Filed

Pursuant to Rule 424(b)(5)

Registration

No. 333-278380

PROSPECTUS

SUPPLEMENT

(To

Prospectus dated May 10, 2024)

DARÉ

BIOSCIENCE, INC.

Up

to $18,089,630

Common

Stock

On

March 31, 2023, we entered into a sales agreement, or the Sales Agreement, with Stifel, Nicolaus & Company, Incorporated, or Stifel,

and Cantor Fitzgerald & Co., or Cantor, relating to the issuance and sale of shares of our common stock, $0.0001 par value per share,

including up to $18,089,630 of shares of common stock offered by this prospectus supplement and the accompanying prospectus. On April

30, 2024, we mutually agreed with Cantor to terminate the Sales Agreement with respect to Cantor. In accordance with the terms of the

Sales Agreement, we may offer and sell shares of our common stock from time to time through or to Stifel acting as our Sales Agent.

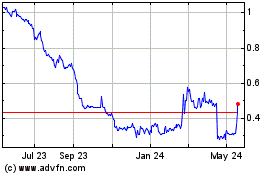

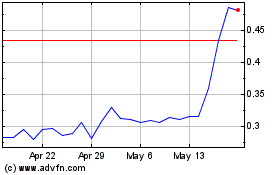

Our

common stock is listed on the Nasdaq Capital Market under the symbol “DARE.” The last reported sale price of our common stock

on May 3, 2024 was $0.3112 per share. On March 28, 2024, the date we filed our Annual Report on Form 10-K for the fiscal year ended December

31, 2023, our prospectus became subject to the offering limits in General Instruction I.B.6 of Form S-3. As of the date hereof, the aggregate

market value of our common stock held by non-affiliates pursuant to General Instruction I.B.6 of Form S-3 is $54,830,751, which was calculated

based on 99,873,864 shares of our common stock outstanding held by non-affiliates and a price of $0.5490 per share, the closing price

of our common stock on March 27, 2024. As of the date of this prospectus supplement, we have offered and sold $187,287 of shares of our

common stock pursuant to General Instruction I.B.6 of Form S-3 during the 12 calendar months prior to, and including, the date of this

prospectus supplement. Pursuant to General Instruction I.B.6 of Form S-3, in no event will we sell securities in public primary offerings

on Form S-3 with a value exceeding more than one-third of our public float (as defined by General Instruction I.B.6) in any 12 calendar

month period so long as our public float remains below $75 million.

Sales

of our common stock, if any, under this prospectus supplement and the accompanying prospectus may be made by any method deemed to be

an “at the market offering” as defined in Rule 415(a)(4) promulgated under the Securities Act of 1933, as amended, or the

Securities Act, including sales made directly on the Nasdaq Capital Market or any other trading market for our common stock. The Sales

Agent will use commercially reasonable efforts to sell on our behalf the shares of our common stock requested by us to be sold, consistent

with their normal trading and sales practices, on mutually agreed terms set forth in the Sales Agreement. There is no arrangement for

funds to be received in any escrow, trust or similar arrangement.

The

compensation to the Sales Agent for sales of our common stock pursuant to the Sales Agreement will be 3.0% of the gross proceeds of the

sales price per share or such lower amount as we and the Sales Agent may agree. See “Plan of Distribution” beginning on page

S-11 for additional information regarding the compensation to be paid to the Sales Agent. In connection with the sale of our common

stock on our behalf, the Sales Agent will be deemed to be an “underwriter” within the meaning of the Securities Act and the

compensation of the Sales Agent will be deemed to be underwriting commissions or discounts. We have also agreed to provide indemnification

and contribution to the Sales Agent with respect to certain liabilities, including liabilities under the Securities Act or the Securities

Exchange Act of 1934, as amended, or the Exchange Act.

Investing

in our common stock involves a high degree of risk. Before deciding whether to purchase shares of our common stock, you should carefully

consider the risks and uncertainties that we have described under the caption “Risk Factors” beginning on page S-6 of this

prospectus supplement, as well as the information under similar captions in the documents incorporated by reference in this prospectus

supplement.

Neither

the Securities and Exchange Commission nor any state securities commission has approved or disapproved of these securities or determined

if this prospectus supplement or the accompanying prospectus is truthful or complete. Any representation to the contrary is a criminal

offense.

Stifel

The

date of this prospectus supplement is May 10, 2024

TABLE

OF CONTENTS

PROSPECTUS

SUPPLEMENT

PROSPECTUS

ABOUT

THIS PROSPECTUS SUPPLEMENT

This

document is in two parts. The first part is the prospectus supplement, including the documents incorporated by reference, which describes

the specific terms of this offering. The second part, the accompanying prospectus, including the documents incorporated by reference,

provides more general information. Before you invest, you should carefully read this prospectus supplement, the accompanying prospectus,

all information incorporated by reference herein and therein, as well as the additional information described under “Where You

Can Find Additional Information” on page S-13 of this prospectus supplement. These documents contain information you should consider

when making your investment decision. This prospectus supplement may add, update or change information contained in the accompanying

prospectus. To the extent there is a conflict between the information contained in this prospectus supplement, on the one hand, and the

information contained in the accompanying prospectus or any document incorporated by reference therein filed prior to the date of this

prospectus supplement, on the other hand, you should rely on the information in this prospectus supplement. If any statement in one of

these documents is inconsistent with a statement in another document having a later date—for example, a document filed after the

date of this prospectus supplement and incorporated by reference in this prospectus supplement and the accompanying prospectus—the

statement in the document having the later date modifies or supersedes the earlier statement.

You

should rely only on the information contained or incorporated by reference in this prospectus supplement, the accompanying prospectus

and in any free writing prospectus we may provide to you in connection with this offering. We have not, and the Sales Agent has not,

authorized any other person to provide you with any information that is different. If anyone provides you with different or inconsistent

information, you should not rely on it. We are offering to sell, and seeking offers to buy, shares of our common stock only in jurisdictions

where offers and sales are permitted. The distribution of this prospectus supplement and the accompanying prospectus and the offering

of the common stock in certain jurisdictions may be restricted by law. Persons outside the United States who come into possession of

this prospectus supplement and the accompanying prospectus must inform themselves about, and observe any restrictions relating to, the

offering of the common stock and the distribution of this prospectus supplement and the accompanying prospectus outside the United States.

This prospectus supplement and the accompanying prospectus do not constitute, and may not be used in connection with, an offer to sell,

or a solicitation of an offer to buy, any securities offered by this prospectus supplement and the accompanying prospectus by any person

in any jurisdiction in which it is unlawful for such person to make such an offer or solicitation.

We

further note that the representations, warranties and covenants made by us in any agreement that is filed as an exhibit to any document

that is incorporated by reference in this prospectus supplement and the accompanying prospectus were made solely for the benefit of the

parties to such agreement, including, in some cases, for the purpose of allocating risk among the parties to such agreements, and should

not be deemed to be a representation, warranty or covenant to you. Moreover, such representations, warranties or covenants were accurate

only as of the date when made. Accordingly, such representations, warranties and covenants should not be relied on as accurately representing

the current state of our affairs.

Unless

the context otherwise requires, “Daré,” “Daré Bioscience,” “the Company,” “we,”

“us,” “our” and similar terms refer to Daré Bioscience, Inc. and its subsidiaries. When we refer to “you”

we mean potential holders of the securities we may offer under this prospectus supplement and the accompanying prospectus.

