Exceeded Second Quarter Expectations with

Strong Growth Anticipated for the Third Quarter

Diodes Incorporated (Diodes) (Nasdaq: DIOD) today reported its

financial results for the second quarter ended June 30, 2024.

Second Quarter Highlights

- Revenue was $319.8 million, compared to $302.0 million in the

first quarter 2024 and $467.2 million in the second quarter

2023;

- Global Point of Sales (POS) increased over 7 percent

sequentially;

- GAAP gross profit was $107.4 million, compared to $99.6 million

in the first quarter 2024 and $195.4 million in the second quarter

2023;

- GAAP gross profit margin was 33.6 percent, compared to 33.0

percent in the first quarter 2024 and 41.8 percent in the second

quarter 2023;

- GAAP net income was $8.0 million, compared to $14.0 million in

the first quarter 2024 and $82.0 million in the second quarter

2023;

- Non-GAAP adjusted net income was $15.4 million, compared to

$13.0 million in the first quarter 2024 and $73.3 million in the

second quarter 2023;

- GAAP EPS was $0.17 per diluted share, compared to $0.30 per

diluted share in the first quarter 2024 and $1.77 per diluted share

in the second quarter 2023;

- Non-GAAP EPS was $0.33 per diluted share, compared to $0.28 per

diluted share last quarter and $1.59 per diluted share in the prior

year quarter;

- Excluding GAAP and non-GAAP $3.4 million and $2.8 million,

respectively, net of tax, of non-cash share-based compensation

expense, GAAP and non-GAAP earnings per share would have increased

by $0.07 per share and $0.06 per share, respectively;

- EBITDA was $41.1 million, or 12.8 percent of revenue, compared

to $48.3 million, or 16.0 percent of revenue, in the first quarter

2024 and $133.5 million, or 28.6 percent of revenue, in the second

quarter 2023; and

- Cash flow provided by operations was $14.4 million and a

negative $3.5 million of free cash flow, including $17.9 million of

capital expenditures. Net cash flow was a negative $2.9 million,

including the pay-down of $22.2 million of total debt.

Commenting on the results, Gary Yu, President of Diodes, stated,

“Second quarter results exceeded our prior expectations as Diodes’

demand began to recover from the low point in the first quarter,

especially in the computing market in Asia. Additional positive

indicators included improvement in distributor inventory levels

with a sequential decrease in channel inventory weeks. Demand

improvement during the quarter was most prominent in our computing

end market, where Diodes is increasingly participating in the

growth of AI servers. In fact, POS across the 3C markets increased

significantly over the prior quarter, and Diodes was able to

maintain automotive and industrial product revenue at 41% of total

due to content increases in both markets, even though the recovery

remained slow due to the ongoing inventory adjustments.

“As we look to the third quarter, we are guiding for strong

revenue growth of over 8% at the mid-point, supported by overall

POS growth of more than 7% in the second quarter. Our near-term

expectation for gross margin continues to reflect factory

underloading related to our wafer service agreements as well as our

internal demand. However, we expect to continue margin expansion

toward our target model of 40% as loading improves combined with a

resumption of growth in the automotive and industrial end markets.

As global demand strengthens, we remain focused on driving further

operational improvements to deliver increased earnings and cash

flow.”

Second Quarter 2024

Revenue for second quarter 2024 was $319.8 million, compared to

$302.0 million in the first quarter 2024 and $467.2 million in the

second quarter 2023.

GAAP gross profit for the second quarter 2024 was $107.4

million, or 33.6 percent of revenue, compared to $99.6 million, or

33.0 percent of revenue, in the first quarter 2024 and $195.4

million, or 41.8 percent of revenue, in the second quarter of

2023.

GAAP operating expenses for second quarter 2024 were $103.7

million, or 32.4 percent of revenue, and on a non-GAAP basis were

$90.9 million, or 28.4 percent of revenue, which excludes an $8.3

million restructuring charge, $3.9 million amortization of

acquisition-related intangible asset expenses and $0.6 million in

officer retirement costs. GAAP operating expenses in the first

quarter 2024 were $86.6 million, or 28.7 percent of revenue and in

the second quarter 2023 were $105.8 million, or 22.7 percent of

revenue.

