CEO Transition Taking Shape with Focus on

Customer Experience, Filling out Product Portfolio, and Market

Diversification with Enhanced Go-to-Market Strategies

Continued Operating Efficiencies and Expense

Discipline

Data I/O Corporation (NASDAQ: DAIO), the leading global provider

of advanced security and data deployment solutions for

microcontrollers, security ICs and memory devices, today announced

financial results for the third quarter ended September 30,

2024.

Management Comments

William Wentworth was appointed CEO of Data I/O Corporation on

October 1, 2024. Commenting on his view of the Company, Mr.

Wentworth said, “I am excited to have been appointed to lead Data

I/O given the substantial market opportunities that set the stage

for heightened value creation for our customers, business partners

and shareholders. This is possible because of the impressive

building blocks in place with the Company. We intend to leverage

our technology platform, our significant intellectual property

portfolio and our highly experienced engineering team.

“During this transitional time, our team is thoroughly engaged

in defining the future direction of the Company to drive growth and

implement transformative strategies for Data I/O to become a higher

value supply chain partner. The focus over the last month has been

assessing our strengths and weaknesses while visiting our customers

and business partners. Our findings have been encouraging as we set

our sights on initiatives grounded in a reimagined approach to the

markets we serve and how our capabilities are best utilized to

support the global electronics supply chain. Many of these

initiatives are based on improvement and expansion of existing

strategies selling to global providers of semiconductors,

Electronics Manufacturing Service providers, and independent

service providers.

“The team will leverage technology to enhance customer

engagement strategies, fill out our product portfolio and improve

speed-to-market. In turn, we anticipate capturing a greater

percentage of what customers spend across their entire enterprise.

Furthermore, diversification of revenue streams and customer

segmentation will be important elements to our go-forward strategy.

Data I/O is dominant in the Automotive Electronics sector and we

intend to diversify our approach to the markets we serve to create

strongholds in other electronics sectors.”

Third Quarter 2024 Financial Results

Net sales in the third quarter 2024 were $5.4 million, down 17%

compared with $6.6 million in the third quarter 2023. Since the

beginning of the year, automotive electronics uncertainty has

increased and customer capacity expansion has slowed, resulting in

lower system shipments in the Americas and Europe which are

offsetting growth in Asia. While the automotive system results are

below expectations, the Company continues to achieve steady

performance from programming centers, industrial markets, and its

recurring revenue offerings. Third quarter 2024 recurring services

and consumable adapter sales increased by 6% from the prior year,

while system sales declined by 34% during the same periods.

Third-quarter bookings mirrored sales at $4.7 million, down from

$5.3 million in the prior year. Backlog remains strong at $4.7

million as of September 30, 2024, down $0.7 million from the start

of the quarter, with further reductions expected as planned

customer deliveries occur in future quarters.

Gross margin as a percentage of sales was 53.9% in the third

quarter 2024, as compared to 53.7% in the prior year period.

Despite lower sales volume, gross margin as a percentage of sales

remained at steady levels due to product mix favoring software and

services over reduced system sales, and successful efforts to

improve material, production and service costs through ongoing cost

reduction initiatives.

Operating expenses in the third quarter 2024 were $3.2 million,

down $334,000 or 9% from the prior year period and down $1.3

million or 11% year-to-date compared to the prior year. All

operational areas including manufacturing, service, R&D and

SG&A contributed to these reductions through efficiency

improvements and cost reduction efforts.

Net loss in the third quarter 2024 was ($307,000), or ($0.03)

per share, compared with net loss of ($53,000), or ($0.01) per

share, in the third quarter 2023. Adjusted earnings before

interest, taxes, depreciation and amortization (“Adjusted EBITDA”),

which excludes equity compensation, was $37,000 in the third

quarter 2024, compared to Adjusted EBITDA of $402,000 in the third

quarter 2023.

The Company’s balance sheet remained strong with cash of $12.4

million at the end of the third quarter 2024 compared to $11.4

million on June 30, 2024 and $12.3 million on December 31, 2023.

