false

0000913277

0000913277

2024-02-29

2024-02-29

iso4217:USD

xbrli:shares

iso4217:USD

xbrli:shares

United States

Securities and Exchange Commission

Washington, D.C. 20549

Form 8-K

Current Report

Pursuant to Section 13 or 15(d) of the Securities

Exchange Act of 1934

Date of Report (Date of earliest event reported):

February 29, 2024

CLARUS

CORPORATION

(Exact name of registrant as specified in its

charter)

Delaware

(State or other jurisdiction

of incorporation) |

001-34767

(Commission File Number) |

58-1972600

(IRS Employer

Identification Number) |

2084

East 3900 South, Salt Lake City,

Utah

(Address of principal executive offices) |

84124

(Zip Code) |

Registrant’s telephone number, including

area code: (801) 278-5552

N/A

(Former name or former address, if changed since

last report.)

Check the appropriate box below if the Form 8-K

filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

| ¨ | Written

communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| ¨ | Soliciting

material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| ¨ | Pre-commencement

communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| ¨ | Pre-commencement

communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Indicate by check mark whether the registrant

is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the

Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

| |

¨ |

Emerging growth company |

If an emerging growth company, indicate by check

mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting

standards provided pursuant to Section 13(a) of the Exchange Act. ¨

Securities registered pursuant to Section 12(b) of the Act:

| Title

of each class |

|

Trading

Symbol |

|

Name

of each exchange on which

registered |

| Common

Stock, par value $.0001 per share |

|

CLAR |

|

NASDAQ

Global Select Market |

| Item

1.02 | Termination of a Material Definitive Agreement. |

Contemporaneous with the closing of the Sale

Transaction (hereinafter defined), Clarus Corporation (the “Company”) directed $135,013,124 of the proceeds from the closing

of the Sale Transaction to payoff any and all outstanding borrowings under that certain Amended and Restated Credit Agreement, dated

April 18, 2022, by and among the Company, Black Diamond Retail, Inc., Black Diamond Retail – Alaska, LLC, Sierra

Bullets, L.L.C. (“Sierra”), SKINourishment, LLC, Black Diamond Retail – Colorado, LLC, Black Diamond Retail –

Montana, LLC, Black Diamond Retail – Wyoming, LLC, Barnes Bullets-Mona, LLC (“Barnes”), Black Diamond Retail –

Oregon, LLC, Black Diamond Retail – Vermont, LLC (collectively with the Company, the “Borrowers”) and the other

loan parties party thereto (together with the Borrowers, each a “Loan Party”, and collectively, the “Loan Parties”)

and JPMorgan Chase Bank, N.A., as administrative agent (the “Administrative Agent”) and the lenders party thereto (the “Amended

and Restated Credit Agreement”). Accordingly, on February 29, 2024, all balances owing the lenders and the Administrative Agent

thereunder were paid off, and the Amended and Restated Credit Agreement was terminated, together with the Pledge and Security Agreement,

effective as of May 3, 2019, by and among the Company, Black Diamond Retail, Inc., Sierra, Everest Sapphire Acquisition, LLC (“Seller”),

BD European Holdings, LLC, SKINourishmnet, LLC, Black Diamond Retail – Alaska, LLC, the other grantors party thereto, and the Administrative

Agent (the “Pledge Agreement”), as well as any and all of the other loan documentation associated therewith (including but

not limited to the UCC-1 financing statements and the deeds of trust in respect of owned real property in Utah and Missouri evidencing

the liens in favor of the Administrative Agent and the lenders).

The full text of (a) the Amended

and Restated Credit Agreement was filed as Exhibit 10.1 to the Current Report on Form 8-K that was filed with the Securities

and Exchange Commission (the “Commission”) by the Company on April 21, 2022, and (b) the Pledge Agreement was filed as Exhibit

10.3 to the Company’s Quarterly Report on Form 10-Q, filed with the Commission on May 6, 2019.

| Item

2.01 | Completion

of Acquisition or Disposition of Assets. |

As previously announced, on December 29, 2023,

the Company and Seller, a wholly owned subsidiary of the Company, entered into a Purchase and Sale Agreement (the “Purchase Agreement”)

with Bullseye Acquisitions, LLC (the “Buyer”), an affiliate of JDH Capital Company, pursuant to which the Company and Seller

agreed to sell all of the equity associated with the Company’s Precision Sport segment, which is comprised of the Company’s

subsidiaries Sierra and Barnes to the Buyer for a purchase price of $175 million, subject to a customary working capital adjustment (the

“Sale Transaction”). The Sale Transaction was completed on February 29, 2024, and the Company has realized net proceeds of

approximately $37.9 million after payment of all outstanding amounts under the Amended and Restated Credit Agreement and certain other

fees and expenses.