PROSPECTUS

SUPPLEMENT SUMMARY

This

summary highlights selected information about us, this offering and information appearing elsewhere in this prospectus supplement and

in the documents we incorporate by reference. This summary is not complete and does not contain all the information you should consider

before investing in our common stock pursuant to this prospectus supplement and the accompanying prospectus. Before making an investment

decision, to fully understand this offering and its consequences to you, you should carefully read this entire prospectus supplement

and the accompanying prospectus, including the financial statements and related notes and the other information that we incorporated

by reference herein, including our Annual Reports on Form 10-K, Quarterly Reports on Form 10-Q and Current Reports on Form 8-K that we

file from time to time.

About

Daré Bioscience

We

are a biopharmaceutical company committed to advancing innovative products for women’s health. We are driven by a mission to identify,

develop and bring to market a diverse portfolio of differentiated therapies that prioritize women’s health and well-being, expand

treatment options, and improve outcomes, primarily in the areas of contraception, vaginal health, reproductive health, menopause, sexual

health and fertility. Our business strategy is to in-license or otherwise acquire the rights to differentiated product candidates in

our areas of focus, some of which have existing clinical proof-of-concept data, to take those candidates through mid to late-stage clinical

development or regulatory approval, and to establish and leverage strategic collaborations to achieve commercialization. We and our wholly

owned subsidiaries operate in one business segment.

The

first FDA-approved product to emerge from our portfolio of women’s health product candidates is XACIATO (clindamycin phosphate)

vaginal gel 2%, or XACIATO (pronounced zah-she-AH-toe). XACIATO was approved by the FDA in December 2021 as a single-dose prescription

medication for the treatment of bacterial vaginosis in females 12 years of age and older. In March 2022, we entered into an agreement

with an affiliate of Organon & Co., Organon International GmbH, or Organon, which became fully effective in June 2022, whereby Organon

licensed exclusive worldwide rights to develop, manufacture and commercialize XACIATO. Accordingly, our potential future revenue from

the commercialization of XACIATO will consist of royalties based on net sales and milestone payments from Organon. Organon commenced

U.S. marketing of XACIATO in the fourth quarter of 2023.

Our

product pipeline includes diverse programs that target unmet needs in women’s health in the areas of contraception, vaginal health,

reproductive health, menopause, sexual health and fertility, and aim to expand treatment options, enhance outcomes and improve ease of

use for women. We are primarily focused on progressing the development of our existing portfolio of product candidates. However, we also

explore opportunities to expand our portfolio by leveraging assets to which we hold rights or obtaining rights to new assets, with continued

focus solely on women’s health.

Our

current portfolio includes five product candidates in advanced clinical development (Phase 2-ready to Phase 3):

| ● | Ovaprene®,

a hormone-free, monthly intravaginal contraceptive; |

| ● | Sildenafil

Cream, 3.6%, a proprietary cream formulation of sildenafil for topical administration

to the female genitalia on demand for the treatment of female sexual arousal disorder (FSAD); |

| ● | DARE-HRT1,

an intravaginal ring designed to deliver both bio-identical estradiol and progesterone together,

continuously over a 28-day period, for the treatment of moderate-to-severe vasomotor symptoms,

as part of menopausal hormone therapy; |

| ● | DARE-VVA1,

a proprietary formulation of tamoxifen for intravaginal administration being developed as

a hormone-free alternative to estrogen-based therapies for the treatment of moderate-to-severe

dyspareunia, or pain during sexual intercourse, a symptom of vulvar and vaginal atrophy associated

with menopause; and |

| ● | DARE-CIN,

a proprietary, fixed-dose formulation of lopinavir and ritonavir in a soft gel vaginal insert

for the treatment of cervical intraepithelial neoplasia (CIN) and other human papillomavirus

(HPV)-related pathologies. |

Our

portfolio also includes five product candidates in Phase 1 clinical development or that we believe are Phase 1-ready:

| ● | DARE-PDM1,

a proprietary hydrogel formulation of diclofenac, a nonsteroidal anti-inflammatory drug,

for vaginal administration as a treatment for primary dysmenorrhea; |

| |

● |

DARE-204 and DARE-214, injectable formulations

of etonogestrel designed to provide contraception over 6-month and 12-month periods, respectively; |

| |

● |

DARE-FRT1, an intravaginal ring designed to deliver bio-identical

progesterone continuously for up to 14 days for luteal phase support as part of an in vitro fertilization treatment plan; and |

| |

● |

DARE-PTB1, an intravaginal ring designed to deliver bio-identical

progesterone continuously for up to 14 days for the prevention of preterm birth. |

In

addition, our portfolio includes five preclinical stage programs:

| |

● |

DARE-LARC1, a contraceptive implant delivering levonorgestrel

with a woman-centered design that has the potential to be a long-acting, yet convenient and user-controlled contraceptive option; |

| |

● |

DARE-LBT, a novel hydrogel formulation for vaginal delivery

of live biotherapeutics to support vaginal health; |

| |

● |

DARE-GML, an intravaginally-delivered potential multi-target

antimicrobial agent formulated with glycerol monolaurate (GML), which has shown broad antimicrobial activity, killing bacteria and viruses; |

| |

● |

DARE-RH1, a novel approach to non-hormonal contraception

for both men and women by targeting the CatSper ion channel; and |

| |

● |

DARE-PTB2, a novel approach for the prevention and treatment

of idiopathic preterm birth through inhibition of a stress response protein. |

The

product candidates and potential product candidates in our portfolio will require review and approval from the FDA, or a comparable foreign

regulatory authority, prior to being marketed or sold. See ITEM 1. “BUSINESS,” in Part I of our Annual Report on Form 10-K

for the year ended December 31, 2023 for additional information regarding our product and product candidates.

Our

primary operations have consisted of research and development activities to advance our portfolio of product candidates through late-stage

clinical development and/or regulatory approval. We expect our research and development expenses will continue to represent the majority

of our operating expenses for at least the next twelve months. Until we secure additional capital to fund our operating needs, we will

focus our resources primarily on advancement of Ovaprene and Sildenafil Cream. In addition, we expect to incur significant research and

development expenses for the DARE-LARC1 program for the next several years, but we also expect such expenses will be supported by non-dilutive

funding provided under a grant agreement we entered into in June 2021.

We

will need to raise substantial additional capital to continue to fund our operations and execute our current business strategy. We are

also subject to a number of other risks common to biopharmaceutical companies, including, but not limited to, dependence on key employees,

reliance on third-party collaborators, service providers and suppliers, being able to develop commercially viable products in a timely

and cost-effective manner, dependence on intellectual property we own or in-license and the need to protect that intellectual property

and maintain those license agreements, uncertainty of market acceptance of products, uncertainty of third-party payor coverage, pricing

and reimbursement for products, rapid technology change, intense competition, compliance with government regulations, product liability

claims, and exposure to cybersecurity threats and incidents.

The

process of developing and obtaining regulatory approvals for prescription drug and drug/device products in the United States and in foreign

jurisdictions is inherently uncertain and requires the expenditure of substantial financial resources without any guarantee of success.

To the extent we receive regulatory approvals to market and sell our product candidates, the commercialization of any product and compliance

with subsequently applicable laws and regulations requires the expenditure of further substantial financial resources without any guarantee

of commercial success. The amount of post-approval financial resources required for commercialization and the potential revenue we may

receive from sales of any product will vary significantly depending on many factors, including whether, and the extent to which, we establish

our own sales and marketing capabilities and/or enter into and maintain commercial collaborations with third parties with established

commercialization infrastructure.