Second quarter 2024 GAAP net income was $8.0 million, or $0.17

per diluted share, compared to GAAP net income in the first quarter

2024 of $14.0 million, or $0.30 per diluted share, and $82.0

million, or $1.77 per diluted share, of GAAP net income in the

second quarter 2023.

Second quarter 2024 non-GAAP adjusted net income was $15.4

million, or $0.33 per diluted share, which excluded, net of tax,

$7.2 million in restructuring charges, $3.5 million non-cash

mark-to-market investment value adjustment, $3.1 million of

acquisition-related intangible asset costs and $0.5 million in

officer retirement costs. This compares to non-GAAP adjusted net

income of $13.0 million, or $0.28 per diluted share, in the first

quarter 2024 and $73.3 million, or $1.59 per diluted share, in the

second quarter 2023.

The following is an unaudited summary reconciliation of GAAP net

income to non-GAAP adjusted net income and per share data, net of

tax (in thousands, except per share data):

Three Months Ended June 30, 2024 GAAP net

income

$

8,000

GAAP diluted earnings per share

$

0.17

Adjustments to reconcile net income to non-GAAP net

income: Amortization of acquisition-related

intangible assets

3,147

Officer retirement

509

Restructuring charge

7,244

Non-cash mark-to-market investment value adjustments

(3,480

)

Non-GAAP net income

$

15,420

Non-GAAP diluted earnings per share

$

0.33

Note: Throughout this release, we refer to “net income

attributable to common stockholders” as “net income.”

(See the reconciliation tables of GAAP net income to non-GAAP

adjusted net income near the end of this release for further

details.)

Included in second quarter 2024 GAAP net income and non-GAAP

adjusted net income was approximately $3.4 million and $2.8

million, respectively, net of tax, non-cash share-based

compensation expense. Excluding share-based compensation expense,

GAAP earnings per share (“EPS”) would have increased by $0.07 per

share and non-GAAP adjusted EPS would have increased by $0.06 per

share for the second quarter 2024, compared to $0.09 for the first

quarter 2024 and $0.13 for second quarter 2023.

EBITDA (a non-GAAP measure), which represents earnings before

net interest expense, income tax, depreciation and amortization, in

second quarter 2024 was $41.1 million, or 12.8 percent of revenue,

compared to $48.3 million, or 16.0 percent of revenue, in first

quarter 2024 and $133.5 million, or 28.6 percent of revenue, in

second quarter 2023. For a reconciliation of GAAP net income to

EBITDA, see the table near the end of this release for further

details.

For the second quarter 2024, net cash provided by operating

activities was $14.4 million. Net cash flow was a negative $2.9

million, including the pay-down of $22.2 million of total debt.

Free cash flow (a non-GAAP measure) was a negative $3.5 million,

which includes $17.9 million of capital expenditures.

Balance Sheet

As of June 30, 2024, the Company had approximately $277 million

in cash and cash equivalents, restricted cash, and short-term

investments. Total debt (including long-term and short-term)

amounted to approximately $47 million and working capital was

approximately $860 million.

The results announced today are preliminary and unaudited, as

they are subject to the Company finalizing its closing procedures

and completion of the quarterly review by its independent

registered public accounting firm. As such, these results are

subject to revision until the Company files its Form 10-Q for the

quarter ending June 30, 2024.

Business Outlook

Gary Yu further commented, “For the third quarter of 2024, we

expect revenue to be approximately $346 million, plus or minus 3

percent, representing an 8.2% sequential increase at the mid-point,

which is the highest sequential growth in the last 14 quarters.