The foregoing description

of the Purchase Agreement and the Sale Transaction does not purport to be a complete statement of the parties’ rights and obligations

under the Purchase Agreement and the transactions contemplated thereby or a complete explanation of the material terms thereof. The foregoing

description is subject to and qualified in its entirety by reference to the text of the Purchase Agreement, which was filed as Exhibit

2.1 to the Current Report on Form 8-K filed by the Company on January 3, 2024, and which is incorporated herein by reference.

The Purchase Agreement has been incorporated

by reference into this Current Report on Form 8-K only to provide investors with information regarding its terms and not to provide investors

with any other factual information regarding the Company, the Buyer, Sierra, Barnes, their affiliates, or its and their respective businesses

as of the date of the Purchase Agreement or as of any other date. The representations, warranties and covenants contained in the Purchase

Agreement were made only for purposes of that agreement and as of specific dates; were made solely for the benefit of the parties to

that agreement; may be subject to limitations agreed upon by the contracting parties, including being qualified by confidential disclosures;

may not have been intended to be statements of fact, but rather, as a method of allocating contractual risk and governing the contractual

rights and relationships between the parties to that agreement; and may be subject to standards of materiality applicable to contracting

parties that differ from those applicable to investors. Investors should not rely on the representations, warranties and covenants or

any descriptions thereof as characterizations of the actual state of facts or condition of the Seller, the Buyer, Sierra, Barnes or any

of their respective subsidiaries or affiliates and/or the Business. Moreover, information concerning the subject matter of the representations,

warranties and covenants may change after the date of the Purchase Agreement, which subsequent information may or may not be fully reflected

in the Company’s public disclosures.

The Company

previously disseminated a press release announcing the closing of the Sale Transaction and the termination of the Amended and Restated

Credit Agreement. The press release is attached to this Current Report on Form 8-K as Exhibit 99.1 and is incorporated herein by reference.

The information in Item 8.01 of this Report and the press release included as Exhibit 99.1 shall not be deemed “filed” for

purposes of Section 18 of the Securities Act of 1934, as amended, nor shall they be deemed incorporated by reference in any filing under

the Securities Act of 1933, as amended, except as shall be expressly set forth by specific reference in such filing.

| Item 9.01 | Financial

Statements and Exhibits. |

(b) Pro Forma Financial Information.

The unaudited interim pro forma condensed consolidated statement of

operations for the three months ended September 30, 2023, the unaudited pro forma condensed consolidated statement of operations for

the year ended December 31, 2022 and the unaudited interim pro forma condensed consolidated balance sheet as of September 30, 2023 of

the Company is hereby included as Exhibit 99.2 to this Report.

(d) Exhibits. The following exhibits are hereby filed as part of this

Report.

SIGNATURES

Pursuant to the requirements of the Securities

Exchange Act of 1934, as amended, the Company has duly caused this report to be signed on its behalf by the undersigned hereunto duly

authorized.

Dated: March 6, 2024

| |

CLARUS CORPORATION |

| |

|

| |

By: |

/s/ Michael J. Yates |

| |

Name: |

Michael J. Yates |

| |

Title: |

Chief Financial Officer |

Exhibit 99.1

Clarus Completes Sale of Precision Sport

Segment

to JDH Capital

Successful Outcome that Strengthens

Balance Sheet and Positions the Company as a Pure-Play Outdoor Business

SALT LAKE CITY, Utah – February

29, 2024 – Clarus Corporation (NASDAQ: CLAR) (“Clarus” and/or the “Company”), a global company focused

on the outdoor and consumer enthusiast markets, today announced that it has completed the sale of its Precision Sport segment, which is

comprised of Sierra Bullets, L.L.C. and Barnes Bullets – Mona, LLC, to Bullseye Acquisitions, LLC, an affiliate of JDH Capital Company.

