Form DEFA14A - Additional definitive proxy soliciting materials and Rule 14(a)(12) material

30 July 2024 - 6:10AM

Edgar (US Regulatory)

UNITED STATES

SECURITIES AND EXCHANGE

COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

Proxy Statement Pursuant to

Section 14(a) of the Securities Exchange Act of 1934

(Amendment No. )

Filed by the Registrant ☒

Filed by a Party other than the Registrant ☐

Check the appropriate box:

| ☐ | Preliminary Proxy Statement |

| ☐ | Confidential,

for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

| ☐ | Definitive Proxy Statement |

| ☐ | Definitive Additional Materials |

| ☒ | Soliciting Material under § 240.14a-12 |

CEPTON, INC.

(Name of Registrant

as Specified in Its Charter)

(Name of Person(s) Filing Proxy Statement, if other than the Registrant)

Payment of Filing Fee (Check the appropriate box):

| ☐ | Fee paid previously with preliminary materials. |

| ☐ | Fee computed on table below per Exchange Act Rules 14a-6(i)(1)

and 0-11. |

Dear Employees of Cepton,

We are pleased to announce that Cepton has signed a definitive agreement

to be acquired by Koito, an event that marks the culmination of seven years of partnership and underscores our commitment to developing

and commercializing next-generation sensor technologies.

Koito shares Cepton’s goal to make LiDAR mainstream and supports

its focus on developing best-in-class, scalable and intelligent 3D imaging solutions for various industries. Through our years of partnership

and close collaboration, Koito has come to intimately understand and appreciate Cepton’s LiDAR innovation and our uncompromising

drive to raise industry standards with our next-generation products. In less than a decade, Cepton has established itself as a leading

player in the global LiDAR-based solutions market, and we are confident that this proposed transaction will enhance our combined position

globally and open the door to many more years of success at the forefront of LiDAR-based technology.

Together, Koito and Cepton will continue to collaborate on developing

integrated solutions and leverage the unique expertise of our employees to continue securing industry-leading production awards. Our joint

efforts will help us to lead the way in driving safer, more efficient transportation and unparalleled automotive safety. As demand for

high performance, reliable and affordable LiDAR solutions accelerates, Koito will employ its large-scale manufacturing capabilities to

ensure that Cepton’s LiDAR systems can be efficiently produced at scale. Koito looks forward to capitalizing on its global presence

and established relationships with major OEMs to maximize the adoption of Cepton’s technology in the automotive industry.

Until the closing, which is expected to be by early 2025 and is subject

to shareholder approval and the satisfaction of applicable closing conditions, Koito and Cepton will continue to operate as separate entities.

Koito believes the proposed transaction marks the beginning of a new era in its history, and Koito is delighted to welcome Cepton to its

group. We will share more information on the transaction as we are permitted. In the meantime, please continue with your work as you would

normally. We would like to emphasize our sincere appreciation for your cooperation during this time.

Jun Pei, PhD

CEO, Cepton Inc.

Additional Information About the Merger and Where to Find It

This communication relates to the proposed transaction (the “Transaction”)

involving Cepton, Inc. (the “Company”) and KOITO MANUFACTURING CO., LTD (“Parent”). In connection with

the proposed Transaction, the Company intends to file relevant materials with the SEC, including a proxy statement on Schedule 14A (the

“Proxy Statement”) and a transaction statement on Schedule 13E-3 (the “Schedule 13E-3”). The Proxy

Statement will contain important information about the proposed Transaction and related matters. This communication is not a substitute

for the Proxy Statement, the Schedule 13E-3 or any other document that the Company may file with the SEC or send to its stockholders in

connection with proposed Transaction. BEFORE MAKING ANY VOTING OR INVESTMENT DECISION WITH RESPECT TO THE PROPOSED TRANSACTION, STOCKHOLDERS

OF THE COMPANY ARE URGED TO READ THE PROXY STATEMENT REGARDING THE PROPOSED TRANSACTION (INCLUDING ANY AMENDMENTS OR SUPPLEMENTS THERETO),

SCHEDULE 13E-3 AND OTHER RELEVANT MATERIALS CAREFULLY AND IN THEIR ENTIRETY WHEN THEY BECOME AVAILABLE BECAUSE THEY WILL CONTAIN IMPORTANT

INFORMATION ABOUT THE COMPANY AND THE PROPOSED TRANSACTION. The Proxy Statement (any amendments or supplements thereto), Schedule

13E-3 and other relevant materials, and any other documents filed by the Company with the SEC, may be obtained once such documents are

filed with the SEC free of charge on the SEC’s website at www.sec.gov or free of charge from the Company on the Company’s

investor relation’s website at www.https://investors.cepton.com.

