Cricut, Inc. (“Cricut”) (NASDAQ: CRCT), the creative technology

company that has brought a connected platform for making to

millions of users worldwide, today announced financial results for

its first quarter ended March 31, 2023.

“Despite softer than expected Q1 results, we are

very encouraged by our subscriptions revenue growth which increased

16% year over year and 6% quarter over quarter. The Cricut platform

now has over 8.2 million total users, up 19% over Q1 last year. We

saw 3.7 million users, or 45% of total users, cut a project at

least once within the first quarter. This creates a tremendous

opportunity for us to build deeper user engagement on our platform.

Our goal is to bring a majority of our users into Design Space

monthly to be inspired,” said Ashish Arora, Chief Executive Officer

of Cricut. “Our international growth efforts are seeing material

traction demonstrated by the milestone that we just crossed over

1.1 million international users outside of North America as of the

end of Q1.”

First Quarter 2023 Financial

Results

- Revenue was $181.2

million, down 26% from Q1 2022.

- Connected machine

revenue was $34.1 million, down 45% from Q1 2022.

- Subscriptions

revenue was $75.1 million, up 16% over Q1 2022.

- Accessories and

materials revenue was $72.0 million, down 39% from Q1 2022.

- International

revenue decreased by 8% over Q1 2022 and was 18% of total revenue,

up from 15% of total revenue in Q1 2022.

- Gross margin was

42.3%, up from 40.5% in Q1 2022.

- Operating income

was $10.5 million, or 5.8% of total revenue or 10.5% excluding an

$8.6 million inventory write-down and related tax effect, compared

to $31.4 million, or 12.8% of revenue in Q1 2022.

- Net income was $9.1

million, or 5.0% of revenue, and included an $8.6 million inventory

write-down. Net income in Q1 2022 was $23.5 million, or 9.6% of

revenue.

- Diluted earnings

per share was $0.04 or $0.07 excluding the inventory write-down and

related tax effect, down from $0.11 per share in Q1 2022.

- Generated $95.2

million in Cash from Operations at the end of Q1 2023. Used $3.2

million of cash to repurchase 347 thousand shares of our common

stock and $75.5 million to pay a special shareholder dividend.

"We delivered our 17th consecutive quarter of

positive net income and continue to generate healthy cash flow on

an annual basis. For the quarter, we generated $95.2 million in

cash from operations, ending with a balance of $307.3 million and

we continue to remain debt free. As part of the Company’s ongoing

evaluation of capital allocation, we seek to balance multiple

considerations, including ensuring that the Company has more than

adequate liquidity and financial flexibility, evaluating

opportunities to invest in our business to drive long-term

shareholder returns (organically or through potential acquisitions)

and returning capital to our shareholders. During the quarter,

we used $3.2 million of cash to repurchase 347 thousand shares of

our stock. In addition, in Q1 we used $75.5 million to pay a

special shareholder dividend,” said Kimball Shill, Chief Financial

Officer of Cricut. “We remain committed to our long-term

operating margin targets of 15-19%. Our proven model

has demonstrated that when we operate at scale and drive

top line growth, these margins are achievable.”

Recent Business Highlights

- Total user base

grew to over 8.2 million, or 19% year over year. This includes 1.1

million international users outside of North America, a major

milestone that reflects growth from continued investments in global

markets.

- As of the end of Q1

2023, there were 3.7 million engaged users cutting on the Cricut

platform in the past 90 days, or 45% of our total user base.

- Paid subscribers

grew to over 2.7 million by the end of Q1, up 17% year over year,

with steady attach rate of 33%.

- Our Contributing

Artists Program (CAP) continues to expand. The program includes

diverse artists from around the world and represents an

increasingly significant portion of new images on Design

Space.

- Launched new

exclusive Cricut Access feature, Warp, which enables creative

effects on any text object. Over 50% of projects made on our

platform contain text, making Warp a highly valuable tool for many

Paid Subscribers.

