NYSE Owner ICE, CME Group Mull Bids for LSE -- 4th Update

02 March 2016 - 1:22AM

Dow Jones News

By Ian Walker and Eyk Henning

Intercontinental Exchange Inc. and CME Group Inc. are

considering bids for London Stock Exchange Group PLC, potentially

gate-crashing the British company's proposed $28 billion merger

with Deutsche Börse AG.

ICE, the owner of the New York Stock Exchange, said in a

statement Tuesday it was mulling a bid for the LSE, but had yet to

make a decision and hadn't made any approach to the British

company.

CME, the operator of the Chicago Mercantile Exchange, is also

considering an approach for LSE, according to a person familiar

with the matter.

The news comes a week after the LSE said it was in advanced

talks with Deutsche Börse about a so-called merger of equals that

would value the combined company at about $28 billion based on

their closing stock prices the day before the announcement.

A bid from either ICE or CME would be one way to stop the

formation of a leading European exchange that could pose a

formidable threat to the two leading U.S. exchanges.

Deutsche Börse and LSE alone aren't big or diverse enough to

truly challenge their U.S. rivals. But together, they could control

not just stock markets but derivative markets as well, which

include instruments such as futures and options that command higher

margins and are harder for rivals to replicate. A deal would give

LSE a large derivatives trading business, while Deutsche Börse

would gain a leading cash market and post-trading business from its

U.K. counterpart.

Shares in the LSE rose more than 7% in response to a potential

bidding war for the company. Deutsche Börse traded 0.4% higher.

The biggest challenge facing ICE or CME, say analysts, is the

regulatory environment. CME and ICE, the largest and second-largest

exchanges in the world by revenue, could be thwarted by regulators

if they attempted to take over the fourth largest exchange by

revenue, LSE, according to Burton-Taylor International Consulting

LLC.

"Any participant entering the game can anticipate substantial

scrutiny and attention from authorities," said Steve Woodyatt,

chief executive of Object Trading, a market-access provider.

The exchange industry has a history of failed attempts at

consolidation. Deals were struck over and over, only to unravel due

to shareholder resistance or antitrust concerns. LSE and Deutsche

Börse, for example, have been in on-again off-again talks since at

least 2000. Deutsche Börse also held talks with Euronext, which was

ultimately bought by the New York Stock Exchange. When NYSE

Euronext then tried to do a deal with Deutsche Börse, regulators

shot it down over fear of creating a monopoly.

In addition to Deutsche Börse, other bidders for LSE included OM

Gruppen in 2000, Macquarie Bank Ltd. in 2005, Nasdaq Inc. in 2006

and Canadian exchange operator TMX Group in 2011.

LSE said it noted ICE's announcement and confirmed it hasn't

received any proposal from the company, adding that talks with

Deutsche Börse continue to progress. Deutsche Börse also said it

noted ICE's statement and would closely monitor future

developments, while talks with LSE continue.

While CME hasn't yet decided whether to proceed with a bid, it

appears to have more financial firepower and fewer antitrust issues

than ICE, the person familiar with the situation said.

LSE remains committed to a friendly deal with Deutsche Börse but

it would have to consider potential rival bids by ICE or CME, the

person added.

A spokeswoman for CME declined to comment.

Talks between Deutsche Börse and the LSE represent at least the

third attempt by the companies to combine. The deal would create

the largest exchange in Europe and a formidable rival to the big

U.S. marketplaces.

The companies said Friday the combined group would be domiciled

in London with head offices in both London and Frankfurt.

ICE has until 1600 GMT on March 29 to either make an offer or

withdraw under U.K. takeover rules. The deadline for the LSE and

Deutsche Börse merger is 1700 GMT on March 22.

James Rundle contributed to this article.

Write to Eyk Henning at eyk.henning@wsj.com and Shayndi Raice at

shayndi.raice@wsj.com

(END) Dow Jones Newswires

March 01, 2016 09:07 ET (14:07 GMT)

Copyright (c) 2016 Dow Jones & Company, Inc.

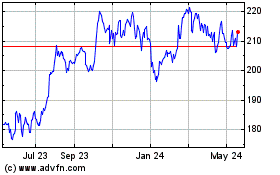

CME (NASDAQ:CME)

Historical Stock Chart

From Jun 2024 to Jul 2024

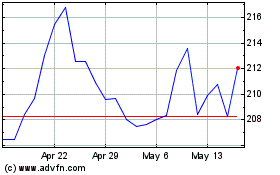

CME (NASDAQ:CME)

Historical Stock Chart

From Jul 2023 to Jul 2024