As filed with the Securities and Exchange Commission

on May 31, 2024

Registration No. 333-

UNITED STATES SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM S-3

REGISTRATION STATEMENT UNDER THE SECURITIES

ACT OF 1933

CHARLES & COLVARD, LTD.

(Exact name of registrant as specified in its

charter)

| North

Carolina |

56-1928817 |

| (State

or other jurisdiction of incorporation) |

(IRS Employer

Identification Number) |

170 Southport Drive

Morrisville, NC 27560

(919) 468-0399

(Address, including zip code, and telephone

number, including area code, of registrant’s principal executive offices)

Don O’Connell

President and Chief Executive Officer

Charles & Colvard, Ltd.

170 Southport Drive

Morrisville, NC 27560

(919) 468-0399

(Name, address, including zip code, and telephone

number, including area code, of agent for service)

Please send copies of all communications to:

Julie F. Rizzo

K&L Gates LLP

301 Hillsborough Street

Suite 1200

Raleigh, North Carolina 27603

(919) 743-7330

Approximate

date of commencement of proposed sale to the public: From time to time after the effective date of this Registration Statement

as determined by market conditions.

If the only

securities being registered on this Form are being offered pursuant to dividend or interest reinvestment plans, please check the following

box. ¨

If any of

the securities being registered on this Form are to be offered on a delayed or continuous basis pursuant to Rule 415 under the Securities

Act of 1933, other than securities offered only in connection with dividend or interest reinvestment plans, check the following box. x

If this Form

is filed to register additional securities for an offering pursuant to Rule 462(b) under the Securities Act, please check the following

box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ¨

If this Form

is a post-effective amendment filed pursuant to Rule 462(c) under the Securities Act, check the following box and list the Securities

Act registration statement number of the earlier effective registration statement for the same offering. ¨

If this Form

is a registration statement pursuant to General Instruction I.D. or a post-effective amendment thereto that shall become effective upon

filing with the Commission pursuant to Rule 462(e) under the Securities Act, check the following box. ¨

If this Form

is a post-effective amendment to a registration statement filed pursuant to General Instruction I.D. filed to register additional securities

or additional classes of securities pursuant to Rule 413(b) under the Securities Act, check the following box. ¨

Indicate by check mark if the registrant is a large accelerated filer,

an accelerated filer, a non-accelerated filer, a smaller reporting company, or an emerging growth company. See the definitions of “large

accelerated filer,” “accelerated filer,” “smaller reporting company” and “emerging growth company”

in Rule 12b-2 of the Exchange Act.

| Large accelerated filer ¨ |

Accelerated filer ¨ |

| Non-accelerated filer x |

Smaller reporting company x |

| |

Emerging growth company ¨ |

If an emerging

growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any

new or revised financial accounting standards provided pursuant to Section 7(a)(2)(B) of the Securities Act. ¨

The Registrant hereby amends this Registration Statement on such

date or dates as may be necessary to delay its effective date until the Registrant shall file a further amendment which specifically

states that this Registration Statement shall thereafter become effective in accordance with Section 8(a) of the Securities Act of 1933

or until the Registration Statement shall become effective on such date as the Commission acting pursuant to said Section 8(a), may determine.

The

information in this prospectus is not complete and may be changed. We may not sell these securities until the registration

statement filed with the Securities and Exchange Commission is effective. This prospectus is not an offer to sell these securities and

it is not soliciting an offer to buy these securities in any state where the offer or sale is not permitted.

Subject

to completion, dated May 31, 2024

Charles & Colvard, Ltd.

Prospectus

$25,000,000

Common Stock

Preferred Stock

Warrants

Units

This prospectus relates to common stock, preferred stock, warrants

and units that Charles & Colvard, Ltd. may sell from time to time in one or more offerings on terms to be determined at the time

of sale. We will provide specific terms of these securities in supplements to this prospectus. You should read this prospectus and any

supplement carefully before you invest. This prospectus may not be used to offer and sell securities unless accompanied by a prospectus

supplement for those securities.

These securities may be sold directly by us, through dealers or agents

designated from time to time, to or through underwriters or through a combination of these methods. See “Plan of Distribution”

in this prospectus. We may also describe the plan of distribution for any particular offering of these securities in any applicable prospectus

supplement. If any agents, underwriters or dealers are involved in the sale of any securities in respect of which this prospectus is

being delivered, we will disclose their names and the nature of our arrangements with them in a prospectus supplement. The net proceeds

we expect to receive from any such sale will also be included in a prospectus supplement.

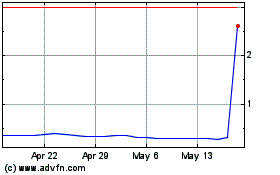

Our common stock trades on the Nasdaq Capital Market under the symbol

“CTHR.” On May 24, 2024, the last reported sale price for our Common Stock was $2.37 per share. Our principal executive offices

are located at 170 Southport Drive, Morrisville, NC 27560.

As of

the date of this prospectus, the aggregate market value of our outstanding common stock held by non-affiliates, or public float, was

approximately $5,940,533, which was calculated based on 3,118,273 shares of outstanding common stock, of which 2,506,554

shares were held by non-affiliates, and the last reported sale price of our common stock of $2.37 per share on May 24, 2024.

Pursuant to General Instruction I.B.6 of Form S-3, in no event will we sell securities in a public primary offering with a value

exceeding one-third of our public float in any 12-month period, so long as our public float remains below $75 million. During the 12

calendar months prior to and including the date of this prospectus, we have not offered or sold any securities pursuant to General

Instruction I.B.6 of Form S-3.

INVESTING

IN OUR SECURITIES INVOLVES RISKS. YOU SHOULD REVIEW CAREFULLY THE RISKS AND UNCERTAINTIES DESCRIBED UNDER THE HEADING “RISK FACTORS”

CONTAINED IN THE APPLICABLE PROSPECTUS SUPPLEMENT AND ANY RELATED FREE WRITING PROSPECTUS, AND UNDER SIMILAR HEADINGS IN OTHER DOCUMENTS

THAT ARE INCORPORATED BY REFERENCE INTO THIS PROSPECTUS OR ANY SUCH PROSPECTUS SUPPLEMENT. SEE “RISK FACTORS” ON PAGE 4

OF THIS PROSPECTUS.

Neither the Securities and Exchange Commission nor any state securities

commission has approved or disapproved of these securities or passed upon the adequacy or accuracy of this prospectus. Any representation

to the contrary is a criminal offense.

The date of this prospectus is , 2024.

Table of Contents

Page

ABOUT THIS PROSPECTUS

This prospectus is part of a registration statement on Form S-3 that

we filed with the Securities and Exchange Commission, or the SEC, utilizing a “shelf” registration process. Under this shelf

process, we may from time to time sell any combination of securities described in this prospectus in one or more offerings.

This prospectus provides you with a general description of the securities

we may offer. Each time we sell securities under this shelf registration process, we will provide a prospectus supplement that will contain

specific information about the terms of the securities being offered. That prospectus supplement may include a discussion of any risk

factors or other special consideration that apply to those securities. The prospectus supplement may also add, update or change information

contained in this prospectus. If there is any inconsistency between the information in this prospectus and a prospectus supplement, you

should rely on the information in that prospectus supplement. You should read both this prospectus and any applicable prospectus supplement

together with additional information described below under the headings “Where You Can Find More Information” and

“Incorporation by Reference.”

