Cemtrex Inc. (NASDAQ: CETX, CETXP), an advanced security

technology and industrial services company, has reported its

financial and operational results for the fiscal fourth quarter and

year ended September 30, 2024.

Key Highlights for Fiscal Year

2024

- Revenue for the year ended

September 30, 2024, increased 13% to $66.9 million, compared to

revenue in the prior year of $59.4 million.

- Revenue for Q4’24 increased 9% to

$18.1 million, compared to revenue of $16.6 million for Q4’23.

- AIS Revenue: Surged 39% to $34.8

million, capitalizing on strategic acquisitions and growing market

demand.

- Vicon Innovations: Launched NEXT™

Modular Camera System, integrating groundbreaking AI analytics and

Hailo-15 edge AI processing, poised to redefine the surveillance

industry.

- Strategic Momentum: Secured a

record-breaking $10.4 million order for Valerus surveillance system

expansion

Management Commentary

Cemtrex Chairman and CEO, Saagar Govil,

commented on the results: “Fourth quarter revenue grew 9% to $18.1

million, year over year, and for the full year increased 13% to

$66.9 million, primarily driven by record demand for AIS products

and services. Continued high demand for AIS products and services

drove a 39% increase in revenue for fiscal 2024 to $34.8 million,

offset by a 7% decrease in Vicon revenue due to the delay of

multiple projects and a weaker industrywide demand for security

solutions. Operating loss for the fiscal year 2024 was $5.3

million, compared to $1.5 million a year ago, mainly due to an

increase in selling, general, and administrative costs.

“Our Security segment revenue in the fourth

quarter grew 2% to $8.6 million despite the softening we’ve seen

across the industry for the last several months. The team at Vicon

is highly focused on the launch of new security technologies and

products to expand its exciting portfolio and grow market share.

Recently, Vicon unveiled NEXT™, a next generation modular camera

platform that transforms how security integrators and end-users

install, interact, and support their camera systems, primed for

release in first calendar quarter of 2025. NEXT completely rethinks

the traditional camera experience by reducing installation time

from hours to minutes, leveraging the most powerful AI processing

capabilities on the market, and deploying advanced onboard

technologies and integrations.

“NEXT represents a strategic shift for Vicon. By

integrating with other major video management systems, we’re

expanding beyond our own ecosystem to deliver broader value in the

security market. We have also integrated a disruptive AI analytic

for detecting armed persons in surveillance footage to be included

in NEXT Cameras. This novel detection feature is designed to

function on edge devices, offering a low-cost, high-efficiency

solution for assistance in the detection of armed persons in

surveillance footage and enhancing the capabilities of video

management systems to initiate specific responses upon

detection.

“We believe that these investments in new

technologies and products will enable Vicon to ramp sales in the

coming year. We expect with the launch the NEXT Camera and the

innovative new cloud security platform Anavio, along with new

technologies and continued improvements to our core software

platform Valerus, there is significant further opportunity to grow

revenue and gross margin over the next several quarters including

our most recent announcement of a record breaking $10.4 million

order for a state government corrections facility to expand the

customer’s Valerus surveillance security system with additional

hardware, including enhanced storage infrastructure.

“For our Industrial services segment, AIS, the

year was highlighted by new orders and record revenue growth of 39%

to $34.8 million. A recent $6.7 million contract highlighted the

success of AIS’s strategic entry into the wastewater infrastructure

market through its acquisition of Heisey Mechanical in 2023 that

significantly broadened its capabilities and expanded the markets

we serve. Other projects set for completion in 2025 included

several large-scale infrastructure contracts. These orders from

leading companies reaffirm AIS’s optimistic growth outlook,

building a pipeline of growth for 2025.

“Looking ahead, we believe 2024 has demonstrated

the long-term potential of our two segments’ products and services

that will drive further momentum in 2025. Vicon’s next generation

cameras and software will continue to capture orders in the video

surveillance market, which is expected to expand to $88.7 billion

globally by 2030, according to Markets & Markets. AIS is set

for another breakout year with strong order flow and an expanded

market opportunity of leading companies and governmental

departments. Taken together, we are confident that will deliver

strong long-term value to our shareholders and drive sustainable

growth for years to come,” concluded Govil.

