FALSE0001341766561276-223900013417662024-11-062024-11-06

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): November 6, 2024

CELSIUS HOLDINGS, INC.

(Exact name of registrant as specified in its charter)

| | | | | | | | | | | | | | |

Nevada | | 001-34611 | | 20-2745790 |

| (State or other jurisdiction of incorporation) | | (Commission File Number) | | (IRS Employer Identification No.) |

2424 N Federal Highway, Suite 208, Boca Raton, Florida 33431

(Address of principal executive offices and zip code)

| | |

(561) 276-2239 |

| (Registrant’s telephone number, including area code) |

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (see General Instruction A.2. below):

| | | | | | | | |

| ☐ | Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| | |

| ☐ | Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| | |

| ☐ | Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| | |

| ☐ | Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities registered pursuant to Section 12(b) of the Act:

| | | | | | | | | | | | | | |

| Title of each class | | Trading Symbol(s) | | Name of Each Exchange on Which Registered |

| Common Stock, $0.001 par value per share | | CELH | | Nasdaq Capital Market |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company o

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. o

Item 2.02 Results of Operations and Financial Condition.

On November 6, 2024, Celsius Holdings, Inc., a Nevada corporation ("Celsius"), issued an earnings release announcing its financial results for the third quarter and nine months ended September 30, 2024, and announcing that Celsius' Management team will host a webcast that day at 8:00 a.m. Eastern Time to discuss the financial results with the investment community. A copy of the earnings release is furnished as Exhibit 99.1 to this Current Report on Form 8-K and is incorporated by reference in this Item 2.02.

The webcast may be accessed at https://ir.celsiusholdingsinc.com at least 10 minutes before the start of the call.

Item 7.01 Regulation FD Disclosure.

The information furnished pursuant to Item 2.02 of this Current Report on Form 8-K is incorporated by reference in this Item 7.01. In addition, Celsius is providing a third Quarter 2024 Investor Presentation which it has furnished as Exhibit 99.2 to this Current Report on Form 8-K and which is incorporated by reference in this Item 7.01.

The information contained in this Current Report on Form 8-K, including Exhibit 99.1 and Exhibit 99.2 furnished herewith, shall not be deemed “filed” for purposes of Section 18 of the Securities Exchange Act of 1934, as amended (the "Exchange Act"), or otherwise subject to the liabilities of that Section and shall not be deemed incorporated by reference in any filing under the Securities Act of 1933, as amended, or the Exchange Act, except as shall be expressly set forth by specific reference in such a filing.

Item 9.01 Financial Statements and Exhibits.

(d)Exhibits

| | | | | | | | |

| Exhibit No | | Description |

| | |

| | |

| 104 | | Cover Page Interactive Data File (embedded within the Inline XBRL document) |

SIGNATURE

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| | | | | | | | |

| CELSIUS HOLDINGS, INC. |

| | |

Date: November 6, 2024 | By: | /s/ John Fieldly |

| | John Fieldly, Chief Executive Officer |

Celsius Holdings Reports Third Quarter 2024 Financial Results

Quarterly results reflect the impact of supply chain optimization by company’s largest distributor

Growth of sugar-free energy category propels YTD revenue over $1 billion

Co-packer acquisition unlocks innovation and manufacturing capabilities

BOCA RATON, Fla., Nov. 6, 2024 — Celsius Holdings, Inc. (Nasdaq: CELH), maker of CELSIUS®, the premium lifestyle energy drink formulated to power active lifestyles, today reported third quarter 2024 financial results.

| | | | | | | | | | | | | | | | | | | | | | | |

| Summary Financials | 3Q 2024 | 3Q 2023 | Change | YTD 2024 | YTD 2023 | Change |

| (Millions except for percentages and EPS) |

| Revenue | $265.7 | $384.8 | (31)% | $1,023.4 | $970.6 | 5% |

| N. America | $247.1 | $371.2 | (33)% | $969.0 | $930.5 | 4% |

| International | $18.6 | $13.6 | 37% | $54.4 | $40.1 | 36% |

| Gross Margin | 46.0% | 50.4% | -440 BPS | 50.2% | 48.1% | +210 BPS |

| Net Income | $6.4 | $83.9 | (92)% | $164.0 | $176.7 | (7)% |

| Net Income att. to Common Shareholders | $(0.6) | $70.4 | (101)% | $131.0 | $142.6 | (8)% |

| Diluted EPS | $(0.00) | $0.30 | (100)% | $0.55 | $0.60 | (8)% |

| Adjusted EBITDA* | $4.4 | $103.6 | (96)% | $192.8 | $230.4 | (16)% |

*The company reports financial results in accordance with generally accepted accounting principles in the United States (“GAAP”), but management believes that disclosure of Adjusted EBITDA and Adjusted EBITDA Margin, non-GAAP financial measures that management uses to assess our performance, may provide users with additional insights into operating performance. Please see “Use of Non-GAAP Measures” and reconciliations of these non-GAAP measures to the most directly comparable GAAP measures, both of which can be found below.

John Fieldly, Chairman and CEO of Celsius Holdings, Inc., said: “Celsius continued to drive energy drink category growth at retail in the third quarter and outpaced the category in dollar and volume sales gains despite overall category softness. Pronounced supply chain optimization by our largest distributor, which we believe has largely stabilized, had an outsized and adverse impact on our operating results during an otherwise solid quarter. We remain focused on our long-term growth strategy of expanding our consumer base, broadening our availability, and being the preferred beverage for more occasions.”

Jarrod Langhans, Chief Financial Officer of Celsius Holdings, Inc., said: “Gross and operating margins in the third quarter fell short due to significantly reduced orders because our largest distributor implemented a sizable, successful and efficient supply chain optimization program in the quarter, but we managed our sales and marketing spend to minimize interruptions while still turning a profit in the quarter. This activity did not impact customer sales at the retail level, which remain healthy. Our strong balance sheet enabled us to acquire a long-time Celsius co-packer, Big Beverages, which we believe will unlock innovation and other supply chain efficiencies.”