In deciding whether or not to invest in our securities, you should

rely on the information provided in this prospectus and the prospectus supplement, including the information incorporated by reference.

Neither we, nor any underwriters or agents, have authorized anyone to provide you with different information. We are not offering the

securities in any state where such an offer is prohibited. You should not assume that the information in this prospectus, any prospectus

supplement, or any document incorporated by reference, is truthful or complete at any date other than the date mentioned on the cover

page of those documents. You should also carefully review the section entitled “Risk Factors”, which highlights certain

risks associated with an investment in our securities, to determine whether an investment in our securities is appropriate for you.

Unless otherwise stated or the context requires otherwise, references

to “Charles & Colvard,” the “Company,” “we,” “us” or “our” are to Charles

& Colvard, Ltd. and its subsidiaries.

CAUTIONARY NOTE REGARDING FORWARD-LOOKING STATEMENTS

Certain information set forth in this prospectus or incorporated by

reference in this prospectus may contain forward-looking statements within the meaning of Section 27A of the Securities Act of 1933,

as amended (the “Securities Act”), and Section 21E of the Exchange Act of 1934 (the “Exchange Act”), that are

intended to be covered by the “safe harbor” created by those sections. Forward-looking statements, which are based on certain

assumptions and describe our future plans, strategies and expectations, can generally be identified by the use of forward-looking terms

such as “believe,” “expect,” “may,” “will,” “should,” “would,”

“could,” “seek,” “intend,” “plan,” “estimate,” “goal,” “anticipate,”

“project” or other comparable terms. All statements other than statements of historical facts included in this prospectus

regarding our strategies, prospects, financial condition, operations, costs, plans and objectives are forward-looking statements. Examples

of forward-looking statements include, among others, statements we make regarding: expectations for revenues, cash flows and financial

performance, the anticipated results of our development efforts and the timing for receipt of required regulatory approvals and product

launches.

Forward-looking statements are neither historical facts nor assurances

of future performance. Instead, they are based only on our current beliefs, expectations and assumptions regarding the future of our

business, future plans and strategies, projections, anticipated events and trends, the economy and other future conditions. Because forward-looking

statements relate to the future, they are subject to inherent uncertainties, risks and changes in circumstances that are difficult to

predict and many of which are outside our control. Our actual results and financial condition may differ materially from those in the

forward-looking statements. Therefore, you should not rely on any of these forward-looking statements. Important factors that could cause

our actual results and financial condition to differ materially from those indicated in the forward-looking statements include, among

others, the following:

Related to our Operations

| · | Our

business and our results of operations could be materially adversely affected as a result

of general economic and market conditions; |

| · | Our

future financial performance depends upon increased consumer acceptance, growth of sales

of our products, and operational execution of our strategic initiatives; |

| · | We

face intense competition in the worldwide gemstone and jewelry industry; |

| · | We

have historically been dependent on a single supplier for substantially all of our silicon

carbide, or SiC crystals, the raw materials we use to produce moissanite jewels; if our supply

of high quality SiC crystals is interrupted, our business may be materially harmed; |

| · | Constantly

evolving privacy regulatory regimes are creating new legal compliance challenges; |

| · | Our

information technology, or IT, infrastructure, and our network has been and may be impacted

by a cyber-attack or other security incident as a result of the rise of cybersecurity events; |

| · | We

are subject to certain risks due to our international operations, distribution channels and

vendors; |

| · | Our

business and our results of operations could be materially adversely affected as a result

of our inability to fulfill orders on a timely basis; |

| · | We

are currently dependent on a limited number of distributor and retail partners in our Traditional

segment for the sale of our products; |

| · | We

may experience quality control challenges from time to time that can result in lost revenue

and harm to our brands and reputation; |

| · | Seasonality

of our business may adversely affect our net sales and operating income; |

| · | Our

operations could be disrupted by natural disasters; |

| · | Sales

of moissanite and lab grown diamond jewelry could be dependent upon the pricing of precious

metals, which is beyond our control; |

| · | Our

current customers may potentially perceive us as a competitor in the finished jewelry business; |

| · | If

the e-commerce opportunity changes dramatically or if e-commerce technology or providers

change their models, our results of operations may be adversely affected; |

| · | Governmental

regulation and oversight might adversely impact our operations; |

| · | The

effects of COVID-19 and other potential future public health crises, epidemics, pandemics

or similar events on our business, operating results, and cash flows are uncertain; |

Related to our Financial Position

| · | The execution of management’s plans as disclosed in our Form 10-Q filed May 6, 2024 could significantly impact our liquidity and ability to continue

as a going concern; |

| · | We

are subject to arbitration, litigation and demands, which could result in significant liability

and costs, and impact our resources and reputation; |

| · | The

financial difficulties or insolvency of one or more of our major customers or their lack

of willingness and ability to market our products could adversely affect results; |

| · | Negative

or inaccurate information on social media could adversely impact our brand and reputation; |

| · | We

rely on assumptions, estimates, and data to calculate certain of our key metrics and real

or perceived inaccuracies in such metrics may harm our reputation and negatively affect our

business; |

| · | We

may not be able to adequately protect our intellectual property, which could harm the value

of our products and brands and adversely affect our business; |

| · | Environmental,

social, and governance matters may impact our business, reputation, financial condition,

and results of operations; |

| · | If

we fail to evaluate, implement, and integrate strategic acquisition or disposition opportunities

successfully, our business may suffer; |

Related to Ownership of our Common Stock

| · | Our

failure to maintain compliance with The Nasdaq Stock Market’s continued listing requirements

could result in the delisting of our common stock; |

| · | Some

anti-takeover provisions of our charter documents may delay or prevent a takeover of our

Company; and |

| · | We

cannot guarantee that our share repurchase program will be utilized to the full value approved,

or that it will enhance long-term stockholder value and repurchases we consummate could increase

the volatility of the price of our common stock and could have a negative impact on our available

cash balance. |

We urge you to consider those risks and uncertainties in evaluating

our forward-looking statements. All subsequent written and oral forward-looking statements attributable to us or to persons acting on

our behalf are expressly qualified in their entirety by the applicable cautionary statements. We further caution readers not to place

undue reliance upon any such forward-looking statements, which speak only as of the date made. Except as otherwise required by the federal

securities laws, we undertake no obligation to publicly update any forward-looking statement, whether written or oral, that may be made

from time to time, whether as a result of new information, future developments or otherwise.

Refer to the section titled “Risk Factors” in this

prospectus, any other risk factors set forth in the applicable prospectus supplement and in any information incorporated by reference

into this prospectus or the applicable prospectus supplement to better understand the risks and uncertainties inherent in our business

and underlying these forward-looking statements, as well as any other risk factors and cautionary statements described in the documents

we file from time to time with the SEC, including those discussed in our Annual Report on Form 10-K and subsequently filed Quarterly

Reports on Form 10-Q under the headings “Risk Factors,” “Legal Proceedings,” and “Management’s

Discussion and Analysis of Financial Condition and Results of Operations”, which are incorporated by reference into this prospectus.