The Company sold its Precision Sport

segment for approximately $175 million and used a portion of the proceeds to retire in full all of the Company’s outstanding debt

as of February 29, 2024. In connection with the repayment of the outstanding debt in full, the Amended and Restated Credit Agreement with

JPMorgan Chase Bank, N.A., as administrative agent, was terminated.

As previously announced, the Company

will hold a conference call on Thursday, March 7, 2024, at 5:00 pm ET to discuss its financial results for the fourth quarter and full

year ended December 31, 2023, and host an investor day on Monday, March 11 in New York City.

Kane Kessler, P.C. acted as legal advisor

to the Company in the transaction, Richards, Layton & Finger, P.A. acted as legal advisor to a special committee of independent directors

of the Company (the “Special Committee”) and Houlihan Lokey acted as financial advisor to the Special Committee.

2024 Investor Day

The upcoming investor day will feature

additional commentary on Clarus’ strategic initiatives and growth opportunities with presentations from management, including Warren

Kanders, Executive Chairman; Mike Yates, Chief Financial Officer; Neil Fiske, President, Black Diamond Equipment; and Mathew Hayward,

Managing Director of Clarus' Adventure segment; followed by Q&A sessions.

| · | Date: Monday, March 11, 2024 |

| · | Time: 12:00 pm to 2:00 pm ET |

Institutional investors and analysts

interested in attending the event should contact The IGB Group at Clarus@igbir.com. Virtual attendance registration and webcast details

will be available on the Company’s website. For those unable to attend the Investor Day, a replay will be made available after the

event.

About Clarus Corporation

Headquartered in Salt Lake City, Utah,

Clarus Corporation is a global leading designer, developer, manufacturer and distributor of best-in-class outdoor equipment and lifestyle

products focused on the outdoor and consumer enthusiast markets. Our mission is to identify, acquire and grow outdoor “super fan”

brands through our unique “innovate and accelerate” strategy. We define a “super fan” brand as a brand that creates

the world’s pre-eminent, performance-defining product that the best-in-class user cannot live without. Each of our brands has a

long history of continuous product innovation for core and everyday users alike. The Company’s products are principally sold globally

under the Black Diamond®, Rhino-Rack®, MAXTRAX®, TRED Outdoors® brand names through outdoor specialty and online retailers,

our own websites, distributors, and original equipment manufacturers. Our portfolio of iconic brands is well-positioned for sustainable,

long-term growth underpinned by powerful industry trends across the outdoor and adventure sport end markets. For additional information,

please visit www.claruscorp.com or the brand websites at www.blackdiamondequipment.com,

www.rhinorack.com, www.maxtrax.com.au, www.tredoutdoors.com,

or www.pieps.com.

Forward-Looking Statements

Please note that in this press release

we may use words such as “appears,” “anticipates,” “believes,” “plans,” “expects,”

“intends,” “future,” and similar expressions which constitute forward-looking statements within the meaning of

the safe harbor provisions of the Private Securities Litigation Reform Act of 1995. Forward-looking statements are made based on our expectations

and beliefs concerning future events impacting the Company and therefore involve a number of risks and uncertainties. We caution that

forward-looking statements are not guarantees and that actual results could differ materially from those expressed or implied in the forward-looking

statements. Any number of factors could cause actual results to differ materially from projections or forward-looking statements in this

press release, including, but not limited to, those risks and uncertainties more fully described from time to time in the Company's public

reports filed with the Securities and Exchange Commission, including under the section titled “Risk Factors” in the Company's

Annual Report on Form 10-K, and/or Quarterly Reports on Form 10-Q, as well as in the Company’s Current Reports on Form 8-K. All

forward-looking statements included in this press release are based upon information available to the Company as of the date of this press

release and speak only as of the date hereof. We assume no obligation to update any forward-looking statements to reflect events or circumstances

after the date of this press release.

