Filed Pursuant to Rule 424(b)(5)

Registration No. 333-271567

PROSPECTUS SUPPLEMENT

(To Prospectus dated June 13, 2023)

6,650,000 Shares of Common Stock

8,350,000 Pre-Funded Warrants to Purchase Shares

of Common Stock

8,350,000 Shares of Common Stock Underlying

the Pre-Funded Warrants

Cyngn Inc. (the “Company,” “Cyngn,”

the “registrant,” “we,” “our” or “us”) is offering 6,650,000 shares of common stock, par

value $0.00001, pursuant to this prospectus supplement and accompanying prospectus at a public offering price of $0.60 per share.

We are also offering the opportunity to purchase,

if the purchaser so chooses and in lieu of shares of common stock, 8,350,000 pre-funded warrants (the “Pre-Funded Warrants”)

to purchasers whose purchase of shares in this offering would otherwise result in the purchaser, together with its affiliates and certain

related parties, beneficially owning more than 4.99% (or, at the election of the purchaser, 9.99%) of our outstanding common stock immediately

following the consummation of this offering. The purchase price of each Pre-Funded Warrant is $0.5999 (equal to the price per share minus

$0.0001), and the exercise price of each Pre-Funded Warrant is $0.0001 per share. The Pre-Funded Warrants will be immediately exercisable

and may be exercised at any time until all of the Pre-Funded Warrants are exercised in full.

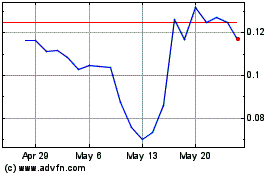

Our common stock is listed on The Nasdaq Capital

Market under the symbol “CYN.” The last reported sale price of our common stock on The Nasdaq Capital Market on December 30,

2024, was $0.8103 per share. There is no established trading market for Pre-Funded Warrants, and we do not intend to list the Pre-Funded

Warrants on any securities exchange or nationally recognized trading system.

We have engaged Aegis Capital Corp. to act as

our exclusive placement agent in connection with this offering. The placement agent has agreed to use its best efforts to arrange for

the sale of the securities offered by this prospectus. The placement agent is not purchasing or selling any of the securities we are offering

and the placement agent is not required to arrange the purchase or sale of any specific number or dollar amount of securities. We have

agreed to pay to the placement agent the placement agent fees set forth in the table below. We will bear all costs associated with the

offering. See “Plan of Distribution” on page S-14 of this prospectus supplement for more information regarding these

arrangements.

We have entered into a securities purchase agreement

with the purchasers for the sale of all of the securities being offered hereunder. We will have one closing for all the securities purchased

in this offering. The offering will terminate upon the completion of a single closing, which is expected to occur on or about December

31, 2024.

We intend to use the proceeds from this offering

for working capital and other general corporate purposes. See “Use of Proceeds.”

Investing in these securities involves a high

degree of risk. See “Risk Factors” beginning on page S-9 of this prospectus supplement and on page 2 of the accompanying

base prospectus, as well as the risk factors incorporated by reference into this prospectus supplement and accompanying base prospectus,

for a discussion of information that should be considered in connection with an investment in our securities.

Neither the Securities and Exchange Commission

(“SEC”) nor any state securities commission has approved or disapproved of these securities or determined if this prospectus

is truthful or complete. Any representation to the contrary is a criminal offense.

We are an “emerging growth company”

as that term is used in the Jumpstart Our Business Startups Act of 2012, and we have elected to comply with certain reduced public company

reporting requirements.

| | |

Per Share | | |

Per

Pre-Funded

Warrant | | |

Total | |

| Public offering price | |

$ | 0.60 | | |

$ | 0.5999 | | |

$ | 9,000,000 | |

| Placement agent fees(1) | |

$ | 0.048 | | |

$ | 0.048 | | |

$ | 720,000 | |

| Proceeds, before expenses, to us(2) | |

$ | 0.552 | | |

$ | 0.552 | | |

$ | 8,280,000 | |

| (1) | Represents

a cash fee equal to 8% of the aggregate purchase price paid by investors in this offering. We have also agreed to reimburse the placement

agent for the fees and disbursements of its legal counsel in an amount of $75,000. See “Plan of Distribution” beginning

on page S-14 of this prospectus supplement for a description of the compensation to be received by the placement agent. |

| (2) | The

amount of offering proceeds to us presented in this table does not give effect to any exercise of the Pre-Funded Warrants. |

The delivery to purchasers of securities in this

offering is expected to be made on or about December 31, 2024, subject to satisfaction of certain customary closing conditions.

Sole Placement Agent

Aegis Capital Corp.

The date of this prospectus is December 30, 2024

TABLE OF CONTENTS

PROSPECTUS SUPPLEMENT

PROSPECTUS

ABOUT

THIS PROSPECTUS SUPPLEMENT

This prospectus supplement

and the accompanying prospectus are part of a registration statement on Form S-3 (File No. 333-271567) that we filed with the Securities

and Exchange Commission, or SEC, on May 2, 2023, as amended on May 31, 2023, and that was declared effective by the SEC on June 13, 2023

using a “shelf” registration process. This document is in two parts. The first part is this prospectus supplement, which describes

the specific terms of this offering and also adds to and updates information contained in the accompanying prospectus and the documents

incorporated by reference herein. The second part, the accompanying prospectus, provides more general information, some of which may not

apply to this offering. Generally, when we refer to this prospectus, we are referring to both parts of this document combined. To the

extent there is a conflict between the information contained in this prospectus supplement and the information contained in the accompanying

prospectus or any document incorporated by reference therein filed prior to the date of this prospectus supplement, you should rely on

the information in this prospectus supplement. If any statement in one of these documents is inconsistent with a statement in another

document having a later date—for example, a document incorporated by reference in the accompanying prospectus—the statement

in the document having the later date modifies or supersedes the earlier statement.

We further note that the

representations, warranties and covenants made by us in any agreement that is filed as an exhibit to any document that is incorporated

by reference herein were made solely for the benefit of the parties to such agreement, including, in some cases, for the purpose of allocating

risk among the parties to such agreements, and should not be deemed to be a representation, warranty or covenant to you. Moreover, such

representations, warranties or covenants were accurate only as of the date when made. Accordingly, such representations, warranties and

covenants should not be relied on as accurately representing the current state of our affairs.

You should rely only on the

information contained in this prospectus supplement or the accompanying prospectus or incorporated by reference herein. We have not authorized,

and the placement agent has not authorized, anyone to provide you with information that is different. The information contained in this

prospectus supplement or the accompanying prospectus or incorporated by reference herein or therein is accurate only as of the respective

dates thereof, regardless of the time of delivery of this prospectus supplement and the accompanying prospectus or of any sale of our

common stock.

This prospectus supplement

and the accompanying prospectus contain summaries of certain provisions contained in some of the documents described herein, but reference

is made to the actual documents for complete information. All of the summaries are qualified in their entirety by the actual documents.

Copies of some of the documents referred to herein have been filed, will be filed or will be incorporated herein by reference as exhibits

to the registration statement, and you may obtain copies of those documents as described below in the section entitled “Where You

Can Find More Information.”

It is important for you to

read and consider all information contained in this prospectus supplement and the accompanying prospectus, including the documents incorporated

by reference herein and therein, in making your investment decision. You should also read and consider the information in the documents

to which we have referred you in the sections entitled “Where You Can Find More Information” and “Information Incorporated

By Reference” in this prospectus supplement and in the accompanying prospectus, respectively.