THE COMPANY

Charles &

Colvard, Ltd., a North Carolina corporation founded in 1995 (which may be referred to as Charles & Colvard, we, us, or our), is a

globally recognized fine jewelry company specializing in lab created gemstones. We have manufactured, marketed, and distributed Charles

& Colvard Created Moissanite® (which we refer to as moissanite or moissanite jewels) since introducing

created moissanite to the world nearly three decades ago. After years of perfecting the process, Charles & Colvard debuted the world’s

first colorless moissanite and its premium moissanite gemstone brand, Forever One™, in 2015. As an e-commerce and multi-channel

destination for fine jewelry featuring lab grown gemstones, we believe the addition of lab grown diamonds is a natural progression for

the Charles & Colvard brand. In September 2020, we announced our expansion into the lab grown diamond market with the launch of Caydia®,

our brand of premium lab grown diamonds.

We offer

gemstones and finished jewelry featuring our proprietary moissanite jewels, premium lab grown diamonds, and created color gemstones for

sale in the worldwide fine jewelry market through two operating segments: our Online Channels segment, which encompasses our digital

properties components, comprised of our charlesandcolvard.com, moissaniteoutlet.com, charlesandcolvarddirect.com, and madeshopping.com

websites, e-commerce outlets, including marketplaces, drop-ship customers, and other pure-play, exclusively e-commerce customers;

and our Traditional segment, which consists of domestic and international distributors and retail customers, including end-consumers

through our first Charles & Colvard Signature Showroom, which opened in October 2022. We report segment information based

on the “management” approach. This segment reporting approach designates the internal reporting used by management for making

operating decisions and assessing performance as the source of our operating and reportable segments. We operate in an e-commerce

environment characterized by both complexity in global markets and ongoing economic uncertainties in the U.S. and internationally. Our

strategy is to build a globally revered and accessible brand of gemstones and finished fine jewelry products set with moissanite and

lab grown diamonds. We believe our goods appeal to a broad consumer audience and leverage our advantage of being the original and leading

worldwide source of moissanite and purveyor of premium lab grown diamonds. We believe a direct relationship with consumers is an essential

component of this strategy, which entails delivering tailored educational content, engaging in an interactive dialogue with our audience,

and positioning our brand to meet the demands of today’s discerning consumer. A significant component of our strategy in this environment

is to focus on our core products, improving the quality and predictability of the delivery of our products and services and placing those

products quickly into the hands of our U.S. and international customers at affordable prices.

Moreover,

recognizing today that our customers and vendors are resource-constrained, we are endeavoring to develop and extend our portfolio of

products in a disciplined manner with a focus on domestic markets close to our core capabilities, and growing our global marketplace

sales. We continue to focus on affordability initiatives. We also expect to continue innovating and investing in lab created gemstone

technologies to fulfill evolving product requirements for our customers and investing in our people so that we have the technical and

production skills necessary to succeed without limiting our ability to build sound financial returns to our investors.

Corporate Information

We were incorporated under the laws of the State of North Carolina

in 1995. Our principal executive offices are located at 170 Southport Drive, Morrisville, North Carolina 27560, and our telephone number

is (919) 468-0399. Our Internet address is www.charlesandcolvard.com. The information on our website is not incorporated by reference

into this prospectus, and you should not consider it part of this prospectus.

RISK FACTORS

Investing in our securities involves a high degree of risk. You should

carefully consider the risk factors described in our Annual Report on Form 10-K for our most recent fiscal year (together with any material

changes thereto contained in subsequent filed Quarterly Reports on Form 10-Q) and those contained in our other filings with the SEC,

which are incorporated by reference in this prospectus and any accompanying prospectus supplement.

The prospectus supplement applicable to each type or series of securities

we offer may contain a discussion of risks applicable to the particular types of securities that we are offering under that prospectus

supplement. Prior to making a decision about investing in our securities, you should carefully consider the specific factors discussed

under the caption “Risk Factors” in the applicable prospectus supplement, together with all of the other information

contained in the prospectus supplement or appearing or incorporated by reference in this prospectus. These risks could materially affect

our business, results of operations or financial condition and cause the value of our securities to decline. You could lose all or part

of your investment.

USE OF PROCEEDS

Except as described in any applicable prospectus supplement or in

any free writing prospectuses we have authorized for use in connection with a specific offering, we currently intend to use the net proceeds

from the sale of the securities offered by us hereunder, if any, for working capital and general corporate purposes, including, among

other things, capital expenditures.

The amounts and timing of our use of the net proceeds from this offering

will depend on a number of factors, such as the timing and progress of our strategic initiatives, technological advances and the competitive

environment for our products. As of the date of this prospectus, we cannot specify with certainty all of the particular uses for the

net proceeds to us from the sale of the securities offered by us hereunder. As a result, our management will have broad discretion to

allocate the net proceeds, if any, we receive in connection with securities offered pursuant to this prospectus for any purpose. Pending

application of the net proceeds as described above, we may initially invest the net proceeds in short-term, investment-grade, interest-bearing

securities.

DESCRIPTION OF SECURITIES WE MAY OFFER

We may issue from time to time, in one or more offerings, the following

securities:

| · | shares of preferred

stock; |

| · | warrants for the purchase

of common stock or preferred stock; and |

| · | units consisting of

two or more of the foregoing. |

Set forth below is a description of the capital stock that may be

offered under this prospectus. We will set forth in the applicable prospectus supplement and/or free writing prospectus a description

of the warrants that may be offered under this prospectus. The terms of the offering of our common stock, preferred stock or any such

other securities, the initial offering price and the net proceeds to us will be contained in the prospectus supplement, and other offering

material, relating to such offer.

We may sell the securities being offered pursuant to this prospectus

directly to purchasers, to or through underwriters, through dealers or agents, or through a combination of such methods. The prospectus

supplement with respect to the securities being offered will set forth the terms of the offering of those securities, including the names

of any such underwriters, dealers or agents, the purchase price, the net proceeds to us, any underwriting discounts and other items constituting

underwriters’ compensation, the public offering price, any discounts or concessions allowed or reallowed or paid to dealers and

any securities exchanges on which such securities may be listed.

DESCRIPTION OF CAPITAL STOCK

The following description of our capital stock is based upon our Restated

Articles of Incorporation, as amended, which we will refer to hereafter as our Articles of Incorporation, our Amended and Restated Bylaws,

which we will refer to hereafter as our Bylaws, and applicable provisions of law. We have summarized certain portions of the Articles

of Incorporation and Bylaws below. The summary is not complete and is qualified in its entirety by reference to the Articles of Incorporation

and Bylaws, which are incorporated by reference as exhibits to the registration statement of which this prospectus forms a part. You

should read the Articles of Incorporation and Bylaws for the provisions that are important to you.

Our authorized capital stock consists of 50,000,000 shares of

common stock, no par value per share, and 10,000,000 shares of preferred stock in one or more series, no par value per share. As of

May 24, 2024, there were 3,118,273 shares of our common stock outstanding held of record by 215 shareholders. In addition, there are

outstanding options and rights to acquire up to an additional 282,073 shares of common stock. As of May 24, 2024, there were no

shares of preferred stock outstanding.

