of 2024 and increased $15.5 million, or 0.6%, over

the fourth quarter of 2023. Compared to the first quarter of 2024,

the slight decrease was driven by a decline in the consumer loans

(primarily indirect auto) of $19.0 million, partially offset by

increases in residential real estate loans of $10.1 million and

commercial real estate loans of $8.0 million. Compared

to the fourth quarter of 2023, the increase was primarily

attributable to a $51.8 million increase in residential real estate

loans that was partially offset by a decrease of $35.0 million in

consumer loans (primarily indirect auto).

Period end loans HFI decreased $40.9 million, or 1.5%, from the

first quarter of 2024 and decreased $43.7 million, or 1.6%, from

the fourth quarter of 2023. Compared to the first quarter of 2024,

the decline reflected a $20.0 million decrease in consumer loans

(primarily indirect auto) and a $13.3 million decrease in

commercial loans (primarily tax-exempt loans). The decrease from

the fourth quarter of 2023 was primarily attributable to a $36.8

million decrease in consumer loans (primarily indirect auto) and

commercial loans of $20.2 million (primarily tax-exempt loans) that

was partially offset by a $11.3 million increase in residential

real estate loans.

Allowance for Credit Losses

At June 30, 2024, the allowance for credit losses for HFI loans

totaled $29.2 million compared to $29.3 million at March 31, 2024

and $29.9 million at December 31, 2023. Activity within the

allowance is provided on Page 9. The slight decrease in the

allowance from March 31, 2024 reflected a lower level of net

charge-offs (18 basis points for the second quarter of 2024 versus

22 basis points for the first quarter of 2024) that was offset by a

higher credit loss provision (see above – Provision for Credit

Losses). The decrease in the allowance from December 31, 2023 was

primarily due to lower loan balances. At June 30, 2024, the

allowance represented 1.09% of HFI loans compared to 1.07% at March

30, 2024, and 1.10% at December 31, 2023.

Credit Quality

Nonperforming assets (nonaccrual loans and other real estate)

totaled $6.2 million at June 30, 2024 compared to $6.8 million at

March 31, 2024 and $6.2 million at December 31, 2023. At June 30,

2024, nonperforming assets as a percent of total assets equaled

0.15%, compared to 0.16% at March 31, 2024 and 0.15% at December

31, 2023. Nonaccrual loans totaled $5.5 million at June 30, 2024, a

$1.3 million decrease from March 31, 2024 and a $0.7 million

decrease from December 31, 2024. Further, classified loans totaled

$25.6 million at June 30, 2024, a $3.3 million increase over March

31, 2024 and a $3.4 million increase over December 31, 2023.

Deposits

Average total deposits were $3.641 billion for the second

quarter of 2024, an increase of $64.5 million, or 1.8%, over the

first quarter of 2024 and an increase of $92.5 million, or 2.6%,

over the fourth quarter of 2023. Compared to both prior periods,

growth occurred in both money market and CD balances which

reflected a combination of balances migrating from savings, and to

a lesser extent noninterest bearing accounts, in addition to

receiving new deposits from existing and new clients via various

deposit strategies. In addition, compared to the fourth quarter of

2023, the increase in NOW balances reflected higher average public

funds balances as municipal tax receipts are received/deposited by

those clients starting in late November. To a lesser extent, we

have realized NOW account inflows from new and existing business

accounts which reflected our bankers focus on deposit gathering

initiatives.

At June 30, 2024, total deposits were $3.609 billion, a decrease

of $46.2 million, or 1.3%, from March 31, 2024, and a decrease of

$93.3 million, or 2.5%, from December 31, 2023. The decreases from

both prior periods was primarily due to lower NOW account balances,

partially offset by the aforementioned growth in money market and

CD balances from both new and existing clients. The decline in NOW

accounts primarily reflects seasonal public fund balance activity.

Total public funds balances were $575.0 million at June 30, 2024,

$615.0 million at March 31, 2024, and $709.8 million at December

31, 2023.

Liquidity

The Bank maintained an average net overnight funds (deposits

with banks plus FED funds sold less FED funds purchased) sold

position of $262.4 million in the second quarter of 2024 compared

to $140.5 million in the first quarter of 2024 and $99.8 million in

the fourth quarter of 2023. Compared to both prior periods, the

increase was primarily driven by higher average deposits and

investment portfolio cash flow run-off.

At

June 30, 2024, we had the ability to generate approximately $1.500

billion (excludes overnight funds position of $273 million) in

additional liquidity through various sources including various

federal funds purchased lines, Federal Home Loan Bank borrowings,

the Federal Reserve Discount Window, and brokered

deposits.

We also view our investment portfolio as a liquidity source as

we have the option to pledge securities in our portfolio as

collateral for borrowings or deposits, and/or to sell selected

securities in our portfolio. Our portfolio consists of

debt issued by the U.S. Treasury, U.S. governmental agencies,

municipal governments, and corporate entities. At June

30, 2024, the weighted-average maturity and duration of our

portfolio were 2.67 years and 2.16, respectively, and the

available-for-sale portfolio had a net unrealized tax-effected loss

of $24.5 million.

Capital

Shareowners’ equity was $461.0 million at June 30, 2024 compared

to $448.3 million at March 31, 2024 and $440.6 million at December

31, 2023. For the first six months of 2024, shareowners’ equity was

positively impacted by net income attributable to shareowners of

$26.7 million, a $1.2 million decrease in the net unrealized loss

on available for sale securities, net adjustments totaling $0.9

million related to transactions under our stock compensation plans,

stock compensation accretion of $0.7 million, and a $0.3 million

increase in the fair value of the interest rate swap related to

subordinated debt. Shareowners’ equity was reduced by a

common stock dividend of $7.1 million ($0.42 per share) and the

repurchase of common stock of $2.3 million (82,540 shares).

