- Noventiq (LSE: NVIQ) is a leading provider of digital

transformation and cybersecurity solutions and services focused on

high-growth emerging markets

- The transaction values Noventiq at a pro-forma enterprise

value and pro-forma equity market cap of approximately $800 million

and $1 billion, respectively

- No minimum amount of equity or debt financing is required to

close the transaction

- Noventiq is on track to report record turnover of

approximately $1.5B in FY 2022, underpinned by an expanding

recurring revenue base and history of profitable growth

- Noventiq operates in almost 60 countries with deep local

expertise, connecting 75,000 customers and industry-leading

strategic partners including Microsoft, Amazon Web Services and

Google

- Noventiq continuously extends its portfolio with new service

offerings in domains including multi-cloud, software engineering

and integration, cyber security and artificial

intelligence

- Noventiq intends to de-list from the London Stock Exchange

and list on Nasdaq through the merger

Noventiq (LSE: NVIQ) (“Noventiq”), a global digital

transformation and cybersecurity solutions and services provider,

and Corner Growth Acquisition Corp. (Nasdaq: COOL) (“Corner

Growth”), a special purpose acquisition company led by veteran

technology investors (“Sponsors”), today announced they have

entered into a business combination agreement that is expected to

result in the combined company (“Combined Company”) being listed on

Nasdaq under the symbol “NVIQ”. The Combined Company will operate

under the same management team, including Hervé Tessler, Chief

Executive Officer, and Sergey Chernovolenko, President & Chief

Operating Officer, with current Noventiq shareholders rolling 100%

of their equity into the Combined Company.

This press release features multimedia. View

the full release here:

https://www.businesswire.com/news/home/20230504005627/en/

The proposed business combination (“Business Combination”) is

expected to provide Noventiq with improved access to new sources of

capital, accelerate M&A opportunities, and enhance its reach

and capabilities in fast-growing in-house technology development in

cyber security, generative-AI, and other high-margin products and

tools.

Hervé Tessler, CEO of Noventiq Group, said:

“Noventiq has an established history of delivering digital

transformation and cybersecurity solutions and services to high

growth markets. The backbone of our success is a highly

decentralized, expert team of thought leaders across the almost 60

countries we serve. As a responsible organisation, we believe that

it is our duty to create value not only for our shareholders but

also for our employees, customers, and technology partners. We are

proud to collaborate with the incredible team at Corner Growth on

this transaction and are confident that it will propel our efforts

globally and open a pathway for a broader set of public investors

to participate in our important work.”

Marvin Tien, Co-Chairman & CEO of Corner Growth,

said:

“Hervé, Sergey, and the impressive Noventiq management team are

leading the way in delivering digital success to growth markets,

leveraging best-in-breed technology partnerships and unrivaled

local expertise in the markets they serve. With our unique

relationships in the Asia-Pacific region and decades of

technology-driven investment experience, we believe we can help

deliver long-term value for all stakeholders in this

transaction.”

Noventiq Investment Highlights

- Leading enabler of digital success. Noventiq sits at the

heart of the $3.8 trillion digital transformation and cybersecurity

ecosystem.

- Global reach and focus on high growth emerging markets.

These growing markets represent a substantial total addressable

market (TAM) – estimated to grow at an approximately 9%CAGR from

$330 billion in 2020 to approximately $500 billion in 20251 – and

are underserved and historically difficult to penetrate. Noventiq’s

extensive global reach, coupled with a strong local presence and

recognized execution capability, uniquely positions it for success

in these markets.

- Strategic partnerships amplify growth strategy and widen

Noventiq’s competitive reach. Noventiq ranks as a premier

partner for the top public cloud companies globally, including

Microsoft – as well as other key technology players such as AWS and

Google. Noventiq has collaborated with Microsoft for over 25 years,

becoming a leading strategic partner in a large number of growing

markets, and is focused on continuing to expand its services

footprint, while also actively delivering other partners’

technologies as part of its portfolio of customer outcome-focused

solutions.