Additional

Information

For

additional information related to our business and operations, please refer to the annual and quarterly reports incorporated herein by

reference, as described under the caption “Incorporation of Documents by Reference” on page S-13 of this prospectus supplement.

Corporate

Information

We

are incorporated under the laws of the State of Delaware. Our principal executive offices are located at 3655 Nobel Drive, Suite 260,

San Diego, California 92122, and our telephone number at that address is (858) 926-7655. We maintain a website at www.darebioscience.com,

to which we regularly post copies of our press releases as well as additional information about us. The information contained on, or

that can be accessed through, our website is not a part of this prospectus supplement. We have included our website address in this prospectus

supplement solely as an inactive textual reference.

Daré

Bioscience® is a registered trademark of Daré Bioscience, Inc. Ovaprene® is a registered trademark licensed to Daré

Bioscience, Inc. All brand names or trademarks appearing in this prospectus supplement are the property of their respective holders.

Use or display by us of other parties’ trademarks, trade dress, or products in this prospectus supplement is not intended to, and

does not, imply a relationship with, or endorsements or sponsorship of, us by the trademark or trade dress owners.

The

Offering

| Issuer |

|

Daré

Bioscience, Inc. |

| |

|

|

| Common

stock offered by us |

|

Shares

of our common stock having an aggregate offering price of not more than $18,089,630. |

| |

|

|

| Common

stock to be outstanding after this offering |

|

Up

to 158,102,563 shares, assuming sales of 58,128,631 shares of our common stock in this offering at an assumed offering price of $0.3112

per share, which was the last reported sale price of our common stock on the Nasdaq Capital Market on May 3, 2024. The actual number

of shares issued will vary depending on the sales prices at which our common stock is sold under this offering. |

| |

|

|

| Plan

of Distribution |

|

“At

the market offering” that may be made from time to time on the Nasdaq Capital Market or any other existing trading market for

our common stock through or to our sales agent, Stifel. See “Plan of Distribution” on page S-11 of this prospectus supplement. |

| |

|

|

| Use

of proceeds |

|

We

intend to use the net proceeds, if any, for general corporate purposes, which may include, among other things, increasing working

capital and funding operating expenses and capital expenditures to advance the development of and help bring to market our product

candidates. See “Use of Proceeds” on page S-9 of this prospectus supplement. |

| |

|

|

| Risk

factors |

|

Investment

in our common stock involves a high degree of risk. You should read the “Risk Factors” section of this prospectus supplement

on page S-6, as well as the other information included or incorporated by reference in this prospectus supplement and the accompanying

prospectus, for a discussion of risks and uncertainties you should carefully consider before deciding to purchase shares of our common

stock. |

| |

|

|

| Nasdaq

Capital Market symbol |

|

DARE |

The

number of our shares of common stock to be outstanding after this offering is based on 99,973,932 shares of our common stock outstanding

as of December 31, 2023 and excludes:

| ● | 15,006,500

shares of our common stock issuable upon exercise of warrants outstanding as of December

31, 2023, having a weighted-average exercise price of $0.63 per share; |

| ● | 9,463,556

shares of our common stock issuable upon exercise of options outstanding as of December 31,

2023, having a weighted-average exercise price of $1.46 per share; |

| ● | 6,725,579

shares of our common stock reserved and available as of December 31, 2023 for future issuance

under our 2022 Stock Incentive Plan; and |

| ● | 1,118,968

shares of our common stock sold under the Sales Agreement after December 31, 2023 and on

or before May 3, 2024. |

To

the extent that outstanding options or warrants have been or may be exercised, new equity awards were or are issued, shares of our common

stock are sold under our employee stock purchase plan, or we otherwise issued or sell equity or convertible debt securities, the issuance

of these securities could result in further dilution to our stockholders.

RISK

FACTORS

Investing

in our common stock involves a high degree of risk and uncertainty. In addition to the other information included or incorporated by

reference in this prospectus supplement and the accompanying prospectus, you should carefully consider the risks described below, before

making an investment decision with respect to our common stock. We expect to update these Risk Factors from time to time in the periodic

and current reports that we file with the SEC after the date of this prospectus supplement. These updated Risk Factors will be incorporated

by reference in this prospectus supplement and the accompanying prospectus. Please refer to these subsequent reports for additional information

relating to the risks associated with investing in our common stock. If any of such risks and uncertainties actually occurs, our business,

financial condition, and results of operations could be severely harmed. This could cause the trading price of our common stock to decline,

and you could lose all or part of your investment.

Risks

Related to this Offering

Resales

of our common stock in the public market by our stockholders during this offering may cause the market price of our common stock to fall.

We

may issue shares of our common stock from time to time in connection with this offering. The issuance from time to time of these new

shares, or our ability to issue new shares of common stock in this offering, could result in resales of our common stock by our current

stockholders concerned about the potential ownership dilution of their holdings. In turn, these resales could have the effect of depressing

the market price for our common stock.

There

may be future sales or other dilution of our equity, which may adversely affect the market price of our common stock.

We

are generally not restricted from issuing additional common stock, including any securities that are convertible into or exchangeable

for, or that represent the right to receive, common stock. The market price of our common stock could decline as a result of sales of

common stock or securities that are convertible into or exchangeable for, or that represent the right to receive, common stock after

this offering or the perception that such sales could occur.

Our

management will have broad discretion over the use of the net proceeds from this offering, you may not agree with how we use the proceeds

and any proceeds invested may not be invested successfully.

We

have not designated any portion of the net proceeds from this offering, if any, to be used for any particular purpose. Accordingly, our

management will have broad discretion as to the use of the net proceeds from this offering and could use them for purposes other than

those contemplated at the time of commencement of this offering. Accordingly, you will be relying on the judgment of our management with

regard to the use of these net proceeds, and you will not have the opportunity, as part of your investment decision, to assess whether

the proceeds are being used appropriately. It is possible that, pending their use, we may invest the net proceeds in a way that does

not yield a favorable, or any, return for our company.

The

common stock offered hereby will be sold in “at the market offerings” and investors who buy shares at different times will

likely pay different prices.

Investors

who purchase shares in this offering at different times will likely pay different prices, and accordingly may experience different levels

of dilution and different outcomes in their investment results. We will have discretion, subject to market demand, to vary the timing,

prices and number of shares sold in this offering. Investors may experience a decline in the value of the shares they purchase in this

offering as a result of sales made at prices lower than the prices they paid.

The

actual number of shares we will issue under the Sales Agreement, at any one time or in total, is uncertain.

Subject

to certain limitations in the Sales Agreement and compliance with applicable law, we have the discretion to deliver a placement notice

to the Sales Agent at any time throughout the term of the Sales Agreement. The number of shares that are sold by a Sales Agent after

delivering a placement notice will fluctuate based on the market price of our common stock during the sales period and limits we set

with such Sales Agent. Because the price per share of each share sold will fluctuate based on the market price of our common stock during

the sales period, it is not possible at this stage to predict the number of shares that will be ultimately issued.

You

may experience immediate and substantial dilution in the book value per share of the common stock you purchase.