At June 30, 2024, our total risk-based capital ratio was 17.50%

compared to 16.84% at March 31, 2024 and 16.57% at December 31,

2023. Our common equity tier 1 capital ratio was 14.44%, 13.82%,

and 13.52%, respectively, on these dates. Our leverage ratio was

10.51%, 10.45%, and 10.30%, respectively, on these dates. At June

30, 2024, all our regulatory capital ratios exceeded the thresholds

to be designated as “well-capitalized” under the Basel III capital

standards. Further, our tangible common equity ratio (non-GAAP

financial measure) was 8.91% at June 30, 2024 compared to 8.53% and

8.26% at March 31, 2024 and December 31, 2023, respectively. If our

unrealized held-to-maturity securities losses of $21.7 million

(after-tax) were recognized in accumulated other comprehensive

loss, our adjusted tangible capital ratio would be 8.38%.

About Capital City Bank Group,

Inc.

Capital City Bank Group, Inc. (NASDAQ: CCBG) is one

of the largest publicly traded financial holding companies

headquartered in Florida and has approximately $4.2 billion in

assets. We provide a full range of banking services, including

traditional deposit and credit services, mortgage banking, asset

management, trust, merchant services, bankcards, securities

brokerage services and financial advisory services, including the

sale of life insurance, risk management and asset protection

services. Our bank subsidiary, Capital City Bank, was founded in

1895 and now has 63 banking offices and 105 ATMs/ITMs in Florida,

Georgia and Alabama. For more information about Capital City Bank

Group, Inc., visit www.ccbg.com.

FORWARD-LOOKING STATEMENTS

Forward-looking statements in this Press Release are based on

current plans and expectations that are subject to uncertainties

and risks, which could cause our future results to differ

materially. The words “may,” “could,” “should,” “would,” “believe,”

“anticipate,” “estimate,” “expect,” “intend,” “plan,” “target,”

“vision,” “goal,” and similar expressions are intended to identify

forward-looking statements. The following factors, among others,

could cause our actual results to differ: our ability to

successfully manage credit risk, interest rate risk, liquidity

risk, and other risks inherent to our industry; legislative or

regulatory changes; adverse developments in the financial services

industry; the effects of changes in the levels of checking or

savings account deposits and the competition for deposits on our

funding costs, net interest margin and ability to replace maturing

deposits and advances; inflation, interest rate, market and

monetary fluctuations; uncertainty in the pricing of residential

mortgage loans that we sell, as well as competition for the

mortgage servicing rights related to these loans; interest rate

risk and price risk resulting from retaining mortgage servicing

rights and the effects of higher interest rates on our loan

origination volumes; changes in monetary and fiscal policies of the

U.S. Government; the cost and effects of cybersecurity incidents or

other failures, interruptions, or security breaches of our systems

or those of our customers or third-party providers; the effects of

fraud related to debit card products; the accuracy of our financial

statement estimates and assumptions; changes in accounting

principles, policies, practices or guidelines; the frequency and

magnitude of foreclosure of our loans; the effects of our lack of a

diversified loan portfolio; the strength of the local economies in

which we operate; our ability to declare and pay dividends;

structural changes in the markets for origination, sale and

servicing of residential mortgages; our ability to retain key

personnel; the effects of natural disasters (including hurricanes),

widespread health emergencies (including pandemics), military

conflict, terrorism, civil unrest or other geopolitical events; our

ability to comply with the extensive laws and regulations to which

we are subject; the impact of the restatement of our previously

issued consolidated statements of cash flows; any deficiencies in

the processes undertaken to effect these restatements and to

identify and correct all errors in our historical financial

statements that may require restatement; any inability to implement

and maintain effective internal control over financial reporting

and/or disclosure control or inability to remediate our existing

material weaknesses in our internal controls deemed ineffective;

the willingness of clients to accept third-party products and

services rather than our products and services; technological

changes; the outcomes of litigation or regulatory proceedings;

negative publicity and the impact on our reputation; changes in

consumer spending and saving habits; growth and profitability of

our noninterest income; the limited trading activity of our common

stock; the concentration of ownership of our common stock;

anti-takeover provisions under federal and state law as well as our

Articles of Incorporation and our Bylaws; other risks described

from time to time in our filings with the Securities and Exchange

Commission; and our ability to manage the risks involved in the

foregoing. Additional factors can be found in our Annual Report on

Form 10-K/A for the fiscal year ended December 31, 2023, and our

other filings with the SEC, which are available at the SEC’s

internet site (http://www.sec.gov). Forward-looking statements in

this Press Release speak only as of the date of the Press Release,

and we assume no obligation to update forward-looking statements or

the reasons why actual results could differ, except as may be

required by law.

USE OF NON-GAAP FINANCIAL

MEASURESUnaudited

We present a tangible common equity ratio and a tangible book

value per diluted share that removes the effect of goodwill and

other intangibles resulting from merger and acquisition activity.

We believe these measures are useful to investors because it allows

investors to more easily compare our capital adequacy to other

companies in the industry.

The GAAP to non-GAAP reconciliations are provided below.

