0000913277

false

0000913277

2023-09-15

2023-09-15

iso4217:USD

xbrli:shares

iso4217:USD

xbrli:shares

United States

Securities and Exchange Commission

Washington, D.C. 20549

Form 8-K

Current Report

Pursuant to Section 13 or 15(d) of the

Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): September 15, 2023

CLARUS CORPORATION

(Exact name of registrant as specified in

its charter)

|

Delaware

(State or other jurisdiction

of incorporation) |

001-34767

(Commission File Number) |

58-1972600

(IRS Employer

Identification Number) |

|

2084 East 3900 South, Salt Lake City, Utah

(Address of principal executive offices) |

84124

(Zip Code) |

Registrant’s telephone number, including

area code: (801) 278-5552

N/A

(Former name or former address, if changed

since last report.)

Check the appropriate box below if the Form 8-K filing is intended

to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

| ¨ | Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| ¨ | Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| ¨ | Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| ¨ | Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Indicate by check mark whether the registrant is an emerging

growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities

Exchange Act of 1934 (§240.12b-2 of this chapter).

| |

¨ |

Emerging growth company |

If an emerging growth company, indicate by check mark if the

registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards

provided pursuant to Section 13(a) of the Exchange Act. ¨

Securities registered pursuant to Section

12(b) of the Act:

| Title of each class |

|

Trading Symbol |

|

Name of each exchange on which

registered |

| Common Stock, par value $.0001 per share |

|

CLAR |

|

NASDAQ Global Select Market |

| Item 7.01 |

Regulation FD Disclosure. |

On September 19, 2023,

Clarus Corporation (the “Company”) issued a press release confirming its receipt on September 15, 2023 of a non-binding indication

of interest from Warren B. Kanders to acquire, through an affiliated entity, the Company’s Precision Sport segment, which is comprised

of the Company’s Sierra Bullets, L.L.C. and Barnes Bullets – Mona, LLC subsidiaries. Mr. Kanders is the Company’s Executive

Chairman of the Board of Directors. The press release is attached hereto as Exhibit 99.1 and is incorporated herein by reference.

The information set forth

under Item 7.01 of this Current Report on Form 8-K, including Exhibit 99.1 attached hereto, is being furnished and shall not be deemed

“filed” for purposes of Section 18 of the Securities Exchange Act of 1934, as amended (the “Exchange Act”), or

otherwise subject to the liabilities of such section, and shall not be incorporated by reference into any filing under the Securities

Act of 1933, as amended, or the Exchange Act, regardless of any incorporation by reference language in any such filing, except as expressly

set forth by specific reference in such a filing.

| Item 9.01 |

Financial Statements and Exhibits |

(d) Exhibits.

The following Exhibits are filed herewith as a part of this Report:

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934,

as amended, the Company has duly caused this Report to be signed on its behalf by the undersigned hereunto duly authorized.

Dated: September 19, 2023

| |

CLARUS CORPORATION |

| |

|

| |

By: |

/s/ Michael J. Yates |

| |

Name: |

Michael J. Yates |

| |

Title: |

Chief Financial Officer |

Exhibit 99.1

Clarus

Confirms Receipt of Non-Binding Indication of Interest

Regarding

Precision Sport Segment

SALT

LAKE CITY, Utah – September 19, 2023 – Clarus Corporation (NASDAQ: CLAR) (“Clarus” and/or the “Company”),

a global company focused on the outdoor and consumer enthusiast markets, today confirmed the receipt of a non-binding indication of interest

from Warren B. Kanders to acquire the Company’s Precision Sport segment, which is comprised of the Company’s Sierra Bullets,

L.L.C. and Barnes Bullets – Mona, LLC subsidiaries, through an affiliated entity (the “Buyer”), for approximately $160

million on a cash-free, debt-free basis (the “Buyer’s Proposal”), the terms of which are more fully set forth in the

complete text of the Buyer’s Proposal, included as Exhibit 1 to Mr. Kanders’ statement of beneficial ownership on Schedule

13D/A as publicly filed on September 18, 2023 with the U.S. Securities and Exchange Commission. Mr. Kanders is the Company’s Executive

Chairman of the Board of Directors (the “Board”).

