UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the

Securities Exchange Act of 1934

Date of Report (Date of earliest event reported) October 23, 2024

ChoiceOne Financial Services, Inc.

(Exact Name of Registrant as

Specified in its Charter)

|

|

|

|

|

|

Michigan

(State or Other Jurisdiction

of Incorporation) |

001-39209

(Commission

File Number) |

38-2659066

(IRS Employer

Identification No.) |

|

|

|

109 East Division Street

Sparta, Michigan

(Address of Principal Executive Offices) |

49345

(Zip Code)

|

Registrant's telephone number, including area code: (616) 887-7366

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (see General Instruction A.2. below):

☒ Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

☐ Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

☐ Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

☐ Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

Securities registered pursuant to Section 12(b) of the Act:

|

|

|

Title of each class |

Trading symbol(s) |

Name of each exchange on which registered |

Common stock |

COFS |

NASDAQ Capital Market |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

|

|

Item 2.02 |

Results of Operations and Financial Condition. |

On October 23, 2024, ChoiceOne Financial Services, Inc. issued the press release attached as Exhibit 99.1 to this Form 8-K, which is here incorporated by reference. This Report and the Exhibit are furnished to, and not filed with, the Commission.

|

|

Item 9.01 |

Financial Statements and Exhibits. |

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

|

|

|

|

Dated: |

October 23, 2024 |

CHOICEONE FINANCIAL SERVICES, INC.

(Registrant) |

|

|

|

|

|

|

|

|

|

|

By: |

/s/ Adom J. Greenland |

|

|

|

Adom J. Greenland

Its Chief Financial Officer and Treasurer |

EXHIBIT 99.1

News Release

ChoiceOne Reports Third Quarter 2024 Results

Sparta, Michigan – October 23, 2024 – ChoiceOne Financial Services, Inc. ("ChoiceOne", NASDAQ:COFS), the parent company for ChoiceOne Bank, reported financial results for the quarter ended September 30, 2024.

Quarterly Highlights

•ChoiceOne reported net income of $7,348,000 and $19,568,000 for the three and nine months ended September 30, 2024, compared to $5,122,000 and $15,968,000 for the same periods in 2023, representing growth of 43.5% and 22.6%, respectively. Net income adjusted for merger related expenses was $7,981,000 and $20,201,000 for the three and nine months ended September 30, 2024.

•ChoiceOne entered into a definitive merger agreement with Fentura Financial, Inc. ("Fentura") on July 25, 2024. Fentura is the parent company of The State Bank, with $1.8 billion in assets as of June 30, 2024 and has 20 branches and a loan production office in the following counties of Michigan: Genesee, Ingham, Jackson, Livingston, Oakland, Saginaw, and Shiawassee.

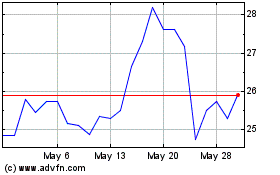

•On July 26, 2024, ChoiceOne completed an underwritten public offering of 1,380,000 shares of its common stock at a price to the public of $25.00 per share for aggregate gross proceeds of approximately $34.5 million before deducting underwriting discounts and estimated offering expenses (the “Capital Raise”).

•Diluted earnings per share were $0.85 and $2.46 in the three and nine months ended September 30, 2024, compared to $0.68 and $2.12 per share in the same periods in the prior year. Diluted earnings per share was negatively impacted by the sale of 1,380,000 shares of common stock in the Capital Raise. Diluted earnings per share adjusted for merger expenses was $0.93 and $2.54 in the three and nine months ended September 30, 2024.

•GAAP Net interest margin in the third quarter of 2024 increased to 3.17%, compared to 2.95% in the second quarter of 2024, and 2.64% in the third quarter of 2023. GAAP net interest income was $20.2 million in the third quarter of 2024 compared to $16.2 million in the third quarter of 2023. Net interest income was aided by cash settlements from pay-fixed interest rate swaps which started paying in April 2024.

•Core loans, which exclude held for sale loans and loans to other financial institutions, grew organically by $64.5 million or 18.4% on an annualized basis during the third quarter of 2024 and $179.4 million or 14.0% since September 30, 2023. Loan interest income increased $5.5 million in the third quarter of 2024 compared to the same period in 2023.

•Deposits, excluding brokered deposits, increased $102.1 million or an annualized 19.5% in the third quarter of 2024 and $117.6 million or 5.7% during the twelve months since September 30, 2023. The increase in deposits in the third quarter was driven by public funds including schools and townships which historically increase in the third quarter of each year due to the timing of tax collection. The increase in deposits in the twelve months ended September 30, 2024 is a combination of new business and recapture of deposit losses from the prior year.

•Asset quality remains strong with only 0.19% of nonperforming loans to total loans (excluding held for sale) as of September 30, 2024.

“I am very pleased with the results of the third quarter of 2024, which highlight the growth in core loans and deposits driven by the success of our experienced team. The proactive management of our balance sheet has also resulted in improvements in our net interest margin in the third quarter and positions us to manage changing market conditions. We remain committed to our communities, customers, and stakeholders, and sincerely appreciate the trust they place in us as their local financial partner," said Kelly Potes, Chief Executive Officer.

ChoiceOne reported net income of $7,348,000 and $19,568,000 for the three and nine months ended September 30, 2024, compared to $5,122,000 and $15,968,000 for the same periods in 2023, representing growth of 43.5% and 22.6%, respectively. Net income adjusted for merger related expenses was $7,981,000 and $20,201,000 for the three and nine months ended September 30, 2024. Diluted earnings per share were $0.85 and $2.46 in the three and nine months ended September 30, 2024, compared to $0.68 and $2.12 per share in the

same periods in the prior year. Earnings per share was negatively impacted by the sale of 1,380,000 shares of common stock in the Capital Raise completed on July 26, 2024.

As of September 30, 2024, total assets were $2.7 billion, an increase of $151.8 million compared to September 30, 2023. The growth is primarily attributed to an increase in core loans of $179.4 million and loans to other financial institutions of $14.7 million. This growth was offset by a $16.0 million reduction in securities during the same time period. ChoiceOne has actively managed its balance sheet to support organic loan growth, strategically shifting from lower-yielding assets to higher-yielding loans. This is reflected in the loan growth observed.

Deposits, excluding brokered deposits, increased $102.1 million or an annualized 19.5% in the third quarter of 2024 and $117.6 million or 5.7% during the twelve months since September 30, 2023. The increase in deposits in the third quarter was driven by public funds including schools and townships which historically increase in the third quarter of each year due to the timing of tax collection. The increase in deposits in the twelve months ended September 30, 2024 is a combination of new business and recapture of deposit losses from the prior year. ChoiceOne continues to be proactive in managing its liquidity position by using brokered deposits, the Bank Term Funding Program (“BTFP”), and FHLB advances to ensure ample liquidity. At September 30, 2024, total available borrowing capacity secured by pledged assets was $780.6 million. ChoiceOne can increase its capacity by utilizing unsecured federal fund lines and pledging additional assets. Uninsured deposits totaled $863.3 million or 39.1% of deposits at September 30, 2024.

