Form 8-K - Current report

12 March 2024 - 1:44AM

Edgar (US Regulatory)

false

0000913277

0000913277

2024-03-11

2024-03-11

iso4217:USD

xbrli:shares

iso4217:USD

xbrli:shares

United States

Securities and Exchange Commission

Washington, D.C. 20549

Form 8-K

Current Report

Pursuant to Section 13 or 15(d) of the Securities

Exchange Act of 1934

Date of Report (Date of earliest event reported):

March 11, 2024

CLARUS

CORPORATION

(Exact name of registrant as specified in its

charter)

Delaware

(State or other jurisdiction

of incorporation) |

001-34767

(Commission File Number) |

58-1972600

(IRS Employer

Identification Number) |

2084

East 3900 South, Salt Lake City,

Utah

(Address of principal executive offices) |

84124

(Zip Code) |

Registrant’s telephone number, including

area code: (801) 278-5552

N/A

(Former name or former address, if changed since

last report.)

Check the appropriate box below if the Form 8-K

filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

| ¨ | Written

communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| ¨ | Soliciting

material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| ¨ | Pre-commencement

communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| ¨ | Pre-commencement

communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Indicate by check mark whether the registrant

is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the

Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

| |

¨ |

Emerging growth company |

If an emerging growth company, indicate by check

mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting

standards provided pursuant to Section 13(a) of the Exchange Act. ¨

Securities registered pursuant to Section 12(b) of the Act:

| Title

of each class |

|

Trading

Symbol |

|

Name

of each exchange on which

registered |

| Common

Stock, par value $.0001 per share |

|

CLAR |

|

NASDAQ

Global Select Market |

Item 7.01. Regulation FD Disclosure.

Clarus Corporation (“Clarus” or the

“Company”) will host an investor day event on Monday, March 11, 2024, from 12:00 pm to 2:00 pm EDT in New York City, NY. The

event will include a presentation (the “Presentation”) by Clarus’ management, including Warren B. Kanders, Executive

Chairman; Michael J. Yates, Chief Financial Officer; Neil Fiske, President, Black Diamond Equipment; and Mathew Hayward, Managing Director

of Clarus' Adventure segment; followed by Q&A sessions. The investor day event will be broadcast live and available for replay on

the Company’s website at www.claruscorp.com. The Presentation and related information are furnished herewith as Exhibit 99.1 and

are incorporated herein by reference.

The Presentation contains the non-GAAP measures:

(i) adjusted gross margin and adjusted gross profit, (ii) adjusted (loss) income from continuing operations and related earnings (loss)

per diluted share, (iii) earnings before interest, taxes, other income or expense, depreciation and amortization (“EBITDA”),

EBITDA margin, adjusted EBITDA, and adjusted EBITDA margin, and (iv) free cash (defined as net cash provided by operating activities less

capital expenditures). The Company believes the presentation of these non-GAAP measures provides useful information for the understanding

of its ongoing operations and enables investors to focus on period-over-period operating performance, and thereby enhances the user’s

overall understanding of the Company’s current financial performance relative to past performance and provides, along with the nearest

GAAP measures, a baseline for modeling future earnings expectation. The non-GAAP measures are reconciled to comparable GAAP financial

measures within the Presentation. The Company cautions that non-GAAP measures should be considered in addition to, but not as a substitute

for, the Company's reported GAAP results. Additionally, the Company notes that there can be no assurance that the above referenced non-GAAP

financial measures are comparable to similarly titled financial measures used by other publicly traded companies.

The information in this Form 8-K and the Presentation

attached hereto as Exhibit 99.1 shall not be deemed “filed” for purposes of Section 18 of the Securities Act of 1934, as amended,

nor shall it be deemed incorporated by reference in any filing under the Securities Act of 1933, as amended, except as shall be expressly

set forth by specific reference in such filing.

Item 9.01. Financial Statements and Exhibits

(d) Exhibits.

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934,

as amended, the Company has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

Dated: March 11, 2024

| |

CLARUS CORPORATION |

| |

|

| |

By: |

/s/ Michael J. Yates |

| |

Name: Michael J. Yates |

| |

Title: Chief Financial Officer |

Exhibit 99.1

| 6 February 2023 |

| 6 February 2023

▪

▪

▪

▪

▪

▪

▪ |

| 6 February 2023

▪

▪

▪

▪

▪

▪

▪

▪ |

| 6 February 2023 |

| 6 February 2023

We help people make space for adventure with world

ready outdoor gear born and proven in Australia.