- Consolidator with track record of successful M&A. 14

companies acquired since 2020 including multiple transactions in

2022/2023, with a strategic approach towards geographic, portfolio

and sales channel expansion.

- Inclusive and diverse culture, industry leading talent and

unparalleled local expertise. Noventiq is a people-first and

customer-centric organization. Eighty-five percent of headcount is

customer facing and is led by a low-turnover, long-tenured

management team with deep experience in developing markets and

providing services to Fortune 500 global operations.

- New product lines and product categories on the horizon.

Significant organic growth opportunities in selling in-house

developed solutions like enterprise-grade smart assistants powered

by generative AI, Microsoft Azure OpenAI Service, and other

services and tools to new and existing customers. These are key

drivers in growing high-margin solutions through Noventiq’s land

and expand model.

Expanding recurring revenue base with history of profitable

growth

Noventiq is on track to report record revenue and gross profit

for the fiscal year ended March 31, 2023. As announced on February

28, 2023:

- Q3 2022 turnover was $398.8 million, an increase of 45% in USD,

and 57% in constant currency. For the nine months ended December

31, 2022, turnover was $1,089.9 million, an increase of 37% in USD,

and 49% in constant currency.

- Q3 YTD FY2022 turnover was close to the level of turnover

delivered for the whole of the prior year FY2021.

- Q3 2022 gross profit was $71.4 million, an increase of 75% in

USD, and 82% in constant currency. For the 9 months ended December

31, 2022, gross profit was $167.2 million, an increase of 65% in

USD, and 73% in constant currency.

- Q3 YTD FY2022 gross profit of $167.2 million was more than was

delivered for the whole of the prior year FY2021 ($146

million).

Transaction summary

Upon closing of the transaction, and assuming no stockholders of

Corner Growth redeem their shares, Noventiq will have $278M pro

forma cash on balance sheet, consisting of $112 million in

anticipated new financing proceeds and $191 million in existing

cash (as of 12/31/2022), less $25 million in transaction fees.

Existing Noventiq shareholders are expected to own 84.7% of the

fully diluted shares of the Combined Company, with public

stockholders of Corner Growth expected to own 10.6%, and the

Sponsors expected to own 4.7%.

The transaction, which has been approved unanimously by the

Boards of Directors of both Noventiq and Corner Growth, is subject

to approval by Corner Growth’s and Noventiq’s stockholders and

subject to other customary closing conditions, including the

receipt of certain regulatory approvals, and is expected to close

in the second half of 2023.

Additional information about the proposed transaction, including

a copy of the business combination agreement will be provided in a

Current Report on Form 8-K to be filed by Corner Growth with the

Securities and Exchange Commission (“SEC”) and will be available at

www.sec.gov.

Additional Information about the Transaction and Where to

Find It

In connection with the Business Combination, Corner Growth

intends to file with the SEC and Registration Statement on Form F-4

(the “Registration Statement”), which will include a preliminary

prospectus and preliminary proxy statement. Corner Growth will mail

a definitive proxy statement and other relevant documents to its

shareholders. This communication is not a substitute for the

Registration Statement, the definitive proxy statement or any other

document that Corner Growth will send to its shareholders in

connection with the Business Combination. Investors and security

holders of Corner Growth are advised to read, when available, the

proxy statement in connection with Corner Growth’s solicitation of

proxies for its special meeting of shareholders to be held to

approve the Business Combination (and related matters) because the

proxy statement will contain important information about the

Business Combination and the parties to the Business Combination.

The definitive proxy statement will be mailed to shareholders of

Corner Growth as of a record date to be established for voting on

the Business Combination. Shareholders will also be able to obtain

copies of the proxy statement, without charge, once available, at

the SEC’s website www.sec.gov or by directing a request to:

ryan.flanagan@icrinc.com.