ChoiceOne's cost of deposits to average total deposits has declined since peaking in the first quarter of 2024 due to positive cash flow from pay-fixed interest rate swaps, hedged against deposits, decreasing deposit expenses. In addition, the Federal Reserve decreased the federal funds rate by 50 basis points in September 2024 and signaled potential further rate drops in the future. These factors led to a slight decline in the cost of deposits to average total deposits to an annualized 1.53% in the third quarter of 2024 compared to an annualized 1.56% in the second quarter of 2024 and an annualized 1.65% in the first quarter of 2024. Due to hedge instruments we have in place, our balance sheet is asset sensitive. If rates decline, we expect to see slight declines in deposit costs; however these declines will be muted by the decrease in cash flows from pay-fixed interest rate swaps collected. Interest expense on borrowings for the three and nine months ended September 30, 2024 increased $239,000 and $3.4 million compared to the same period in the prior year, due to increases in borrowing amounts and interest rates. Borrowings include $170 million from the BTFP and $40 million of FHLB borrowings at a weighted average fixed rate of 4.7%, with the earliest maturity in January 2025. Total cost of funds decreased to an annualized 1.87% in the third quarter of 2024 compared to an annualized 1.92% in the second quarter of 2024, and increased compared to an annualized 1.70% in the third quarter of 2023.

The provision for credit losses expense on loans was $425,000 in the third quarter of 2024, due in part to loan growth during the quarter. The ratio of the allowance for credit losses to total loans (excluding loans held for sale) was 1.10% on September 30, 2024 compared to 1.14% on September 30, 2023. Asset quality continues to remain strong, with annualized net loan charge-offs to average loans of 0.02% and nonperforming loans to total loans (excluding loans held for sale) of 0.19% as of September 30, 2024.

ChoiceOne uses interest rate swaps to manage interest rate exposure to certain fixed rate assets and variable rate liabilities. On September 30, 2024, ChoiceOne had pay-fixed interest rate swaps with a total notional value of $401.0 million, a weighted average coupon of 3.07%, a fair value of $4.4 million and an average remaining contract length of 7 to 8 years. These derivative instruments increase in value as long-term interest rates rise, which offsets the reduction in equity due to unrealized losses on securities available for sale. Included in the total is $200.0 million of forward starting pay-fixed, receive floating interest rate swaps used to hedge interest bearing liabilities. These forward starting swaps pay a fixed coupon of 2.75% while receiving SOFR. Settlements from these swaps amounted to $1.3 million for the third quarter of 2024 and were a contributing factor to the increase in net interest margin during the third quarter of 2024. Fully tax equivalent net interest margin excluding the swaps was 39 basis points lower than tax equivalent net interest margin reported for the third quarter of 2024. In addition to the pay-fixed interest rate swaps, ChoiceOne also employs back-to-back swaps on a commercial loans, with the impact reflected in interest income.

Shareholders’ equity totaled $247.7 million as of September 30, 2024, up from $181.2 million as of September 30, 2023, due in large part to the $34.5 million in aggregate gross proceeds (before deducting discounts and estimated offering expenses) received in the Capital Raise. The additional increase is due to retained earnings and an improvement in accumulated other compressive loss (AOCI) of $17.0 million compared to September 30, 2023. The improvement in AOCI, is due to both the shortening duration and maturing (paydowns) of the securities portfolio, offset by the change in unrealized gain of the pay-fixed swap derivatives. ChoiceOne Bank remains “well-capitalized” with a total risk-based capital ratio of 13.1% as of September 30, 2024, compared to 12.7% on September 30, 2023.

Noninterest income increased $1.2 million and $2.1 million in the three and nine months ended September 30, 2024, compared to the same periods in the prior year. The increase was largely due to an increase in customer service charges of $391,000 and $920,000 in the three and nine months ended September 30, 2024 compared to the same periods in 2023 and changes in the market value of equity securities in the three and nine months ended September 30, 2024, compared to the same periods in the prior year. Equity securities

include community bank stocks and CRA focused bond mutual funds. In addition, ChoiceOne recognized earnings on a bank owned life insurance death benefit claim in the amount of $196,000 during the first quarter of 2024.

Noninterest expense increased by $1.7 million or 12.3% and $2.1 million or 5.0% in the three and nine months ended September 30, 2024 compared to the same period in 2023. The increase in total noninterest expense was due in part to merger related expenses of $645,000 during the quarter compared to $0 in the prior year. Additionally, there was an increase to employee health insurance and other benefit costs, and an increase to FDIC insurance and other costs related to the inflationary environment. The year to date increase in costs were offset by a decline in occupancy and equipment related to two branch closures during the first quarter of 2024. Management continues to seek out ways to manage costs, but also recognizes the value of investing in innovation and attracting the best talent in our industry to compete effectively in our markets.

“I am very pleased with the results of the third quarter of 2024, showing core loan growth, an improving net interest margin and excellent credit metrics. In addition, we announced completion of the Capital Raise to supplement regulatory capital ratios, and the pending merger with Fentura and the State Bank, a highly respected community bank in Michigan. We are excited to welcome their customers, communities, and employees to the ChoiceOne team,” said Kelly Potes, Chief Executive Officer.

About ChoiceOne

ChoiceOne Financial Services, Inc. is a financial holding company headquartered in Sparta, Michigan and the parent corporation of ChoiceOne Bank, Member FDIC. ChoiceOne Bank operates 35 offices in parts of Kent, Lapeer, Macomb, Muskegon, Newaygo, Ottawa, and St. Clair counties. ChoiceOne Bank offers insurance and investment products through its subsidiary, ChoiceOne Insurance Agencies, Inc. For more information, please visit Investor Relations at ChoiceOne’s website at choiceone.bank.

Forward-Looking Statements

This news release contains forward-looking statements. Words such as “anticipates,” “believes,” “estimates,” “expects,” “forecasts,” “intends,” “is likely,” “plans,” “predicts,” “projects,” “may,” “could,” “look forward,” “continue”, “future” and variations of such words and similar expressions are intended to identify such forward-looking statements. Examples of forward-looking statements include, but are not limited to, statements regarding the outlook and expectations of ChoiceOne or Fentura with respect to the planned merger, the strategic benefits and financial benefits of the merger, including the expected impact of the proposed transaction on the combined company’s future financial performance and the timing of the closing of the proposed transaction. These statements reflect current beliefs as to the expected outcomes of future events and are not guarantees of future performance. These statements involve certain risks, uncertainties and assumptions (“risk factors”) that are difficult to predict with regard to timing, extent, likelihood and degree of occurrence. Therefore, actual results and outcomes may materially differ from what may be expressed, implied or forecasted in such forward-looking statements. Furthermore, ChoiceOne does not undertake any obligation to update, amend, or clarify forward-looking statements, whether as a result of new information, future events, or otherwise. Such risks, uncertainties and assumptions, include, among others, the following:

•the failure to obtain necessary regulatory approvals when expected or at all (and the risk that such approvals may result in a materially burdensome regulatory condition (as defined in the merger agreement));

•the failure of Fentura to obtain shareholder approval, for ChoiceOne to obtain the shareholder approval, or for either party to satisfy any of the other closing conditions to the proposed transaction on a timely basis or at all;

•the occurrence of any event, change or other circumstances that could give rise to the right of one or both of the parties to terminate the merger agreement;

•the possibility that the anticipated benefits of the proposed transaction are not realized when expected or at all, including as a result of the impact of, or problems arising from, the integration of the two companies or as a result of the strength of the economy, competitive factors in the areas where ChoiceOne and Fentura do business, or as a result of other unexpected factors or events;

•the impact of purchase accounting with respect to the proposed transaction, or any change in the assumptions used regarding the assets purchased and liabilities assumed to determine their fair value;

•diversion of management’s attention from ongoing business operations and opportunities;

•potential adverse reactions or changes to business or employee relationships, including those resulting from the announcement or completion of the proposed transaction; or

•the outcome of any legal proceedings that may be instituted against ChoiceOne or Fentura.