This prospectus supplement

and the accompanying prospectus contain and incorporate by reference statistical data and estimates, including those relating to market

size and competitive position of the markets in which we participate, that we obtained from our own internal estimates and research, as

well as from industry and general publications and research, surveys and studies conducted by third parties. Industry publications, studies

and surveys generally state that they have been obtained from sources believed to be reliable. While we believe our internal company research

is reliable and the definitions of our market and industry are appropriate, neither this research nor these definitions have been verified

by any independent source.

We further note that the

representations, warranties and covenants made by us in any agreement that is filed as an exhibit to any document that is incorporated

by reference into this prospectus supplement and the accompanying prospectus were made solely for the benefit of the parties to such agreement,

including, in some cases, for the purpose of allocating risk among the parties to such agreement, and should not be deemed to be a representation,

warranty or covenant to you. Moreover, such representations, warranties or covenants were accurate only as of the date when made. Accordingly,

such representations, warranties and covenants should not be relied on as accurately representing the current state of our affairs.

We are offering to sell,

and seeking offers to buy, the securities offered by this prospectus supplement only in jurisdictions where offers and sales are permitted.

The distribution of this prospectus supplement and the accompanying prospectus and the offering of the securities offered by this prospectus

supplement in certain jurisdictions may be restricted by law. Persons outside the United States who come into possession of this prospectus

supplement and the accompanying prospectus must inform themselves about, and observe any restrictions relating to, the offering of the

common stock and the distribution of this prospectus supplement and the accompanying prospectus outside the United States. This prospectus

supplement and the accompanying prospectus do not constitute, and may not be used in connection with, an offer to sell, or a solicitation

of an offer to buy, any securities offered by this prospectus supplement and the accompanying prospectus by any person in any jurisdiction

in which it is unlawful for such person to make such an offer or solicitation.

CYNGN Inc. and its consolidated

subsidiaries are referred to herein as “Cyngn,” “the Company,” “we,” “us” and “our,”

unless the context indicates otherwise.

This prospectus contains,

or incorporates by reference, trademarks, tradenames, service marks and service names of CYNGN Inc. and its subsidiaries.

PROSPECTUS SUPPLEMENT SUMMARY

This summary highlights selected information

included elsewhere in or incorporated by reference in this prospectus supplement, in the accompanying prospectus and in the documents

incorporated by reference herein and therein, and does not contain all the information that you should consider before investing in our

securities pursuant to this prospectus supplement and the accompanying prospectus. You should read the entire prospectus supplement and

the accompanying prospectus carefully, especially “Risk Factors” and the financial statements and related notes and other

information incorporated by reference herein and therein, before deciding whether to participate in the offering described in this prospectus

supplement and the accompanying prospectus.

Overview

We are an autonomous vehicle

(“AV”) technology company that is focused on addressing industrial uses for autonomous vehicles. We believe that technological

innovation is needed to enable adoption of autonomous industrial vehicles that will address the substantial industry challenges that exist

today. These challenges include labor shortages, high labor costs and work safety.

We integrate our full-stack

autonomous driving software, DriveMod, onto vehicles manufactured by Original Equipment Manufacturers (“OEM”) either via retrofit

of existing vehicles or by integration directly into vehicle assembly. We design the Enterprise Autonomy Suite (“EAS”) to

be compatible with sensors and components from leading hardware technology providers and integrate our proprietary AV software to produce

differentiated autonomous vehicles.

Autonomous driving has common

technological building blocks that remain similar across vehicles and applications. By tapping into these building blocks, DriveMod is

designed to deliver autonomy to new vehicles via streamlined hardware/software integration. This vehicle-agnostic approach enables DriveMod

to expand to new vehicles and novel operational design domains (“ODD”). In short, nearly every industrial vehicle, regardless

of use case, can move autonomously using our technology.

Our approach accomplishes

several primary value propositions:

| |

1. |

Provide autonomous capabilities to industrial vehicles built by established manufacturers that are already trusted by customers. |

| |

|

|

| |

2. |

Generate continual customer value by leveraging the synergistic relationship of autonomous vehicles and data. |

| |

|

|

| |

3. |

Develop consistent autonomous vehicle operation and user interfaces for diverse vehicle fleets. |

| |

|

|

| |

4. |

Complement the core competencies of existing industry players by introducing the leading-edge technologies like Artificial Intelligence (“AI”) and Machine Learning (“ML”), cloud/connectivity, sensor fusion, high-definition mapping, and real-time dynamic path planning and decision making. |

We believe our market positioning

as a technology partner to vehicle manufacturers creates a synergy with incumbent suppliers that already have established sales, distribution,

and service/maintenance channels. By focusing on industrial use cases and partnering with the incumbent OEMs in these markets, we believe

we can source and execute revenue-generating opportunities more quickly.

Our long-term vision is for

EAS to become a universal autonomous driving solution with minimal marginal cost for companies to adopt new vehicles and expand their

autonomous fleets across new deployments. We have already deployed DriveMod software on more than ten different vehicle form factors that

range from stockchasers and stand-on floor scrubbers to 14-seat shuttles and electric forklifts as part of prototypes and proof of concept

projects, demonstrating the extensibility of our AV building blocks.

Our recent progress contributes

to the validation of EAS with OEM partners and end customers. We also continue to build upon our ability to scale our products and generate

novel technological developments. The DriveMod Stockchaser became commercially available in early 2023 starting with the deployment from

our partner-customer US Continental, a California-based leading manufacturer of quality leather and fabric care products. We also launched

the DriveMod Forklift and the DriveMod Tugger as we expand our vehicle-type portfolio fleet through our OEM partnership with BYD and Motrec,

respectively.

We secured paid projects with

leading global customers like Arauco, along with additional projects from big brands in the Global 500 and the Fortune 100. Our patent

portfolio expanded with 16 new U.S. patent grants in 2023 and 2 granted in 2024, bringing the total grants to 21.

We intend to continue to pursue

and win additional license agreements with companies that depend heavily on the use of material handling vehicles and that all recognize

the need for automation to i) compete in todays economy, ii) combat the significant labor shortages and escalating costs, and iii) improve

safety. Our approach to securing these opportunities will be a continued direct sales effort coupled with increasing our network of industrial

vehicle dealers that already have significant sales of industrial vehicles.

Our Products

EAS is a suite of technology

and tools that consists of three complementary categories: DriveMod, Cyngn Insight, and Cyngn Evolve.

DriveMod: Industrial Autonomous Vehicle System

We built DriveMod as a modular

software product that is compatible with various sensor and computer hardware components that are widely used throughout the autonomous

vehicle industry. Our software combined with sensors and components from industry leading technology providers covers the end-to-end requirements

that enable vehicles to operate autonomously with leading-edge technology. The modularity of DriveMod allows our AV technology to be compatible

across vehicle platforms as well as indoor and outdoor environments. DriveMod can be retrofitted to existing vehicle assets or integrated

into a manufacturing partner’s vehicles at assembly, providing accessible options for our customers to integrate leading-edge technology

whether their AV adoption strategies are evolutionary or revolutionary.

The core vehicle-agnostic

DriveMod software stack is targeted and deployed to different vehicles through DriveMod Kits, which are the AV hardware systems

that take into account the specific needs of operating the DriveMod software on a specific target vehicle. Then, after prototyping and

productization, DriveMod kits streamline the integration AV hardware and software integration onto vehicles at scale. The DriveMod Kit

for Columbia Stockchasers is commercially released and available at scale. Subsequently, we expect to create different instances of DriveMod

Kits to support the commercial release of new vehicles on the EAS platform, such as the electric forklifts and other industrial vehicles.