Participants in the Solicitation

Corner Growth, Noventiq and their respective directors,

executive officers, other members of management, and employees,

under SEC rules, may be deemed to be participants in the

solicitation of proxies of Corner Growth’s shareholders in

connection with the Business Combination. Investors and security

holders may obtain more detailed information regarding the names

and interests in the Business Combination of Corner Growth’s

directors and officers in Corner Growth’s filings with the SEC

including the Registration Statement to be filed with the SEC by

Corner Growth, which will include the proxy statement Corner Growth

for the Business Combination, and such information and names of

Noventiq’s directors and executive officers will also be in the

Registration Statement filed with the SEC by Corner Growth, which

will include the proxy statement of Corner Growth for the Business

Combination.

About Noventiq

Noventiq is a leading global solutions and services provider in

digital transformation and cybersecurity, headquartered in London.

Noventiq enables, facilitates and accelerates the digital

transformation of its customers' businesses, connecting over 75,000

organisations from all industries with hundreds of best-in-class IT

vendors, and delivering its own services and solutions.

Noventiq delivered a turnover of approximately US$1.1 billion in

the fiscal year of 2021. Noventiq’s c. 6,400 employees work in

almost 60 countries throughout Asia, Latin America, Europe, The

Middle East and Africa – with a focus on markets with significant

growth potential.

Additional information about Noventiq can be found here:

https://noventiq.com/investor-relations

About Corner Growth Acquisition Corp.

Corner Growth Acquisition Corp. (Nasdaq: COOL) is a special

purpose acquisition company (SPAC) focused on partnering with a

high growth technology company. Corner Growth’s mission is to

deliver value to its investors by providing a compelling

alternative to a traditional public offering. Corner Growth is

uniquely positioned to deliver on its value-add approach given its

management team’s history, experience, relationships, leadership

and track record in identifying and investing in disruptive

technology companies across all technology verticals.

Corner Growth also brings a group of highly respected investment

professionals, with strong track records and deep individual

experience in SPAC and de-SPAC processes, a rolodex of premier

public market investors, and a team of advisors who offer

experience and access to networks across a broad functional and

physical geography.

Forward Looking Statements

Certain statements made herein that are not historical facts are

forward-looking statements for purposes of the safe harbor

provisions under The Private Securities Litigation Reform Act of

1995. Forward-looking statements generally are accompanied by words

such as “believe,” “may,” “will,” “estimate,” “continue,”

“anticipate,” “intend,” “expect,” “should,” “would,” “plan,”

“predict,” “potential,” “seem,” “seek,” “future,” “outlook” and

similar expressions that predict or indicate future events or

trends or that are not statements of historical matters. These

forward-looking statements include, but are not limited to,

statements regarding future events, the Business Combination

between Corner Growth and Noventiq, the estimated or anticipated

future results and benefits of the Combined Company following the

Business Combination, including the likelihood and ability of the

parties to successfully consummate the Business Combination, future

opportunities for the Combined Company, and other statements that

are not historical facts. These statements are based on the current

expectations of Corner Growth’s management and are not predictions

of actual performance. These forward-looking statements are

provided for illustrative purposes only and are not intended to

serve as, and must not be relied on, by any investor as a

guarantee, an assurance, a prediction or a definitive statement of

fact or probability. Actual events and circumstances are difficult

or impossible to predict and will differ from assumptions. Many

actual events and circumstances are beyond the control of Corner

Growth and Noventiq. These statements are subject to a number of

risks and uncertainties regarding Corner Growth’s businesses and

the Business Combination, and actual results may differ materially.