Common Stock

Holders of our common stock are entitled to one vote for each share

held on all matters submitted to a vote of shareholders and do not have cumulative voting rights. An election of directors by our shareholders

shall be determined by a plurality of the votes cast by the shareholders entitled to vote on the election. Holders of common stock are

entitled to receive proportionately any dividends as may be declared and paid by our board of directors, subject to such funds being

legally available for the payment of dividends and any preferential dividend rights of any series of preferred stock that we may designate

and issue in the future.

In the event of our liquidation, dissolution or winding up, the holders

of common stock are entitled to receive proportionately our net assets available for distribution to shareholders after the payment of

all debts and other liabilities and subject to the prior rights of any outstanding preferred stock. Holders of common stock have no preemptive,

subscription, redemption or conversion rights. Our outstanding shares of common stock are, and the shares offered by us in this offering

will be, when issued and paid for, validly issued, fully paid and nonassessable.

The rights, preferences and privileges of holders of common stock

are subject to and may be adversely affected by the rights of the holders of shares of any series of preferred stock that we may designate

and issue in the future.

The transfer agent for our common stock is Equiniti Trust Company,

LLC. Our common stock is traded on the Nasdaq Capital Market and is quoted under the symbol CTHR.

Preferred Stock

Under the terms of our Articles of Incorporation, our board of directors

is authorized to provide for the issuance of shares of preferred stock in one or more series without shareholder approval. Our board

of directors has the discretion to determine the preferences, limitations and relative rights, including voting rights, dividend rights,

conversion rights, redemption privileges and liquidation preferences, of each series of preferred stock. The preferred stock may have

voting or conversion rights that could have the effect of restricting dividends on our common stock, diluting the voting power of our

shares of common stock, impairing the rights of our common stock in the event of our dissolution, liquidation or winding-up or otherwise

adversely affecting the rights of holders of our common stock. The holders of preferred stock are not entitled to vote at any meeting

of shareholders, except as otherwise provided in the rights and restrictions attached to the shares by our board of directors.

We will fix the rights, preferences, privileges, qualifications and

restrictions of the preferred stock of each series that we sell under this prospectus and any applicable prospectus supplements in one

or more articles of amendment to our Articles of Incorporation relating to that series. We will incorporate by reference into the registration

statement of which this prospectus is a part the form of any articles of amendment to our Articles of Incorporation that describe the

terms of the series of preferred stock we are offering before the issuance of the related series of preferred stock. We urge you to read

the prospectus supplements (and any related free writing prospectus that we may authorize to be provided to you) related to the series

of preferred stock being offered, as well as the complete articles of amendment to our Articles of Incorporation that contain the terms

of the applicable series of preferred stock.

Anti-Takeover Effects of Our Articles of Incorporation and Bylaws

Our Articles of Incorporation and Bylaws contain provisions that will

make it more difficult for our existing shareholders to replace our board of directors as well as for another party to obtain control

of the Company by replacing our board of directors. Since our board of directors has the power to retain and discharge our officers,

these provisions could also make it more difficult for existing shareholders or another party to effect a change in management or could

otherwise impede the success of any attempt to change the control of the Company.

These provisions are intended to enhance the likelihood of continued

stability in the composition of our board of directors and its policies and to discourage certain types of transactions that may involve

an actual or threatened acquisition of the Company. These provisions are also designed to reduce our vulnerability to an unsolicited

acquisition proposal and to discourage certain tactics that may be used in proxy fights. However, these provisions could have the effect

of discouraging others from making tender offers for our shares and may have the effect of deterring hostile takeovers or delaying changes

in control of the Company or management. As a consequence, these provisions also may inhibit fluctuations in the market price of our

stock that could result from actual or rumored takeover attempts.

Authorized

but Unissued Stock. Our Articles of Incorporation authorize the issuance of a significant number of shares of common stock

and preferred stock. A large quantity of authorized but unissued shares may deter potential takeover attempts because of the ability

of our board of directors to authorize the issuance of some or all of these shares to a friendly party, or to the public, which would

make it more difficult for a potential acquirer to obtain control of the Company. This possibility may encourage persons seeking to acquire

control of the Company to negotiate first with our board of directors.

Our authorized but unissued shares of preferred stock could also have

anti-takeover effects. Under certain circumstances, any or all of the preferred stock could be used as a method of discouraging, delaying

or preventing a change in control or management of the Company. For example, our board of directors could designate and issue a series

of preferred stock in an amount that sufficiently increases the number of outstanding shares to overcome a vote by the holders of common

stock, or with rights and preferences that include special voting rights to veto a change in control. The preferred stock could also

be used in connection with the issuance of a shareholder rights plan, sometimes referred to as a “poison pill.” Our board

of directors is able to implement a shareholder rights plan without further action by our shareholders.

Use of our preferred stock in the foregoing manner could delay or

frustrate a merger, tender offer or proxy contest, the removal of incumbent directors or the assumption of control by shareholders, even

if these actions would be beneficial to our shareholders. In addition, the existence of authorized but unissued shares of preferred stock

could discourage bids for the Company even if such bid represents a premium over our then-existing trading price.

No Cumulative

Voting. Because our shareholders do not have cumulative voting rights, our shareholders holding a majority of the voting power

of our shares of common stock outstanding will be able to elect all of our directors.

Special

Meetings of Shareholders. Our Bylaws provide that special meetings of shareholders may be called only by our president or

by our board of directors. Shareholders are not permitted to call a special meeting of shareholders or to require that our president

or our board of directors request the calling of a special meeting of shareholders. These provisions may make a change in control of

the Company more difficult by delaying shareholder actions to elect directors until the next annual shareholder meeting.

Advance

Notice Requirement. Shareholder proposals to be brought before an annual meeting of our shareholders must comply with advance

notice procedures. These advance notice procedures require timely notice and apply in several situations, including shareholder proposals

relating to the nomination of persons for election to our board of directors. Generally, to be timely, notice must be delivered to or

mailed and received at our principal executive offices not less than 60 nor more than 90 days prior to the first anniversary of the notice

date in our proxy statement for the previous year’s annual meeting of shareholders. These provisions may have the effect of precluding

the conduct of certain business at a meeting if the proper procedures are not followed. These provisions may also discourage or deter

a potential acquirer from conducting a solicitation of proxies to elect the acquirer’s own slate of directors or otherwise attempting

to obtain control of the Company.

Election

and Removal of Directors; Filling Vacancies. Our Bylaws permit vacancies in our board of directors to be filled by our board

of directors, or in the event that the remaining directors in office constitute fewer than a quorum of the board of directors, by the

affirmative vote of a majority of the remaining directors or by a plurality of the votes cast at a meeting of shareholders. Given that

a special shareholder meeting may only be called by our president or by our board of directors, effectively only the board of directors

may fill vacancies.

While we do not currently have a classified board, our Bylaws provide

that at any time that we have nine or more directors, the directors will be divided into three classes, as nearly equal in number as

possible. As a result, if we have nine or more directors, only one class of directors will be elected at each annual meeting of shareholders,

with the other classes continuing for the remainder of their respective three-year terms. The classification of our board of directors

and provisions described above may have the effect of delaying or preventing changes in our control or management.