GAAP gross margin is expected to be 34.0 percent, plus or minus 1

percent. Non-GAAP operating expenses, which are GAAP operating

expenses adjusted for amortization of acquisition-related

intangible assets, are expected to be approximately 27.5 percent of

revenue, plus or minus 1 percent. We expect net interest income to

be approximately $2.5 million. Our income tax rate is expected to

be 18.5 percent, plus or minus 3 percent, and shares used to

calculate diluted EPS for the third quarter are anticipated to be

approximately 46.6 million.”

Amortization of acquisition-related intangible assets of $3.1

million, after tax, for previous acquisitions is not included in

these non-GAAP estimates.

Conference Call

Diodes will host a conference call on Thursday, August 8, 2024

at 4:00 p.m. Central Time (5:00 p.m. Eastern Time) to discuss its

second quarter financial results. Investors and analysts may join

the conference call by dialing 1-833-634-2590, and

international callers may join the teleconference by dialing

+1-412-317-6038. A telephone replay of the call will be made

available approximately two hours after the call and will remain

available until August 15, 2024 at midnight Central Time. The

replay number is 1-877-344-7529 with a pass code of 1321163.

International callers should dial +1-412-317-0088 and enter the

same pass code at the prompt.

Additionally, this conference call will be broadcast live over

the Internet and can be accessed by all interested parties on the

Investor Relations section of the Company’s website. To listen to

the live call, please go to the investors’ section of Diodes’

website and click on the conference call link at least 15 minutes

prior to the start of the call to register, download and install

any necessary audio software. For those unable to participate

during the live broadcast, a replay will be available shortly after

the call on Diodes' website for approximately 90 days.

About Diodes Incorporated

Diodes Incorporated (Nasdaq: DIOD), a Standard and Poor’s

SmallCap 600 and Russell 3000 Index company, delivers high-quality

semiconductor products to the world’s leading companies in the

automotive, industrial, computing, consumer electronics, and

communications markets. We leverage our expanded product portfolio

of analog and discrete power solutions combined with leading-edge

packaging technology to meet customers’ needs. Our broad range of

application-specific products and solutions-focused sales, coupled

with global operations including engineering, testing,

manufacturing, and customer service, enable us to be a premier

provider for high-volume, high-growth markets. For more

information, visit www.diodes.com.

Safe Harbor Statement Under the Private Securities Litigation

Reform Act of 1995: Any statements set forth above that are not

historical facts are forward-looking statements that involve risks

and uncertainties that could cause actual results to differ

materially from those in the forward-looking statements. Such

statements include statements containing forward-looking words such

as “expect,” “anticipate,” “aim,” “estimate,” and variations

thereof, including without limitation statements, whether direct or

implied, regarding expectations of that for the third quarter of

2024, we expect revenue to be approximately $346 million plus or

minus 3 percent; we expect GAAP gross margin to be 34.0 percent,

plus or minus 1 percent; non-GAAP operating expenses, which are

GAAP operating expenses adjusted for amortization of

acquisition-related intangible assets, are expected to be

approximately 27.5 percent of revenue, plus or minus 1 percent; we

expect non-GAAP net interest income to be approximately $2.5

million; we expect our income tax rate to be 18.5 percent, plus or

minus 3 percent; shares used to calculate diluted EPS for the third

quarter are anticipated to be approximately 46.6 million. Potential

risks and uncertainties include, but are not limited to, such

factors as: the risk that such expectations may not be met; the

risk that the expected benefits of acquisitions may not be realized

or that integration of acquired businesses may not continue as

rapidly as we anticipate; the risk that we may not be able to

maintain our current growth strategy or continue to maintain our

current performance, costs, and loadings in our manufacturing

facilities; the risk that we may not be able to increase our

automotive, industrial, or other revenue and market share; risks of

domestic and foreign operations, including excessive operating

costs, labor shortages, higher tax rates, and our joint venture

prospects; the risks of cyclical downturns in the semiconductor

industry and of changes in end-market demand or product mix that

may affect gross margin or render inventory obsolete; the risk of

unfavorable currency exchange rates; the risk that our future

outlook or guidance may be incorrect; the risks of global economic

weakness or instability in global financial markets; the risks of

trade restrictions, tariffs, or embargoes; the risk of breaches of

our information technology systems; and other information,

including the “Risk Factors” detailed from time to time in Diodes’

filings with the United States Securities and Exchange

Commission.

