false

0001865861

0001865861

2024-08-29

2024-08-29

0001865861

ccts:UnitsEachConsistingOfOneClassAOrdinaryShareAndOnehalfRedeemableWarrantCustomMember

2024-08-29

2024-08-29

0001865861

ccts:ClassAOrdinarySharesParValue00001PerShareCustomMember

2024-08-29

2024-08-29

0001865861

ccts:RedeemableWarrantsEachWarrantExercisableForOneClassAOrdinaryShareAtAnExercisePriceOf1150CustomMember

2024-08-29

2024-08-29

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, DC 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934

Date of Report (Date of earliest event reported):

August 29, 2024

CACTUS ACQUISITION CORP. 1 LTD.

(Exact Name of Registrant as Specified in its Charter)

|

Cayman Islands

|

|

001-40981

|

|

N/A

|

|

(State or other jurisdiction

|

|

(Commission File Number)

|

|

(I.R.S. Employer

|

|

of incorporation)

|

|

|

|

Identification No.)

|

|

4B Cedar Brook Drive

|

|

|

|

Cranbury, New Jersey

|

|

08512

|

|

(Address of Principal Executive Offices)

|

|

(Zip Code)

|

(609) 495-2222

Registrant’s telephone number, including area code

Not Applicable

(Former name or former address, if changed since last report)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (see General Instruction A.2. below):

|

☒

|

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

|

|

☐

|

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

|

|

☐

|

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

|

|

☐

|

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

|

Securities registered pursuant to Section 12(b) of the Act:

|

Title of each class

|

|

Trading

Symbol(s)

|

|

Name of each exchange on

which registered

|

|

Units, each consisting of one Class A ordinary share and one-half redeemable warrant

|

|

CCTSU

|

|

The Nasdaq Stock Market LLC

|

|

Class A ordinary shares, par value $0.0001 per share

|

|

CCTS

|

|

The Nasdaq Stock Market LLC

|

|

Redeemable warrants, each warrant exercisable for one Class A ordinary share at an exercise price of $11.50

|

|

CCTSW

|

|

The Nasdaq Stock Market LLC

|

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ☒

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Item 7.01 Regulation FD Disclosure

On August 29, 2024, Tembo e-LV B.V. (“Tembo”), a private company with limited liability incorporated under the laws of the Netherlands and a subsidiary of VivoPower International PLC (“VivoPower”), a Nasdaq-listed company, issued a press release announcing that it signed a Business Combination Agreement (the “Business Combination Agreement”) with Cactus Acquisition Corp. 1 Limited, a Cayman Islands exempted company (“CCTS”), VivoPower, Tembo Group B.V., a private company with limited liability incorporated under the laws of the Netherlands and a wholly-owned subsidiary of Tembo (“Holdco”) and Tembo EUV Investment Corporation Limited, a Cayman Islands exempted company and a wholly owned subsidiary of Holdco (“Merger Sub”), providing for a business combination between CCTS and Tembo (the “Business Combination”). Pursuant to the Business Combination Agreement, among other things, (i) each shareholder of Tembo will contribute and transfer each share of Tembo held by it to Holdco in exchange for ordinary shares of Holdco (the “Share Exchange”) and (ii) following the Share Exchange, Merger Sub will merge with and into CCTS, with CCTS surviving such merger as a wholly-owned subsidiary of Holdco (the “Merger”) and by virtue of the Merger, each outstanding security of CCTS immediately prior to the effective time of the Merger will automatically convert into the right to receive a substantially equivalent security of Holdco, all upon the terms and subject to the conditions set forth in the Business Combination Agreement and in accordance with the provisions of applicable law.

A copy of the press release is attached hereto as Exhibit 99.1 and incorporated herein by reference.