FINANCIAL HIGHLIGHTS FOR THE THIRD QUARTER OF 2024

For the three months ended Sept. 30, 2024, revenue was approximately $265.7 million, compared to $384.8 million for the three months ended Sept. 30, 2023. Revenue from our largest distributor declined $123.9 million in the three months ended Sept. 30, 2024, compared to the same period last year, which was primarily driven by

the distributor’s inventory optimization. Concurrently, related retailer promotional allowances created revenue headwinds that would have otherwise been offset by proportional distributor sell-in during the quarter. Retail sales of Celsius in total U.S. MULO Plus with Convenience grew by 7.1% year over year in the third quarter of 2024 as reported by Circana for the last-thirteen-week period ended Sept. 29, 20241.

International sales of $18.6 million increased 37% year over year in the third quarter from $13.6 million for the third quarter of 2023.

For the three months ended Sept. 30, 2024, gross profit decreased by $71.9 million, or 37%, to $122.2 million from $194.1 million for the three months ended Sept. 30, 2023. Gross profit margin was 46.0% for the three months ended Sept. 30, 2024, a 440 basis point decrease from 50.4% for the same period in 2023. The decrease in gross profit was due to promotional allowances, incentives, and other billbacks as a percentage of gross revenue. These programs are driven by consumer purchases and sales from our distributors into retail, neither of which correlated with the sales that we made to our distributors this quarter due to supply chain optimization conducted by our largest distributor. Although gross profit as a percentage of revenue was lower year over year, we did receive the benefit of lower outbound freight and materials as a percentage of gross revenue in the three months ended Sept. 30, 2024, compared to the same period last year.

Diluted earnings per share for the third quarter was $(0.00) compared to $0.30 for the prior-year period.

YEAR-TO-DATE FINANCIAL HIGHLIGHTS 2024

Year-to-date revenue for the nine months ended Sept. 30, 2024, increased 5% to $1.02 billion compared to $970.6 million for the prior-year period. International sales of $54.4 million increased 36% from $40.1 million for the prior-year period.

Year-to-date gross profit increased 10% to $513.5 million compared to $466.9 million for the prior-year period. Gross profit as a percentage of revenue was 50.2% for the nine months ended Sept. 30, 2024, up from 48.1% in the prior-year period.

1 Circana Total US MULO+ w/C L13W ended 9/29/24, RTD Energy

BUSINESS OPERATIONS AND COMPANY HIGHLIGHTS

Share Growth

Celsius’ energy drink category dollar share in MULO Plus with Convenience in the last-four-week period ended Oct. 6, 2024, was 11.6%, an increase of 0.1 points compared to the year-ago period2. For the quarter ended Sept. 29, 2024, Celsius’ dollar share was 11.8%3.

Alternative Growth Drivers

Sales to Costco in the third quarter of 2024 increased 15%; however, sales to Sam’s club and BJs were negatively affected due to the timing of promotions and innovation loading in the year-ago period. Total club channel sales decreased 4% to $60.5 million in the third quarter 2024 from $63.2 million for the prior-year period.

Celsius sales to Amazon increased 21% year over year to approximately $27.0 million for the quarter ended Sept. 30, 2024. Celsius’ share on Amazon for the three-month period ended Oct. 5, 2024, was 20.4%4.

Approximately 12.3% of Celsius’ total U.S. sales to PepsiCo in the third quarter of 2024 was to the food service channel.

Innovation and Marketing

In October, Celsius introduced two new flavors in the CELSIUS ESSENTIALS line at NACS Show 2024, including Watermelon Ice and Grape Slush, and revealed plans for two new flavors in each of the CELSIUS Vibe and core product lines to come in the first half of 2025.

Organizational Excellence

Celsius acquired Big Beverages Contract Manufacturing (“Big Beverages”) in November. The strategic transaction provides Celsius with a 170,000-square-foot, modern manufacturing and warehouse facility that is expected to provide greater supply chain control, quicker innovation cycles and greater production flexibility. The facility will continue to be principally dedicated to the manufacture of Celsius products and provides the option to add capacity as the business scales and grows.

International Expansion

Sales of Celsius in Canada, the UK and Ireland continued to exceed the company’s initial expectations for the third quarter of 2024. Sales in Australia and New Zealand began in the third quarter of 2024 through major national retailers.

Third Quarter 2024 Earnings Webcast

Management will host a webcast at 8 a.m. EST on Wednesday, Nov. 6, 2024, to discuss the company’s third quarter financial results with the investment community. Investors are invited to join the webcast accessible from https://ir.celsiusholdingsinc.com. Downloadable files, an audio replay and transcript will be made available on the Celsius Holdings investor relations website.

About Celsius Holdings, Inc.

Celsius Holdings, Inc. (Nasdaq: CELH) is the maker of energy drink brand CELSIUS®, a lifestyle energy drink born in fitness and a pioneer in the rapidly growing energy category. For more information, please visit www.celsiusholdingsinc.com.

Contact

Paul Wiseman

Investors: investorrelations@celsius.com

Press: press@celsius.com

Forward-Looking Statements

This press release contains statements that are not historical facts and are considered forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995. These forward-looking statements contain projections of Celsius Holdings’ future results of operations or financial position, or state other forward-looking information. You can identify