Segment Highlights:

Vicon Industries:

- Revenues for the year ended

September 30, 2024, decreased 7% to $32.0 million compared to $34.4

million for the year ended September 30, 2023.

- Revenues increased 2% to $8.6

million in Q4’24 compared to Q4’23.

- Announced a record breaking $10.4

million order for a state government corrections facility in the

mid-Atlantic region, expanding the customer’s Valerus surveillance

security system with additional hardware, including enhanced

storage infrastructure.

- Secured a partnership with Hailo,

an AI chip manufacturer known for its high-performance edge AI

processors, to integrate the groundbreaking Hailo-15

System-on-a-Chip (SoC) into Vicon’s NEXT™ Modular Camera

System.

- Announced integration of an

innovative Artificial Intelligence (AI) gun detection feature in

its NEXT Cameras, which will be released in the first calendar

quarter of 2025, marking a significant milestone in public safety

and security technology.

- Unveiled NEXT a next generation

modular camera platform that transforms how security integrators

and end-users install, interact, and support their camera

systems.

Advanced Industrial Services:

- Industrial Services segment

revenues for the year ended September 30, 2024, increased 39% to

$34.8 million compared to $25.0 million for the year ended

September 30, 2023.

- Industrial Services segment

revenues for Q4’24 increased 17% to $9.6 million, on increased

demand.

- Awarded two project contracts

totaling $6.7 million for upgrades at the Clearwater Road

Wastewater Treatment Facility in Derry Township, Pennsylvania.

- Awarded a $4.7 million contract for

Trade in Services Agreement (TiSA) energy upgrades at Fort

Indiantown Gap in Lebanon County, PA.

- Received a $4.5 million contract

for both Phase 1 and Phase 2 of the Department of General Services’

Elizabethtown Training Academy project.

Fourth Quarter and Full Year 2023

Financial Results Overview

Revenue for the full year of 2024 totaled $66.9

million, compared to revenue of $59.4 million for the full year of

2023, a 13% increase year over year. Revenues for the fourth

quarter of 2024 were $18.1 million, compared to $16.6 million in

the fourth quarter of 2023, an increase of 9%. The increase in

revenue for the year was due to increased demand for the Company’s

AIS products and services, offset by a decrease in security

technology products under our Vicon brand.

The Security segment revenues for the years

ended September 30, 2024, and 2023 were $32.0 million and $34.4

million, respectively, a decrease of 7%, due to decreased demand

for security technology products under the Vicon brand. Industrial

Services segment revenues for the full year 2024 increased by 39%

to $34.8 million, up from $25.0 million in 2023, primarily due to

the increase in demand for its products and services, and the

additional revenue from the business related to the acquisition of

Heisey Mechanical.

Gross profit for the year ended September 30,

2024, was $27.5 million, or 41% of revenues, as compared to gross

profit of $25.7 million, or 43% of revenues, for the year ended

September 30, 2023, mainly attributed to a decrease in gross margin

percent at AIS due the Heisey acquisition. Fourth quarter gross

profit of $7.6 million increased 11% from $6.8 million in the prior

year quarter.

Total operating expenses for 2024 were $32.8

million compared to $27.2 million in 2023. Total operating expenses

for the fourth quarter of 2024 were $7.9 compared to $6.8 in the

fourth quarter of 2023. The increase in total operating expenses

was primarily driven by increases in salaries and wages, general

and administrative expenses, and research and development expenses

related to the Security Segment’s development of proprietary

technology and next generation solutions associated with security

and surveillance systems software.

Operating loss for the full year of 2024 was

$5.3 million as compared to an operating loss of $1.5 million for

the full year of 2023. Operating loss for the fourth quarter of

2024 was $0.3 million as compared to an operating income of $.3

million for the fourth quarter of 2023. The operating loss was

primarily due to overall increased general and administration

expenses.

Net loss for the full year of 2024 was $7.7

million, as compared to a net loss of $9.2 million in 2023. Net

income in the fourth quarter of 2024 totaled $4.4 million compared

to a net loss of $1.2 million in the fourth quarter of 2023.

Cash, cash equivalents and restricted cash as of

September 30, 2024 was $5.4 million, compared to $6.3 million as of

September 30, 2023.