Forward-Looking Statements

The information in this Current Report on Form 8-K includes “forward-looking statements” within the meaning of the “safe harbor” provisions of the United States Private Securities Litigation Reform Act of 1995. Forward-looking statements may be identified by the use of words such as “estimate,” “plan,” “project,” “forecast,” “intend,” “may,” “will,” “expect,” “continue,” “should,” “would,” “anticipate,” “believe,” “seek,” “target,” “predict,” “potential,” “seem,” “future,” “outlook” or other similar expressions that predict or indicate future events or trends or that are not statements of historical matters, but the absence of these words does not mean that a statement is not forward-looking. These forward‑looking statements include, but are not limited to, statements regarding estimates and forecasts of financial and performance metrics and projections of market opportunity and market share; references with respect to the anticipated benefits of the proposed Business Combination and the projected future financial performance of CCTS, Tembo and Holdco following the proposed Business Combination; changes in the market for Tembo’s products and services and expansion plans and opportunities; Tembo’s ability to successfully execute its expansion plans and business initiatives; ability for Tembo to raise funds to support its business; the sources and uses of cash of the proposed Business Combination; the anticipated capitalization and enterprise value of Holdco following the consummation of the proposed Business Combination; the projected technological developments of Tembo and its competitors; ability of Tembo to control costs associated with operations; the ability to manufacture efficiently at scale; anticipated investments in research and development and the effect of these investments and timing related to commercial product launches; and expectations related to the terms and timing of the proposed Business Combination. These statements are based on various assumptions, whether or not identified in this Current Report on Form 8-K, and on the current expectations of VivoPower’s, Tembo’s and CCTS’s management and are not predictions of actual performance. These forward-looking statements are provided for illustrative purposes only and are not intended to serve as, and must not be relied on by any investor as, a guarantee, an assurance, a prediction or a definitive statement of fact or probability. Actual events and circumstances are difficult or impossible to predict and will differ from assumptions. Many actual events and circumstances are beyond the control of Tembo, CCTS, VivoPower and Holdco. These forward-looking statements are subject to a number of risks and uncertainties, including the occurrence of any event, change or other circumstances that could give rise to the termination of the Business Combination Agreement; the risk that the Business Combination disrupts current plans and operations as a result of the announcement and consummation of the transactions described herein; the inability to recognize the anticipated benefits of the Business Combination; the ability to obtain or maintain the listing of the Holdco’s securities on The Nasdaq Stock Market, following the Business Combination, including having the requisite numbers of shareholders and free-trading shares; costs related to the Business Combination; changes in domestic and foreign business, market, financial, political and legal conditions; risks relating to the uncertainty of certain projected financial information and other forecasts with respect to Tembo; Tembo’s ability to successfully and timely develop, manufacture, sell and expand its technology and products, including implementing its growth strategy and satisfactory fulfillment of existing orders; Tembo’s ability to adequately manage any supply chain risks, including the purchase of a sufficient supply of critical components incorporated into its current and future product offerings; risks relating to Tembo’s operations and business, including information technology and cybersecurity risks, failure to adequately forecast supply and demand, including order volume and fulfillment, loss of key customers or distribution relationships and deterioration in relationships between Tembo and its employees; Tembo’s ability to successfully collaborate with business partners; demand for Tembo’s current and future offerings; risks that orders that have been placed for Tembo’s products are cancelled or modified; risks related to increased competition; risks relating to potential disruption in the transportation and shipping infrastructure, including trade policies and export controls; risks that Tembo is unable to secure or protect its intellectual property; risks of product liability or regulatory lawsuits relating to Tembo’s products and services; risks that Holdco experiences difficulties managing its growth and expanding operations; the inability of the parties to successfully or timely consummate the proposed Business Combination, including the risk that any required shareholder or regulatory approvals are not obtained, are delayed or are subject to unanticipated conditions that could adversely affect the combined company or the expected benefits of the proposed Business Combination; the outcome of any legal proceedings that may be instituted against Tembo, VivoPower, CCTS, Holdco or others following announcement of the proposed Business Combination and transactions contemplated thereby; the ability of Tembo to execute its business model, including market acceptance of its planned products and services and achieving sufficient production volumes at acceptable quality levels and prices; technological improvements by Tembo’s peers and competitors; and those risk factors discussed in documents of Holdco, VivoPower and CCTS filed, or to be filed, with the SEC. If any of these risks materialize or our assumptions prove incorrect, actual results could differ materially from the results implied by these forward-looking statements. There may be additional risks that none of VivoPower, Tembo or CCTS presently know or that VivoPower, Tembo or CCTS currently believe are immaterial that could also cause actual results to differ from those contained in the forward-looking statements. In addition, forward-looking statements reflect VivoPower’s, Tembo’s or CCTS’s expectations, plans or forecasts of future events and views as of the date of this Current Report on Form 8-K. VivoPower, Tembo, CCTS and Holdco anticipate that subsequent events and developments will cause VivoPower’s, Tembo’s or CCTS’s assessments to change. However, while VivoPower, Tembo, CCTS and Holdco may elect to update these forward-looking statements at some point in the future, VivoPower, Tembo, CCTS and Holdco specifically disclaim any obligation to do so. Investors are referred to the most recent reports filed with the SEC by VivoPower and CCTS. Investors are cautioned not to place undue reliance upon any forward-looking statements, which speak only as of the date made, and we undertake no obligation to update or revise the forward-looking statements, whether as a result of new information, future events or otherwise.

