Strong Gross Profit Margin and Cash Flow

Reinforce Durability of Strategy

CDW Corporation (Nasdaq:CDW):

(Dollars in millions, except per share amounts and

percentage)

Three Months Ended March

31,

2024

2023

%

Chg.

Net Sales

$

4,872.7

$

5,103.1

(4.5

)

Gross Profit

$

1,063.3

$

1,089.4

(2.4

)

Gross Profit Margin

21.8

%

21.3

%

Operating Income

$

328.0

$

355.3

(7.7

)

Non-GAAP Operating Income2

$

403.5

$

434.3

(7.1

)

Net Income

$

216.1

$

230.1

(6.1

)

Non-GAAP Net Income2

$

260.8

$

278.7

(6.4

)

Net Income per Diluted Share

$

1.59

$

1.68

(5.2

)

Non-GAAP Net Income per Diluted Share2

$

1.92

$

2.03

(5.5

)

Average Daily Sales1

$

76.1

$

79.7

(4.5

)

1 Defined as Net sales divided by the

number of selling days. There were 64 selling days for both the

three months ended March 31, 2024 and 2023.

2 Non-GAAP measures used in this release

that are not based on accounting principles generally accepted in

the United States of America ("US GAAP") are each defined and

reconciled to the most directly comparable US GAAP measure in the

attached schedules.

CDW Corporation (Nasdaq: CDW), a leading multi-brand provider of

information technology solutions to business, government, education

and healthcare customers in the United States, the United Kingdom

and Canada, today announced first quarter 2024 results. CDW also

announced the approval by its Board of Directors of a quarterly

cash dividend of $0.62 per share to be paid on June 11, 2024 to all

stockholders of record as of the close of business on May 24,

2024.

"Within a persistently challenging environment, our strong gross

margin reinforces the significant progress we continue to make

executing our long-term strategy," said Christine A. Leahy, chair

and chief executive officer, CDW. "During this time, the need for a

trusted advisor has never been greater and our teams are helping

customers navigate complexity and maximize return on their IT

investments."

"First quarter IT market conditions were weaker than expected,

with caution, concern, and complexity adversely impacting

customers' capital investment decisions and elongating customer

decision-making. The resulting decline in solutions spend was

partially offset by demand for client devices," said Albert J.

Miralles, chief financial officer, CDW. "In 2024, we will continue

to optimize our cash flow generation through effective management

of our working capital, providing strategic flexibility across our

capital priorities including strategic M&A and share

repurchases."

"Customers continue to turn to CDW to address their

mission-critical IT and operational needs across the full IT

solutions stack and lifecycle. We remain well-positioned to attain

our target of exceeding US IT market growth by 200 to 300 basis

points on a constant currency basis. To achieve this, we remain

laser focused on meeting the needs of our more than 250,000

customers around the globe and remaining the partner of choice for

more than 1,000 leading and emerging technology brands as the IT

market continues to evolve," concluded Leahy.

First Quarter of 2024

Highlights:

Net sales in the first quarter of 2024 were $4,873 million,

compared to $5,103 million in the first quarter of 2023, a decrease

of 4.5 percent. There were 64 selling days for both the three

months ended March 31, 2024 and 2023. Net sales on a constant

currency basis decreased 4.9 percent. Continued economic

uncertainty has led customers to be cautious and measured in their

approach to technology spending, resulting in a reduction or delay

in their spend. The first quarter Net sales performance

included:

- Corporate segment Net sales of $2,136 million, 3.1 percent

lower than 2023.

- Small Business segment Net sales of $381 million, 7.4 percent

lower than 2023.

- Public segment Net sales of $1,725 million, 4.9 percent lower

than 2023. Public results were primarily driven by a decrease in

Net sales to Education customers of 10.4 percent.

- Net sales for CDW's UK and Canadian operations, combined as

“Other” for financial reporting purposes, were $631 million, 6.5

percent lower than 2023.

Gross profit in the first quarter of 2024 was $1,063 million,

compared to $1,089 million for 2023, representing a decrease of 2.4

percent. Gross profit margin was 21.8 percent in the first quarter

of 2024 versus 21.3 percent for 2023. The increase in Gross profit

margin was primarily driven by a more favorable contribution of

netted down revenue, primarily software as a service, partially

offset by lower product margin due to a higher mix of

notebooks/mobile devices.

Selling and administrative expenses were $735 million in the

first quarter of 2024, compared to $734 million in the first

quarter of 2023, representing an increase of 0.2 percent, primarily

due to workplace optimization costs, partially offset by lower

performance-based compensation.