Inventories decreased to $7.0 million at

September 30, 2024, from $8.7 million at September 30, 2023.

About CemtrexCemtrex Inc.

(CETX) is a company that owns two operating subsidiaries: Vicon

Industries Inc and Advanced Industrial Services Inc.

Vicon Industries, a subsidiary

of Cemtrex Inc., is a global leader in advanced security and

surveillance technology to safeguard businesses, schools,

municipalities, hospitals and cities. Since 1967, Vicon delivers

mission-critical security surveillance systems, specializing in

engineering complete security solutions that simplify deployment,

operation and ongoing maintenance. Vicon provides security

solutions for some of the largest municipalities and businesses in

the U.S. and around the world, offering a wide range of

cutting-edge and compliant security technologies, from AI-driven

video analytics to fully integrated access control solutions. For

more information visit www.vicon-security.com

AIS – Advanced Industrial

Services, a subsidiary of Cemtrex, Inc., is a premier

provider of industrial contracting services including

millwrighting, rigging, piping, electrical, welding. AIS Installs

high precision equipment in a wide variety of industrial markets

including automotive, printing & graphics, industrial

automation, packaging, and chemicals. AIS owns and operates a

modern fleet of custom designed specialty equipment to assure safe

and quick installation of your production equipment. Our talented

staff participates in recurring instructional training, provided to

ensure that the most current industry methods are being utilized to

provide an efficient and safe working environment. For more

information visit www.ais-york.com

For more information visit www.cemtrex.com.

Forward-Looking Statements

This press release contains “forward-looking

statements” within the meaning of the Private Securities Litigation

Reform Act of 1995, including statements relating to the closing of

the offering, gross proceeds from the offering, our new product

offerings, expected use of proceeds, or any proposed fundraising

activities. These forward-looking statements are based on

management’s current expectations and are subject to certain risks

and uncertainties that could cause actual results to differ

materially from those set forth in or implied by such forward

looking statements. Statements made herein are as of the date of

this press release and should not be relied upon as of any

subsequent date. These risks and uncertainties are discussed under

the heading “Risk Factors” contained in our Form 10-K filed with

the Securities and Exchange Commission. All information in this

press release is as of the date of the release and we undertake no

duty to update this information unless required by law.

Investor RelationsChris TysonExecutive Vice

President – MZ North AmericaDirect:

