Châtillon, France, July 30, 2024

DBV Technologies Provides Updates on the

Viaskin Peanut Program in Children and Toddlers and Reports Second

Quarter and Half-Year 2024 Financial Results

- VITESSE enrollment in

peanut allergic 4-7-year-olds is on-track and recruitment is

expected to be complete by end of Q3 2024

- DBV submitted a labeling

proposal, informed by the EPITOPE efficacy data, to the Food and

Drug Administration (FDA) to address the FDA’s protocol queries

regarding patch wear-time in COMFORT Toddlers

- DBV closes Q2 2024 with a

cash balance of $66.2 million; due to cost-saving measures, the

Company’s cash runway is extended into Q1 2025

DBV Technologies (Euronext: DBV – ISIN:

FR0010417345 – Nasdaq Stock Market: DBVT), a clinical-stage

biopharmaceutical company, today shared an update on the Phase 3

study, VITESSE (Viaskin Peanut

Immunotherapy Trial to

Evaluate Safety,

Simplicity and Efficacy), using

the modified Viaskin Peanut Patch, in children ages 4 – 7 years old

with peanut allergy. The Company also provided a status update on

the COMFORT (Characterization of the

Optimal Management of

FOod allergy Relief and

Treatment) Toddlers supplemental safety study in 1

– 3-year-olds with peanut allergy. DBV reported financial results

for the second quarter and the first half of 2024. The quarterly

and half-year financial statements were approved by the Board of

Directors on July 30, 2024.

Business Update

VITESSEDBV Technologies reports

that enrollment for the VITESSE Phase 3 pivotal study in children 4

- 7-year-olds with a peanut allergy continues to be on track to

screen the last subject by the end of Q3 2024. VITESSE is a trial

evaluating efficacy and safety of the modified Viaskin® Peanut

patch in approximately 600 subjects (randomized 2:1) with 86

participating sites in US, Canada, Europe, UK and Australia.

“We are pleased that sites in the U.S., Canada,

Europe, Australia, and the UK are working hard to continue

screening and enrolling subjects so that we are on-track to reach

our goal of last subject into VITESSE by the end of Q3 2024,” said

Pharis Mohideen, M.D. Chief Medical Officer at DBV

Technologies. “We are seeing great momentum via our

engagements at medical conferences and through our outreach efforts

via the patient advocacy community and with study investigators. I

look forward to the completion of study recruitment in the months

to come.”

COMFORT ToddlersDBV

Technologies and the FDA have been engaged in ongoing dialogue

since May 2023 on the COMFORT Toddlers supplemental safety study in

1 – 3-year-olds with a peanut allergy. The study protocol was

submitted on November 9, 2023, with comments provided by FDA on

March 11, 2024. Since March, much of the dialogue between DBV and

FDA regarding the COMFORT Toddlers supplemental study has focused

on patch wear-time experience, including how prescribers would

advise parents and caregivers to manage day-to-day variability in

patch wear time.

In this context, DBV proposed an approach,

informed by the EPITOPE efficacy data, that focuses on the user

experience during the first 90-days of treatment. DBV submitted to

the FDA draft labeling for Section 2 – Dosing and Administration,

for a potential Viaskin Peanut Prescribing Information (PI), along

with comprehensive supportive data and analyses. Within the first

90-days of treatment (excluding the lead-in dosing period) it is

possible to identify those patients who are very likely to have a

robust clinical efficacy response based on patch wear time

experience (i.e., “Label-in” patients). The proposed PI recommends

continuation of treatment for these patients. With the same 90-day

approach, patients less likely to have a robust clinical efficacy

response, identified by their patch wear-time experience, would be

identified as “Label-out” patients. In these instances, the PI

would recommend a shared decision-making process, between the

health care provider and the parent or caregiver, to determine

whether treatment should be discontinued.

Importantly, the data shows that the “Label-in”

and “Label-out” populations have similar immunological

characteristics at baseline and have a similar safety profile while

on treatment. However, there is clearly a difference in immune

physiology (i.e., local application site sensitivity to the

allergen, peanut protein) which impacts an individual patient’s

wear time experience.

“DBV is and always has been dedicated to

families in the food allergy community—our future patients are our

top priority,” said Daniel Tasse, Chief Executive Officer

of DBV Technologies. “We have offered a robust proposal to

the FDA with the goal of expediting and finalizing a path forward

for Viaskin Peanut in 1–3-year-olds. We believe the proposed

labeling solution, which identifies patients to label-in and

label-out of treatment with the Viaskin Peanut patch, will provide

data-driven instructions to prescribers, and thus optimize Viaskin

Peanut treatment for toddlers suffering from peanut allergy.