Participants in the Solicitation

The Company and its executive officers and directors and certain other

members of management and employees may, under the rules of the SEC, be deemed to be “participants” in the solicitation of

proxies in connection with the proposed Transaction. Information about the directors and executive officers of the Company and their ownership

of the Company’s common stock is set forth in the definitive proxy statement for the Company’s 2024 Annual Meeting of Stockholders,

which was filed with the SEC on May 15, 2024, or its Annual Report on Form 10-K for the year ended December 31, 2023, and in other documents

filed by the Company with the SEC. Other information regarding the participants in the proxy solicitation and a description of their direct

and indirect interests, by security holdings or otherwise, will be contained in the Proxy Statement and other relevant materials to be

filed with the SEC in respect of the proposed Transaction when they become available. Free copies of the Proxy Statement and such other

materials may be obtained as described in the preceding paragraph.

Forward-Looking Statements Safe Harbor

This email communication includes forward-looking statements, within

the meaning of the “safe harbor” provisions of the United States Private Securities Litigation Reform Act of 1995, including

without limitation, the Company’s expectations, plans and opinion regarding the proposed Transaction. Forward-looking statements

can be identified by words such as “estimate,” “objective,” “plan,” “project,” “forecast,”

“intend,” “aim,” “will,” “expect,” “anticipate,” “believe,” “seek,”

“target,” “milestone,” “designed to,” “proposed” or other similar expressions that predict

or imply future events, trends, terms, and/or conditions or that are not statements of historical fact. The Company cautions readers of

this email communication that these forward-looking statements are subject to risks and uncertainties, most of which are difficult to

predict and many of which are beyond the Company’s control, that could cause the actual results to differ materially from the expected

results. These forward-looking statements include, but are not limited to: (i) the occurrence of any event, change or other circumstances

that could give rise to the termination of the Merger Agreement between the parties to the proposed Transaction; (ii) the failure to obtain

the approval of the proposed Transaction from the Company’s stockholders, (iii) the failure to obtain certain regulatory approvals

or the failure to satisfy any of the other closing conditions to the completion of the proposed Transaction within the expected timeframes

or at all; (iv) risks related to disruption of management’s attention from the Company’s ongoing business operations due to

the proposed Transaction; (v) the effect of the announcement of the proposed Transaction on the ability of the Company to retain and hire

key personnel and maintain relationships with its customers, suppliers and others with whom it does business, or on its operating results

and business generally; (vi) uncertain global macro-economic and political conditions; and (vii) other risks listed from time to time

in the Company’s filings with the SEC. These forward-looking statements should not be relied upon as representing the Company’s

assessments as of any date subsequent to the date of this email communication. Accordingly, undue reliance should not be placed upon the

forward-looking statements. All forward-looking statements speak only as of the date hereof. The Company undertakes no obligation to update

any forward-looking statement to reflect events or circumstances after the date on which the statement is made or to reflect the occurrence

of unanticipated events. The Company does not intend or undertake, and expressly disclaims, any duty or obligation to publicly update

any forward-looking statements to reflect events, circumstances or new information after the date of this email communication, or to reflect

the occurrence of unanticipated events.

2

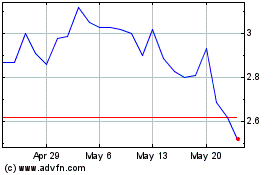

Cepton (NASDAQ:CPTN)

Historical Stock Chart

From Jun 2024 to Jul 2024

Cepton (NASDAQ:CPTN)

Historical Stock Chart

From Jul 2023 to Jul 2024