Shareholder

Approval of Certain Business Combinations. Our Articles of Incorporation contain a supermajority vote provision requiring

approval of two-thirds in interest of our issued and outstanding voting shares for certain business combinations involving significant

beneficial owners, or Interested Shareholders, such as a merger, unless (i) the business combination has been approved by at least two-thirds

of the directors serving on the date the supermajority provisions of the articles of incorporation were adopted by our shareholders,

or directors who have been nominated by us to directly succeed such a director or to join the board of directors, or the Continuing Directors,

and, if deemed advisable by a majority of the Continuing Directors, the Board has obtained an opinion of a reputable investment banking

firm stating that the financial terms of such business combination are fair from a financial point of view to the holders of our voting

shares, or (ii) all of the following conditions are satisfied: (A) the consideration to be received by the shareholders is cash or in

the same form as previously paid by or on behalf of any Interested Shareholder in connection with its direct or indirect acquisition

of beneficial ownership of any shares of common stock, (B) the aggregate amount of the cash and the fair market value of consideration

other than cash to be received per share by holders of common stock in any business combination is at least equal to the greater of (1)

the fair market value per share of common stock on the date of the first public announcement of the proposal of a business combination,

or the Announcement Date, or on the date on which the Interested Shareholder became an Interested Shareholder, whichever is higher, multiplied

by the ratio of (a) the highest per share price paid by the Interested Shareholder for any shares of common stock acquired by it within

the two-year period immediately prior to the Announcement Date to (b) the fair market value per share of common stock on the first day

in such two-year period on which the Interested Shareholder acquired any shares of common stock, or (2) the highest per share price paid

by such Interested Shareholder in acquiring any of our common stock; and (C) after becoming an Interested Shareholder and prior to the

consummation of any business combination, (1) such Interested Shareholder must not have acquired any newly issued shares of capital stock,

directly or indirectly, from us (except upon conversion of convertible securities acquired by it prior to becoming an Interested Shareholder

or upon compliance with the supermajority provisions of the Articles of Incorporation or as a result of a pro rata stock dividend or

stock split) and (2) such Interested Shareholder must not have received the benefit, directly or indirectly (except proportionately as

a shareholder), of any loans, advances, guarantees, pledges or other financial assistance or tax credits provided by us, or made any

significant changes in our business or equity capital structure.

DESCRIPTION OF WARRANTS WE MAY OFFER

We may issue warrants for the purchase of common stock or preferred

stock. Warrants may be issued independently or together with common stock or preferred stock and may be attached to or separate from

any offered securities. Any issue of warrants will be governed by the terms of the applicable form of warrant and any related warrant

agreement which we will file with the SEC and they will be incorporated by reference to the registration statement of which this prospectus

is a part on or before the time we issue any warrants.

The particular terms of any issue of warrants will be described in

the prospectus supplement relating to the issue. Those terms may include:

| · | the title of such

warrants; |

| · | the aggregate number

of such warrants; |

| · | the price or prices

at which such warrants will be issued; |

| · | the currency or currencies

(including composite currencies) in which the price of such warrants may be payable; |

| · | the terms of the securities

issuable upon exercise of such warrants and the procedures and conditions relating to the

exercise of such warrants; |

| · | the price at which

the securities issuable upon exercise of such warrants may be acquired; |

| · | the dates on which

the right to exercise such warrants will commence and expire; |

| · | any provisions for

adjustment of the number or amount of securities receivable upon exercise of the warrants

or the exercise price of the warrants; |

| · | if applicable, the

minimum or maximum amount of such warrants that may be exercised at any one time; |

| · | if applicable, the

designation and terms of the securities with which such warrants are issued and the number

of such warrants issued with each such security or principal amount of such security; |

| · | if applicable, the

date on and after which such warrants and the related securities will be separately transferable; |

| · | information with respect

to book-entry procedures, if any; and |

| · | any other terms of

such warrants, including terms, procedures and limitations relating to the exchange or exercise

of such warrants. |

The prospectus supplement relating to any warrants to purchase equity

securities may also include, if applicable, a discussion of certain U.S. federal income tax and ERISA considerations.

Warrants for the purchase of common stock and preferred stock will

be offered and exercisable for U.S. dollars only.

Each warrant will entitle its holder to purchase the number of shares

of common stock or preferred stock at the exercise price set forth in, or calculable as set forth in, the applicable prospectus supplement.

After the close of business on the expiration date, unexercised warrants

will become void. We will specify the place or places where, and the manner in which, warrants may be exercised in the applicable prospectus

supplement.

Prior to the exercise of any warrants to purchase common stock or

preferred stock, holders of the warrants will not have any of the rights of holders of the common stock or preferred stock purchasable

upon exercise.

DESCRIPTION OF UNITS WE MAY OFFER

We may issue units consisting of any combination of the other types

of securities offered under this prospectus in one or more series. We may evidence each series of units by unit certificates that we

will issue under a separate agreement. We may enter into unit agreements with a unit agent. Each unit agent will be a bank or trust company

that we select. We will indicate the name and address of the unit agent in the applicable prospectus supplement relating to a particular

series of units.

The following description, together with the additional information

included in any applicable prospectus supplement, summarizes the general features of the units that we may offer under this prospectus.

We urge you to read the prospectus supplements (and any related free writing prospectus that we may authorize to be provided to you)

related to the series of units being offered, as well as the complete unit agreements that contain the terms of the units. Specific unit

agreements will contain additional important terms and provisions and we will file as an exhibit to the registration statement of which

this prospectus is a part, or will incorporate by reference from another report that we file with the SEC, the form of each unit agreement

relating to units offered under this prospectus.

If we offer any units, certain terms of that series of units will

be described in the applicable prospectus supplement, including, without limitation, the following, as applicable:

| · | the title of the series

of units; |

| · | identification and

description of the separate constituent securities comprised in the units; |

| · | the price or prices

at which the units will be issued; |

| · | the date, if any,

on and after which the constituent securities comprised in the units will be separately transferable; |

| · | a discussion of certain

U.S. federal income tax considerations applicable to the units; and |

| · | any other terms of

the units and their constituent securities. |

PLAN OF DISTRIBUTION

We may sell the securities offered by this prospectus to one or more

underwriters or dealers for public offering, through agents, directly to purchasers or through a combination of any such methods of sale.

The name of any such underwriters, dealers or agents involved in the offer and sale of the securities, the amounts underwritten

and the nature of its obligation to take the securities will be specified in the applicable prospectus supplement. We have reserved

the right to sell the securities directly to investors on our own behalf in those jurisdictions where we are authorized to do so. The

sale of the securities may be effected in transactions (a) on any national or international securities exchange or quotation service

on which the securities may be listed or quoted at the time of sale, (b) in the over-the-counter market, (c) in transactions otherwise

than on such exchanges or in the over-the-counter market or (d) through the writing of options.

We and our agents and underwriters may offer and sell the securities

at a fixed price or prices that may be changed, at market prices prevailing at the time of sale, at prices related to such prevailing

market prices or at negotiated prices. The securities may be offered on an exchange, which will be disclosed in the applicable

prospectus supplement. We may, from time to time, authorize dealers, acting as our agents, to offer and sell the securities upon

such terms and conditions as set forth in the applicable prospectus supplement. We may also sell the securities offered by any applicable

prospectus supplement in “at-the-market offerings” within the meaning of Rule 415 of the Securities Act, to or through a

market maker or into an existing trading market, on an exchange or otherwise.

