0001421517false00014215172025-02-262025-02-26

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 OR 15(d) of The Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): February 26, 2025

| | | | | | | | |

| Energy Recovery, Inc. | |

| (Exact Name of Registrant as Specified in its Charter) | |

| | | | | | | | | | | | | | |

| Delaware | | 001-34112 | | 01-0616867 |

| (State or Other Jurisdiction of Incorporation) | | (Commission File Number) | | (I.R.S. Employer Identification No.) |

1717 Doolittle Dr., San Leandro, CA 94577

(Address of Principal Executive Offices) (Zip Code)

510-483-7370

(Registrant’s telephone number, including area code)

Not applicable

(Former Name or Former Address, if Changed Since Last Report)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

☐ Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

☐ Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

☐ Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

☐ Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

Securities registered pursuant to Section 12(b) of the Act:

| | | | | | | | | | | | | | |

| Title of each class | | Trading Symbol | | Name of each exchange on which registered |

| Common Stock, $0.001 par value per share | | ERII | | The Nasdaq Stock Market LLC |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 or Rule 12b-2 of the Securities Exchange Act of 1934.

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ¨

Item 2.02 Results of Operations and Financial Condition

On February 26, 2025, Energy Recovery, Inc. (the “Company”) issued an earnings press release announcing its financial results for the fourth quarter and year ended December 31, 2024. A copy of the press release is attached as Exhibit 99.1 to this Current Report on Form 8-K and is incorporated herein by reference in its entirety.

The information in this report (including Exhibit 99.1) is being furnished pursuant to Item 2.02 and shall not be deemed to be “filed” for purposes of Section 18 of the Securities Exchange Act of 1934, as amended (the “Exchange Act”) or otherwise subject to the liabilities of that section, nor shall it be deemed to be incorporated by reference in any filing under the Securities Act of 1933, as amended, or the Exchange Act.

Item 9.01 Financial Statements and Exhibits

(d) Exhibits

| | | | | | | | |

Exhibit Number | | Description |

| | |

SIGNATURE

Pursuant to the requirements of the Securities Exchange Act of 1934, the Registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

Date: February 26, 2025

| | | | | | | | | | | |

| Energy Recovery, Inc. | |

| | | |

| By: | /s/ William Yeung | |

| | William Yeung | |

| | Chief Legal Officer | |

Exhibit 99.1

Energy Recovery Reports its Fourth Quarter 2024 Financial Results

SAN LEANDRO, Calif. - February 26, 2025 – Energy Recovery, Inc. (Nasdaq:ERII) (“Energy Recovery” or the “Company”) today announced its financial results for the fourth quarter and year ended December 31, 2024.

Fourth Quarter Highlights

•Revenue of $67.1 million, an increase of 17% as compared to Q4’2023 and resulting in full-year revenue at the midpoint of guidance.

•Gross margin of 70.2%, an increase of 110 bps, as compared to Q4’2023, due primarily to benefits from our manufacturing transformation.

•Operating expenses of $21.5 million, an increase of 13.9%, as compared to Q4’2023, due primarily to $2.5 million of restructuring costs related to our announced workforce reduction and executive transition costs.

•Income from operations of $25.6 million, an increase of 24.3%, as compared to Q4’2023, mainly due to higher revenue and higher gross margin.

•Net income of $23.5 million and adjusted EBITDA(1) of $31.3 million.

•Cash and investments of $99.9 million, which includes cash, cash equivalents, and short- and long-term investments.

In conjunction with these financial results, management has released a letter to shareholders reviewing business and financial updates from the fourth quarter and discussing our outlook for 2025. This letter is located under “Financial Info” in the “Investors” section on the Energy Recovery website (https://ir.energyrecovery.com/financial-information).