Additional Information and Where to Find It

Holdco intends to file with the SEC a Registration Statement on Form F-4 (as may be amended, the “Registration Statement”), which will include a preliminary proxy statement of CCTS and a prospectus of Holdco in connection with the proposed Business Combination. The definitive proxy statement and other relevant documents will be mailed to shareholders of CCTS as of a record date to be established for voting on the proposed Business Combination. SHAREHOLDERS OF CCTS AND OTHER INTERESTED PARTIES ARE URGED TO READ, WHEN AVAILABLE, THE PRELIMINARY PROXY STATEMENT, AND AMENDMENTS THERETO, AND THE DEFINITIVE PROXY STATEMENT IN CONNECTION WITH CCTS’S SOLICITATION OF PROXIES FOR THE EXTRAORDINARY GENERAL MEETING OF ITS SHAREHOLDERS TO BE HELD TO APPROVE THE BUSINESS COMBINATION BECAUSE THESE DOCUMENTS WILL CONTAIN IMPORTANT INFORMATION ABOUT CCTS, TEMBO, HOLDCO AND THE BUSINESS COMBINATION. Shareholders will also be able to obtain copies of the Registration Statement and the proxy statement/prospectus, without charge, once available, on the SEC’s website at www.sec.gov or by directing a request to CCTS at Cactus Acquisition Corp. 1 Ltd, 4B Cedar Brook Drive, Cranbury, NJ 08512, telephone: (609) 495-2222.

Participants in the Solicitation

CCTS, Tembo, VivoPower, Holdco and their respective directors and officers may be deemed participants in the solicitation of proxies of CCTS shareholders in connection with the proposed transaction. More detailed information regarding the directors and officers of CCTS is contained in CCTS’s filings with the SEC, including its Annual Report on Form 10-K for the fiscal year ended December 31, 2023, which was filed with the SEC on April 15, 2024, and is available free of charge at the SEC’s website at www.sec.gov. Information regarding the persons who may, under SEC rules, be deemed participants in the solicitation of proxies of CCTS’s shareholders in connection with the proposed Business Combination and other matters to be voted upon at the meeting of CCTS’s shareholders will be set forth in the Registration Statement for the transaction when available.

No Offer or Solicitation

This Current Report on Form 8-K shall not constitute a solicitation of a proxy, consent, or authorization with respect to any securities or in respect of the proposed transaction. This Current Report on Form 8-K shall also not constitute an offer to sell or the solicitation of an offer to buy any securities, nor shall there be any sale of securities in any states or jurisdictions in which such offer, solicitation, or sale would be unlawful prior to registration or qualification under the securities laws of any such jurisdiction. No offering of securities shall be made except by means of a prospectus meeting the requirements of Section 10 of the Securities Act of 1933, as amended, or an exemption therefrom.