2 Circana Total US MULO+ w/C L4W ended 10/6/24, RTD Energy

3 Circana Total US MULO+ w/C L13W ended 9/29/24, RTD Energy

4 Stackline, Total US L13W ended 10/5/24, Energy Drinks

these statements by the use of words such as “anticipate,” “believe,” “could,” “estimate,” “expect,” “intend,” “may,” “should,” “will,” “would,” “could,” “project,” “plan,” “potential,” “designed,” “seek,” “target,” and variations of these terms, the negatives of such terms and similar expressions. You should not rely on forward-looking statements because Celsius Holdings’ actual results may differ materially from those indicated by forward-looking statements as a result of a number of important factors. These factors include but are not limited to: our ability to realize the benefits anticipated from acquisitions, such as the acquisition of Big Beverages, our ability to successfully manage and integrate the operations, internal controls, procedures, financial reporting and accounting systems of acquisitions, and other factors related to the operational challenges and risks of acquisitions, including (i) increased costs, indebtedness, contractual obligations and/or other liabilities; (ii) the expense of integrating acquired businesses; (iii) the ability to retain or hire the personnel required for the successful operation of the acquired business and expanded business operations, in general; (iv) the ability to retain the business relationships of the acquired businesses; (v) diversion of management’s attention; and (vi) the availability of funding sufficient to meet increased capital needs, among others; the strategic investment by and long term partnership with PepsiCo, Inc.; management’s plans and objectives for international expansion and future operations globally; general economic and business conditions; our business strategy for expanding our presence in our industry; our expectations of revenue; operating costs and profitability; our expectations regarding our strategy and investments; our expectations regarding our business, including market opportunity, consumer demand and our competitive advantage; anticipated trends in our financial condition and results of operation; the impact of competition and technology change; existing and future regulations affecting our business; the Company’s ability to satisfy, in a timely manner, all Securities and Exchange Commission (the “SEC”) required filings and the requirements of Section 404 of the Sarbanes-Oxley Act of 2002 and the rules and regulations adopted under that Section; and other risks and uncertainties discussed in the reports Celsius Holdings has filed previously with the SEC, such as its Annual Report on Form 10-K, Quarterly Reports on Form 10-Q and Current Reports on Form 8-K. Forward-looking statements speak only as of the date the statements were made. Celsius Holdings does not undertake any obligation to update forward-looking information, except to the extent required by applicable law.

CELSIUS HOLDINGS, INC. - FINANCIAL TABLES

CONDENSED CONSOLIDATED BALANCE SHEETS

(In thousands, except par value)

(Unaudited)

| | | | | | | | | | | |

| September 30, 2024 | | December 31, 2023 |

| ASSETS | | | |

| Current assets: | | | |

| Cash and cash equivalents | $ | 903,748 | | | $ | 755,981 | |

| | | |

Accounts receivable-net1 | 208,774 | | | 183,703 | |

| Note receivable-current-net | 1,025 | | | 2,318 | |

| Inventories-net | 197,572 | | | 229,275 | |

Deferred other costs-current2 | 14,124 | | | 14,124 | |

| Prepaid expenses and other current assets | 38,227 | | | 19,503 | |

| Total current assets | 1,363,470 | | 1,204,904 |

| | | |

| | | |

| Property and equipment-net | 38,370 | | | 24,868 | |

| Deferred tax assets | 24,186 | | | 29,518 | |

| Right of use assets-operating leases | 5,506 | | | 1,957 | |

| Right of use assets-finance leases | 214 | | | 208 | |

Deferred other costs-non-current2 | 237,746 | | | 248,338 | |

| Intangibles-net | 11,877 | | | 12,139 | |

| Goodwill | 14,360 | | | 14,173 | |

| Other long-term assets | 8,594 | | | 291 | |

| Total Assets | $ | 1,704,323 | | | $ | 1,536,396 | |

| | | |

| LIABILITIES, MEZZANINE EQUITY AND STOCKHOLDERS’ EQUITY | | | |

| | | |

| Current liabilities: | | | |

Accounts payable3 | $ | 30,938 | | | $ | 42,840 | |

Accrued expenses4 | 73,024 | | | 62,120 | |

| Income taxes payable | 739 | | | 50,424 | |

| | | |

Accrued promotional allowance5 | 158,810 | | | 99,787 | |

| Lease liability operating-current | 1,358 | | | 980 | |

| Lease liability finance-current | 99 | | | 59 | |

Deferred revenue-current2 | 9,513 | | | 9,513 | |

| Other current liabilities | 14,979 | | | 10,890 | |

| Total current liabilities | 289,460 | | | 276,613 | |

| | | |

| Lease liability operating-non-current | 4,193 | | | 955 | |

| Lease liability finance-non-current | 189 | | | 193 | |

| Deferred tax liabilities | 2,275 | | | 2,880 | |

Deferred revenue-non-current2 | 160,092 | | | 167,227 | |

| Total Liabilities | 456,209 | | 447,868 |

| | | |

| Commitment and contingencies (Note 16) | | | |

| | | |

Mezzanine Equity2: | | | |

Series A convertible preferred shares, $0.001 par value, 5% cumulative dividends; 1,466,666 shares issued and outstanding at each of September 30, 2024 and December 31, 2023, aggregate liquidation preference of $550,000 as of September 30, 2024 and December 31, 2023. | 824,488 | | | 824,488 | |

| | | |

| Stockholders’ Equity: | | | |

| Common stock, $0.001 par value; 300,000,000 shares authorized, 234,982,044 and 231,787,482 shares issued and outstanding at September 30, 2024 and December 31, 2023, respectively. | 79 | | | 77 | |

| Additional paid-in capital | 292,576 | | | 276,717 | |

| Accumulated other comprehensive loss | (338) | | | (701) | |

| Retained earnings (accumulated deficit) | 131,309 | | | (12,053) | |

| Total Stockholders’ Equity | 423,626 | | | 264,040 | |

| Total Liabilities, Mezzanine Equity and Stockholders’ Equity | $ | 1,704,323 | | | $ | 1,536,396 | |

[1] Includes $118.1 million and $130.0 million from a related party as of September 30, 2024 and December 31, 2023, respectively.

[2] Amounts in this line item are associated with a related party for all periods presented.

[3] Includes $0.8 million and $0.1 million due to a related party as of September 30, 2024 and December 31, 2023, respectively.

[4] Includes no balance due to a related party as of September 30, 2024 and $1.0 million as of December 31, 2023.

[5] Includes $101.3 million and $51.8 million due to a related party as of September 30, 2024 and December 31, 2023, respectively.

CONSOLIDATED STATEMENTS OF OPERATIONS AND COMPREHENSIVE INCOME

(In thousands, except per share amounts)