|

(Dollars in Thousands, except per share data) |

Jun 30, 2024 |

Mar 31, 2024 |

Dec 31, 2023 |

Sep 30, 2023 |

Jun 30, 2023 |

|

Shareowners' Equity (GAAP) |

|

$ |

460,999 |

|

$ |

448,314 |

|

$ |

440,625 |

|

$ |

419,706 |

|

$ |

412,422 |

|

| Less: Goodwill and Other

Intangibles (GAAP) |

|

|

92,853 |

|

|

92,893 |

|

|

92,933 |

|

|

92,973 |

|

|

93,013 |

|

| Tangible Shareowners' Equity

(non-GAAP) |

A |

|

368,146 |

|

|

355,421 |

|

|

347,692 |

|

|

326,733 |

|

|

319,409 |

|

| Total Assets (GAAP) |

|

|

4,225,695 |

|

|

4,259,922 |

|

|

4,304,477 |

|

|

4,138,287 |

|

|

4,391,206 |

|

| Less: Goodwill and Other

Intangibles (GAAP) |

|

|

92,853 |

|

|

92,893 |

|

|

92,933 |

|

|

92,973 |

|

|

93,013 |

|

| Tangible Assets

(non-GAAP) |

B |

$ |

4,132,842 |

|

$ |

4,167,029 |

|

$ |

4,211,544 |

|

$ |

4,045,314 |

|

$ |

4,298,193 |

|

| Tangible Common Equity

Ratio (non-GAAP) |

A/B |

|

8.91% |

|

|

8.53% |

|

|

8.26% |

|

|

8.08% |

|

|

7.43% |

|

| Actual Diluted Shares

Outstanding (GAAP) |

C |

|

16,970,228 |

|

|

16,947,204 |

|

|

17,000,758 |

|

|

16,997,886 |

|

|

17,025,023 |

|

| Tangible Book Value

per Diluted Share (non-GAAP) |

A/C |

$ |

21.69 |

|

$ |

20.97 |

|

$ |

20.45 |

|

$ |

19.22 |

|

$ |

18.76 |

|

|

CAPITAL CITY BANK GROUP,

INC. |

| EARNINGS

HIGHLIGHTS |

|

Unaudited |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Three Months Ended |

