Daktronics, Inc. (NASDAQ-DAKT), the leading U.S.-based designer and

manufacturer of best-in-class dynamic video communication displays

and control systems for customers worldwide, today reported results

for its fiscal 2025 third quarter which ended January 25,

2025.

Fiscal Q3 2025 financial highlights include:

- Sales of $149.5 million, a 12.2

percent decrease from the third quarter of fiscal 2024

- Gross profit

as a percentage of net sales of 24.6 percent was similar as

compared to 24.5 percent for the third quarter of fiscal 2024

- Operating loss

of $3.6 million, compared to operating income of $8.0 million for

the third quarter of fiscal 2024; adjusted operating income was

$1.2 million(1) after excluding $4.8 million of consultant and

advisor related expenses associated with business transformation

initiatives and corporate governance matters

- Net loss for

the quarter was $17.2 million, adjusted net income(1) was $0.5

million for the quarter after excluding the non-operating non-cash

debt fair value adjustment and tax impacted operating adjustment

for consultant and advisor related expenses associated with

business transformation initiatives and corporate governance

matters

- Cash flows

from operations of $12.0 million for the fiscal third quarter

and $74.8 million for the first nine months of fiscal 2025

- Product and

service orders of $186.9 million(2) for the quarter, a decrease of

2.7 percent from the third quarter of 2024 and $540.7 million on a

year-to-date basis, a year-to-date increase of 1.2 percent

- Product order

backlog of $273.2 million(2) at January 25, 2025, compared to

$236.0 million at the end of the second quarter of fiscal 2025 and

$328.3 million at the end of the third quarter of fiscal 2024

Reece Kurtenbach, Daktronicsʹ Chairman,

President and Chief Executive Officer, commented, “Our orders grew

sequentially in the third quarter, driven by a strong increase in

Commercial orders, securing a major NFL stadium order, and a

rebound in International orders. Despite the traditionally lower

volume in the third quarter due to the completion of fall sports

installations, a natural slowdown in outdoor construction projects,

and the impact of two major holidays, we successfully preserved our

gross margin and increased quarterly cash flow compared to last

year through cost mitigations, favorable sales mix, and careful

working capital management.”

OutlookThe underlying long-term

drivers of customers’ desire to expand usage of digital display

systems and quoting activity remain strong. Nevertheless, recent

actions by the US government, including global tariff policy and

federal funding priority changes, may affect near-term business

conditions, and may have some impact on the timing of expected and

quoted orders. We have been seeing some delays in US-based project

bookings across markets. Additionally, costs related to corporate

governance matters and business transformation are expected to

remain elevated in the fourth fiscal quarter.

Leadership TransitionToday,

Daktronics also announced that Mr. Kurtenbach is stepping down from

his roles as President, CEO and Chairman of the Company’s Board of

Directors (the “Board”), effective at close of business on March 5,

2025. Mr. Kurtenbach will remain involved with the business in an

advisory role supporting Daktronics’ digital transformation plan.

The Board will engage a nationally recognized executive search firm

to help identify a permanent Chief Executive Officer. While this

process continues, the Board has appointed Brad Wiemann, the

Company’s Executive Vice President, as Interim President and CEO.

Mr. Wiemann has been with Daktronics since 1993. He has served in a

variety of roles at the Company across manufacturing, engineering,

product development and other functions. In his current role, he

oversees the Company’s Commercial and High Schools & Parks and

Recreation business units. He has played a key role in

standardizing products to simplify engineering and manufacturing

for outdoor products, such as billboards and message centers, as

well as developing Daktronics’ sales and service channels.

To further accelerate the Company’s

transformation, Daktronics Board member and former CFO of Wells

Fargo, Howard Atkins, has been appointed Acting CFO and Chief

Transformation Officer, effective at close of business today, March

5, 2025. This transition allows Sheila Anderson to focus on her

role as Chief Data and Analytics Officer, a position she assumed in

October 2024, while the Company’s search for a permanent CFO

proceeds.

The Board has also appointed Andrew Siegel,

currently the Company’s lead independent director, to serve as the

new independent Chair of the Board. Mr. Siegel is an accomplished

investor and sports, media and technology executive.

These appointments support the Board-led

business transformation intended to position the Company for its

next phase of innovation, commercial growth and global market

expansion.

“Since its founding over 50 years ago,

Daktronics has grown into a world leader in video communications

displays and control systems,” said Mr. Kurtenbach. “I am

incredibly proud of what we have been able to achieve together, and

deeply humbled by the remarkable hard work, commitment and loyalty

of our team members that has enabled us to get to this point. I am

confident that Daktronics has a strong foundation in place,

supported by the increasing momentum from the Company’s

transformation, to continue its global growth. This is the right

moment for me to step back as CEO and to turn the business over to

the next generation of leadership. I believe Daktronics is

well-positioned to expand its market leadership position and create

significant long-term value for our customers, shareholders and all

stakeholders.”

