0001262976false00012629762024-09-122024-09-12

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

__________________________________________

Form 8-K

| | | | | |

| CURRENT REPORT |

| Pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934 |

|

| Date of Report (Date of earliest event reported): | March 7, 2025 |

__________________________________________

Cimpress plc

(Exact Name of Registrant as Specified in Its Charter)

__________________________________________

| | | | | | | | | | | | | | | | | |

| Ireland | | 000-51539 | | 98-0417483 |

| (State or Other Jurisdiction of Incorporation) | | (Commission File Number) | | (IRS Employer Identification No.) |

| | | | | |

| First Floor Building 3, | Finnabair Business and Technology Park A91 XR61 |

| Dundalk, Co. Louth |

| Ireland |

| (Address of Principal Executive Offices) |

Registrant’s telephone number, including area code: +353 42 938 8500

not applicable

(Former Name or Former Address, if Changed Since Last Report)

__________________________________________

| | | | | | | | | | | | | | |

| Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (see General Instruction A.2. below): |

| |

| ☐ | Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| |

| ☐ | Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| |

| ☐ | Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| |

| ☐ | Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Indicate by check mark whether the registrant is an emerging growth company, as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Securities registered pursuant to Section 12(b) of the Act:

| | | | | | | | | | | | | | | | | |

| Title of Each Class | | Trading Symbol(s) | | Name of Exchange on Which Registered |

| Ordinary Shares, nominal value per share of €0.01 | | CMPR | | NASDAQ | Global Select Market |

Item 8.01 Other Events

The US tariff environment is dynamic, with the implementation of tariffs recently imposed by the US government pursuant to the International Emergency Economic Powers Act (50 U.S.C. § 1701 et seq.) (IEEPA) for goods imported from Canada, Mexico and China (collectively, the “recent tariffs”) being delayed, modified and/or suspended at times, in whole or in part. This update describes the potential impact of the recent tariffs if all of them were to take effect. It is based on information available at the time of this filing, which is subject to change, and any such changes may materially alter the impact of the recent tariffs on our future results. Additionally, this update is limited to an overview of the direct impact of the recent tariffs; other potential indirect impacts such as changes in consumer sentiment, trade relations, and other topics are not covered by this update.

In summary, based on currently available exclusions and exemptions and our understanding of the rules (all of which are subject to change and interpretation), we estimate the annual impact of the recent tariffs on products imported from Canada, Mexico and China to be less than $10 million in the aggregate, before taking account of potential mitigation activities described below.

Products imported from Canada and Mexico to the United States

Cimpress’ North American production footprint includes significant operations in Canada and Mexico that fulfill orders for US customers. If and when tariffs apply, Cimpress believes it would be subject to tariffs on the “computed value” of our products. Computed value is akin to, albeit not synonymous with, the cost of goods sold excluding outbound shipping (i.e., the fully-burdened cost to manufacture) plus the profit earned by the producing legal entity. As a point of reference, for the trailing twelve months ended December 31, 2024, Cimpress’ estimated total US product COGS (excluding outbound shipping) that was fulfilled from Canada or Mexico was approximately $230 million.

However, Cimpress believes that most of its US imported printed products, including business cards, postcards, flyers, brochures, branded folders, banners, labels, posters, photographs and more, qualify for exclusion from the recent tariffs, as 50 U.S.C. § 1702(b)(3) explicitly precludes the President from regulating the importation of "informational materials" under IEEPA. Informational products promote the free flow of information consistent with the First Amendment to the U.S. Constitution’s protection of free speech. Products that we believe qualify for this “informational materials” exclusion account for approximately 70% of what would otherwise be the computed value tariff basis under the recent tariffs.

Of the remaining imported products that we believe do not qualify for such exclusion, the vast majority enter the US under the de minimis exemption codified at 19 U.S.C. § 1321(a)(2)(C), which exempts orders with an aggregate fair retail value of $800 or less per customer per day. On March 3, 2025, the US government announced that the de minimis exemption will remain available for the time being, although this is subject to change once adequate systems are in place to allow for such change. Therefore, for the time being, most of the products imported from Canada or Mexico that we believe do not qualify for the aforementioned “informational materials” exclusion remain exempt from the recent tariffs and duties under the de minimis exemption.

