Filed by ClimateRock

Holdings Limited

Pursuant to Rule 425 under

the Securities Act of 1933, and

deemed filed pursuant to

Rule 14a-12 under the

Securities Exchange Act

of 1934

Subject Companies:

ClimateRock

(Commission

File No. 001-41363)

EEW

Eco Energy World PLC Announces Proposed NASDAQ Listing at a $650 Million Equity Value

Independent Global Developer of Solar Power

Projects to list via SPAC Combination

Svante Kumlin, Chief Executive and Founder

of EEW, said:

“Our mission is to support the world’s

journey to a net-zero future by driving the development of solar power. Solar power is now the cheapest form of electricity generation

and is forecast for a period of unprecedented growth driven by the global energy transition. Having successfully developed approximately

1.5 GW of solar power capacity and sold 21 utility-scale solar projects, we believe EEW is a strong player in this field.

“EEW expects to sell approximately a

further 2.0 GW over the next three years; this transaction will allow us to expand our project development pipeline and enter new growth

markets to enable EEW to benefit from the opportunity represented by forecast growth rates for solar power capacity expected to be up

to 42% of the total energy market by 2050. For EEW and solar power, we believe the future really is very bright.”

United Kingdom, October 7, 2022 –

EEW Eco Energy World PLC (“EEW” or “Company”),

an independent global developer of utility scale solar photovoltaic (PV) projects, announces that it plans to list on Nasdaq via a business

combination agreement with ClimateRock (the “Business Combination”). Upon the closing of the Business Combination, a newly

formed holding company will own ClimateRock and EEW (“Pubco”). EEW will continue to be led by Svante Kumlin, the founder and

chief executive officer, who has more than 14 years’ experience in the industry.

EEW develops utility-scale solar power projects

around the world for the generation of clean and renewable energy, having developed approximately 1.5 GW across mainland Europe, the UK

and Australia to date. EEW’s experienced and diverse team combines technical skills with a rigorous commercial mind-set, borne of

more than a decade in the industry. This blend of skills and experience enables EEW to drive value in the early stages of solar power

development, and ultimately for EEW’s customers.

EEW is focused on the non-subsidised solar PV

energy market and develops projects until they are at or near Ready to Build (“RTB”) status, at which point it seeks buyers

for the project through its established network which includes financial investors, infrastructure funds, private equity firms, large

utility players and oil and gas companies.

There is an unprecedented growth in demand for

solar projects forecast, with strong market drivers underpinned by the global energy transition. Solar power is now the cheapest utility-scale

energy source in the world and solar PV installations are expected to increase 6-fold by 2030, from 2018 levels.

About Eco Energy World

EEW is an independent global developer of utility

scale solar photovoltaic projects from greenfield to ready-to-build stage, with a recognized track record, with founders and management

who have been operating in the industry since 2008. EEW has developed projects with a capacity of approximately 1.5 GW, which it has deployed

for major institutional investors across Europe, the UK and Australia. EEW has significant experience in delivering successful turnkey

developments globally including green field development, technical design, construction, permitting, power purchase agreements and structured

financing.

EEW has a strong pipeline of new opportunities

to take advantage of the next wave of global subsidy-free renewable energy development including solar and hydrogen. Headquartered in

London, EEW has assets under development in the UK, Spain, Sweden, Australia and Italy. For further information, please visit www.eew.solar.

Forward-Looking Statements

This press release contains certain forward-looking

statements within the meaning of the federal securities laws with respect to the proposed Business Combination between EEW and ClimateRock

and Pubco, including statements regarding the benefits of the Business Combination, the anticipated timing of the completion of the Business

Combination, the services offered by EEW and the markets in which it operates, the expected total addressable market for the services

offered by EEW, the sufficiency of the net proceeds of the proposed Business Combination to fund EEW’s operations and business plan

and EEW’s projected future results. These forward-looking statements generally are identified by the words “believe,”

“project,” “expect,” “anticipate,” “estimate,” “intend,” “strategy,”

“future,” “opportunity,” “plan,” “may,” “should,” “will,” “would,”

“will be,” “will continue,” “will likely result,” and similar expressions. Forward-looking statements

are predictions, projections and other statements about future events that are based on current expectations and assumptions and, as a

result, are subject to risks and uncertainties. Many factors could cause actual future events to differ materially from the forward-looking

statements in this document, including, but not limited to: (i) the risk that the Business Combination may not be completed in a timely

manner or at all; (ii) the risk that the Business Combination may not be completed by ClimateRock’s business combination deadline

and the potential failure to obtain an extension of the business combination deadline if sought by ClimateRock; (iii) the failure to satisfy

the conditions to the consummation of the Business Combination, including the adoption of the business combination agreement by the shareholders

of ClimateRock, the satisfaction of the minimum trust account amount following redemptions by ClimateRock’s public shareholders,

retaining a minimum amount of available cash and the receipt of certain governmental and regulatory approvals; (iv) the occurrence of

any event, change or other circumstance that could give rise to the termination of the business combination agreement; (v) the effect

of the announcement or pendency of the Business Combination on EEW’s business relationships, performance, and business generally;

(vi) risks that the Business Combination disrupts current plans and operations of EEW as a result; (vii) the outcome of any legal proceedings

that may be instituted against EEW, ClimateRock, Pubco or others related to the business combination agreement or the Business Combination;

(viii) the ability of Pubco to meet Nasdaq Stock Exchange listing standards at or following the consummation of the Business Combination;