.. |

| THIS IS OUR LAB |

| THIS IS OUR QUALITY CONTROL |

| AND THIS IS OUR FIELD TEST |

| GLOBAL ROOF

-RACK

& HITCH

CARAVAN & CAMPING

MARKET

GLOBAL ROOF

-RACK

& HITCH

CARAVAN & CAMPING

MARKET |

| FY24F Revenue FY24F EBITDA # Retail Doors Worldwide # Countries Distributed to # Employee’s Worldwide |

| 6 February 2023

ANZ, 65%

Americas, 25%

ROW, 10%

Wholesale,

75%

DTC, 15%

OEM, 10%

Trays, 20%

Bars, 30%

Accessories,

50% |

| 6 February 2023

OVERLANDING CAMPING

CYCLING

TOURING

WATER SPORTS

WEEKEND ADVENTURE

SNOW TRADE |

| 6 February 2023 |

| 6 February 2023

SNOW

OVERLANDING

CAMPING

CYCLING TOURING

WATER SPORTS WEEKEND ADVENTURE

TRADE |

| 6 February 2023 |

| 6 February 2023 |

| 6 February 2023

x663

x180

x4

X530*

x10

x2 |

| 6 February 2023

[ PRIMARY SEGMENT]

[ Overlanding & 4WD ]

[ SECONDARY SEGMENT ]

[ Work & Play, Tools & Toys ]

[ SECONDARY SEGMENT ]

[ Bike, Kayak, Snow]

[ SECONDARY SEGMENT ]

[ Families, Mall Crawlers]

[ AU SECONDARY SEGMENT ]

[ Sports, Camping, Van Life]

[ US SECONDARY SEGMENT ]

[ Hunter, Fisher, Camper] |

| 6 February 2023 |

| 6 February 2023

PRESIDENT

1 .3Year at Clarus

35 years industry experience

Chief Finance Officer

6 Years at Rhino Rack

35 years industry experience

Head of Operations

0.1 Years at Rhino Rack

20 years industry experience

Head of Product

6 Years at Rhino Rack

10 years industry experience

Head of Marketing & Digital

0.5 Years at Rhino Rack

15 years industry experience

Head of People & Culture

0.3 Years at Rhino Rack

20 years industry experience

GM ANZ

0.5 Years at Rhino Rack

20 years industry experience

GM AMERICAS

2 Years at Rhino Rack

35 years industry experience

GM Rest of World

3 Years at Rhino Rack

30 years industry experience |

| 6 February 2023 |

| 6 February 2023

•••••

•••

•••

•••• |

| 6 February 2023 |

| 6 February 2023 |

| 6 February 2023 |

| OUTDOOR |

| 6 February 2023

Iconic founder driven brand

W e h e l p p e o p l e m a k e s p a c e f o r a d v e n t u r e w i t h w o r l d

r e a d y o u t d o o r g e a r b o r n a n d p r o v e n i n A u s t r a l i a . |

| CORE

CLIMBING MARKET

OUTDOOR GEAR &

EQUIPMENT MARKET

GYM

CLIMBING MARKET

CORE

CLIMBING MARKET

OUTDOOR GEAR &

EQUIPMENT MARKET

GYM

CLIMBING MARKET |

| Climb 10M, Backcountry 4M, Trail Run 12 M, Hike/Trak Represent US

Participation data from OIA and SIA.

BD FOCUS: TOURING,

FREERIDE, MOUNTAINEERING,

SIDE-COUNRY, OFF-PISTE

INDOOR, BOULDER, SPORT,

TRAD, ICE, MIXED, BIG WALL,

ALPINE, MOUNTAINEERING,

VIA-FERRATA

MOUNTAIN RUN, TRAIL RUN,

FKT, ULTRA

OBJECTIVE DAY HIKING, FAST

PACKING, PEAK BAGGING,

BASECAMP TREK |

| FY24F Revenue FY24F EBITDA # Retail Doors Worldwide # Countries Distributed to # Employee’s Worldwide |

| 6 February 2023

North America,

65%

EU, 25%

ROW, 10%

Wholesale,

75%

DTC, 15%

IGD, 10%

Mountain, 40%

Climb, 25%

Apparel, 20%

Ski, 10%

Footwear, 5% |

| 6 February 2023 |

| 6 February 2023

Managing Director

1 Year at Clarus

28 years industry experience

Chief Finance Officer

Recent return to BLACK

DIAMOND (6.5 years prior

experience)

17 years industry experience

Head of Operations

Recent return to BLACK

DIAMOND (20 years prior

experience)

45 years industry experience

Head of Product

20 Years at BLACK DIAMOND

20 years industry experience

Head of Marketing & Digital

2 Years at BLACK DIAMOND

22 years industry experience

Head of People & Culture

25 Years at BLACK DIAMOND

25 years industry experience

GM ANZ

10 Years at BLACK DIAMOND

20 years industry experience

Head of People & Culture

Recent return to BLACK DIAMOND

(17 years prior experience)

26 years industry experience |

| 6 February 2023 |

| 6 February 2023

▪

▪

▪

▪ |

| 6 February 2023 |

| 6 February 2023 |

| 6 February 2023 |

| 6 February 2023 |

| 6 February 2023

▪▪▪▪

▪▪▪

▪▪

▪▪▪▪ |

| 6 February 2023

204 |

| 6 February 2023 |

| 6 February 2023 |

| 6 February 2023 |

| 6 February 2023 |

| On December 29, 2023, the Company announced the sale of its Precision Sport segment for $175

million. As the disposition was completed on February 29, 2024, we expect to recognize a gain on

the disposition during the three months ending March 31, 2024. The activities of the Precision Sport

segment have been segregated and reported as discontinued operations for all periods presented.