Financial Highlights

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Quarter-to-Date | | | Year to Date |

| Q4’2024 | | Q4’2023 | | vs. Q4’2023 | | | 2024 | | 2023 | | 2024 vs. 2023 |

| (In millions, except net income per share, percentages and basis points) |

| Revenue | $67.1 | | $57.2 | | up 17% | | | $144.9 | | $128.3 | | up 13% |

| Gross margin | 70.2% | | 69.1% | | up 110 bps | | | 66.9% | | 67.8% | | down 90 bps |

| | | | | | | | | | | | |

| Operating margin | 38.2% | | 36.0% | | up 220 bps | | | 13.6% | | 14.8% | | down 120 bps |

| Net income | $23.5 | | $19.8 | | up 19% | | | $23.1 | | $21.5 | | up 7% |

| Net income per share | $0.41 | | $0.34 | | up $0.07 | | | $0.40 | | $0.37 | | up $0.03 |

| Effective tax rate | | | | | | | | 10.4% | | 5.3% | | |

| Cash provided by operations | $9.0 | | $13.8 | | | | | $20.5 | | $26.1 | | |

| | | | | | | | | | | | |

Non-GAAP Financial Highlights (1)

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Quarter-to-Date | | | Year to Date |

| Q4’2024 | | Q4’2023 | | vs. Q4’2023 | | | 2024 | | 2023 | | 2024 vs. 2023 |

| (In millions, except adjusted net income per share, percentages and basis points) |

| | | | | | | | | | | | |

| | | | | | | | | | | | |

| Adjusted operating margin | 45.2% | | 39.9% | | up 530 bps | | | 26.2% | | 21.1% | | up 510 bps |

| Adjusted net income | $28.3 | | $22.0 | | up 29% | | | $40.7 | | $28.9 | | up 41% |

| Adjusted net income per share | $0.50 | | $0.39 | | up $0.11 | | | $0.71 | | $0.51 | | up $0.20 |

| | | | | | | | | | | | |

| Adjusted EBITDA | $31.3 | | $23.9 | | | | | $42.0 | | $31.2 | | |

| Free cash flow | $8.9 | | $12.4 | | | | | $19.2 | | $23.5 | | |

(1)Refer to the sections “Use of Non-GAAP Financial Measures” and “Reconciliation of Non-GAAP Financial Measures” for definitions of our non-GAAP financial measures and reconciliations of GAAP to non-GAAP amounts, respectively.

Forward-Looking Statements

Certain matters discussed in this press release and on the conference call are “forward-looking statements” within the meaning of Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities Exchange Act of 1934, as amended. These forward-looking statements are based on information currently available to the Company and on management’s beliefs, assumptions, estimates, or projections and are not guarantees of future events or results. Potential risks and uncertainties include risks relating to the future demand for the Company’s products, risks relating to performance by our customers and third-party partners, risks relating to the timing of revenue, and any other factors that may have been discussed herein regarding the risks and uncertainties of the Company’s business, and the risks discussed under “Risk Factors” in the Company’s Form 10-K filed with the U.S. Securities and Exchange Commission (“SEC”) for the year ended December 31, 2023, as well as other reports filed by the Company with the SEC from time to time. Because such forward-looking statements involve risks and uncertainties, the Company’s actual results may differ materially from the predictions in these forward-looking statements. All forward-looking statements are made as of today, and the Company assumes no obligation to update such statements.

Use of Non-GAAP Financial Measures

This press release includes certain non-GAAP financial measures, including adjusted operating margin, adjusted net income, adjusted net income per share, adjusted EBITDA and free cash flow. Generally, a non-GAAP financial measure is a numerical measure of a company’s performance, financial position, or cash flows that either exclude or include amounts that are not normally excluded or included in the most directly comparable measure calculated and presented in accordance with generally accepted accounting principles in the United States of America, or GAAP. These non-GAAP financial measures do not reflect a comprehensive system of accounting, differ from GAAP measures with the same captions, and may differ from non-GAAP financial measures with the same or similar captions that are used by other companies. As such, these non-GAAP measures should be considered as a supplement to, and not as a substitute for, or superior to, financial measures calculated in accordance with GAAP. The Company uses these non-GAAP financial measures to analyze its operating performance and future prospects, develop internal budgets and financial goals, and to facilitate period-to-period comparisons. The Company believes these non-GAAP financial measures reflect an additional way of viewing aspects of its operations that, when viewed with its GAAP results, provide a more complete understanding of factors and trends affecting its business.

Notes to the Financial Results

•Adjusted operating margin is a non-GAAP financial measure that the Company defines as income from operations which excludes i) stock-based compensation; ii) executive transition costs, such as executive search costs, retention costs, one-time severance costs and one-time corporate growth strategy costs; and iii) restructuring charges, divided by revenues.

•Adjusted net income is a non-GAAP financial measure that the Company defines as net income which excludes i) stock-based compensation; ii) executive transition costs; iii) restructuring charges; and iv) the applicable tax effect of the excluded items including the stock-based compensation discrete tax item.

