Cue Biopharma, Inc. (Nasdaq: CUE), a clinical-stage

biopharmaceutical company developing a novel class of therapeutic

biologics to selectively engage and modulate disease-specific T

cells for the treatment of cancer and autoimmune disease, today

provided a business and financial update for the third quarter of

2024.

Recent Business Highlights

- Presented positive updated data from the Phase 1 trials of

CUE-101 and CUE-102 at the Society for Immunotherapy of

Cancer’s 39th Annual Meeting (SITC 2024) November 6-10

- Updated data from Phase 1 trial of CUE-101 in combination with

KEYTRUDA® (pembrolizumab) continued to demonstrate enhanced

benefit versus historical studies with pembrolizumab alone. Key

findings included an objective response rate (ORR) of 46%, 12-month

overall survival (OS) of 91.3% and a median overall survival (mOS)

of 21.8 months in first line (1L) HPV+ R/M HNSCC patients, as well

as an ORR of 50% in the subset of 1L patients with low PD-L1

expression (combined positive score (CPS) 1-19)

- Updated data from Phase 1 monotherapy trial of CUE-102 included

evidence of selective expansion of WT1-specific T cells and

anti-tumor activity, as well as a favorable tolerability profile

with no dose limiting toxicities (DLTs) in patients with Wilms’

Tumor 1 (WT1)-expressing colorectal, gastric, ovarian and

pancreatic cancers

- Demonstrated disease control rate (DCR) of 67% in late-stage

pancreatic cancer patients treated with CUE-102 monotherapy,

including an unconfirmed partial response (PR) with a 40% decrease

in tumor burden

- Announced pricing of $12.0 million public offering

- Appointed industry veteran Lucinda Warren as Chief Business

Officer

- Continued advancement of preclinical programs, CUE-401 for

induction and expansion of regulatory T cells, in collaboration

with Ono Pharmaceutical, and CUE-501 for B cell depletion,

positioning both programs towards drug candidate selection

“We are very pleased with the validating updated clinical data

from our Phase 1 trials for both CUE-101 and CUE-102,” said Daniel

Passeri, chief executive officer of Cue Biopharma. “Importantly, we

believe the maturing data further supports and strengthens our

competitive differentiation and positioning for selective

modulation of disease-specific T cells. This data further bolsters

our confidence that the CUE-100 series, exemplified by CUE-101 and

CUE-102, represents the potential of establishing a new standard of

care for cancer patients. We are also very pleased with the

continued progress of our preclinical autoimmune programs, both of

which have moved closer towards drug candidate selection.”

Third Quarter 2024 Financial Results

Collaboration revenue increased by $1.2 million to $3.3 million for

the three months ended September 30, 2024, from $2.1 million for

the three months ended September 30, 2023. The increase was due to

revenue earned from the Ono Collaboration and Option Agreement,

which was executed in February 2023.

Research and development expenses decreased by $0.5 million to

$9.4 million for the three months ended September 30, 2024, from

$9.9 million for the three months ended September 30, 2023. The

decrease was primarily due to lower clinical trial costs and

employee compensation, which includes stock-based compensation,

partially offset by an increase in drug substance manufacturing

costs related to the continued advancement of CUE-401.

General and administrative expenses decreased by $0.7 million to

$2.9 million for the three months ended September 30, 2024, from

$3.6 million for the three months ended September 30, 2023. The

decrease was primarily due to a decrease in employee compensation,

which includes stock-based compensation.

Collaboration revenue increased by $4.0 million to $7.7 million

for the nine months ended September 30, 2024, from $3.7 million for

the nine months ended September 30, 2023. The increase was due to

revenue earned from the Ono Collaboration and Option Agreement,

which was executed in February 2023.

Research and development expenses decreased by $0.8 million to

$29.1 million for the nine months ended September 30, 2024,

from $29.9 million for the nine months ended September 30,

2023. The decrease was primarily due to lower clinical trial costs

and employee compensation, which includes stock-based compensation,

partially offset by an increase in professional outside services

related to the continued advancement of CUE-401.

General and administrative expenses decreased by $1.5 million to

$10.6 million for the nine months ended September 30, 2024,

from $12.1 million for the nine months ended September 30,

2023. The decrease was primarily due to a decrease in employee

compensation, which includes stock-based compensation.