“On behalf of the Board, I want to express our

gratitude and highest respect to Reece for his leadership and

continued commitment to Daktronics,” Mr. Siegel said. “During

Reece’s 34-year tenure – including 12 years as CEO – he has been a

thoughtful leader and mentor to the team, and instrumental in

building Daktronics into the world-class business it is today. From

developing groundbreaking new technology and expanding Daktronics’

global footprint into new markets, Reece has helped establish

Daktronics as an industry leader. We will continue to benefit from

his expertise and deep industry relationships as we welcome this

next chapter of evolution for Daktronics.”

Siegel continued, “Daktronics is a world-class

business with an unmatched culture of excellence – from the quality

of our engineering, manufacturing and installation expertise, our

solution-oriented sales team, to our committed customer service

throughout the entire lifetime of display use. We must build on

these strengths while looking into new technology advancements and

services to accelerate Daktronics’ growth potential. With the

benefit of fresh perspectives and diversified experience,

Daktronics can further capture its potential and secure our market

leadership.”

Update on Business and Digital

Transformation “During the quarter, we completed the

rigorous analysis and planning phase of our business transformation

plan. The transformation, built upon our market leadership

position, our technical and strengthening operating financial

profile, and our capable employees, was designed and structured to

support our ambitious targets to grow revenue faster than our

addressable market, currently estimated in the 7-10 percent range,

expand operating margins of a sustainable 10-12 percent, and

achieve 17-20 percent return on capital by fiscal 2028. In concert

with these efforts, we continue to advance our digital

transformation projects to realize efficiencies across the company

and in interactions with our customers. We have also added rigor to

our annual planning, capital allocation and risk assessment

processes," said Sheila Anderson, CFO and Chief Data and Analytics

Officer.

The business transformation, overseen by

management and the board, is focused on completing initiatives with

velocity in the following categories, with preponderance of

benefits expected in the second half of fiscal 2026 and fiscal

2027.

Driving profitable growth

- Prioritizing most profitable sales

channels on a global basis

- Strategic pricing and value selling

activities enhancements

- Priority development of new

products for displays and control systems

Driving down product costs and structural

costs

- Agile alignment and optimization of

our global manufacturing resources

- Company wide re-invigoration of

operational efficiency practices

- Renegotiation of key supply

agreements and scrubbing the entire supply chain

- Simplifying product complexities to

enhance cost-effectiveness and reliability

Digital transformation, supporting aggressive

growth, data-driven planning and operational efficiencies

- Enhanced enterprise performance

management tools deployment

- Redesigning front-end quoting and

sales processes, building in automation and efficiency

- Data driven culture and development

of data platforms

- Lower of information technology

maintenance spend

Daktronics is also introducing a new management

compensation plan to retain and attract the best talent and align

incentives with long-term shareholder interests. This is designed

to reinforce incredible teamwork and ensure Daktronics continues to

deliver enhanced customer value for long-term success for all

stakeholders.

Anderson continued, "Our transformation is

already gaining momentum by achieving quick wins in the last

quarter, including adjustments to service parts pricing systems,

negotiations of lower cost material supply contracts, and

implementation of manufacturing operational efficiencies in our

high school product focused factory. Our dedicated Business

Transformation Office is in operation to maintain momentum, oversee

a disciplined implementation process, and ensure financial targets

are met with accountability at every level."

Third Quarter ResultsOrders for

the third quarter of fiscal 2025 decreased by 2.7 percent from the

third quarter of fiscal 2024. Order volume for the quarter declined

primarily due to an order decrease in the Live Events, High School

Park and Recreation, and Transportation business units. Variability

in orders between periods is natural in these large project

business areas and the time of year for sports projects and due to

some delayed buying behaviors. In Live Events, we booked a large

project during the quarter for a new NFL stadium system. These

declines were offset by order bookings in the Commercial business

unit and the International business unit, both led by strength in

the Out-of-Home niche. Orders for the first nine months of the year

increased 1.2 percent. Third quarter fiscal 2025 orders increased

by 5.2 percent from the second quarter of fiscal 2025.

Net sales for the third quarter of fiscal 2025

decreased by 12.2 percent as compared to the third quarter of

fiscal 2024. The third quarter of every fiscal year is

characterized by seasonally lower volume. The sales decrease was

driven by comparatively lower volumes in the Live Events and

Transportation business units, partially offset by increased order

fulfillment in the Commercial, High School Park and Recreation, and

International business units.

