Capital Southwest Announces Supplemental Dividend of $0.05 per share for the Quarter Ending December 31, 2022

27 October 2022 - 7:01AM

Capital Southwest Corporation (“Capital Southwest,” the “Company”

or “we”) (Nasdaq: CSWC), an internally managed business development

company focused on providing flexible financing solutions to

support the acquisition and growth of middle market businesses, is

pleased to announce that its Board of Directors has declared a

supplemental dividend of $0.05 per share. This supplemental

dividend is in addition to the previously announced regular

dividend of $0.52 per share, resulting in total dividends of $0.57

per share for the quarter ending December 31, 2022.

The Company’s dividends will be payable as

follows:

| Regular Dividend |

| Amount Per

Share: |

$0.52 |

| Ex-Dividend Date: |

December 14, 2022 |

| Record Date: |

December 15, 2022 |

| Payment Date: |

December 30, 2022 |

| |

|

| Supplemental Dividend |

| Amount Per Share: |

$0.05 |

| Ex-Dividend Date: |

December 14, 2022 |

| Record Date: |

December 15, 2022 |

| Payment Date: |

December 30, 2022 |

| |

|

When declaring dividends, the Board reviews

estimates of taxable income available for distribution, which may

differ from net investment income under generally accepted

accounting principles. The final determination of taxable income

for each year, as well as the tax attributes for dividends in such

year, will be made after the close of the tax year.

Capital Southwest maintains a dividend

reinvestment plan ("DRIP") that provides for the reinvestment of

dividends on behalf of its registered stockholders who hold their

shares with Capital Southwest’s transfer agent and registrar,

American Stock Transfer and Trust Company. Under the DRIP, if the

Company declares a dividend, registered stockholders who have opted

in to the DRIP by the dividend record date will have their dividend

automatically reinvested into additional shares of Capital

Southwest common stock.

About Capital Southwest

Capital Southwest Corporation (Nasdaq: CSWC) is

a Dallas, Texas-based, internally managed business development

company with approximately $1.0 billion in investments at fair

value as of June 30, 2022. Capital Southwest is a middle market

lending firm focused on supporting the acquisition and growth of

middle market businesses with $5 million to $35 million investments

across the capital structure, including first lien, second lien,

and non-control equity co-investments. As a public company with a

permanent capital base, Capital Southwest has the flexibility to be

creative in its financing solutions and to invest to support the

growth of its portfolio companies over long periods of time.

Forward-Looking Statements

This press release contains historical

information and forward-looking statements with respect to the

business and investments of Capital Southwest, including, but not

limited to, the statements about Capital Southwest's future

performance and financial condition, and the timing, form and

amount of any distributions in the future. Forward-looking

statements are statements that are not historical statements and

can often be identified by words such as "will," "believe,"

"expect" and similar expressions and variations or negatives of

these words. These statements are based on management's current

expectations, assumptions and beliefs. They are not guarantees of

future results and are subject to numerous risks, uncertainties and

assumptions that could cause actual results to differ materially

from those expressed in any forward-looking statement. These risks

include risks related to: changes in the markets in which Capital

Southwest invests; changes in the financial, capital, and lending

markets; changes in the interest rate environment; regulatory

changes; tax treatment and general economic and business

conditions; our ability to operate our wholly owned subsidiary,

Capital Southwest SBIC I, as a small business investment company;

and uncertainties associated with the impact from the COVID-19

pandemic, including its impact on the global and U.S. capital

markets and the global and U.S. economy, the length and duration of

the COVID-19 outbreak in the United States as well as worldwide and

the magnitude of the economic impact of that outbreak; the effect

of the COVID-19 pandemic on our business prospects and the

operational and financial performance of our portfolio companies,

including our ability and their ability to achieve their respective

objectives, and the effects of the disruptions caused by the

COVID-19 pandemic on our ability to continue to effectively manage

our business.

Readers should not place undue reliance on any

forward-looking statements and are encouraged to review Capital

Southwest's Annual Report on Form 10-K for the year ended March 31,

2022 and subsequent filings, including the "Risk Factors" sections

therein, with the Securities and Exchange Commission for a more

complete discussion of the risks and other factors that could

affect any forward-looking statements. Except as required by the

federal securities laws, Capital Southwest does not undertake any

obligation to publicly update or revise any forward-looking

statements, whether as a result of new information, future events,

changing circumstances or any other reason after the date of this

press release.

Investor Relations Contact:

Michael S. Sarner, Chief Financial

Officer214-884-3829

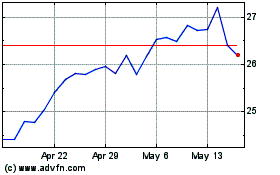

Capital Southwest (NASDAQ:CSWC)

Historical Stock Chart

From Dec 2024 to Jan 2025

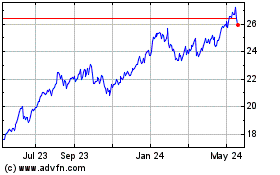

Capital Southwest (NASDAQ:CSWC)

Historical Stock Chart

From Jan 2024 to Jan 2025