As of September 30, 2024, the Company had

approximately $32.4 million in cash and cash equivalents

compared with $48.5 million in cash and cash equivalents

as of December 31, 2023. The Company expects its current cash

and cash equivalents to fund operations into the fourth quarter of

2025.

|

Cue Biopharma, Inc. |

|

Condensed Consolidated Statements of Operations and Other

Comprehensive Loss |

|

(Unaudited) |

|

(In thousands, except share and per share

amounts) |

|

|

| |

|

Three Months

EndedSeptember 30, |

|

Nine Months EndedSeptember

30, |

|

|

|

2024 |

|

|

2023 |

|

|

2024 |

|

|

2023 |

|

|

Collaboration revenue |

$ |

3,336 |

|

$ |

2,100 |

|

$ |

7,711 |

|

$ |

3,669 |

|

| Operating

expenses: |

|

|

|

|

|

|

|

|

|

|

General and administrative |

|

2,867 |

|

|

3,645 |

|

|

10,564 |

|

|

12,071 |

|

|

Research and development |

|

9,381 |

|

|

9,874 |

|

|

29,111 |

|

|

29,915 |

|

|

Gain on fixed asset disposal |

|

(97) |

|

|

- |

|

|

(97) |

|

|

- |

|

|

Total operating expenses |

|

12,151 |

|

|

13,519 |

|

|

39,578 |

|

|

41,986 |

|

| Loss from

operations |

|

(8,815) |

|

|

(11,419) |

|

|

(31,867) |

|

|

(38,317) |

|

| Other income

(expense): |

|

|

|

|

|

|

|

|

|

Interest income |

|

343 |

|

|

700 |

|

|

1,332 |

|

|

1,756 |

|

|

Interest expense |

|

(188) |

|

|

(286) |

|

|

(643) |

|

|

(738) |

|

| Total other income,

net |

|

155 |

|

|

414 |

|

|

689 |

|

|

1,018 |

|

| Net loss |

$ |

(8,660) |

|

$ |

(11,005) |

|

$ |

(31,178) |

|

$ |

(37,299) |

|

| Unrealized gain from

available-for-sale securities |

|

- |

|

|

5 |

|

|

- |

|

|

96 |

|

| Comprehensive

loss |

$ |

(8,660) |

|

$ |

(11,000) |

|

$ |

(31,178) |

|

$ |

(37,203) |

|

| Net loss per common share – basic

and diluted |

$ |

(0.17) |

|

$ |

(0.24) |

|

$ |

(0.62) |

|

$ |

(0.82) |

|

| Weighted average common shares

outstanding – basic and diluted |

|

51,229,701 |

|

|

46,358,555 |

|

|

50,292,983 |

|

|

45,274,124 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

Cue Biopharma, Inc. |

|

Condensed Consolidated Balance Sheets |

|

(Unaudited, In thousands) |

|

|

|

September 30, 2024 |

|

|

December 31, 2023 |

|

| Assets |

|

|

|

|

|

|

|

Cash and cash equivalents |

$ |

32,420 |

|

$ |

48,514 |

|

|

Other assets |

|

12,390 |

|

|

13,016 |

|

|

Total assets |

$ |

44,810 |

|

$ |

61,530 |

|

| Liabilities and

stockholders’ equity |

|

|

|

|

|

|

|

Liabilities |

$ |

19,444 |

|

$ |

24,445 |

|

|

Stockholders' equity |

|

25,366 |

|

|

37,085 |

|

|

Total Liabilities and stockholders’ equity |

$ |

44,810 |

|

$ |

61,530 |

|

|

|

|

|

|

|

|

|

About Cue BiopharmaCue Biopharma, a

clinical-stage biopharmaceutical company, is developing a novel

class of injectable biologics to selectively engage and modulate

disease-specific T cells directly within the patient’s body. The

company’s proprietary platform, Immuno-STAT™ (Selective Targeting

and Alteration of T cells), and biologics are designed to harness

the curative potential of the body’s intrinsic immune system

through the selective modulation of disease-specific T cells

without the adverse effects of broad systemic immune

modulation.