|

Six Months Ended |

|

|

(Dollars in thousands, except per share data) |

|

Jun 30, 2024 |

|

Mar 31, 2024 |

|

Jun 30, 2023 |

|

Jun 30, 2024 |

|

Jun 30, 2023 |

|

|

EARNINGS |

|

|

|

|

|

|

|

|

|

|

|

| Net Income Attributable to

Common Shareowners |

$ |

14,150 |

$ |

12,557 |

$ |

14,174 |

$ |

26,707 |

$ |

27,883 |

|

| Diluted

Net Income Per Share |

$ |

0.83 |

$ |

0.74 |

$ |

0.83 |

$ |

1.57 |

$ |

1.64 |

|

|

PERFORMANCE |

|

|

|

|

|

|

|

|

|

|

|

| Return on Average Assets

(annualized) |

|

1.33 |

% |

1.21 |

% |

1.32 |

% |

1.27 |

% |

1.29 |

% |

| Return on Average Equity

(annualized) |

|

12.23 |

|

11.07 |

|

13.58 |

|

11.66 |

|

13.67 |

|

| Net Interest Margin |

|

4.02 |

|

4.01 |

|

4.06 |

|

4.01 |

|

4.05 |

|

| Noninterest Income as % of

Operating Revenue |

|

33.30 |

|

32.06 |

|

33.22 |

|

32.69 |

|

31.90 |

|

|

Efficiency Ratio |

|

68.61 |

% |

71.06 |

% |

66.93 |

% |

69.81 |

% |

65.82 |

% |

|

CAPITAL ADEQUACY |

|

|

|

|

|

|

|

|

|

|

|

| Tier 1 Capital |

|

16.31 |

% |

15.67 |

% |

14.56 |

% |

16.31 |

% |

14.56 |

% |

| Total Capital |

|

17.50 |

|

16.84 |

|

15.68 |

|

17.50 |

|

15.68 |

|

| Leverage |

|

10.51 |

|

10.45 |

|

9.54 |

|

10.51 |

|

9.54 |

|

| Common Equity Tier 1 |

|

14.44 |

|

13.82 |

|

12.73 |

|

14.44 |

|

12.73 |

|

| Tangible Common Equity(1) |

|

8.91 |

|

8.53 |

|

7.43 |

|

8.91 |

|

7.43 |

|

| Equity

to Assets |

|

10.91 |

% |

10.52 |

% |

9.39 |

% |

10.91 |

% |

9.39 |

% |

|

ASSET QUALITY |

|

|

|

|

|

|

|

|

|

|

|

| Allowance as % of

Non-Performing Loans |

|

529.79 |

% |

431.46 |

% |

426.44 |

% |

529.79 |

% |

426.44 |

% |

| Allowance as a % of Loans

HFI |

|

1.09 |

|

1.07 |

|

1.05 |

|

1.09 |

|

1.05 |

|

| Net Charge-Offs as % of

Average Loans HFI |

|

0.18 |

|

0.22 |

|

0.07 |

|

0.20 |

|

0.15 |

|

| Nonperforming Assets as % of

Loans HFI and OREO |

|

0.23 |

|

0.25 |

|

0.25 |

|

0.23 |

|

0.25 |

|

|

Nonperforming Assets as % of Total Assets |

|

0.15 |

% |

0.16 |

% |

0.15 |

% |

0.15 |

% |

0.15 |

% |

|

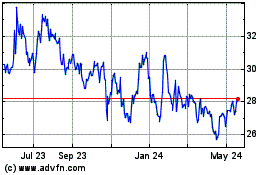

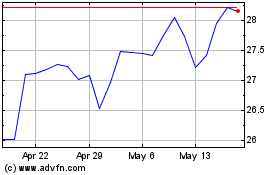

STOCK PERFORMANCE |

|

|

|

|

|

|

|

|

|

|

|

| High |

$ |

28.58 |

$ |

31.34 |

$ |

34.16 |

$ |

31.34 |

$ |

36.86 |

|

| Low |

|

25.45 |

|

26.59 |

|

28.03 |

|

25.45 |

|

28.03 |

|

| Close |

$ |

28.44 |

$ |

27.70 |

$ |

30.64 |

$ |

28.44 |

$ |

30.64 |

|

| Average

Daily Trading Volume |

|

29,861 |

|

31,023 |

|

33,412 |

|

30,433 |

|

37,574 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| (1)Tangible common

equity ratio is a non-GAAP financial measure. For additional

information, including a reconciliation to GAAP, refer to Page

6. |

|

|

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

| CAPITAL

CITY BANK GROUP,

INC. |

|

CONSOLIDATED STATEMENT OF FINANCIAL CONDITION |

|

Unaudited |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

2024 |

|

2023 |

|

(Dollars in thousands) |

Second Quarter |

|

First Quarter |

|

Fourth Quarter |

|

Third Quarter |

|

Second Quarter |

|

ASSETS |

|

|

|

|

|

|

|

|

|

|

|

Cash and Due From Banks |

$ |

75,304 |

|

$ |

73,642 |

|

$ |

83,118 |

|

$ |

72,379 |

|

$ |

83,679 |

|

| Funds

Sold and Interest Bearing Deposits |

|

272,675 |

|

|

231,047 |

|

|

228,949 |

|

|

95,119 |

|

|

285,129 |

|

|

Total Cash and Cash Equivalents |

|

347,979 |

|

|

304,689 |

|

|

312,067 |

|

|

167,498 |

|

|

368,808 |

|

| |

|

|

|

|

|

|

|

|

|

|

| Investment Securities

Available for Sale |

|

310,941 |

|

|

327,338 |

|

|

337,902 |

|

|

334,052 |

|

|

386,220 |

|

| Investment Securities Held to

Maturity |

|

582,984 |

|

|

603,386 |

|

|

625,022 |

|

|

632,076 |

|

|

641,398 |

|

| Other

Equity Securities |

|

2,537 |

|

|

3,445 |

|

|

3,450 |

|

|

3,585 |

|

|

1,703 |

|

|

Total Investment Securities |

|

896,462 |

|

|

934,169 |

|

|

966,374 |

|

|

969,713 |

|

|

1,029,321 |

|

| |

|

|

|

|

|

|

|

|

|

|

| Loans Held for Sale |

|

24,022 |

|

|

24,705 |

|

|

28,211 |

|

|

34,013 |

|

|

44,659 |

|

| |

|

|

|

|

|

|

|

|

|

|

| Loans Held for Investment

("HFI"): |

|

|

|

|

|

|

|

|

|

|

| Commercial, Financial, &

Agricultural |

|

204,990 |

|

|

218,298 |

|

|

225,190 |

|

|

221,704 |

|

|

227,219 |

|

| Real Estate -

Construction |

|

200,754 |

|

|

202,692 |

|

|

196,091 |

|

|

197,526 |

|

|

226,404 |

|

| Real Estate - Commercial |

|

823,122 |

|

|

823,690 |

|

|

825,456 |

|

|

828,234 |

|

|

831,285 |

|

| Real Estate - Residential |

|

1,012,541 |

|

|

1,012,791 |

|

|

1,001,257 |

|

|

966,512 |

|

|

893,384 |

|

| Real Estate - Home Equity |

|

211,126 |

|

|

214,617 |

|

|

210,920 |

|

|

203,606 |

|

|

203,142 |

|

| Consumer |

|

234,212 |

|

|

254,168 |

|

|

270,994 |

|

|

285,122 |

|

|

295,646 |

|

| Other Loans |

|

2,286 |

|

|

3,789 |

|

|

2,962 |

|

|

1,401 |

|

|

5,425 |

|

|

Overdrafts |

|

1,192 |

|

|

1,127 |

|

|

1,048 |

|

|

1,076 |

|

|

1,007 |

|

|

Total Loans Held for Investment |

|

2,690,223 |

|

|

2,731,172 |

|

|

2,733,918 |

|

|

2,705,181 |

|

|

2,683,512 |

|

|

Allowance for Credit Losses |

|

(29,219 |

) |

|

(29,329 |

) |

|

(29,941 |

) |

|

(29,083 |

) |

|

(28,243 |

) |

|

Loans Held for Investment, Net |

|

2,661,004 |

|

|

2,701,843 |

|

|

2,703,977 |

|

|

2,676,098 |

|

|

2,655,269 |

|

| |

|

|

|

|

|

|

|

|

|

|

| Premises and Equipment,

Net |

|

81,414 |

|

|

81,452 |

|

|

81,266 |

|

|

81,677 |

|

|

82,062 |

|

| Goodwill and Other

Intangibles |

|

92,853 |

|

|

92,893 |

|

|

92,933 |

|

|

92,973 |

|

|

93,013 |

|

| Other Real Estate Owned |

|

650 |

|

|

1 |

|

|

1 |

|

|

1 |

|

|

1 |

|

| Other

Assets |

|

121,311 |

|

|

120,170 |

|

|

119,648 |

|

|

116,314 |

|

|

118,073 |

|

|

Total Other Assets |

|

296,228 |

|

|

294,516 |

|

|

293,848 |

|

|

290,965 |

|

|

293,149 |

|

|

Total Assets |

$ |

4,225,695 |

|

$ |

4,259,922 |

|

$ |

4,304,477 |

|

$ |

4,138,287 |

|

$ |

4,391,206 |

|

|

LIABILITIES |

|

|

|

|

|

|

|

|

|

|

| Deposits: |

|

|

|

|

|

|

|

|

|

|

| Noninterest Bearing

Deposits |

$ |

1,343,606 |

|

$ |

1,361,939 |

|

$ |

1,377,934 |

|

$ |

1,472,165 |

|

$ |

1,520,134 |

|

| NOW Accounts |

|

1,177,180 |

|

|

1,212,452 |

|

|

1,327,420 |

|

|

1,092,996 |

|

|

1,269,839 |

|

| Money Market Accounts |

|

413,594 |

|

|

398,308 |

|

|

319,319 |

|

|

304,323 |

|

|

321,743 |

|

| Savings Accounts |

|

514,560 |

|

|

530,782 |

|

|

547,634 |

|

|

571,003 |

|

|

590,245 |

|

|

Certificates of Deposit |

|

159,624 |

|

|

151,320 |

|

|

129,515 |

|

|

99,958 |

|

|

86,905 |

|

|

Total Deposits |

|

3,608,564 |

|

|

3,654,801 |

|

|

3,701,822 |

|

|

3,540,445 |

|

|

3,788,866 |

|

| |

|

|

|

|

|

|

|

|

|

|

| Repurchase Agreements |

|

22,463 |

|

|

23,477 |

|

|

26,957 |

|

|

22,910 |

|

|

22,619 |

|

| Other Short-Term

Borrowings |

|

3,307 |

|

|

8,409 |

|

|

8,384 |

|

|

18,786 |

|

|

28,054 |

|

| Subordinated Notes

Payable |

|

52,887 |

|

|

52,887 |

|

|

52,887 |

|

|

52,887 |

|

|

52,887 |

|

| Other Long-Term

Borrowings |

|

1,009 |

|

|

265 |

|

|

315 |

|

|

364 |

|

|

414 |

|

| Other

Liabilities |

|

69,987 |

|

|

65,181 |

|

|

66,080 |

|

|

75,585 |

|

|

77,192 |

|

|

Total Liabilities |

|

3,758,217 |

|

|

3,805,020 |

|

|

3,856,445 |

|

|

3,710,977 |

|

|

3,970,032 |

|

|

|

|

|

|

|

|

|

|

|

|

|

| Temporary Equity |

|

6,479 |

|

|

6,588 |

|

|

7,407 |

|

|

7,604 |

|

|

8,752 |

|

| SHAREOWNERS'