Because

the prices per share at which shares of our common stock are sold in this offering may be substantially higher than the book value per

share of our common stock, you may suffer immediate and substantial dilution in the net tangible book value of the common stock you purchase

in this offering. The shares sold in this offering, if any, will be sold from time to time at various prices. After giving effect to

the sale of our common stock in the maximum aggregate offering amount of $18,089,630 at an assumed offering price of $0.3112 per share,

which was the last reported sale price of our common stock on the Nasdaq Capital Market on May 3, 2024, and after deducting estimated

offering commissions and expenses payable by us, our net tangible book value as of December 31, 2023 would have been approximately $12.37

million, or $0.08 per share of common stock. This represents an immediate dilution of $0.23 in net tangible book value per share to purchasers

of our common stock in this offering and an immediate accretion in as-adjusted net tangible book value of approximately $0.13 per share

to our existing stockholders. See “Dilution” below for a more detailed discussion of the dilution you may incur in connection

with this offering.

CAUTIONARY

NOTE REGARDING FORWARD-LOOKING STATEMENTS

This

prospectus supplement, the accompanying prospectus and our SEC filings that are incorporated by reference into this prospectus supplement

and the accompanying prospectus contain or incorporate by reference forward-looking statements within the meaning of Section 27A of the

Securities Act and Section 21E of the Exchange Act. All statements, other than statements of historical fact, included or incorporated

by reference in this prospectus supplement and the accompanying prospectus regarding development and potential regulatory review or approval

and commercialization of our products, our future financial position, future operations, strategy, prospects, collaborations, competition,

intellectual property, objectives of management, and compliance with Nasdaq Capital Market listing standards are forward-looking statements.

Forward-looking statements may include, but are not limited to, any statements concerning:

| ● | the

anticipated timing, structure and results of clinical and nonclinical development of our

product candidates; |

| ● | the

anticipated pathway, timing and outcome of the regulatory review process for our product

candidates; |

| ● | the

plans, strategies and objectives of management for future operations, partnerships and other

collaborations; |

| ● | proposed

new products, services or developments; |

| ● | our

future funding requirements, the sufficiency of our cash resources and our need for additional

capital resources; |

| ● | our

future financial performance; |

| ● | future

economic and industry conditions; |

| ● | our

ability to protect our intellectual property and operate our business without infringing

upon the intellectual property rights of others; and |

| ● | our

intended use of the net proceeds from offerings of our securities under this prospectus supplement. |

The

words believe,” “may,” “will,” “estimate,” “continue,” “anticipate,”

“design,” “intend,” “expect,” “could,” “plan,” “potential,” “predict,”

“seek,” “should,” “would,” “contemplate,” project,” “target,” “tend

to,” or the negative version of these words and similar expressions are intended to identify forward-looking statements, although

not all forward-looking statements contain these identifying words. Forward-looking statements reflect our current views with respect

to future events, are based on assumptions and are subject to risks and uncertainties. We cannot guarantee that we actually will achieve

the plans, intentions or expectations expressed in our forward-looking statements and you should not place undue reliance on these statements.

There are a number of important factors that could cause our actual results to differ materially from those indicated or implied by forward-looking

statements. These important factors include those discussed under the heading “Risk Factors” contained or incorporated in

this prospectus supplement and the accompanying prospectus and any free writing prospectus we may authorize for use in connection with

a specific offering. These factors and the other cautionary statements made in this prospectus supplement and the accompanying prospectus

should be read as being applicable to all related forward-looking statements whenever they appear in this prospectus supplement and the

accompanying prospectus. Except as required by law, we do not assume any obligation to update any forward-looking statement. We disclaim

any intention or obligation to update or revise any forward-looking statement, whether as a result of new information, future events

or otherwise.

USE

OF PROCEEDS

We

may issue and sell shares of our common stock having aggregate sales proceeds of up to $18,089,630 from time to time. The amount of proceeds

from this offering will depend upon the number of shares of our common stock sold and the market price at which they are sold, if any,

and is not determinable at this time. We intend to use the net proceeds from this offering, if any, for general corporate purposes, which

include, but are not limited to, increasing working capital and funding operating expenses to advance the development of and help bring

to market our product candidates. We may also use a portion of the net proceeds to acquire or invest in complementary businesses, product

candidates or technologies, although we have no current commitments or agreements with respect to any such acquisitions or investments

as of the date of this prospectus supplement. We have not determined the amount of net proceeds to be used specifically for the purposes

described above. We will have broad discretion in the use of the net proceeds from this offering, if any. Pending use of the net proceeds,

we intend to invest the proceeds in interest-bearing, marketable securities.

DILUTION

If

you invest in our common stock, your interest will be diluted immediately to the extent of the difference between the public offering

price per share and the adjusted net tangible book value per share of our common stock after this offering.

The

historical net tangible book value of our common stock as of December 31, 2023, was approximately negative $5.05 million, or approximately

negative $0.05 per share. Net tangible book value per share represents the amount of our total tangible assets, excluding goodwill and

intangible assets, less total liabilities, divided by the total number of shares of our common stock outstanding. Dilution per share

to new investors represents the difference between the amount per share paid by purchasers for each share of common stock in this offering

and the net tangible book value per share of our common stock immediately following the completion of this offering.

After

giving effect to the sale of shares of our common stock in the aggregate amount of $18.09 million at an assumed offering price of $0.3112

per share, the last reported sale price of our common stock on May 3, 2024 on the Nasdaq Capital Market, and after deducting estimated

commissions and estimated offering expenses, our pro forma as-adjusted net tangible book value as of December 31, 2023 would have been

approximately $12.37 million, or approximately $0.08 per share. This represents an immediate dilution of $0.23 in pro forma net tangible

book value per share to purchasers of our common stock in this offering and an immediate accretion in pro forma as-adjusted net tangible

book value of approximately $0.13 per share to our existing stockholders, as illustrated by the following table:

| Assumed offering price per share of common stock | |

| | |

| $ |

0.31 |

|

| Historical net tangible book value per share as of December 31, 2023 | |

$ | (0.05 | ) |

|

|

|

|

| Increase in pro forma net tangible book value per share attributable to this offering | |

$ | 0.13 | |

|

|

|

|

| Pro forma as adjusted net tangible book value per share after giving effect to this offering | |

| | |

| $ |

0.08 |

|

| Dilution per share to new investors | |

| | |

| $ |

0.23 |

|

The

table above assumes, for illustrative purposes only, an aggregate of 58,128,631 shares of our common stock are sold at a price of $0.3112

per share, for aggregate gross proceeds of $18,089,630. The shares, if any, sold in this offering will be sold from time to time at various

prices. An increase of $0.031 per share in the price at which the shares are sold from the assumed offering price of $0.3112 per share

shown in the table above, assuming all of our common stock in the aggregate amount of $18,089,630 is sold at that price, would result

in an increase of $0.003 to our pro forma as-adjusted net tangible book value per share after the offering and result in an immediate

dilution of $0.26 in pro forma as-adjusted net tangible book value per share to purchasers of our common stock in this offering, after

deducting commissions and estimated aggregate offering expenses payable by us. A decrease of $0.031 per share in the price at which the

shares are sold from the assumed offering price of $0.3112 per share shown in the table above, assuming all of our common stock in the

aggregate amount of $18,089,630 is sold at that price, would result in a decrease of $0.003 to our pro forma as-adjusted net tangible

book value per share after the offering and result in an immediate dilution of $0.20 in pro forma as-adjusted net tangible book value

per share to purchasers of our common stock in this offering, after deducting commissions and estimated aggregate offering expenses payable

by us. This information is supplied for illustrative purposes only.

