UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): June 12, 2024 (June 6, 2024)

EDUCATIONAL DEVELOPMENT CORPORATION

(Exact name of registrant as specified in its charter)

| Delaware | 000-04957 | 73-0750007 |

| (State or Other Jurisdiction of Incorporation) | (Commission File Number) | (I.R.S Employer Identification No.) |

5402 S 122nd E Avenue, Tulsa, Oklahoma 74146

(Address of principal executive offices and Zip Code)

(918) 622-4522

(Registrant’s telephone number, including area code)

(Former name or former address, if changed since last report)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (see General Instruction A.2. below):

☐ Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

☐ Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

☐ Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

☐ Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

Securities registered pursuant to Section 12(b) of the Act:

| Common Stock, $.20 par value | EDUC | NASDAQ |

| (Title of class) | (Trading symbol) | (Name of each exchange on which registered) |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act.

☐

ITEM 1.01 ENTRY INTO A MATERIAL AGREEMENT

On June 6, 2024, Educational Development Corporation (“EDC”, the “Company” or “Seller”) executed a Commercial Real Estate Sale Contract (“Contract”) with Rockford Holdings, LLC (“Buyer”) for the Company’s headquarters and distribution warehouse located at 5400-5402 South 122nd East Avenue, Tulsa, Oklahoma 74146 (the “Hilti Complex”).

The agreed upon sale price of the Hilti Complex per the executed Contract totaled $35,500,000. The proceeds from the sale will be utilized to pay off the Term Loans and Revolving Loan outstanding in the Credit Agreement with the Company's Bank. At closing, EDC will assign the existing third-party tenant lease to the Buyer and will execute a separate Triple-Net Lease (the "Lease") for its occupied space in the Hilti Complex. The Contract does not include the excess land parcel, consisting of approximately 16.75 acres of undeveloped land adjacent to the Hilti Complex, which will remain under the ownership of EDC.

The terms of the lease will be 10 years and the initial lease rate will be $8.72 per square foot, with 2% annual escalations beginning in year six of the lease. The Lease will also include triple-net terms, where the Seller will be responsible for utilities, insurance, property taxes, and regular maintenance, excluding roof and structural maintenance, which will be the Buyer's responsibility. Additionally, the Seller will retain the rights to sublease any available unused space in the building during the lease term. The Lease will also encompass other standard terms that are customary in the local market.

The foregoing descriptions are a summary of the material terms of the Contract and are not complete. These descriptions are qualified in all respects subject to the actual provisions of the sale Contract and Lease with the Buyer.

ITEM 9.01 FINANCIAL STATEMENTS AND EXHIBITS

(d) EXHIBITS

SIGNATURE

Pursuant to the requirements of the Exchange Act, the Registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

Educational Development Corporation

By: /s/ Craig M. White

Craig M. White

President and Chief Executive Officer

Date: June 12, 2024

false

0000031667

0000031667

2024-06-06

2024-06-06

Exhibit 99.1

EDUCATIONAL DEVELOPMENT CORPORATION ANNOUNCES

SALE AND LEASEBACK AGREEMENT OF HEADQUARTERS AND WAREHOUSE FACILITY

TULSA, OK, June 12, 2024 Educational Development Corporation (“EDC”, the “Company” or “Seller”) (NASDAQ: EDUC) (http://www.edcpub.com) today announced that on June 6, 2024, it executed a Commercial Real Estate Contract (“Contract”) with Rockford Holdings ("Rockford" or “Buyer”) for the sale of the Company’s headquarters and distribution warehouse located at 5400-5402 South 122nd East Avenue, Tulsa, Oklahoma 74146 (the “Hilti Complex”).

The agreed upon sale price of the Hilti Complex per the executed Contract totaled $35,500,000. The proceeds from the sale will be utilized to pay off the Term Loans and Revolving Loan outstanding in the Credit Agreement with the Company's Bank. At closing, EDC will assign the existing Hilti tenant lease to the Buyer and will execute a separate Triple-Net Lease (the "Lease") for its occupied space in the Hilti Complex. The sale agreement does not include the excess land parcel adjacent to the Hilti Complex which will remain under the ownership of EDC.

“We recently announced a new lease agreement for 110,000 available square feet in the Hilti Complex. This new lease, along with our existing lease with Hilti, improved the financial strength and marketing ability for the sale the Hilti Complex,” said Craig White, President and Chief Executive Officer of Educational Development Corporation. “As previously mentioned, selling the Hilti Complex and reducing our borrowings is in the best interest of our shareholders, and we expect to have limited working capital borrowings going forward. The interest saved on the reduced borrowings will exceed our monthly rental payments and we will no longer have monthly mortgage payments, providing an immediate improvement to our financial performance. This cash flow improvement, along with our recently announced lease agreement for approximately half of our space, will have a positive benefit on our monthly cashflows. We also expect our cashflow from operations to be very strong in the upcoming years as we convert our excess inventory into cash.”

The Complex consists of multiple buildings totaling 402,000 square feet of rentable office and warehouse space on 34-acres. Approximately 183,800 square feet of the Hilti Complex is occupied by Hilti under a 15-year lease which will be assigned to the Buyer at the Contract close. The Company will execute a new lease for the remaining 218,200 square feet and will retain the recent lease/sub-lease for approximately 110,000 square feet under a 5-year term. In addition, the sale Contract does not include the excess land parcel, consisting of approximately 16.75 acres of undeveloped land adjacent to the Hilti Complex, which will remain under the Company’s ownership.

Per the terms of the Contract, Buyer will have 60 days to complete due diligence, commencing June 6th, including necessary investigations, inspections, and reviews. The closing of the Contract is to be completed 30 days after the due diligence period. The Contract does not contain a financing contingency.

The terms of the Company’s lease will be 10 years and the initial lease rate will be $8.72 per square foot, with 2% annual escalations beginning in year six of the lease. The Lease will also include triple-net terms, where the Seller will be responsible for utilities, insurance, property taxes, and regular maintenance, excluding roof and structural maintenance, which will be the Buyer's responsibility. Additionally, the Company retains the rights to sublease any available unused space in the building during the lease term. The Lease will also encompass other standard terms that are customary in the local market.

About Educational Development Corporation (EDC)

EDC began as a publishing company specializing in books for children. EDC is the owner and exclusive publisher of Kane Miller Books (“Kane Miller”); Learning Wrap-Ups, maker of educational manipulatives; and SmartLab Toys, maker of STEAM-based toys and games. EDC is also the exclusive United States MLM distributor of Usborne Publishing Limited (“Usborne”) children’s books. EDC-owned products are sold via 4,000 retail outlets and EDC and Usborne products are offered by independent brand partners who hold book showings through social media, book fairs with schools and public libraries, in individual homes, as well as other in-person events and internet sales.

Contact:

Educational Development Corporation

Craig White, (918) 622-4522

Investor Relations:

Three Part Advisors, LLC

Steven Hooser (214) 872-2710

v3.24.1.1.u2

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14a

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

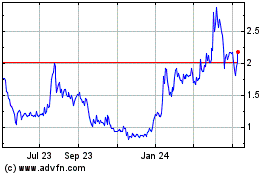

Educational Development (NASDAQ:EDUC)

Historical Stock Chart

From Mar 2025 to Apr 2025

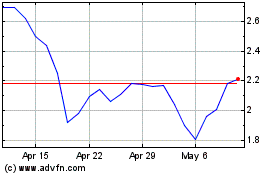

Educational Development (NASDAQ:EDUC)

Historical Stock Chart

From Apr 2024 to Apr 2025