Crypto Stocks Gain After Judge Dismisses Part of SEC's Ripple Case

14 July 2023 - 4:16AM

Dow Jones News

By Dean Seal

Shares of companies in the cryptocurrency space are trading

higher after the crypto firm Ripple Labs won early dismissal of

some regulatory allegations related to its selling of $1.4 billion

worth of a digital token known as XRP.

Shares of Coinbase Global, operator of the largest U.S. crypto

exchange, are up 10% at $94.66 in midday trading. Shares of the

digital payments group Block were up 6.3% at $75.73. Bitcoin miner

Riot Platform's shares are 12% higher at $19.82. Fellow miner

Marathon Digital's shares are up 12% at $18.85.

A federal judge on Thursday sided with Ripple's argument that

roughly half of its sales of XRP, a token that Ripple founders

developed in 2012 to facilitate cross-border payments, didn't

constitute an illegal securities offering. Ripple has argued that

XRP isn't a security, contrary to claims by the Securities and

Exchange Commission.

The decision could be helpful to other cryptocurrency companies

that are fighting similar enforcement actions by the SEC. The Wall

Street regulator's case against Ripple has largely been seen as a

litmus test for the agency's authority in the crypto space.

Shares of crypto miners Cleanspark and Bit Digital were up 12%

each as well, at $7.38 and $4.36, respectively. Hut 8 Mining shares

have climbed 14% to $4.28. The stock of Iris Energy, a sustainable

bitcoin mining company, is up 12% at $7.80.

MicroStrategy, a business-intelligence software provider that

has built a large position in Bitcoin, saw its shares rise 5.7% to

$436.93.

Bitcoin, the largest crypto asset by market capitalization, is

up 1.7% at $30,820. Other major crypto assets are trading even

larger gains.

Write to Dean Seal at dean.seal@wsj.com

(END) Dow Jones Newswires

July 13, 2023 14:01 ET (18:01 GMT)

Copyright (c) 2023 Dow Jones & Company, Inc.

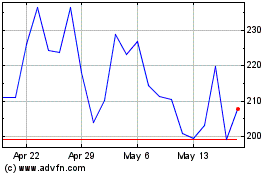

Coinbase Global (NASDAQ:COIN)

Historical Stock Chart

From Dec 2024 to Jan 2025

Coinbase Global (NASDAQ:COIN)

Historical Stock Chart

From Jan 2024 to Jan 2025