The Diodes logo is a registered trademark of Diodes Incorporated

in the United States and other countries.

© 2024 Diodes Incorporated. All Rights Reserved.

DIODES INCORPORATED AND

SUBSIDIARIES

CONSOLIDATED CONDENSED

STATEMENTS OF OPERATIONS

(in thousands, except per share

data)

(unaudited)

Three Months Ended Six Months Ended June

30, June 30,

2024

2023

2024

2023

Net sales

$

319,771

$

467,152

$

621,743

$

934,393

Cost of goods sold

212,385

271,776

414,773

544,563

Gross profit

107,386

195,376

206,970

389,830

Operating expenses Selling, general and

administrative

58,467

67,500

112,202

138,491

Research and development

33,189

34,611

67,153

67,843

Amortization of acquisition-related intangible assets

3,854

3,816

7,664

7,668

(Gain)loss on disposal of fixed assets

(82

)

(105

)

(4,954

)

(153

)

Restructuring charge

8,250

-

8,250

-

Other operating (income)expense

-

(13

)

(1

)

(13

)

Total operating expense

103,678

105,809

190,314

213,836

Income from operations

3,708

89,567

16,656

175,994

Other (expense) income Interest income

4,237

2,224

8,851

3,996

Interest expense

(852

)

(2,189

)

(1,384

)

(4,321

)

Foreign currency gain(loss), net

799

(2,217

)

1,771

(4,110

)

Unrealized gain(loss) on investments

4,350

12,172

4,720

16,061

Other income

562

1,398

996

1,928

Total other income (expense)

9,096

11,388

14,954

13,554

Income before income taxes and noncontrolling

interest

12,804

100,955

31,610

189,548

Income tax provision

2,643

17,224

6,180

33,840

Net income

10,161

83,731

25,430

155,708

Less net (income) attributable to noncontrolling interest

(2,161

)

(1,711

)

(3,392

)

(2,538

)

Net income attributable to common stockholders

$

8,000

$

82,020

$

22,038

$

153,170

Earnings per share attributable to common

stockholders: Basic

$

0.17

$

1.79

$

0.48

$

3.35

Diluted

$

0.17

$

1.77

0.48

$

3.31

Number of shares used in earnings per share computation:

Basic

46,133

45,733

46,083

45,667

Diluted

46,324

46,243

46,320

46,263

Note: Throughout this release, we refer to “net

income attributable to common stockholders” as “net income.”

DIODES INCORPORATED AND

SUBSIDIARIES

RECONCILIATION OF NET INCOME

TO ADJUSTED NET INCOME

(in thousands, except per share

data)

(unaudited)

For the three months

ended June 30, 2024:

Operating Expenses

Other (Income) Expense

Income Tax Provision

Net Income

Per-GAAP

$

8,000

Diluted earnings per share (per-GAAP)

$

0.17

Adjustments to reconcile net income to non-GAAP net

income: Amortization of acquisition-related

intangible assets

3,854

(707

)

3,147

Officer retirement

644

(135

)

509

Restructuring charge

8,250

789

(1,795

)

7,244

Non-cash mark-to-market investment value adjustments

(4,350

)

870

(3,480

)

Non-GAAP

$

15,420

Diluted shares used in computing earnings per share

46,324

Non-GAAP diluted earnings per share

$

0.33

Note: Included in GAAP and non-GAAP income was approximately

$3.4 million and $2.8 million respectively, net of tax, non-cash

share-based compensation expense. Excluding share-based

compensation expense, GAAP diluted earnings per share would have

improved by $0.07 per share and non-GAAP diluted earnings per share

would have improved by $0.06 per share..

DIODES INCORPORATED AND

SUBSIDIARIES

CONSOLIDATED RECONCILIATION OF

NET INCOME TO ADJUSTED NET INCOME – Cont.