Company Contacts:

Michael J. Yates

Chief Financial Officer

Tel 1-801-993-1304

mike.yates@claruscorp.com

Investor Relations Contact:

The IGB Group

Leon Berman / Matt Berkowitz

Tel 1-212-477-8438 / 1-212-227-7098

lberman@igbir.com / mberkowitz@igbir.com

Exhibit 99.2

UNAUDITED PRO FORMA CONDENSED CONSOLIDATED FINANCIAL

INFORMATION

The following unaudited pro forma condensed consolidated

balance sheet and statements of operations are based upon the historical consolidated financial statements of Clarus Corporation (the

“Company,” “Clarus,” “we,” or “our”). The unaudited pro forma condensed consolidated

financial information has been prepared to illustrate the effect of the sale (the “Precision Sport Disposition”) by Clarus

and Everest/Sapphire Acquisition, LLC (“Seller”), its wholly-owned subsidiary, of all of the equity associated with the Company’s

Precision Sport segment, which is comprised of the Company’s subsidiaries Sierra Bullets, L.L.C. and Barnes Bullets – Mona,

LLC, pursuant to a Purchase and Sale Agreement, dated as of December 29, 2023, by and among the Company and Seller, as the seller

parties, and Bullseye Acquisitions, LLC, an affiliate of JDH Capital Company, as purchaser. The Precision Sport segment is engaged in

the business of designing, developing, manufacturing, and marketing bullets and ammunition to the military, law enforcement, and commercial/consumer

markets. For a detailed description of the Precision Sport Disposition please see Note 1 of the accompanying unaudited pro forma condensed

consolidated financial information.

The unaudited pro forma condensed consolidated

balance sheet as of September 30, 2023 has been prepared by including the unaudited historical condensed consolidated balance sheet

of Clarus as of September 30, 2023, adjusted to reflect the pro forma effect as if the Precision Sport Disposition had been consummated

on that date. The interim unaudited pro forma condensed consolidated statement of operations for the nine months ended September 30,

2023 and the unaudited pro forma condensed consolidated statement of operations for the year ended December 31, 2022 have been prepared

by including the Company’s historical condensed consolidated statements of operations, adjusted to reflect the pro forma effect

as if the Precision Sport Disposition had been consummated on January 1, 2022.

The

historical consolidated financial statements referred to above for Clarus were included in its Quarterly Report on Form 10-Q for

the nine months ended September 30, 2023 (unaudited) and Annual Report on Form 10-K for the year ended December 31,

2022, each previously filed with the Securities and Exchange Commission (the “SEC”). The accompanying unaudited pro

forma condensed consolidated financial information and the historical consolidated financial information presented herein should be read

in conjunction with the historical consolidated financial statements and notes thereto of Clarus.

The unaudited pro forma condensed consolidated

balance sheet and statements of operations include pro forma adjustments which reflect transactions and events that (a) are directly

attributable to the Precision Sport Disposition, (b) are factually supportable, and (c) with respect to the statements of operations,

have a continuing impact on consolidated results of operations. The pro forma adjustments are described in the accompanying notes to the

unaudited pro forma condensed consolidated financial information.

The unaudited pro forma condensed consolidated

financial information was prepared for information purposes only and is not necessarily indicative of the financial position or results

of operations that would have occurred if the Precision Sport Disposition had been completed on the dates indicated, nor is it indicative

of the future financial position or results of operations of the Company. Assumptions and estimates underlying the pro forma

adjustments are described in the accompanying notes, which should be read in conjunction with the unaudited pro forma condensed consolidated

financial information. The accounting for the Precision Sport Disposition is dependent upon final balances related to the assets and liabilities

at the closing date that have yet to progress to a stage where there is sufficient information for a definitive measurement. Due to the

fact that the unaudited pro forma condensed consolidated financial information has been prepared based upon preliminary estimates, and

account balances other than those on the actual Precision Sport Disposition closing date, the final amounts recorded for the Precision

Sport Disposition may differ materially from the pro forma condensed consolidated financial information presented.

The unaudited pro forma condensed consolidated

financial information does not reflect future events that may occur after the Precision Sport Disposition, including potential restructuring

and related general and administrative cost savings. The pro forma adjustments are subject to change and are based upon currently available

information.