Key Performance Metrics

| |

As of March 31, |

| |

2023 |

|

2022 |

|

Users (in thousands) |

8,239 |

|

|

6,904 |

|

| Percentage of Users Creating

in Trailing 90 Days |

45 |

% |

|

54 |

% |

| Paid Subscribers (in

thousands) |

2,715 |

|

|

2,311 |

|

| |

Three Months Ended March 31, |

| |

2023 |

2022 |

|

Subscription ARPU |

$ |

9.31 |

|

$ |

9.73 |

| Accessories and Materials

ARPU |

$ |

8.93 |

|

$ |

17.67 |

| |

|

|

|

|

|

Webcast and Conference Call

Information

Cricut management will host a conference call

and webcast to discuss the results today, Tuesday, May 9, 2023

at 3:00 p.m. Mountain Time (5:00 p.m. Eastern Time). Information

about Cricut’s financial results, including a link to the live and

archived webcast of the conference call, will be made available on

Cricut’s investor relations website at

https://investor.cricut.com/.

The live call may also be accessed via

telephone. Please pre-register using this link:

https://register.vevent.com/register/BIcad720d3a0c148d584555fdf3dc6ebd2.

After registering, a confirmation will be sent via email and will

include dial-in details and a unique PIN code for entry to the

call. To avoid long wait times, we suggest registering at minimum

15 minutes before the start of the call to receive your unique PIN

code.

About Cricut, Inc.

Cricut, Inc. is a creative technology platform

company whose cutting machines and design software help people lead

creative lives. Cricut hardware and software work together as a

connected platform for consumers to make beautiful, high-quality

DIY projects quickly and easily. These industry-leading products

include a flagship line of smart cutting machines — the Cricut

Maker® family, the Cricut Explore® family, and Cricut Joy® —

accompanied by other unique tools like Cricut EasyPress®, the

Infusible Ink™ system, and a diverse collection of materials. In

addition to providing tools and materials, Cricut fosters a

thriving community of millions of dedicated users worldwide.

Cricut has used, and intends to continue using,

its investor relations website and the Cricut News Blog

(https://cricut.com/blog/news/) to disclose material non-public

information and to comply with its disclosure obligations under

Regulation FD. Accordingly, you should monitor our investor

relations website and the Cricut News Blog in addition to following

our press releases, SEC filings and public conference calls and

webcasts.

Media Contact:Kriselle Laranpr@cricut.com

Investor Contact:Jim

Suvainvestors@cricut.comSource: Cricut, Inc.

Key Performance Metrics

In addition to the measures presented in our

consolidated financial statements, we use the following key

business metrics to help us evaluate our business, identify trends

affecting our business, formulate business plans and make strategic

decisions. We believe these metrics are useful to investors because

they can help in monitoring the long-term health of our business.

Our determination and presentation of these metrics may differ from

that of other companies. The presentation of these metrics is meant

to be considered in addition to, not as a substitute for or in

isolation from, our financial measures prepared in accordance with

GAAP.

Glossary of Terms

Users: We define a User as a

registered user of at least one registered connected machine as of

the end of a period. One user may own multiple registered connected

machines, but is only counted once if that user registers those

connected machines by using the same email address.

Engaged Users: We define the

Engaged Users as users who have used a connected machine for any

activity, such as cutting, writing or any other activity enabled by

our connected machines, in the past 90 days.

Percentage of Users Creating in Trailing

90 Days: We define the Percentage of Users Creating in

Trailing 90 Days (Engaged Users) as the percentage of users who

have used a connected machine for any activity, such as cutting,

writing or any other activity enabled by our connected machines, in

the past 90 days. We calculate the percentage by dividing the

number of Engaged Users in the period by the total user base.

Paid Subscribers: We define

Paid Subscribers as the number of users with a subscription to

Cricut Access or Cricut Access Premium, excluding cancelled, unpaid

or free trial subscriptions, as of the end of a period.

Subscription ARPU: We define

Subscription ARPU as Subscriptions revenue divided by average users

in a period.

Accessories and Materials ARPU:

We define Accessories and Materials ARPU as Accessories and

Materials revenue divided by average users in a period. Accessories

and Materials ARPU fluctuates over time as we introduce new

accessories and materials at various price points and as the volume

and mix of accessories and materials purchased changes.