Operating income was $328 million in the first quarter of 2024,

compared to $355 million in the first quarter of 2023, representing

a decrease of 7.7 percent. Non-GAAP operating income was $404

million in the first quarter of 2024, compared to $434 million in

the first quarter of 2023, representing a decrease of 7.1 percent.

Operating income margin and Non-GAAP operating income margin were

6.7 percent and 8.3 percent, respectively, for the first quarter of

2024 versus 7.0 percent and 8.5 percent for the first quarter of

2023.

Interest expense, net includes interest expense and interest

income. Interest expense, net was $51 million for the first quarter

of 2024, compared to $58 million for the first quarter of 2023. The

decrease was primarily due to higher interest income earned on cash

balances and lower debt levels, partially offset by a higher

variable interest rate on the senior unsecured term loan.

The effective tax rate was 21.9 percent in the first quarter of

2024, compared to 22.3 percent in the first quarter of 2023, which

resulted in tax expense of $61 million and $66 million,

respectively. The decrease in effective tax rate was primarily

attributable to higher excess tax benefits on equity-based

compensation.

Net income was $216 million in the first quarter of 2024,

compared to $230 million in the first quarter of 2023, representing

a decrease of 6.1 percent. Non-GAAP net income was $261 million for

the first quarter of 2024, compared to $279 million in the first

quarter of 2023, representing a decrease of 6.4 percent.

Weighted average diluted shares outstanding were 136 million for

the first quarter of 2024, compared to 137 million for the first

quarter of 2023. Net income per diluted share for the first quarter

of 2024 was $1.59, compared to $1.68 for 2023, representing a

decrease of 5.2 percent. Non-GAAP net income per diluted share for

the first quarter of 2024 was $1.92, compared to $2.03 for 2023,

representing a decrease of 5.5 percent.

Forward-Looking Statements

This release contains "forward-looking statements" within the

meaning of the federal securities laws. All statements other than

statements of historical fact are forward-looking statements. These

statements relate to analyses and other information, which are

based on forecasts of future results or events and estimates of

amounts not yet determinable. These statements also relate to our

future prospects, growth, developments and business strategies. We

claim the protection of The Private Securities Litigation Reform

Act of 1995 for all forward-looking statements in this release.

These forward-looking statements are identified by the use of

terms and phrases such as "anticipate," "assume," "believe,"

"estimate," "expect," "goal," "intend," "plan," "potential,"

"predict," "project," "target" and similar terms and phrases or

future or conditional verbs such as "could," "may," "should,"

"will," and "would." However, these words are not the exclusive

means of identifying such statements. Although we believe that our

plans, intentions and other expectations reflected in or suggested

by such forward-looking statements are reasonable, we cannot assure

you that we will achieve those plans, intentions or expectations.

All forward-looking statements are subject to risks and

uncertainties that may cause actual results or events to differ

materially from those that we expected.

Important factors that could cause actual results or events to

differ materially from our expectations, or cautionary statements,

are disclosed under the sections entitled "Risk Factors" and

"Trends and Key Factors Affecting our Financial Performance"

included in our Annual Report on Form 10-K for the year ended

December 31, 2023 and from time to time in our subsequent Quarterly

Reports on Form 10-Q and our other US Securities and Exchange

Commission ("SEC") filings and public communications. These factors

include, among others, inflationary pressures; level of interest

rates; CDW's relationships with vendor partners and terms of their

agreements; continued innovations in technology by CDW's vendor

partners; the use or capabilities of artificial intelligence;

substantial competition that could reduce CDW's market share; the

continuing development, maintenance and operation of CDW's

information technology systems; potential breaches of data security

and failure to protect our information technology systems from

cybersecurity threats; potential failures to provide high-quality

services to CDW's customers; potential losses of any key personnel,

significant increases in labor costs or ineffective workforce

management; potential adverse occurrences at one of CDW's primary

facilities or third-party data centers, including as a result of

climate change; increases in the cost of commercial delivery

services or disruptions of those services; CDW's exposure to

accounts receivable and inventory risks; future acquisitions or

alliances; fluctuations in CDW's operating results; fluctuations in

foreign currency; global and regional economic and political

conditions, including the impact of pandemics such as COVID-19 and

armed conflicts; potential interruptions of the flow of products

from suppliers; decreases in spending on technology products and

services, including impacts of adverse change in government

spending policies; potential failures to comply with Public segment

contracts or applicable laws and regulations; current and future

legal proceedings, investigations and audits, including

intellectual property infringement claims; changes in laws,

including regulations or interpretations thereof, or the potential

failure to meet stakeholder expectations on environmental

sustainability and corporate responsibility matters; CDW's level of

indebtedness; restrictions imposed by agreements relating to CDW's

indebtedness on its operations and liquidity; failure to maintain

the ratings assigned to CDW's debt securities by rating agencies;