Item 9.01. Financial Statements and Exhibits.

| |

(d)

|

Exhibits.

|

| |

|

|

| |

|

The following exhibits are being filed herewith:

|

|

99.1

|

|

|

|

104

|

|

Cover Page Interactive Data File (embedded within the Inline XBRL document).

|

SIGNATURE

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| |

CACTUS ACQUISITION CORP. 1 LTD.

|

| |

|

|

|

Date: August 29, 2024

|

By:

|

/s/ Gary Challinor

|

| |

|

Gary Challinor

|

| |

|

Chief Executive Officer

|

Exhibit 99.1

Tembo E-LV, a subsidiary of Nasdaq-listed VivoPower International PLC (“VVPR”) executes a definitive Business Combination Agreement with CCTS for a combined enterprise value of US $904 million

Independent third-party fairness opinion was obtained and satisfactorily completed

Pro forma fully diluted combined enterprise value assumes no public trust redemptions

LONDON, 29 August 2024 – Tembo E-LV B.V. (“Tembo”), a subsidiary of Nasdaq-listed B Corporation, VivoPower International PLC (Nasdaq: VVPR) (“VivoPower”), today announced that it has executed a definitive Business Combination Agreement (“BCA”) with Cactus Acquisition Corp. 1 Limited, a Cayman Islands exempted special purpose acquisition company (Nasdaq: CCTS, CCTSW, CCTSU) (“CCTS”).

The BCA assigns a pro forma enterprise value to the combination of Tembo and CCTS, assuming no redemptions by CCTS public shareholders at or before closing of US$904 million and precludes any further direct investment into Tembo.

The BCA was entered into by the parties following due diligence and receipt by the CCTS board of directors of a fairness opinion from an independent third party.

The parties expect a registration statement on Form F-4 to be filed with the U.S. Securities and Exchange Commission (the “SEC”) in connection with the proposed transaction (the “Business Combination”), which they are working to close, subject to satisfaction (or waiver, as applicable) of closing conditions, including, without limitation, the completion of the SEC review process and approval of the transaction by CCTS shareholders, prior to the end of calendar year 2024.

In connection with the Business Combination, the parties will submit to Nasdaq an application to list the securities of a newly formed company (“Tembo Group”) established in connection with the transaction on Nasdaq.

Advisors

Chardan is acting as exclusive financial and capital markets advisor to VivoPower and Tembo. White & Case LLP is serving as U.S. legal advisor to VivoPower and Tembo; NautaDutilh N.V. is serving as Dutch legal counsel to VivoPower and Tembo. Ellenoff Grossman & Schole LLP is serving as U.S. legal advisor to CCTS; De Metz Advocaten N.V. is serving as Dutch counsel to CCTS.

About Tembo

Tembo electric utility vehicles (EUVs) are a 100% electric solution for ruggedised and/or customised applications for fleet owners in the mining, agriculture, energy utilities, defence, police, construction, infrastructure, government, humanitarian, and game safari industries. Tembo provides safe, high-performance off-road and on-road electric utility vehicles. Its core purpose is to provide safe and reliable electrification solutions for utility vehicle fleet owners, helping to perpetuate useful life, reduce costs, maximise return on assets, meet ESG goals and seeks to further the circular economy. Tembo is a subsidiary of VivoPower, a Nasdaq listed B Corporation.

About VivoPower

VivoPower is an award-winning global sustainable energy solutions B Corporation company focused on electric solutions for off-road and on-road customised and ruggedised fleet applications as well as ancillary financing, charging, battery and microgrids solutions.

The Company’s core purpose is to provide its customers with turnkey decarbonisation solutions that enable them to move toward net-zero carbon status. VivoPower has operations and personnel covering Australia, Canada, the Netherlands, the United Kingdom, the United States, the Philippines, and the United Arab Emirates.