Cautionary Statement Regarding Forward

Looking Statements

This press release contains “forward-looking

statements” within the meaning of Section 27A of the Securities Act

of 1933 as amended (the “Act”), and Section 21E of the Securities

Exchange Act of 1934, as amended (the “Exchange Act”). These

statements include, but are not limited to, quotations from

management, business outlook, strategies, market size and growth

opportunities. Forward-looking statements generally can be

identified by the fact that they do not relate strictly to

historical or current facts and by the use of forward-looking words

such as “anticipates,” “believes,” “targets,” “potential,”

“estimates,” “expects,” “intends,” “plans,” “projects,” “may” or

similar terminology. In particular, statements, express or implied,

concerning future actions, conditions or events, future results of

operations or the ability to generate revenues, income or cash flow

are forward-looking statements. These statements are based on and

reflect our current expectations, estimates, assumptions and/ or

projections and our perception of historical trends and current

conditions, as well as other factors that we believe are

appropriate and reasonable under the circumstances. Forward-looking

statements are neither predictions nor guarantees of future events,

circumstances or performance and are inherently subject to known

and unknown risks, uncertainties and assumptions, many of which are

beyond our control, that could cause our actual results to differ

materially from those indicated by those statements. There can be

no assurance that our expectations, estimates, assumptions and/or

projections will prove to be correct or that any of our

expectations, estimates or projections will be achieved. The

forward-looking statements included in this press release are only

made as of the date indicated on the relevant materials and are

based on our estimates and opinions at the time the statements are

made. We disclaim any obligation to publicly update any

forward-looking statement to reflect subsequent events or

circumstances or changes in opinion, except as required by law.

Numerous factors could cause our actual results

and events to differ materially from those expressed or implied by

forward-looking statements including, but not limited to, risks and

uncertainties associated with: our ability to attract and engage

with our users; competitive risks; supply chain, manufacturing,

distribution and fulfillment risks; international risks, including

regulation and tariffs that have materially increased our costs and

the potential for further trade barriers or disruptions; sales and

marketing risks, including our dependence on sales to

brick-and-mortar and online retail partners and our need to

continue to grow online sales; risks relating to the complexity of

our business, which includes connected machines, custom tools,

hundreds of materials, design apps, e-commerce software,

subscriptions, content, international production, direct sales and

retail distribution; risks related to product quality, safety and

warranty claims and returns; risks related to the fluctuation of

our quarterly results of operations and other operating metrics;

risks related to intellectual property, cybersecurity and potential

data breaches; risks related to our dependence on our Chief

Executive Officer; risks related to our status as a “controlled

company”; and the impact of economic and geopolitical events,

natural disasters and actual or threatened public health

emergencies, current recessionary pressures and any resulting

economic slowdown from any of these events, or other resulting

interruption to our operations. These risks and uncertainties are

described in greater detail under the heading “Risk Factors” in the

most recent form 10-K that we have filed with the Securities and

Exchange Commission (“SEC”).