Additional risk factors include, but are not limited to, the risk factors described in Item 1A in ChoiceOne’s Annual Report on Form 10-K for the year ended December 31, 2023 and in any of ChoiceOne’s subsequent SEC filings, which are available on the SEC’s website, www.sec.gov.

Non-GAAP Financial Measures

In addition to results presented in accordance with GAAP, this presentation includes certain non-GAAP financial measures. ChoiceOne believes these non-GAAP financial measures provide additional information that is useful to investors in helping to understand underlying financial performance and condition and trends of ChoiceOne.

Non-GAAP financial measures have inherent limitations. Readers should be aware of these limitations and should be cautious with respect to the use of such measures. To compensate for these limitations, non-GAAP measures are used as comparative tools, together with GAAP measures, to assist in the evaluation of operating performance or financial condition. These measures are also calculated using the appropriate GAAP or regulatory components in their entirety and are computed in a manner intended to facilitate consistent period-to-period comparisons. ChoiceOne’s method of calculating these non-GAAP measures may differ from methods used by other companies. These non-GAAP measures should not be considered in isolation or as a substitute for those financial measures prepared in accordance with GAAP or in-effect regulatory requirements.

Where non-GAAP financial measures are used, the most directly comparable GAAP or regulatory financial measure, as well as the reconciliation to the most directly comparable GAAP or regulatory financial measure, can be found in the tables to this news release under the heading non-GAAP reconciliation.

For Further Information:

Adom Greenland

Executive Vice President & CFO

(616) 887 – 2334

IR@ChoiceOne.bank

Important Additional Information and Where to Find It

This communication is being made in respect of the proposed merger between ChoiceOne and Fentura. This material is not a solicitation of any vote or approval of the ChoiceOne or Fentura shareholders and is not a substitute for the proxy statement/prospectus or any other documents that ChoiceOne and Fentura may send to their respective shareholders in connection with the proposed transaction.

In connection with the proposed Merger, ChoiceOne has filed with the SEC a Registration Statement on Form S-4 that will include a Proxy Statement and Prospectus of ChoiceOne and Fentura, as well as other relevant documents regarding the proposed Merger. A definitive Proxy Statement and Prospectus will be sent to ChoiceOne and Fentura shareholders when available. INVESTORS AND SECURITY HOLDERS ARE URGED TO READ THE PROXY STATEMENT AND PROSPECTUS REGARDING THE PROPOSED MERGER WHEN IT BECOMES AVAILABLE AND ANY OTHER RELEVANT DOCUMENTS FILED WITH THE SEC, AS WELL AS ANY AMENDMENTS OR SUPPLEMENTS TO THOSE DOCUMENTS, BECAUSE THEY WILL CONTAIN IMPORTANT INFORMATION.

This communication does not constitute an offer to sell or the solicitation of an offer to buy any securities or a solicitation of any vote or approval, nor shall there be any sale of securities in any jurisdiction in which such offer, solicitation or sale would be unlawful prior to registration or qualification under the securities laws of such jurisdiction.

A free copy of the Proxy Statement and Prospectus, once available, as well as other filings containing information about ChoiceOne, Fentura, and the proposed transaction may be obtained at the SEC’s Internet site http://www.sec.gov. You will also be able to obtain these documents, free of charge, from ChoiceOne under the "Investor Relations" section of its website, www.choiceone.bank (which website is not incorporated herein by reference). In addition, investors and security holders may obtain free copies of the documents ChoiceOne has filed with the SEC by directing a request to ChoiceOne Financial Services, Inc., Attn: Adom Greenland, 109 E. Division Street, Sparta, Michigan 49345 or by phone at (616) 887-2334.

Participants in Solicitation

ChoiceOne, Fentura, and certain of their respective directors, executive officers and other members of management or employees may, under the SEC’s rules, be deemed to be participants in the solicitation of proxies from ChoiceOne and Fentura shareholders in respect of the proposed merger, which will be described in the Proxy Statement and Prospectus. Information about ChoiceOne’s directors and executive officers is available in its definitive proxy statement relating to its 2024 annual meeting of shareholders, which was filed with the SEC on April 11, 2024, and other documents filed by ChoiceOne with the SEC. Information about the directors and executive officers of Fentura and their ownership of Fentura common stock and those participants and other persons who may, under the SEC’s rules, be deemed participants in the proposed transaction may be obtained by reading the Proxy Statement and Prospectus regarding the proposed merger when it becomes available. Free copies of this document may be obtained as described in the preceding paragraph.

Condensed Balance Sheets

(Unaudited)