Gross profit as a percentage of net sales

increased slightly to 24.6 percent for the third quarter of fiscal

2025 as compared to 24.5 percent a year earlier. We reduced shifts

and work schedules to adjust for lower volumes to preserve gross

profit margin as we continue to drive operational efficiencies.

Operating expenses increased to $40.4 million in

the third quarter of fiscal 2025 as compared to $33.7 million for

the third quarter of fiscal 2024. Increased operating expenses

reflect investments in staffing resources to support information

technology and digital transformation plans as well as sales team

expansion to support opportunities for future growth. During the

third quarter of fiscal 2025, we incurred $2.1 million of

consultant related expenses associated with the previously

announced strategic and digital transformation initiatives and $2.7

million of costs related to corporate governance matters including

redomiciling and shareholder relations legal and advisory

costs.

The above changes resulted in an operating

margin loss for the third quarter of fiscal 2025 of 2.4 percent as

compared to an operating margin income of 4.7 percent a year

earlier. For the third quarter of fiscal 2025, adjusted for

consultant and governance matters related expenses, adjusted

operating margin income was 0.8 percent(1).

The increase in interest income, net for the

third quarter of fiscal 2025 compared to the same period one year

ago was primarily due to interest income earned on cash

balances.

For the quarter ended January 25, 2025, we

recorded $14.1 million of expense for the non-cash change in fair

value of a convertible note payable, which is accounted for under

the fair value option.

The effective income tax rate for the third

quarter of fiscal 2025 produced an effective tax rate of 3.7

percent primarily due to the tax effect of the increase of the

convertible note fair value adjustment to expense that is not

deductible for tax purposes reduced by the tax effect of the

period's decrease in pre-tax income. The effective tax rate for the

third quarter of fiscal 2024 was 15.0 percent due to a decrease in

the fair value adjustment in proportion to the increase in pre-tax

income for the period.

Balance Sheet and Cash Flow

Cash, restricted cash and marketable securities totaled $132.2

million at January 25, 2025, and $42.5 million of total

current and long-term debt was outstanding as of that date, which

included $23.9 million of face value and convertible fair value

adjustments of $19.1 million, and is net of $0.5 million of debt

issuance costs. There were no draw-downs on the asset-based

revolving credit facility during the first nine months of fiscal

2025, and $33.4 million was available to draw at January 25,

2025. During the quarter, we converted a total of $13.9 million

face value ($7.0 million on December 3, 2024 and $6.9 million on

January 3, 2024) of the $25.0 million senior second lien secured

promissory note (the "Convertible Note") and stopped accruing

interest on this portion of note. Upon the occurrence of the two

conversions, and in accordance with the terms of the Convertible

Note, the Company issued and delivered 2.2 million shares of the

Company's common stock on January 27, 2025, the first trading day

after the effective date of the percentage cap increase to 14.99

percent. The fair value of these conversions totaled $36.8 million.

During the quarter, we also issued a forced conversion notice of

$6.9 million face value of the note on January 10, 2025, effective

February 3, 2025. Subsequent to the end of the quarter, we issued

1.1 million shares for this conversion. On February 10, 2025, we

issued notice that we would force the conversion of the fourth and

final tranche of approximately $4.2 million face value and

approximately 0.7 million shares on March 4, 2025, eliminating this

debt upon final issuance of these shares.

In the first nine months of fiscal 2025,

Daktronics generated $74.8 million of cash from operations and used

$14.7 million for purchases of property and equipment and used $9.0

million for share repurchases.

At the end of the fiscal 2025 third quarter, the

working capital ratio was 2.4 to 1. Inventory levels dropped 18.3

percent since the end of the 2024 fiscal year on April 27, 2024.

Management’s focus remains on managing working capital through

expected growth of the company and through the dynamic business

cycles.

Webcast Information The Company

will host a conference call and webcast to discuss its financial

results today at 10:00 a.m. (Central Time). This call will be

broadcast live at http://investor.daktronics.com where related

presentation materials will also be posted prior to the conference

call. A webcast will be available for replay shortly after the

event.

About DaktronicsDaktronics has

strong leadership positions in, and is the world’s largest supplier

of, large-screen video displays, electronic scoreboards, LED text

and graphics displays, and related control systems. The Company

excels in the control of display systems, including those that

require integration of multiple complex displays showing real-time

information, graphics, animation, and video. Daktronics designs,

manufactures, markets and services display systems for customers

around the world in four domestic business units: Live Events,

Commercial, High School Park and Recreation, and Transportation,

and one International business unit. For more information, visit

the Company's website at: www.daktronics.com.