CLARUS CORPORATION

UNAUDITED PRO FORMA CONDENSED

CONSOLIDATED BALANCE SHEET

AS OF SEPTEMBER 30, 2023

(IN THOUSANDS, EXCEPT

PER SHARE AMOUNTS)

| | |

Historical | | |

Pro Forma Adjustments | | |

| | |

Pro Forma | |

| Assets | |

| | | |

| | | |

| | | |

| | |

| Current assets | |

| | | |

| | | |

| | | |

| | |

| Cash | |

$ | 8,024 | | |

$ | 48,112 | | |

| A | | |

$ | 56,136 | |

| Accounts receivable, net | |

| 72,601 | | |

| (12,418 | ) | |

| B | | |

| 60,183 | |

| Inventories | |

| 140,460 | | |

| (44,943 | ) | |

| B | | |

| 95,517 | |

| Prepaid and other current assets | |

| 7,155 | | |

| (1,866 | ) | |

| B | | |

| 5,289 | |

| Income tax receivable | |

| 2,444 | | |

| (324 | ) | |

| C | | |

| 2,120 | |

| Total current assets | |

| 230,684 | | |

| (11,439 | ) | |

| | | |

| 219,245 | |

| | |

| | | |

| | | |

| | | |

| | |

| Property and equipment, net | |

| 41,131 | | |

| (24,682 | ) | |

| B | | |

| 16,449 | |

| Other intangible assets, net | |

| 44,305 | | |

| (5,434 | ) | |

| B | | |

| 38,871 | |

| Indefinite lived intangible assets | |

| 80,936 | | |

| (24,500 | ) | |

| B | | |

| 56,436 | |

| Goodwill | |

| 61,895 | | |

| (26,715 | ) | |

| B | | |

| 35,180 | |

| Deferred income taxes | |

| 20,333 | | |

| (11,169 | ) | |

| C | | |

| 9,164 | |

| Other long-term assets | |

| 17,942 | | |

| (15 | ) | |

| B | | |

| 17,927 | |

| Total assets | |

$ | 497,226 | | |

$ | (103,954 | ) | |

| | | |

$ | 393,272 | |

| | |

| | | |

| | | |

| | | |

| | |

| Liabilities and Stockholders' Equity | |

| | | |

| | | |

| | | |

| | |

| Current liabilities | |

| | | |

| | | |

| | | |

| | |

| Accounts payable | |

$ | 28,864 | | |

$ | (2,491 | ) | |

| B | | |

$ | 26,373 | |

| Accrued liabilities | |

| 22,435 | | |

| (3,049 | ) | |

| B | | |

| 19,386 | |

| Current portion of long-term debt | |

| 12,566 | | |

| (12,500 | ) | |

| A | | |

| 66 | |

| Total current liabilities | |

| 63,865 | | |

| (18,040 | ) | |

| | | |

| 45,825 | |

| | |

| | | |

| | | |

| | | |

| | |

| Long-term debt | |

| 110,077 | | |

| (110,077 | ) | |

| A | | |

| - | |

| Deferred income taxes | |

| 17,534 | | |

| - | | |

| | | |

| 17,534 | |

| Other long-term liabilities | |

| 14,480 | | |

| - | | |

| | | |

| 14,480 | |

| Total liabilities | |

| 205,956 | | |

| (128,117 | ) | |

| | | |

| 77,839 | |

| | |

| | | |

| | | |

| | | |

| | |

| Stockholders' Equity | |

| | | |

| | | |

| | | |

| | |

| Preferred stock, $.0001 par value; 5,000 shares authorized; none

issued | |

| - | | |

| - | | |

| | | |

| - | |

| Common stock, $.0001 par value; 100,000 shares authorized; 42,582

and 41,637 issued and 37,970 and 37,048 outstanding, respectively | |

| 4 | | |

| - | | |

| | | |

| 4 | |

| Additional paid in capital | |

| 688,878 | | |

| - | | |

| | | |

| 688,878 | |

| Accumulated deficit | |

| (341,396 | ) | |

| 24,163 | | |

| D | | |

| (317,233 | ) |

| Treasury stock, at cost | |

| (32,929 | ) | |

| - | | |

| | | |

| (32,929 | ) |

| Accumulated other comprehensive loss | |

| (23,287 | ) | |

| - | | |

| | | |

| (23,287 | ) |

| Total stockholders' equity | |

| 291,270 | | |

| 24,163 | | |

| | | |

| 315,433 | |

| Total liabilities and stockholders' equity | |

$ | 497,226 | | |

$ | (103,954 | ) | |

| | | |

$ | 393,272 | |

See notes to unaudited pro forma condensed consolidated financial

information.