If we use underwriters to sell securities, we will enter into an underwriting

agreement with them at the time of the sale to them. In connection with the sale of the securities, underwriters may receive compensation

from us in the form of underwriting discounts or commissions and may also receive commissions from purchasers of the securities for whom

they may act as agent. Any underwriting compensation paid by us to underwriters or agents in connection with the offering of the

securities, and any discounts, concessions or commissions allowed by underwriters to participating dealers, will be set forth in the

applicable prospectus supplement to the extent required by applicable law. Underwriters may sell the securities to or through dealers,

and such dealers may receive compensation in the form of discounts, concessions or commissions from the underwriters or commissions (which

may be changed from time to time) from the purchasers for whom they may act as agents.

Dealers and agents participating in the distribution of the securities

may be deemed to be underwriters, and any discounts and commissions received by them and any profit realized by them on resale of the

securities may be deemed to be underwriting discounts and commissions under the Securities Act. Unless otherwise indicated in the applicable

prospectus supplement, an agent will be acting on a best efforts basis.

If so indicated in the prospectus supplement, we will authorize underwriters,

dealers or agents to solicit offers by certain specified institutions to purchase offered securities from us at the public offering price

set forth in the prospectus supplement pursuant to delayed delivery contracts providing for payment and delivery on a specified date

in the future. Such contracts will be subject to any conditions set forth in the applicable prospectus supplement and the prospectus

supplement will set forth the commission payable for solicitation of such contracts. The underwriters and other persons soliciting

such contracts will have no responsibility for the validity or performance of any such contracts.

Underwriters, dealers and agents may be entitled, under agreements

entered into with us, to indemnification against and contribution towards certain civil liabilities, including any liabilities under

the Securities Act.

To facilitate the offering of securities, certain persons participating

in the offering may engage in transactions that stabilize, maintain, or otherwise affect the price of the securities. These may

include over-allotment, stabilization, syndicate short covering transactions and penalty bids. Over-allotment involves sales in

excess of the offering size, which creates a short position. Stabilizing transactions involve bids to purchase the underlying security

so long as the stabilizing bids do not exceed a specified maximum. Syndicate short covering transactions involve purchases of securities

in the open market after the distribution has been completed in order to cover syndicate short positions. Penalty bids permit the

underwriters to reclaim selling concessions from dealers when the securities originally sold by the dealers are purchased in covering

transactions to cover syndicate short positions. These transactions may cause the price of the securities sold in an offering to

be higher than it would otherwise be. These transactions, if commenced, may be discontinued by the underwriters at any time.

Any securities other than our common stock issued hereunder may be

new issues of securities with no established trading market. Any underwriters or agents to or through whom such securities are

sold for public offering and sale may make a market in such securities, but such underwriters or agents will not be obligated to do so

and may discontinue any market making at any time without notice. No assurance can be given as to the liquidity of the trading

market for any such securities. The amount of expenses expected to be incurred by us in connection with any issuance of securities

will be set forth in the applicable prospectus supplement. Certain of the underwriters, dealers or agents and their associates

may engage in transactions with, and perform services for, us and certain of our affiliates in the ordinary course of business.

During such time as we may be engaged in a distribution of the securities

covered by this prospectus we are required to comply with Regulation M promulgated under the Exchange Act. With certain exceptions,

Regulation M precludes us, any affiliated purchasers, and any broker-dealer or other person who participates in such distribution from

bidding for or purchasing, or attempting to induce any person to bid for or purchase, any security which is the subject of the distribution

until the entire distribution is complete. Regulation M also restricts bids or purchases made in order to stabilize the price of

a security in connection with the distribution of that security. All of the foregoing may affect the marketability of our shares

of common stock.

LEGAL MATTERS

The validity and legality of the securities offered hereby and certain

other legal matters will be passed upon for the Company by K&L Gates LLP, Raleigh, North Carolina.

EXPERTS

The consolidated financial statements as of June 30, 2023 and 2022

and for the years then ended incorporated by reference in this Prospectus and in the Registration Statement have been so incorporated

in reliance on the report of BDO USA, P.C., an independent registered public accounting firm, incorporated herein by reference, given

on the authority of said firm as experts in auditing and accounting.

WHERE YOU CAN FIND MORE INFORMATION

We file annual, quarterly and current reports, proxy statements and

other information with the SEC. Our SEC filings are available to the public over the Internet at the SEC’s website at www.sec.gov.

Copies of certain information filed by us with the SEC are also available on our website at www.charlesandcolvard.com. Our website is

not a part of this prospectus and is not incorporated by reference in this prospectus.

This prospectus is part of a registration statement we filed with

the SEC. This prospectus omits some information contained in the registration statement in accordance with SEC rules and regulations.

You should review the information and exhibits in the registration statement for further information about us and our consolidated subsidiary

and the securities we are offering. Statements in this prospectus concerning any document we filed as an exhibit to the registration

statement or that we otherwise filed with the SEC are not intended to be comprehensive and are qualified by reference to these filings

and the exhibits attached thereto. You should review the complete document to evaluate these statements.

INCORPORATION BY REFERENCE

The SEC allows us to “incorporate by reference” information

from other documents that we file with it, which means that we can disclose important information to you by referring you to those documents.

The information incorporated by reference is considered to be part of this prospectus. Information in this prospectus supersedes information

incorporated by reference that we filed with the SEC prior to the date of this prospectus.

We incorporate by reference into this prospectus and the registration

statement of which this prospectus is a part the information or documents listed below that we have filed with the SEC:

| |

· |

Annual Report on Form 10-K for the fiscal year ended

June 30, 2023 filed with the SEC on October 12, 2023; |

| |

· |

Quarterly Reports on Form 10-Q for the period ended

September 30, 2023, filed with the SEC on November 13, 2023, for the period ended December 31, 2023, filed with the SEC on February 14, 2024, and for the period ended March 31, 2024, filed with the SEC on May 2, 2024; |

| |

· |

The information incorporated by reference into our

Annual Report on Form 10-K for the fiscal year ended June 30, 2023 from our Proxy Statement on Schedule 14A related to our 2023 Annual

Meeting of Stockholders, filed with the SEC on October 27, 2023; and |

| |

· |

The description of our common stock set forth in Exhibit 4.2 to our Annual Report on Form 10-K for the fiscal year ended June 30, 2021, including any amendments or reports filed for purposes

of updating such description. |

We also incorporate by reference any future filings (other than current

reports furnished under Item 2.02 or Item 7.01 of Form 8-K and exhibits filed on such form that are related to such items unless such

Form 8-K expressly provides to the contrary) made with the SEC pursuant to Sections 13(a), 13(c), 14 or 15(d) of the Exchange Act, including

those made on or after the date of the initial filing of the registration statement of which this prospectus is a part and prior to effectiveness

of such registration statement, until we file a post-effective amendment that indicates the termination of the offering of the Securities

made by this prospectus and will become a part of this prospectus from the date that such documents are filed with the SEC. Information

in such future filings updates and supplements the information provided in this prospectus. Any statement contained in a document incorporated

or deemed to be incorporated by reference in this prospectus will be deemed to be modified or superseded for purposes of this prospectus

to the extent that a statement contained in this prospectus or in any other subsequently filed document which also is or is deemed to

be incorporated by reference in this prospectus modifies or supersedes that statement. Any statement that is modified or superseded will

not constitute a part of this prospectus, except as modified or superseded.