(ix) the ability to recognize the anticipated benefits of Business Combination, which may be affected by a variety of factors, including

changes in the competitive and highly regulated industries in which EEW (and following the Business Combination, Pubco) operates, variations

in performance across competitors and partners, changes in laws and regulations affecting EEW’s business and the ability of EEW

and the post-combination company to retain its management and key employees; (x) the ability to implement business plans, forecasts, and

other expectations after the completion of the Business Combination; (xi) the risk that EEW (and following the Business Combination, Pubco)

will need to raise additional capital to execute its business plan, which may not be available on acceptable terms or at all; (xii) the

risk that Pubco experiences difficulties in managing its growth and expanding operations; (xiii) the risk of cyber security or foreign

exchange losses; (xiv) the effects of COVID-19 or other public health crises on the business and results of operations of EEW (and following

the Business Combination, Pubco) and the global economy generally; and (xv) costs related to the Business Combination. The foregoing list

of factors is not exhaustive. You should carefully consider the foregoing factors and the other risks and uncertainties described in the

“Risk Factors” section of ClimateRock’s Quarterly Reports on Form 10-Q, the registration statement on Form F-4 and proxy

statement/prospectus that will be filed by Pubco, and other documents filed by ClimateRock and Pubco from time to time with the SEC. These

filings identify and address other important risks and uncertainties that could cause actual events and results to differ materially from

those contained in the forward-looking statements. Forward-looking statements speak only as of the date they are made. Readers are cautioned

not to put undue reliance on forward-looking statements, and EEW and ClimateRock assume no obligation and do not intend to update or revise

these forward-looking statements, whether as a result of new information, future events, or otherwise. Neither EEW nor ClimateRock gives

any assurance that either EEW or ClimateRock will achieve its expectations.

Additional Information and Where to Find It

This press release relates to the Business Combination,

but does not contain all the information that should be considered concerning the Business Combination and is not intended to form the

basis of any investment decision or any other decision in respect of the transaction. Pubco intends to file with the SEC a registration

statement on Form F-4 relating to the transaction that will include a proxy statement of ClimateRock and a prospectus of Pubco. When available,

the definitive proxy statement/prospectus and other relevant materials will be sent to all ClimateRock shareholders as of a record date

to be established for voting on the Business Combination. ClimateRock and Pubco also will file other documents regarding the Business

Combination with the SEC. Before making any voting decision, investors and securities holders of ClimateRock are urged to read the registration

statement, the proxy statement/prospectus and all other relevant documents filed or that will be filed with the SEC in connection with

the Business Combination as they become available because they will contain important information about ClimateRock, EEW and the Business

Combination.

Investors and securities holders will be able

to obtain free copies of the proxy statement/prospectus and all other relevant documents filed or that will be filed with the SEC by ClimateRock

and Pubco through the website maintained by the SEC at www.sec.gov. In addition, the documents filed by ClimateRock and Pubco may be obtained

free of charge from ClimateRock’s website at https://www.climate-rock.com/or by contacting its Chief Financial Officer, Abhishek

Bawa, c/o ClimateRock, 50 Sloane Avenue, London, SW3 3DD, United Kingdom, at +44 203 954 0590 or at info@climate-rock.com.

Participants in the Solicitation

ClimateRock, the Pubco and EEW and their respective

directors and officers may be deemed to be participants in the solicitation of proxies from ClimateRock’s shareholders in connection

with the Business Combination. Information about ClimateRock’s directors and executive officers and their ownership of ClimateRock’s

securities is set forth in ClimateRock’s filings with the SEC, including ClimateRock’s final prospectus in connection with

its initial public offering, which was filed with the SEC on April 29, 2022. To the extent that such persons’ holdings of ClimateRock’s

securities have changed since the amounts disclosed in ClimateRock’s final prospectus in connection with its initial public offering,

such changes have been or will be reflected on Statements of Change in Ownership on Form 4 filed with the SEC. Additional information

regarding the names and interests in the Business Combination of ClimateRock’s and EEW’s respective directors and officers

and other persons who may be deemed participants in the Business Combination may be obtained by reading the proxy statement/prospectus

regarding the Business Combination when it becomes available. You may obtain free copies of these documents as described in the preceding

paragraph.

No Offer or Solicitation

This press release is not a proxy statement or

solicitation of a proxy, consent or authorization with respect to any securities or in respect of the transaction and shall not constitute

an offer to sell or a solicitation of an offer to buy the securities of ClimateRock, Pubco or EEW, nor shall there be any sale of any

such securities in any state or jurisdiction in which such offer, solicitation, or sale would be unlawful prior to registration or qualification

under the securities laws of such state or jurisdiction. No offer of securities shall be made except by means of a prospectus meeting

the requirements of Section 10 of the Securities Act of 1933, as amended, or exemptions therefrom.

Enquiries

| E.E.W. Eco Energy World PLC |

|

Via FTI Consulting |

| Svante Kumlin, Chief Executive Officer |

|

|

| Kaveh Ertefai, Chief Financial Officer |

|

|

| Reza Ghanei, Chief Commercial Officer |

|

|

| |

|

|

| FTI Consulting LLP (PR Advisors) |

|

+44 (0) 203 727 1000 |

| Ben Brewerton / Dhruv Soni / Kelly Smith |

|

eew@fticonsulting.com |

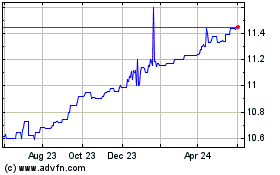

ClimateRock (NASDAQ:CLRC)

Historical Stock Chart

From Dec 2024 to Jan 2025

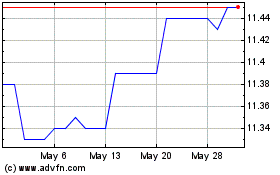

ClimateRock (NASDAQ:CLRC)

Historical Stock Chart

From Jan 2024 to Jan 2025