CLARUS CORPORATION

UNAUDITED PRO FORMA CONDENSED

CONSOLIDATED STATEMENT OF OPERATIONS

FOR THE YEAR ENDED DECEMBER

31, 2022

(IN THOUSANDS, EXCEPT

PER SHARE AMOUNTS)

| | |

Historical | | |

Pro Forma Adjustments | | |

| | |

Pro Forma | |

| Sales | |

| | | |

| | | |

| | | |

| | |

| Domestic sales | |

$ | 238,144 | | |

$ | (105,326 | ) | |

| E | | |

$ | 132,818 | |

| International sales | |

| 209,962 | | |

| (27,529 | ) | |

| E | | |

| 182,433 | |

| Total sales | |

| 448,106 | | |

| (132,855 | ) | |

| | | |

| 315,251 | |

| | |

| | | |

| | | |

| | | |

| | |

| Cost of goods sold | |

| 284,690 | | |

| (79,392 | ) | |

| E | | |

| 205,298 | |

| Gross profit | |

| 163,416 | | |

| (53,463 | ) | |

| | | |

| 109,953 | |

| | |

| | | |

| | | |

| | | |

| | |

| Operating expenses | |

| | | |

| | | |

| | | |

| | |

| Selling, general and administrative | |

| 135,039 | | |

| (14,225 | ) | |

| E | | |

| 120,814 | |

| Transaction costs | |

| 2,967 | | |

| (149 | ) | |

| F | | |

| 2,818 | |

| Contingent consideration expense | |

| 493 | | |

| - | | |

| | | |

| 493 | |

| Impairment of goodwill and indefinite-lived intangible assets | |

| 92,311 | | |

| - | | |

| | | |

| 92,311 | |

| | |

| | | |

| | | |

| | | |

| | |

| Total operating expenses | |

| 230,810 | | |

| (14,374 | ) | |

| | | |

| 216,436 | |

| | |

| | | |

| | | |

| | | |

| | |

| Operating loss | |

| (67,394 | ) | |

| (39,089 | ) | |

| | | |

| (106,483 | ) |

| | |

| | | |

| | | |

| | | |

| | |

| Other expense | |

| | | |

| | | |

| | | |

| | |

| Interest expense, net | |

| (7,895 | ) | |

| 7,895 | | |

| A | | |

| - | |

| Other, net | |

| (1,842 | ) | |

| 807 | | |

| E | | |

| (1,035 | ) |

| | |

| | | |

| | | |

| | | |

| | |

| Total other expense, net | |

| (9,737 | ) | |

| 8,702 | | |

| | | |

| (1,035 | ) |

| | |

| | | |

| | | |

| | | |

| | |

| Loss before income tax | |

| (77,131 | ) | |

| (30,387 | ) | |

| | | |

| (107,518 | ) |

| Income tax benefit | |

| (7,351 | ) | |

| (7,365 | ) | |

| G | | |

| (14,716 | ) |

| Loss from continuing operations | |

$ | (69,780 | ) | |

$ | (23,022 | ) | |

| | | |

$ | (92,802 | ) |

| | |

| | | |

| | | |

| | | |

| | |

| Loss from continuing operations per share: | |

| | | |

| | | |

| | | |

| | |

| Basic | |

$ | (1.88 | ) | |

| | | |

| | | |

$ | (2.49 | ) |

| Diluted | |

| (1.88 | ) | |

| | | |

| | | |

| (2.49 | ) |

| | |

| | | |

| | | |

| | | |

| | |

| Weighted average shares outstanding: | |

| | | |

| | | |

| | | |

| | |

| Basic | |

| 37,201 | | |

| | | |

| | | |

| 37,201 | |

| Diluted | |

| 37,201 | | |

| | | |

| | | |

| 37,201 | |

See notes to unaudited pro forma condensed consolidated financial

information.

CLARUS CORPORATION

UNAUDITED PRO FORMA CONDENSED

CONSOLIDATED STATEMENT OF OPERATIONS

FOR THE NINE MONTHS ENDED

SEPTEMBER 30, 2023

(IN THOUSANDS, EXCEPT

PER SHARE AMOUNTS)

