false

0001851909

0001851909

2024-07-11

2024-07-11

0001851909

CDAQ:UnitsEachConsistingOfOneClassOrdinaryShareAndOnethirdOfOneRedeemableWarrantMember

2024-07-11

2024-07-11

0001851909

CDAQ:ClassOrdinarySharesParValue0.0001PerShareMember

2024-07-11

2024-07-11

0001851909

CDAQ:WarrantsEachExercisableForOneClassOrdinaryShareFor11.50PerShareMember

2024-07-11

2024-07-11

iso4217:USD

xbrli:shares

iso4217:USD

xbrli:shares

UNITED

STATES

SECURITIES

AND EXCHANGE COMMISSION

Washington,

D.C. 20549

FORM

8-K

CURRENT

REPORT

Pursuant

to Section 13 or 15(d) of The Securities Exchange Act of 1934

Date

of Report (Date of earliest event reported): July 11, 2024

COMPASS

DIGITAL ACQUISITION CORP.

(Exact

name of registrant as specified in its charter)

| Cayman

Islands |

|

001-40912 |

|

N/A |

(State

or other jurisdiction

of

incorporation) |

|

(Commission

File

Number) |

|

(IRS

Employer

Identification

No.) |

195

US HWY 50, Suite 309

Zephyr

Cove, NV

(Address

of principal executive offices)

89448

(Zip

Code)

Registrant’s

telephone number, including area code: (214) 526-4423

Not

Applicable

(Former

name or former address, if changed since last report.)

Check

the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under

any of the following provisions:

| ☐ |

Written

communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| |

|

| ☐ |

Soliciting

material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| |

|

| ☐ |

Pre-commencement

communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| |

|

| ☐ |

Pre-commencement

communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities

registered pursuant to Section 12(b) of the Act:

| Title

of each class |

|

Trading

Symbol(s) |

|

Name

of each exchange on which registered |

| Units,

each consisting of one Class A Ordinary Share and one-third of one redeemable Warrant |

|

CDAQU |

|

The

Nasdaq Stock Market LLC |

| |

|

|

|

|

| Class

A Ordinary Shares, par value $0.0001 per share |

|

CDAQ |

|

The

Nasdaq Stock Market LLC |

| |

|

|

|

|

| Warrants,

each exercisable for one Class A Ordinary Share for $11.50 per share |

|

CDAQW |

|

The

Nasdaq Stock Market LLC |

Indicate

by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405

of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging

growth company ☒

If

an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying

with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act.

| Item 7.01. |

Regulation

FD Disclosure. |

On

June 6, 2024, Compass Digital Acquisition Corp., a Cayman Islands exempted company (the “Company”), entered into a

non-binding letter of intent with a renewable energy platform company for an initial business combination.

Completion

of the transaction is subject to, among other matters, the completion of due diligence, the negotiation of a definitive agreement providing

for the transaction, satisfaction of the conditions negotiated therein and approval of the transaction by the Company’s shareholders.

Accordingly, there can be no assurance that a definitive agreement will be entered into or that the proposed transaction will be consummated.

The

information in this Item 7.01 is furnished and shall not be deemed “filed” for purposes of Section 18 of the Securities Exchange

Act of 1934, as amended (the “Exchange Act”), or otherwise subject to liabilities under that section, and shall not

be deemed to be incorporated by reference into the filings of the Company under the Securities Act of 1933, as amended (the “Securities

Act”), or the Exchange Act, regardless of any general incorporation language in such filings. This Amended Form 8-K will not

be deemed an admission as to the materiality of any information of the information in this Item 7.01.

