SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

___________________

FORM 8‑K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the

Securities Exchange Act of 1934

Date of Report (Date of Earliest Event reported)

May 29, 2015

CITY HOLDING COMPANY

(Exact Name of Registrant as Specified in its Charter)

|

|

Commission File Number: 0-11733 |

|

| | |

West Virginia | | 55-0619957 |

(State or other jurisdiction of incorporation) | | (IRS Employer Identification Number) |

|

|

25 Gatewater Road, Cross Lanes, WV 25313 |

(Address of Principal Executive Offices, Including Zip Code) |

(304) 769-1100

(Registrant’s Telephone Number, Including Area Code)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (see General Instruction A.2. below):

__ Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

__ Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

__ Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

__ Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

Item 8.01 Other Events.

On May 29, 2015, City National Bank of West Virginia (“City National”), a wholly-owned subsidiary of City Holding Company, entered into a Branch Purchase and Assumption Agreement (the “Purchase Agreement”) with American Founders Bank, Inc. (“AFB”), a wholly-owned subsidiary of Financial Holdings, Inc., pursuant to which City National will purchase AFB’s three Lexington, Kentucky branch locations (the “Acquisition”). Under the terms of the Purchase Agreement, City National will acquire $125 million in performing loans and will assume deposit liabilities of approximately $164.2 million. City National will pay AFB a deposit premium of 5.5% on non-time deposits, and 1.0% on premium loan balances acquired.

Closing of the Acquisition is subject to customary closing conditions, including receipt of all necessary regulatory approvals.

A copy of the press release announcing the execution of the Purchase Agreement is filed as Exhibit 99.1 hereto.

Forward Looking Statements

This Current Report on Form 8-K and the press release included as Exhibit 99.1 contain forward-looking statements within the meaning of Section 27A of the Securities Act of 1933 and Section 21E of the Securities Exchange Act of 1934. These forward-looking statements are intended to be covered by the safe harbor provisions for forward-looking statements contained in the Private Securities Litigation Reform Act of 1995. These forward-looking statements include, but are not limited to, statements identified by words such as “expects,” “anticipates,” “intends,” “plans,” “believes,” “seeks,” “estimates,” “targets,” “projects,” or words of similar meaning generally intended to identify forward-looking statements. These forward-looking statements are based upon the current beliefs and expectations of the management of City and are inherently subject to significant business, economic and competitive uncertainties and contingencies, many of which are beyond the control of City. In addition, these forward-looking statements are subject to assumptions with respect to future business strategies and decisions that are subject to change. Actual results may differ materially from the anticipated results discussed in these forward-looking statements because of possible uncertainties. Additional factors that could cause actual results to differ materially from those expressed in the forward-looking statements are discussed in City’s reports (such as its Annual Report on Form 10-K, Quarterly Reports on Form 10-Q and Current Reports on Form 8-K) filed with the Securities and Exchange Commission and available on the SEC’s Internet site (www.sec.gov) and on City’s website (bankatcity.com). City does not undertake any obligation to update any forward-looking statement to reflect circumstances or events that occur after the date the forward-looking statements are made.

Item 9.01 Financial Statements and Exhibits.

(d) Exhibits.

Exhibit No. Description

| |

99.1 | Press release issued by City Holding Company on June 1, 2015. |

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the Registrant has duly caused this Report to be signed on its behalf by the undersigned thereunto duly authorized.

|

| | | | | | | | | | | |

| | | | | | | City Holding Company |

| | | | | | | | | |

| | | | | | | | | | |

Date: June 1, 2015 | | | By: /s/ David L. Bumgarner |

| | | | | | | | David L. Bumgarner Chief Financial Officer |

| | | | | | | |

Exhibit 99.1

For Immediate Release

June 1, 2015

For Further Information Contact:

Charles R. Hageboeck, Chief Executive Officer and President

(304) 769-1102

Craig G. Stilwell, Executive Vice President

(304) 769-1113

City Holding Company acquires branches in Lexington, KY

CHARLESTON, West Virginia, and Lexington, Kentucky – City Holding Company (“City”) (NASDAQ: CHCO) announced today the execution of an agreement by City’s wholly-owned subsidiary City National Bank of West Virginia (“City National”) to acquire three branches in Lexington, Kentucky, from American Founders Bank, Inc. (“AFB”), a wholly-owned subsidiary of Financial Holdings, Inc. (the “Acquisition”). The Acquisition will expand City National’s presence to 11 branches in Kentucky, in addition to 74 branches in West Virginia, Virginia, and Ohio. As of May 15, 2015, AFB’s Lexington based branches had deposits of $164.2 million, of which $93.5 million was in core deposits (excluding time and sweep deposits). City National also is to acquire $125 million in performing loans as part of the transaction at closing.