EQUITY |

|

|

|

|

|

|

|

|

|

|

| Common Stock |

|

169 |

|

|

169 |

|

|

170 |

|

|

170 |

|

|

170 |

|

| Additional Paid-In

Capital |

|

35,547 |

|

|

34,861 |

|

|

36,326 |

|

|

36,182 |

|

|

36,853 |

|

| Retained Earnings |

|

445,959 |

|

|

435,364 |

|

|

426,275 |

|

|

418,030 |

|

|

408,771 |

|

|

Accumulated Other Comprehensive Loss, Net of Tax |

|

(20,676 |

) |

|

(22,080 |

) |

|

(22,146 |

) |

|

(34,676 |

) |

|

(33,372 |

) |

|

Total Shareowners' Equity |

|

460,999 |

|

|

448,314 |

|

|

440,625 |

|

|

419,706 |

|

|

412,422 |

|

|

Total Liabilities, Temporary Equity and Shareowners' Equity |

$ |

4,225,695 |

|

$ |

4,259,922 |

|

$ |

4,304,477 |

|

$ |

4,138,287 |

|

$ |

4,391,206 |

|

|

OTHER BALANCE SHEET DATA |

|

|

|

|

|

|

|

|

|

|

| Earning Assets |

$ |

3,883,382 |

|

$ |

3,921,093 |

|

$ |

3,957,452 |

|

$ |

3,804,026 |

|

$ |

4,042,621 |

|

|

Interest Bearing Liabilities |

|

2,344,624 |

|

|

2,377,900 |

|

|

2,412,431 |

|

|

2,163,227 |

|

|

2,372,706 |

|

|

Book Value Per Diluted Share |

$ |

27.17 |

|

$ |

26.45 |

|

$ |

25.92 |

|

$ |

24.69 |

|

$ |

24.21 |

|

|

Tangible Book Value Per Diluted Share(1) |

|

21.69 |

|

|

20.97 |

|

|

20.45 |

|

|

19.22 |

|

|

18.76 |

|

|

Actual Basic Shares Outstanding |

|

16,942 |

|

|

16,929 |

|

|

16,950 |

|

|

16,958 |

|

|

16,992 |

|

| Actual

Diluted Shares Outstanding |

|

16,970 |

|

|

16,947 |

|

|

17,001 |

|

|

16,998 |

|

|

17,025 |

|

| (1)Tangible book

value per diluted share is a non-GAAP financial measure. For

additional information, including a reconciliation to GAAP, refer

to Page 6. |

| CAPITAL

CITY BANK GROUP,

INC. |

|

CONSOLIDATED STATEMENT OF

OPERATIONS |

|

Unaudited |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

2024 |

|

2023 |

|

Six Months EndedJune 30, |

|

(Dollars in thousands, except per share data) |

|

SecondQuarter |

|

FirstQuarter |

|

FourthQuarter |

|

ThirdQuarter |

|

SecondQuarter |

|

2024 |

|

2023 |

|

INTEREST INCOME |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Loans, including Fees |

$ |

41,138 |

$ |

40,683 |

$ |

40,407 |

$ |

39,344 |

$ |

37,608 |

|

$ |

81,821 |

$ |

72,499 |

| Investment Securities |

|

4,004 |

|

4,244 |

|

4,392 |

|

4,561 |

|

4,815 |

|

|

8,248 |

|

9,739 |

| Federal

Funds Sold and Interest Bearing Deposits |

|

3,624 |

|

1,893 |

|

1,385 |

|

1,848 |

|

2,782 |

|

|

5,517 |

|

6,893 |

|

Total Interest Income |

|

48,766 |

|

46,820 |

|

46,184 |

|

45,753 |

|

45,205 |

|

|

95,586 |

|

89,131 |

|

INTEREST EXPENSE |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Deposits |

|

8,579 |

|

7,594 |

|

5,872 |

|

5,214 |

|

4,008 |

|

|

16,173 |

|

6,496 |

| Repurchase Agreements |

|

217 |

|

201 |

|

199 |

|

190 |

|

115 |

|

|

418 |

|

124 |

| Other Short-Term

Borrowings |

|

68 |

|

39 |

|

310 |

|

440 |

|

336 |

|

|

107 |

|

788 |

| Subordinated Notes

Payable |

|

630 |

|

628 |

|

627 |

|

625 |

|

604 |

|

|

1,258 |

|

1,175 |

| Other

Long-Term Borrowings |

|

3 |

|

3 |

|

5 |

|

4 |

|

5 |

|

|

6 |

|

11 |

|

Total Interest Expense |

|

9,497 |

|

8,465 |

|

7,013 |

|

6,473 |

|

5,068 |

|

|

17,962 |

|

8,594 |

|

Net Interest Income |

|

39,269 |

|

38,355 |

|

39,171 |

|

39,280 |

|

40,137 |

|

|

77,624 |

|

80,537 |

|

Provision for Credit Losses |

|

1,204 |

|

920 |

|

2,025 |

|

2,393 |

|

2,197 |

|

|

2,124 |

|

5,296 |

|

Net Interest Income after Provision for Credit Losses |

|

38,065 |

|

37,435 |

|

37,146 |

|

36,887 |

|

37,940 |

|

|

75,500 |

|

75,241 |

|

NONINTEREST INCOME |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Deposit Fees |