We will furnish without charge to you, on written or oral request,

a copy of any or all of the documents incorporated by reference, including exhibits to these documents. You should direct any requests

for documents to Charles & Colvard, Ltd., 170 Southport Drive, Morrisville, North Carolina 27560; Telephone: (919) 468-0399. Copies

of the above reports may also be accessed from our web site at www.charlesandcolvard.com. We have authorized no one to provide you with

any information that differs from that contained in this prospectus. Accordingly, you should not rely on any information that is not

contained in this prospectus. You should not assume that the information in this prospectus is accurate as of any date other than the

date of the front cover of this prospectus.

Charles & Colvard, Ltd.

$25,000,000

Common Stock

Preferred Stock

Warrants

Units

PROSPECTUS

, 2024

PART II

INFORMATION NOT REQUIRED IN PROSPECTUS

Item 14. Other Expenses of Issuance and Distribution.

The following is an itemized statement of expenses of the Company

in connection with the issuance and delivery of the securities being registered hereby, other than underwriting discounts and commissions.

| SEC registration fee | |

| | | |

$ | 2,943.24 | (1) |

| Printing Expenses | |

| | | |

| * | |

| NASDAQ Listing Fees | |

| | | |

| * | |

| Trustee Fees and Expenses | |

| | | |

| * | |

| Accounting Fees and Expenses | |

| | | |

| * | |

| Legal Fees and Expenses | |

| | | |

| * | |

| Miscellaneous | |

| | | |

| * | |

| Total | |

| $ | | |

| * | |

(1) In

accordance with Rule 415(a)(6) under the Securities Act, the filing fees previously paid in connection with the securities registered

under the Registration Statement on Form S-3 (File No. 333-256495), $25,000,000 worth of securities of which remain unsold, will continue

to be applied to the securities registered under this registration statement. Please see the registration fee table contained in Exhibit

107 to this registration statement for more information.

* These

fees will be dependent on the types of securities offered and number of offerings and, therefore, cannot be estimated at this time.

An estimate of the aggregate expenses in connection with the sale and distribution of securities being offered will be included in the

applicable prospectus supplement.

Item 15. Indemnification of Directors and Officers.

The following summary is qualified in its entirety by reference to

the complete text of any statutes referred to below and the Restated Articles of Incorporation of Charles & Colvard, Ltd., a North

Carolina corporation.

Sections 55-8-50 through 55-8-58 of the North Carolina Business Corporation

Act, or the NCBCA, permit a corporation to indemnify its directors, officers, employees, or agents under either or both a statutory or

non-statutory scheme of indemnification. Under the statutory scheme, a corporation may, with certain exceptions, indemnify a director,

officer, employee, or agent of the corporation who was, is, or is threatened to be made, a party to any threatened, pending, or completed

legal action, suit, or proceeding, whether civil, criminal, administrative, or investigative, because such person is or was a director,

officer, agent, or employee of the corporation, or is or was serving at the request of such corporation as a director, officer, employee,

or agent of another corporation or enterprise. This indemnity may include the obligation to pay any judgment, settlement, penalty, fine

(including an excise tax assessed with respect to an employee benefit plan), and reasonable expenses incurred in connection with a proceeding

(including counsel fees), but no such indemnification may be granted unless such director, officer, agent or employee (i) conducted himself

in good faith, (ii) reasonably believed (A) that their or his or her conduct in their or his or her official capacity with the corporation

was in the best interests of the corporation or (B) that in all other cases their or his or her conduct at least was not opposed to the

corporation’s best interests, and (iii) in the case of any criminal proceeding, had no reasonable cause to believe their or his

or her conduct was unlawful. Whether a director, officer, employee or agent has met the requisite standard of conduct for the type of

indemnification set forth above is determined by the board of directors, a committee of directors, special legal counsel, or the shareholders

in accordance with Section 55-8-55. A corporation may not indemnify a director, officer, agent, or employee under the statutory scheme

in connection with a proceeding by or in the right of the corporation in which the director, officer, agent, or employee was adjudged

liable to the corporation or in connection with a proceeding in which a director, officer, agent, or employee was adjudged liable on

the basis of having received an improper personal benefit.

In addition to, and separate and apart from the indemnification described

above under the statutory scheme, Section 55-8-57 of the NCBCA permits a corporation to indemnify or agree to indemnify any of its directors,

officers, employees, or agents against liability and expenses (including counsel fees) in any proceeding (including proceedings brought

by or on behalf of the corporation) arising out of their status as such or their activities in any of such capacities; provided, however,

that a corporation may not indemnify or agree to indemnify a person against liability or expenses such person may incur on account of

activities that were, at the time taken, known or believed by the person to be clearly in conflict with the best interests of the corporation.

Our Bylaws provide for indemnification, to the fullest extent from

time to time permitted by law, of any person who at any time serves or has served as a director or officer of the Company, or, at our

request, is or was serving as a director or officer of another entity in the event such person is made, or is threatened to be made,

a party to any threatened, pending, or completed civil, criminal, administrative, or investigative action, suit, or proceeding, and any

appeal of such an action, whether or not brought by or on behalf of the Company, seeking to hold such person liable by reason of the

fact that he or she is or was acting in such capacity.

The rights of indemnification found in our Bylaws cover:

| |

· |

reasonable expenses, including without limitation all

attorneys’ fees actually incurred by such person in connection with any action, suit or proceeding; |

| |

· |

payments in satisfaction of any judgment, money decree,

fine, penalty or settlement; and |

| |

· |

all reasonable expenses incurred in enforcing such

person’s indemnification rights. |

Sections 55-8-52 and 55-8-56 of the NCBCA require a corporation, unless

limited by its articles of incorporation, to indemnify a director or officer who has been wholly successful, on the merits or otherwise,

in the defense of any proceeding to which such director or officer was a party because he or she is or was a director or officer of the

corporation against reasonable expenses incurred in connection with the proceeding. Unless a corporation’s articles of incorporation

provide otherwise, a director or officer also may apply for and obtain court-ordered indemnification if the court determines that such

director or officer is fairly and reasonably entitled to such indemnification as provided in Sections 55-8-54 and 55-8-56.

Finally, Section 55-8-57 of the NCBCA provides that a corporation

may purchase and maintain insurance on behalf of an individual who is or was a director, officer, employee, or agent of the corporation

against liability asserted against or incurred by such person, whether or not the corporation is otherwise authorized by the NCBCA to

indemnify such party. Our directors and officers are currently covered under directors’ and officers’ insurance policies

maintained by the Company. Our Articles of Incorporation do not limit the personal liability of directors for monetary damages for breaches

of duty as a director.

The limitations of liability and indemnification provisions in our

Articles of Incorporation and Bylaws may discourage shareholders from bringing a lawsuit against directors for breach of their fiduciary

duty. These provisions may also have the effect of reducing the likelihood of derivative litigation against directors and officers, even

though such an action, if successful, might otherwise benefit our stockholders and us. In addition, your investment may be adversely

affected to the extent we pay the costs of settlement and damage awards against directors and officers pursuant to these indemnification

provisions.