Products imported from China to the United States

Cimpress does not expect a significant impact from the recent tariffs on Chinese imports at this time, since in our case, the recent tariffs primarily affect the sourcing of certain raw materials – particularly in the promotional products category – rather than finished goods.

Further Mitigation Activities

Recognizing that the continued availability of the previously described exclusion for “informational materials” and the de minimis exemption are subject to change and future changes are outside of our control, Cimpress has planned extensive near-term mitigation activities for potentially impacted products that include shifting the source of production or raw material sourcing and changes to pricing and discounts, amongst other actions, that can be deployed to address the current environment and as facts and circumstances evolve. Cimpress is also evaluating strategic changes to its North American production footprint to increase tariff resilience and flexibility amongst other benefits.

Forward-Looking Statements

Some of the statements in this Current Report on Form 8-K are “forward-looking” and are made pursuant to the safe harbor provision of the Private Securities Litigation Reform Act of 1995. These “forward-looking” statements include statements relating to, among other things, the impact of tariffs, the manner in which duties are calculated, the applicability of potential exclusions and exemptions, and Cimpress’ response strategies. These statements involve risks and uncertainties that may cause actual results to differ materially from such statements, including as a result of changes in, or in the interpretation of, governmental policies, laws and regulations, general economic and market conditions and the risks and uncertainties referenced from time to time in Cimpress’ filings with the Securities and Exchange Commission. These statements speak only as of the date hereof, and the Company expressly disclaims any obligation or undertaking to release publicly any updates or revisions to such statements to reflect any change in its expectations with regard thereto or any changes in the events, conditions or circumstances on which any such statement is based.

Item 9.01. Financial Statements and Exhibits

(d) Exhibits

| | | | | | | | |

| Exhibit | | |

| No. | | Description |

| 104 | | Cover Page Interactive Data File, formatted in iXBRL |

SIGNATURE

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| | | | | |

| March 7, 2025 | Cimpress plc |

| | | | | | | | |

| | By: | /s/ Sean E. Quinn |

| | Sean E. Quinn |

| | Executive Vice President and Chief Financial Officer |

v3.25.0.1

Cover Page

|

Sep. 12, 2024 |

| Cover [Abstract] |

|

| Document Type |

8-K

|

| Document Period End Date |

Mar. 07, 2025

|

| Entity Registrant Name |

Cimpress plc

|

| Entity Incorporation, State or Country Code |

L2

|

| Entity File Number |

000-51539

|

| Entity Tax Identification Number |

98-0417483

|

| Entity Address, Address Line One |

First Floor Building 3,

|

| Entity Address, Address Line Two |

Finnabair Business and Technology Park A91 XR61

|

| Entity Address, City or Town |

Dundalk, Co. Louth

|

| Entity Address, Country |

IE

|

| City Area Code |

353

|

| Local Phone Number |

42 938 8500

|

| Written Communications |

false

|

| Soliciting Material |

false

|

| Pre-commencement Tender Offer |

false

|

| Pre-commencement Issuer Tender Offer |

false

|

| Entity Emerging Growth Company |

false

|

| Title of 12(b) Security |

Ordinary Shares, nominal value per share of €0.01

|

| Trading Symbol |

CMPR

|

| Security Exchange Name |

NASDAQ

|

| Entity Central Index Key |

0001262976

|

| Amendment Flag |

false

|

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 2 such as Street or Suite number

| Name: |

dei_EntityAddressAddressLine2 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionISO 3166-1 alpha-2 country code.

| Name: |

dei_EntityAddressCountry |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:countryCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14a

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

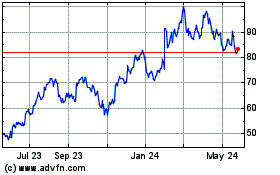

Cimpress (NASDAQ:CMPR)

Historical Stock Chart

From Feb 2025 to Mar 2025

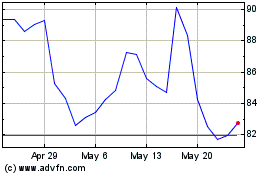

Cimpress (NASDAQ:CMPR)

Historical Stock Chart

From Mar 2024 to Mar 2025