949-491-8235CETX@mzgroup.us www.mzgroup.us

Cemtrex, Inc. and

SubsidiariesConsolidated Balance

Sheets

| |

|

September 30, |

|

September 30, |

|

Assets |

|

|

2024 |

|

|

|

2023 |

|

| Current assets |

|

|

|

|

|

Cash and cash equivalents |

|

$ |

3,897,511 |

|

|

$ |

5,329,910 |

|

|

Restricted cash |

|

|

1,522,881 |

|

|

|

1,019,652 |

|

|

Trade receivables, net |

|

|

11,159,676 |

|

|

|

9,209,695 |

|

|

Trade receivables, net - related party |

|

|

685,788 |

|

|

|

1,143,342 |

|

|

Inventory, net |

|

|

6,988,529 |

|

|

|

8,739,219 |

|

|

Contract assets, net |

|

|

985,207 |

|

|

|

1,739,201 |

|

|

Prepaid expenses and other current assets |

|

|

1,456,687 |

|

|

|

2,112,022 |

|

|

Total current assets |

|

|

26,696,279 |

|

|

|

29,293,041 |

|

| |

|

|

|

|

| Property and equipment,

net |

|

|

9,133,578 |

|

|

|

9,218,701 |

|

| Right-of-use operating lease

assets |

|

|

1,933,378 |

|

|

|

2,287,623 |

|

| Royalties receivable, net -

related party |

|

|

456,611 |

|

|

|

674,893 |

|

| Note receivable, net - related

party |

|

|

- |

|

|

|

761,585 |

|

| Goodwill |

|

|

3,708,347 |

|

|

|

4,381,891 |

|

| Other |

|

|

2,187,265 |

|

|

|

1,836,009 |

|

|

Total Assets |

|

$ |

44,115,458 |

|

|

$ |

48,453,743 |

|

| |

|

|

|

|

|

Liabilities & Stockholders' Equity |

|

|

|

|

| Current liabilities |

|

|

|

|

|

Accounts payable |

|

$ |

4,520,173 |

|

|

$ |

6,196,406 |

|

|

Accounts payable - related party |

|

|

- |

|

|

|

68,509 |

|

|

Sales tax payable |

|

|

73,024 |

|

|

|

35,829 |

|

|

Revolving line of credit |

|

|

3,125,011 |

|

|

|

- |

|

|

Current maturities of long-term liabilities |

|

|

4,732,377 |

|

|

|

14,507,711 |

|

|

Operating lease liabilities - short-term |

|

|

832,823 |

|

|

|

741,487 |

|

|

Deposits from customers |

|

|

408,415 |

|

|

|

57,434 |

|

|

Accrued expenses |

|

|

2,034,352 |

|

|

|

2,784,390 |

|

|

Contract liabilities |

|

|

1,254,204 |

|

|

|

980,319 |

|

|

Deferred revenue |

|

|

1,297,616 |

|

|

|

1,583,406 |

|

|

Accrued income taxes |

|

|

314,827 |

|

|

|

388,627 |

|

|

Total current liabilities |

|

|

18,592,822 |

|

|

|

27,344,118 |

|

| Long-term liabilities |

|

|

|

|

|

Long-term debt |

|

|

13,270,178 |

|

|

|

9,929,348 |

|

|

Long-term operating lease liabilities |

|

|

1,159,204 |

|

|

|

1,607,202 |

|

|

Other long-term liabilities |

|

|

274,957 |

|

|

|

501,354 |

|

|

Deferred Revenue - long-term |

|

|

658,019 |

|

|

|

727,928 |

|

|

Warrant liabilities |

|

|

5,199,436 |

|

|

|

- |

|

|

Total long-term liabilities |

|

|

20,561,794 |

|

|

|

12,765,832 |

|

|

Total liabilities |

|

|

39,154,616 |

|

|

|

40,109,950 |

|

| |

|

|

|

|

| Commitments and

contingencies |

|

|

- |

|

|

|

- |

|

| |

|

|

|

|

| Stockholders' equity |

|

|

|

|

|

Preferred stock , $0.001 par value, 10,000,000 shares

authorized, |

|

|

|

|

|

Series 1, 3,000,000 shares authorized, 2,456,827 shares issued

and |

|

|

|

|

|

2,392,727 shares outstanding as of September 30, 2024 and 2,293,016

shares issued and |

|

|

|

|

|

2,228,916 shares outstanding as of September 30, 2023 (liquidation

value of $10 per share) |

|

2,457 |

|

|

|

2,293 |

|

|