These risks and uncertainties include, but are not limited to,

general economic, political and business conditions; the inability

of the parties to consummate the Business Combination or the

occurrence of any event, change or other circumstances that could

give rise to the termination of the Business Combination Agreement;

the outcome of any legal proceedings that may be instituted against

the parties following the announcement of the Business Combination;

the receipt of an unsolicited offer from another party for an

alternative business transaction that could interfere with the

Business Combination; the risk that the approval of the

shareholders of Corner Growth or Noventiq for the potential

transaction is not obtained; failure to realize the anticipated

benefits of the Business Combination, including as a result of a

delay in consummating the potential transaction or difficulty in

integrating the businesses of Corner Growth or Novenitq; the risk

that the Business Combination disrupts current plans and operations

as a result of the announcement and consummation of the Business

Combination; the ability of the Combined Company to grow and manage

growth profitably and retain its key employees; the amount of

redemption requests made by Corner Growth’s shareholders; the

inability to obtain or maintain the listing of the post-acquisition

company’s securities on Nasdaq following the Business Combination;

costs related to the Business Combination; and those factors

discussed in Corner Growth’s Annual Report on Form 10-K for the

fiscal year ended December 31, 2020, filed with the SEC on March

31, 2021, in Corner Growth’s Annual Report on Form 10-K for the

fiscal year ended December 31, 2022, filed with the SEC on March

31, 2023, and other filings with the SEC. If any of these risks

materialize or if assumptions prove incorrect, actual results could

differ materially from the results implied by these forward-looking

statements. There may be additional risks that Corner Growth

presently does not know or that Corner Growth currently believes

are immaterial that could also cause actual results to differ from

those contained in the forward-looking statements. In addition,

forward-looking statements provide Corner Growth’s expectations,

plans or forecasts of future events and views as of the date of

this communication. Corner Growth anticipates that subsequent

events and developments will cause Corner Growth’s assessments to

change. However, while Corner Growth may elect to update these

forward-looking statements at some point in the future, Corner

Growth specifically disclaims any obligation to do so. These

forward-looking statements should not be relied upon as

representing Corner Growth’s assessments as of any date subsequent

to the date of this communication. Accordingly, undue reliance

should not be placed upon the forward-looking statements.

Disclaimer

This release shall neither constitute an offer to sell or the

solicitation of an offer to buy any securities, nor shall there be

any sale of securities in any jurisdiction in which the offer,

solicitation or sale would be unlawful prior to the registration or

qualification under the securities laws of any such

jurisdiction.

The unaudited estimated financial results for Noventiq included

in this release are preliminary and subject to revision based upon

the completion of Noventiq’s fiscal year-end audit. As a result,

Noventiq’s actual results for the fiscal year ended March 31, 2023

may differ materially from the estimated preliminary unaudited

financial results upon the completion of the Noventiq’s financial

closing procedures, as a result of the fiscal year-end audit, or

upon occurrence of other developments that may arise prior to the

time its financial results are finalized. Additional information

and disclosures would be required for a more complete understanding

of Noventiq’s financial position and results of operations as of,

and for the fiscal year ended, March 31, 2023.

1 AMR International (now STAX).

View source

version on businesswire.com: https://www.businesswire.com/news/home/20230504005627/en/

Noventiq Contacts

Investors: Steven Salter Global Investor Relations VP

IR@noventiq.com

Media: Rocio Herraiz Global Head of Communications

pr@noventiq.com

Corner Growth Contacts

Investors: Ryan Flanagan, ICR

ryan.flanagan@icrinc.com

Media: Brian Ruby, ICR Brian.ruby@icrinc.com

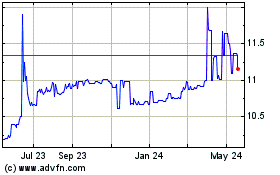

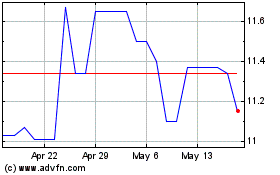

Corner Growth Acquisition (NASDAQ:COOL)

Historical Stock Chart

From Feb 2025 to Mar 2025

Corner Growth Acquisition (NASDAQ:COOL)

Historical Stock Chart

From Mar 2024 to Mar 2025