In

response to the Buyer’s Proposal, the Board formed a special committee of the Board comprised of independent directors (the “Special

Committee”) to review and evaluate the Buyer’s Proposal and any alternative proposals that may be available to the Company,

including the possibility of rejecting the Buyer’s Proposal and/or any alternative proposals. The Special Committee has been empowered,

among other things, to retain financial advisors and counsel to assist it in its directive from the Board.

Separately,

Keith Enlow, President of the Company’s Precision Sport segment, has advised the Company that he will resign his position effective

September 29, 2023 in order to pursue other opportunities. Michael J. Yates, the Company’s Chief Financial Officer, will serve

as interim President of the Company’s Precision Sport segment until a successor is hired and formally appointed.

There

can be no assurance that any definitive agreement will result from the Buyer’s Proposal or that any transaction will be consummated

with the Buyer or any other third party. The Company and the Special Committee do not intend to comment further about the Buyer’s

Proposal unless and until they deem further disclosure is appropriate.

About

Clarus Corporation

Headquartered

in Salt Lake City, Utah, Clarus Corporation is a global leading designer, developer, manufacturer and distributor of best-in-class outdoor

equipment and lifestyle products focused on the outdoor and consumer enthusiast markets. Our mission is to identify, acquire and grow

outdoor “super fan” brands through our unique “innovate and accelerate” strategy. We define a “super fan”

brand as a brand that creates the world’s pre-eminent, performance-defining product that the best-in-class user cannot live without.

Each of our brands has a long history of continuous product innovation for core and everyday users alike. The Company’s products

are principally sold globally under the Black Diamond®, Rhino-Rack®, MAXTRAX®, Sierra®, and Barnes® brand names through

outdoor specialty and online retailers, our own websites, distributors, and original equipment manufacturers. Our portfolio of iconic

brands is well-positioned for sustainable, long-term growth underpinned by powerful industry trends across the outdoor and adventure

sport end markets. For additional information, please visit www.claruscorp.com or the brand websites at www.blackdiamondequipment.com,

www.rhinorack.com, www.maxtrax.com.au, www.sierrabullets.com, www.barnesbullets.com, www.pieps.com,

or www.goclimbon.com.

Forward-Looking

Statements

Please

note that in this press release we may use words such as “appears,” “anticipates,” “believes,” “plans,”

“expects,” “intends,” “future,” and similar expressions which constitute forward-looking statements

within the meaning of the safe harbor provisions of the Private Securities Litigation Reform Act of 1995. Forward-looking statements

are made based on our expectations and beliefs concerning future events impacting the Company and therefore involve a number of risks

and uncertainties. We caution that forward-looking statements are not guarantees and that actual results could differ materially from

those expressed or implied in the forward-looking statements. Potential risks and uncertainties that could cause the actual results of

operations or financial condition of the Company to differ materially from those expressed or implied by forward-looking statements in

this release, include, but are not limited to, the Company’s potential responses to the Buyer’s Proposal, the exploration

of strategic alternatives by the Company, the potential impact of the Buyer’s Proposal on our business, results of operations,

and financial condition, as well as those risks and uncertainties more fully described from time to time in the Company's public reports

filed with the Securities and Exchange Commission, including under the section titled “Risk Factors” in the Company's Annual

Report on Form 10-K, and/or Quarterly Reports on Form 10-Q, as well as in the Company’s Current Reports on Form 8-K. All forward-looking

statements included in this press release are based upon information available to the Company as of the date of this press release and

speak only as of the date hereof. We assume no obligation to update any forward-looking statements to reflect events or circumstances

after the date of this press release.

Company

Contacts:

Michael

J. Yates

Chief

Financial Officer

Tel

1-801-993-1304

mike.yates@claruscorp.com

Investor

Relations Contact:

Gateway

Group, Inc.

Cody

Slach

Tel

1-949-574-3860

CLAR@gateway-grp.com

v3.23.3

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

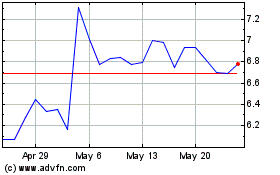

Clarus (NASDAQ:CLAR)

Historical Stock Chart

From Apr 2024 to May 2024

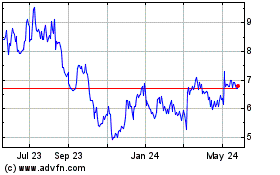

Clarus (NASDAQ:CLAR)

Historical Stock Chart

From May 2023 to May 2024