Safe Harbor StatementCautionary

Notice: In addition to statements of historical fact, this news

release contains forward-looking statements within the meaning of

the federal securities laws and is intended to receive the

protections of such laws.

All statements, other than historical facts,

included or incorporated in this presentation could be deemed

forward-looking statements, particularly statements that reflect

the expectations or beliefs of Daktronics, Inc. (the “Company,”

“Daktronics,” “we,” or “us”) concerning future events or our future

financial performance. You are cautioned not to place undue

reliance on forward-looking statements, which are often

characterized by discussions of strategy, plans, or intentions or

by the use of words such as "may," "would," "could," "should,"

"will," "expect," "estimate," "anticipate," "believe," "intend,"

"plan," "forecast," "project," “predict,” “potential,” “continue,”

or “intend,” the negative or other variants of such terms, or other

comparable terminology. The Company cautions that these

forward-looking statements are subject to risks and uncertainties

that could cause actual results to differ materially from our

expectations as a result of various factors, including, but not

limited to, changes in economic and market conditions, management

of growth, timing and magnitude of future contracts and orders,

fluctuations in margins, the introduction of new products and

technology, the impact of adverse weather conditions, increased

regulation, the imposition of tariffs, trade wars, the availability

and costs of raw materials, components, and shipping services,

geopolitical and governmental actions, and other risks described in

the Company’s Annual Report on Form 10-K for its 2024 fiscal year

(the “Form 10-K”) and in other reports filed with or furnished to

the U.S. Securities and Exchange Commission (the "SEC") by the

Company. You should carefully consider the trends, risks, and

uncertainties described in this presentation, the Form 10-K, and

other reports filed with or furnished to the SEC by the Company

before making any investment decision with respect to our

securities. If any of these trends, risks, or uncertainties

continues or occurs, our business, financial condition, or

operating results could be materially and adversely affected, the

trading prices of our securities could decline, and you could lose

part or all of your investment.

Forward-looking statements are made in the

context of information available as of the date of this news

release and are based on our current expectations, forecasts,

estimates, and assumptions. The Company undertakes no obligation to

update or revise such statements to reflect circumstances or events

occurring after this presentation except as may be required by

applicable law. All forward-looking statements attributable to us

or persons acting on our behalf are expressly qualified in their

entirety by this cautionary statement.

For more information contact:INVESTOR

RELATIONS:Sheila M. Anderson, CFO and Chief Data and Analytics

OfficerTel (605) 692-0200Investor@daktronics.com

Alliance Advisors IRCarolyn Capaccio / Jody Burfening

DAKTIRTeam@allianceadvisors.com

|

Daktronics, Inc. and

SubsidiariesConsolidated Statements of

Operations(in thousands, except per share

amounts)(unaudited) |

| |

| |

Three Months Ended |

|

Nine Months Ended |

| |

January 25,2025 |

|

January 27,2024 |

|

January 25,2025 |

|

January 27,2024 |

|

Net sales |

$ |

149,507 |

|

|

$ |

170,303 |

|

|

$ |

583,926 |

|

|

$ |

602,203 |

|

| Cost of sales |

|

112,726 |

|

|

|

128,585 |

|

|

|

431,584 |

|

|

|

435,139 |

|

|

Gross profit |

|

36,781 |

|

|

|

41,718 |

|

|

|

152,342 |

|

|

|

167,064 |

|

| |

|

|

|

|

|

|

|

| Operating expenses: |

|

|

|

|

|

|

|

|

Selling |

|

14,471 |

|

|

|

14,258 |

|

|

|

44,811 |

|

|

|

41,840 |

|

|

General and administrative |

|

16,498 |

|

|

|

10,589 |

|

|

|

43,771 |

|

|

|

31,077 |

|

|

Product design and development |

|

9,440 |

|

|

|

8,835 |

|

|

|

28,902 |

|

|

|

26,459 |

|

| |

|

40,409 |

|

|

|

33,682 |

|

|

|

117,484 |

|

|

|

99,376 |

|

|

Operating (loss) income |

|

(3,628 |

) |

|

|

8,036 |

|

|

|

34,858 |

|

|

|

67,688 |

|

| |

|

|

|

|

|

|

|

| Nonoperating (expense)