Series C, 100,000 shares authorized, 50,000 shares issued and

outstanding at |

|

|

|

|

|

September 30, 2024 and September 30, 2023 |

|

|

50 |

|

|

|

50 |

|

|

Common stock, $0.001 par value, 70,000,000 shares authorized, |

|

|

|

|

|

14,176 shares issued and outstanding at September 30, 2024 and |

|

|

|

|

|

50,000,000 shares authorized, 498 shares issued and outstanding at

September 30, 2023 |

|

|

14 |

|

|

|

1 |

|

|

Additional paid-in capital |

|

|

73,262,536 |

|

|

|

68,882,750 |

|

|

Accumulated deficit |

|

|

(71,355,386 |

) |

|

|

(64,125,895 |

) |

|

Treasury stock, 64,100 shares of Series 1 Preferred Stock at

September 30, 2024, |

|

|

|

|

|

and September 30, 2023 |

|

|

(148,291 |

) |

|

|

(148,291 |

) |

|

Accumulated other comprehensive income |

|

|

2,949,297 |

|

|

|

3,076,706 |

|

|

Total Cemtrex stockholders' equity |

|

|

4,710,677 |

|

|

|

7,687,614 |

|

|

Non-controlling interest |

|

|

250,165 |

|

|

|

656,179 |

|

| Total liabilities and

stockholders' equity |

|

$ |

44,115,458 |

|

|

$ |

48,453,743 |

|

| |

|

|

|

|

Cemtrex, Inc. and

SubsidiariesConsolidated Statements of

Operations

| |

|

For the year ended |

|

|

| |

|

September 30, 2024 |

|

September 30, 2023 |

|

|

| |

|

|

|

|

|

|

| Revenues |

|

|

|

|

|

|

|

Security Revenue |

|

$ |

32,021,899 |

|

|

$ |

34,359,470 |

|

|

|

|

Industrial Services Revenue |

|

|

34,841,985 |

|

|

|

25,009,092 |

|

|

|

| Revenues |

|

|

66,863,884 |

|

|

|

59,368,562 |

|

|

|

| |

|

|

|

|

|

|

| Cost of revenues |

|

|

|

|

|

|

|

Cost of revenues, Security |

|

|

15,854,560 |

|

|

|

17,253,170 |

|

|

|

|

Cost of revenues, Industrial Services |

|

|

23,531,120 |

|

|

|

16,429,566 |

|

|

|

| Cost of revenues |

|

|

39,385,680 |

|

|

|

33,682,736 |

|

|

|

|

Gross profit |

|

|

27,478,204 |

|

|

|

25,685,826 |

|

|

|

| Operating expenses |

|

|

|

|

|

|

|

General and administrative |

|

|

28,860,019 |

|

|

|

23,929,340 |

|

|

|

|

Research and development |

|

|

3,357,455 |

|

|

|

3,267,994 |

|

|

|

|

Goodwill impairment |

|

|

530,475 |

|

|

|

- |

|

|

|

|

Total operating expenses |

|

|

32,747,949 |

|

|

|

27,197,334 |

|

|

|

|

Operating loss |

|

|

(5,269,745 |

) |

|

|

(1,511,508 |

) |

|

|

| Other (expense)/income |

|

|

|

|

|

|

|

Other(expense)/income, net |

|

|

(622,558 |

) |

|

|

476,693 |

|

|

|

|

Interest expense |

|

|

(2,169,469 |

) |

|

|

(4,966,298 |

) |

|

|

|

Loss on excess fair value of warrants |

|

|

(7,255,528 |

) |

|

|

- |

|

|

|

|

Changes in fair value of warrant liability |

|

|

7,840,951 |

|

|

|

- |

|

|

|

|

Total other expense, net |

|

|

(2,206,604 |

) |

|

|

(4,489,605 |

) |

|

|

| Net loss before income

taxes |

|

|

(7,476,349 |

) |

|

|

(6,001,113 |

) |

|

|

|

Income tax expense |

|

|

(202,280 |

) |

|

|

(394,272 |

) |

|

|

| Loss from Continuing

operations |

|

|

(7,678,629 |

) |

|

|

(6,395,385 |

) |

|

|

| Income/(loss) from

discontinued operations, net of tax |

|

|

43,124 |

|

|

|

(2,838,053 |

) |

|

|

| Net loss |

|

|

(7,635,505 |

) |

|

|

(9,233,438 |

) |

|

|

| Less net loss in

noncontrolling interest |

|

|

(406,014 |

) |

|

|

(36,563 |

) |

|

|

|

Net loss attributable to Cemtrex, Inc.