The

information in the table above is based on 99,973,932 shares of our common stock outstanding as of December 31, 2023 and excludes:

| ● | 15,006,500

shares of our common stock issuable upon exercise of warrants outstanding as of December

31, 2023, having a weighted-average exercise price of $0.63 per share; |

| ● | 9,463,556

shares of our common stock issuable upon exercise of options outstanding as of December 31,

2023, having a weighted-average exercise price of $1.46 per share; |

| ● | 6,725,579

shares of our common stock reserved and available as of December 31, 2023 for future issuance

under our 2022 Stock Incentive Plan; and |

| ● | 1,118,968

shares of our common stock sold under the Sales Agreement after December 31, 2023 and on

or before May 3, 2024. |

To

the extent that outstanding options or warrants have been or may be exercised, new equity awards were or are issued, shares of our common

stock are sold under our employee stock purchase plan, or we otherwise issued or sell equity or convertible debt securities, the issuance

of these securities could result in further dilution to our stockholders.

PLAN

OF DISTRIBUTION

We

have entered into the Sales Agreement with Stifel, Nicolaus & Company, Incorporated as the Sales Agent, under which we may issue

and sell shares of our common stock, including shares of common stock having an aggregate gross sales price of up to $18,089,630 from

time to time through or to the Sales Agent pursuant to this prospectus supplement and the accompanying prospectus. The Sales Agreement

has been filed as an exhibit to a current report on Form 8-K filed under the Exchange Act and incorporated by reference in this prospectus

supplement and the accompanying prospectus.

Upon

delivery of a placement notice and subject to the terms and conditions of the Sales Agreement, the Sales Agent may sell our common stock

by any method permitted by law deemed to be an “at the market offering” as defined in Rule 415 of the Securities Act, including

sales made directly on the Nasdaq Capital Market, on any other existing trading market for our common stock, or to or through a market

maker. We may instruct the Sales Agent not to sell common stock if the sales cannot be effected at or above the price designated by us

from time to time. We or the Sales Agent may suspend the offering of common stock upon notice and subject to other conditions.

We

will pay the Sales Agent commissions, in cash, for its services in acting as sales agent in the sale of our common stock. The Sales Agent

will be entitled to compensation at a fixed commission rate of 3.0% of the gross sales price per share sold or such lower amount as we

and the Sales Agent may agree. Because there is no minimum offering amount required as a condition to close this offering, the actual

total public offering amount, commissions and proceeds to us, if any, are not determinable at this time. We also agreed to pay the fees

and associated expenses of the Sales Agent’s outside legal counsel for filings with the FINRA Corporate Financing Department in

an amount not to exceed $15,000 and the reasonable fees and disbursements of the Sales Agent’s outside legal counsel in an amount

not to exceed $75,000 arising out of the execution of the Sales Agreement and our delivery of the initial placement notice under the

Sales Agreement. We estimate that the total initial expenses of the offering payable by us, excluding commissions payable to the Sales

Agent under the Sales Agreement, will be approximately $125,000. We have also agreed to pay the ongoing fees and associated expenses

of the Sales Agent’s outside legal counsel in an amount not to exceed $15,000 per quarter arising out of each quarterly representation

date under the Sales Agreement.

The

remaining sales proceeds, after deducting any expenses payable by us and any transaction fees imposed by any governmental, regulatory

or self-regulatory organization in connection with this offering, will equal our net proceeds for the sale of such shares of our common

stock.

If

acting as a sales agent, the Sales Agent will provide written confirmation to us no later than the opening of the trading day on the

Nasdaq Capital Market after each trading day on which common stock is sold through it as sales agent under the Sales Agreement. Each

confirmation will include the number or amount of shares sold through it as sales agent on that day, the volume-weighted average price

of the shares sold and the net proceeds to us from such sales.

Settlement

for sales of common stock will occur on the second trading day following the date on which any sales are made, or on some other date

that is agreed upon by us and the Sales Agent in connection with a particular transaction, in return for payment of the net proceeds

to us. Sales of our common stock as contemplated in this prospectus supplement will be settled through the facilities of The Depository

Trust Company or by such other means as we and the Sales Agent may agree upon. There is no arrangement for funds to be received in an

escrow, trust or similar arrangement.

To

the extent any sales are made, we will report at least quarterly the number of shares of our common stock sold through the Sales Agent

under the Sales Agreement, the net proceeds to us and the compensation paid by us to the Sales Agent in connection with the sales of

our common stock.

The

Sales Agent will use their commercially reasonable efforts, consistent with their sales and trading practices, to solicit offers to purchase

shares of our common stock under the terms and subject to the conditions set forth in the Sales Agreement. In connection with the sale

of the common stock on our behalf, the Sales Agent will be deemed to be an “underwriter” within the meaning of the Securities

Act and the compensation of the Sales Agent will be deemed to be underwriting commissions or discounts. We have agreed to provide indemnification

and contribution to the Sales Agent against certain civil liabilities, including liabilities under the Securities Act.

This

offering of our common stock pursuant to the Sales Agreement will terminate upon the termination of the Sales Agreement as permitted

therein. We and the Sales Agent may each terminate the Sales Agreement at any time upon five days’ prior notice.

The

Sales Agent and/or its affiliates have provided, and may in the future provide, various investment banking, commercial banking and other

financial services for us and our affiliates, for which services they may in the future receive customary fees. The Sales Agent will

not engage in any transactions that stabilize our common stock. To the extent required by Regulation M, the Sales Agent will not engage

in any market making activities involving our common stock while the offering is ongoing under this prospectus supplement and the accompanying

prospectus.

This

prospectus supplement and the accompanying prospectus in electronic format may be made available on a website maintained by the Sales

Agent and the Sales Agent may distribute this prospectus supplement and the accompanying prospectus electronically.

LEGAL

MATTERS

Mintz,

Levin, Cohn, Ferris, Glovsky and Popeo, P.C., San Diego, California, will pass upon certain legal matters in connection with the offering

and validity of the securities offered by this prospectus supplement. Stifel is being represented in connection with this offering by

Duane Morris LLP, New York, New York.

EXPERTS

Haskell

& White LLP, an independent registered public accounting firm, has audited our consolidated financial statements included in our

Annual Report on Form 10-K for the year ended December 31, 2023, as set forth in its report, which is incorporated by reference in this

prospectus supplement and the registration statement. Our financial statements are incorporated by reference in reliance on Haskell &

White LLP’s report, given on the authority of said firm as experts in accounting and auditing.

Mayer

Hoffman McCann P.C., an independent registered public accounting firm, has audited our consolidated financial statements included in

our Annual Report on Form 10-K for the year ended December 31, 2022, as set forth in its report, which is incorporated by reference in

this prospectus supplement and the registration statement. Our financial statements are incorporated by reference in reliance on Mayer

Hoffman McCann P.C.’s report, given on the authority of said firm as experts in accounting and auditing.

WHERE

YOU CAN FIND MORE INFORMATION

We

are subject to the reporting requirements of the Exchange Act and file annual, quarterly and current reports, proxy statements and other

information with the Securities and Exchange Commission, or the SEC. The SEC maintains an internet site that contains reports, proxy

and information statements and other information regarding issuers, such as our company, that file documents electronically with the

SEC. Our SEC filings are available to the public at the SEC’s website address at http://www.sec.gov. The information on

the SEC’s website is not part of this prospectus supplement, and any references to the SEC’s website or any other website

are inactive textual references only.