(in thousands, except per share

data)

(unaudited)

For the three months

ended June 30, 2023:

OperatingExpenses Other(Income)Expense

Income TaxProvision Net Income Per-GAAP

$

82,020

Diluted earnings per share (per-GAAP)

$

1.77

Adjustments to reconcile net income to non-GAAP net

income: Amortization of acquisition-related

intangible assets

3,817

(726

)

3,091

Officer retirement

(57

)

11

(46

)

Non-cash mark-to-market investment value adjustments

(12,172

)

440

(11,732

)

Non-GAAP

$

73,333

Diluted shares used in computing earnings per share

46,243

Non-GAAP diluted earnings per share

$

1.59

Note: Included in GAAP and non-GAAP adjusted net income was

approximately $6.0 million, net of tax, non-cash share-based

compensation expense. Excluding share-based compensation expense,

both GAAP and non-GAAP adjusted diluted earnings per share would

have improved by $0.13 per share.

DIODES INCORPORATED AND

SUBSIDIARIES

CONSOLIDATED RECONCILIATION OF

NET INCOME TO ADJUSTED NET INCOME – Cont.

(in thousands, except per share

data)

(unaudited)

For the six months

ended June 30, 2024:

OperatingExpenses Other(Income)Expense

Income TaxProvision Net Income Per-GAAP

$

22,038

Diluted earnings per share (per-GAAP)

$

0.48

Adjustments to reconcile net income to non-GAAP net

income: Amortization of acquisition-related

intangible assets

7,664

(1,406

)

6,258

Officer retirement

644

(135

)

509

Restructuring charge

8,250

789

(1,795

)

7,244

Non-cash mark-to-market investment value adjustments

(4,720

)

944

(3,776

)

Insurance recovery for manufacturing facility

(4,804

)

961

(3,843

)

Non-GAAP

$

28,430

Diluted shares used in computing earnings per share

46,319

Non-GAAP diluted earnings per share

$

0.61

Note: Included in GAAP and non-GAAP income was approximately

$7.4 million and $6.8 million respectively, net of tax, non-cash

share-based compensation expense. Excluding share-based

compensation expense, GAAP diluted earnings per share would have

improved by $0.16 per share and non-GAAP diluted earnings per share

would have improved by $0.15 per share.

DIODES INCORPORATED AND

SUBSIDIARIES

CONSOLIDATED RECONCILIATION OF

NET INCOME TO ADJUSTED NET INCOME – Cont.

(in thousands, except per share

data)

(unaudited)

For the six months

ended June 30, 2023:

OperatingExpenses Other(Income)Expense

Income TaxProvision Net Income Per-GAAP

$

153,170

Diluted earnings per share (per-GAAP)

$

3.31

Adjustments to reconcile net income to non-GAAP net

income: Amortization of acquisition-related

intangible assets

7,668

(1,432

)

6,236

Officer retirement

2,788

(558

)

2,230

Non-cash mark-to-market investment value adjustments

(16,061

)

1,257

(14,804

)

Non-GAAP

$

146,832

Diluted shares used in computing earnings per share

46,263

Non-GAAP diluted earnings per share

$

3.17

Note: Included in GAAP and non-GAAP adjusted net income was

approximately $13.7 million, net of tax, non-cash share-based

compensation expense. Excluding share-based compensation expense,

both GAAP and non-GAAP adjusted diluted earnings per share would

have improved by $0.30 per share.

ADJUSTED NET INCOME

AND ADJUSTED EARNINGS PER SHARE

The Company’s financial statements present net income and

earnings per share that are calculated using accounting principles

generally accepted in the United States (“GAAP”). The Company’s

management makes adjustments to the GAAP measures that it feels are

necessary to allow investors and other readers of the Company’s

financial releases to view the Company’s operating results as

viewed by the Company’s management, board of directors and research

analysts in the semiconductor industry. These non-GAAP measures are

not prepared in accordance with, and should not be considered

alternatives or necessarily superior to, GAAP financial data and

may be different from non-GAAP measures used by other companies.