stockholders |

|

$ |

(7,229,491 |

) |

|

$ |

(9,196,875 |

) |

|

|

| (Loss)/income per share -

Basic & Diluted |

|

|

|

|

|

|

|

Continuing Operations |

|

$ |

(17.96 |

) |

|

$ |

(15,760.64 |

) |

|

|

|

Discontinued Operations |

|

$ |

0.11 |

|

|

$ |

(3.89 |

) |

|

|

| Weighted Average Number of

Shares-Basic & Diluted |

|

|

408,602 |

|

|

|

414 |

|

|

|

| |

|

|

|

|

|

|

Cemtrex, Inc. and

SubsidiariesConsolidated Statements of Cash

Flows

| |

|

For the year ended |

|

|

|

|

|

September 30, |

|

|

Cash Flows from Operating Activities |

|

|

2024 |

|

|

|

2023 |

|

|

|

|

|

|

|

|

|

| Net loss |

|

$ |

(7,635,505 |

) |

|

$ |

(9,233,438 |

) |

|

|

|

|

|

|

|

|

| Adjustments to

reconcile net loss to net cash used by operating activities |

|

|

|

|

|

|

Depreciation and amortization |

|

|

1,328,741 |

|

|

|

1,026,075 |

|

|

|

(Gain)/loss on disposal of property and equipment |

|

|

(19,133 |

) |

|

|

69,601 |

|

|

|

Noncash lease expense |

|

|

829,119 |

|

|

|

702,747 |

|

|

|

Goodwill impairment |

|

|

530,475 |

|

|

|

- |

|

|

|

Bad debt expense (recovery) |

|

|

(79,006 |

) |

|

|

(14,515 |

) |

|

|

Loss on write-off of related party receivables |

|

|

1,409,500 |

|

|

|

- |

|

|

|

Share-based compensation |

|

|

30,235 |

|

|

|

106,839 |

|

|

|

Shares issued to pay for services |

|

|

169,000 |

|

|

|

215,800 |

|

|

|

Interest expense paid in equity shares |

|

|

- |

|

|

|

409,541 |

|

|

|

Accrued interest on notes payable |

|

|

1,189,629 |

|

|

|

2,707,262 |

|

|

|

Non-cash royalty income |

|

|

(53,126 |

) |

|

|

(44,272 |

) |

|

|

Amortization of original issue discounts on notes payable |

|

|

- |

|

|

|

1,264,111 |

|

|

|

Amortization of loan origination costs |

|

|

72,533 |

|

|

|

- |

|

|

|

Loss on excess fair value of warrants |

|

|

7,255,528 |

|

|

|

- |

|

|

|

Changes in fair value of warrant liability |

|

|

(7,840,951 |

) |

|

|

- |

|

|

| |

|

|

|

|

|

|

Changes in operating assets and liabilities net of effects from

acquisition |

|

|

|

|

|

|

of subsidiaries: |

|

|

|

|

|

|

Trade receivables |

|

|

(1,870,975 |

) |

|

|

(3,795,964 |

) |

|

|

Trade receivables - related party |

|

|

(63,462 |

) |

|

|

(1,099,070 |

) |

|

|

Inventory |

|

|

1,893,759 |

|

|

|

48,598 |

|

|

|

Contract assets |

|

|

753,994 |

|

|

|

(290,123 |

) |

|

|

Prepaid expenses and other current assets |

|

|

733,168 |

|

|

|

(458,476 |

) |

|

|

Other assets |

|

|

(251,256 |

) |

|

|

(336,264 |

) |

|

|

Accounts payable |

|

|

(818,733 |

) |

|

|

3,145,469 |

|

|

|

Accounts payable - related party |

|

|

- |

|

|

|

49,376 |

|

|

|

Sales tax payable |

|

|

37,195 |

|

|

|

15,734 |

|

|

|

Operating lease liabilities |

|

|

(831,536 |

) |

|

|

(577,446 |

) |

|

|

Deposits from customers |

|

|

350,981 |

|

|

|

(15,710 |

) |

|

|

Accrued expenses |

|

|

(690,038 |

) |

|

|

475,798 |

|

|

|

Contract liabilities |

|

|

273,885 |

|

|

|

393,960 |

|

|

|

Deferred revenue |

|

|

(355,699 |

) |

|

|

522,827 |

|

|

|

Income taxes payable |

|

|

(71,285 |

) |

|

|

293,779 |

|

|

|

Other liabilities |

|

|

(226,397 |

) |

|

|

(306,544 |

) |

|

|

Net cash used by operating activities - continuing operations |

|

|

(3,949,360 |

) |

|

|

(4,724,305 |

) |

|

|

Net cash provided by operating activities -

discontinued operations |

|

|

- |

|

|

|

2,491,581 |

|

|

|

Net cash used by operating activities |