changes in, or the discontinuation of, CDW's share repurchase

program or dividend payments; and other risk factors or

uncertainties identified from time to time in CDW's filings with

the SEC. All written and oral forward-looking statements

attributable to us, or persons acting on our behalf, are expressly

qualified in their entirety by those cautionary statements as well

as other cautionary statements that are made from time to time in

our other SEC filings and public communications. You should

evaluate all forward-looking statements made in this release in the

context of these risks and uncertainties.

We caution you that the important factors referenced above may

not reflect all of the factors that could cause actual results or

events to differ from our expectations. In addition, we cannot

assure you that we will realize the results or developments we

expect or anticipate or, even if substantially realized, that they

will result in the consequences or affect us or our operations in

the way we expect. The forward-looking statements included in this

release are made only as of the date hereof. We undertake no

obligation to publicly update or revise any forward-looking

statement as a result of new information, future events or

otherwise, except as otherwise required by law.

Non-GAAP Financial Information

Generally, a non-GAAP financial measure is a numerical measure

of a company’s performance or financial condition that either

excludes or includes amounts that are not normally included or

excluded in the most directly comparable measure calculated and

presented in accordance with US GAAP. Non-GAAP measures used by

management may differ from similar measures used by other

companies, even when similar terms are used to identify such

measures.

Our non-GAAP performance measures include Non-GAAP operating

income, Non-GAAP operating income margin, Non-GAAP net income,

Non-GAAP net income per diluted share and Net sales on a constant

currency basis, and our non-GAAP financial condition measures

include Free cash flow and Adjusted free cash flow. These non-GAAP

performance measures and non-GAAP financial condition measures are

collectively referred to as "non-GAAP financial measures".

Non-GAAP operating income excludes, among other things, charges

related to the amortization of acquisition-related intangible

assets, equity-based compensation and the associated payroll taxes,

acquisition and integration expenses, transformation initiatives

and workplace optimization. Non-GAAP operating income margin is

defined as Non-GAAP operating income as a percentage of Net sales.

Non-GAAP net income and Non-GAAP net income per diluted share

excludes, among other things, charges related to

acquisition-related intangible asset amortization, equity-based

compensation, acquisition and integration expenses, transformation

initiatives, workplace optimization and the associated tax effects

of each. Net sales on a constant currency basis is defined as Net

sales excluding the impact of foreign currency translation on Net

sales. Free cash flow is defined as cash flows provided by

operating activities less capital expenditures. Adjusted free cash

flow is defined as Free cash flow adjusted to include certain cash

flows from financing activities incurred in the normal course of

operations or as capital expenditures.

We believe our non-GAAP performance measures provide analysts,

investors and management with useful information regarding the

underlying operating performance of our business, as they remove

the impact of items that management believes are not reflective of

underlying operating performance. Management uses these measures to

evaluate period-over-period performance as management believes they

provide a more comparable measure of the underlying business. We

also present non-GAAP financial condition measures as we believe

they provide analysts, investors and management with more

information regarding our liquidity and capital resources. Certain

non-GAAP financial measures are also used to determine certain

components of performance-based compensation.

Our outlook includes non-GAAP financial measures because certain

reconciling items are dependent on future events that either cannot

be controlled, such as currency impacts or interest rates, or

reliably predicted because they are not part of our routine

activities, such as refinancing activities or acquisition and

integration expenses.

The financial statement tables that accompany this press release

include a reconciliation of non-GAAP financial measures to the

applicable most comparable US GAAP financial measures.

About CDW

CDW Corporation (Nasdaq: CDW) is a leading multi-brand provider

of information technology solutions to business, government,

education and healthcare customers in the United States, the United

Kingdom and Canada. A Fortune 500 company and member of the S&P

500 Index, CDW helps its customers to navigate an increasingly

complex IT market and maximize return on their technology

investments. For more information about CDW, please visit

www.CDW.com.