|

|

|

|

|

|

|

|

|

|

|

|

|

(In thousands) |

|

September 30, 2024 |

|

|

June 30, 2024 |

|

|

September 30, 2023 |

|

Cash and cash equivalents |

|

$ |

145,938 |

|

|

$ |

101,002 |

|

|

$ |

144,673 |

|

Equity securities, at fair value |

|

|

7,816 |

|

|

|

7,502 |

|

|

|

7,262 |

|

Securities Held to Maturity |

|

|

391,954 |

|

|

|

392,699 |

|

|

|

414,743 |

|

Securities Available for Sale |

|

|

497,552 |

|

|

|

491,670 |

|

|

|

490,804 |

|

Federal Home Loan Bank stock |

|

|

4,449 |

|

|

|

4,449 |

|

|

|

4,449 |

|

Federal Reserve Bank stock |

|

|

5,307 |

|

|

|

5,066 |

|

|

|

5,065 |

|

Loans held for sale |

|

|

5,994 |

|

|

|

5,946 |

|

|

|

5,222 |

|

Loans to other financial institutions |

|

|

38,492 |

|

|

|

36,569 |

|

|

|

23,763 |

|

Core loans |

|

|

1,465,458 |

|

|

|

1,400,958 |

|

|

|

1,286,037 |

|

Total loans held for investment |

|

|

1,503,950 |

|

|

|

1,437,527 |

|

|

|

1,309,800 |

|

Allowance for credit losses |

|

|

(16,490 |

) |

|

|

(16,152 |

) |

|

|

(14,872 |

) |

Loans, net of allowance for credit losses |

|

|

1,487,460 |

|

|

|

1,421,375 |

|

|

|

1,294,928 |

|

Premises and equipment |

|

|

27,135 |

|

|

|

27,370 |

|

|

|

29,628 |

|

Cash surrender value of life insurance policies |

|

|

45,699 |

|

|

|

45,384 |

|

|

|

44,788 |

|

Goodwill |

|

|

59,946 |

|

|

|

59,946 |

|

|

|

59,946 |

|

Core deposit intangible |

|

|

1,250 |

|

|

|

1,448 |

|

|

|

2,057 |

|

Other assets |

|

|

45,503 |

|

|

|

59,210 |

|

|

|

70,631 |

|

|

|

|

|

|

|

|

|

|

|

Total Assets |

|

$ |

2,726,003 |

|

|

$ |

2,623,067 |

|

|

$ |

2,574,196 |

|

|

|

|

|

|

|

|

|

|

|

Noninterest-bearing deposits |

|

$ |

521,055 |

|

|

$ |

517,137 |

|

|

$ |

531,962 |

|

Interest-bearing deposits |

|

|

1,680,546 |

|

|

|

1,582,365 |

|

|

|

1,551,995 |

|

Brokered deposits |

|

|

6,627 |

|

|

|

27,177 |

|

|

|

49,238 |

|

Borrowings |

|

|

210,000 |

|

|

|

210,000 |

|

|

|

180,000 |

|

Subordinated debentures |

|

|

35,691 |

|

|

|

35,630 |

|

|

|

35,446 |

|

Other liabilities |

|

|

24,338 |

|

|

|

36,239 |

|

|

|

44,394 |

|

|

|

|

|

|

|

|

|

|

|

Total Liabilities |

|

|

2,478,257 |

|

|

|

2,408,548 |

|

|

|

2,393,035 |

|

|

|

|

|

|

|

|

|

|

|

Common stock and paid-in capital, no par value; shares authorized: 15,000,000; shares outstanding: 8,959,664 at September 30, 2024, 7,573,618 at June 30, 2024, and 7,541,187 at September 30, 2023 |

|

|

206,427 |

|

|

|

173,984 |

|

|

|

173,187 |

|

Retained earnings |

|

|

86,765 |

|

|

|

81,836 |

|

|

|

70,444 |

|

Accumulated other comprehensive income (loss), net |

|

|

(45,446 |

) |

|

|

(41,301 |

) |

|

|

(62,470 |

) |

Shareholders' Equity |

|

|

247,746 |

|

|

|

214,519 |

|

|

|

181,161 |

|

|

|

|

|

|

|

|

|

|

|

Total Liabilities and Shareholders’ Equity |

|

$ |

2,726,003 |

|

|

$ |

2,623,067 |

|

|

$ |

2,574,196 |

|

Condensed Statements of Income

(Unaudited)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Three Months Ended |

|

|

Nine Months Ended |

|

(Dollars in thousands, except per share data) |

|

September 30, |

|

|

September 30, |

|

|

|

2024 |

|

|

2023 |

|

|

2024 |

|

|

2023 |

|

Interest income |

|

|

|

|

|

|

|

|

|

|

|

|

Loans, including fees |

|

$ |

23,252 |

|

|

$ |

17,774 |

|

|

$ |

66,009 |

|

|

$ |

48,625 |

|

Securities: |

|

|

|

|

|

|

|

|

|

|

|

|

Taxable |

|

|

5,563 |

|

|

|

5,346 |

|

|

|

16,382 |

|

|

|

15,637 |

|

Tax exempt |

|

|

1,402 |

|

|

|

1,420 |

|

|

|

4,224 |

|

|

|

4,244 |

|

Other |

|

|

1,473 |

|

|

|

1,764 |

|

|

|

3,451 |

|

|

|

2,512 |

|

Total interest income |

|

|

31,690 |

|

|

|

26,304 |

|

|

|

90,066 |

|

|

|

71,018 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Interest expense |

|

|

|

|

|

|

|

|

|

|

|

|

Deposits |

|

|

8,362 |

|

|

|

7,237 |

|

|

|

25,464 |

|

|

|

15,569 |

|

Advances from Federal Home Loan Bank |

|

|

468 |

|

|

|

272 |

|

|

|

1,372 |

|

|

|

1,498 |

|

Other |

|

|

2,612 |

|

|

|

2,569 |

|

|

|

8,137 |

|

|

|

4,622 |

|

Total interest expense |

|

|

11,442 |

|

|

|

10,078 |

|

|

|

34,973 |

|

|

|

21,689 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Net interest income |

|

|

20,248 |

|

|

|

16,226 |

|

|

|

55,093 |

|

|

|

49,329 |

|

Provision for credit losses on loans |

|

|

425 |

|

|

|

438 |

|

|

|

1,100 |

|

|

|

332 |

|

Provision for credit losses on unfunded commitments |

|

|

- |

|

|

|

(438 |

) |

|

|

(675 |

) |

|

|

(557 |

) |

Net Provision for credit losses expense |

|

|

425 |

|

|

|

- |

|

|

|

425 |

|

|

|

(225 |

) |

Net interest income after provision |

|

|

19,823 |

|

|

|

16,226 |

|

|

|

54,668 |

|

|

|

49,554 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Noninterest income |

|

|

|

|

|

|

|

|

|

|

|

|

Customer service charges |

|

|

2,773 |

|

|

|

2,382 |

|

|

|

7,840 |

|

|

|

6,920 |

|

Insurance and investment commissions |

|

|

184 |

|

|

|

173 |

|

|

|

572 |

|

|

|

541 |

|

Gains on sales of loans |

|

|

631 |

|

|

|

536 |

|

|

|

1,610 |

|

|

|

1,479 |

|

Net gains (losses) on sales of securities |

|

|

- |

|

|

|

(71 |

) |

|

|

- |

|

|

|

(71 |

) |

Net gains (losses) on sales and write downs of other assets |

|

|

191 |

|

|

|

13 |

|

|

|

203 |

|

|

|

149 |

|

Earnings on life insurance policies |

|

|

315 |

|

|

|

278 |

|

|

|

1,115 |

|

|

|

810 |

|

Trust income |

|

|

232 |

|

|

|

197 |

|

|

|

665 |

|

|

|

577 |

|

Change in market value of equity securities |

|

|

277 |

|

|

|

(134 |

) |

|

|

241 |

|

|

|

(456 |

) |

Other |

|

|

264 |

|

|

|

330 |

|

|

|

755 |

|

|

|

911 |

|

Total noninterest income |

|

|

4,867 |

|

|

|

3,704 |

|

|

|

13,001 |

|

|

|

10,860 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Noninterest expense |