|

5,377 |

|

5,250 |

|

5,304 |

|

5,456 |

|

5,326 |

|

|

10,627 |

|

10,565 |

| Bank Card Fees |

|

3,766 |

|

3,620 |

|

3,713 |

|

3,684 |

|

3,795 |

|

|

7,386 |

|

7,521 |

| Wealth Management Fees |

|

4,439 |

|

4,682 |

|

4,276 |

|

3,984 |

|

4,149 |

|

|

9,121 |

|

8,077 |

| Mortgage Banking Revenues |

|

4,381 |

|

2,878 |

|

2,327 |

|

1,839 |

|

3,363 |

|

|

7,259 |

|

6,234 |

|

Other |

|

1,643 |

|

1,667 |

|

1,537 |

|

1,765 |

|

3,334 |

|

|

3,310 |

|

5,328 |

|

Total Noninterest Income |

|

19,606 |

|

18,097 |

|

17,157 |

|

16,728 |

|

19,967 |

|

|

37,703 |

|

37,725 |

|

NONINTEREST EXPENSE |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Compensation |

|

24,406 |

|

24,407 |

|

23,822 |

|

23,003 |

|

23,438 |

|

|

48,813 |

|

46,962 |

| Occupancy, Net |

|

6,997 |

|

6,994 |

|

7,098 |

|

6,980 |

|

6,820 |

|

|

13,991 |

|

13,582 |

|

Other |

|

9,038 |

|

8,770 |

|

9,038 |

|

9,122 |

|

10,027 |

|

|

17,808 |

|

17,417 |

|

Total Noninterest Expense |

|

40,441 |

|

40,171 |

|

39,958 |

|

39,105 |

|

40,285 |

|

|

80,612 |

|

77,961 |

|

OPERATING PROFIT |

|

17,230 |

|

15,361 |

|

14,345 |

|

14,510 |

|

17,622 |

|

|

32,591 |

|

35,005 |

| Income

Tax Expense |

|

3,189 |

|

3,536 |

|

2,909 |

|

3,004 |

|

3,417 |

|

|

6,725 |

|

7,126 |

|

Net Income |

|

14,041 |

|

11,825 |

|

11,436 |

|

11,506 |

|

14,205 |

|

|

25,866 |

|

27,879 |

| Pre-Tax

Loss (Income) Attributable to Noncontrolling Interest |

|

109 |

|

732 |

|

284 |

|

1,149 |

|

(31 |

) |

|

841 |

|

4 |

|

NET INCOME ATTRIBUTABLE TOCOMMON

SHAREOWNERS |

$ |

14,150 |

$ |

12,557 |

$ |

11,720 |

$ |

12,655 |

$ |

14,174 |

|

$ |

26,707 |

$ |

27,883 |

|

PER COMMON SHARE |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Basic Net Income |

$ |

0.84 |

$ |

0.74 |

$ |

0.69 |

$ |

0.75 |

$ |

0.83 |

|

$ |

1.58 |

$ |

1.64 |

| Diluted Net Income |

|

0.83 |

|

0.74 |

|

0.70 |

|

0.74 |

|

0.83 |

|

|

1.57 |

|

1.64 |

| Cash Dividend |

$ |

0.21 |

$ |

0.21 |

$ |

0.20 |

$ |

0.20 |

$ |

0.18 |

|

$ |

0.42 |

$ |

0.36 |

| AVERAGE

SHARES |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Basic |

|

16,931 |

|

16,951 |

|

16,947 |

|

16,985 |

|

17,002 |

|

|

16,941 |

|

17,009 |

|

Diluted |

|

16,960 |

|

16,969 |

|

16,997 |

|

17,025 |

|

17,035 |

|

|

16,964 |

|

17,040 |

| CAPITAL

CITY BANK GROUP, INC. |

| ALLOWANCE

FOR CREDIT LOSSES ("ACL") |

| AND

CREDIT QUALITY |

|

Unaudited |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

2024 |

|

2023 |

|

Six Months EndedJune 30, |

|

(Dollars in thousands, except per share data) |

|

SecondQuarter |

|

FirstQuarter |

|

FourthQuarter |

|

ThirdQuarter |

|

SecondQuarter |

|

2024 |

|

2023 |

|

ACL - HELD FOR INVESTMENT LOANS |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Balance at Beginning of Period |

$ |

29,329 |

|

$ |

29,941 |

|

$ |

29,083 |

|

$ |

28,243 |

|

$ |

26,808 |

|

$ |

29,941 |

|

$ |

25,068 |

|

| Transfer from Other (Assets)

Liabilities |

|

- |

|

|

(50 |

) |

|

66 |

|

|

- |

|

|

- |

|

|

(50 |

) |

|

- |

|

| Provision for Credit

Losses |

|

1,129 |

|

|

932 |

|

|

2,354 |

|

|

1,993 |

|

|

1,922 |

|

|

2,061 |

|

|

5,182 |

|

| Net Charge-Offs

(Recoveries) |

|

1,239 |

|

|

1,494 |

|

|

1,562 |

|

|

1,153 |

|

|

487 |

|

|

2,733 |

|

|

2,007 |

|

| Balance

at End of Period |

$ |

29,219 |

|

$ |

29,329 |

|

$ |

29,941 |

|

$ |

29,083 |

|

$ |

28,243 |

|

$ |

29,219 |

|

$ |

28,243 |

|

|

As a % of Loans HFI |

|

1.09% |

|

|

1.07% |

|

|

1.10% |

|

|

1.08% |

|

|

1.05% |

|

|

1.09% |

|

|

1.05% |

|

| As a %

of Nonperforming Loans |

|

529.79% |

|

|

431.46% |

|

|

479.70% |

|

|

619.58% |

|

|

426.44% |

|

|

529.79% |

|

|

426.44% |

|

|

ACL - UNFUNDED COMMITMENTS |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Balance at Beginning of