(Unaudited)

| | | | | | | | | | | | | | | | | | | | | | | |

| For the Three Months Ended September 30, | | For the Nine Months Ended September 30, |

| 2024 | | 2023 | | 2024 | | 2023 |

Revenue1 | $ | 265,748 | | | $ | 384,757 | | | $ | 1,023,433 | | | $ | 970,579 | |

| Cost of revenue | 143,519 | | | 190,675 | | | 509,899 | | | 503,685 | |

| Gross profit | 122,229 | | | 194,082 | | | 513,534 | | | 466,894 | |

Selling, general and administrative expenses2 | 125,443 | | | 96,385 | | | 339,310 | | | 259,471 | |

| | | | | | | |

| (Loss) income from operations | (3,214) | | | 97,697 | | | 174,224 | | | 207,423 | |

| | | | | | | |

| Other income (expense): | | | | | | | |

| Interest income on note receivable | — | | | 28 | | | 28 | | | 101 | |

| Interest income-net | 11,112 | | | 7,197 | | | 31,371 | | | 17,666 | |

| Foreign exchange gain (loss) | 277 | | | (177) | | | (356) | | | (1,226) | |

| Total other income | 11,389 | | | 7,048 | | | 31,043 | | | 16,541 | |

| | | | | | | |

| Net income before provision for income taxes | 8,175 | | | 104,745 | | | 205,267 | | | 223,964 | |

| | | | | | | |

| Provision for income taxes | (1,819) | | | (20,796) | | | (41,317) | | | (47,279) | |

| | | | | | | |

| Net income | $ | 6,356 | | | $ | 83,949 | | | $ | 163,950 | | | $ | 176,685 | |

| | | | | | | |

Dividends on Series A convertible preferred stock3 | (6,913) | | | (6,875) | | | (20,588) | | | (20,512) | |

Income allocated to participating preferred stock3 | — | | | (6,702) | | | (12,357) | | | (13,605) | |

| Net (loss) income attributable to common stockholders | $ | (557) | | | $ | 70,372 | | | $ | 131,005 | | | $ | 142,568 | |

| | | | | | | |

| Other comprehensive income (loss): | | | | | | | |

| Foreign currency translation adjustments, net of income tax | 2,025 | | | (664) | | | 363 | | | (660) | |

| Comprehensive income | $ | 1,468 | | | $ | 69,708 | | | $ | 131,368 | | | $ | 141,908 | |

| | | | | | | |

*(Loss) earnings per share4: | | | | | | | |

| Basic | $ | (0.00) | | | $ | 0.30 | | | $ | 0.56 | | | $ | 0.62 | |

| Diluted | $ | (0.00) | | | $ | 0.30 | | | $ | 0.55 | | | $ | 0.60 | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

*Please refer to Note 3 in the Company’s Quarterly Report on Form 10-Q for the period ended September 30, 2024, for Earnings per Share reconciliations.

[1] Includes $124.7 million and $547.8 million for the three and nine months ended September 30, 2024, respectively, and $248.6 million and $590.0 million for the three and nine months ended September 30, 2023, respectively, from a related party.

[2] Includes $0.5 million and $1.6 million for the three and nine months ended September 30, 2024, respectively, and $0.5 million and $1.1 million for the three and nine months ended September 30, 2023, respectively, from a related party.

[3] Amounts in this line item are associated with a related party for all periods presented.

[4] Forward Stock Split - The accompanying consolidated financial statements and notes thereto have been retrospectively adjusted to reflect the three-for-one stock split that became effective on November 13, 2023. See Note 2. Basis of Presentation and Summary of Significant Accounting Policies for more information.

RECONCILIATION OF NON-GAAP FINANCIAL MEASURES

Reconciliation of GAAP net income to non-GAAP adjusted EBITDA and Adjusted EBITDA Margin

| | | | | | | | | | | | | | | | | | | | | | | |

| Three months ended

September 30, | | Nine months ended

September 30, |

| 2024 | | 2023 | | 2024 | | 2023 |

| Net income (GAAP measure) | $ | 6,356 | | | $ | 83,949 | | | $ | 163,950 | | | $ | 176,685 | |

| Add back/(Deduct): | | | | | | | |

| Net interest income | (11,112) | | | (7,225) | | | (31,399) | | | (17,767) | |

| Provision for income taxes | 1,819 | | | 20,796 | | | 41,317 | | | 47,279 | |

| Depreciation and amortization expense | 2,241 | | | 875 | | | 4,888 | | | 2,121 | |

| Non-GAAP EBITDA | (696) | | | 98,395 | | | 178,756 | | | 208,318 | |

Stock-based compensation1 | 5,377 | | | 4,979 | | | 13,685 | | | 16,221 | |

| Foreign exchange | (277) | | | 177 | | | 356 | | | 1,226 | |

Distributor Termination2 | — | | | — | | | — | | | (3,241) | |

Legal Settlement Costs3 | — | | | — | | | — | | | 7,900 | |

| Non-GAAP Adjusted EBITDA | $ | 4,404 | | | $ | 103,551 | | | $ | 192,797 | | | $ | 230,424 | |

| | | | | | | |

| | | | | | | |

| Non-GAAP Adjusted EBITDA Margin | 1.7 | % | | 26.9 | % | | 18.8 | % | | 23.7 | % |

a5

b6

15Selling, general and administrative expenses related to employee non-cash stock-based compensation expense. Stock-based compensation expense consists of non-cash charges for the estimated fair value of unvested restricted share unit and stock option awards granted to employees and directors. The Company believes that the exclusion provides a more accurate comparison of operating results and is useful to investors to understand the impact that stock-based compensation expense has on its operating results.

26 2023 distributor termination represents reversals of accrued termination payments. The unused funds designated for termination expense payments to legacy distributors were reimbursed to Pepsi for the quarter ended June 30, 2023.

3 2023 Legal class action settlement pertained to the McCallion vs Celsius Holdings class action lawsuit, which we settled during the quarter ended June 30, 2023.

USE OF NON-GAAP MEASURES

Celsius defines Adjusted EBITDA as net income before net interest income, income tax expense (benefit), and depreciation and amortization expense, further adjusted by excluding stock-based compensation expense, foreign exchange gains or losses, distributor termination fees and legal settlement costs. Adjusted EBITDA Margin is the ratio between the company’s Adjusted EBITDA and net revenue, expressed as a percentage. Adjusted EBITDA and Adjusted EBITDA Margin are non-GAAP financial measures.

Celsius uses Adjusted EBITDA and Adjusted EBITDA Margin for operational and financial decision-making and believes these measures are useful in evaluating its performance because they eliminate certain items that management does not consider indicators of Celsius’ operating performance. Adjusted EBITDA and Adjusted EBITDA Margin may also be used by many of Celsius’ investors, securities analysts, and other interested parties in evaluating its operational and financial performance across reporting periods. Celsius believes that the presentation of Adjusted EBITDA and Adjusted EBITDA Margin provides useful information to investors by allowing an understanding of measures that it uses internally for operational decision-making, budgeting and assessing operating performance.