|

|

|

|

|

|

|

|

|

|

|

|

Salaries and benefits |

|

|

8,372 |

|

|

|

8,038 |

|

|

|

24,467 |

|

|

|

23,958 |

|

Occupancy and equipment |

|

|

1,475 |

|

|

|

1,427 |

|

|

|

4,414 |

|

|

|

4,577 |

|

Data processing |

|

|

1,932 |

|

|

|

1,724 |

|

|

|

5,382 |

|

|

|

5,087 |

|

Professional fees |

|

|

610 |

|

|

|

435 |

|

|

|

1,818 |

|

|

|

1,675 |

|

Supplies and postage |

|

|

174 |

|

|

|

192 |

|

|

|

520 |

|

|

|

580 |

|

Advertising and promotional |

|

|

168 |

|

|

|

269 |

|

|

|

517 |

|

|

|

573 |

|

Intangible amortization |

|

|

198 |

|

|

|

247 |

|

|

|

604 |

|

|

|

752 |

|

FDIC insurance |

|

|

390 |

|

|

|

270 |

|

|

|

1,155 |

|

|

|

790 |

|

Merger related expenses |

|

|

645 |

|

|

|

- |

|

|

|

645 |

|

|

|

- |

|

Other |

|

|

1,453 |

|

|

|

1,126 |

|

|

|

3,857 |

|

|

|

3,304 |

|

Total noninterest expense |

|

|

15,417 |

|

|

|

13,728 |

|

|

|

43,379 |

|

|

|

41,296 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Income before income tax |

|

|

9,273 |

|

|

|

6,202 |

|

|

|

24,290 |

|

|

|

19,118 |

|

Income tax expense |

|

|

1,925 |

|

|

|

1,080 |

|

|

|

4,722 |

|

|

|

3,150 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Net income |

|

$ |

7,348 |

|

|

$ |

5,122 |

|

|

$ |

19,568 |

|

|

$ |

15,968 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Basic earnings per share |

|

$ |

0.86 |

|

|

$ |

0.68 |

|

|

$ |

2.48 |

|

|

$ |

2.12 |

|

Diluted earnings per share |

|

$ |

0.85 |

|

|

$ |

0.68 |

|

|

$ |

2.46 |

|

|

$ |

2.12 |

|

Dividends declared per share |

|

$ |

0.27 |

|

|

$ |

0.26 |

|

|

$ |

0.81 |

|

|

$ |

0.78 |

|

Income Adjusted for Merger Expenses - Non-GAAP Reconciliation

(Unaudited)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Three Months Ended |

|

|

Nine Months Ended |

|

|

|

September 30, |

|

|

September 30, |

|

|

|

2024 |

|

|

2023 |

|

|

2024 |

|

|

2023 |

|

(In Thousands, Except Per Share Data) |

|

|

|

|

|

|

|

|

|

|

|

|

Net income |

|

$ |

7,348 |

|

|

$ |

5,122 |

|

|

$ |

19,568 |

|

|

$ |

15,968 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Merger related expenses net of tax |

|

|

633 |

|

|

|

- |

|

|

|

633 |

|

|

|

- |

|

Adjusted net income |

|

$ |

7,981 |

|

|

$ |

5,122 |

|

|

$ |

20,201 |

|

|

$ |

15,968 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Weighted average number of shares |

|

|

8,567,548 |

|

|

|

7,537,996 |

|

|

|

7,898,938 |

|

|

|

7,528,887 |

|

Diluted average shares outstanding |

|

|

8,615,500 |

|

|

|

7,568,034 |

|

|

|

7,944,143 |

|

|

|

7,562,160 |

|

Adjusted basic earnings per share |

|

$ |

0.94 |

|

|

$ |

0.68 |

|

|

$ |

2.56 |

|

|

$ |

2.12 |

|

Adjusted diluted earnings per share |

|

$ |

0.93 |

|

|

$ |

0.68 |

|

|

$ |

2.54 |

|

|

$ |

2.12 |

|

Other Selected Financial Highlights

(Unaudited)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Quarterly |

|

Earnings |

|

2024 3rd

Qtr. |

|

|

2024 2nd

Qtr. |

|

|

2024 1st

Qtr. |

|

|

2023 4th

Qtr. |

|

|

2023 3rd

Qtr. |

|

(in thousands except per share data) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Net interest income |