•Adjusted net income per share is a non-GAAP financial measure that the Company defines as net income, which excludes i) stock-based compensation; ii) executive transition costs; iii) restructuring charges; and iv) the applicable tax effect of the excluded items including the stock-based compensation discrete tax item, divided by basic shares outstanding.

•Adjusted EBITDA is a non-GAAP financial measure that the Company defines as net income which excludes i) depreciation and amortization; ii) stock-based compensation; iii) executive transition costs; iv) restructuring charges; v) other income, net, such as interest income and other non-operating income (expense), net; and vi) provision for income taxes.

•Free cash flow is a non-GAAP financial measure that the Company defines as net cash provided by operating activities less capital expenditures.

Conference Call to Discuss Financial Results

LIVE CONFERENCE Q&A CALL:

Wednesday, February 26, 2025, 2:00 PM PT / 5:00 PM ET

US / Canada Toll-Free: +1 (866) 682-6100

Local / International Toll: +1 (862) 298-0702

CONFERENCE Q&A CALL REPLAY:

Available approximately three hours after conclusion of the live call.

Expiration: Tuesday, March 25, 2025

US / Canada Toll-Free: +1 (877) 660-6853

Local / International Toll: +1 (201) 612-7415

Access code: 13749222

Investors may also access the live call and the replay over the internet on the “Events” page of the Company’s website located at https://ir.energyrecovery.com/news-events/ir-calendar.

Disclosure Information

Energy Recovery uses the investor relations section on its website as means of complying with its disclosure obligations under Regulation FD. Accordingly, investors should monitor Energy Recovery’s investor relations website in addition to following Energy Recovery’s press releases, SEC filings, and public conference calls and webcasts.

About Energy Recovery

Energy Recovery (Nasdaq: ERII) is a trusted global leader in energy efficiency technology. Building on the Company’s pressure exchanger technology platform, the Company designs and manufactures reliable, high-performance solutions that generate cost savings and increase energy efficiency across several industries. With a strong foundation in the desalination industry, the Company has delivered transformative solutions that optimize operations and deliver positive environmental impact to its customers worldwide for more than 30 years. Headquartered in the San Francisco Bay Area, the Company has manufacturing and research and development facilities across California with sales and on-site technical support available globally. To learn more, visit https://energyrecovery.com/.

Contact

Investor Relations

ir@energyrecovery.com

ENERGY RECOVERY, INC.

CONDENSED CONSOLIDATED BALANCE SHEETS

(Unaudited)

| | | | | | | | | | | |

| December 31,

2024 | | December 31,

2023 |

| (In thousands) |

| ASSETS | | | |

| | | |

| | | |

| | | |

| Cash, cash equivalents and investments | $ | 99,851 | | | $ | 122,375 | |

| | | |

| | | |

| | | |

| Accounts receivable and contract assets | 66,842 | | | 47,529 | |

| Inventories, net | 24,906 | | | 26,149 | |

| Prepaid expenses and other assets | 3,889 | | | 3,251 | |

| | | |

| | | |

| | | |

| | | |

| | | |

| Property, equipment and operating leases | 25,119 | | | 30,168 | |

| Goodwill | 12,790 | | | 12,790 | |

| | | |

| | | |

| Deferred tax assets and other assets | 9,395 | | | 10,712 | |

| TOTAL ASSETS | $ | 242,792 | | | $ | 252,974 | |

| | | |

| LIABILITIES AND STOCKHOLDERS’ EQUITY | | | |

| Liabilities | | | |

| | | |

| | | |

| | | |

| Accounts payable, accrued expenses, and other liabilities, current | $ | 20,837 | | | $ | 18,583 | |

| | | |

| | | |

| Contract liabilities and other liabilities, non-current | 628 | | | 1,304 | |

| | | |

| | | |

| Lease liabilities | 11,317 | | | 13,279 | |

| | | |

| | | |

| | | |

| | | |

| | | |

| Total liabilities | 32,782 | | | 33,166 | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| Stockholders’ equity | 210,010 | | | 219,808 | |

| TOTAL LIABILITIES AND STOCKHOLDERS’ EQUITY | $ | 242,792 | | | $ | 252,974 | |

| | | |

| | | |

ENERGY RECOVERY, INC.