|

Cricut, Inc. |

|

Condensed Consolidated Statements of Operations and

Comprehensive Income |

|

(unaudited) |

|

(in thousands, except share and per share

amounts) |

| |

Three Months Ended March 31, |

| |

2023 |

|

2022 |

| Revenue: |

|

|

|

|

Connected machines |

$ |

34,131 |

|

$ |

62,391 |

|

|

Subscriptions |

|

75,083 |

|

|

64,778 |

|

|

Accessories and materials |

|

72,013 |

|

|

117,614 |

|

|

Total revenue |

|

181,227 |

|

|

244,783 |

|

| Cost of revenue: |

|

|

|

|

Connected machines |

|

33,066 |

|

|

60,713 |

|

|

Subscriptions |

|

7,631 |

|

|

6,252 |

|

|

Accessories and materials |

|

63,864 |

|

|

78,798 |

|

|

Total cost of revenue |

|

104,561 |

|

|

145,763 |

|

| Gross profit |

|

76,666 |

|

|

99,020 |

|

| Operating expenses: |

|

|

|

|

Research and development |

|

17,801 |

|

|

20,530 |

|

|

Sales and marketing |

|

29,616 |

|

|

32,789 |

|

|

General and administrative |

|

18,720 |

|

|

14,294 |

|

|

Total operating expenses |

|

66,137 |

|

|

67,613 |

|

| Income from operations |

|

10,529 |

|

|

31,407 |

|

| Total other income (expense),

net |

|

2,315 |

|

|

(39 |

) |

| Income before provision for

income taxes |

|

12,844 |

|

|

31,368 |

|

| Provision for income taxes |

|

3,745 |

|

|

7,864 |

|

| Net income |

$ |

9,099 |

|

$ |

23,504 |

|

| Other comprehensive income

(loss): |

|

|

|

|

Change in net unrealized gains on marketable securities, net of

tax |

$ |

188 |

|

$ |

— |

|

|

Change in foreign currency translation adjustment, net of tax |

|

18 |

|

|

(12 |

) |

| Comprehensive income |

$ |

9,305 |

|

$ |

23,492 |

|

| Earnings per share, basic |

$ |

0.04 |

|

$ |

0.11 |

|

| Earnings per share, diluted |

$ |

0.04 |

|

$ |

0.11 |

|

| Weighted-average common shares

outstanding, basic |

|

215,587,699 |

|

|

212,403,383 |

|

| Weighted-average common shares

outstanding, diluted |

|

218,749,255 |

|

|

220,967,935 |

|

|

Cricut, Inc. |

|

Condensed Consolidated Balance Sheets |

|

(in thousands, except share and per share

amounts) |

| |

| |

As of March 31,2023 |

|

As of December 31,2022 |

| |

(unaudited) |

|

|

| Assets |

|

|

|

| Current assets: |

|

|

|

|

Cash and cash equivalents |

$ |

232,321 |

|

|

$ |

224,943 |

|

|

Marketable securities |

|

75,011 |

|

|

|

74,256 |

|

|

Accounts receivable, net |

|

90,391 |

|

|

|

136,539 |

|

|

Inventories |

|

293,696 |

|

|

|

351,682 |

|

|

Prepaid expenses and other current assets |

|

15,629 |

|

|

|

23,842 |

|

|

Total current assets |

|

707,048 |

|

|

|

811,262 |

|

|

Property and equipment, net |

|

61,165 |

|

|

|

63,407 |

|

|

Operating lease right-of-use asset |

|

15,843 |

|

|

|

17,078 |

|

|

Intangible assets, net |

|

570 |

|

|

|

760 |

|

|

Deferred tax assets |

|

27,066 |

|

|

|

23,819 |

|

|

Other assets |

|

34,747 |

|

|

|

33,301 |

|

|

Total assets |

$ |

846,439 |

|

|

$ |

949,627 |

|

| Liabilities and

Stockholders’ Equity |

|

|

|

| Current liabilities: |

|

|

|

|

Accounts payable |

$ |

38,454 |

|

|

$ |

63,195 |

|

|

Accrued expenses and other current liabilities |

|

47,014 |

|

|

|

69,775 |

|

|

Deferred revenue, current portion |

|

38,556 |

|

|

|

34,869 |

|

|

Operating lease liabilities, current portion |

|

5,474 |

|

|

|

5,436 |

|

|

Dividends payable, current portion |

|

984 |

|

|

|

80,781 |

|

|

Total current liabilities |

|

130,482 |

|

|

|

254,056 |

|

|

Operating lease liabilities, net of current portion |

|

12,554 |

|

|

|

13,935 |

|

|

Deferred revenue, net of current portion |

|

3,220 |

|

|

|

3,789 |

|

|

Other non-current liabilities |

|

6,020 |

|

|

|

5,112 |

|

|

Total liabilities |

|

152,276 |

|

|

|

276,892 |

|

| Commitments and contingencies

(Note 11) |

|

|

|

| Stockholders’ equity: |

|

|

|

|

Preferred stock, par value $0.001 per share, 100,000,000 shares

authorized, no shares issued and outstanding as of March 31,

2023 and December 31, 2022. |

|

— |

|

|

|

— |

|

|

Common stock, par value $0.001 per share, 1,250,000,000 shares

authorized as of March 31, 2023, 219,249,653 shares issued and

outstanding as of March 31, 2023; 1,250,000,000 shares