|

$ |

20,248 |

|

|

$ |

18,371 |

|

|

$ |

16,474 |

|

|

$ |

16,555 |

|

|

$ |

16,226 |

|

Net provision expense |

|

|

425 |

|

|

|

- |

|

|

|

- |

|

|

|

375 |

|

|

|

- |

|

Noninterest income |

|

|

4,867 |

|

|

|

4,083 |

|

|

|

4,051 |

|

|

|

4,046 |

|

|

|

3,704 |

|

Noninterest expense |

|

|

15,417 |

|

|

|

14,278 |

|

|

|

13,684 |

|

|

|

13,778 |

|

|

|

13,728 |

|

Net income before federal income tax expense |

|

|

9,273 |

|

|

|

8,176 |

|

|

|

6,841 |

|

|

|

6,449 |

|

|

|

6,202 |

|

Income tax expense |

|

|

1,925 |

|

|

|

1,590 |

|

|

|

1,207 |

|

|

|

1,156 |

|

|

|

1,080 |

|

Net income |

|

|

7,348 |

|

|

|

6,586 |

|

|

|

5,634 |

|

|

|

5,293 |

|

|

|

5,122 |

|

Basic earnings per share |

|

|

0.86 |

|

|

|

0.87 |

|

|

|

0.75 |

|

|

|

0.70 |

|

|

|

0.68 |

|

Diluted earnings per share |

|

|

0.85 |

|

|

|

0.87 |

|

|

|

0.74 |

|

|

|

0.70 |

|

|

|

0.68 |

|

Adjusted basic earnings per share |

|

|

0.94 |

|

|

|

0.87 |

|

|

|

0.75 |

|

|

|

0.70 |

|

|

|

0.68 |

|

Adjusted diluted earnings per share |

|

|

0.93 |

|

|

|

0.87 |

|

|

|

0.74 |

|

|

|

0.70 |

|

|

|

0.68 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

End of period balances |

|

2024 3rd

Qtr. |

|

|

2024 2nd

Qtr. |

|

|

2024 1st

Qtr. |

|

|

2023 4th

Qtr. |

|

|

2023 3rd

Qtr. |

|

(in thousands) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Gross loans |

|

$ |

1,509,944 |

|

|

$ |

1,443,473 |

|

|

$ |

1,424,625 |

|

|

$ |

1,415,363 |

|

|

$ |

1,315,022 |

|

Loans held for sale (1) |

|

|

5,994 |

|

|

|

5,946 |

|

|

|

6,035 |

|

|

|

4,710 |

|

|

|

5,222 |

|

Loans to other financial institutions (2) |

|

|

38,492 |

|

|

|

36,569 |

|

|

|

30,032 |

|

|

|

19,400 |

|

|

|

23,763 |

|

Core loans (gross loans excluding 1 and 2 above) |

|

|

1,465,458 |

|

|

|

1,400,958 |

|

|

|

1,388,558 |

|

|

|

1,391,253 |

|

|

|

1,286,037 |

|

Allowance for credit losses |

|

|

16,490 |

|

|

|

16,152 |

|

|

|

16,037 |

|

|

|

15,685 |

|

|

|

14,872 |

|

Securities available for sale |

|

|

497,552 |

|

|

|

491,670 |

|

|

|

504,636 |

|

|

|

514,598 |

|

|

|

490,804 |

|

Securities held to maturity |

|

|

391,954 |

|

|

|

392,699 |

|

|

|

397,981 |

|

|

|

407,959 |

|

|

|

414,743 |

|

Other interest-earning assets |

|

|

116,643 |

|

|

|

84,484 |

|

|

|

100,175 |

|

|

|

39,411 |

|

|

|

130,178 |

|

Total earning assets (before allowance) |

|

|

2,516,093 |

|

|

|

2,412,326 |

|

|

|

2,427,417 |

|

|

|

2,377,331 |

|

|

|

2,350,747 |

|

Total assets |

|

|

2,726,003 |

|

|

|

2,623,067 |

|

|

|

2,670,699 |

|

|

|

2,576,706 |

|

|

|

2,574,196 |

|

Noninterest-bearing deposits |

|

|

521,055 |

|

|

|

517,137 |

|

|

|

502,685 |

|

|

|

547,625 |

|

|

|

531,962 |

|

Interest-bearing deposits |

|

|

1,680,546 |

|

|

|

1,582,365 |

|

|

|

1,641,193 |

|

|

|

1,550,985 |

|

|

|

1,551,995 |

|

Brokered deposits |

|

|

6,627 |

|

|

|

27,177 |

|

|

|

41,970 |

|

|

|

23,445 |

|

|

|

49,238 |

|

Total deposits |

|

|

2,208,228 |

|

|

|

2,126,679 |

|

|

|

2,185,848 |

|

|

|

2,122,055 |

|

|

|

2,133,195 |

|

Deposits excluding brokered |

|

|

2,201,601 |

|

|

|

2,099,502 |

|

|

|

2,143,878 |

|

|

|

2,098,610 |

|

|

|

2,083,957 |

|

Total subordinated debt |

|

|

35,691 |

|

|

|

35,630 |

|

|

|

35,568 |

|

|

|

35,507 |

|

|

|

35,446 |

|

Total borrowed funds |

|

|

210,000 |

|

|

|

210,000 |

|

|

|

210,000 |

|

|

|

200,000 |

|

|

|

180,000 |

|

Other interest-bearing liabilities |

|

|

4,956 |

|

|

|

22,378 |

|

|

|

21,512 |

|

|

|

8,060 |

|

|

|

32,204 |

|

Total interest-bearing liabilities |

|

|

1,937,820 |

|

|

|

1,877,550 |

|

|

|

1,950,243 |

|

|

|

1,817,997 |

|

|

|

1,848,883 |

|

Shareholders' equity |

|

|

247,746 |

|

|

|

214,519 |

|

|

|

206,756 |

|

|

|

195,634 |

|

|

|

181,161 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Average Balances |

|

2024 3rd

Qtr. |

|

|

2024 2nd

Qtr. |

|

|

2024 1st

Qtr. |

|

|

2023 4th

Qtr. |

|

|

2023 3rd

Qtr. |

|

(in thousands) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Loans |

|

$ |

1,460,033 |

|

|

$ |

1,435,966 |

|

|

$ |

1,412,569 |

|

|

$ |

1,359,643 |

|

|

$ |

1,278,421 |

|

Securities |

|

|

970,913 |

|

|

|

986,281 |

|

|

|

1,002,140 |

|

|

|

1,019,218 |

|

|

|

1,035,785 |

|

Other interest-earning assets |

|

|

108,019 |

|

|

|

80,280 |

|

|

|

64,064 |

|

|

|

92,635 |

|

|

|

128,704 |

|

Total earning assets (before allowance) |

|

|

2,538,965 |

|

|

|

2,502,527 |

|

|

|

2,478,773 |

|

|

|

2,471,496 |

|

|

|

2,442,910 |

|

Total assets |

|

|

2,685,190 |

|

|

|

2,647,716 |

|

|

|

2,621,009 |

|

|

|

2,589,541 |

|

|

|

2,568,240 |

|

Noninterest-bearing deposits |

|

|

519,511 |

|

|

|

516,308 |

|

|

|

506,175 |

|

|

|

546,778 |

|

|

|

540,497 |

|

Interest-bearing deposits |

|

|

1,634,255 |

|

|

|

1,601,020 |

|

|

|

1,599,509 |

|

|

|

1,565,493 |

|

|

|

1,550,591 |

|

Brokered deposits |

|

|

17,227 |

|

|

|

34,218 |

|

|

|

34,708 |

|

|

|

32,541 |

|

|

|

44,868 |

|

Total deposits |

|

|

2,170,993 |

|

|

|

2,151,546 |

|

|

|

2,140,392 |

|

|

|

2,144,812 |

|

|

|

2,135,956 |

|

Total subordinated debt |

|

|

35,658 |

|

|

|

35,596 |

|

|

|

35,535 |

|

|

|

35,474 |

|

|

|

35,413 |

|

Total borrowed funds |

|

|

210,000 |

|

|

|

210,000 |

|

|

|

214,835 |

|

|

|

185,707 |

|

|

|

181,739 |

|

Other interest-bearing liabilities |

|

|

11,756 |

|

|

|

26,426 |

|

|

|

18,399 |

|

|

|

25,729 |

|

|

|

20,480 |

|

Total interest-bearing liabilities |

|

|

1,908,896 |

|

|

|

1,907,260 |

|

|

|

1,902,986 |

|

|

|

1,844,944 |

|

|

|

1,833,091 |

|

Shareholders' equity |

|

|

237,875 |

|

|

|

210,742 |

|

|

|

200,177 |

|

|

|

187,099 |

|

|

|

181,219 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Loan Breakout (in thousands) |

|

2024 3rd

Qtr. |

|

|

2024 2nd

Qtr. |

|

|

2024 1st

Qtr. |

|

|

2023 4th

Qtr. |

|

|

2023 3rd

Qtr. |

|

Agricultural |

|

$ |

49,147 |

|

|

$ |

45,274 |

|

|

$ |

41,950 |

|

|

$ |

49,210 |

|

|

$ |

43,290 |

|

Commercial and Industrial |

|

|

229,232 |

|

|

|

224,031 |

|

|

|

231,222 |

|

|

|

229,915 |

|

|

|

222,357 |

|

Commercial Real Estate |

|

|

862,773 |

|

|

|

804,213 |

|

|

|

794,705 |

|

|

|

786,921 |

|

|

|

709,960 |

|

Consumer |

|

|

30,693 |

|

|

|

32,811 |

|

|

|

34,268 |

|

|

|

36,541 |

|

|

|

37,605 |

|

Construction Real Estate |

|

|

14,555 |

|

|

|

18,751 |

|

|

|

17,890 |

|

|

|

20,936 |

|

|

|

16,477 |

|

Residential Real Estate |

|

|

279,058 |

|

|

|

275,878 |

|

|

|

268,523 |

|

|

|

267,730 |

|

|

|

256,348 |

|

Loans to Other Financial Institutions |

|

|

38,492 |

|

|

|

36,569 |

|

|

|

30,032 |

|

|

|

19,400 |

|

|

|

23,763 |

|

Gross Loans (excluding held for sale) |

|

$ |

1,503,950 |

|

|

$ |

1,437,527 |

|

|

$ |

1,418,590 |

|

|

$ |

1,410,653 |

|

|

$ |

1,309,800 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Allowance for credit losses |

