Yellen Says Rate Increase Possible in December

05 November 2015 - 4:10AM

Dow Jones News

WASHINGTON—Federal Reserve Chairwoman Janet Yellen said the U.S.

central bank may raise short-term interest rates at its

mid-December meeting, but emphasized no decision has yet been

made.

The Fed expects "the economy will continue to grow at a pace

that's sufficient to generate further improvements in the labor

market and to return inflation to our 2% target over the medium

term, and if the incoming information supports that expectation,

then our statement indicates that December would be a live

possibility," Ms. Yellen said Wednesday while testifying before the

House Financial Services Committee. "But importantly, we've made no

decision about it."

The Fed has kept its benchmark short-term interest rate, the

federal-funds rate, pinned near zero since December 2008. Ms.

Yellen said in late September that she and most other policy makers

"anticipate that it will likely be appropriate to raise the target

range for the federal-funds rate sometime later this year and to

continue boosting short-term rates at a gradual pace thereafter as

the labor market improves further and inflation moves back to our

2% objective."

Ms. Yellen said Wednesday that "moving in a timely fashion, if

the data and the outlook justify such a move, is a prudent thing to

do because we will be able to move at a more gradual and measured

pace. We fully expect that the economy will evolve in such a way

that we can move at a very gradual pace, and of course, after we do

so, we will be watching very carefully whether our expectations are

realized."

Referring to recent remarks by Fed governor Lael Brainard on the

subdued state of U.S. inflation, Ms. Yellen told lawmakers that "if

we were to move, say in December, it would be based on an

expectation -- which I believe is justified -- that with an

improving labor market and transitory factors fading, that

inflation will move up to 2%. But of course if we were to move, we

would need to verify over time that expectation was being realized,

and if not, adjust policy appropriately."

The Fed's policy-setting committee decided to hold rates near

zero at a closely watched meeting in mid-September but signaled in

its late October policy statement that a rate increase was possible

"at its next meeting" on Dec. 15-16.

CME Group said Tuesday, ahead of Ms. Yellen's testimony, that

fed-funds futures suggested a 52% probability of a rate increase in

December.

Other top Fed officials may add to Ms. Yellen's comments later

Wednesday. Federal Reserve Bank of New York President William

Dudley is set to speak Wednesday afternoon at a press briefing in

New York, and Fed Vice Chairman Stanley Fischer will deliver a

speech Wednesday evening at the Canadian embassy in Washington.

Write to Ben Leubsdorf at ben.leubsdorf@wsj.com

Subscribe to WSJ: http://online.wsj.com?mod=djnwires

(END) Dow Jones Newswires

November 04, 2015 11:55 ET (16:55 GMT)

Copyright (c) 2015 Dow Jones & Company, Inc.

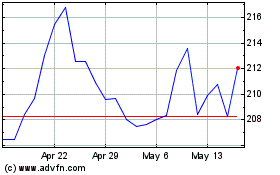

CME (NASDAQ:CME)

Historical Stock Chart

From Jun 2024 to Jul 2024

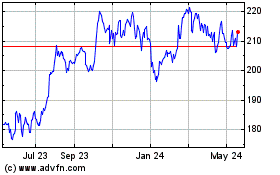

CME (NASDAQ:CME)

Historical Stock Chart

From Jul 2023 to Jul 2024