Period |

|

3,121 |

|

$ |

3,191 |

|

$ |

3,502 |

|

$ |

3,120 |

|

$ |

2,833 |

|

$ |

3,191 |

|

$ |

2,989 |

|

| Provision for Credit

Losses |

|

18 |

|

|

(70 |

) |

|

(311 |

) |

|

382 |

|

|

287 |

|

|

(52 |

) |

|

131 |

|

| Balance

at End of Period(1) |

|

3,139 |

|

|

3,121 |

|

|

3,191 |

|

|

3,502 |

|

|

3,120 |

|

|

3,139 |

|

|

3,120 |

|

|

ACL - DEBT SECURITIES |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Provision for Credit Losses |

$ |

57 |

|

$ |

58 |

|

$ |

(18 |

) |

$ |

18 |

|

$ |

(12 |

) |

$ |

115 |

|

$ |

(17 |

) |

|

CHARGE-OFFS |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Commercial, Financial and

Agricultural |

$ |

400 |

|

$ |

282 |

|

$ |

217 |

|

$ |

76 |

|

$ |

54 |

|

$ |

682 |

|

$ |

218 |

|

| Real Estate -

Construction |

|

- |

|

|

- |

|

|

- |

|

|

- |

|

|

- |

|

|

- |

|

|

- |

|

| Real Estate - Commercial |

|

- |

|

|

- |

|

|

- |

|

|

- |

|

|

- |

|

|

- |

|

|

120 |

|

| Real Estate - Residential |

|

- |

|

|

17 |

|

|

79 |

|

|

- |

|

|

- |

|

|

17 |

|

|

- |

|

| Real Estate - Home Equity |

|

- |

|

|

76 |

|

|

- |

|

|

- |

|

|

39 |

|

|

76 |

|

|

39 |

|

| Consumer |

|

1,061 |

|

|

1,550 |

|

|

1,689 |

|

|

1,340 |

|

|

993 |

|

|

2,611 |

|

|

2,725 |

|

| Overdrafts |

|

571 |

|

|

638 |

|

|

602 |

|

|

659 |

|

|

894 |

|

|

1,209 |

|

|

1,528 |

|

| Total

Charge-Offs |

$ |

2,032 |

|

$ |

2,563 |

|

$ |

2,587 |

|

$ |

2,075 |

|

$ |

1,980 |

|

$ |

4,595 |

|

$ |

4,630 |

|

|

RECOVERIES |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Commercial, Financial and

Agricultural |

$ |

59 |

|

$ |

41 |

|

$ |

83 |

|

$ |

28 |

|

$ |

71 |

|

$ |

100 |

|

$ |

166 |

|

| Real Estate -

Construction |

|

- |

|

|

- |

|

|

- |

|

|

- |

|

|

1 |

|

|

- |

|

|

2 |

|

| Real Estate - Commercial |

|

19 |

|

|

204 |

|

|

16 |

|

|

17 |

|

|

11 |

|

|

223 |

|

|

19 |

|

| Real Estate - Residential |

|

23 |

|

|

37 |

|

|

34 |

|

|

30 |

|

|

132 |

|

|

60 |

|

|

189 |

|

| Real Estate - Home Equity |

|

37 |

|

|

24 |

|

|

17 |

|

|

53 |

|

|

131 |

|

|

61 |

|

|

156 |

|

| Consumer |

|

313 |

|

|

410 |

|

|

433 |

|

|

418 |

|

|

514 |

|

|

723 |

|

|

1,085 |

|

| Overdrafts |

|

342 |

|

|

353 |

|

|

442 |

|

|

376 |

|

|

633 |

|

|

695 |

|

|

1,006 |

|

| Total

Recoveries |

$ |

793 |

|

$ |

1,069 |

|

$ |

1,025 |

|

$ |

922 |

|

$ |

1,493 |

|

$ |

1,862 |

|

$ |

2,623 |

|

|

NET CHARGE-OFFS (RECOVERIES) |

$ |

1,239 |

|

$ |

1,494 |

|

$ |

1,562 |

|

$ |

1,153 |

|

$ |

487 |

|

$ |

2,733 |

|

$ |

2,007 |

|

|

Net Charge-Offs as a % of Average Loans HFI(2) |

|

0.18% |

|

|

0.22% |

|

|

0.23% |

|

|

0.17% |

|

|

0.07% |

|

|

0.20% |

|

|

0.15% |

|

|

CREDIT QUALITY |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Nonaccruing Loans |

$ |

5,515 |

|

$ |

6,798 |

|

$ |

6,242 |

|

$ |

4,694 |

|

$ |

6,623 |

|

|

|

|

|

| Other Real Estate Owned |

|

650 |

|

|

1 |

|

|

1 |

|

|

1 |

|

|

1 |

|

|

|

|

|

| Total

Nonperforming Assets ("NPAs") |

$ |

6,165 |

|

$ |

6,799 |

|

$ |

6,243 |

|

$ |

4,695 |

|

$ |

6,624 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Past Due Loans 30-89 Days |

$ |

5,672 |

|

$ |

5,392 |

|

$ |

6,854 |

|

$ |

5,577 |

|

$ |

4,207 |

|

|

|

|

|

| Classified Loans |

|

25,566 |

|

|

22,305 |

|

|

22,203 |

|

|

21,812 |

|

|

14,973 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Nonperforming Loans as a % of

Loans HFI |

|

0.21% |

|

|

0.25% |

|

|

0.23% |

|

|

0.17% |

|

|

0.25% |

|

|

|

|

|

| NPAs as a % of Loans HFI and

Other Real Estate |

|

0.23% |

|

|

0.25% |

|

|

0.23% |

|

|

0.17% |

|

|

0.25% |

|

|

|

|

|

| NPAs as

a % of Total Assets |

|

0.15% |

|

|

0.16% |

|

|

0.15% |

|

|

0.11% |

|

|

0.15% |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| (1)Recorded in other

liabilities |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| (2)Annualized |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| CAPITAL