Because non-GAAP financial measures are not standardized, it may

not be possible to compare these financial measures with other

companies’ non-GAAP financial measures, even if they have similar

names. The explanation of the adjustments made in the table above,

are set forth below:

Detail of non-GAAP adjustments

Amortization of acquisition-related

intangible assets – The Company excluded this item,

including amortization of developed technologies and customer

relationships. The fair value of the acquisition-related intangible

assets is amortized using straight-line methods which approximate

the proportion of future cash flows estimated to be generated each

period over the estimated useful life of the applicable assets. The

Company believes that exclusion of this item is appropriate because

a significant portion of the purchase price for its acquisitions

was allocated to the intangible assets that have short lives and

exclusion of the amortization expense allows comparisons of

operating results that are consistent over time for both the

Company’s newly acquired and long-held businesses. In addition, the

Company excluded this item because there is significant variability

and unpredictability among companies with respect to this

expense.

Officer retirement – The

Company excluded costs related to the retirement of two executives.

These costs represent cash payments and the accelerated vesting of

previously issued stock awards. The Company feels it is appropriate

to exclude these costs since they don’t represent ongoing operating

expenses and will present investors with a more accurate indication

of our continuing operations.

Insurance recovery for manufacturing

facility – The Company recorded gains related to

insurance recovery for a manufacturing facility in Asia. The

Company believes the exclusion of the insurance recovery provides

investors with a more accurate reflection of the continuing

operations of the Company and facilitates comparisons with the

results of other periods which may not reflect such gains.

Non-cash mark-to-market investment

adjustments – The Company excluded mark-to-market

adjustments on various equity related investments. The Company

believes this is not reflective of the ongoing operations and

exclusion of this provides investors an enhanced view of the

Company’s operating results.

Restructuring charge – The

Company recorded restructuring charges related to various

locations. These restructuring charges are excluded from

management’s assessment of the Company’s operating performance. The

Company believes the exclusion of the restructuring charges

provides investors an enhanced view of the cost structure of the

Company’s operations and facilitates comparisons with the results

of other periods that may not reflect such charges or may reflect

different levels of such charges.

CASH FLOW

ITEMS

Free cash flow (FCF)

(Non-GAAP)

FCF for the second quarter of 2024 is a non-GAAP financial

measure, which is calculated by subtracting capital expenditures

from cash flow from operations. For the second quarter of 2024, FCF

was a negative $3.5 million, which represents the cash and cash

equivalents that we are able to generate after taking into account

cash outlays required to maintain or expand property, plant and

equipment. FCF is important because it allows us to pursue

opportunities to develop new products, make acquisitions and reduce

debt.

CONSOLIDATED

RECONCILIATION OF NET INCOME TO EBITDA

EBITDA represents earnings before net interest expense, income

tax provision, depreciation and amortization. Management believes

EBITDA is useful to investors because it is frequently used by

securities analysts, investors and other interested parties, such

as financial institutions in extending credit, in evaluating

companies in our industry and provides further clarity on our

profitability. In addition, management uses EBITDA, along with

other GAAP and non-GAAP measures, in evaluating our operating

performance compared to that of other companies in our industry.

The calculation of EBITDA generally eliminates the effects of

financing, operating in different income tax jurisdictions, and

accounting effects of capital spending, including the impact of our

asset base, which can differ depending on the book value of assets

and the accounting methods used to compute depreciation and

amortization expense. EBITDA is not a recognized measurement under

GAAP, and when analyzing our operating performance, investors

should use EBITDA in addition to, and not as an alternative for,

income from operations and net income, each as determined in

accordance with GAAP. Because not all companies use identical

calculations, our presentation of EBITDA may not be comparable to

similarly titled measures used by other companies. For example, our

EBITDA takes into account all net interest expense, income tax

provision, depreciation and amortization without taking into

account any amounts attributable to noncontrolling interest.

Furthermore, EBITDA is not intended to be a measure of free cash

flow for management’s discretionary use, as it does not consider

certain cash requirements such as tax and debt service

payments.