Webcast

CDW Corporation will hold a conference call today, May 1, 2024

at 7:30 a.m. CT/8:30 a.m. ET to discuss its first quarter financial

results. The conference call, which will be broadcast live via the

Internet, and a copy of this press release along with supplemental

slides used during the call, can be accessed on CDW’s website at

investor.cdw.com. For those unable to participate in the live call,

a replay of the webcast will be available at investor.cdw.com

approximately 90 minutes after the completion of the call and will

be accessible on the site for approximately one year.

CDWPR-FI

CDW CORPORATION AND

SUBSIDIARIES

CONSOLIDATED STATEMENTS OF

OPERATIONS

(dollars and shares in millions,

except per-share amounts)

(unaudited)

Three Months Ended March

31,

2024

2023

% Change

Net sales

$

4,872.7

$

5,103.1

(4.5

)%

Cost of sales

3,809.4

4,013.7

(5.1

)

Gross profit

1,063.3

1,089.4

(2.4

)

Selling and administrative expenses

735.3

734.1

0.2

Operating income

328.0

355.3

(7.7

)

Interest expense, net

(51.3

)

(57.7

)

(11.1

)

Other expense, net

(0.1

)

(1.3

)

(92.3

)

Income before income taxes

276.6

296.3

(6.6

)

Income tax expense

(60.5

)

(66.2

)

(8.6

)

Net income

$

216.1

$

230.1

(6.1

)%

Net income per common share:

Basic

$

1.61

$

1.70

(5.3

)%

Diluted

$

1.59

$

1.68

(5.2

)%

Weighted-average common shares

outstanding:

Basic

134.4

135.6

Diluted

136.0

137.3

CDW CORPORATION AND

SUBSIDIARIES

NET SALES DETAIL

(dollars in millions)

(unaudited)

Three Months Ended March

31,

2024

2023

% Change(i)

Corporate

$

2,135.9

$

2,203.7

(3.1

)%

Small Business

380.9

411.4

(7.4

)

Public:

Government

543.3

551.5

(1.5

)

Education

596.8

665.7

(10.4

)

Healthcare

584.6

595.6

(1.8

)

Total Public

1,724.7

1,812.8

(4.9

)

Other

631.2

675.2

(6.5

)

Total Net sales

$

4,872.7

$

5,103.1

(4.5

)%

(i)

There were 64 selling days for both the

three months ended March 31, 2024 and 2023. Average Daily Sales is

defined as Net sales divided by the number of selling days.

CDW CORPORATION AND

SUBSIDIARIES

TIMING OF REVENUE

RECOGNITION

(dollars in millions)

(unaudited)

Three Months Ended March 31,

2024

Corporate

Small Business

Public

Other

Total

Timing of Revenue Recognition

Transferred at a point in time where CDW

is principal

$

1,779.3

$

331.7

$

1,515.7

$

542.1

$

4,168.8

Transferred at a point in time where CDW

is agent

194.8

39.1

108.2

31.2

373.3

Transferred over time where CDW is

principal

161.8

10.1

100.8

57.9

330.6

Total Net sales

$

2,135.9

$

380.9

$

1,724.7

$

631.2

$

4,872.7

Three Months Ended March 31,

2023

Corporate

Small Business

Public

Other

Total

Timing of Revenue Recognition

Transferred at a point in time where CDW

is principal

$

1,861.4

$

365.3

$

1,608.6

$

590.5

$

4,425.8

Transferred at a point in time where CDW

is agent

185.4

36.8

101.5

28.4

352.1

Transferred over time where CDW is

principal

156.9

9.3

102.7

56.3

325.2

Total Net sales

$

2,203.7

$

411.4

$

1,812.8

$

675.2

$

5,103.1

CDW CORPORATION AND

SUBSIDIARIES

CONDENSED CONSOLIDATED BALANCE

SHEETS

(dollars in millions)

March 31, 2024

December 31, 2023

March 31, 2023

Assets

(unaudited)

(unaudited)

Current assets:

Cash and cash equivalents

$

803.8

$

588.7

$

279.4

Accounts receivable, net of allowance for

credit losses

of $30.2, $28.8, and $27.4,

respectively

4,310.4

4,567.5

4,262.3

Merchandise inventory

670.8

668.1

781.1

Miscellaneous receivables

482.2

470.5

469.4

Prepaid expenses and other

366.6

410.2

487.7

Total current assets

6,633.8

6,705.0

6,279.9

Operating lease right-of-use assets

135.1

128.8

145.7

Property and equipment, net

190.2

195.5

187.4

Goodwill

4,409.8

4,413.4

4,365.5

Other intangible assets, net

1,331.2

1,369.7

1,455.0

Other assets

492.7

472.2

334.6

Total assets

$

13,192.8

$

13,284.6

$

12,768.1

Liabilities and Stockholders’