|

|

(3,949,360 |

) |

|

|

(2,232,724 |

) |

|

|

|

|

|

|

|

|

|

Cash Flows from Investing Activities |

|

|

|

|

|

| Purchase

of property and equipment |

|

|

(1,297,346 |

) |

|

|

(2,761,314 |

) |

|

| Proceeds from sale

of property and equipment |

|

|

63,953 |

|

|

|

26,205 |

|

|

| Royalties on

related party revenues |

|

|

76,000 |

|

|

|

- |

|

|

| Acquisitions, Net

of Cash Acquired |

|

|

- |

|

|

|

(2,793,291 |

) |

|

| Investment in

MasterpieceVR |

|

|

(100,000 |

) |

|

|

(100,000 |

) |

|

|

Net cash used by investing activities |

|

|

(1,257,393 |

) |

|

|

(5,628,400 |

) |

|

|

|

|

|

|

|

|

|

Cash Flows from Financing Activities |

|

|

|

|

|

| Proceeds

on revolving line of credit |

|

|

33,071,722 |

|

|

|

- |

|

|

| Payments on

revolving line of credit |

|

|

(30,019,244 |

) |

|

|

- |

|

|

| Payments on

debt |

|

|

(7,923,914 |

) |

|

|

(1,533,059 |

) |

|

| Payments on

Paycheck Protection Program Loans |

|

|

(40,486 |

) |

|

|

(30,286 |

) |

|

| Proceeds on bank

loans |

|

|

340,267 |

|

|

|

3,360,000 |

|

|

| Proceeds from

notes payable |

|

|

- |

|

|

|

240,000 |

|

|

| Purchases of

treasury stock |

|

|

(69,705 |

) |

|

|

- |

|

|

| Proceeds from

offerings |

|

|

10,035,292 |

|

|

|

- |

|

|

| Expenses on

offerings |

|

|

(995,333 |

) |

|

|

- |

|

|

|

Net cash provided by financing activities |

|

|

4,398,599 |

|

|

|

2,036,655 |

|

|

| |

|

|

|

|

|

| Effect of currency

translation |

|

|

(121,016 |

) |

|

|

700,355 |

|

|

| Net decrease in

cash, cash equivalents, and restricted cash |

|

|

(808,154 |

) |

|

|

(5,824,469 |

) |

|

|

Cash, cash equivalents, and restricted cash at beginning of

period |

|

|

6,349,562 |

|

|

|

11,473,676 |

|

|

|

Cash, cash equivalents, and restricted cash at end of

period |

|

$ |

5,420,392 |

|

|

$ |

6,349,562 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Balance Sheet Accounts Included in Cash, Cash Equivalents,

and Restricted Cash |

|

|

|

|

|

|

Cash and cash equivalents |

|

$ |

3,897,511 |

|

|

$ |

5,329,910 |

|

|

|

Restricted cash |

|

|

1,522,881 |

|

|

|

1,019,652 |

|

|

|

Total cash, cash equivalents, and restricted

cash |

|

$ |

5,420,392 |

|

|

$ |

6,349,562 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Supplemental

Disclosure of Cash Flow Information: |

|

|

|

|

|

| Cash paid during

the period for interest |

|

$ |

738,307 |

|

|

$ |

585,384 |

|

|

|

Cash paid during the period for income taxes, net of refunds |

|

$ |

196,727 |

|

|

$ |

293,779 |

|

|

|

|

|

|

|

|

|

| Supplemental

Schedule of Non-Cash Investing and Financing

Activities |

|

|

|

|

|

| Shares issued to

pay notes payable |

|

$ |

- |

|

|

$ |

1,917,873 |

|

|

| Financing of fixed

asset purchase |

|

$ |

28,331 |

|

|

$ |

- |

|

|

| Financing of

building purchase |

|

$ |

- |

|

|

$ |

1,200,000 |

|

|

| Financing of

acquisition |

|

$ |

- |

|

|

$ |

2,400,000 |

|

|

| Purchase of

property and equipment through vendor financing |

|

$ |

- |

|

|

$ |

675,000 |

|

|

| Noncash

recognition of new leases |

|

$ |

474,874 |

|

|

$ |

349,172 |

|

|

|

|

|

|

|

|

Investor Relations

Chris Tyson

Executive Vice President – MZ North America

Direct: 949-491-8235

CETX@mzgroup.us

www.mzgroup.us

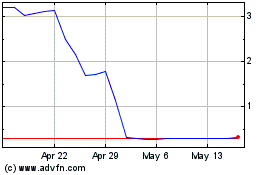

Cemtrex (NASDAQ:CETX)

Historical Stock Chart

From Dec 2024 to Jan 2025

Cemtrex (NASDAQ:CETX)

Historical Stock Chart

From Jan 2024 to Jan 2025