About Cactus Acquisition Corp.

Cactus Acquisition Corp. 1 Limited is a blank check company formed for the purpose of effecting a merger, share exchange, asset acquisition, share purchase, reorganisation or similar business combination.

Forward-Looking Statements

The information in this press release includes “forward-looking statements” within the meaning of the “safe harbor” provisions of the United States Private Securities Litigation Reform Act of 1995. Forward-looking statements may be identified by the use of words such as “estimate,” “plan,” “project,” “forecast,” “intend,” “may,” “will,” “expect,” “continue,” “should,” “would,” “anticipate,” “believe,” “seek,” “target,” “predict,” “potential,” “seem,” “future,” “outlook” or other similar expressions that predict or indicate future events or trends or that are not statements of historical matters, but the absence of these words does not mean that a statement is not forward-looking. These forward-looking statements include, but are not limited to, statements regarding estimates and forecasts of financial and performance metrics and projections of market opportunity and market share; references with respect to the anticipated benefits of the proposed Business Combination and the projected future financial performance of CCTS, Tembo and Pubco following the proposed Business Combination; changes in the market for Tembo’s products and services and expansion plans and opportunities; Tembo’s ability to successfully execute its expansion plans and business initiatives; ability for Tembo to raise funds to support its business; the sources and uses of cash of the proposed Business Combination; the anticipated capitalization and enterprise value of Pubco following the consummation of the proposed Business Combination; the projected technological developments of Tembo and its competitors; ability of Tembo to control costs associated with operations; the ability to manufacture efficiently at scale; anticipated investments in research and development and the effect of these investments and timing related to commercial product launches; and expectations related to the terms and timing of the proposed Business Combination. These statements are based on various assumptions, whether or not identified in this press release, and on the current expectations of VivoPower’s, Tembo’s and CCTS’s management and are not predictions of actual performance. These forward-looking statements are provided for illustrative purposes only and are not intended to serve as, and must not be relied on by any investor as, a guarantee, an assurance, a prediction or a definitive statement of fact or probability. Actual events and circumstances are difficult or impossible to predict and will differ from assumptions. Many actual events and circumstances are beyond the control of Tembo, CCTS, VivoPower and Pubco. These forward-looking statements are subject to a number of risks and uncertainties, including the occurrence of any event, change or other circumstances that could give rise to the termination of the Business Combination Agreement, the risk that the Business Combination disrupts current plans and operations as a result of the announcement and consummation of the transactions described herein; the inability to recognize the anticipated benefits of the Business Combination; the ability to obtain or maintain the listing of the Pubco’s securities on The Nasdaq Stock Market, following the Business Combination, including having the requisite number of shareholders and free trading shares; costs related to the Business Combination; changes in domestic and foreign business, market, financial, political and legal conditions; risks relating to the uncertainty of certain projected financial information and other forecasts with respect to Tembo; Tembo’s ability to successfully and timely develop, manufacture, sell and expand its technology and products, including implementing its growth strategy and satisfactory fulfillment of existing orders; Tembo’s ability to adequately manage any supply chain risks, including the purchase of a sufficient supply of critical components incorporated into its product offerings; risks relating to Tembo’s operations and business, including information technology and cybersecurity risks, failure to adequately forecast supply and demand, including order volume and fulfillment, loss of key customers or distribution relationships and deterioration in relationships between Tembo and its employees; Tembo’s ability to successfully collaborate with business partners; demand for Tembo’s current and future offerings; risks that orders that have been placed for Tembo’s products are cancelled or modified; risks related to increased competition; risks relating to potential disruption in the transportation and shipping infrastructure, including trade policies and export controls; risks that Tembo is unable to secure or protect its intellectual property; risks of product liability or regulatory lawsuits relating to Tembo’s products and services; risks that Pubco experiences difficulties managing its growth and expanding operations; the inability of the parties to successfully or timely consummate the proposed Business Combination, including the risk that any required shareholder or regulatory approvals are not obtained, are delayed or are subject to unanticipated conditions that could adversely affect the combined company or the expected benefits of the proposed Business Combination; the outcome of any legal proceedings that may be instituted against Tembo, VivoPower, CCTS, Pubco or others following announcement of the proposed Business Combination and transactions contemplated thereby; the ability of Tembo to execute its business model, including market acceptance of its planned products and services and achieving sufficient production volumes at acceptable quality levels and prices; technological improvements by Tembo’s peers and competitors; and those risk factors discussed in documents of Pubco, VivoPower and CCTS filed, or to be filed, with the SEC. If any of these risks materialize or our assumptions prove incorrect, actual results could differ materially from the results implied by these forward-looking statements. There may be additional risks that none of VivoPower, Tembo or CCTS presently know or that VivoPower, Tembo or CCTS currently believe are immaterial that could also cause actual results to differ from those contained in the forward-looking statements. In addition, forward-looking statements reflect VivoPower’s, Tembo’s or CCTS’s expectations, plans or forecasts of future events and views as of the date of this press release. VivoPower, Tembo, CCTS and Pubco anticipate that subsequent events and developments will cause VivoPower’s, Tembo’s or CCTS’s assessments to change. However, while VivoPower, Tembo, CCTS and Pubco may elect to update these forward-looking statements at some point in the future, VivoPower, Tembo, CCTS and Pubco specifically disclaim any obligation to do so. Investors are referred to the most recent reports filed with the SEC by VivoPower and CCTS. Investors are cautioned not to place undue reliance upon any forward-looking statements, which speak only as of the date made, and we undertake no obligation to update or revise the forward-looking statements, whether as a result of new information, future events or otherwise.