CONDENSED CONSOLIDATED STATEMENTS OF OPERATIONS

(Unaudited)

| | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | Three Months Ended December 31, | | Years Ended December 31, |

| | | 2024 | | 2023 | | 2024 | | 2023 | | |

| | | (In thousands, except per share data) |

| Revenue | | $ | 67,075 | | | $ | 57,189 | | | $ | 144,948 | | | $ | 128,349 | | | |

| Cost of revenue | | 19,955 | | | 17,690 | | | 48,015 | | | 41,270 | | | |

| Gross profit | | 47,120 | | | 39,499 | | | 96,933 | | | 87,079 | | | |

| | | | | | | | | | |

| | | | | | | | | | |

| | | | | | | | | | |

| Operating expenses | | | | | | | | | | |

| General and administrative | | 8,303 | | | 7,160 | | | 33,074 | | | 28,864 | | | |

| Sales and marketing | | 6,754 | | | 6,767 | | | 25,423 | | | 22,164 | | | |

| | | | | | | | | | |

| Research and development | | 3,972 | | | 4,958 | | | 16,236 | | | 17,001 | | | |

| | | | | | | | | | |

| Restructuring charges | | 2,476 | | | — | | | 2,476 | | | — | | | |

| | | | | | | | | | |

| | | | | | | | | | |

| | | | | | | | | | |

| Total operating expenses | | 21,505 | | | 18,885 | | | 77,209 | | | 68,029 | | | |

| Income from operations | | 25,615 | | | 20,614 | | | 19,724 | | | 19,050 | | | |

| | | | | | | | | | |

| | | | | | | | | | |

| | | | | | | | | | |

| | | | | | | | | | |

| | | | | | | | | | |

| Other income, net | | 1,240 | | | 1,298 | | | 6,011 | | | 3,655 | | | |

| Income before income taxes | | 26,855 | | | 21,912 | | | 25,735 | | | 22,705 | | | |

| Provision for income taxes | | 3,384 | | | 2,107 | | | 2,685 | | | 1,201 | | | |

| Net income | | $ | 23,471 | | | $ | 19,805 | | | $ | 23,050 | | | $ | 21,504 | | | |

| | | | | | | | | | |

| Net income per share | | | | | | | | | | |

| Basic | | $ | 0.41 | | | $ | 0.35 | | | $ | 0.40 | | | $ | 0.38 | | | |

| Diluted | | $ | 0.41 | | | $ | 0.34 | | | $ | 0.40 | | | $ | 0.37 | | | |

| | | | | | | | | | |

| Number of shares used in per share calculations | | | | | | | | | | |

| Basic | | 56,629 | | | 56,735 | | | 57,213 | | | 56,444 | | | |

| Diluted | | 57,236 | | | 57,671 | | | 57,822 | | | 57,740 | | | |

| | | | | | | | | | |

| | | | | | | | | | |

ENERGY RECOVERY, INC.

CONDENSED CONSOLIDATED STATEMENTS OF CASH FLOWS

(Unaudited)

| | | | | | | | | | | | | | | | | | | | |

| | | | Years Ended December 31, |

| | | | | | 2024 | | 2023 | | |

| | | | (In thousands) |

| Cash flows from operating activities: | | | | | | | | | | |

| Net income | | | | | | $ | 23,050 | | | $ | 21,504 | | | |

| | | | | | | | | | |

| | | | | | | | | | |

| | | | | | | | | | |

| | | | | | | | | | |

| | | | | | | | | | |

| | | | | | | | | | |

| | | | | | | | | | |

| | | | | | | | | | |

| | | | | | | | | | |

| | | | | | | | | | |

| | | | | | | | | | |

| | | | | | | | | | |

| | | | | | | | | | |

| | | | | | | | | | |

| | | | | | | | | | |

| | | | | | | | | | |

| | | | | | | | | | |

| | | | | | | | | | |

| | | | | | | | | | |

| Non-cash adjustments | | | | | | 16,214 | | | 13,889 | | | |

| | | | | | | | | | |

| | | | | | | | | | |

| | | | | | | | | | |

| | | | | | | | | | |

| | | | | | | | | | |

| | | | | | | | | | |

| | | | | | | | | | |

| | | | | | | | | | |

| | | | | | | | | | |

| | | | | | | | | | |

| | | | | | | | | | |

| Net cash used in operating assets and liabilities | | | | | | (18,742) | | | (9,339) | | | |