|

|

16,490 |

|

|

|

16,152 |

|

|

|

16,037 |

|

|

|

15,685 |

|

|

|

14,872 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Net loans |

|

$ |

1,487,460 |

|

|

$ |

1,421,375 |

|

|

$ |

1,402,553 |

|

|

$ |

1,394,968 |

|

|

$ |

1,294,928 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Performance Ratios |

|

2024 3rd

Qtr. |

|

|

2024 2nd

Qtr. |

|

|

2024 1st

Qtr. |

|

|

2023 4th

Qtr. |

|

|

2023 3rd

Qtr. |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Annualized return on average assets |

|

|

1.09 |

% |

|

|

0.99 |

% |

|

|

0.86 |

% |

|

|

0.82 |

% |

|

|

0.80 |

% |

Annualized return on average equity |

|

|

12.36 |

% |

|

|

12.50 |

% |

|

|

11.26 |

% |

|

|

11.32 |

% |

|

|

11.31 |

% |

Annualized return on average tangible common equity |

|

|

16.29 |

% |

|

|

17.22 |

% |

|

|

15.81 |

% |

|

|

16.40 |

% |

|

|

16.55 |

% |

Net interest margin (GAAP) |

|

|

3.17 |

% |

|

|

2.95 |

% |

|

|

2.67 |

% |

|

|

2.66 |

% |

|

|

2.64 |

% |

Net interest margin (fully tax-equivalent) |

|

|

3.23 |

% |

|

|

3.01 |

% |

|

|

2.74 |

% |

|

|

2.72 |

% |

|

|

2.70 |

% |

Efficiency ratio |

|

|

60.80 |

% |

|

|

61.47 |

% |

|

|

64.55 |

% |

|

|

65.31 |

% |

|

|

65.74 |

% |

Annualized cost of funds |

|

|

1.87 |

% |

|

|

1.92 |

% |

|

|

2.00 |

% |

|

|

1.91 |

% |

|

|

1.70 |

% |

Annualized cost of deposits |

|

|

1.53 |

% |

|

|

1.56 |

% |

|

|

1.65 |

% |

|

|

1.57 |

% |

|

|

1.36 |

% |

Cost of interest bearing liabilities |

|

|

2.38 |

% |

|

|

2.44 |

% |

|

|

2.53 |

% |

|

|

2.45 |

% |

|

|

2.18 |

% |

Shareholders' equity to total assets |

|

|

9.09 |

% |

|

|

8.18 |

% |

|

|

7.74 |

% |

|

|

7.59 |

% |

|

|

7.04 |

% |

Tangible common equity to tangible assets |

|

|

7.00 |

% |

|

|

5.98 |

% |

|

|

5.56 |

% |

|

|

5.32 |

% |

|

|

4.74 |

% |

Annualized noninterest expense to average assets |

|

|

2.30 |

% |

|

|

2.16 |

% |

|

|

2.09 |

% |

|

|

2.13 |

% |

|

|

2.14 |

% |

Loan to deposit |

|

|

68.38 |

% |

|

|

67.87 |

% |

|

|

65.17 |

% |

|

|

66.70 |

% |

|

|

61.65 |

% |

Full-time equivalent employees |

|

|

371 |

|

|

|

368 |

|

|

|

367 |

|

|

|

369 |

|

|

|

376 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Capital Ratios ChoiceOne Financial Services Inc. |

|

2024 3rd

Qtr. |

|

|

2024 2nd

Qtr. |

|

|

2024 1st

Qtr. |

|

|

2023 4th

Qtr. |

|

|

2023 3rd

Qtr. |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Total capital (to risk weighted assets) |

|

|

15.0 |

% |

|

|

13.5 |

% |

|

|

13.3 |

% |

|

|

13.0 |

% |

|

|

13.2 |

% |

Common equity Tier 1 capital (to risk weighted assets) |

|

|

12.3 |

% |

|

|

10.7 |

% |

|

|

10.5 |

% |

|

|

10.3 |

% |

|

|

10.4 |

% |

Tier 1 capital (to risk weighted assets) |

|

|

12.5 |

% |

|

|

10.9 |

% |

|

|

10.7 |

% |

|

|

10.5 |

% |

|

|

10.7 |

% |

Tier 1 capital (to average assets) |

|

|

9.0 |

% |

|

|

7.7 |

% |

|

|

7.6 |

% |

|

|

7.5 |

% |

|

|

7.4 |

% |

Commercial Real Estate Loans as a percentage of total capital |

|

|

193.3 |

% |

|

|

205.1 |

% |

|

|

206.8 |

% |

|

|

213.6 |

% |

|

|

186.3 |

% |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Capital Ratios ChoiceOne Bank |

|

2024 3rd

Qtr. |

|

|

2024 2nd

Qtr. |

|

|

2024 1st

Qtr. |

|

|

2023 4th

Qtr. |

|

|

2023 3rd

Qtr. |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Total capital (to risk weighted assets) |

|

|

13.1 |

% |

|

|

13.2 |

% |

|

|

12.6 |

% |

|

|

12.4 |

% |

|

|

12.7 |

% |

Common equity Tier 1 capital (to risk weighted assets) |

|

|

12.3 |

% |

|

|

12.5 |

% |

|

|

11.8 |

% |

|

|

11.8 |

% |

|

|

12.0 |

% |

Tier 1 capital (to risk weighted assets) |

|

|

12.3 |

% |

|

|

12.5 |

% |

|

|

11.8 |

% |

|

|

11.8 |

% |

|

|

12.0 |

% |

Tier 1 capital (to average assets) |

|

|

8.9 |

% |

|

|

8.8 |

% |

|

|

8.3 |

% |

|

|

8.4 |

% |

|

|

8.3 |

% |

Commercial Real Estate Loans as a percentage of total capital |

|

|

221.8 |

% |

|

|

208.9 |

% |

|

|

218.2 |

% |

|

|

222.9 |

% |

|

|

194.4 |

% |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Asset Quality |

|

2024 3rd

Qtr. |

|

|

2024 2nd

Qtr. |

|

|

2024 1st

Qtr. |

|

|

2023 4th

Qtr. |

|

|

2023 3rd

Qtr. |

|

(in thousands) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Net loan charge-offs (recoveries) |

|

$ |

87 |

|

|

$ |

157 |

|

|

$ |

51 |

|

|

$ |

120 |

|

|

$ |

148 |

|

Annualized net loan charge-offs (recoveries) to average loans |

|

|

0.02 |

% |

|

|

0.04 |

% |

|

|

0.01 |

% |

|

|

0.04 |

% |

|

|

0.05 |

% |

Allowance for credit losses |

|

$ |

16,490 |

|

|

$ |

16,152 |

|

|

$ |

16,037 |

|

|

$ |

15,685 |

|

|

$ |

14,872 |

|

Unfunded commitment liability |

|

$ |

1,485 |

|

|

$ |

1,485 |

|

|

$ |

1,757 |

|

|

$ |

2,160 |

|

|

$ |

2,718 |

|

Allowance to loans (excludes held for sale) |

|

|

1.10 |

% |

|

|

1.12 |

% |

|

|

1.13 |

% |

|

|

1.11 |

% |

|

|

1.14 |

% |

Total funds reserved to pay for loans (includes liability for unfunded commitments and excludes held for sale) |