Additional Information and Where to Find It

The Registration Statement to be filed by Pubco with the SEC will include a preliminary proxy statement of CCTS and a prospectus of Pubco in connection with the proposed Business Combination. The definitive proxy statement and other relevant documents will be mailed to shareholders of CCTS as of a record date to be established for voting on the proposed Business Combination.

SHAREHOLDERS OF CCTS AND OTHER INTERESTED PARTIES ARE URGED TO READ, WHEN AVAILABLE, THE PRELIMINARY PROXY STATEMENT, AND AMENDMENTS THERETO, AND THE DEFINITIVE PROXY STATEMENT IN CONNECTION WITH CCTS’S SOLICITATION OF PROXIES FOR THE EXTRAORDINARY GENERAL MEETING OF ITS SHAREHOLDERS TO BE HELD TO APPROVE THE BUSINESS COMBINATION BECAUSE THESE DOCUMENTS WILL CONTAIN IMPORTANT INFORMATION ABOUT CCTS, TEMBO, PUBCO AND THE BUSINESS COMBINATION.

Shareholders will also be able to obtain copies of the Registration Statement and the proxy statement/prospectus, without charge, once available, on the SEC’s website at www.sec.gov or by directing a request to CCTS at Cactus Acquisition Corp. 1 Ltd, 4B Cedar Brook Drive, Cranbury, NJ 08512, telephone: (609) 495-2222.

Participants in the Solicitation

Tembo, VivoPower, CCTS, Pubco and their respective directors and officers may be deemed participants in the solicitation of proxies of CCTS shareholders in connection with the proposed transaction. More detailed information regarding the directors and officers of CCTS is contained in CCTS’s filings with the SEC, including its Annual Report on Form 10-K for the fiscal year ended December 31, 2023, which was filed with the SEC on April 15, 2024, and is available free of charge at the SEC’s website at www.sec.gov. Information regarding the persons who may, under SEC rules, be deemed participants in the solicitation of proxies of CCTS’s shareholders in connection with the proposed Business Combination and other matters to be voted upon at the meeting of CCTS’s shareholders will be set forth in the Registration Statement for the transaction when available.