Certain prior period financial information, related to discontinued operations, have been reclassified

and separately presented in the consolidated financial statements and accompanying notes to

conform to the current period presentation. The following unaudited financial information is based

upon the historical consolidated financial statements of the Company and provides information for

continuing operations for each quarter during 2023. |

| 6 February 2023

Sales

Domestic sales $ 24,197 $ 25,925 $ 30,423 $ 31,840

International sales 46,081 32,012 50,879 44,663

Total sales 70,278 57,937 81,302 76,503

Cost of goods sold 44,770 35,360 54,018 54,361

Gross profit 25,508 22,577 27,284 22,142

Operating expenses

Selling, general and administrative 29,482 27,237 28,983 30,665

Restructuring charges - 736 1,076 1,411

Transaction costs 37 22 400 134

Contingent consideration benefit (1,565) - - -

Total operating expenses 27,954 27,995 30,459 32,210

Operating loss (2,446) (5,418) (3,175) (10,068)

Other income (expense)

Interest income, net 5 8 19 35

Other, net 76 226 (445) 1,104

Total other income (expense), net 81 234 (426) 1,139

Loss before income tax (2,365) (5,184) (3,601) (8,929)

Income tax (benefit) expense (334) (862) (1,395) (1,700)

Loss from continuing operations (2,031) (4,322) (2,206) (7,229)

Discontinued operations, net of tax 3,629 2,231 942 (1,160)

Net income (loss) $ 1,598 $ (2,091) $ (1,264) $ (8,389)

Loss from continuing operations per share:

Basic $ (0.05) $ (0.12) $ (0.06) $ (0.19)

Diluted (0.05) (0.12) (0.06) (0.19)

Net income (loss) per share:

Basic $ 0.04 $ (0.06) $ (0.03) $ (0.22)

Diluted 0.04 (0.06) (0.03) (0.22)

Weighted average shares outstanding:

Basic 37,137 37,192 37,470 38,312

Diluted 37,137 37,192 37,470 38,312

CLARUS CORPORATION

CONDENSED CONSOLIDATED STATEMENTS OF LOSS

(Unaudited)

(In thousands, except per share amounts)

Three Months Ended

March 31, 2023 June 30, 2023 September 30, 2023 December 31, 2023 |

| 6 February 2023

As reported $ 70,278 $ 25,508 $ 27,954 $ (334) (14.1) % $ (2,031) $ (0.05)

Amortization of intangibles - - (2,768) 278 2,490

Stock-based compensation - - (1,285) 277 1,008

Transaction costs - - (37) 6 31

Contingent consideration (benefit) expense - - 1,565 (335) (1,230)

As adjusted $ 70,278 $ 25,508 $ 25,429 $ (108) (67.5) % $ 268 $ 0.01

As reported $ 57,937 $ 22,577 $ 27,995 $ (862) (16.6) % $ (4,322) $ (0.12)

Amortization of intangibles - - (2,714) 613 2,101

Stock-based compensation - - (1,486) 295 1,191

Restructuring charges - - (736) 74 662

Transaction costs - - (22) 2 20

As adjusted $ 57,937 $ 22,577 $ 23,037 $ 122 54.0 % $ (348) $ (0.01)

CLARUS CORPORATION

RECONCILIATION FROM LOSS FROM CONTINUING OPERATIONS TO ADJUSTED (LOSS) INCOME FROM CONTINUING OPERATIONS AND

RELATED EARNINGS PER DILUTED SHARE

(In thousands, except per share amounts)

Three Months Ended March 31, 2023

Total Gross Operating Income tax Tax (Loss) income from Diluted

(benefit) expense rate continuing operations EPS (1)

(1) Potentially dilutive securities are excluded from the computation of diluted earnings (loss) per share if their effect is anti-dilutive to the loss from continuing operations. Reported loss from continuing operations per share is calculated based on 37,137

basic and diluted weighted average shares of common stock. Adjusted income from continuing operations per share is calculated based on 38,109 diluted shares of common stock.

sales profit expenses

Three Months Ended June 30, 2023

Total Gross Operating Income tax

continuing operations EPS (1)

(1) Potentially dilutive securities are excluded from the computation of diluted earnings (loss) per share if their effect is anti-dilutive to the loss from continuing operations. Reported loss from continuing operations per share and adjusted loss from continuing

operations per share are both calculated based on 37,192 basic and diluted weighted average shares of common stock.