“On April 29th, the FDA Office of Vaccine

Research and Review stated that non-COVID related backlogs were

behind them, that the Division was caught-up, allowing more time

for interactions with sponsors. We have indeed seen more engagement

from FDA, particularly on CMC and our clinical program. DBV looks

forward to continued dialogue with FDA in advancing a regulatory

pathway for Viaskin Peanut in 1–3-year-olds.”

DBV is currently awaiting FDA’s response to the

proposed labeling approach which was submitted on June 28th.

Conference Call

DBV will host a conference call and live audio

webcast on Tuesday, July 30th, at 5:30 p.m. ET to review its second

quarter 2024 financial results and provide a business update.

Participants may access this call via the below

teleconferencing numbers and asking to join the DBV Technologies

call:

United States: +1-877-346-6112International:

+1-848-280-6350

A live webcast of the call will be available on

the Investors & Media section of the Company’s website:

https://www.dbv-technologies.com/investor-relations/. A replay of

the presentation will also be available on DBV’s website after the

event.

Financial Highlights for the second quarter

Ended June 30, 2024

The Company’s interim condensed consolidated

financial statements for the six months ended June 30, 2024, are

prepared in accordance with accounting principles in the U.S.

(“U.S. GAAP”).

Cash and Cash Equivalents

|

In millions of USD(unaudited) |

U.S. GAAP |

IFRS |

|

six months ended June 30, |

six months ended June 30, |

|

2024 |

2023 |

2024 |

2023 |

|

Net cash & cash equivalents at the beginning

of the period |

141.4 |

209.2 |

141.4 |

209.2 |

|

Net cash flow used in operating activities |

(69.8) |

(46.4) |

(68.7) |

(45.4) |

|

Net cash flow provided by / (used in) investing activities |

(1.4) |

(0.3) |

(1.4) |

(0.3) |

|

Net cash flow provided by / (used in) financing activities |

(0.1) |

7.8 |

(1.2) |

6.8 |

|

Effect of exchange rate changes on cash & cash equivalents |

(3.9) |

3.7 |

(3.9) |

3.7 |

|

Net cash & cash equivalents at the end of the period |

66.2 |

174.0 |

66.2 |

174.0 |

Cash and cash equivalents amounted to $66.2

million as of June 30, 2024, compared to $141.4 million as of

December 31, 2023, a net decrease by $75.2 million including $69.8

million of net cash flow used in operating activities, mainly

external clinical-related expenses notably progress on patient

enrollment in the VITESSE Phase 3 clinical trial.

The Company has incurred operating losses and

negative cash flows from operations since inception. As of July

30th, DBV’s available cash and cash equivalents are not projected

to be sufficient to support the Company’s operating plan for at

least the next 12 months. As such, there is substantial doubt

regarding its ability to continue as a going concern.

Based on its current operations, plans and

assumptions, the Company expects that its balance of cash and cash

equivalents will be sufficient to fund its operations into Q1 2025

due to the implementation of cost-savings measures.

The Company intends to seek additional capital

as it continues research and development efforts and prepares for

the launch of Viaskin Peanut, if approved. The Company cannot

guarantee that it will be able to obtain the necessary financing to

meet its needs or to obtain funds at attractive terms and

conditions, including as a result of disruptions to the global

financial markets due to any future pandemics, epidemics or global

health crises and conflict in Ukraine or other global political or

military crises. A severe or prolonged economic downturn could

result in a variety of risks to the Company, including reduced

ability to raise additional capital when needed or on acceptable

terms, if at all.

If the Company is not successful in its

financing objectives, the Company could have to scale back its

operations, notably by delaying or reducing the scope of its

research and development efforts or obtain financing through

arrangements with collaborators or others that may require the

Company to relinquish rights to its product candidates that the

Company might otherwise seek to develop or commercialize

independently.

This interim condensed financial information

does not include any adjustments to the carrying amounts and

classification of assets, liabilities, and reported expenses that

may be necessary if the Company was unable to continue as a going

concern.

Operating Income

|

In millions of USD(unaudited) |

U.S. GAAP |

U.S. GAAP |

IFRS |

|

|

six monthsended June 30, |

three months ended June 30, |

six months ended June 30, |

|

|

2024 |

2023 |

2024 |

2023 |

2024 |

2023 |

|

|

Research tax credits |

2.6 |

3.7 |

1.2 |

2.0 |

2.6 |

3.7 |

|

|

Other operating income |

— |

0.7 |

— |

0.3 |

— |

0.8 |

|

|

Operating income |

2.6 |

4.5 |

1.2 |

2.3 |

2.6 |

4.5 |

|

Operating income amounted to $2.6 million for

the 6 months ended June 30, 2024, compared with $4.5 million for

the same period in 2023. This decrease by $1.9 million is mostly

due to a lower Research Tax credit entitlement as a greater

proportion of studies activities are carried out in North

America.