Equity

Current liabilities:

Accounts payable - trade

$

2,741.1

$

2,881.0

$

2,644.0

Accounts payable - inventory financing

384.8

430.9

532.2

Current maturities of long-term debt

604.7

613.1

45.7

Contract liabilities

469.5

487.4

495.7

Accrued expenses and other current

liabilities

1,060.9

1,029.6

1,060.3

Total current liabilities

5,261.0

5,442.0

4,777.9

Long-term liabilities:

Debt

5,027.6

5,031.8

5,749.9

Deferred income taxes

161.7

171.4

193.0

Operating lease liabilities

167.5

164.0

171.0

Other liabilities

436.3

432.9

307.4

Total long-term liabilities

5,793.1

5,800.1

6,421.3

Total stockholders’ equity

2,138.7

2,042.5

1,568.9

Total liabilities and stockholders’

equity

$

13,192.8

$

13,284.6

$

12,768.1

CDW CORPORATION AND

SUBSIDIARIES

DEBT AND WORKING CAPITAL

INFORMATION

(dollars in millions)

(unaudited)

March 31, 2024

December 31, 2023

March 31, 2023

Debt and Revolver Availability

Cash and cash equivalents

$

803.8

$

588.7

$

279.4

Total debt

5,632.3

5,644.9

5,795.6

Net debt (total debt net of cash and cash

equivalents)

4,828.5

5,056.2

5,516.2

Revolver availability

1,251.7

1,208.1

1,051.0

Cash plus revolver availability

2,055.5

1,796.8

1,330.4

Working Capital(i)

Days of sales outstanding

75

77

72

Days of supply in inventory

14

13

15

Days of purchases outstanding

(73

)

(73

)

(69

)

Cash conversion cycle

16

17

18

(i)

Based on a rolling three-month

average.

CDW CORPORATION AND

SUBSIDIARIES

CASH FLOW INFORMATION

(dollars in millions)

(unaudited)

Three Months Ended March

31,

2024

2023

Cash flows provided by operating

activities

$

440.0

$

365.4

Capital expenditures

(29.5

)

(31.7

)

Acquisition of businesses, net of cash

acquired

(0.2

)

(22.5

)

Cash flows used in investing

activities

(29.7

)

(54.2

)

Net change in accounts payable - inventory

financing

(46.1

)

77.6

Other cash flows used in financing

activities

(146.5

)

(425.8

)

Cash flows used in financing

activities

(192.6

)

(348.2

)

Effect of exchange rate changes on cash

and cash equivalents

(2.6

)

1.2

Net increase (decrease) in cash and cash

equivalents

215.1

(35.8

)

Cash and cash equivalents - beginning of

period

588.7

315.2

Cash and cash equivalents - end of

period

$

803.8

$

279.4

Supplementary disclosure of cash flow

information:

Interest paid

$

(22.5

)

$

(24.9

)

Income taxes paid, net

$

(16.8

)

$

(21.5

)

CDW CORPORATION AND

SUBSIDIARIES

NON-GAAP FINANCIAL MEASURE

RECONCILIATIONS

CDW has included reconciliations of

Non-GAAP operating income, Non-GAAP operating income margin,

Non-GAAP net income, Non-GAAP net income per diluted share and Net

sales on a constant currency basis for the three months ended March

31, 2024 and 2023 below. In addition, a reconciliation of Free cash

flow and Adjusted free cash flow is included for the three months

ended March 31, 2024 and 2023.

CDW CORPORATION AND

SUBSIDIARIES

NON-GAAP OPERATING INCOME AND

NON-GAAP OPERATING INCOME MARGIN

(dollars in millions)

(unaudited)

Three Months Ended March

31,

2024

% of Net sales

2023

% of Net sales

Operating income, as reported

$

328.0

6.7

%

$

355.3

7.0

%

Amortization of intangibles(i)

37.7

41.6

Equity-based compensation

19.4

20.8

Acquisition and integration expenses

0.7

8.9

Transformation initiatives(ii)

6.1

5.0

Workplace optimization(iii)

7.3

0.9

Other adjustments

4.3

1.8

Non-GAAP operating income

$

403.5

8.3

%

$

434.3

8.5

%

(i)

Includes amortization expense for

acquisition-related intangible assets, primarily customer

relationships, customer contracts and trade names.

(ii)

Includes costs related to strategic

transformation initiatives focused on optimizing various operations

and systems.