Figure 1: Overview of Cyngn’s autonomous

vehicle technology (DriveMod)

DriveMod’s flexibility

combines with our network of manufacturing and service partners to support customers at different stages of autonomous technology integration.

This allows customers to grow the complexity and scope of their industrial autonomy deployments as their business transforms while continually

capturing returns throughout their transition to full autonomy. EAS will also grant customers access to over-the-air software upgrades,

ad hoc customer support, and flexible consumption based on usage and scale of operations. By lessening both the commercial and technical

burdens of traditional vehicle automation and industrial robotics investments, industrial AVs can become universally available to the

market, even reaching small and medium-sized businesses that may otherwise struggle to adopt Industry 4.0 and 5.0 technology.

Cyngn Insight: Intelligent Control Center

Cyngn Insight is the customer-facing

tool suite for managing AV fleets and aggregating data to extract business insights. Analytics dashboards surface data about the system’s

status, vehicle telemetry, and performance metrics. Cyngn Insight also provides tools to switch between autonomous, manual, and remote

operation when required. This flexibility allows customers to use the autonomous capabilities of the system in a way that is tailored

to their own operational environment. Customers can choose when to operate their DriveMod-powered vehicles autonomously and when to have

human operators operate the vehicles manually or remotely based on their own business needs. When combined, these capabilities and tools

make up the Cyngn Insight intelligent control center that enables flexible fleet management from any location.

Cyngn Insight’s tool

suite includes configurable cloud dashboards that aggregate diverse data streams at several levels of granularity (i.e., site, fleet,

vehicle, module, and component). We can collect data during “open loop” vehicle operation, meaning that the vehicles can be

operated manually while still collecting the rich data enabled by the advanced on-vehicle sensors and computers. Data can be used for

predictive maintenance, operational improvements, educating employees on digital transformation and more.

Cyngn Evolve: Data Optimization Tools

Cyngn Evolve is our internal

tool suite that underpins the relationship between AVs and data. Through a unifying cloud-based data infrastructure, our proprietary data

tools strengthen the positive network effects derived from the valuable new data created by AVs. Cyngn Evolve and its data pipelines facilitate

AI/ML training and deployment, manage data sets, and support driving simulation and grading to test and validate new DriveMod releases,

using both real-world and simulated data.

Figure 2: The Cyngn “AnyDrive”

simulation is part of the Cyngn Evolve toolchain. The simulation environment creates a digital version of the physical world. This allows

for customer data sets to be leveraged and augmented to achieve testing and validation prior to releasing new AV features.

As AV technology expertise

matures globally, there may be opportunities to monetize the sophisticated AV-centric tools of Cyngn Evolve. Currently, we believe that

AV development is confined to small groups of experts. Therefore, Cyngn Evolve is currently an internal EAS tool that we use to advance

DriveMod and Cyngn Insight, our customer-facing EAS products.

Intellectual Property Portfolio

Our ability to drive impact

and growth within the autonomous industrial vehicle market largely depends on our ability to obtain, maintain, and protect our intellectual

property and all other property rights related to our products and technology. To accomplish this, we utilize a combination of patents,

trademarks, copyrights, and trade secrets as well as employee and third-party non-disclosure agreements, licenses, and other contractual

obligations. In addition to protecting our intellectual property and other assets, our success also depends on our ability to develop

our technology and operate without infringing, misappropriating, or otherwise violating the intellectual property and property rights

of third parties, customers, and partners.

Our software stack has over

30 subsystems, including those designed for perception, mapping & localization, decision making, planning, and control. As of the

date of this prospectus, we have 21 granted U.S. patents and submitted 4 pending U.S. patent and expect to continue to file additional

patent applications with respect to our technology in the future.

Recent Developments

April 2024 Public Offering

On April 23, 2024, the Company

entered into an underwritten Agreement with Aegis Capital Corp. (“Aegis”), pursuant to which Aegis acted as the Company’s

underwriter on a firm commitment basis in connection with the sale by the Company of an aggregate of 500,000 shares of common stock

in a public offering, which included: (i) 198,000 shares of common stock, and (ii) pre-funded warrants to purchase 302,000 shares

of common stock. The pre-funded warrants had a nominal exercise price of $0.00001. Each share of common stock was sold at an offering

price of $0.10, and each pre-funded warrant was sold at an offering price of $0.09999. On May 3, 2024, the Company closed on the sale

of an additional 20,400 shares of common stock, upon exercise by the underwriter of the over-allotment option. The Company received gross

proceeds of approximately $5.2 million before deducting transaction related expenses payable by the Company.

Amended Bylaws

On May 7, 2024, we amended

our Amended and Restated Bylaws (the “Amended Bylaws”), for the purpose of reducing the quorum required to hold meetings of

the stockholders of the Company (the “Quorum Requirement”). The Amended Bylaws reduced the Quorum Requirement from a majority

to one-third (1/3rd) of the voting power of the shares of stock issued and outstanding and entitled to vote at the meeting. The Amended

Bylaws was approved by the Board of Directors of the Company on May 7, 2024.

Reverse Stock Split

At the Annual Meeting of Stockholders

on June 25, 2024, the stockholders of the Company approved the grant of discretionary authority to the board of directors of the Company

to effect a reverse stock split of its outstanding shares of common stock at a specific ratio within a range of one-for-five (1-for-5)

to a maximum of a one-for-one hundred (1-for-100) split. On July 3, 2024, we implemented a 1-for-100 reverse stock split (the “Reverse

Stock Split”) of our common stock. As a result of the Reverse Stock Split, every one hundred (100) shares of our pre-Reverse Stock

Split common stock were combined and reclassified into one share of our common stock. The number of shares of common stock subject to

outstanding options and warrants were also reduced by a factor of one hundred and the exercise price of such securities increased by a

factor of one hundred effective as of July 3, 2024. Our common stock commenced trading on a post- reverse stock split basis on July 5,

2024.

NASDAQ Compliance

On July 19, 2024, the Company

was notified by Nasdaq that the Company has regained compliance with the bid price requirement as set forth in Listing Rule 5550(a)(2),

and that the Company is therefore in compliance with the Nasdaq Capital Market’s listing requirements and will remain listed on

Nasdaq.

Private Placement

On November 12, 2024, the

Company entered into a Securities Purchase Agreement (the “SPA”) with certain investors (the “Purchasers”) pursuant

to which we sold, in a private placement (the “Private Placement”), senior notes with an aggregate principal amount of $4,375,000

(the “Notes”), and received proceeds before expenses of $3,500,000. As consideration for entering into the SPA, we issued

a total of 405,125 shares of common stock of the Company to the Purchasers on November 13, 2024.

In connection with the Purchase

Agreement, the Company entered into a registration rights agreement with the Purchasers (the “Registration Rights Agreement”).

Pursuant to the Registration Rights Agreement, we are required to file a resale registration statement, or the Registration Statement,

with the SEC to register for resale the 405,125 shares of common stock by November 28, 2024, and to have such Registration Statement declared

effective within thirty days of filing (sixty days in the event the Registration Statement is reviewed by the SEC). We will be obligated

to pay liquidated damages to the Purchasers if we fail to file the resale registration statement when required, fail to request effectiveness

within five trading days after being notified that the Registration Statement will not be reviewed or not subject to further review, fail

to respond to comments to the Registration statement within ten calendar days, fail to cause the Registration Statement to be declared

effective by the SEC when required, fail to maintain the effectiveness of the Registration Statement, or if the Registration Statement

ceases to remain effective. On November 25, 2024, the Company filed a registration statement to satisfy its obligations under the Registration

Rights Agreement.