| Net cash provided by operating activities | | | | | | 20,522 | | | 26,054 | | | |

| | | | | | | | | | |

| Cash flows from investing activities: | | | | | | | | | | |

| | | | | | | | | | |

| | | | | | | | | | |

| | | | | | | | | | |

| Net investment in marketable securities | | | | | | (14,489) | | | (16,634) | | | |

| Capital expenditures | | | | | | (1,298) | | | (2,567) | | | |

| Proceeds from sales of fixed assets | | | | | | 133 | | | 87 | | | |

| | | | | | | | | | |

| | | | | | | | | | |

| Net cash used in investing activities | | | | | | (15,654) | | | (19,114) | | | |

| | | | | | | | | | |

| Cash flows from financing activities: | | | | | | | | | | |

| Net proceeds from issuance of common stock | | | | | | 7,100 | | | 4,794 | | | |

| | | | | | | | | | |

| | | | | | | | | | |

| | | | | | | | | | |

| | | | | | | | | | |

| Repurchase of common stock | | | | | | (50,384) | | | — | | | |

| Net cash (used in) provided by financing activities | | | | | | (43,284) | | | 4,794 | | | |

| | | | | | | | | | |

| Effect of exchange rate differences | | | | | | (52) | | | 33 | | | |

| Net change in cash, cash equivalents and restricted cash | | | | | | $ | (38,468) | | | $ | 11,767 | | | |

| | | | | | | | | | |

| Cash, cash equivalents and restricted cash, end of year | | | | | | $ | 29,757 | | | $ | 68,225 | | | |

| | | | | | | | | | |

| | | | | | | | | | |

ENERGY RECOVERY, INC.

SUPPLEMENTAL FINANCIAL INFORMATION

(Unaudited)

Channel Revenue

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Three Months Ended December 31, | | Years Ended December 31, |

| 2024 | | 2023 | | vs. 2023 | | 2024 | | 2023 | | vs. 2023 |

| (In thousands, except percentages) |

| Megaproject | $ | 46,475 | | $ | 41,382 | | up 12% | | $ | 95,399 | | $ | 83,665 | | up 14% |

| Original equipment manufacturer | 16,315 | | 9,150 | | up 78% | | 31,525 | | 25,995 | | up 21% |

| Aftermarket | 4,285 | | 6,657 | | down 36% | | 18,024 | | 18,689 | | down 4% |

| | | | | | | | | | | |

| Total revenue | $ | 67,075 | | $ | 57,189 | | up 17% | | $ | 144,948 | | $ | 128,349 | | up 13% |

| | | | | | | | | | | |

| | | | | | | | | | | |

| | | | | | | | | | | |

Segment Activity

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | Three Months Ended December 31, |

| | 2024 | | 2023 |

| | Water | | Emerging Technologies | | Corporate | | Total | | Water | | Emerging Technologies | | Corporate | | Total |

| | (In thousands) |

| Revenue | | $ | 66,959 | | | $ | 116 | | | $ | — | | | $ | 67,075 | | | $ | 57,103 | | | $ | 86 | | | $ | — | | | $ | 57,189 | |

| Cost of revenue | | 19,756 | | | 199 | | | — | | | 19,955 | | | 17,154 | | | 536 | | | — | | | 17,690 | |

| Gross profit (loss) | | 47,203 | | | (83) | | | — | | | 47,120 | | | 39,949 | | | (450) | | | — | | | 39,499 | |

| | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | |

| Operating expenses | | | | | | | | | | | | | | | | |

| General and administrative | | 2,490 | | | 913 | | | 4,900 | | | 8,303 | | | 1,914 | | | 951 | | | 4,295 | | | 7,160 | |

| Sales and marketing | | 4,324 | | | 1,856 | | | 574 | | | 6,754 | | | 4,124 | | | 1,882 | | | 761 | | | 6,767 | |

| | | | | | | | | | | | | | | | |

| Research and development | | 1,205 | | | 2,767 | | | — | | | 3,972 | | | 1,130 | | | 3,828 | | | — | | | 4,958 | |

| | | | | | | | | | | | | | | | |

| Restructuring charges | | 1,147 | | | 832 | | | 497 | | | 2,476 | | | — | | | — | | | — | | | — | |