Postponement

of the Meeting

The

Company has determined to postpone the extraordinary general meeting in lieu of an annual general meeting of the shareholders of the

Company (the “Meeting”), initially scheduled to occur on Monday, July 15, 2024 at 12:00 p.m., Eastern Time, to Thursday,

July 18, 2024, at 9:00 a.m., Eastern Time. As previously disclosed, the purpose of the Meeting is to, among other things, approve an

amendment to the Company’s amended and restated memorandum and articles of association, as amended and currently in effect, with

immediate effect, to extend the date by which the Company must consummate an initial business combination from July 19, 2024 to December

19, 2024, and then on a monthly basis up to four (4) times until April 19, 2025 (or such earlier date as determined by the Company’s

board of directors (the “Extension”)). The Meeting will be held in person at the offices of Ellenoff Grossman &

Schole LLP, located at 1345 Avenue of the Americas, 11th Floor, New York, New York 10105. The deadlines by which shareholders

must (i) exercise their redemption rights in connection with the vote to approve the Extension and (ii) reserve their attendance at the

Meeting has been extended to Tuesday, July 16, 2024, at 5:00 p.m., Eastern Time, which is two business days prior to the Meeting.

Participants

in the Solicitation

The

Company and its directors and executive officers and other persons may be deemed to be participants in the solicitation of proxies from

the Company’s shareholders in respect of the Meeting and related matters. Information regarding the Company’s directors and

executive officers is available in the definitive proxy statement on Schedule 14A (the “Proxy Statement”). Additional

information regarding the participants in the proxy solicitation and a description of their direct and indirect interests are contained

in the Proxy Statement.

No

Offer or Solicitation

This

communication shall not constitute an offer to sell or the solicitation of an offer to buy any securities, nor shall there be any sale

of securities in any jurisdiction in which the offer, solicitation or sale would be unlawful prior to the registration or qualification

under the securities laws of any such jurisdiction. No offering of securities shall be made except by means of a prospectus meeting the

requirements of Section 10 of the Securities Act.

Additional

Information

The

Company has filed the Proxy Statement with the U.S. Securities and Exchange Commission (the “SEC”) in connection with

the Meeting to consider and vote upon the Extension, the Auditor Ratification and other matters and, beginning on or about June 25, 2024,

mailed the Proxy Statement and other relevant documents to its shareholders as of the June 13, 2024, the record date for the Meeting.

The Company’s shareholders and other interested persons are advised to read the Proxy Statement and any other relevant documents

that have been or will be filed with the SEC in connection with the Company’s solicitation of proxies for the Meeting because these

documents contain important information about the Company, the Extension, the Auditor Ratification and related matters. Shareholders

may also obtain a free copy of the Proxy Statement, as well as other relevant documents that have been or will be filed with the SEC,

without charge, at the SEC’s website located at www.sec.gov or by directing a request to: Compass Digital Acquisition Corp., 195

US HWY 50, Suite 309, Zephyr Cove, NV 89448, Telephone No.: (310) 954-9665.

Forward-Looking

Statements

This

Current Report on Form 8-K (this “Form 8-K”) includes “forward-looking statements” within the meaning of Section

27A of the Securities Act and Section 21E of the Securities Exchange Act of 1934, as amended. All statements other than statements of

historical fact included in this Form 8-K are forward-looking statements. When used in this Form 8-K, words such as “anticipate,”

“believe,” “continue,” “could,” “estimate,” “expect,” “intend,”

“may,” “might,” “plan,” “possible,” “potential,” “predict,” “project,”

“should,” “would” and similar expressions, as they relate to us or our management team, identify forward-looking

statements. Such forward-looking statements are based on the beliefs of the Company’s management, as well as assumptions made by,

and information currently available to, the Company’s management. Actual results could differ materially from those contemplated

by the forward-looking statements as a result of certain factors detailed in the Company’s filings with the SEC. All subsequent

written or oral forward-looking statements attributable to the Company or persons acting on its behalf are qualified in their entirety

by this paragraph. Forward-looking statements are subject to numerous conditions, many of which are beyond the control of the Company,

including those set forth in the “Risk Factors” section of the Company’s Proxy Statement, Annual Reports on

Form 10-K, Quarterly Reports on Form 10-Q and initial public offering prospectus. The Company undertakes no obligation to update these

statements for revisions or changes after the date of this release, except as required by law.