Under the terms of the agreement, City National will pay a deposit premium of 5.5% on non-time deposits, excluding repurchase agreements. Also, City National will pay a 1.0% premium on loan balances acquired. Based on May 15, 2015 balances, the aggregate premium would have been approximately $6.4 million. City expects the Acquisition to be immediately accretive to earnings per share.

City National and AFB anticipate the Acquisition will be completed in the third quarter of 2015, pending regulatory approval and the completion of other closing conditions. AFB’s President, Bill Craycraft, a veteran Lexington banker, will serve as City National’s Market President in Lexington. City’s CEO, Skip Hageboeck, stated, “The Lexington market is clearly one of the best markets in this region of the country. We have had an interest in expanding into this area for a long time and are excited to become a part of the Lexington community. We look forward to partnering with Bill and his experienced team at AFB. AFB’s success in the Lexington market is the result of their strong focus on customers, and AFB has clearly established itself as a leading commercial lender within this dynamic market. We believe City’s own emphasis on community-based banking, combined with our ability to bring additional products and services to both retail and business customers of AFB, makes this an excellent opportunity for both organizations.”

Craycraft said, “Upon closing this transaction AFB’s Lexington customers will have access to the broad products and services that City provides. City has a reputation as one of the best-run banks in the country, and enjoys success that is grounded in their roots as a true community-focused bank. In addition, City’s size will enable our team to serve larger companies in the region.”

Austin Associates LLC is serving as financial advisor to AFB. Boenning & Scattergood, Inc. is serving as financial advisor to City. The legal advisor to AFB is Wyatt, Tarrant & Combs, LLP. The legal advisor to City is Dinsmore & Shohl LLP.

About American Founders Bank

American Founders Bank is a locally owned bank founded in 2001, and headquartered in Lexington, Kentucky. American Founders has five branches (two in Louisville and three in Lexington), and as of March 31, 2015 had total deposits of $256 million, total loans of $201 million, and total assets of $293 million.

About City Holding Company

City Holding Company, through its wholly-owned subsidiary City National Bank of West Virginia, operates 82 branches in Kentucky, Ohio, West Virginia and Virginia. As of March 31, 2015, City has total assets of $3.6 billion, loans of $2.6 billion, and deposits of $2.9 billion.

Forward Looking Statements

This press release contains forward-looking statements within the meaning of Section 27A of the Securities Act of 1933 and Section 21E of the Securities Exchange Act of 1934. These forward-looking statements are intended to be covered by the safe harbor provisions for forward-looking statements contained in the Private Securities Litigation Reform Act of 1995. These forward-looking statements include, but are not limited to, statements identified by words such as “expects,” “anticipates,” “intends,” “plans,” “believes,” “seeks,” “estimates,” “targets,” “projects,” or words of similar meaning generally intended to identify forward-looking statements. These forward-looking statements are based upon the current beliefs and expectations of the management of City and are inherently subject to significant business, economic and competitive uncertainties and contingencies, many of which are beyond the control of City. In addition, these forward-looking statements are subject to assumptions with respect to future business strategies and decisions that are subject to change. Actual results may differ materially from the anticipated results discussed in these forward-looking statements because of possible uncertainties. Additional factors that could cause actual results to differ materially from those expressed in the forward-looking statements are discussed in City’s reports (such as its Annual Report on Form 10-K, Quarterly Reports on Form 10-Q and Current Reports on Form 8-K) filed with the Securities and Exchange Commission and available on the SEC’s Internet site (www.sec.gov) and on City’s website (bankatcity.com). City does not undertake any obligation to update any forward-looking statement to reflect circumstances or events that occur after the date the forward-looking statements are made.

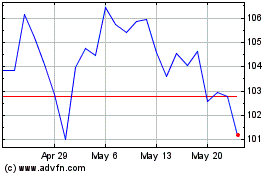

City (NASDAQ:CHCO)

Historical Stock Chart

From Jun 2024 to Jul 2024

City (NASDAQ:CHCO)

Historical Stock Chart

From Jul 2023 to Jul 2024