Cash increased from the beginning of the year due to reduced

operating expenses and improved collections of receivables,

partially offset by operating losses, higher inventories, cash

expenses paid annually in the first quarter, and the second quarter

tax repatriation expense of approximately $337,000.

Inventories at $6.6 million at the end of the third quarter 2024

increased from $5.9 million on December 31, 2023, due to lower

system shipments year-to-date and anticipation of future backlog

reductions based on the timing of contractual orders. Data I/O had

net working capital of $17.6 million on September 30, 2024 compared

to $18.4 million on December 31, 2023. The Company continues to

have no debt.

Conference Call Information

A conference call discussing financial results for the third

quarter ended September 30, 2024 will follow this release today at

2 p.m. Pacific Time/5 p.m. Eastern Time. To listen to the

conference call, please dial 412-317-5788. A replay will be made

available approximately one hour after the conclusion of the call.

To access the replay, please dial 412-317-0088, access code

7407913. The conference call will also be simultaneously webcast

over the Internet; visit the Webcasts and Presentations section of

the Data I/O Corporation website at www.dataio.com to access the

call from the site. This webcast will be recorded and available for

replay on the Data I/O Corporation website approximately one hour

after the conclusion of the conference call.

About Data I/O Corporation

Since 1972, Data I/O has developed innovative solutions to

enable the design and manufacture of electronic products for

automotive, Internet-of-Things, medical, wireless, consumer

electronics, industrial controls and other electronics devices.

Today, our customers use Data I/O’s data provisioning solutions to

manage device intellectual property from point of inception to

deployment in the field. OEMs of any size can program and securely

provision devices from early samples all the way to high volume

production prior to shipping semiconductor devices to a

manufacturing line. Data I/O enables customers to reliably,

securely, and cost-effectively bring innovative new products to

life. These solutions are backed by a portfolio of patents and a

global network of Data I/O support and service professionals,

ensuring success for our customers. Learn more at

dataio.com/Company/Patents.

Learn more at dataio.com

Forward Looking Statement and Non-GAAP financial

measures

Statements in this news release concerning economic outlook,

expected revenue, expected margins, expected savings, expected

results, expected expenses, orders, deliveries, backlog and

financial positions, semiconductor chip shortages, supply chain

expectations, as well as any other statement that may be construed

as a prediction of future performance or events are forward-looking

statements which involve known and unknown risks, uncertainties and

other factors which may cause actual results to differ materially

from those expressed or implied by such statements.

Forward-looking statement disclaimers also apply to the demand

for the Company’s products and the impact from geopolitical

conditions including any related international trade restrictions.

These factors include uncertainties as to the ability to record

revenues based upon the timing of product deliveries, shipping

availability, installations and acceptance, accrual of expenses,

coronavirus related business interruptions, changes in economic

conditions, part shortages and other risks including those

described in the Company’s filings on Forms 10-K and 10-Q with the

Securities and Exchange Commission (SEC), press releases and other

communications.

Non-GAAP financial measures, such as EBITDA and Adjusted EBITDA,

excluding equity compensation, should not be considered a

substitute for, or superior to, measures of financial performance

prepared in accordance with GAAP. We believe that these non-GAAP

financial measures provide meaningful supplemental information

regarding the Company’s results and facilitate the comparison of

results.

DATA I/O CORPORATION

CONSOLIDATED STATEMENTS OF

OPERATIONS

(in thousands, except per

share amounts)

(UNAUDITED)

Three Months Ended September

30,

Nine Months Ended September

30,

2024

2023

2024

2023

Net Sales

$5,423

$6,561

$16,584

$21,190

Cost of goods sold

2,499

3,041

7,684

8,995

Gross margin

2,924

3,520

8,900

12,195

Operating expenses:

Research and development

1,544

1,577

4,539

4,922

Selling, general and administrative

1,705

2,006

6,112

7,003

Total operating expenses

3,249

3,583

10,651

11,925

Operating income (loss)

(325)

(63)

(1,751)

270

Non-operating income (loss):

Interest income

71

41

224

125

Foreign currency transaction gain

(loss)

