Central Garden's Earnings Miss, Rev Up - Analyst Blog

09 May 2013 - 6:06PM

Zacks

Central Garden & Pet Company’s (CENT)

second-quarter 2013 earnings came in at 46 cents a share that

missed the Zacks Consensus Estimate of 53 cents a share but rose

2.2% year over year.

Total sales increased approximately 7% year over year to $498.2

million, reflecting higher sales across the Pet and Garden

segments. Moreover total sales surpassed the Zacks Consensus

Estimate of $495 million.

Consolidated gross profit increased 3.7% year over year to

$153.2 million, while gross margin decreased approximately 90 basis

points to 30.7%, reflecting lower margins in the Garden segment.

The company reported an operating income of $46.7 million, up 3.4%

year over year. However, operating margin contracted 30 basis

points to 9.4% during the quarter.

Segment Details

Pet segment net sales increased 6% year over

year to $234.8 million, reflecting enhanced sales in bird feed,

professional sales and dog and cat care business. The segment’s

branded product sales increased 7% to $193.1 million, whereas sales

of other manufacturers’ products decreased 2% to $41.7 million in

the quarter. Pet segment’s operating income rose 31% year over year

to $27.5 million, whereas operating margin improved 230 basis

points, reflecting increased sales of higher margin products and

lower selling and marketing expenses.

Revenue at the Garden segment rose 8% year over

year to $263.4 million, reflecting increased sales of bird feed and

Amdro Powerflex and Pennigton Smart Feed products. The Garden

segment’s branded product sales increased 8% to $229.2 million,

whereas sale of other manufacturers’ products escalated 5% to $34.2

million during the quarter. The segment reported an operating

income of $34 million, down 7.1% year over year, whereas operating

margin declined 210 basis points, reflecting lower gross margins

and higher promotional costs.

Other Financial Details

Central Garden & Pet ended the quarter with cash and cash

equivalents of $11.3 million, total long-term debt of $593.7

million and shareholders’ equity of $474.6 million, excluding

non-controlling interest of $1 million. The leverage ratio was 5.1x

for the quarter. The company repurchased $1.5 million worth of

shares during the quarter under its $100 million share repurchase

authorization.

Our Take

Central Garden & Pet’s primary focus is on streamlining its

cost structure, increasing operating efficiencies in order to

improve its margins and concentrating on revenue enhancement

through marketing and brand-building initiatives.

Alongside, being the leading producer of garden and pet supplies

products in the U.S. and with a diversified portfolio of brands,

Central Garden & Pet developed a healthy commercial

relationship with giant retailers, such as Wal-Mart Stores

Inc. (WMT) and The Home Depot, Inc. (HD).

This provides a significant upside potential for the company.

However, the discretionary spending environment continues to

remain sluggish amid high unemployment levels and tight credit

markets. This is a looming concern for the company as a significant

portion of its product portfolio consists of premium offerings.

Moreover, the company expects its third-quarter results to decline

year over year.

Consequently, shares of Central Garden & Pet carry a Zacks

Rank #3 (Hold).

Other Stocks to Consider

Besides Central Garden, the other stock in the consumer goods

sector worth considering includes Jarden Corp.

(JAH), which holds a Zacks Rank #2 (Buy) and is expected to

continue with its upbeat performance.

CENTRAL GARDEN (CENT): Free Stock Analysis Report

HOME DEPOT (HD): Free Stock Analysis Report

JARDEN CORP (JAH): Free Stock Analysis Report

WAL-MART STORES (WMT): Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research

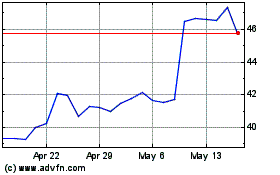

Central Garden and Pet (NASDAQ:CENT)

Historical Stock Chart

From Jun 2024 to Jul 2024

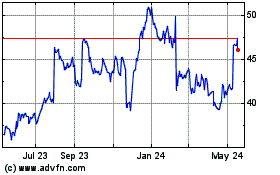

Central Garden and Pet (NASDAQ:CENT)

Historical Stock Chart

From Jul 2023 to Jul 2024