The following table provides a reconciliation of net income to

EBITDA (in thousands, unaudited):

Three Months Ended Six Months Ended June 30,

June 30,

2024

2023

2024

2023

Net income (per-GAAP)

$

8,000

$

82,020

$

22,038

$

153,170

Plus: Interest expense, net

(3,385

)

(35

)

(7,467

)

325

Income tax provision

2,643

17,224

6,180

33,840

Depreciation and amortization

33,794

34,243

68,649

67,896

EBITDA (non-GAAP)

$

41,052

$

133,452

$

89,400

$

255,231

DIODES INCORPORATED AND SUBSIDIARIES CONDENSED

CONSOLIDATED BALANCE SHEETS (Unaudited) (In thousands, except

share and per share data)

June 30, December 31,

2024

2023

Assets Current assets: Cash and cash equivalents

$

264,709

$

315,457

Restricted Cash

2,948

3,026

Short-term investments

9,188

10,174

Accounts receivable, net of allowances of $12,133 and $5,641 atJune

30, 2024 and December 31, 2023, respectively

384,965

371,930

Inventories

461,539

389,774

Prepaid expenses and other

97,115

97,024

Total current assets

1,220,464

1,187,385

Property, plant and equipment, net

707,617

746,169

Deferred income tax

50,956

51,620

Goodwill

145,595

146,558

Intangible assets, net

57,391

63,937

Other long-term assets

179,034

171,990

Total assets

$

2,361,057

$

2,367,659

Liabilities Current liabilities: Line of credit

$

26,343

$

40,685

Accounts payable

156,687

158,261

Accrued liabilities

167,436

179,674

Income tax payable

9,145

10,459

Current portion of long-term debt

1,344

4,419

Total current liabilities

360,955

393,498

Long-term debt, net of current portion

18,988

16,979

Deferred tax liabilities

9,532

13,662

Unrecognized tax benefits

34,035

34,035

Other long-term liabilities

85,971

99,808

Total liabilities

509,481

557,982

Commitments and contingencies

Stockholders'

equity Preferred stock - par value $1.00 per share; 1,000,000

shares authorized; no shares issued or outstanding

-

-

Common stock - par value $0.66 2/3 per share; 70,000,000 shares

authorized; 46,146,009 and 45,938,382, issued and outstanding at

June 30, 2024 and December 31, 2023, respectively

36,958

36,819

Additional paid-in capital

513,309

509,861

Retained earnings

1,697,312

1,675,274

Treasury stock, at cost, 9,287,762 and 9,286,862 shares held at

June 30, 2024 and December 31, 2023

(338,052

)

(337,986

)

Accumulated other comprehensive loss

(135,172

)

(143,227

)

Total stockholders' equity

1,774,355

1,740,741

Noncontrolling interest

77,221

68,936

Total equity

1,851,576

1,809,677

Total liabilities and stockholders' equity

$

2,361,057

$

2,367,659

View source

version on businesswire.com: https://www.businesswire.com/news/home/20240808156839/en/

Company Contact: Diodes Incorporated Gurmeet Dhaliwal

Director, IR & Corporate Marketing P: 408-232-9003 E:

Gurmeet_Dhaliwal@diodes.com Investor Relations Contact:

Shelton Group Leanne Sievers President, Investor Relations P:

949-224-3874 E: lsievers@sheltongroup.com

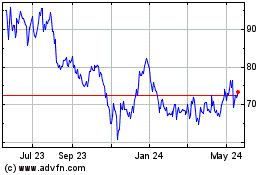

Diodes (NASDAQ:DIOD)

Historical Stock Chart

From Dec 2024 to Jan 2025

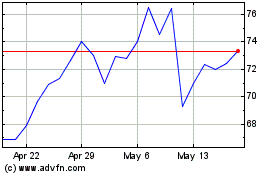

Diodes (NASDAQ:DIOD)

Historical Stock Chart

From Jan 2024 to Jan 2025