| | |

Historical | | |

Pro Forma Adjustments | | |

| | |

Pro Forma | |

| Sales | |

| | | |

| | | |

| | | |

| | |

| Domestic sales | |

$ | 135,724 | | |

$ | (55,179 | ) | |

| E | | |

$ | 80,545 | |

| International sales | |

| 145,463 | | |

| (16,491 | ) | |

| E | | |

| 128,972 | |

| Total sales | |

| 281,187 | | |

| (71,670 | ) | |

| | | |

| 209,517 | |

| | |

| | | |

| | | |

| | | |

| | |

| Cost of goods sold | |

| 178,864 | | |

| (44,716 | ) | |

| E | | |

| 134,148 | |

| Gross profit | |

| 102,323 | | |

| (26,954 | ) | |

| | | |

| 75,369 | |

| | |

| | | |

| | | |

| | | |

| | |

| Operating expenses | |

| | | |

| | | |

| | | |

| | |

| Selling, general and administrative | |

| 94,809 | | |

| (9,107 | ) | |

| E | | |

| 85,702 | |

| Restructuring charge | |

| 1,835 | | |

| (23 | ) | |

| F | | |

| 1,812 | |

| Transaction costs | |

| 975 | | |

| (516 | ) | |

| F | | |

| 459 | |

| Contingent consideration benefit | |

| (1,565 | ) | |

| - | | |

| | | |

| (1,565 | ) |

| | |

| | | |

| | | |

| | | |

| | |

| Total operating expenses | |

| 96,054 | | |

| (9,646 | ) | |

| | | |

| 86,408 | |

| | |

| | | |

| | | |

| | | |

| | |

| Operating loss | |

| 6,269 | | |

| (17,308 | ) | |

| | | |

| (11,039 | ) |

| | |

| | | |

| | | |

| | | |

| | |

| Other expense | |

| | | |

| | | |

| | | |

| | |

| Interest expense, net | |

| (8,445 | ) | |

| 8,477 | | |

| A | | |

| 32 | |

| Other, net | |

| (134 | ) | |

| (9 | ) | |

| E | | |

| (143 | ) |

| | |

| | | |

| | | |

| | | |

| | |

| Total other expense, net | |

| (8,579 | ) | |

| 8,468 | | |

| | | |

| (111 | ) |

| | |

| | | |

| | | |

| | | |

| | |

| Loss before income tax | |

| (2,310 | ) | |

| (8,840 | ) | |

| | | |

| (11,150 | ) |

| Income tax benefit | |

| (553 | ) | |

| (2,038 | ) | |

| G | | |

| (2,591 | ) |

| Loss from continuing operations | |

| (1,757 | ) | |

| (6,802 | ) | |

| | | |

| (8,559 | ) |

| | |

| | | |

| | | |

| | | |

| | |

| Loss from continuing operations per share: | |

| | | |

| | | |

| | | |

| | |

| Basic | |

$ | (0.05 | ) | |

| | | |

| | | |

$ | (0.23 | ) |

| Diluted | |

| (0.05 | ) | |

| | | |

| | | |

| (0.23 | ) |

| | |

| | | |

| | | |

| | | |

| | |

| Weighted average shares outstanding: | |

| | | |

| | | |

| | | |

| | |

| Basic | |

| 37,267 | | |

| | | |

| | | |

| 37,267 | |

| Diluted | |

| 37,267 | | |

| | | |

| | | |

| 37,267 | |

See notes to unaudited pro forma condensed consolidated financial

information.

Clarus Corporation

Notes to Unaudited Pro Forma Condensed Consolidated

Financial Information

(In thousands, except per share amounts)

1 Description

of Transaction

On February 29, 2024, Clarus Corporation

(the “Company,” “Clarus,” “we,” or “our”) and Everest/Sapphire Acquisition, LLC, its wholly-owned

subsidiary, completed the sale (“Precision Sport Disposition”) to Bullseye Acquisitions, LLC (the “Buyer”), an

affiliate of JDH Capital Company, of all of the equity associated with the Company’s Precision Sport segment, which is comprised

of the Company’s subsidiaries Sierra Bullets, L.L.C. and Barnes Bullets – Mona, LLC, pursuant to a Purchase and Sale Agreement

dated as of December 29, 2023, by and among Bullseye Acquisitions, LLC, as buyer, and Everest/Sapphire Acquisition, LLC and the Company,

as the seller parties (the “Precision Sport Purchase Agreement”). The Precision Sport segment is engaged in the business of

designing, developing, manufacturing, and marketing bullets and ammunition to the military, law enforcement, and commercial/consumer markets.