Adjusted EBITDA and Adjusted EBITDA Margin are not recognized terms under GAAP and should not be considered as a substitute for net income or any other financial measure presented in accordance with GAAP. Non-GAAP financial measures have limitations as analytical tools and should not be considered in isolation or as substitutes for analysis of Celsius’ results as reported under GAAP. Celsius strongly encourages investors to review its financial statements and publicly filed reports in their entirety and not to rely on any single financial measure.

Because non-GAAP financial measures are not standardized, Adjusted EBITDA and EBITDA Margin, as defined by Celsius, may not be comparable to similarly titled measures reported by other companies. It therefore may not be possible to compare Celsius’ use of these non-GAAP financial measures with those used by other companies.

C E LS I US HO LD IN GS , IN C . | QU A RT E R 3, 2 02 4 IN V E S TOR P R E S E N TAT ION Nov. 6, 2024 THIRD QUARTER 2024 INVESTOR PRESENTATION

C E LS I US HO LD IN GS , IN C . | QU A RT E R 3, 2 02 4 IN V E S TOR P R E S E N TAT ION SAFE HARBOR & NON-GAAP MEASURES This presentation contains statements that are not historical facts and are considered forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995. These forward- looking statements contain projections of Celsius’ future results of operations or financial position, or state other forward -looking information. You can identify these statements by the use of words such as “anticipate,” “believe,” “could,” “estimate,” “expect,” “intend,” “may,” “should,” “will,” “would,” “could,” “project,” “plan,” “potential,” “designed,” “seek,” “target,” and variations of these terms, the negatives of such terms and similar expressions. You should not rely on forward-looking statements because Celsius’ actual results may differ materially from those indicated by forward-looking statements as a result of a number of important factors. These factors include but are not limited to: our ability to realize the benefits anticipated from acquisitions, such as the acquisition of Big Beverages, our ability to successfully manage and integrate the operations, internal controls, procedures, financial reporting and accounting systems of acquisition s, and other factors related to the operational challenges and risks of acquisitions, including (i) increased costs, indebtedness, contractual obligations and/or other liabilities; (ii) the expense of integrating acquired businesses; (iii) the ability to retain or hire the personnel required for the successful operation of the acquired business and expanded business operations, in general; (iv) the ability to retain the business relationships of the acquired businesses; (v) diversion of management’s attention; and (vi) the availability of funding sufficient to meet increased capital needs, among others; the strategic investment by and long term partnership with PepsiCo, Inc.; management’s plans and objectives for international expansion and future operations globally; general economic and business conditions; our business strategy for expanding our presence in our industry; our expectations of revenue; operating costs and profitability; our expectations regarding our strategy and investments; our expectations regarding our business, including market opportunity, consumer demand and our competitive advantage; anticipated trends in our financial condition and results of operation; the impact of competition and technology change; existing and future regulations affecting our business; our ability to satisfy, in a timely manner, all Securities and Exchange Commission (the “SEC”) required filings and the requirements of Section 404 of the Sarbanes-Oxley Act of 2002 and the rules and regulations adopted under that Section; and other risks and uncertainties discussed in the reports Celsius has filed previously with the SEC, such as i ts Annual Report on Form 10-K, Quarterly Reports on Form 10-Q and Current Reports on Form 8-K. Forward-looking statements speak only as of the date the statements were made. Celsius does not undertake any obligation to update forward-looking information, except to the extent required by applicable law. Use of Non-GAAP Measures Celsius defines Adjusted EBITDA as net income before net interest income, income tax expense (benefit), and depreciation and amortization expense, further adjusted by excluding stock-based compensation expense, foreign exchange gains or losses, distributor termination fees and legal settlement costs. Adjusted EBITDA Margin is the ratio between the company’s Adjusted EBITDA and net revenue, expressed as a percentage. Adjusted EBITDA and Adjusted EBITDA Margin are non-GAAP financial measures. Celsius uses Adjusted EBITDA and Adjusted EBITDA Margin for operational and financial decision-making and believes these measures are useful in evaluating its performance because they eliminate certain items that management does not consider indicators of Celsius’ operating performance. Adjusted EBITDA and Adjusted EBITDA Margin may also be used by many of Celsius’ investors, securities analysts, and other interested parties in evaluating its operational and financial performance across reporting periods. Cels ius believes that the presentation of Adjusted EBITDA and Adjusted EBITDA Margin provides useful information to investors by allowing an understanding of measures that it uses internally for operational dec ision-making, budgeting and assessing operating performance. Adjusted EBITDA and Adjusted EBITDA Margin are not recognized terms under GAAP and should not be considered as substitutes for net income or any other financial measure presented in accordance with GAAP. Non-GAAP financial measures have limitations as analytical tools and should not be considered in isolation or as subs titutes for analysis of Celsius’ results as reported under GAAP. Celsius strongly encourages investors to review its financial statements and publicly filed reports in their entirety and not to rely on any single financial measure. Because non-GAAP financial measures are not standardized, Adjusted EBITDA and Adjusted EBITDA Margin, as defined by Celsius, may not be comparable to similarly titled measures reported by other companies. It therefore may not be possible to compare Celsius’ use of these non -GAAP financial measures with those used by other companies. 2

C E LS I US HO LD IN GS , IN C . | QU A RT E R 3, 2 02 4 IN V E S TOR P R E S E N TAT ION DEFINITIONS MULO: A Circana measurement geography that reports aggregated CPG sales data from top channels across food, drug, mass, dollar and military. MULOC: A Circana measurement geography that reports aggregated CPG sales data from top channels across food, drug, mass, dollar, military and convenience stores. MULO+: A Circana measurement geography that includes MULO reported sources and additional e-commerce and club channel sources. MULO+ With Convenience (MULO+ W/C): A Circana measurement geography that includes MULOC reported sources and additional e-commerce and club channel sources. 3

