CME Group Agrees Terms of GBP3.9 Billion Offer for NEX

29 March 2018 - 5:54PM

Dow Jones News

By Adam Clark

CME Group Inc. (CME) said on Thursday that it has agreed the

terms of a 3.9 billion pounds ($5.49 billion) offer for U.K.

financial-technology company NEX Group PLC (NXG.LN).

Chicago futures-exchange giant CME said the offer comprises 500

pence in cash and 0.0444 new CME shares for each existing NEX

share, equivalent to 1,000 pence a share. CME said this is a 49%

premium to NEX's closing price as of March 15, before news of

preliminary talks was revealed.

CME said the deal will create a leading global markets company,

with significant efficiencies across futures, cash, and

over-the-counter products. CME said it expects the acquisition to

generate run-rate cost synergies of $200 million, to be fully

achieved by the end of 2021. One-off costs to achieve efficiencies

are estimated at $285 million.

The deal will also bring together a complementary combination of

CME's exchange-traded derivative products and NEX's

over-the-counter offering, while expanding CME's international

market and client base across Europe, the Middle East, and Asia,

said CME.

NEX Chief Executive Michael Spencer will join the CME board and

remain with the combined company as a special adviser. NEX's

headquarters will be combined with CME's in Chicago, but the

European headquarters of the merged company will remain in

London.

CME currently has committed support for the deal from NEX's

directors, who hold 17% of the company's shares. The deal is

dependent on approval from NEX shareholders with at least 75% of

the company's shares.

Write to Adam Clark at adam.clark@dowjones.com;

@AdamDowJones

(END) Dow Jones Newswires

March 29, 2018 02:39 ET (06:39 GMT)

Copyright (c) 2018 Dow Jones & Company, Inc.

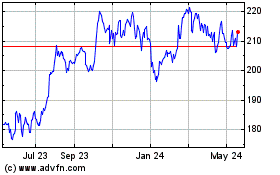

CME (NASDAQ:CME)

Historical Stock Chart

From Jun 2024 to Jul 2024

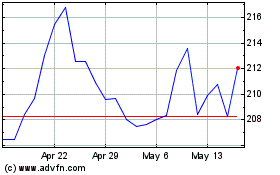

CME (NASDAQ:CME)

Historical Stock Chart

From Jul 2023 to Jul 2024