| | | | | | | | | | | | | | | | |

| Total operating expenses | | 9,166 | | | 6,368 | | | 5,971 | | | 21,505 | | | 7,168 | | | 6,661 | | | 5,056 | | | 18,885 | |

| Operating income (loss) | | $ | 38,037 | | | $ | (6,451) | | | $ | (5,971) | | | 25,615 | | | $ | 32,781 | | | $ | (7,111) | | | $ | (5,056) | | | 20,614 | |

| Other income, net | | | | | | | | 1,240 | | | | | | | | | 1,298 | |

| Income before income taxes | | | | | | | | $ | 26,855 | | | | | | | | | $ | 21,912 | |

| | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | Years Ended December 31, |

| | 2024 | | 2023 |

| | Water | | Emerging Technologies | | Corporate | | Total | | Water | | Emerging Technologies | | Corporate | | Total |

| | (In thousands) |

| Revenue | | $ | 144,310 | | | $ | 638 | | | $ | — | | | $ | 144,948 | | | $ | 127,725 | | | $ | 624 | | | $ | — | | | $ | 128,349 | |

| Cost of revenue | | 47,389 | | | 626 | | | — | | | 48,015 | | | 40,290 | | | 980 | | | — | | | 41,270 | |

| Gross profit (loss) | | 96,921 | | | 12 | | | — | | | 96,933 | | | 87,435 | | | (356) | | | — | | | 87,079 | |

| | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | |

| Operating expenses | | | | | | | | | | | | | | | | |

| General and administrative | | 8,127 | | | 3,821 | | | 21,126 | | | 33,074 | | | 7,751 | | | 3,927 | | | 17,186 | | | 28,864 | |

| Sales and marketing | | 15,683 | | | 7,340 | | | 2,400 | | | 25,423 | | | 13,691 | | | 6,053 | | | 2,420 | | | 22,164 | |

| | | | | | | | | | | | | | | | |

| Research and development | | 4,523 | | | 11,713 | | | — | | | 16,236 | | | 4,251 | | | 12,750 | | | — | | | 17,001 | |

| | | | | | | | | | | | | | | | |

| Restructuring charges | | 1,147 | | | 832 | | | 497 | | | 2,476 | | | — | | | — | | | — | | | — | |

| | | | | | | | | | | | | | | | |

| Total operating expenses | | 29,480 | | | 23,706 | | | 24,023 | | | 77,209 | | | 25,693 | | | 22,730 | | | 19,606 | | | 68,029 | |

| Operating income (loss) | | $ | 67,441 | | | $ | (23,694) | | | $ | (24,023) | | | 19,724 | | | $ | 61,742 | | | $ | (23,086) | | | $ | (19,606) | | | 19,050 | |

| Other income, net | | | | | | | | 6,011 | | | | | | | | | 3,655 | |

| Income before income taxes | | | | | | | | $ | 25,735 | | | | | | | | | $ | 22,705 | |

| | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | |

Stock-based Compensation

| | | | | | | | | | | | | | | | | | | | | | | | | |

| | Three Months Ended December 31, | | Years Ended December 31, | | |

| | 2024 | | 2023 | | 2024 | | 2023 | | |

| (In thousands) |

| Stock-based compensation expense charged to: | | | | | | | | | |

| Cost of revenue | $ | 96 | | | $ | 164 | | | $ | 1,076 | | | $ | 719 | | | |

| General and administrative | 641 | | | 1,033 | | | 4,013 | | | 3,661 | | | |

| Sales and marketing | 722 | | | 649 | | | 3,489 | | | 2,333 | | | |

| Research and development | 351 | | | 381 | | | 1,744 | | | 1,325 | | | |

| Total stock-based compensation expense | $ | 1,810 | | | $ | 2,227 | | | $ | 10,322 | | | $ | 8,038 | | | |

| | | | | | | | | |

| | | | | | | | | |

| | | | | | | | | |

| | | | | | | | | |

| | | | | | | | | |

| | | | | | | | | |

| | | | | | | | | |

| | | | | | | | | |

ENERGY RECOVERY, INC.