The Notes were repaid in full on or about December 23, 2024.

Cost Reduction

On November 12, 2024, the

Company announced it is implementing a cost reduction plan in order to reduce its average monthly cash burn from approximately $1.8

million per month to approximately $1 million per month for 90 days. This includes reducing staff from approximately 80 people to approximately

60 people, temporarily suspending certain non-essential operations and reducing or eliminating all discretionary expenses.

December

2024 Public Offering

On December 20, 2024,

the Company entered into a securities purchase agreement with certain investors for the sale and issuance of (i) 3,076,006 units (the

“Units) at a public offering price per Unit of $1.61 with each Unit consisting of one share of common stock, one Series A warrant

(“Series A Warrant”) to purchase one share of common stock at an exercise price of $2.0125 per share and one Series B warrant

to purchase one share of Common Stock at an exercise price of $2.0125 (“Series B Warrant” and, together with Series A Warrant,

the “Warrants”); and (ii) 9,346,354 pre-funded units (the “Pre-Funded Units”) at a public offering price of $1.6099

per Pre-Funded Unit, with each Pre-Funded Unit consisting of one pre-funded warrant, exercisable for one share of common Stock at an exercise

price of $0.0001 per share, one Series A Warrant and one Series B Warrant.

The Warrants are exercisable

only upon receipt of such stockholder approval as may be required by the applicable rules and regulations of the Nasdaq Stock Market to

permit the exercise of the Warrants (the “Warrant Stockholder Approval”).The Series A Warrants are exercisable commencing

upon the date of receipt of the Warrant Stockholder Approval (the “Warrant Stockholder Approval Date”) until five years after

the Warrant Stockholder Approval Date, and the Series B Warrants are exercisable commencing upon the Warrant Stockholder Approval Date

until two and one-half years after the Warrant Stockholder Approval Date.

The offering closed on December

23, 2024. The Company received net proceeds from the offering of approximately $18.2 million, after deducting placement agent’s

fees and the payment of other estimated offering expenses associated with the offering that were payable by the Company.

Our Corporate Information

The Company was originally

incorporated in the State of Delaware on February 1, 2013, under the name Cyanogen, Inc. or Cyanogen. The Company started as a venture

funded company with offices in Seattle and Palo Alto, aimed at commercializing CyanogenMod, direct to consumer and through collaborations

with mobile phone manufacturers. CyanogenMod was an open-source operating system for mobile devices, based on the Android mobile

platform. Cyanogen released multiple versions of its mobile operating system and collaborated with an ecosystem of companies including

mobile phone OEMs, content providers and leading technology partners from 2013 to 2015.

In 2016 the Company’s

management and board of directors, determined to pivot its product focus and commercial direction from the mobile device and telecom space

to industrial and commercial autonomous driving with the hiring of Lior Tal in June 2016 to serve as the company’s chief operating

officer. Mr. Tal, a seasoned executive of startup firms where prior to joining the company, co-founded Snaptu which later was acquired

by Facebook (currently known as Meta Platforms, Inc.), as well as held various leadership roles at Actimize, DiskSites and Odigo; all

of these companies which were also later acquired. Mr. Tal was promoted to chief executive officer in October 2016 and continues to serve

in this role along with chairman of the board. In May 2017, the Company changed its name to CYNGN Inc.

Available Information

Our principal business address

is 1015 O’Brien Dr., Menlo Park, CA 94025, and our telephone number is (650) 924-5905. We maintain our corporate website at https://cyngn.com

(this website address is not intended to function as a hyperlink and the information contained on our website is not intended to

be a part of this prospectus). Information on our website does not constitute a part of, nor is it incorporated in any way, into this

prospectus and should not be relied upon in connection with making an investment decision. We make available free of charge on https://investors.cyngn.com/

our annual, quarterly, and current reports, and amendments to those reports if any, as soon as reasonably practical after we electronically

file such material with, or furnish it to, the SEC. We may from time to time provide important disclosures to investors by posting them

in the Investor Relations section of our website.

Our common stock is quoted

on the Nasdaq under the symbol “CYN”. We file annual, quarterly, and current reports, proxy statements and other information

with the U.S. Securities Exchange Commission (the “SEC”) and are subject to the requirements of the Securities and Exchange

Act of 1934, as amended (the Exchange Act). These filings are available to the public on the Internet at the SEC’s website at http://www.sec.gov.

THE OFFERING

| Common stock offered by us |

|

6,650,000 shares of common stock. |

| |

|

|

| Pre-Funded Warrants offered by us |

|

We are also offering the opportunity to purchase, if the purchaser so chooses and in lieu of shares of common stock, 8,350,000 Pre-Funded Warrants to purchasers whose purchase of shares of common stock in this offering would otherwise result in the purchaser, together with its affiliates and certain related parties, beneficially owning more than 4.99% (or, at the election of the purchaser, 9.99%) of our outstanding common stock immediately following the consummation of this offering. The purchase price of each Pre-Funded Warrant is $0.5999 (equal to the price per share being sold to the public in this offering, minus $0.0001), and the exercise price of each Pre-Funded Warrant is $0.0001 per share. The Pre-Funded Warrants will be immediately exercisable and may be exercised at any time until all of the Pre-Funded Warrants are exercised in full. This offering also relates to the shares of common stock issuable upon exercise of any Pre-Funded Warrants sold in this offering. |

| |

|

|

| Common stock outstanding prior to the offering(1) |

|

14,854,186 shares. |

| |

|

|

| Common stock to be outstanding after the offering |

|

21,504,186 shares (assuming no exercise of any Pre-Funded Warrants). |

| |

|

|

| Use of Proceeds |

|

We intend to use the net proceeds to us from this offering for working capital and other general corporate purposes. See “Use of Proceeds” beginning on page S-11. |

| |

|

|

| Listing |

|

Our common stock is listed on The Nasdaq Capital Market under the symbol “CYN”. There is no established public trading market for the Pre-Funded Warrants, and we do not intend to list these securities on any national securities exchange or trading system. |

| Public Offering Price |

|

$0.60 per share |

| |

|

|

| Risk Factors |

|

Investing in our common

stock involves a high degree of risk. You should read the “Risk Factors” section beginning on page S-9 of this

prospectus supplement and page 2 of the accompanying prospectus and in the documents incorporated by reference in this prospectus

supplement for a discussion of factors to consider before deciding to invest in our common stock. |

| |

|

|

| Lock-Up Agreements |

|

Our officers and directors and shareholders holding at least ten percent (10%) of our outstanding common stock have agreed, for a period of 90 days after the closing of the offering, subject to certain exceptions, not to offer, sell, contract to sell, encumber, grant any option for the sale of or otherwise dispose of any shares of our common stock or other securities convertible into or exercisable or exchangeable for shares of our common stock without the prior written consent of the placement agent. |

The number of shares of our

common stock that are and will be outstanding immediately before and after this offering as shown above is based on 14,854,186 shares

outstanding as of December 30, 2024. The number of shares outstanding as of December 30, 2024, as used throughout this prospectus supplement,

unless otherwise indicated, excludes, as of that date:

| |

● |

162,400 shares of common stock issuable upon the exercise of outstanding stock options with a weighted-average exercise price of $96.89 per share; |

| |

|

|

| |

● |

2,358 shares of common stock issuable upon vesting of restricted stock unit awards; |

| |

|

|

| |

● |

92,068 shares of common stock reserved for future issuance under our 2021 Equity Incentive Plan; and |

| |

|

|

| |

● |

65,271 shares of common stock issuable upon exercise of warrants to purchase common stock with a weighted-average exercise price of $285.29 per share. |

RISK FACTORS

An

investment in our securities involves a high degree of risk. You should carefully consider the following risks and all of the other information

contained in this prospectus supplement, the accompanying prospectus, and the information and documents incorporated by reference before

deciding whether to invest in our securities, including the risks and uncertainties described below and under the caption “Risk

Factors” in our most recently filed Annual Report on Form 10-K and Quarterly Report on Form 10-Q filed with the SEC, in each case

as these risk factors are amended or supplemented by subsequent Annual Reports on Form 10-K or Quarterly Reports on Form 10-Q. Our business,

financial condition, results of operations and future prospects may be adversely affected as a result of such risks. In such an event,

the market price of our common stock could decline, and you could lose part or all of your investment.