Headquartered in Boston, Massachusetts, we are led by an

experienced management team and independent Board of Directors with

deep expertise in immunology and immuno-oncology as well as the

design and clinical development of protein biologics.

For more information please

visit www.cuebiopharma.com and follow us

on X and LinkedIn.

Forward-Looking StatementsThis press release

contains forward-looking statements within the meaning of the

Private Securities Litigation Reform Act of 1995. Such

forward-looking statements include, but are not limited to, those

regarding: the company’s belief that the CUE-100 series represents

the potential of establishing a new standard of care for cancer

patients; the company’s belief that the Immuno-STAT platform

stimulates targeted immune modulation through the selective

modulation of disease-relevant T cell and the applicability of the

company’s platform across many cancers and autoimmune diseases; the

company’s business strategies, plans and prospects, including the

advancement of the company’s preclinical autoimmune programs toward

drug candidate selection ; and the cash runway of the company and

the sufficiency of the company’s cash and cash equivalents to fund

its operations. Forward-looking statements, which are based on

certain assumptions and describe the company’s future plans,

strategies and expectations, can generally be identified by the use

of forward-looking terms such as “believe,” “expect,” “may,”

“will,” “should,” “would,” “could,” “seek,” “intend,” “plan,”

“goal,” “project,” “estimate,” “anticipate,” “strategy,” “future,”

“likely” or other comparable terms, although not all

forward-looking statements contain these identifying words. All

statements other than statements of historical facts included in

this press release regarding the company’s strategies, prospects,

financial condition, operations, costs, plans and objectives are

forward-looking statements. Important factors that could cause the

company’s actual results and financial condition to differ

materially from those indicated in the forward-looking statements

include, among others, the company’s ability to shift its focus to

its autoimmune assets and achieve the cost savings that it is

projecting; the company’s limited operating history, limited cash

and a history of losses; the company’s ability to achieve

profitability; potential setbacks in the company’s research and

development efforts including negative or inconclusive results from

its preclinical studies or clinical trials or the company’s ability

to replicate in later clinical trials positive results found in

preclinical studies and early-stage clinical trials of its product

candidates; serious and unexpected drug-related side effects or

other safety issues experienced by participants in clinical trials;

its ability to secure required U.S. Food and Drug Administration

(“FDA”) or other governmental approvals for its product candidates

and the breadth of any approved indication; adverse effects caused

by public health pandemics, including possible effects on the

company’s trials; delays and changes in regulatory requirements,

policy and guidelines including potential delays in submitting

required regulatory applications to the FDA; the company’s reliance

on licensors, collaborators, contract research organizations,

suppliers and other business partners; the company’s ability to

obtain adequate financing to fund its business operations in the

future; the company’s ability to maintain and enforce necessary

patent and other intellectual property protection; competitive

factors; general economic and market conditions and the other risks

and uncertainties described in the Risk Factors and in Management's

Discussion and Analysis of Financial Condition and Results of

Operations sections of the company’s most recently filed Annual

Report on Form 10-K and any subsequently filed Quarterly Report(s)

on Form 10-Q. Any forward-looking statement made by the company in

this press release is based only on information currently available

to the company and speaks only as of the date on which it is made.

The company undertakes no obligation to publicly update any

forward-looking statement, whether written or oral, that may be

made from time to time, whether as a result of new information,

future developments or otherwise.

Investor Contact Marie Campinell Senior

Director, Corporate CommunicationsCue Biopharma,

Inc.mcampinell@cuebio.com

Media ContactJonathan PappasLifeSci

Communicationsjpappas@lifescicomms.com

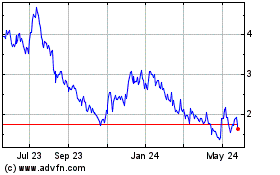

Cue Biopharma (NASDAQ:CUE)

Historical Stock Chart

From Nov 2024 to Dec 2024

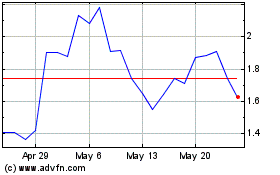

Cue Biopharma (NASDAQ:CUE)

Historical Stock Chart

From Dec 2023 to Dec 2024