(iii)

Includes costs related to the workforce

reduction program and charges related to the reduction of our real

estate lease portfolio.

CDW CORPORATION AND

SUBSIDIARIES

NON-GAAP NET INCOME

AND NON-GAAP NET INCOME PER

DILUTED SHARE

(dollars and shares in millions,

except per-share amounts)

(unaudited)

Three Months Ended March

31,

2024

2023

Income before Income

Taxes

Income Tax Expense(i)

Net Income

Effective Tax Rate

Income before Income

Taxes

Income Tax Expense(i)

Net Income

Effective Tax Rate

Net Income % Change

US GAAP, as reported

$

276.6

$

(60.5

)

$

216.1

21.9

%

$

296.3

$

(66.2

)

$

230.1

22.3

%

(6.1

)%

Amortization of intangibles(ii)

37.7

(9.8

)

27.9

41.6

(10.9

)

30.7

Equity-based compensation

19.4

(16.1

)

3.3

20.8

(15.3

)

5.5

Acquisition and integration expenses

0.7

(0.2

)

0.5

8.9

(2.3

)

6.6

Transformation initiatives(iii)

6.1

(1.6

)

4.5

5.0

(1.3

)

3.7

Workplace optimization(iv)

7.3

(1.9

)

5.4

0.9

(0.2

)

0.7

Other adjustments

4.3

(1.2

)

3.1

1.8

(0.4

)

1.4

Non-GAAP

$

352.1

$

(91.3

)

$

260.8

25.9

%

$

375.3

$

(96.6

)

$

278.7

25.7

%

(6.4

)%

Net income per diluted share, as

reported

$

1.59

$

1.68

Non-GAAP net income per diluted share

$

1.92

$

2.03

Shares used in computing US GAAP and

Non-GAAP net income per diluted share

136.0

137.3

(i)

Income tax on non-GAAP adjustments

includes excess tax benefits associated with equity-based

compensation.

(ii)

Includes amortization expense for

acquisition-related intangible assets, primarily customer

relationships, customer contracts and trade names.

(iii)

Includes costs related to strategic

transformation initiatives focused on optimizing various operations

and systems.

(iv)

Includes costs related to the workforce

reduction program and charges related to the reduction of our real

estate lease portfolio.

CDW CORPORATION AND

SUBSIDIARIES

NET SALES CHANGE ON A CONSTANT

CURRENCY BASIS

(dollars in millions)

(unaudited)

Three Months Ended March

31,

2024

2023

% Change(i)

Net sales, as reported

$

4,872.7

$

5,103.1

(4.5

)%

Foreign currency translation(ii)

—

19.7

Net sales, on a constant currency

basis

$

4,872.7

$

5,122.8

(4.9

)%

(i)

There were 64 selling days for

both the three months ended March 31, 2024 and 2023. Average daily

sales is defined as Net sales divided by the number of selling

days.

(ii)

Represents the effect of

translating the prior year results of CDW UK and CDW Canada at the

average exchange rates applicable in the current year.

CDW CORPORATION AND

SUBSIDIARIES

FREE CASH FLOW AND ADJUSTED

FREE CASH FLOW

(dollars in millions)

(unaudited)

Three Months Ended March

31,

2024

2023

Net cash provided by operating

activities

$

440.0

$

365.4

Capital expenditures

(29.5

)

(31.7

)

Free cash flow

410.5

333.7

Net change in accounts payable - inventory

financing

(46.1

)

77.6

Adjusted free cash flow(i)

$

364.4

$

411.3

(i)

Defined as Net cash provided by operating

activities less capital expenditures, adjusted to include cash

flows from financing activities that relate to the purchase of

inventory.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20240501876406/en/

Investor Inquiries Steven O'Brien

Vice President, Investor Relations (847) 968-0238

investorrelations@cdw.com

Media Inquiries Sara Granack Vice

President, Corporate Communications (847) 419-7411

mediarelations@cdw.com

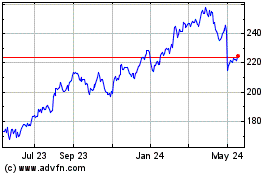

CDW (NASDAQ:CDW)

Historical Stock Chart

From Dec 2024 to Jan 2025

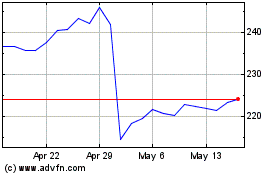

CDW (NASDAQ:CDW)

Historical Stock Chart

From Jan 2024 to Jan 2025