(53)

(15)

9

107

Total non-operating income (loss)

18

26

233

232

Income (loss) before income taxes

(307)

(37)

(1,518)

502

Income tax (expense) benefit

-

(16)

(393)

(160)

Net income (loss)

($307)

($53)

($1,911)

$342

Basic earnings (loss) per share

($0.03)

($0.01)

($0.21)

$0.04

Diluted earnings (loss) per share

($0.03)

($0.01)

($0.21)

$0.04

Weighted-average basic shares

9,235

9,020

9,121

8,914

Weighted-average diluted shares

9,235

9,020

9,121

9,065

DATA I/O CORPORATION

CONSOLIDATED BALANCE

SHEETS

(in thousands, except share

data)

(UNAUDITED)

September 30, 2024

December 31, 2023

ASSETS

CURRENT ASSETS:

Cash and cash equivalents

$12,372

$12,341

Trade accounts receivable, net of

allowance for

credit losses of $20 and $72,

respectively

2,607

5,707

Inventories

6,627

5,875

Other current assets

554

690

TOTAL CURRENT ASSETS

22,160

24,613

Property, plant and equipment – net

928

1,359

Other assets

1,755

1,429

TOTAL ASSETS

$24,843

$27,401

LIABILITIES AND STOCKHOLDERS’

EQUITY

CURRENT LIABILITIES:

Accounts payable

$895

$1,272

Accrued compensation

$1,021

$2,003

Deferred revenue

$1,280

$1,362

Other accrued liabilities

$1,302

$1,438

Income taxes payable

$48

$113

TOTAL CURRENT LIABILITIES

4,546

6,188

Operating lease liabilities

886

702

Long-term other payables

222

192

STOCKHOLDERS’ EQUITY

Preferred stock -

Authorized, 5,000,000 shares,

including

200,000 shares of Series A Junior

Participating

Issued and outstanding, none

$0

$0

Common stock, at stated value -

Authorized, 30,000,000 shares

Issued and outstanding, 9,219,838 shares

as of June 30,

2024 and 9,020,819 shares as of December

31, 2023

$23,482

$22,731

Accumulated earnings (deficit)

($4,556)

($2,645)

Accumulated other comprehensive income

$263

$233

TOTAL STOCKHOLDERS’ EQUITY

19,189

20,319

TOTAL LIABILITIES AND STOCKHOLDERS’

EQUITY

$24,843

$27,401

DATA I/O CORPORATION

NON-GAAP FINANCIAL MEASURE

RECONCILIATION

Three Months Ended September

30,

Nine Months Ended September

30,

2024

2023

2024

2023

(in thousands)

Net Income (loss)

($307)

($53)

($1,911)

$342

Interest (income)

($71)

($41)

($224)

($125)

Taxes

$0

$16

$393

$160

Depreciation and amortization

$111

$180

$451

$468

EBITDA earnings

($267)

$102

($1,291)

$845

Equity compensation

$304

$300

$967

$929

Adjusted EBITDA, excluding equity

compensation

$37

$402

($324)

$1,774

View source

version on businesswire.com: https://www.businesswire.com/news/home/20241024896760/en/

Gerald Ng Vice President and CFO Data I/O Corporation 6645 185th

Ave. NE, Suite 100 Redmond, WA 98052

Investor-Relations@dataio.com

Darrow Associates, Inc. Jordan Darrow (512) 551-9296

jdarrow@darrowir.com

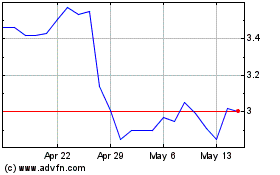

Data I O (NASDAQ:DAIO)

Historical Stock Chart

From Dec 2024 to Jan 2025

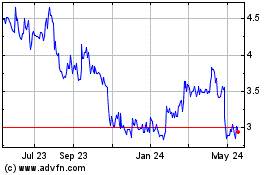

Data I O (NASDAQ:DAIO)

Historical Stock Chart

From Jan 2024 to Jan 2025