Why Coinbase Stock Is Down 80% From Record Highs?

12 May 2022 - 8:50PM

Finscreener.org

Shares of cryptocurrency exchange

company, Coinbase (NASDAQ:

COIN) have declined by

80% from record highs. At the time of writing, the COIN stock is

down over 15% in early market trading on May 11, valuing the company at $17 billion by

market cap.

The price of COIN stock is tied

to the

performance of the cryptocurrency

market. In the last six

months, several digital assets have declined at an accelerated pace

driving shares of Coinbase lower in the process.

The company announced its Q1

results yesterday, after market hours, and

reported revenue

of $1.165 billion with an adjusted

loss of $1.98 per share. Comparatively, analysts forecast the

company to report revenue of $1.48 billion and earnings of $0.17

per share in the March quarter.

In the year-ago period, Coinbase

sales and earnings per share stood at $1.8 billion and $3.05

respectively.

Coinbase’s adjusted EBITDA also

slumped to $20 million in Q1, compared to $1.11 billion in the

prior-year quarter. We can see that the company’s earnings and

revenue miss in Q1 left investors unimpressed, resulting in the

sell-off of Coinbase stock.

What impacted Coinbase revenue in Q1?

Coinbase explained lower crypto

prices and volatility impacted its performance in Q1. In its

prospectus filed in 2021, it stated, “You can expect volatility in

our financials, given the price cycles of the cryptocurrency

industry. This doesn’t faze us, because we’ve always taken a

longterm perspective on crypto adoption. We may earn a profit when

revenues are high, and we may lose money when revenues are low, but

our goal is to roughly operate the company at break even, smoothed

out over time, for the time being. We are looking for long-term

investors who believe in our mission and will hold through price

cycles.”

The company’s MTU or monthly

transaction users fell sequentially to 9.2 million while total

trading volume stood at $309 billion. Coinbase ended Q1 of 2021

with 6.1 million MTUs but its trading volume was higher at $309

billion.

However, Coinbase continues to

focus on improving user acquisition and engagement rates with the

beta launch of an NFT marketplace, growing adoption of the Coinbase

wallet and expansion of staking offerings by onboarding major

cryptocurrencies such as Cardano.

Its subscription and services

revenue stood at $152 million, accounting for 13% of total sales.

Coinbase will aim to increase subscription sales as it will allow

the company to generate stable cash flows across business

cycles.

In its shareholder letter,

Coinbase emphasized its growing number of users has increased

engagement with its product portfolio. Around 54% of MTUs have

engaged with a non-investment product such as staking in

Q1.

Further, close to six million

users engaged with yield generation products in the quarter, up

from 3.6 million users in Q4 of 2021. Historically, the retention

levels of staking users have been much higher compared to users who

just trade on the Coinbase platform.

What next for COIN stock and investors?

Coinbase expects a prolonged and

stressful period for its business and forecasts an adjusted EBITDA

loss of $500 million in 2022. It estimates annual MTUs to range

between 5 million and 15 million with strong growth in its

subscription and services business.

Analysts expect Coinbase revenue

to fall by 20% year over year to $6.5 billion in 2022 while

adjusted earnings are forecast at $1.13 per share. However, if

crypto markets recover in the next year, Coinbase sales might rise

to $8 billion while adjusted earnings are estimated at $3.74 per

share.

So, Coinbase stock is valued at

2.1 times 2023 sales and a price to earnings multiple of 17x which

is quite attractive.

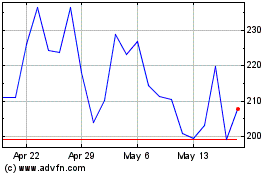

Coinbase Global (NASDAQ:COIN)

Historical Stock Chart

From Dec 2024 to Jan 2025

Coinbase Global (NASDAQ:COIN)

Historical Stock Chart

From Jan 2024 to Jan 2025