Under the terms of the Precision Sport Purchase Agreement, the Buyer paid $175,000 in cash (before purchase price adjustments of $742

relating to estimated net working capital) for the Precision Sport Disposition.

2 Basis

of Presentation

The unaudited pro forma condensed consolidated

balance sheet and statements of operations are based upon the historical consolidated financial statements of Clarus, which were included

in its Annual Report on Form 10-K for the fiscal year ended December 31, 2022, and its Quarterly Report on Form 10-Q for

the nine months ended September 30, 2023, each previously filed with the Securities and Exchange Commission. The unaudited pro forma

condensed consolidated balance sheet as of September 30, 2023 has been prepared by including the unaudited historical condensed consolidated

balance sheet of Clarus as of September 30, 2023, adjusted to reflect the pro forma effect as if the Precision Sport Disposition

had been consummated on that date. The interim unaudited pro forma condensed consolidated statement of operations for the nine months

ended September 30, 2023 and the unaudited pro forma condensed consolidated statement of operations for the year ended December 31,

2022 have been prepared by including the Company’s historical condensed consolidated statements of operations, adjusted to reflect

the pro forma effect as if the Precision Sport Disposition had been consummated on January 1, 2022.

3 Pro

Forma Adjustments

The pro forma adjustments reflect transactions

and events that (a) are directly attributable to the Precision Sport Disposition, (b) are factually supportable, and (c) with

respect to the statements of operations, have a continuing impact on consolidated results of operations. The pro forma adjustments are

based on available information and certain assumptions the Company believes are reasonable.

The following pro forma adjustments

are included in the unaudited pro forma condensed consolidated balance sheet and/or the unaudited pro forma condensed consolidated statements

of operations:

| A | Reflects cash proceeds of the $175,000 sale price (before purchase price adjustments of $742 relating

to estimated net working capital). This is offset by estimated direct transaction expenses of $4,959, cash held by the Precision Sport

segment of $94, and the repayment of the Company’s revolving credit facility and the term loan with JPMorgan Chase Bank, N.A., as

administrative agent, totaling $122,577. The effect of the payment on the revolving credit facility and the term loan is a decrease in

interest expense of $7,895 and $8,477 for the year ended December 31, 2022 and the nine months ended September 30, 2023, respectively. |

| B | Reflects the elimination of assets and liabilities included in the Precision Sport Disposition. |

| C | Reflects the related income tax impacts created by the Precision Sport Disposition. |

| D | Reflects the effect on accumulated deficit related to the estimated gain on sale and related tax impacts

attributable to the Company due to the Precision Sport Disposition. |

| E | Reflects the elimination of the Precision Sport segment’s historical revenues and expenses. |

Clarus Corporation

Notes to Unaudited Pro Forma Condensed Consolidated

Financial Information

(In thousands, except per share amounts)

| F | Total Precision Sport segment related transaction costs of $149 and $516 for the year ended December 31,

2022 and the nine months ended September 30, 2023, respectively, have been removed from the interim unaudited pro forma condensed

consolidated statement of operations as they reflect non-recurring charges directly related to the Precision Sport Disposition. Similarly,

restructuring costs incurred at the Precision Sport segment of $23 during the nine months ended September 30, 2023 have been removed. |

| G | The income tax effect resulting from the pro forma effect of the Precision Sport Disposition based on

the statutory tax rates in effect. |

4 Gain

on Sale

The gain on the Precision Sport Disposition,

as if the transaction had been completed on September 30, 2023, is estimated at $49,976 with a related tax expense of $11,493. The

gain on sale is not considered in the pro forma condensed consolidated statements of operations as it is a nonrecurring credit. The actual

amount of the gain will be based on the balances as of the closing date and may differ materially from the pro forma gain amount.

v3.24.0.1

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

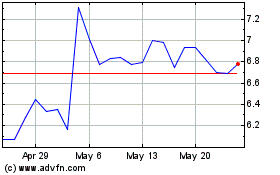

Clarus (NASDAQ:CLAR)

Historical Stock Chart

From Apr 2024 to May 2024

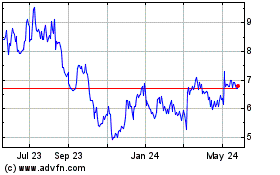

Clarus (NASDAQ:CLAR)

Historical Stock Chart

From May 2023 to May 2024