Risks Related to this Offering and the Ownership of Our Securities

Our management will have broad discretion over the use of the

net proceeds from this offering.

Our management will have broad

discretion as to the use of any net proceeds from this offering and could use them for purposes other than those contemplated at the time

of this offering. As of the date of this prospectus supplement, we intend to use the net proceeds of this offering for general corporate

purposes, including working capital. While management intends to use the net proceeds in a manner that furthers our business objectives

and maximizes the value for our investors, investors will have limited visibility into the specific uses of the net proceeds. This wide-ranging

discretion allows management to allocate funds to areas that investors might not deem a priority or in their best interest. Consequently,

the success of the investment is substantially dependent on the judgment of our management with regard to the application of the net proceeds.

Investors should be aware that the broad discretion in the use of proceeds increases the risk of their investment, as it may reduce the

ability to assess the viability and potential return of the investment. See “Use of Proceeds.”

There is no established public trading market

for the Pre-Funded Warrants being offered in this offering, and we do not expect markets to develop for these securities.

There is no established public

trading market for the Pre-Funded Warrants being offered in this offering, and we do not expect markets to develop for these securities.

In addition, we do not intend to apply to list the Pre-Funded Warrants on any national securities exchange or other nationally recognized

trading system. Without an active market, the liquidity of the Pre-Funded Warrants will be limited.

The Pre-Funded Warrants are speculative

in nature.

Except as otherwise set forth

in the Pre-Funded Warrants, the Pre-Funded Warrants offered in this offering do not confer any rights of common stock ownership on their

holders, such as voting rights, but rather merely represent the right to acquire shares of our common stock at a fixed price. Specifically,

holders of the Pre-Funded Warrants may exercise their right to acquire the common stock and pay an exercise price of $0.0001 per share,

subject to adjustment, from time to time, until all of the Pre-Funded Warrants have been exercised.

Since the Pre-Funded Warrants are executory

contracts, they may have no value in a bankruptcy or reorganization proceeding.

In the event a bankruptcy

or reorganization proceeding is commenced by or against us, a bankruptcy court may hold that any unexercised Pre-Funded Warrants are executory

contracts that are subject to rejection by us with the approval of the bankruptcy court. As a result, holders of the Pre-Funded Warrants

may, even if we have sufficient funds, not be entitled to receive any consideration for their Pre-Funded Warrants or may receive an amount

less than they would be entitled to if they had exercised their Pre-Funded Warrants prior to the commencement of any such bankruptcy or

reorganization proceeding.

Our common stock may be affected by

limited trading volume and price fluctuations, which could adversely impact the value of the securities.

Although our common stock

is traded on The Nasdaq Capital Market, the volume of trading has historically been limited. Our average daily trading volume of our shares

from January 1, 2024 to September 30, 2024 was approximately 389,192 shares. Thinly traded stocks can be more volatile than stock trading

in a more active public market. We cannot predict whether and to what the extent to which an active public market for our common stock

will develop or be sustained. Therefore, a holder of our common stock who wishes to sell his or her shares may not be able to do so immediately

or at an acceptable price.

In addition, our common stock

has experienced, and is likely to experience, significant price and volume fluctuations in the future, which could adversely affect the

market prices of our common stock without regard to our operating performance. In addition, we believe that factors such as quarterly

fluctuations in our financial results and changes in the overall economy or the condition of the financial markets could cause the market

prices of our common stock to fluctuate substantially. These fluctuations may also cause short sellers to periodically enter the market

in the belief that we will have poor results in the future. We cannot predict the actions of market participants and, therefore, can offer

no assurances that the market for our common stock will be stable or appreciate over time.

An investment in our securities is speculative,

and there can be no assurance of any return on any such investment.

Investors are cautioned that

an investment in the securities offered hereby is highly speculative and involves a significant degree of risk. The success of our business

and the ability to achieve our business goals and objectives, as outlined in this prospectus, are subject to numerous uncertainties, contingencies

and risks. As such, there is no assurance that investors will realize a return on their investment or that they will not lose their entire

investment. Potential investors should carefully consider whether such a speculative investment is suitable for their financial situation

and investment objectives before purchasing securities.

SPECIAL

NOTE REGARDING FORWARD-LOOKING STATEMENTS

All statements in this prospectus

supplement, the accompanying prospectus and the documents incorporated by reference that are not historical facts should be considered

“Forward Looking Statements” within the meaning of the “Safe Harbor” provisions of the Private Securities Litigation

Reform Act of 1995. Such statements involve known and unknown risks, uncertainties and other factors that may cause actual results, performance

or achievements of the Company to be materially different from any future results, performance or achievements expressed or implied by

the forward-looking statements. Some of the forward-looking statements can be identified by the use words such as “believe,”

“expect,” “may,” “estimates,” “should,” “seek,” “approximately,”

“intend,” “plan,” “estimate,” “project,” “continue” or “anticipates”

or similar expressions or words, or the negatives of those expressions or words. These statements may be made directly in this prospectus

supplement and the accompanying prospectus and they may also be incorporated by reference in this prospectus supplement and accompanying

prospectus from other documents filed with the SEC, and include, but are not limited to, statements about future financial and operating

results and performance, statements about our plans, objectives, expectations and intentions with respect to future operations, products

and services, and other statements that are not historical facts. These forward-looking statements are based upon the current beliefs

and expectations of our management and are inherently subject to significant business, economic and competitive uncertainties and contingencies,

many of which are difficult to predict and generally beyond our control. In addition, these forward-looking statements are subject to

assumptions with respect to future business strategies and decisions that are subject to change. Actual results may differ materially

from the anticipated results discussed in these forward-looking statements.

We undertake no obligation

to publicly update any forward-looking statement, whether as a result of new information, future developments or otherwise, except as

may be required by applicable laws or regulations.

USE OF

PROCEEDS

We

estimate that the net proceeds to us from this offering will be approximately $8.1 million after deducting placement agent fees and

other estimated offering expenses payable by us for this offering.

We intend to use the net proceeds

from this offering for working capital and other general corporate purposes.

Investors must rely on the

judgment of our management, who will have broad discretion regarding the application of the net proceeds of this offering. The amounts

and timing of our actual expenditures will depend upon numerous factors, including market conditions, cash generated by our operations

(if any), business developments and the rate of our growth. We may find it necessary or advisable to use portions of the proceeds of this

offering for other purposes. Pending these uses, we intend to invest the net proceeds of this offering in a money market or other interest-bearing

account.