C E LS I US HO LD IN GS , IN C . | QU A RT E R 3, 2 02 4 IN V E S TOR P R E S E N TAT ION EXECUTIVE MANAGEMENT JOHN FIELDLY Chairman, President, CEO • Appointed Celsius CEO in 2018 • Appointed interim CEO and Chief Financial Officer in 2017 • Served as Celsius CFO 2012-2017 • Certified Public Accountant JARROD LANGHANS Chief Financial Officer • Joined Celsius as Chief Financial Officer in 2022 • CFO of Eden Springs 2020-2022 • 20+ years finance and operations experience • Certified Public Accountant TONY GUILFOYLE Chief Commercial Officer • Named Celsius Chief Commercial Officer in 2024 • Joined Celsius as EVP sales in 2020 • Previously SVP sales at Rockstar Energy 11 years KYLE WATSON Chief Marketing Officer • Named Celsius Chief Marketing Officer in 2024 • Joined Celsius as VP marketing in 2019 • 20+ years marketing and brand experience TOBY DAVID Chief of Staff • Named Chief of Staff in 2024 • Joined Celsius as Director of Business Development in 2013 • 20+ years business development and operations experience PAUL STOREY Chief Supply Chain Officer • Named Chief Supply Chain Officer in 2024 • Joined Celsius as SVP operations in 2021 • Previously VP Operations and Director of Manufacturing at Monster & Rockstar Energy for 15 years RICHARD MATTESSICH Chief Legal Officer • Joined Celsius as Chief Legal Officer in 2023 • Deputy General Counsel, Corporate & Securities of ADT, Inc. 2019-2023 • Nearly 30 years of corporate securities law and corporate governance experience 4

C E LS I US HO LD IN GS , IN C . | QU A RT E R 3, 2 02 4 IN V E S TOR P R E S E N TAT ION DIRECTORS JOHN FIELDLY CHAIRMAN HAL KRAVITZ LEAD INDEPENDENT DIRECTOR CAROLINE LEVY DIRECTOR JOYCE RUSSELL DIRECTOR HANS MELOTTE* DIRECTOR NICK CASTALDO DIRECTOR CHERYL MILLER DIRECTOR DAMON DESANTIS DIRECTOR A BREADTH OF INDUSTRY, FINANCIAL & EXECUTIVE MANAGEMENT EXPERTISE 5 ISRAEL KONTOROVSKY* DIRECTOR *New to Board since Q2 update

C E LS I US HO LD IN GS , IN C . | QU A RT E R 3, 2 02 4 IN V E S TOR P R E S E N TAT ION CELSIUS: THE WORLD’S MOST REFRESHING ENERGY DRINK OUR MISSION: INSPIRE PEOPLE TO LIVE FITTM WITH THE ENERGY TO ACHIEVE THEIR GOALS #3 ENERGY DRINK IN THE UNITED STATES3 4 CELSIUS PRODUCT LINES: CORE | VIBE ESSENTIALS | ENERGY POWDERS PREMIUM BRAND BETTER-FOR-YOU INGREDIENTS ZERO SUGAR 6 COUNTRIES ADDED IN 2024 20 YEARS IN OPERATION NOTES 1. 2023 full-year results, reported Feb. 29, 2024 2. Circana, MULO+ W/C RTD Energy, L13W ended 9/29/24 3. Circana, MULO+ W/C RTD Energy, L4W ended 10/6/24 #3 RTD ENERGY 2023 FULL-YEAR FINANCIAL HIGHLIGHTS1 $1.32B revenue 48% gross margin $295.6 adjusted EBITDA CATEGORY GROWTH LEADER Celsius contributed 16% of all energy drink category growth YoY in Q3 20242 #3 total share of U.S. energy drink category in tracked channels at 11.6%3 6

C E LS I US HO LD IN GS , IN C . | QU A RT E R 3, 2 02 4 IN V E S TOR P R E S E N TAT ION FUNCTION, BACKED BY SCIENCE 7

C E LS I US HO LD IN GS , IN C . | QU A RT E R 3, 2 02 4 IN V E S TOR P R E S E N TAT ION 2% 2% -4% -3% -3% 5% 13% 5% 8% 1% 2020 2021 2022 2023 2024 RTD ENERGY YEAR-OVER-YEAR UNIT GROWTH VS TOTAL BEVERAGE xENERGY LAST 5 YEARS1 BEVERAGE RTD ENERGY U.S. ENERGY DRINK MARKET OUTPACES TOT. BEVERAGE NOTES 1. Circana US MULO+ W/C RTD Energy, DEPT Beverages xRTD Energy 2020-2024 YTD ending 10/20/2024 YoY Unit % Chg v YA 2. Year to date 8 2

C E LS I US HO LD IN GS , IN C . | QU A RT E R 3, 2 02 4 IN V E S TOR P R E S E N TAT ION CELSIUS IS GROWING THE ENERGY DRINK CATEGORY NOTES 1. Circana US MULO+ W/C, RTD Energy full & building years 2019-2024, building year ended 10/20/24 2. Circana US MULO + W/C, RTD Energy full & building years 2019-2024, building year ended 10/20/24 3. * 2024 YTD through 10/20/24 9 $0.14 $0.41 $1.01 $2.21 $2.23 2020 2021 2022 2023 YTD 2024 CELSIUS RETAIL SALES ACROSS TRACKED CHANNELS1 (MULO+ W/C | BILLIONS) 4.3% 9.9% 24.8% 32.2% 37.2% 0.0% 10.0% 20.0% 30.0% 40.0% 50.0% 60.0% 70.0% 80.0% 90.0% 100.0% 2020 2021 2022 2023 2024 CELSIUS CONTRIBUTION TO CATEGORY GROWTH BY YEAR2 (MULO+ W/C) 3

C E LS I US HO LD IN GS , IN C . | QU A RT E R 3, 2 02 4 IN V E S TOR P R E S E N TAT ION SOLID INCREASING VOLUME GROWTH 0.38 1.68 3.60 6.62 2.89 -2 -1 0 1 2 3 4 5 6 7 2020 2021 2022 2023 2024 B ill io n s YOY VOLUME GROWTH TOP ENERGY BRANDS L5Y (Volume Sales Chg v YA, Billions) CELSIUS RTD ENERGY RED BULL RTD ENERGY MONSTER RTD ENERGY ALANI RTD ENERGY ROCKSTAR RTD ENERGY IN THE PAST 3 YEARS, CELSIUS HAS GROWN 2.3X MORE VOLUME THAN RED BULL, MONSTER, ALANI & ROCKSTAR COMBINED1 NOTES 1. Circana US MULO+ W/C, Volume Sales Chg v YA RTD Energy full & building years 2019-2024, building year ended 10/20/24 10