We

also maintain a website at www.darebioscience.com, through which you can access our SEC filings. The information set forth on

our website is not part of this prospectus supplement. We have included our website address in this prospectus supplement solely as an

inactive textual reference.

INCORPORATION

OF DOCUMENTS BY REFERENCE

The

SEC allows us to “incorporate by reference” into this prospectus supplement the information that we file with the SEC, which

means that we can disclose important information to you by referring you to those publicly available documents. The information that

we incorporate by reference is an important part of this prospectus supplement. This prospectus supplement incorporates by reference

the documents listed below:

| ● | our

Annual Report on Form 10-K for the fiscal year ended December 31, 2023, filed with the SEC

on March 28, 2023 (the “Annual Report”), including all material incorporated

by reference therein; |

| | | |

| ● | our

Current Reports on Form 8-K and on Form 8-K/A filed with the SEC on January 19, 2024, January 26, 2024, and April 30, 2024 (except for any information furnished under Items 2.02 or 7.01

of Form 8-K and all exhibits related to such items); and |

| ● | the

description of our common stock contained in our Registration Statement on Form 8-A filed

on April 4, 2014, including any amendments thereto or reports filed for the purpose of updating

such description, including the description of our common stock in Exhibit 4.5 of the Annual

Report. |

The

SEC file number for each of the documents listed above is 001-36395.

In

addition, all documents filed by us with the SEC pursuant to Sections 13(a), 13(c), 14 and 15(d) of the Exchange Act on and after the

date of this prospectus supplement and prior to the termination of this offering shall be deemed to be incorporated by reference into

this prospectus supplement and to be a part hereof from the date of filing such reports and other documents (excluding any information

in such documents furnished under Item 2.02 or Item 7.01 of any Current Report on Form 8-K and any exhibit furnished with such reports

that is related to those items). We also specifically incorporate by reference into this prospectus supplement all documents filed by

us with the SEC pursuant to Section 13(a), 13(c), 14 or 15(d) of the Exchange Act after the date of the initial registration statement

of which this prospectus supplement is a part and prior to effectiveness of the registration statement (excluding any information in

such documents that is furnished under Item 2.02 or Item 7.01 of any Current Report on Form 8-K and any exhibit furnished with such reports

that is related to those items).

Any

statement contained in this prospectus supplement or in a document incorporated or deemed to be incorporated by reference into this prospectus

supplement will be deemed to be modified or superseded for purposes of this prospectus supplement to the extent that a statement contained

in this prospectus supplement or any other subsequently filed document that is deemed to be incorporated by reference into this prospectus

supplement modifies or supersedes the statement. Any statement so modified or superseded will not be deemed, except as so modified or

superseded, to constitute a part of this prospectus supplement.

We

will provide to each person, including any beneficial owner, to whom this prospectus supplement is delivered, upon written or oral request

and at no cost to the requester, a copy of any or all reports or documents that are incorporated by reference into this prospectus supplement,

but not delivered with the prospectus supplement. Such written or oral requests should be directed to:

Daré

Bioscience, Inc.

3655

Nobel Drive, Suite 260

San

Diego, CA 92122

Attn:

Chief Financial Officer

Telephone:

(858) 926-7655

You

may also access these documents on our website, www.darebioscience.com. The information contained on, or that can be accessed

through, our website is not a part of this prospectus supplement. We have included our website address in this prospectus supplement

solely as an inactive textual reference.

PROSPECTUS

DARÉ

BIOSCIENCE, INC.

$200,000,000

COMMON

STOCK

PREFERRED

STOCK

DEBT

SECURITIES

WARRANTS

RIGHTS

PURCHASE

CONTRACTS

UNITS

This

prospectus will allow us to issue, from time to time at prices and on terms to be determined at or prior to the time of the offering,

up to $200,000,000 of any combination of the securities described in this prospectus, either individually or in units. We may also offer

common stock or preferred stock upon conversion of or exchange for the debt securities; common stock upon conversion of or exchange for

the preferred stock; common stock, preferred stock or debt securities upon the exercise of warrants or rights; or any combination of

our equity securities upon the performance of purchase contracts.

This

prospectus describes the general terms of these securities and the general manner in which these securities will be offered. We will

provide you with the specific terms of any offering in one or more supplements to this prospectus. The prospectus supplements will also

describe the specific manner in which these securities will be offered and may also supplement, update or amend information contained

in this document. You should read this prospectus and any prospectus supplement, as well as any documents incorporated by reference into

this prospectus or any prospectus supplement, carefully before you invest.

Our

securities may be sold directly by us to you, through agents designated from time to time or to or through underwriters or dealers. For

additional information on the methods of sale, you should refer to the section entitled “Plan of Distribution” in this prospectus

and in the applicable prospectus supplement. If any underwriters or agents are involved in the sale of our securities with respect to

which this prospectus is being delivered, the names of such underwriters or agents and any applicable fees, commissions or discounts

and over-allotment options will be set forth in a prospectus supplement. The price to the public of such securities and the net proceeds

that we expect to receive from such sale will also be set forth in a prospectus supplement.

Our

common stock is listed on The Nasdaq Capital Market under the symbol “DARE.” On March 27, 2024, the last reported sale price

of our common stock was $0.55. On March 28, 2024, the date we filed our Annual Report on Form 10-K for the fiscal year ended December

31, 2023, our prospectus became subject to the offering limits in General Instruction I.B.6 of Form S-3. As of the date hereof, the aggregate

market value of our common stock held by non-affiliates pursuant to General Instruction I.B.6 of Form S-3 is $57,034,284, which was calculated

based on 99,362,864 shares of our common stock outstanding held by non-affiliates and a price of $0.57 per share, the closing price of

our common stock on February 29, 2024. As of the date of this prospectus, we have not offered or sold any securities pursuant to General

Instruction I.B.6 of Form S-3 during the 12 calendar months prior to, and including, the date of this prospectus. Pursuant to General

Instruction I.B.6 of Form S-3, in no event will we sell securities in public primary offerings on Form S-3 with a value exceeding more

than one-third of our public float (as defined by General Instruction I.B.6) in any 12 calendar month period so long as our public float

remains below $75 million. The applicable prospectus supplement will contain information, where applicable, as to any other listing,

if any, on any securities market or other securities exchange of the securities covered by the prospectus supplement. Prospective purchasers

of our securities are urged to obtain current information as to the market prices of our securities, where applicable.

Investing

in our securities involves a high degree of risk. Before deciding whether to invest in our securities, you should consider carefully

the risks that we have described on page 8 of this prospectus under the caption “Risk Factors,” as well as in the documents

incorporated by reference in this prospectus.

Neither

the Securities and Exchange Commission nor any state securities commission has approved or disapproved of these securities or determined

if this prospectus is truthful or complete. Any representation to the contrary is a criminal offense.

The

date of this prospectus is May 10, 2024

TABLE

OF CONTENTS

ABOUT

THIS PROSPECTUS

This

prospectus is part of a registration statement that we filed with the Securities and Exchange Commission, or SEC, utilizing a “shelf”

registration process. Under this shelf registration process, we may offer shares of our common stock and preferred stock, various series

of debt securities and/or warrants, rights or purchase contracts to purchase any of such securities, either individually or in units,

in one or more offerings, with a total value of up to $200,000,000. This prospectus provides you with a general description of the securities

we may offer. Each time we offer securities under this prospectus, we will provide a prospectus supplement that will contain specific

information about the type or series of securities offered and the terms of that offering.