authorized as of December 31, 2022, 219,656,587 shares issued

and outstanding as of December 31, 2022. |

|

219 |

|

|

|

220 |

|

|

Additional paid-in capital |

|

685,114 |

|

|

|

672,990 |

|

|

Retained earnings (accumulated deficit) |

|

9,099 |

|

|

|

— |

|

|

Accumulated other comprehensive loss |

|

(269 |

) |

|

|

(475 |

) |

|

Total stockholders’ equity |

|

694,163 |

|

|

|

672,735 |

|

|

Total liabilities and stockholders’ equity |

$ |

846,439 |

|

|

$ |

949,627 |

|

|

Cricut, Inc. |

|

Condensed Consolidated Statements of Cash

Flows |

|

(unaudited) |

|

(in thousands) |

| |

Three Months Ended March 31, |

| |

2023 |

|

2022 |

| Cash flows from operating

activities: |

|

|

|

|

Net income |

$ |

9,099 |

|

|

$ |

23,504 |

|

|

Adjustments to reconcile net income to net cash and cash

equivalents provided by operating activities: |

|

|

|

|

Depreciation and amortization (including amortization of debt

issuance costs) |

|

6,888 |

|

|

|

6,030 |

|

|

Impairments |

|

441 |

|

|

|

— |

|

|

Stock-based compensation |

|

10,421 |

|

|

|

8,958 |

|

|

Deferred income tax |

|

(3,311 |

) |

|

|

— |

|

|

Non-cash lease expense |

|

1,238 |

|

|

|

1,222 |

|

|

Unrealized foreign currency loss |

|

636 |

|

|

|

— |

|

|

Provision for inventory obsolescence |

|

8,477 |

|

|

|

1,063 |

|

|

Other |

|

473 |

|

|

|

— |

|

|

Changes in operating assets and liabilities: |

|

|

|

|

Accounts receivable |

|

44,416 |

|

|

|

76,729 |

|

|

Inventories |

|

48,506 |

|

|

|

(29,127 |

) |

|

Prepaid expenses and other current assets |

|

8,351 |

|

|

|

4,771 |

|

|

Other assets |

|

(466 |

) |

|

|

(134 |

) |

|

Accounts payable |

|

(24,192 |

) |

|

|

(49,688 |

) |

|

Accrued expenses and other current liabilities and other

non-current liabilities |

|

(17,573 |

) |

|

|

(26,845 |

) |

|

Operating lease liabilities |

|

(1,353 |

) |

|

|

(1,185 |

) |

|

Deferred revenue |

|

3,118 |

|

|

|

281 |

|

|

Net cash and cash equivalents used in operating activities |

|

95,169 |

|

|

|

15,579 |

|

| Cash flows from investing

activities: |

|

|

|

|

Acquisitions of property and equipment, including capitalized

software development costs |

|

(7,741 |

) |

|

|

(9,807 |

) |

|

Net cash and cash equivalents used in investing activities |

|

(7,741 |

) |

|

|

(9,807 |

) |

| Cash flows from financing

activities: |

|

|

|

|

Repurchase of common stock |

|

(3,244 |

) |

|

|

— |

|

|

Repurchase of compensatory units |

|

— |

|

|

|

(14 |

) |

|

Proceeds from exercise of stock options |

|

55 |

|

|

|

31 |

|

|

Employee tax withholding payments on stock-based awards |

|

(1,358 |

) |

|

|

(1,659 |

) |

|

Cash dividend |

|

(75,531 |

) |

|

|

— |

|

|

Net cash and cash equivalents used in financing activities |

|

(80,078 |

) |

|

|

(1,642 |

) |

| Effect of exchange rate on

changes on cash and cash equivalents |

|

28 |

|

|

|

(28 |

) |

| Net increase in cash and cash

equivalents |

|

7,378 |

|

|

|

4,102 |

|

| Cash and cash equivalents at

beginning of period |

|

224,943 |

|

|

|

241,597 |

|

| Cash and cash equivalents at end

of period |

$ |

232,321 |

|

|

$ |

245,699 |

|

| Supplemental disclosures

of cash flow information: |

|

|

|

| Cash paid during the period for

interest |

$ |

— |

|

|

$ |

— |

|

| Cash paid during the period for

income taxes |

$ |

115 |

|

|

$ |

532 |

|

| Supplemental disclosures

of non-cash investing and financing activities: |

|

|

|

| Right-of-use assets obtained in

exchange for new operating lease liabilities |

$ |

— |

|

|

$ |

3,579 |

|

|

Property and equipment included in accounts payable and accrued

expenses and other current liabilities |

$ |

2,027 |

|

|

$ |

5,056 |

|

|

Tax withholdings on stock-based awards included in accrued expenses

and other current liabilities |

$ |

190 |

|

|

$ |

559 |

|

|

Stock-based compensation capitalized for software development

costs |

$ |

430 |

|

|

$ |

541 |

|

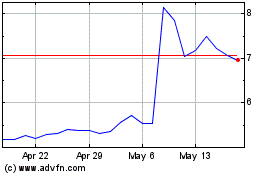

Cricut (NASDAQ:CRCT)

Historical Stock Chart

From Apr 2024 to May 2024

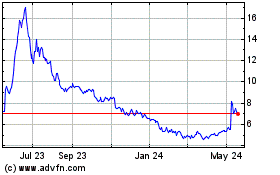

Cricut (NASDAQ:CRCT)

Historical Stock Chart

From May 2023 to May 2024