C E LS I US HO LD IN GS , IN C . | QU A RT E R 3, 2 02 4 IN V E S TOR P R E S E N TAT ION HEALTH & WELLNESS TRENDS ARE DRIVING ZERO-SUGAR ADOPTION TREND TOWARD ZERO-SUGAR, BETTER FOR YOU, FUNCTIONAL ENERGY CONTINUES NOTES 1. Circana Total US MULO+ W/C RTD Energy weekly sugar free dollar share from 1/29/23 – 10/6/24 2. Stifel, 2024 Global Energy Drink Thoughts and Predictions, Update on U.S. Disruptors, January 2024 28% of energy drink consumers aged 18-34 say better for you or natural ingredients are important in purchase decision2 46% of energy drink consumers aged 18-34 say performance important in deciding which energy drink to consume (up 10pts from a year ago and mostly coming from younger consumers)2 11 1/29/2023, 46.8% 10/6/2024, 51.8% 1/29/2023, 16.6% 10/6/2024, 22.3% 0.0% 10.0% 20.0% 30.0% 40.0% 50.0% 60.0% SUGAR FREE SHARE OF MULO+ W/C RTD ENERGY1 SUGAR FREE SHARE OF TTL ENERGY SALES CELSIUS SHARE OF SF ENERGY SALES

C E LS I US HO LD IN GS , IN C . | QU A RT E R 3, 2 02 4 IN V E S TOR P R E S E N TAT ION ONGOING GLOBAL EXPANSION Markets with new Celsius sales and distribution in 2024 12 2024 GLOBAL EXPANSION YTD Canada United Kingdom Ireland Australia New Zealand France

C E LS I US HO LD IN GS , IN C . | QU A RT E R 3, 2 02 4 IN V E S TOR P R E S E N TAT ION CAPITAL EFFICIENT GROWTH INVESTMENT Celsius purchased long-time co-packer Big Beverages Contract Manufacturing in Nov. 2024 Key Facts • Transaction closed Nov. 1, 2024, for $75 million • 170,000 square-foot, turnkey beverage manufacturing facility near Charlotte, N.C. • One operational line; capacity for future line expansion • Includes warehouse • Big Beverages leadership and staff expected to remain with operation under Celsius ownership Strategic Rationale • Vertical integration of a plant primarily dedicated to Celsius provides incremental R&D and LTO (limited time offer) product opportunities, as well as a turnkey facility. • Future expansion opportunities with ability to add additional capacity as the business scales and grows • Per-case savings and improved leverage and margins expected • Solid ROIC (return on invested capital) opportunity • Earnings per share accretion potential 13

C E LS I US HO LD IN GS , IN C . | QU A RT E R 3, 2 02 4 IN V E S TOR P R E S E N TAT ION Q3 2024 FINANCIAL RESULTS 14

C E LS I US HO LD IN GS , IN C . | QU A RT E R 3, 2 02 4 IN V E S TOR P R E S E N TAT ION THIRD QUARTER 2024 KEY MESSAGES 1 Retail dollar and unit sales grew ~7% in challenging category period; increased dollar share by 50BPS YoY1 2 Contributed 16% of Q3 energy drink category growth1 and 37% YTD2 3 Acquired Big Beverages, supporting innovation, R&D, supply chain control; expected near- and medium-term financial benefits 6 International expansion continued in Australia, New Zealand and France 5 Despite retail sales growth, distributor supply chain optimization in Q3 adversely affected net revenue by approximately $124 million YoY 4 Announced six new flavors for H1 2025, including ESSENTIALS Grape Slush and Watermelon Ice 15 NOTES 1. Circana US MULO+ W/C, RTD Energy L13W ended 9/29/24 2. Circana US MULO+ W/C, RTD Energy full & building years 2019-2024, building year ended 10/20/24

C E LS I US HO LD IN GS , IN C . | QU A RT E R 3, 2 02 4 IN V E S TOR P R E S E N TAT ION THIRD QUARTER FINANCIAL HIGHLIGHTS Summary Financials (Millions except for percentages & EPS) 3Q 2024 3Q 2023 Change YTD 2024 YTD 2023 Change Revenue $265.7 $384.8 (31)% $1,023.4 $970.6 5% N. America $247.1 $371.2 (33)% $969.0 $930.5 4% International $18.6 $13.6 37% $54.4 $40.1 36% Gross Margin 46.0% 50.4% -440 BPS 50.2% 48.1% +210 BPS Net Income $6.4 $83.9 (92)% $164.0 $176.7 (7)% Net Income att. to Common Shareholders $(0.6) $70.4 (101)% $131.0 $142.6 (8)% Diluted EPS $(0.00) $0.30 (100)% $0.55 $0.60 (8)% Adjusted EBITDA $4.4 $103.6 (96)% $192.8 $230.4 (16)% 16

C E LS I US HO LD IN GS , IN C . | QU A RT E R 3, 2 02 4 IN V E S TOR P R E S E N TAT ION CONSOLIDATED REVENUE $384.8 $347.4 $355.7 $402.0 $265.7 3Q 23 4Q 23 1Q 24 2Q 24 3Q 24 QUARTERLY REVENUE LAST 5 QUARTERS (MILLIONS) +37% YoY +104% YoY +23% YoY +95% YoY 17 -31% YoY

C E LS I US HO LD IN GS , IN C . | QU A RT E R 3, 2 02 4 IN V E S TOR P R E S E N TAT ION RETAIL SALES $192.6M $186.4M $181.4M $186.9M $209.3M $212.4M $220.8M $233.5M $218.0M $216.8M $212.9M $211.4M $208.5M $0 $50,000,000 $100,000,000 $150,000,000 $200,000,000 $250,000,000 CELSIUS MULO+&C RETAIL DOLLAR SALES LAST 13 PERIODS1 BRAND* 2024 YTD SHARE2 2024 YTD $ CHG v YA2 36.3 $241.5M 27.8 ($62.4M) 12.1 $481.7M 3.5 $237.5M 3.4 $139.9M 3.1 ($56.1M) 2.9 $64.4M 2.9 $30.3M 2.3 $14.3M 1.6 ($73.1M) 1 2 3 4 5 6 7 8 9 10 NOTES 1. Circana Total US MULO+ W/C, RTD Energy, L1Y by quad ended 10/06/24 2. Circana Total US MULO+ W/C, RTD Energy, 2024 YTD ended 10/20/24 *All logos and names displayed on this page are the property o f their respective owners. Their use here is for identification and referential purposes only. Any use of these logos and names does not imply endorsement or affiliation with this presentation. 18

