For Immediate Release

Chicago, IL – April 10, 2012 – Zacks Equity Research highlights

Aetna Inc. (AET) as the Bull of the Day and

Citi Trends, Inc. (CTRN) as the Bear of the Day.

In addition, Zacks Equity Research provides analysis on

Alcoa (AA), AOL (AOL) and

Microsoft (MSFT).

Full analysis of all these stocks is available at

http://at.zacks.com/?id=2678.

Here is a synopsis of all five stocks:

Bull of the Day:

We reiterate our outperform rating on Aetna

Inc. (AET) prior to the release of its first-quarter

earnings scheduled on April 25, 2012, to reflect its

better-than-average operating fundamentals and expected strong

performance in 2012.

The company ended the year 2011 with better performances,

demonstrating growth in membership, revenues, operating margins and

cash flow on the back of low medical utilization, pricing

discipline, medical cost management strategies and cost controls.

In 2011, the company made strategic investments in acquisitions and

technologies, with the intent to extend its core health business

and also to capitalize on exciting new consumer as well as provider

opportunities emerging in the marketplace.

Aetna's strong operating results and significant capital

generation will allow it to continue investing for the future. We

expect the company to keep performing better in 2012. The Zacks

Consensus estimates earnings of $1.39 per share for first quarter

2012, which translates into an expected earnings growth of 10.5%

year over year.

Bear of the Day:

Citi Trends, Inc.'s (CTRN) falling comparable

store sales, coupled with rising cost of goods sold and operating

expenses, battered fourth-quarter 2011 results. The company

incurred a quarterly loss of $0.18 per share, falling drastically

from the year-ago quarter earnings of $0.64 per share. The results,

however, bettered the Zacks Consensus Estimate of a loss of $0.20

per share.

Further, due to uncertainty hovering around sales, given the

global economic unrest, the company decided not to provide any

guidelines unless it finds any near-term catalysts to drive sales.

Intense competition from other retailers, seasonal nature of

business and risks associated with sourcing merchandise from

developing countries may further undermine the company's future

growth prospects.

Currently, we are maintaining a long-term Underperform

recommendation on the stock. Our target price of $10.00 is based on

P/CF (price-to-cash flow) multiple of 8.27x.

Latest Posts on the Zacks Analyst Blog:

Jobs & the Market: Weather or

Not?

In the run-up to the March jobs report, a number of economic

forecasters had started wondering about the extent of temporary

contribution from this year’s unusually warm winter. Even Ben

Bernanke found the labor market strength of the last few months

difficult to reconcile with the relatively slow pace of underlying

economic improvement. We will know for sure only after we get the

April jobs numbers in about three week, but weather seems to be the

most plausible explanation for March’s unexpected under-200K labor

market reading.

The government’s monthly household survey (the unemployment rate

comes out of this report) lists the number of people not at work

because of weather. The non-seasonally adjusted March reading

showed an 82K drop on this count, significantly below the

historical level for this month. The same number for the preceding

three months was above trend compared to history, meaning that the

weather gains of the pre-March months likely got reversed in March.

The persistent downtrend in weekly jobless claims and other labor

market indicators over the last many months would argue against a

fundamental weakness in underlying momentum.

In corporate news, the first quarter earnings season gets underway

unofficially on Tuesday with Alcoa’s (AA) report,

with aggregate earnings growth expectations at their lowest level

since the start of earnings recovery in 2009. Barring unusual

negative surprises, I would expect this earnings season to be

largely uneventful. Given the low hurdle rates as a result of

subdued expectations, the focus will be management guidance for the

coming quarter, particularly with how they see the Chinese and

European situation impacting their profitability.

In other news, shares of AOL (AOL) will be in the

spotlight today after the company announced the sale of over 800

patents to Microsoft (MSFT) for $1.06 billion in

cash.

Get the full analysis of all these stocks by going to

http://at.zacks.com/?id=2649.

About the Bull and Bear of the Day

Every day, the analysts at Zacks Equity Research select two

stocks that are likely to outperform (Bull) or underperform (Bear)

the markets over the next 3-6 months.

About the Analyst Blog

Updated throughout every trading day, the Analyst Blog provides

analysis from Zacks Equity Research about the latest news and

events impacting stocks and the financial markets.

About Zacks Equity Research

Zacks Equity Research provides the best of quantitative and

qualitative analysis to help investors know what stocks to buy and

which to sell for the long-term.

Continuous analyst coverage is provided for a universe of 1,150

publicly traded stocks. Our analysts are organized by industry

which gives them keen insights to developments that affect company

profits and stock performance. Recommendations and target prices

are six-month time horizons.

Zacks "Profit from the Pros" e-mail newsletter provides

highlights of the latest analysis from Zacks Equity Research.

Subscribe to this free newsletter today by visiting

http://at.zacks.com/?id=7158.

About Zacks

Zacks.com is a property of Zacks Investment Research, Inc.,

which was formed in 1978 by Leonard Zacks. As a PhD from MIT Len

knew he could find patterns in stock market data that would lead to

superior investment results. Amongst his many accomplishments was

the formation of his proprietary stock picking system; the Zacks

Rank, which continues to outperform the market by nearly a 3 to 1

margin. The best way to unlock the profitable stock recommendations

and market insights of Zacks Investment

Research is through our free daily email newsletter; Profit from

the Pros. In short, it's your steady flow of Profitable ideas

GUARANTEED to be worth your time! Register for your free

subscription to Profit from the Pros at

http://at.zacks.com/?id=4582.

Visit http://www.zacks.com/performance for information about the

performance numbers displayed in this press release.

Follow us on Twitter: http://twitter.com/zacksresearch

Join us on Facebook:

http://www.facebook.com/home.php#/pages/Zacks-Investment-Research/57553657748?ref=ts

Disclaimer: Past performance does not guarantee future results.

Investors should always research companies and securities before

making any investments. Nothing herein should be construed as an

offer or solicitation to buy or sell any security.

Media Contact

Zacks Investment Research

800-767-3771 ext. 9339

support@zacks.com

http://www.zacks.com

ALCOA INC (AA): Free Stock Analysis Report

AETNA INC-NEW (AET): Free Stock Analysis Report

AOL INC (AOL): Free Stock Analysis Report

CITI TRENDS INC (CTRN): Free Stock Analysis Report

MICROSOFT CORP (MSFT): Free Stock Analysis Report

To read this article on Zacks.com click here.

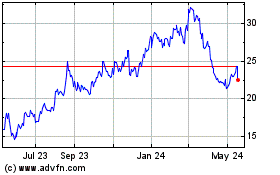

Citi Trends (NASDAQ:CTRN)

Historical Stock Chart

From Jun 2024 to Jul 2024

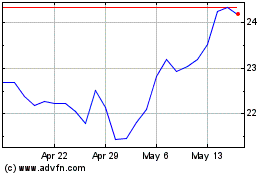

Citi Trends (NASDAQ:CTRN)

Historical Stock Chart

From Jul 2023 to Jul 2024