CITY BANK GROUP, INC. |

| AVERAGE

BALANCE AND INTEREST RATES |

|

Unaudited |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Second Quarter 2024 |

|

|

First Quarter 2024 |

|

|

Fourth Quarter 2023 |

|

|

Third Quarter 2023 |

|

|

Second Quarter 2023 |

|

|

|

Jun 2024 YTD |

|

|

Jun 2023 YTD |

|

|

(Dollars in thousands) |

|

AverageBalance |

|

Interest |

|

AverageRate |

|

|

AverageBalance |

|

Interest |

|

AverageRate |

|

|

AverageBalance |

|

Interest |

|

AverageRate |

|

|

AverageBalance |

|

Interest |

|

AverageRate |

|

|

AverageBalance |

|

Interest |

|

AverageRate |

|

|

|

AverageBalance |

|

Interest |

|

AverageRate |

|

|

AverageBalance |

|

Interest |

|

AverageRate |

|

|

ASSETS: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Loans Held for Sale |

$ |

26,281 |

|

$ |

517 |

|

5.26 |

% |

$ |

27,314 |

|

$ |

563 |

|

5.99 |

% |

$ |

49,790 |

|

$ |

817 |

|

6.50 |

% |

$ |

62,768 |

|

|

971 |

|

6.14 |

% |

$ |

54,350 |

|

$ |

800 |

|

5.90 |

% |

|

$ |

26,797 |

|

$ |

1,080 |

|

5.62 |

% |

$ |

54,728 |

|

$ |

1,445 |

|

5.32 |

% |

| Loans Held for

Investment(1) |

|

2,726,748 |

|

|

40,683 |

|

6.03 |

|

|

2,728,629 |

|

|

40,196 |

|

5.95 |

|

|

2,711,243 |

|

|

39,679 |

|

5.81 |

|

|

2,672,653 |

|

|

38,455 |

|

5.71 |

|

|

2,657,693 |

|

|

36,890 |

|

5.55 |

|

|

|

2,727,688 |

|

|

80,879 |

|

5.99 |

|

|

2,620,252 |

|

|

71,232 |

|

5.48 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Investment Securities |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Taxable Investment Securities |

|

918,989 |

|

|

3,998 |

|

1.74 |

|

|

952,328 |

|

|

4,239 |

|

1.78 |

|

|

962,322 |

|

|

4,389 |

|

1.81 |

|

|

1,002,547 |

|

|

4,549 |

|

1.80 |

|

|

1,041,202 |

|

|

4,803 |

|

1.84 |

|

|

|

935,658 |

|

|

8,237 |

|

1.76 |

|

|

1,051,232 |

|

|

9,716 |

|

1.85 |

|

|

Tax-Exempt Investment Securities(1) |

|

843 |

|

|

9 |

|

4.36 |

|

|

856 |

|

|

9 |

|

4.34 |

|

|

862 |

|

|

7 |

|

4.32 |

|

|

2,456 |

|

|

17 |

|

2.66 |

|

|

2,656 |

|

|

17 |

|

2.47 |

|

|

|

850 |

|

|

18 |

|

4.35 |

|

|

2,747 |

|

|

33 |

|

2.41 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Total Investment

Securities |

|

919,832 |

|

|

4,007 |

|

1.74 |

|

|

953,184 |

|

|

4,248 |

|

1.78 |

|

|

963,184 |

|

|

4,396 |

|

1.82 |

|

|

1,005,003 |

|

|

4,566 |

|

1.81 |

|

|

1,043,858 |

|

|

4,820 |

|

1.84 |

|

|

|

936,508 |

|

|

8,255 |

|

1.76 |

|

|

1,053,979 |

|

|

9,749 |

|

1.85 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Federal Funds Sold and

Interest Bearing Deposits |

|

262,419 |

|

|

3,624 |

|

5.56 |

|

|

140,488 |

|

|

1,893 |

|

5.42 |

|

|

99,763 |

|

|

1,385 |

|

5.51 |

|

|

136,556 |

|

|

1,848 |

|

5.37 |

|

|

218,902 |

|

|

2,782 |

|

5.10 |

|

|

|

201,454 |

|

|

5,517 |

|

5.51 |

|

|

289,543 |

|

|

6,893 |

|

4.80 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Total Earning Assets |

|

3,935,280 |

|

$ |

48,831 |

|

4.99 |

% |

|

3,849,615 |

|

$ |

46,900 |

|

4.90 |

% |

|

3,823,980 |

|

$ |

46,277 |

|

4.80 |

% |

|

3,876,980 |

|

$ |

45,840 |

|

4.69 |

% |

|

3,974,803 |

|

$ |

45,292 |

|

4.57 |

% |

|

|

3,892,447 |

|

$ |

95,731 |

|

4.94 |

% |

|

4,018,502 |

|

$ |

89,319 |

|

4.48 |

% |

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Cash and Due From Banks |

|

74,803 |

|

|

|

|

|

|

|

75,763 |

|

|

|

|

|

|

|

76,681 |

|

|

|

|

|

|

|

75,941 |

|

|

|

|

|

|

|

75,854 |

|

|

|

|

|

|

|

|

75,283 |

|

|

|

|

|

|

|

75,250 |

|

|

|

|

|

|

| Allowance for Credit

Losses |

|

(29,564 |

) |

|

|

|

|

|

|

(30,030 |

) |

|

|

|

|

|

|

(29,998 |

) |

|

|

|

|

|

|

(29,172 |

) |

|

|

|

|

|

|

(27,893 |

) |

|

|

|

|

|

|

|

(29,797 |

) |

|

|

|

|

|

|

(26,771 |

) |

|

|

|

|

|

| Other Assets |

|

291,669 |

|

|

|

|

|

|

|

295,275 |

|

|

|

|

|

|

|

296,114 |

|

|

|

|

|

|

|

295,106 |

|

|

|

|

|

|

|

297,837 |

|

|

|

|

|

|

|

|

293,473 |

|

|

|

|

|

|

|

298,999 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Total Assets |

$ |

4,272,188 |

|

|

|

|

|

|

$ |

4,190,623 |

|

|

|

|

|

|

$ |

4,166,777 |

|

|

|

|

|

|

$ |

4,218,855 |

|

|

|

|

|

|

$ |

4,320,601 |

|

|

|

|

|

|

|

$ |

4,231,406 |

|

|

|

|

|

|

$ |

4,365,980 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

LIABILITIES: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|