DIVIDEND POLICY

We have not declared any cash

dividends since inception. While our board of directors in September 2023, declared a one-time special stock dividend of 10% on our issued

and outstanding shares of our common stock, we currently do not anticipate paying any dividends in the foreseeable future. We anticipate

that all of our earnings will be used to provide working capital, to support our operations, and to finance the growth and development

of our business. The payment of dividends is within the discretion of our board of directors and will depend on our earnings, capital

requirements, financial condition, prospects, applicable Delaware law, which provides that dividends are only payable out of surplus or

current net profits, and other factors our board of directors might deem relevant. There are no restrictions that currently limit our

ability to pay dividends on our common stock other than those generally imposed by applicable state law.

DESCRIPTION

OF SECURITIES OFFERED

We are offering 6,650,000

shares of our common stock and Pre-Funded Warrants to purchase 8,350,000 shares of our common stock. We are also registering the shares

of common stock issuable from time to time upon exercise of the Pre-Funded Warrants offered hereby.

General

Our authorized capital stock

consists of 200,000,000 shares of common stock, $0.00001 par value per share, and 10,000,000 shares of preferred stock, $0.00001 par value

per share.

As of the date of this prospectus

supplement, there were 14,854,186 shares of our common stock issued and outstanding held by approximately 64 holders of record, and no

shares of our preferred stock issued and outstanding.

Common Stock

The material terms and provisions

of our common stock and each other class of our securities which qualifies or limits our common stock are described in the section entitled

“Description of Capital Stock” beginning on page 4 of the accompanying prospectus.

Pre-Funded Warrants Offered in this Offering

The following summary

of certain terms and provisions of the pre-funded warrants that are being offered hereby is not complete and is subject to, and qualified

in its entirety by, the provisions of the Pre-Funded Warrant, the form of which will be filed as an exhibit to a Current Report on Form

8-K in connection with this offering and incorporated by reference into the registration statement of which this prospectus supplement

forms a part. Prospective investors should carefully review the terms and provisions of the form of Pre-Funded Warrant for a complete

description of the terms and conditions of the pre-funded warrants.

Pre-Funded Warrant will be

issued in certificated form only.

Duration and exercise price

Each Pre-Funded Warrant offered

hereby has an initial exercise price per share equal to $0.0001. The Warrants are immediately exercisable and have an indefinite term.

The exercise price and number of shares of common stock issuable upon exercise is subject to appropriate adjustment in the event of stock

dividends, stock splits, reorganizations or similar events affecting our common stock and the exercise price.

Exercisability

The Pre-Funded Warrant will

be exercisable, at the option of each holder, in whole or in part, by delivering to us a duly executed exercise notice accompanied by

payment in full for the number of shares of our common stock purchased upon such exercise (except in the case of a cashless exercise as

discussed below). A holder (together with its affiliates) may not exercise any portion of such holder’s Pre-Funded Warrant to the

extent that the holder would own more than 9.99% (or, at the election of the purchaser, 4.99%) of the outstanding shares of common stock

immediately after exercise, except that upon prior notice from the holder to us, the holder may increase the amount of ownership of outstanding

shares of common stock after exercising the holder’s pre-funded warrants up to 9.99% of the number of shares of common stock outstanding

immediately after giving effect to the exercise, as such percentage ownership is determined in accordance with the terms of the pre-funded

warrants. No fractional shares of common stock will be issued in connection with the exercise of a pre-funded warrant. In lieu of fractional

shares, we will either pay the holder an amount in cash equal to the fractional amount multiplied by the exercise price or round up to

the next whole share.

Cashless exercise

The Pre-Funded Warrants may

be exercised, in whole or in part, by means of cashless exercise. In lieu of making the cash payment otherwise contemplated to be made

to us upon such exercise in payment of the aggregate exercise price, the holder may elect instead to receive upon such exercise (either

in whole or in part) the net number of shares of common stock determined according to a formula set forth in the Pre-Funded Warrants.

Fundamental transactions

In the event of any fundamental

transaction, as described in the Pre-Funded Warrants and generally including any merger with or into another entity, sale of all or substantially

all of our assets, tender offer or exchange offer, or reclassification of our shares of common stock, upon any subsequent exercise of

a Pre-Funded Warrant, the holder will have the right to receive as alternative consideration, for each share of common stock that would

have been issuable upon such exercise immediately prior to the occurrence of such fundamental transaction, the number of shares of common

stock of the successor or acquiring corporation of our company, if it is the surviving corporation, and any additional consideration receivable

upon or as a result of such transaction by a holder of the number of shares of common stock for which the Pre-Funded Warrant is exercisable

immediately prior to such event.

Transferability

Subject to applicable laws,

a Pre-Funded Warrant or the rights thereunder may be transferred or assigned, in whole or in part. The ownership of the Pre-Funded Warrants

and any transfers of the Pre-Funded Warrants will be registered in a warrant register maintained by the warrant agent. We will initially

act as warrant agent.

Exchange listing

There is no trading market

available for the Pre-Funded Warrants on any securities exchange or nationally recognized trading system. We do not intend to list the

Pre-Funded Warrants on any securities exchange or nationally recognized trading system.

Right as a stockholder

Except as otherwise provided

in the Pre-Funded Warrants or by virtue of such holder’s ownership of shares of our common stock, the holders of the Pre-Funded

Warrants do not have the rights or privileges of holders of our common stock, including any voting rights, until they exercise their Pre-Funded

Warrants.

PLAN

OF DISTRIBUTION

We have engaged Aegis Capital

Corp., to act as our sole placement agent to solicit offers to purchase the securities offered by this prospectus supplement on a best

efforts basis. The placement agent is not purchasing or selling any such securities, nor is it required to arrange for the purchase and

sale of any specific number or dollar amount of such securities, other than to use its “best efforts” to arrange for the sale

of such securities by us. The terms of this offering were subject to market conditions and negotiations between us, the placement agent

and prospective investors. The placement agent may retain sub-agents and selected dealers in connection with this offering. We will have

one closing for all the securities purchased in this offering.

We

have entered into a securities purchase agreement directly with investors for the sale of all of the securities being offered hereunder.

Delivery of the securities

offered hereby is expected to occur on or about December 31, 2024 subject to satisfaction of certain customary closing conditions.

We have agreed to pay the

placement agent a fee equal to 8% of the gross proceeds received in the offering. In addition, we have agreed to reimburse the placement

agent for its legal fees, and disbursements and expenses in connection with this offering in an amount of $75,000.

| | |

Per Share | | |

Per

Pre-Funded

Warrant | | |

Total | |

| Public offering price | |

$ | 0.60 | | |

$ | 0.5999 | | |

$ | 9,000,000 | |

| Placement agent fees(1) | |

$ | 0.048 | | |

$ | 0.048 | | |

$ | 720,000 | |

| Proceeds, before expenses, to us(2) | |

$ | 0.552 | | |

$ | 0.552 | | |

$ | 8,280,000 | |

| (1) |

Represents the placement agent fee of 8%. Does not include reimbursement by us of the placement agent’s legal fees and disbursements of its counsel of $75,000. |

| |

|

| (2) |

The amount of offering proceeds to us presented in this table does not give effect to any exercise of the Pre-Funded Warrants. |

We

will pay the placement agent’s legal expenses relating to the offering in the amount of $75,000. We estimate the total expenses

payable by us for this offering, excluding the placement agent fees and expenses, will be approximately $136,378.

We anticipate payment to the

placement agent of approximately $795,000, consisting of $720,000 for the placement agent fee, and up to $75,000 for the reimbursement

of legal expenses which are payable by us.