income: |

|

|

|

|

|

|

|

|

Interest income (expense), net |

|

508 |

|

|

|

(745 |

) |

|

|

710 |

|

|

|

(2,952 |

) |

|

Change in fair value of convertible note |

|

(14,083 |

) |

|

|

6,340 |

|

|

|

(25,369 |

) |

|

|

(11,570 |

) |

|

Other expense and debt issuance costs write-off, net |

|

(613 |

) |

|

|

(1,000 |

) |

|

|

(2,612 |

) |

|

|

(6,282 |

) |

| |

|

|

|

|

|

|

|

|

(Loss) income before income taxes |

|

(17,816 |

) |

|

|

12,631 |

|

|

|

7,587 |

|

|

|

46,884 |

|

|

Income tax (benefit) expense |

|

(660 |

) |

|

|

1,889 |

|

|

|

8,283 |

|

|

|

14,781 |

|

|

Net (loss) income |

$ |

(17,156 |

) |

|

$ |

10,742 |

|

|

$ |

(696 |

) |

|

$ |

32,103 |

|

| |

|

|

|

|

|

|

|

| Weighted average shares

outstanding: |

|

|

|

|

|

|

|

|

Basic |

|

47,764 |

|

|

|

46,173 |

|

|

|

46,944 |

|

|

|

45,975 |

|

|

Diluted |

|

47,764 |

|

|

|

50,837 |

|

|

|

46,944 |

|

|

|

46,608 |

|

| |

|

|

|

|

|

|

|

| Earnings per share: |

|

|

|

|

|

|

|

|

Basic |

$ |

(0.36 |

) |

|

$ |

0.23 |

|

|

$ |

(0.01 |

) |

|

$ |

0.70 |

|

|

Diluted |

$ |

(0.36 |

) |

|

$ |

0.09 |

|

|

$ |

(0.01 |

) |

|

$ |

0.69 |

|

|

Daktronics, Inc. and

SubsidiariesConsolidated Balance

Sheets(in thousands)(unaudited) |

| |

| |

January 25,2025 |

|

April 27,2024 |

| ASSETS |

|

|

|

| CURRENT ASSETS: |

|

|

|

|

Cash and cash equivalents |

$ |

132,169 |

|

$ |

81,299 |

|

Restricted cash |

|

— |

|

|

379 |

|

Accounts receivable, net |

|

95,523 |

|

|

117,186 |

|

Inventories |

|

112,699 |

|

|

138,008 |

|

Contract assets |

|

39,867 |

|

|

55,800 |

|

Current maturities of long-term receivables |

|

1,780 |

|

|

298 |

|

Prepaid expenses and other current assets |

|

7,338 |

|

|

8,531 |

|

Income tax receivables |

|

5,038 |

|

|

448 |

|

Total current assets |

|

394,414 |

|

|

401,949 |

| |

|

|

|

|

Property and equipment, net |

|

73,728 |

|

|

71,752 |

|

Long-term receivables, less current maturities |

|

1,780 |

|

|

562 |

|

Goodwill |

|

3,086 |

|

|

3,226 |

|

Intangibles, net |

|

602 |

|

|

840 |

|

Debt issuance costs, net |

|

1,599 |

|

|

2,530 |

|

Investment in affiliates and other assets |

|

23,970 |

|

|

21,163 |

|

Deferred income taxes |

|

24,977 |

|

|

25,862 |

| TOTAL ASSETS |

$ |

524,156 |

|

$ |

527,884 |

|

Daktronics, Inc. and

SubsidiariesConsolidated Balance Sheets

(continued)(in thousands)(unaudited) |

| |

| |

January 25,2025 |

|

April 27,2024 |

| LIABILITIES AND

SHAREHOLDERS' EQUITY |

|

|

|

| CURRENT LIABILITIES: |

|

|

|

|

Current portion of long-term debt |

$ |

1,500 |

|

|

$ |

1,500 |

|

|

Accounts payable |

|

44,627 |

|

|

|

60,757 |

|

|

Contract liabilities |

|

65,977 |

|

|

|

65,524 |

|

|

Accrued expenses |

|

37,154 |

|

|

|

43,028 |

|

|

Warranty obligations |

|

12,966 |

|

|

|

16,540 |

|

|

Income taxes payable |

|

214 |

|

|

|

4,947 |

|

|

Total current liabilities |

|

162,438 |

|

|

|

192,296 |

|

| |

|

|

|

|

Long-term warranty obligations |

|

23,306 |

|

|

|

21,388 |

|

|

Long-term contract liabilities |

|

18,056 |

|

|

|

16,342 |

|

|

Other long-term obligations |

|

6,909 |

|

|

|

5,759 |

|

|

Long-term debt, net |

|

41,019 |

|

|

|

53,164 |

|

|

Deferred income taxes |

|

137 |

|

|

|

143 |

|

|

Total long-term liabilities |

|

89,427 |

|

|

|

96,796 |

|

| |

|

|

|

| SHAREHOLDERS' EQUITY: |

|

|

|

|

Preferred Shares, no par value, authorized 50 shares; no shares

issued and outstanding |

|

— |

|

|

|

— |

|

|

Common Stock, no par value, authorized 115,000 shares; 49,006 and

48,121 shares issued at January 25, 2025 and April 27,

2024, respectively |

|

71,774 |

|

|

|

65,525 |

|

|

Additional paid-in capital |

|

89,875 |

|

|

|

52,046 |

|

|

Retained earnings |

|

137,335 |

|

|

|

138,031 |

|

|

Treasury Stock, at cost, 2,443 and 1,907 shares at January 25,

2025 and April 27, 2024, respectively |

|

(19,301 |

) |

|

|

(10,285 |

) |

|

Accumulated other comprehensive loss |

|

(7,392 |

) |

|

|

(6,525 |

) |

| TOTAL SHAREHOLDERS'