|

|

1.20 |

% |

|

|

1.23 |

% |

|

|

1.25 |

% |

|

|

1.27 |

% |

|

|

1.34 |

% |

Non-Accruing loans |

|

$ |

2,355 |

|

|

$ |

2,086 |

|

|

$ |

1,715 |

|

|

$ |

1,723 |

|

|

$ |

1,670 |

|

Nonperforming loans (includes OREO) |

|

$ |

2,884 |

|

|

$ |

2,358 |

|

|

$ |

1,837 |

|

|

$ |

1,845 |

|

|

$ |

1,792 |

|

Nonperforming loans to total loans (excludes held for sale) |

|

|

0.19 |

% |

|

|

0.16 |

% |

|

|

0.13 |

% |

|

|

0.13 |

% |

|

|

0.14 |

% |

Nonperforming assets to total assets |

|

|

0.11 |

% |

|

|

0.09 |

% |

|

|

0.07 |

% |

|

|

0.07 |

% |

|

|

0.07 |

% |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

NON-GAAP Reconciliation |

|

2024 3rd

Qtr. |

|

|

2024 2nd

Qtr. |

|

|

2024 1st

Qtr. |

|

|

2023 4th

Qtr. |

|

|

2023 3rd

Qtr. |

|

Net interest income (tax-equivalent basis) (Non-GAAP) |

|

$ |

20,631 |

|

|

$ |

18,756 |

|

|

$ |

16,871 |

|

|

$ |

16,945 |

|

|

$ |

16,609 |

|

Net interest margin (fully tax-equivalent) |

|

|

3.23 |

% |

|

|

3.01 |

% |

|

|

2.74 |

% |

|

|

2.72 |

% |

|

|

2.70 |

% |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Reconciliation to Reported Net Interest Income |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Net interest income (tax-equivalent basis) (Non-GAAP) |

|

$ |

20,631 |

|

|

$ |

18,756 |

|

|

$ |

16,871 |

|

|

$ |

16,945 |

|

|

$ |

16,609 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Adjustment for taxable equivalent interest |

|

|

(383 |

) |

|

|

(385 |

) |

|

|

(397 |

) |

|

|

(390 |

) |

|

|

(383 |

) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Net interest income (GAAP) |

|

$ |

20,248 |

|

|

$ |

18,371 |

|

|

$ |

16,474 |

|

|

$ |

16,555 |

|

|

$ |

16,226 |

|

Net interest margin (GAAP) |

|

|

3.17 |

% |

|

|

2.95 |

% |

|

|

2.67 |

% |

|

|

2.66 |

% |

|

|

2.64 |

% |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Three Months Ended September 30, |

|

|

|

2024 |

|

|

2023 |

|

|

(Dollars in thousands) |

Average |

|

|

|

|

|

|

|

|

Average |

|

|

|

|

|

|

|

|

|

Balance |

|

|

Interest |

|

|

Rate |

|

|

Balance |

|

|

Interest |

|

|

Rate |

|

|

Assets: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Loans (1)(3)(4)(5) |

$ |

1,460,033 |

|

|

$ |

23,262 |

|

|

|

6.34 |

|

% |

$ |

1,278,421 |

|

|

$ |

17,779 |

|

|

|

5.52 |

|

% |

Taxable securities (2) |

|

681,578 |

|

|

|

5,563 |

|

|

|

3.25 |

|

|

|

741,287 |

|

|

|

5,345 |

|

|

|

2.86 |

|

|

Nontaxable securities (1) |

|

289,335 |

|

|

|

1,775 |

|

|

|

2.44 |

|

|

|

294,498 |

|

|

|

1,797 |

|

|

|

2.42 |

|

|

Other |

|

108,019 |

|

|

|

1,473 |

|

|

|

5.43 |

|

|

|

128,704 |

|

|

|

1,766 |

|

|

|

5.44 |

|

|

Interest-earning assets |

|

2,538,965 |

|

|

|

32,073 |

|

|

|

5.03 |

|

|

|

2,442,910 |

|

|

|

26,687 |

|

|

|

4.33 |

|

|

Noninterest-earning assets |

|

146,225 |

|

|

|

|

|

|

|

|

|

125,330 |

|

|

|

|

|

|

|

|

Total assets |

$ |

2,685,190 |

|

|

|

|

|

|

|

|

$ |

2,568,240 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Liabilities and Shareholders' Equity: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Interest-bearing demand deposits |

$ |

916,459 |

|

|

$ |

3,111 |

|

|

|

1.35 |

|

% |

$ |

856,485 |

|

|

$ |

2,885 |

|

|

|

1.34 |

|

% |

Savings deposits |

|

329,613 |

|

|

|

728 |

|

|

|

0.88 |

|

|

|

357,687 |

|

|

|

462 |

|

|

|

0.51 |

|

|

Certificates of deposit |

|

388,183 |

|

|

|

4,296 |

|

|

|

4.40 |

|

|

|

336,419 |

|

|

|

3,308 |

|

|

|

3.90 |

|

|

Brokered deposit |

|

17,227 |

|

|

|

227 |

|

|

|

5.25 |

|

|

|

44,868 |

|

|

|

582 |

|

|

|

5.15 |

|

|

Borrowings |

|

210,000 |

|

|

|

2,508 |

|

|

|

4.75 |

|

|

|

181,739 |

|

|

|

2,171 |

|

|

|

4.74 |

|

|

Subordinated debentures |

|

35,658 |

|

|

|

413 |

|

|

|

4.61 |

|

|

|

35,413 |

|

|

|

413 |

|

|

|

4.62 |

|

|

Other |

|

11,756 |

|

|

|

159 |

|

|

|

5.37 |

|

|

|

20,480 |

|

|

|

257 |

|

|

|

4.97 |

|

|

Interest-bearing liabilities |

|

1,908,896 |

|

|

|

11,442 |

|

|

|

2.38 |

|

|

|

1,833,091 |

|

|

|

10,078 |

|

|

|

2.18 |

|

|

Demand deposits |

|

519,511 |

|

|

|

|

|

|

|

|

|

540,497 |

|

|

|

|

|

|

|

|

Other noninterest-bearing liabilities |

|

18,908 |

|

|

|

|

|

|

|

|

|

13,433 |

|

|

|

|

|

|

|

|

Total liabilities |

|

2,447,315 |

|

|

|

|

|

|

|

|

|

2,387,021 |

|

|

|

|

|

|

|

|

Shareholders' equity |

|

237,875 |

|

|

|

|

|

|

|

|

|

181,219 |

|

|

|

|

|

|

|

|

Total liabilities and shareholders' equity |

$ |

2,685,190 |

|

|

|

|

|