Regulation M

The placement agent may be

deemed to be an underwriter within the meaning of Section 2(a)(11) of the Securities Act, and any commissions received by it and any profit

realized on the resale of the shares sold by it while acting as principal might be deemed to be underwriting discounts or commissions

under the Securities Act. As an underwriter, the placement Agent would be required to comply with the requirements of the Securities Act

and the Exchange Act, including, without limitation, Rule 415(a)(4) under the Securities Act and Rule 10b-5 and Regulation M under the

Exchange Act. These rules and regulations may limit the timing of purchases and sales of shares by the placement agent acting as principal.

Under these rules and regulations, the placement agent:

| |

● |

may not engage in any stabilization activity in connection with our securities; and |

| |

● |

may not bid for or purchase any of our securities or attempt to induce any person to purchase any of our securities, other than as permitted under the Exchange Act, until it has completed its participation in the distribution. |

Listing

Our common stock is listed

on The Nasdaq Capital Market under the trading symbol “CYN.” We do not plan to list the Pre-funded Warrants on the Nasdaq

Capital Market or any other securities exchange or trading market.

Lock-Up and Market Standoff Agreements

Pursuant to certain “lock-up”

agreements, we, our executive officers, directors, and our 10% and greater stockholders have agreed not to, for a period of 90 days after

the closing of this offering, without the prior written consent of the placement agent, directly or indirectly, offer to sell, sell, pledge

or otherwise transfer or dispose of any of shares of (or enter into any transaction or device that is designed to, or could be expected

to, result in the transfer or disposition by any person at any time in the future of) our common stock or any securities convertible into

or exercisable or exchangeable for our common stock, enter into any swap or other derivatives transaction that transfers to another, in

whole or in part, any of the economic benefits or risks of ownership of shares of our common stock, make any demand for or exercise any

right or cause to be filed a registration statement, including any amendments thereto, with respect to the registration of any shares

of common stock or securities convertible into or exercisable or exchangeable for shares of common stock or any other of our securities

or publicly disclose the intention to do any of the foregoing, subject to customary exceptions.

Other Relationships

The placement agent and its

respective affiliates may in the future engage in investment banking and other commercial dealings in the ordinary course of business

with us or our affiliates. The placement agent may in the future receive customary fees and commissions for these transactions.

In the ordinary course of

its various business activities, the placement agent and its affiliates may make or hold a broad array of investments and actively trade

debt and equity securities (or related derivative securities) and financial instruments (including bank loans) for their own account and

for the accounts of its customers, and such investment and securities activities may involve securities and/or instruments of the issuer.

The placement agent and its affiliates may also make investment recommendations and/or publish or express independent research views in

respect of such securities or instruments and may at any time hold, or recommend to clients that they acquire, long and/or short positions

in such securities and instruments.

Discretionary Accounts

The placement agent does not

intend to confirm sales of the securities offered hereby to any accounts over which it has discretionary authority.

Indemnification

We have agreed to indemnify

the placement agent against certain liabilities, including certain liabilities arising under the Securities Act, or to contribute to payments

that the placement agent may be required to make for these liabilities.

Determination of Offering Price

The public offering price

of the securities we are offering was negotiated between us and the investors, in consultation with the placement agent based on the trading

of our common stock prior to the offering, among other things. Other factors considered in determining the public offering price of the

securities we are offering include our history and prospects, the stage of development of our business, our business plans for the future

and the extent to which they have been implemented, an assessment of our management, general conditions of the securities markets at the

time of the offering and such other factors as were deemed relevant.

Electronic Offer, Sale and Distribution

This prospectus in electronic

format may be made available on websites or through other online services maintained by the placement agent, or by its affiliates. Other

than this prospectus in electronic format, the information on the placement agent’s website and any information contained in any

other website maintained by the placement agent is not part of this prospectus or the registration statement of which this prospectus

forms a part, has not been approved and/or endorsed by us or the placement agent in its capacity as a placement agent, and should not

be relied upon by investors.

Offer Restrictions Outside the United States

Other than in the United States,

no action has been taken by us or the placement agent that would permit a public offering of the securities offered by this prospectus

in any jurisdiction where action for that purpose is required. The securities offered by this prospectus may not be offered or sold, directly

or indirectly, nor may this prospectus or any other offering material or advertisements in connection with the offer and sale of any such

securities be distributed or published in any jurisdiction, except under circumstances that will result in compliance with the applicable

rules and regulations of that jurisdiction. Persons who come into possession of this prospectus are advised to inform themselves about

and to observe any restrictions relating to the offering and the distribution of this prospectus. This prospectus does not constitute

an offer to sell or a solicitation of an offer to buy any securities offered by this prospectus in any jurisdiction in which such an offer

or a solicitation is unlawful

Transfer Agent and Registrar

The transfer agent and registrar

for our common stock is Continental Stock Transfer & Trust Company.

EXPERTS

The consolidated balance sheets

of the Company as of December 31, 2023 and 2022, the related consolidated statements of operations, stockholders’ equity and cash

flows for each of the two years in the period ended December 31, 2023 and the related notes, incorporated by reference into this prospectus

supplement, have been audited by Marcum LLP, the independent registered public accounting firm of the Company, as stated in their report

thereon, which includes an explanatory paragraph as to the Company’s ability to continue as a going concern, which is incorporated

herein by reference. Such financial statements have been incorporated herein by reference in reliance on the report of such firm given

upon their authority as experts in accounting and auditing.

LEGAL

MATTERS

Certain legal matters with

respect to the validity of the securities being offered by this prospectus supplement and accompanying prospectus will be passed upon

by Sichenzia Ross Ference Carmel LLP, New York, New York. The placement agent is being represented

by Kaufman & Canoles, P.C., Richmond, VA, in connection with this offering.

INFORMATION INCORPORATED BY REFERENCE

The SEC allows us to “incorporate

by reference” into this prospectus supplement information that we file with them. Incorporation by reference allows us to disclose

important information to you by referring you to those other documents. The information incorporated by reference is an important part

of this prospectus supplement, and information that we file later with the SEC will automatically update and supersede this information.

We filed a registration statement on Form S-3 under the Securities Act with the SEC with respect to the securities being offered pursuant

to this prospectus supplement. This prospectus supplement omits certain information contained in the registration statement, as permitted

by the SEC. You should refer to the registration statement, including the exhibits and schedules attached to the registration statement

and the information incorporated by reference, for further information about us and the securities being offered pursuant to this prospectus.

Statements in this prospectus regarding the provisions of certain documents filed with, or incorporated by reference in, the registration

statement are not necessarily complete, and each statement is qualified in all respects by that reference. Copies of all or any part of

the registration statement, including the documents incorporated by reference or the exhibits, may be obtained upon payment of the prescribed

rates at the offices of the SEC listed below in “Where You Can Find More Information.”