| Item 9.01 |

Financial

Statements and Exhibits. |

(d)

Exhibits

Exhibit

No. |

|

Description

of Exhibits |

| |

|

| 104 |

|

Cover

Page Interactive Data File (embedded within the Inline XBRL documents). |

SIGNATURES

Pursuant

to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by

the undersigned hereunto duly authorized.

| |

COMPASS

DIGITAL ACQUISITION CORP. |

| |

|

| |

By: |

/s/

Nick Geeza |

| |

Name: |

Nick

Geeza |

| |

Title: |

Chief

Financial Officer |

Date:

July 11, 2024

v3.24.2

Cover

|

Jul. 11, 2024 |

| Document Type |

8-K

|

| Amendment Flag |

false

|

| Document Period End Date |

Jul. 11, 2024

|

| Entity File Number |

001-40912

|

| Entity Registrant Name |

COMPASS

DIGITAL ACQUISITION CORP.

|

| Entity Central Index Key |

0001851909

|

| Entity Incorporation, State or Country Code |

E9

|

| Entity Address, Address Line One |

195

US HWY 50

|

| Entity Address, Address Line Two |

Suite 309

|

| Entity Address, City or Town |

Zephyr

Cove

|

| Entity Address, State or Province |

NV

|

| Entity Address, Postal Zip Code |

89448

|

| City Area Code |

(214)

|

| Local Phone Number |

526-4423

|

| Written Communications |

false

|

| Soliciting Material |

false

|

| Pre-commencement Tender Offer |

false

|

| Pre-commencement Issuer Tender Offer |

false

|

| Entity Emerging Growth Company |

true

|

| Elected Not To Use the Extended Transition Period |

false

|

| Units, each consisting of one Class A Ordinary Share and one-third of one redeemable Warrant |

|

| Title of 12(b) Security |

Units,

each consisting of one Class A Ordinary Share and one-third of one redeemable Warrant

|

| Trading Symbol |

CDAQU

|

| Security Exchange Name |

NASDAQ

|

| Class A Ordinary Shares, par value $0.0001 per share |

|

| Title of 12(b) Security |

Class

A Ordinary Shares, par value $0.0001 per share

|

| Trading Symbol |

CDAQ

|

| Security Exchange Name |

NASDAQ

|

| Warrants, each exercisable for one Class A Ordinary Share for $11.50 per share |

|

| Title of 12(b) Security |

Warrants,

each exercisable for one Class A Ordinary Share for $11.50 per share

|

| Trading Symbol |

CDAQW

|

| Security Exchange Name |

NASDAQ

|

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 2 such as Street or Suite number

| Name: |

dei_EntityAddressAddressLine2 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14a

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Details

| Name: |

us-gaap_StatementClassOfStockAxis=CDAQ_UnitsEachConsistingOfOneClassOrdinaryShareAndOnethirdOfOneRedeemableWarrantMember |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

| X |

- Details

| Name: |

us-gaap_StatementClassOfStockAxis=CDAQ_ClassOrdinarySharesParValue0.0001PerShareMember |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

| X |

- Details

| Name: |

us-gaap_StatementClassOfStockAxis=CDAQ_WarrantsEachExercisableForOneClassOrdinaryShareFor11.50PerShareMember |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

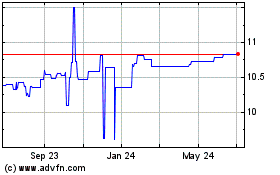

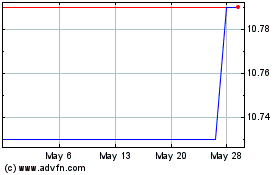

Compass Digital Acquisit... (NASDAQ:CDAQU)

Historical Stock Chart

From Oct 2024 to Nov 2024

Compass Digital Acquisit... (NASDAQ:CDAQU)

Historical Stock Chart

From Nov 2023 to Nov 2024