EQUITY |

|

272,291 |

|

|

|

238,792 |

|

| TOTAL LIABILITIES AND

SHAREHOLDERS' EQUITY |

$ |

524,156 |

|

|

$ |

527,884 |

|

|

Daktronics, Inc. and

SubsidiariesConsolidated Statements of Cash

Flows(in thousands)(unaudited) |

|

|

|

|

Nine Months Ended |

| |

January 25,2025 |

|

January 27,2024 |

| CASH FLOWS FROM OPERATING

ACTIVITIES: |

|

|

|

|

Net (loss) income |

$ |

(696 |

) |

|

$ |

32,103 |

|

|

Adjustments to reconcile net (loss) income to net cash provided by

operating activities: |

|

|

|

|

Depreciation and amortization |

|

14,707 |

|

|

|

14,370 |

|

|

(Gain) loss on sale of property, equipment and other assets |

|

(118 |

) |

|

|

98 |

|

|

Share-based compensation |

|

1,623 |

|

|

|

1,598 |

|

|

Equity in loss of affiliates |

|

2,594 |

|

|

|

2,330 |

|

|

(Recoveries of) provision for doubtful accounts, net |

|

(481 |

) |

|

|

659 |

|

|

Deferred income taxes, net |

|

877 |

|

|

|

23 |

|

|

Non-cash impairment charges |

|

— |

|

|

|

1,091 |

|

|

Change in fair value of convertible note |

|

25,369 |

|

|

|

11,570 |

|

|

Debt issuance costs write-off |

|

— |

|

|

|

3,353 |

|

|

Change in operating assets and liabilities |

|

30,964 |

|

|

|

(13,406 |

) |

|

Net cash provided by operating activities |

|

74,839 |

|

|

|

53,789 |

|

| |

|

|

|

| CASH FLOWS FROM INVESTING

ACTIVITIES: |

|

|

|

|

Purchases of property and equipment |

|

(14,668 |

) |

|

|

(13,628 |

) |

|

Proceeds from sales of property, equipment and other assets |

|

212 |

|

|

|

107 |

|

|

Proceeds from sales or maturities of marketable securities |

|

— |

|

|

|

550 |

|

|

Purchases of equity and loans to equity investees |

|

(3,326 |

) |

|

|

(4,084 |

) |

|

Net cash used in investing activities |

|

(17,782 |

) |

|

|

(17,055 |

) |

| |

|

|

|

| CASH FLOWS FROM FINANCING

ACTIVITIES: |

|

|

|

|

Borrowings on notes payable |

|

— |

|

|

|

40,485 |

|

|

Payments on notes payable |

|

(1,733 |

) |

|

|

(18,500 |

) |

|

Principal payments on long-term obligations |

|

(310 |

) |

|

|

(307 |

) |

|

Debt issuance costs |

|

— |

|

|

|

(6,833 |

) |

|

Payments for common shares repurchased |

|

(9,016 |

) |

|

|

— |

|

|

Proceeds from exercise of stock options |

|

5,056 |

|

|

|

1,147 |

|

|

Tax payments related to RSU issuances |

|

(591 |

) |

|

|

(303 |

) |

|

Net cash (used in) provided by financing

activities |

|

(6,594 |

) |

|

|

15,689 |

|

| |

|

|

|

| EFFECT OF EXCHANGE RATE

CHANGES ON CASH |

|

28 |

|

|

|

80 |

|

| NET INCREASE IN CASH, CASH

EQUIVALENTS AND RESTRICTED CASH |

|

50,491 |

|

|

|

52,503 |

|

| |

|

|

|

| CASH, CASH EQUIVALENTS AND

RESTRICTED CASH: |

|

|

|

|

Beginning of period |

|

81,678 |

|

|

|

24,690 |

|

|

End of period |

$ |

132,169 |

|

|

$ |

77,193 |

|

|

Daktronics, Inc. and SubsidiariesNet Sales

and Orders by Business Unit(in thousands)(unaudited) |

| |

| |

Three Months Ended |

|

Nine Months Ended |

| (in

thousands) |

January 25,2025 |

|