This

prospectus does not contain all of the information included in the registration statement of which this prospectus forms a part. For

a more complete understanding of the offering of the securities, you should refer to the registration statement, including its exhibits.

This prospectus, together with any prospectus supplement or free writing prospectus that we subsequently authorize for use in connection

with this offering and the documents incorporated by reference into this prospectus, includes all material information relating to the

offering of securities under this prospectus. You should carefully read this prospectus, any prospectus supplement or free writing prospectus

that we subsequently authorize for use in connection with this offering, the information and documents incorporated herein by reference

and the additional information under the headings “Where You Can Find More Information” and “Incorporation of Documents

by Reference” before making an investment decision.

You

should rely only on the information we have provided or incorporated by reference in this prospectus, or in any prospectus supplement

or free writing prospectus that we subsequently authorize for use in connection with this offering. We have not authorized anyone to

provide you with information different from that contained or incorporated by reference in this prospectus. If anyone provides you with

different or inconsistent information, you should not rely on it. You should assume that the information in this prospectus, or any related

prospectus supplement or free writing prospectus, is accurate only as of the date on the front of the document and that any information

we have incorporated herein by reference is accurate only as of the date of the document incorporated by reference, regardless of the

time of delivery of this prospectus, or such prospectus supplement or free writing prospectus, or any sale of a security.

We

are not offering to sell or seeking offers to purchase these securities in any jurisdiction where the offer or sale is not permitted.

We have not done anything that would permit this offering or possession or distribution of this prospectus in any jurisdiction where

action for that purpose is required, other than in the United States. Persons outside the United States who come into possession of this

prospectus must inform themselves about, and observe any restrictions relating to, the offering of the securities hereunder and the distribution

of this prospectus outside the United States.

The

representations, warranties and covenants made by us in any agreement that is filed as an exhibit to any document that is incorporated

by reference in this prospectus were made solely for the benefit of the parties to such agreement, including, in some cases, for the

purpose of allocating risk among the parties to such agreements, and should not be deemed to be a representation, warranty or covenant

to you. Moreover, such representations, warranties or covenants were accurate only as of the date when made. Accordingly, such representations,

warranties and covenants should not be relied on as accurately representing the current state of our affairs.

Unless

otherwise indicated, information contained in this prospectus concerning our industry and the markets in which we operate, including

our general expectations and market position, market opportunity and market size, is based on information from various sources, including

peer reviewed journals, formal presentations at medical and scientific society meetings and third-parties commissioned by us or our licensors

to provide market research and analysis, and is subject to a number of assumptions and limitations. Although we are responsible for all

of the disclosure contained in this prospectus and we believe the information from industry publications and other third-party sources

included in this prospectus is reliable, such information is inherently imprecise. Information that is based on estimates, forecasts,

projections, market research or similar methodologies is inherently subject to uncertainties and actual events or circumstances may differ

materially from events and circumstances that are assumed in this information. The industry in which we operate is subject to a high

degree of uncertainty and risk due to a variety of factors.

To

the extent there are inconsistencies between this prospectus, any related prospectus supplement or free writing prospectus, and any documents

incorporated by reference, the document with the most recent date will control.

Unless

the context otherwise requires, “Daré,” “Daré Bioscience,” “the Company,” “we,”

“us,” “our” and similar terms refer to Daré Bioscience, Inc. and its subsidiaries. When we refer to “you”

we mean potential holders of the securities we may offer under this prospectus.

PROSPECTUS

SUMMARY

This

summary highlights information contained elsewhere in this prospectus. This summary does not contain all of the information you should

consider before investing in our securities. We urge you to read this entire prospectus, including our consolidated financial statements,

notes to our consolidated financial statements and other information incorporated herein by reference to our other filings with the SEC,

or included in any applicable prospectus supplement.

About

Daré Bioscience

We

are a biopharmaceutical company committed to advancing innovative products for women’s health. We are driven by a mission to identify,

develop and bring to market a diverse portfolio of differentiated therapies that prioritize women’s health and well-being, expand

treatment options, and improve outcomes, primarily in the areas of contraception, vaginal health, reproductive health, menopause, sexual

health and fertility. Our business strategy is to in-license or otherwise acquire the rights to differentiated product candidates in

our areas of focus, some of which have existing clinical proof-of-concept data, to take those candidates through mid to late-stage clinical

development or regulatory approval, and to establish and leverage strategic collaborations to achieve commercialization. We and our wholly

owned subsidiaries operate in one business segment.

The

first FDA-approved product to emerge from our portfolio of women’s health product candidates is XACIATO (clindamycin phosphate)

vaginal gel 2%, or XACIATO (pronounced zah-she-AH-toe). XACIATO was approved by the FDA in December 2021 as a single-dose prescription

medication for the treatment of bacterial vaginosis in females 12 years of age and older. In March 2022, we entered into an agreement

with an affiliate of Organon & Co., Organon International GmbH, or Organon, which became fully effective in June 2022, whereby Organon

licensed exclusive worldwide rights to develop, manufacture and commercialize XACIATO. Accordingly, our potential future revenue from

the commercialization of XACIATO will consist of royalties based on net sales and milestone payments from Organon. Organon commenced

U.S. marketing of XACIATO in the fourth quarter of 2023.

Our

product pipeline includes diverse programs that target unmet needs in women’s health in the areas of contraception, vaginal health,

reproductive health, menopause, sexual health and fertility, and aim to expand treatment options, enhance outcomes and improve ease of

use for women. We are primarily focused on progressing the development of our existing portfolio of product candidates. However, we also

explore opportunities to expand our portfolio by leveraging assets to which we hold rights or obtaining rights to new assets, with continued

focus solely on women’s health.

Our

current portfolio includes five product candidates in advanced clinical development (Phase 2-ready to Phase 3):

| ● | Ovaprene®,

a hormone-free, monthly intravaginal contraceptive; |

| ● | Sildenafil

Cream, 3.6%, a proprietary cream formulation of sildenafil for topical administration

to the female genitalia on demand for the treatment of female sexual arousal disorder (FSAD); |

| ● | DARE-HRT1,

an intravaginal ring designed to deliver both bio-identical estradiol and progesterone together,

continuously over a 28-day period, for the treatment of moderate-to-severe vasomotor symptoms,

as part of menopausal hormone therapy; |

| ● | DARE-VVA1,

a proprietary formulation of tamoxifen for intravaginal administration being developed as

a hormone-free alternative to estrogen-based therapies for the treatment of moderate-to-severe

dyspareunia, or pain during sexual intercourse, a symptom of vulvar and vaginal atrophy associated

with menopause; and |

| ● | DARE-CIN,

a proprietary, fixed-dose formulation of lopinavir and ritonavir in a soft gel vaginal insert

for the treatment of cervical intraepithelial neoplasia (CIN) and other human papillomavirus

(HPV)-related pathologies. |

Our

portfolio also includes five product candidates in Phase 1 clinical development or that we believe are Phase 1-ready:

| ● | DARE-PDM1,

a proprietary hydrogel formulation of diclofenac, a nonsteroidal anti-inflammatory drug,

for vaginal administration as a treatment for primary dysmenorrhea; |

| ● | DARE-204

and DARE-214, injectable formulations of etonogestrel designed to provide contraception

over 6-month and 12-month periods, respectively; |

| ● | DARE-FRT1,

an intravaginal ring designed to deliver bio-identical progesterone continuously for up to