No Offer or Solicitation

This press release shall not constitute a solicitation of a proxy, consent, or authorization with respect to any securities or in respect of the proposed transaction. This press release shall also not constitute an offer to sell or the solicitation of an offer to buy any securities, nor shall there be any sale of securities in any states or jurisdictions in which such offer, solicitation, or sale would be unlawful prior to registration or qualification under the securities laws of any such jurisdiction. No offering of securities shall be made except by means of a prospectus meeting the requirements of Section 10 of the Securities Act of 1933, as amended, or an exemption therefrom.

Contact

Shareholder Enquiries

shareholders@vivopower.com

v3.24.2.u1

Document And Entity Information

|

Aug. 29, 2024 |

| Document Information [Line Items] |

|

| Entity, Registrant Name |

CACTUS ACQUISITION CORP. 1 LTD.

|

| Document, Type |

8-K

|

| Document, Period End Date |

Aug. 29, 2024

|

| Entity, Incorporation, State or Country Code |

E9

|

| Entity, File Number |

001-40981

|

| Entity, Address, Address Line One |

4B Cedar Brook Drive

|

| Entity, Address, City or Town |

Cranbury

|

| Entity, Address, State or Province |

NJ

|

| Entity, Address, Postal Zip Code |

08512

|

| City Area Code |

609

|

| Local Phone Number |

495-2222

|

| Written Communications |

true

|

| Soliciting Material |

false

|

| Pre-commencement Tender Offer |

false

|

| Pre-commencement Issuer Tender Offer |

false

|

| Entity, Emerging Growth Company |

true

|

| Entity, Ex Transition Period |

false

|

| Amendment Flag |

false

|

| Entity, Central Index Key |

0001865861

|

| UnitsEachConsistingOfOneClassAOrdinaryShareAndOnehalfRedeemableWarrant Custom [Member] |

|

| Document Information [Line Items] |

|

| Title of 12(b) Security |

Units, each consisting of one Class A ordinary share and one-half redeemable warrant

|

| Trading Symbol |

CCTSU

|

| Security Exchange Name |

NASDAQ

|

| ClassAOrdinarySharesParValue00001PerShare Custom [Member] |

|

| Document Information [Line Items] |

|

| Title of 12(b) Security |

Class A ordinary shares, par value $0.0001 per share

|

| Trading Symbol |

CCTS

|

| Security Exchange Name |

NASDAQ

|

| RedeemableWarrantsEachWarrantExercisableForOneClassAOrdinaryShareAtAnExercisePriceOf1150 Custom [Member] |

|

| Document Information [Line Items] |

|

| Title of 12(b) Security |

Redeemable warrants, each warrant exercisable for one Class A ordinary share at an exercise price of $11.50

|

| Trading Symbol |

CCTSW

|

| Security Exchange Name |

NASDAQ

|

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Details

| Name: |

us-gaap_StatementClassOfStockAxis=ccts_UnitsEachConsistingOfOneClassAOrdinaryShareAndOnehalfRedeemableWarrantCustomMember |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

| X |

- Details

| Name: |

us-gaap_StatementClassOfStockAxis=ccts_ClassAOrdinarySharesParValue00001PerShareCustomMember |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

| X |

- Details

| Name: |

us-gaap_StatementClassOfStockAxis=ccts_RedeemableWarrantsEachWarrantExercisableForOneClassAOrdinaryShareAtAnExercisePriceOf1150CustomMember |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

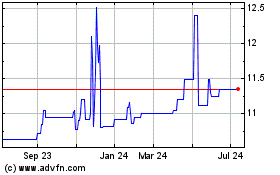

Cactus Acquisition Corp 1 (NASDAQ:CCTSU)

Historical Stock Chart

From Oct 2024 to Nov 2024

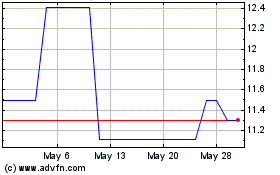

Cactus Acquisition Corp 1 (NASDAQ:CCTSU)

Historical Stock Chart

From Nov 2023 to Nov 2024