January 27,2024 |

|

DollarChange |

|

PercentChange |

|

January 25,2025 |

|

January 27,2024 |

|

DollarChange |

|

PercentChange |

| Net

Sales: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Commercial |

$ |

37,976 |

|

$ |

33,292 |

|

$ |

4,684 |

|

|

14.1 |

% |

|

$ |

115,614 |

|

$ |

122,628 |

|

$ |

(7,014 |

) |

|

(5.7 |

)% |

| Live Events |

|

46,072 |

|

|

73,393 |

|

|

(27,321 |

) |

|

(37.2 |

) |

|

|

231,887 |

|

|

233,602 |

|

|

(1,715 |

) |

|

(0.7 |

) |

| High School Park and

Recreation |

|

29,367 |

|

|

28,764 |

|

|

603 |

|

|

2.1 |

|

|

|

125,444 |

|

|

133,940 |

|

|

(8,496 |

) |

|

(6.3 |

) |

| Transportation |

|

18,789 |

|

|

19,605 |

|

|

(816 |

) |

|

(4.2 |

) |

|

|

62,757 |

|

|

61,217 |

|

|

1,540 |

|

|

2.5 |

|

| International |

|

17,303 |

|

|

15,249 |

|

|

2,054 |

|

|

13.5 |

|

|

|

48,224 |

|

|

50,816 |

|

|

(2,592 |

) |

|

(5.1 |

) |

| |

$ |

149,507 |

|

$ |

170,303 |

|

$ |

(20,796 |

) |

|

(12.2 |

)% |

|

$ |

583,926 |

|

$ |

602,203 |

|

$ |

(18,277 |

) |

|

(3.0 |

)% |

| Orders: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Commercial |

$ |

40,983 |

|

$ |

34,524 |

|

$ |

6,459 |

|

|

18.7 |

% |

|

$ |

127,653 |

|

$ |

101,167 |

|

$ |

26,486 |

|

|

26.2 |

% |

| Live Events |

|

78,132 |

|

|

95,217 |

|

|

(17,085 |

) |

|

(17.9 |

) |

|

|

199,555 |

|

|

226,436 |

|

|

(26,881 |

) |

|

(11.9 |

) |

| High School Park and

Recreation |

|

34,549 |

|

|

35,385 |

|

|

(836 |

) |

|

(2.4 |

) |

|

|

116,834 |

|

|

103,924 |

|

|

12,910 |

|

|

12.4 |

|

| Transportation |

|

13,838 |

|

|

18,924 |

|

|

(5,086 |

) |

|

(26.9 |

) |

|

|

48,819 |

|

|

59,409 |

|

|

(10,590 |

) |

|

(17.8 |

) |

| International |

|

19,402 |

|

|

8,013 |

|

|

11,389 |

|

|

142.1 |

|

|

|

47,803 |

|

|

43,450 |

|

|

4,353 |

|

|

10.0 |

|

| |

$ |

186,904 |

|

$ |

192,063 |

|

$ |

(5,159 |

) |

|

(2.7 |

)% |

|

$ |

540,664 |

|

$ |

534,386 |

|

$ |

6,278 |

|

|

1.2 |

% |

|

Reconciliation of Free Cash

Flow*(in thousands)(unaudited) |

| |

| |

Nine Months Ended |

| |

January 25,2025 |

|

January 27,2024 |

|

Net cash provided by operating activities |

$ |

74,839 |

|

|

$ |

53,789 |

|

| Purchases of property and

equipment |

|

(14,668 |

) |

|

|

(13,628 |

) |

| Proceeds from sales of

property and equipment |

|

212 |

|

|

|

107 |

|

|

Free cash flow |

$ |

60,383 |

|

|

$ |

40,268 |

|

* In evaluating its business, Daktronics

considers and uses free cash flow as a key measure of its operating

performance. The term free cash flow is not defined under

accounting principles generally accepted in the United States of

America ("GAAP") and is not a measure of operating income, cash

flows from operating activities or other GAAP figures and should

not be considered alternatives to those computations. Free cash

flow is intended to provide information that may be useful for

investors when assessing period to period results.