This prospectus supplement

and the accompanying prospectus incorporate by reference the documents set forth below that have previously been filed with the SEC:

| |

● |

Our Annual Report on Form 10-K for the fiscal year ended December 31, 2023, filed with the SEC on March 7, 2024. |

| |

● |

Our Quarterly Report on Form 10-Q for the quarter ended March 31, 2024, filed with the SEC on May 9, 2024. |

| |

● |

Our Quarterly Report on Form 10-Q for the quarter ended June 30, 2024, filed with the SEC on August 8, 2024. |

| |

● |

Our Quarterly Report on Form 10-Q for the quarter ended September 30, 2024, filed with the SEC on November 7, 2024. |

| |

● |

Our Current Reports on Form 8-K filed on February 21, 2024, April 24, 2024, May 10, 2024, May 17, 2024, June 25, 2024, July 9, 2024, November 12, 2024, and December 23, 2024. |

| |

● |

The description of our common stock contained in our Registration Statement on Form 8-A, registering our common stock under Section 12(b) under the Exchange Act, filed with the SEC on October 19, 2021. |

We also incorporate by reference

all documents we file pursuant to Section 13(a), 13(c), 14 or 15 of the Exchange Act (other than any portions of filings that are furnished

rather than filed pursuant to Items 2.02 and 7.01 of a Current Report on Form 8-K) after the date of the initial registration statement

of which this prospectus supplement is a part and prior to effectiveness of such registration statement. All documents we file in the

future pursuant to Section 13(a), 13(c), 14 or 15(d) of the Exchange Act after the date of this prospectus supplement and prior to the

termination of the offering are also incorporated by reference and are an important part of this prospectus supplement and the accompanying

prospectus.

Any statement contained in

a document incorporated or deemed to be incorporated by reference herein shall be deemed to be modified or superseded for the purposes

of this registration statement to the extent that a statement contained herein or in any other subsequently filed document which also

is or deemed to be incorporated by reference herein modifies or supersedes such statement. Any statement so modified or superseded shall

not be deemed, except as so modified or superseded, to constitute a part of this registration statement.

You may request a copy of

these filings, at no cost, by writing or telephoning us at the following address: Cyngn Inc., Attention: Corporate Secretary, 1015

O’Brien Dr., Menlo Park, CA 94025, phone number (650) 924-5905.

WHERE

YOU CAN FIND MORE INFORMATION

We have filed with the SEC

a registration statement on Form S-3 under the Securities Act with respect to the securities offered hereby. This prospectus supplement,

which constitutes a part of the registration statement, does not contain all of the information set forth in the registration statement

or the exhibits and schedules filed therewith. For further information about us and our securities offered hereby, we refer you to the

registration statement and the exhibits and schedules filed therewith. Statements contained in this prospectus supplement and the accompanying

prospectus regarding the contents of any contract or any other document that is filed as an exhibit to the registration statement are

not necessarily complete, and each such statement is qualified in all respects by reference to the full text of such contract or other

document filed as an exhibit to the registration statement. The SEC maintains a website that contains reports, proxy and information statements

and other information regarding registrants that file electronically with the SEC. The address is http://www.sec.gov.

We are subject to the reporting

requirements of the Exchange Act, and file annual, quarterly and current reports, proxy statements and other information with the SEC.

You can read our SEC filings, including the registration statement, over the Internet at the SEC’s website. We also

maintain a website at http://www.shiftpixy.com, at which you may access these materials free of charge as soon as reasonably

practicable after they are electronically filed with, or furnished to, the SEC. The information contained in, or that can be accessed

through, our website is not part of this prospectus. You may also request a copy of these filings, at no cost, by writing or telephoning

us at: 1015 O’Brien Dr., Menlo Park, CA 94025, phone number (650) 924-5905.

CYNGN INC.

$50,000,000

COMMON STOCK

PREFERRED STOCK

WARRANTS

RIGHTS

UNITS

We may from time to time,

in one or more offerings at prices and on terms that we will determine at the time of each offering, sell common stock, preferred stock,

warrants, rights, or a combination of these securities, or units, for an aggregate initial offering price of up to $50,000,000. This

prospectus describes the general manner in which our securities may be offered using this prospectus. Each time we offer and sell securities,

we will provide you with a prospectus supplement that will contain specific information about the terms of that offering. Any prospectus

supplement may also add, update, or change information contained in this prospectus. You should carefully read this prospectus and the

applicable prospectus supplement as well as the documents incorporated or deemed to be incorporated by reference in this prospectus before

you purchase any of the securities offered hereby.

This prospectus may not be

used to offer and sell securities unless accompanied by a prospectus supplement.

Our common stock is listed

on The Nasdaq Capital Market under the symbol “CYN”. On May 30, 2023, the last reported sale price of our common stock was

$1.04.

The aggregate market value

of our outstanding common stock held by non-affiliates is approximately $26,316,196 based on 33,723,669 shares of outstanding common

stock, of which 15,059,700 shares are held by affiliates, and a per share price of $1.41, which was the closing sale price of our common

stock as quoted on the Nasdaq Capital Market on April 18, 2023. Pursuant to General Instruction I.B.6 of Form S-3, in no event will we

sell securities registered on the registration statement of which this prospectus is a part with a value of more than one-third of the

aggregate market value of our common stock held by non-affiliates in any 12-month period, so long as the aggregate market value of our

common stock held by non-affiliates is less than $75,000,000. During the 12 calendar month period that ends on, and includes, the date

of this prospectus, we have not offered and sold any of our securities pursuant to General Instruction I.B.6 of Form S-3.

The securities offered

by this prospectus involve a high degree of risk. See “Risk Factors” beginning on page 2, in addition to Risk Factors contained

in the applicable prospectus supplement.

Neither the SEC nor any state securities commission

has approved or disapproved of these securities or passed upon the accuracy or adequacy of this prospectus. Any representation to the

contrary is a criminal offense.

The date of this prospectus is June 13,

2023

TABLE

OF CONTENTS

ABOUT THIS PROSPECTUS

This prospectus is part of

a registration statement on Form S-3 that we filed with the U.S. Securities and Exchange Commission, or the SEC, using the “shelf”

registration process. Under this shelf registration process, we may offer and sell, either individually or in combination, in one or

more offerings, any of the securities described in this prospectus, for total gross proceeds of up to $50,000,000.

This prospectus provides

you with a general description of the securities we may offer. Each time that we offer and sell securities under this prospectus, we

will provide a prospectus supplement to this prospectus that contains specific information about the securities being offered and sold

and the specific terms of that offering. The prospectus supplement may also add, update or change information contained in this prospectus

with respect to that offering. If there is any inconsistency between the information in this prospectus and the applicable prospectus

supplement, you should rely on the prospectus supplement. Before purchasing any securities, you should carefully read both this prospectus

and the applicable prospectus supplement, together with the additional information described under the headings “Where You Can

Find More Information” and “Incorporation of Certain Documents by Reference.”

We have not authorized any

other person to provide you with different information. If anyone provides you with different or inconsistent information, you should

not rely on it. We will not make an offer to sell these securities in any jurisdiction where the offer or sale is not permitted. You

should assume that the information appearing in this prospectus and the applicable prospectus supplement to this prospectus is accurate

as of the date on its respective cover, and that any information incorporated by reference is accurate only as of the date of the document

incorporated by reference, unless we indicate otherwise. Our business, financial condition, results of operations and prospects may have

changed since those dates.

As used in this prospectus

and unless otherwise indicated, the terms “we,” “us,” “our,” “Cyngn,” or the “Company”

refer to CYNGN Inc. and its consolidated subsidiaries.

CAUTIONARY NOTE REGARDING FORWARD-LOOKING STATEMENTS

This prospectus and the documents

and information incorporated by reference in this prospectus include forward-looking statements. Forward-looking statements give current

expectations or forecasts of future events or our future financial or operating performance. These forward-looking statements involve

risks and uncertainties, including statements regarding our capital needs, business strategy and expectations. Any statements that are

not of historical fact may be deemed to be forward-looking statements. In some cases you can identify forward-looking statements by terminology

such as “may,” “will,” “should,” “expect,” “plan,” “intend,”