Insofar as indemnification for liabilities arising under the Securities

Act may be permitted to our directors, officers and controlling persons pursuant to the foregoing provisions, or otherwise, we have been

advised that, in the opinion of the SEC, such indemnification is against public policy as expressed in the Securities Act and is, therefore,

unenforceable.

Item 16. Exhibits.

* To be filed, if necessary, with a Current Report on Form 8-K or

a Post-Effective Amendment to the registration statement.

Item 17. Undertakings.

Insofar as indemnification for liabilities arising under the Securities

Act may be permitted to directors, officers and controlling persons of the registrant, pursuant to the provisions described under Item 15

or otherwise, the registrant has been advised that in the opinion of the Securities and Exchange Commission such indemnification by it

is against public policy as expressed in the Securities Act and is, therefore, unenforceable. In the event that a claim for indemnification

against such liabilities (other than the payment by the registrant of expenses incurred or paid by a director, officer or controlling

person of the registrant in the successful defense of any action, suit or proceeding) is asserted by such director, officer or controlling

person in connection with the securities being registered, the registrant will, unless in the opinion of its counsel the matter has been

settled by controlling precedent, submit to a court of appropriate jurisdiction the question whether such indemnification by it is against

public policy as expressed in the Securities Act and will be governed by the final adjudication of such issue.

The undersigned registrant hereby undertakes:

(1) To file, during any period

in which offers or sales are being made, a post-effective amendment to this registration statement:

(i) to

include any prospectus required by Section 10(a)(3) of the Securities Act;

(ii) to

reflect in the prospectus any facts or events arising after the effective date of this registration statement (or the most recent post-effective

amendment thereof) which, individually or in the aggregate, represent a fundamental change in the information set forth in this registration

statement. Notwithstanding the foregoing, any increase or decrease in volume of securities offered (if the total dollar value of securities

offered would not exceed that which was registered) and any deviation from the low or high end of the estimated maximum offering range

may be reflected in the form of a prospectus filed with the SEC pursuant to Rule 424(b) under the Securities Act if, in the aggregate,

the changes in volume and price represent no more than 20% change in the maximum aggregate offering price set forth in the “Calculation

of Registration Fee” table in the effective registration statement); and

(iii) to

include any material information with respect to the plan of distribution not previously disclosed in this registration statement or

any material change to such information in this registration statement;

provided,

however, that subparagraphs (i), (ii) and (iii) do not apply if the information required to be included in a post-effective

amendment by those subparagraphs is contained in reports filed with or furnished to the SEC by the registrant pursuant to Section 13

or Section 15(d) of the Securities Exchange Act of 1934, that are incorporated by reference in this registration statement, or is

contained in a form of prospectus filed pursuant to Rule 424(b) that is part of the registration statement.

(2) That, for the purpose

of determining any liability under the Securities Act, each such post-effective amendment shall be deemed to be a new registration statement

relating to the securities offered therein, and the offering of such securities at that time shall be deemed to be the initial bona fide

offering thereof.

(3) To remove from registration,

by means of a post-effective amendment, any of the securities being registered which remain unsold at the termination of the offering.

(4) That, for the purpose

of determining liability under the Securities Act of 1933 to any purchaser if the registrant is relying on Rule 430B: (A) each prospectus

filed by the registrant pursuant to Rule 424(b)(3) shall be deemed to be part of the registration statement as of the date the filed

prospectus was deemed part of and included in the registration statement; and (B) each prospectus required to be filed pursuant to Rule

424(b)(2), (b)(5), or (b)(7) as part of a registration statement in reliance on Rule 430B relating to an offering made pursuant to Rule

415(a)(1)(i), (vii), or (x) for the purpose of providing the information required by section 10(a) of the Securities Act of 1933 shall

be deemed to be part of and included in the registration statement as of the earlier of the date such form of prospectus is first used

after effectiveness or the date of the first contract of sale of securities in the offering described in the prospectus. As provided

in Rule 430B, for liability purposes of the issuer and any person that is at that date an underwriter, such date shall be deemed to be

a new effective date of the registration statement relating to the securities in the registration statement to which that prospectus

relates, and the offering of such securities at that time shall be deemed to be the initial bona fide offering thereof. Provided,

however, that no statement made in a registration statement or prospectus that is part of the registration statement or made in

a document incorporated or deemed incorporated by reference into the registration statement or prospectus that is part of the registration

statement will, as to a purchaser with a time of contract of sale prior to such effective date, supersede or modify any statement that

was made in the registration statement or prospectus that was part of the registration statement or made in any such document immediately

prior to such effective date.

(5) That, for the purpose

of determining liability under the Securities Act of 1933 to any purchaser, if the registrant is subject to Rule 430C, each prospectus

filed pursuant to Rule 424(b) as part of a registration statement relating to an offering, other than registration statements relying

on Rule 430B or other than prospectuses filed in reliance on Rule 430A, shall be deemed to be part of and included in the registration

statement as of the date it is first used after effectiveness; provided, however, that no statement made in a registration statement

or prospectus that is part of the registration statement or made in a document incorporated or deemed incorporated by reference into

the registration statement or prospectus that is part of the registration statement will, as to a purchaser with a time of contract of

sale prior to such first use, supersede or modify any statement that was made in the registration statement or prospectus that was part

of the registration statement or made in any such document immediately prior to such date of first use.

(6) That, for the purpose

of determining liability under the Securities Act of 1933 to any purchaser in the initial distribution of the securities: the undersigned

registrant undertakes that in a primary offering of securities of the undersigned registrant pursuant to this registration statement,

regardless of the underwriting method used to sell the securities to the purchaser, if the securities are offered or sold to such purchaser

by means of any of the following communications, the undersigned registrant will be a seller to the purchaser and will be considered

to offer or sell such securities to such purchaser: (i) any preliminary prospectus or prospectus of the undersigned registrant relating

to the offering required to be filed pursuant to Rule 424; (ii) any free writing prospectus relating to the offering prepared by or on

behalf of the undersigned registrant or used or referred to by the undersigned registrant; (iii) the portion of any other free writing

prospectus relating to the offering containing material information about the undersigned registrant or its securities provided by or

on behalf of the undersigned registrant; and (iv) any other communication that is an offer in the offering made by the undersigned registrant

to the purchaser.

(7) That, for purposes of

determining any liability under the Securities Act of 1933, each filing of the registrant’s annual report pursuant to Section 13(a)

or Section 15(d) of the Securities Exchange Act of 1934 (and, where applicable, each filing of an employee benefit plan’s

annual report pursuant to Section 15(d) of the Securities Exchange Act of 1934) that is incorporated by reference in this registration

statement shall be deemed to be a new registration statement relating to the securities offered therein, and the offering of such securities

at that time shall be deemed to be the initial bona fide offering thereof.

(8) That, for purposes of

determining any liability under the Securities Act of 1933, the information omitted from the form of prospectus filed as part of this

registration statement in reliance upon Rule 430A and contained in a form of prospectus filed by the registrant pursuant to Rule 424(b)(1)

or (4) or 497(h) under the Securities Act of 1933 shall be deemed to be part of this registration statement as of the time it was

declared effective.

(9) That, for the purpose of determining any liability under the