RECONCILIATION OF NON-GAAP FINANCIAL MEASURES (1)

(Unaudited)

This press release includes certain non-GAAP financial information because we plan and manage our business using such information. The following table reconciles the GAAP financial information to the non-GAAP financial information.

| | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Quarter-to-Date | | Year to Date | |

| Q4'2024 | | Q4'2023 | | | | 2024 | | 2023 | | | |

| (In millions, except shares, per share and percentages) | |

| | | | | | | | | | | | |

| | | | | | | | | | | | |

| | | | | | | | | | | | |

| | | | | | | | | | | | |

| | | | | | | | | | | | |

| | | | | | | | | | | | |

| | | | | | | | | | | | |

| | | | | | | | | | | | |

| | | | | | | | | | | | |

| | | | | | | | | | | | |

| | | | | | | | | | | | |

| | | | | | | | | | | | |

| | | | | | | | | | | | |

| | | | | | | | | | | | |

| | | | | | | | | | | | |

| | | | | | | | | | | | |

| | | | | | | | | | | | |

| | | | | | | | | | | | |

| | | | | | | | | | | | |

| | | | | | | | | | | | |

| | | | | | | | | | | | |

| | | | | | | | | | | | |

| | | | | | | | | | | | |

| | | | | | | | | | | | |

| | | | | | | | | | | | |

| | | | | | | | | | | | |

| | | | | | | | | | | | |

| | | | | | | | | | | | |

| | | | | | | | | | | | |

| | | | | | | | | | | | |

| | | | | | | | | | | | |

| | | | | | | | | | | | |

| | | | | | | | | | | | |

| | | | | | | | | | | | |

| | | | | | | | | | | | |

| | | | | | | | | | | | |

| | | | | | | | | | | | |

| | | | | | | | | | | | |

| | | | | | | | | | | | |

| | | | | | | | | | | | |

| | | | | | | | | | | | |

| | | | | | | | | | | | |

| | | | | | | | | | | | |

| | | | | | | | | | | | |

| | | | | | | | | | | | |

| | | | | | | | | | | | |

| | | | | | | | | | | | |

| | | | | | | | | | | | |

| | | | | | | | | | | | |

| | | | | | | | | | | | |

| | | | | | | | | | | | |

| | | | | | | | | | | | |

| | | | | | | | | | | | |

| | | | | | | | | | | | |

| | | | | | | | | | | | |

| | | | | | | | | | | | |

| | | | | | | | | | | | |

| | | | | | | | | | | | |

| | | | | | | | | | | | |

| | | | | | | | | | | | |

| | | | | | | | | | | | |

| | | | | | | | | | | | |

| | | | | | | | | | | | |

| | | | | | | | | | | | |

| | | | | | | | | | | | |

| | | | | | | | | | | | |

| | | | | | | | | | | | |

| | | | | | | | | | | | |

| | | | | | | | | | | | |

| | | | | | | | | | | | |

| | | | | | | | | | | | |

| | | | | | | | | | | | |

| | | | | | | | | | | | |

Operating margin | 38.2 | % | | 36.0 | % | | | | 13.6 | % | | 14.8 | % | | | |

| Stock-based compensation | 2.7 | | | 3.9 | | | | | 7.1 | | | 6.3 | | | | |

| | | | | | | | | | | | |

| | | | | | | | | | | | |

| Executive transition costs | 0.7 | | | — | | | | | 3.7 | | | — | | | | |

| Restructuring charges | 3.7 | | | — | | | | | 1.7 | | | — | | | | |

| | | | | | | | | | | | |

| | | | | | | | | | | | |

Adjusted operating margin | 45.2 | % | | 39.9 | % | | | | 26.2 | % | | 21.1 | % | | | |