Operating Expenses

|

In millions of USD(unaudited) |

U.S. GAAP |

U.S. GAAP |

IFRS |

|

six months ended June 30, |

three months ended June 30, |

six months ended June 30, |

|

2024 |

2023 |

2024 |

2023 |

2024 |

2023 |

|

Research & Development |

(46.8) |

(33.7) |

(25.4) |

(17.6) |

(46.7) |

(33.6) |

|

Sales & Marketing |

(1.7) |

(0.9) |

(1.0) |

(0.5) |

(1.7) |

(0.9) |

|

General & Administrative |

(16.4) |

(16.1) |

(8.6) |

(9.2) |

(16.5) |

(16.2) |

|

Operating expenses |

(65.0) |

(50.7) |

(35.0) |

(27.4) |

(64.9) |

(50.7) |

Operating expenses amounted to $65.0 million for

the six months ended June 30, 2024, compared with $50.7 million for

the six months ended June 30, 2023, an increase by $14.3 million

driven primarily by Research & Development resulting from both

patient enrollment in VITESSE Phase 3 clinical trial

and preparatory activities for the COMFORT studies in

anticipation of initiation after FDA alignment.

Employee-related costs increased overall by $3.1

million for the six months ended June 30, 2024, compared to the six

months ended June 30, 2023, as the Company expanded headcount by 24

to support clinical, regulatory and quality activities in

preparation for BLA submission.

General and Administrative expenses increased

slightly during the six months ended June 30, 2024, compared to the

six months ended June 30, 2023, due to the optimization and

rationalization of external professional services.

Net Loss and Net Loss Per Share

|

|

U.S. GAAP |

U.S. GAAP |

IFRS |

| |

six months ended June 30, |

three months ended June 30, |

six months ended June 30, |

|

|

|

2024 |

2023 |

2024 |

2023 |

2024 |

2023 |

|

|

Net income / (loss) (in millions of USD) |

(60.5) |

(44.8) |

(33.1) |

(24.2) |

(60.6) |

(44.9) |

|

|

Basic / diluted net income / (loss) per share (USD/share) |

(0.63) |

(0.48) |

(0.34) |

(0.26) |

(0.63) |

(0.48) |

|

The Company recorded a net loss for the first

six months ended June 30, 2024, of $60.5 million, compared to a net

loss of $44.8 million for the first six months ended June 30,

2023.

On a per share basis, net loss (based on the

weighted average number of shares outstanding over the period) was

$(0.63) for the first six months ended June 30, 2024.

CONDENSED CONSOLIDATED STATEMENTS OF

FINANCIAL POSITION (unaudited)

|

In millions of USD |

U.S. GAAP |

IFRS |

|

June 30,2024 |

December 31, 2023 |

June 30,2024 |

December 31, 2023 |

|

Assets |

114.2 |

183.0 |

114.2 |

183.0 |

|

of which cash & cash equivalents |

66.2 |

141.4 |

66.2 |

141.4 |

|

Liabilities |

35.1 |

42.8 |

35.0 |

42.7 |

|

Shareholders’ equity |

79.1 |

140.2 |

79.2 |

140.3 |

CONDENSED CONSOLIDATED STATEMENTS OF

OPERATIONS(unaudited)

|

In millions of USD |

U.S. GAAP |

U.S. GAAP |

IFRS |

|

six months ended June 30, |

three months ended June 30, |

six months ended June 30,three months ended June 30, |

|

2024 |

2023 |

2024 |

2023 |

2024 |

2023 |

|

Revenues |

2.6 |

4.5 |

1.2 |

2.3 |

2.6 |

4.5 |

|

Research & Development |

(46.8) |

(33.7) |

(25.4) |

(17.6) |

(46.7) |

(33.6) |

|

Sales & Marketing |

(1.7) |

(0.9) |

(1.0) |

(0.5) |

(1.7) |

(0.9) |

|

General & Administrative |

(16.4) |

(16.1) |

(8.6) |

(9.2) |

(16.5) |

(16.2) |

|

Operating expenses |

(65.0) |

(50.7) |

(35.0) |

(27.4) |

(64.9) |

(50.7) |

|

Financial income/(expenses) |

2.0 |

1.5 |

0.7 |

0.8 |

1.8 |

1.4 |

|

Income tax |

— |

— |

— |

— |

— |

— |

|

Net loss |

(60.5) |

(44.8) |

(33.1) |

(24.2) |

(60.6) |

(44.9) |

|

Basic/diluted net loss per share attributable

to shareholders |

(0.63) |

(0.48) |

(0.34) |

(0.26) |

(0.63) |

(0.48) |

CONDENSED CONSOLIDATED STATEMENTS OF

CASH FLOWS (unaudited)