Tax (Loss) income from Diluted

sales profit expenses (benefit) expense rate |

| 6 February 2023

As reported $ 81,302 $ 27,284 $ 30,459 $ (1,395) (38.7) % $ (2,206) $ (0.06)

Amortization of intangibles - - (2,553) 866 1,687

Stock-based compensation - - (1,152) 284 868

Restructuring charges - - (1,076) 334 742

Transaction costs - - (400) 92 308

As adjusted $ 81,302 $ 27,284 $ 25,278 $ 181 11.5 % $ 1,399 $ 0.04

As reported $ 76,503 $ 22,142 $ 32,210 $ (1,700) (19.0) % $ (7,229) $ (0.19)

Amortization of intangibles - - (2,680) 536 2,144

Stock-based compensation - - (1,218) 244 974

Inventory fair value of purchase accounting - 64 - 14 50

Restructuring charges - - (1,411) 282 1,129

Transaction costs - - (134) 27 107

As adjusted $ 76,503 $ 22,206 $ 26,767 $ (597) (17.4) % $ (2,825) $ (0.07)

CLARUS CORPORATION

RECONCILIATION FROM LOSS FROM CONTINUING OPERATIONS TO ADJUSTED (LOSS) INCOME FROM CONTINUING OPERATIONS AND

RELATED EARNINGS PER DILUTED SHARE

(In thousands, except per share amounts)

Three Months Ended September 30, 2023

Total Gross Operating Income tax Tax (Loss) income from Diluted

(benefit) expense rate continuing operations EPS (1)

(1) Potentially dilutive securities are excluded from the computation of diluted earnings (loss) per share if their effect is anti-dilutive to the loss from continuing operations. Reported loss from continuing operations per share is calculated based on 37,470 basic

and diluted weighted average shares of common stock. Adjusted income from continuing operations per share is calculated based on 37,871 diluted shares of common stock.

sales profit expenses

Three Months Ended December 31, 2023

Total Gross Operating Income tax Tax (Loss) income from Diluted

(benefit) expense rate continuing operations EPS (1)

(1) Potentially dilutive securities are excluded from the computation of diluted earnings (loss) per share if their effect is anti-dilutive to the loss from continuing operations. Reported loss from continuing operations per share and adjusted loss from continuing

operations per share are both calculated based on 38,312 basic and diluted weighted average shares of common stock.

sales profit expenses |

| 6 February 2023

Loss from continuing operations $ (2,031) $ (4,322) $ (2,206) $ (7,229)

Income tax (benefit) expense (334) (862) (1,395) (1,700)

Other, net (76) (226) 445 (1,104)

Interest expense, net (5) (8) (19) (35)

Operating loss (2,446) (5,418) (3,175) (10,068)

Depreciation 939 1,080 1,045 1,086

Amortization of intangibles 2,768 2,714 2,553 2,680

EBITDA 1,261 (1,624) 423 (6,302)

Restructuring charges - 736 1,076 1,411

Transaction costs 37 22 400 134

Contingent consideration expense (1,565) - - -

Inventory fair value of purchase accounting - - - 64

Stock-based compensation 1,285 1,486 1,152 1,218

Adjusted EBITDA $ 1,018 $ 620 $ 3,051 $ (3,475)

Sales $ 70,278 $ 57,937 $ 81,302 $ 76,503

EBITDA margin 1.8% -2.8% 0.5% -8.2%

Adjusted EBITDA margin 1.4% 1.1% 3.8% -4.5%

CLARUS CORPORATION

RECONCILIATION FROM LOSS FROM CONTINUING OPERATIONS TO EARNINGS BEFORE INTEREST, TAXES, DEPRECIATION, AND AMORTIZATION

(EBITDA), EBITDA MARGIN, ADJUSTED EBITDA, AND ADJUSTED EBITDA MARGIN

(In thousands)

March 31, 2023 June 30, 2023 September 30, 2023 December 31, 2023

Three Months Ended |

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

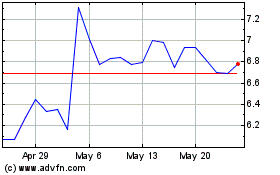

Clarus (NASDAQ:CLAR)

Historical Stock Chart

From Apr 2024 to May 2024

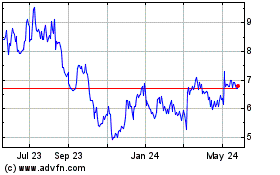

Clarus (NASDAQ:CLAR)

Historical Stock Chart

From May 2023 to May 2024