|

Reconciliation of Adjusted Operating Income*(in

thousands)(unaudited) |

| |

| |

Three Months Ended |

|

Nine Months Ended |

| |

January 25,2025 |

|

January 27,2024 |

|

January 25,2025 |

|

January 27,2024 |

|

Operating (loss) income (GAAP Measure) |

$ |

(3,628 |

) |

|

$ |

8,036 |

|

$ |

34,858 |

|

$ |

67,688 |

| Consultant related expenses

associated with business transformation initiatives |

|

2,130 |

|

|

|

— |

|

|

6,054 |

|

|

— |

| Corporate governance

expenses |

|

2,711 |

|

|

|

— |

|

|

2,944 |

|

|

— |

| Adjusted operating income

(non-GAAP measure) |

$ |

1,213 |

|

|

$ |

8,036 |

|

$ |

43,856 |

|

$ |

67,688 |

* In evaluating its business, Daktronics

considers and uses adjusted operating income as a key measure of

its operating performance. The term adjusted operating income is

not defined under GAAP and is not a measure of operating income,

cash flows from operating activities, or other GAAP figures and

should not be considered alternatives to those computations. We

define non-GAAP adjusted operating income as operating (loss)

income plus consulting related expenses related to our business

transformation initiatives and corporate governance expenses

related to legal and advisory costs of reincorporation and

shareholder relations. Management believes non-GAAP adjusted

operating income is a useful indicator of our financial performance

and our ability to generate cash flows from operations. Our

definition of non-GAAP adjusted operating income may not be

comparable to similarly titled definitions used by other companies.

The table above reconciles non-GAAP adjusted operating income to

comparable GAAP financial measures.

|

Reconciliation of Adjusted Net Income*(in

thousands)(unaudited) |

| |

| |

Three Months Ended |

|

Nine Months Ended |

| |

January 25,2025 |

|

January 27,2024 |

|

January 25,2025 |

|

January 27,2024 |

|

Net (loss) income |

$ |

(17,156 |

) |

|

$ |

10,742 |

|

|

$ |

(696 |

) |

|

$ |

32,103 |

| Consultant related expenses

associated with business transformation initiatives, net of

taxes |

|

1,576 |

|

|

|

— |

|

|

|

4,480 |

|

|

|

— |

| Corporate governance expenses,

net of taxes |

|

2,006 |

|

|

|

— |

|

|

|

2,179 |

|

|

|

— |

| Change in fair value of

convertible note |

|

14,083 |

|

|

|

(6,340 |

) |

|

|

25,369 |

|

|

|

11,570 |

| Debt issuance costs expensed

due to fair value of convertible note, net of taxes |

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

2,297 |

| Adjusted net income |

$ |

509 |

|

|

$ |

4,402 |

|

|

$ |

31,332 |

|

|

$ |

45,970 |

* Adjusted net income. We disclose adjusted net

income as a non-GAAP financial measurement in order to report our

results exclusive of items that are non-recurring, unique, or not

core to our operating business. We believe presenting this non-GAAP

financial measurement provides investors with a consistent way to

analyze our performance.

|

Reconciliation of Long-term Debt(in

thousands)(unaudited) |

| |

| Long-term debt

consists of the following: |

| |

| |

January 25,2025 |

|

April 27,2024 |

|

Mortgage |

$ |

12,750 |

|

|

$ |

13,875 |

|

| Convertible note |

|

11,128 |

|

|

|

25,000 |

|

| Long-term debt, gross |

|

23,878 |

|

|

|

38,875 |

|

| Debt issuance costs, net |

|

(481 |

) |

|

|

(761 |

) |

| Change in fair value of

convertible note |

|

19,122 |

|

|

|

16,550 |

|

| Current portion |

|

(1,500 |

) |

|

|

(1,500 |

) |

| Long-term debt, net |

$ |

41,019 |

|

|

$ |

53,164 |

|

______________________(1) Adjusted

operating income and adjusted net income is not a measure defined

by accounting principles generally accepted in the United States of

America ("GAAP"), to report our results exclusive of items that are

non-recurring or not core to our operating business. We believe

presenting this non-GAAP financial measurement provides investors

with a consistent way to analyze our performance. For more

information, see the supplemental calculation contained later in

this release. (2) Orders and backlog metrics are not measures

defined by GAAP, and our methodology for determining orders and

backlog may vary from the methodology used by other companies in

determining their orders and backlog amounts. For more information

related to backlog, see Part I, Item 1. Business of our Annual

Report on Form 10-K for the fiscal year ended April 27, 2024.

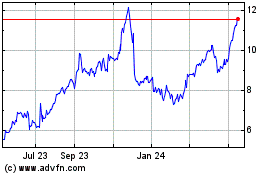

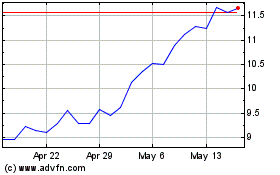

Daktronics (NASDAQ:DAKT)

Historical Stock Chart

From Feb 2025 to Mar 2025

Daktronics (NASDAQ:DAKT)

Historical Stock Chart

From Mar 2024 to Mar 2025