14 days for luteal phase support as part of an in vitro fertilization treatment plan; and |

| ● | DARE-PTB1,

an intravaginal ring designed to deliver bio-identical progesterone continuously for up to

14 days for the prevention of preterm birth. |

In

addition, our portfolio includes five preclinical stage programs:

| ● | DARE-LARC1,

a contraceptive implant delivering levonorgestrel with a woman-centered design that has the

potential to be a long-acting, yet convenient and user-controlled contraceptive option; |

| ● | DARE-LBT,

a novel hydrogel formulation for vaginal delivery of live biotherapeutics to support vaginal

health; |

| ● | DARE-GML,

an intravaginally-delivered potential multi-target antimicrobial agent formulated with glycerol

monolaurate (GML), which has shown broad antimicrobial activity, killing bacteria and viruses;

|

| ● | DARE-RH1,

a novel approach to non-hormonal contraception for both men and women by targeting the CatSper

ion channel; and |

| ● | DARE-PTB2,

a novel approach for the prevention and treatment of idiopathic preterm birth through inhibition

of a stress response protein. |

The

product candidates and potential product candidates in our portfolio will require review and approval from the FDA, or a comparable foreign

regulatory authority, prior to being marketed or sold. See ITEM 1. “BUSINESS,” in Part I of our Annual Report on Form 10-K

for the year ended December 31, 2023 for additional information regarding our product and product candidates.

Our

primary operations have consisted of research and development activities to advance our portfolio of product candidates through late-stage

clinical development and/or regulatory approval. We expect our research and development expenses will continue to represent the majority

of our operating expenses for at least the next twelve months. Until we secure additional capital to fund our operating needs, we will

focus our resources primarily on advancement of Ovaprene and Sildenafil Cream. In addition, we expect to incur significant research and

development expenses for the DARE-LARC1 program for the next several years, but we also expect such expenses will be supported by non-dilutive

funding provided under a grant agreement we entered into in June 2021.

We

will need to raise substantial additional capital to continue to fund our operations and execute our current business strategy. We are

also subject to a number of other risks common to biopharmaceutical companies, including, but not limited to, dependence on key employees,

reliance on third-party collaborators, service providers and suppliers, being able to develop commercially viable products in a timely

and cost-effective manner, dependence on intellectual property we own or in-license and the need to protect that intellectual property

and maintain those license agreements, uncertainty of market acceptance of products, uncertainty of third-party payor coverage, pricing

and reimbursement for products, rapid technology change, intense competition, compliance with government regulations, product liability

claims, and exposure to cybersecurity threats and incidents.

The

process of developing and obtaining regulatory approvals for prescription drug and drug/device products in the United States and in foreign

jurisdictions is inherently uncertain and requires the expenditure of substantial financial resources without any guarantee of success.

To the extent we receive regulatory approvals to market and sell our product candidates, the commercialization of any product and compliance

with subsequently applicable laws and regulations requires the expenditure of further substantial financial resources without any guarantee

of commercial success. The amount of post-approval financial resources required for commercialization and the potential revenue we may

receive from sales of any product will vary significantly depending on many factors, including whether, and the extent to which, we establish

our own sales and marketing capabilities and/or enter into and maintain commercial collaborations with third parties with established

commercialization infrastructure.

Summary

of Risk Factors

Investing

in our securities involves a high degree of risk. Before deciding whether to purchase any of our securities, you should carefully consider

the risks and uncertainties described in the section captioned “Risk Factors” in this prospectus and the applicable accompanying

prospectus supplement, and under similar headings in the documents incorporated by reference into this prospectus and the applicable

accompanying prospectus supplement. The occurrence of any of these risk factors could have a material adverse effect on our business,

financial condition, results of operations and growth prospects. In these circumstances, the market price of our common stock could decline,

and you may lose all or part of your investment in our common stock. These risk factors include, but are not limited to, the following:

| ● | We

will need to raise substantial additional capital to continue our operations, execute our

business strategy and remain a going concern, and we may not be able to raise adequate capital

on a timely basis, on favorable terms, or at all. Raising additional capital may cause substantial

dilution to our stockholders, restrict our operations or require us to relinquish rights

in our technologies or product candidates and their future revenue streams. |

| ● | We

have a limited operating history, have incurred significant losses since our inception and

expect to continue to incur losses for the foreseeable future, which, together with our limited

financial resources and substantial capital requirements, make it difficult to assess our

prospects. |

| ● | Our

business depends on obtaining the approval of regulatory authorities, and in particular,

FDA approval, to market products that we develop. All of our product candidates are investigational,

require the conduct and successful completion of clinical studies and nonclinical work, and

may never complete development or be submitted for or receive regulatory approval. The FDA’s

approval of XACIATO is not predictive of favorable development or marketing approval outcomes

for our product candidates. |

| ● | Clinical

development is a lengthy and expensive process with an inherently uncertain outcome. Failure

to successfully complete clinical trials and nonclinical activities and obtain regulatory

approval to market and sell our product candidates on our anticipated timelines at reasonable

costs to us, or at all, particularly Ovaprene and Sildenafil Cream, could have a material

adverse effect on our business, operating results and financial condition. |

| ● | The

regulatory approval processes of the FDA and comparable foreign authorities are expensive,

lengthy, time-consuming, and inherently unpredictable. If we are not able to obtain regulatory

approvals for our product candidates, our ability to generate product revenue will be materially

impaired. |

| ● | Drug

products and drug/device combination products are complex to manufacture and we face significant

challenges in scaling up manufacturing of our product candidates for larger clinical trials

and commercial production. Manufacturing and supply delays and disruptions could postpone

the initiation of or interrupt our clinical studies, extend the timeframe and cost of development

of our product candidates, delay potential regulatory approvals and adversely impact the

commercialization of any approved products. |

| ● | Strategic

collaborations are a key part of our strategy and our existing strategic collaborations are

important to our business. If we are unable to maintain existing strategic collaborations

or establish new ones, or if they are not successful, we may require substantial additional

capital to develop and commercialize our products and product candidates and our business

and prospects may be materially harmed. |

| ● | Unless

and until one of our product candidates receives regulatory approval, payments under our

license agreement with Organon based on net sales of XACIATO represent our only potential

source of ongoing revenue and the amount of those net sales is largely outside of our control.

|

| ● | We

have no manufacturing, sales, marketing or distribution infrastructure. We depend heavily

on, and expect to continue to rely on, the performance of third parties, including our strategic

collaborators, contract manufacturers and suppliers, CROs, medical institutions, and scientific,

medical, regulatory and other consultants and advisors, to develop our product candidates

and commercialize any approved products. Failure of these third parties to perform as expected

could result in substantial delays, increased costs or failures of our product development

programs, delayed or unsuccessful commercialization of any approved products, and the need

for significant additional capital. |

| ● | Due

in part to our limited financial and human resources, we may fail to effectively execute

our product development, regulatory submission and commercialization plans in accordance

with communicated timelines, or at all. |

| ● | The

loss or impairment of our rights under our license agreements for XACIATO or any of our product

candidates could prevent us from developing or commercializing them, which could have a material

adverse effect on our business prospects, operations and viability. |

| ● | The

commercial success of XACIATO will depend on Organon’s efforts and capabilities and