|

In millions of USD |

U.S. GAAP |

IFRS |

|

six months ended June 30, |

six months ended June 30, |

|

2024 |

2023 |

2024 |

2023 |

|

Net cash flows provided / (used) in operating activities |

(69.8) |

(46.4) |

(68.7) |

(45.4) |

|

Net cash flows provided / (used) in investing activities |

(1.4) |

(0.3) |

(1.4) |

(0.3) |

|

Net cash flows provided / (used) in financing activities |

(0.1) |

7.8 |

(1.2) |

6.8 |

|

Effect of exchange rate changes on cash & cash equivalents

(U.S. GAAP presentation) |

(3.9) |

3.7 |

(3.9) |

3.7 |

|

Net increase / (decrease) in cash & cash equivalents |

(75.2) |

(35.2) |

(71.3) |

(38.9) |

|

Net cash & cash equivalents at the beginning of the period |

141.4 |

209.2 |

141.4 |

209.2 |

|

Net cash & cash equivalents at the end of the period |

66.2 |

174.0 |

66.2 |

174.0 |

About DBV TechnologiesDBV

Technologies is a clinical-stage biopharmaceutical company

developing treatment options for food allergies and other

immunologic conditions with significant unmet medical need. DBV is

currently focused on investigating the use of its proprietary

technology platform, Viaskin, to address food allergies, which are

caused by a hypersensitive immune reaction and characterized by a

range of symptoms varying in severity from mild to life-threatening

anaphylaxis. Millions of people live with food allergies, including

young children. Through epicutaneous immunotherapy (EPIT™), the

Viaskin platform is designed to introduce microgram amounts of a

biologically active compound to the immune system through intact

skin. EPIT is a new class of non-invasive treatment that seeks to

modify an individual’s underlying allergy by re-educating the

immune system to become desensitized to allergen by leveraging the

skin’s immune tolerizing properties. DBV is committed to

transforming the care of food allergic people. The Company’s food

allergy programs include ongoing clinical trials of Viaskin Peanut

in peanut allergic toddlers (1 through 3 years of age) and children

(4 through 7 years of age).

DBV Technologies is headquartered in Châtillon,

France, with North American operations in Warren, NJ. The Company’s

ordinary shares are traded on segment B of Euronext Paris (Ticker:

DBV, ISIN code: FR0010417345) and the Company’s ADSs (each

representing one ordinary share) are traded on the Nasdaq Capital

Select Market (Ticker: DBVT).

For more information, please visit

www.dbv-technologies.com and engage with us on X (formerly Twitter)

and LinkedIn.

Forward Looking StatementsThis

press release may contain forward-looking statements and estimates,

including statements regarding DBV’s financial condition, forecast

of its cash runway, the therapeutic potential of Viaskin® Peanut

patch and EPIT™, designs of DBV’s anticipated clinical trials,

DBV’s planned regulatory and clinical efforts including timing and

results of communications with regulatory agencies, the ability of

any of DBV’s product candidates, if approved, to improve the lives

of patients with food allergies. These forward-looking statements

and estimates are not promises or guarantees and involve

substantial risks and uncertainties. At this stage, DBV’s product

candidates have not been authorized for sale in any country. Among

the factors that could cause actual results to differ materially

from those described or projected herein include uncertainties

associated generally with research and development, clinical trials

and related regulatory reviews and approvals, and DBV’s ability to

successfully execute on its budget discipline measures. A further

list and description of risks and uncertainties that could cause

actual results to differ materially from those set forth in the

forward-looking statements in this press release can be found in

DBV’s regulatory filings with the French Autorité des Marchés

Financiers (“AMF”), DBV’s filings and reports with the U.S.

Securities and Exchange Commission (“SEC”), including in DBV’s

Annual Report on Form 10-K for the year ended December 31, 2023,

filed with the SEC on March 7, 2024, and future filings and reports

made with the AMF and SEC by DBV. Existing and prospective

investors are cautioned not to place undue reliance on these

forward-looking statements and estimates, which speak only as of

the date hereof. Other than as required by applicable law, DBV

Technologies undertakes no obligation to update or revise the

information contained in this Press Release.

Viaskin is a registered trademark and EPIT is a

trademark of DBV Technologies.

Investor Contact Katie

MatthewsDBV Technologieskatie.matthews@dbv-technologies.com

Media ContactAngela MarcucciDBV

Technologiesangela.marcucci@dbv-technologies.com

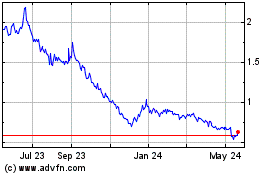

DBV Technologies (NASDAQ:DBVT)

Historical Stock Chart

From Nov 2024 to Dec 2024

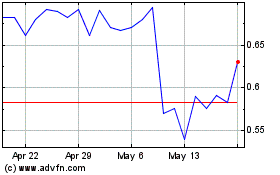

DBV Technologies (NASDAQ:DBVT)

Historical Stock Chart

From Dec 2023 to Dec 2024