C E LS I US HO LD IN GS , IN C . | QU A RT E R 3, 2 02 4 IN V E S TOR P R E S E N TAT ION ENERGY MULO+ W/C DOLLAR SHARE NOTES 1. Circana Total US MULO+ W/C dollar share of RTD Energy by quarter ended 9/29/24 19 4.6 5.1 5.4 6.2 8.2 9.7 11.2 11.4 12.3 12.3 11.8 38.2 38.7 38.7 39.2 37.2 36.9 36.1 36.4 35.8 36.5 36.6 31.3 30.5 30.5 30.8 30.4 29.3 28.7 28.6 28.1 27.7 27.5 0.0 5.0 10.0 15.0 20.0 25.0 30.0 35.0 40.0 45.0 Q1 2022 Q2 2022 Q3 2022 Q4 2022 Q1 2023 Q2 2023 Q3 2023 Q4 2023 Q1 2024 Q2 2024 Q3 2024 TOP 3 BRAND $ SHARE OF MULO+&C BY QUARTER 2022-PRESENT CELSIUS RED BULL MONSTER

C E LS I US HO LD IN GS , IN C . | QU A RT E R 3, 2 02 4 IN V E S TOR P R E S E N TAT ION INTERNATIONAL SALES $13.6 $14.6 $16.2 $19.6 $18.6 3Q 23 4Q 23 1Q 24 2Q 24 3Q 24 INTERNATIONAL REVENUE LAST 5 QUARTERS (IN MILLIONS) NOTES 1. Chart: International revenue excludes N. America (U.S. and Canada) 20

C E LS I US HO LD IN GS , IN C . | QU A RT E R 3, 2 02 4 IN V E S TOR P R E S E N TAT ION GROSS PROFIT -50 0 50 100 150 200 250 3Q 23 4Q 23 1Q 24 2Q 24 3Q 24 GROSS AND OPERATING PROFIT ($ IN MILLIONS) PERCENTAGES REPRESENT QUARTERLY PERCENTAGE OF REVENUE Gross Profit Dollars Operating Profit Dollars 52.0% 50.4% 23.4% 25.4% 23.4% 46.0% (1.2)% 47.8% 17.0% 51.2% 21

C E LS I US HO LD IN GS , IN C . | QU A RT E R 3, 2 02 4 IN V E S TOR P R E S E N TAT ION EPS $0.30 $0.17 $0.27 $0.28 $0.00 3Q 23 4Q 23 1Q 24 2Q 24 3Q 24 QUARTERLY EPS (DILUTED) LAST 5 QUARTERS 22

C E LS I US HO LD IN GS , IN C . | QU A RT E R 3, 2 02 4 IN V E S TOR P R E S E N TAT ION NON-GAAP EBITDA SCHEDULE The company reports financial results in accordance with generally accepted accounting principles in the United States (“GAAP”), but management believes that disclosure of Adjusted EBITDA and Adjusted EBITDA Margin, non-GAAP financial measures that management uses to assess our performance, may provide users with additional insights into operating performance. See “Use of Non-GAAP Measures” above. 23 2024 2023 Var. % 2024 2023 Var. % Net income (GAAP Measure) 6,356$ 83,949$ (77,593)$ -92% 163,950$ 176,685$ (12,735)$ -7% Add back / (Deduct) Net interest income (11,112) (7,225) (31,399) (17,767) Income tax expense 1,819 20,796 41,317 47,279 Depreciation and amortization expense 2,241 875 4,888 2,121 Non-GAAP EBITDA (696) 98,395 (99,091) -101% 178,756 208,318 (29,562) -14% Stock-based compensation 5,377 4,979 13,685 16,221 Foreign exchange (277) 177 356 1,226 Distributor Termination - - - (3,241) Litigation Settlement - - - 7,900 Non-GAAP Adjusted EBITDA 4,404$ 103,551$ (99,147)$ -96% 192,797$ 230,424$ (37,627)$ -16% 3 months ended September 30, 9 months ended September 30,

v3.24.3

Cover

|

Nov. 06, 2024 |

| Document Information [Line Items] |

|

| Document Type |

8-K

|

| Document Period End Date |

Nov. 06, 2024

|

| Entity Registrant Name |

CELSIUS HOLDINGS, INC.

|

| Entity Incorporation, State or Country Code |

NV

|

| Entity File Number |

001-34611

|

| Entity Tax Identification Number |

20-2745790

|

| Entity Address, Address Line One |

2424 N Federal Highway

|

| Entity Address, Address Line Two |

Suite 208

|

| Entity Address, City or Town |

Boca Raton

|

| Entity Address, State or Province |

FL

|

| Entity Address, Postal Zip Code |

33431

|

| City Area Code |

561

|

| Local Phone Number |

276-2239

|

| Written Communications |

false

|

| Soliciting Material |

false

|

| Pre-commencement Tender Offer |

false

|

| Pre-commencement Issuer Tender Offer |

false

|

| Title of 12(b) Security |

Common Stock, $0.001 par value per share

|

| Trading Symbol |

CELH

|

| Security Exchange Name |

NASDAQ

|

| Entity Emerging Growth Company |

false

|

| Amendment Flag |

false

|

| Entity Central Index Key |

0001341766

|

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 2 such as Street or Suite number

| Name: |

dei_EntityAddressAddressLine2 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

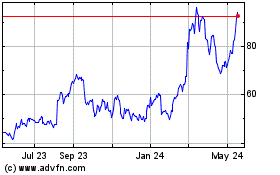

Celsius (NASDAQ:CELH)

Historical Stock Chart

From Jan 2025 to Feb 2025

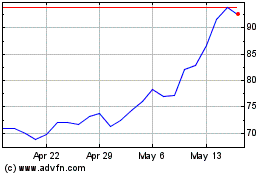

Celsius (NASDAQ:CELH)

Historical Stock Chart

From Feb 2024 to Feb 2025