| | | | | | | | | | | | |

| | | | | | | | | | | | |

| | | | | | | | | | | | |

| | | | | | | | | | | | |

| | | | | | | | | | | | |

| | | | | | | | | | | | |

| | | | | | | | | | | | |

| | | | | | | | | | | | |

| | | | | | | | | | | | |

| | | | | | | | | | | | |

| | | | | | | | | | | | |

| | | | | | | | | | | | |

| | | | | | | | | | | | |

| | | | | | | | | | | | |

| | | | | | | | | | | | |

| | | | | | | | | | | | |

| | | | | | | | | | | | |

| | | | | | | | | | | | |

| | | | | | | | | | | | |

| | | | | | | | | | | | |

Net income | $ | 23.5 | | | $ | 19.8 | | | | | $ | 23.1 | | | $ | 21.5 | | | | |

| | | | | | | | | | | | |

| | | | | | | | | | | | |

Stock-based compensation | 1.8 | | | 2.2 | | | | | 10.3 | | | 8.0 | | | | |

| | | | | | | | | | | | |

| | | | | | | | | | | | |

Executive transition costs (2) | 0.4 | | | — | | | | | 4.8 | | | — | | | | |

Restructuring charges (2) | 2.2 | | | — | | | | | 2.2 | | | — | | | | |

| | | | | | | | | | | | |

| | | | | | | | | | | | |

| | | | | | | | | | | | |

| | | | | | | | | | | | |

| | | | | | | | | | | | |

| Stock-based compensation discrete tax item | 0.4 | | | — | | | | | 0.3 | | | (0.7) | | | | |

| | | | | | | | | | | | |

| | | | | | | | | | | | |

Adjusted net income | $ | 28.3 | | | $ | 22.0 | | | | | $ | 40.7 | | | $ | 28.9 | | | | |

| | | | | | | | | | | | |

| | | | | | | | | | | | |

| | | | | | | | | | | | |

| | | | | | | | | | | | |

| | | | | | | | | | | | |

| | | | | | | | | | | | |

| | | | | | | | | | | | |

| | | | | | | | | | | | |

| | | | | | | | | | | | |

| | | | | | | | | | | | |

| | | | | | | | | | | | |

| | | | | | | | | | | | |

Net income per share | $ | 0.41 | | | $ | 0.34 | | | | | $ | 0.40 | | | $ | 0.37 | | | | |

Adjustments to net income per share (3) | 0.09 | | | 0.05 | | | | | 0.31 | | | 0.14 | | | | |

Adjusted net income per share | $ | 0.50 | | | $ | 0.39 | | | | | $ | 0.71 | | | $ | 0.51 | | | | |

| | | | | | | | | | | | |

| | | | | | | | | | | | |

| | | | | | | | | | | | |

| | | | | | | | | | | | |

| | | | | | | | | | | | |

| | | | | | | | | | | | |

| | | | | | | | | | | | |

| | | | | | | | | | | | |

| | | | | | | | | | | | |

| | | | | | | | | | | | |

Net income | $ | 23.5 | | | $ | 19.8 | | | | | $ | 23.1 | | | $ | 21.5 | | | | |

| | | | | | | | | | | | |

| | | | | | | | | | | | |

| Stock-based compensation | 1.8 | | | 2.2 | | | | | 10.3 | | | 8.0 | | | | |

| | | | | | | | | | | | |

| Depreciation and amortization | 1.0 | | | 1.0 | | | | | 4.0 | | | 4.1 | | | | |

| Executive transition costs | 0.4 | | | — | | | | | 5.4 | | | — | | | | |

| Restructuring charges | 2.5 | | | — | | | | | 2.5 | | | — | | | | |

| | | | | | | | | | | | |

| | | | | | | | | | | | |

| | | | | | | | | | | | |

| | | | | | | | | | | | |

| | | | | | | | | | | | |

| | | | | | | | | | | | |

Other income, net | (1.2) | | | (1.3) | | | | | (6.0) | | | (3.7) | | | | |

| | | | | | | | | | | | |

| | | | | | | | | | | | |

| | | | | | | | | | | | |

| | | | | | | | | | | | |

| | | | | | | | | | | | |

| Provision for income taxes | 3.4 | | | 2.1 | | | | | 2.7 | | | 1.2 | | | | |

| | | | | | | | | | | | |

Adjusted EBITDA | $ | 31.3 | | | $ | 23.9 | | | | | $ | 42.0 | | | $ | 31.2 | | | | |

| | | | | | | | | | | | |

| Free cash flow | | | | | | | | | | | | |

| Net cash provided by operating activities | $ | 9.0 | | | $ | 13.8 | | | | | $ | 20.5 | | | $ | 26.1 | | | | |

| Capital expenditures | (0.1) | | | (1.4) | | | | | (1.3) | | | (2.6) | | | | |

| | | | | | | | | | | | |

| Free cash flow | $ | 8.9 | | | $ | 12.4 | | | | | $ | 19.2 | | | $ | 23.5 | | | | |

(1)Amounts may not total due to rounding.

(2)Amounts presented are net of tax.

(3)Refer to the sections “Use of Non-GAAP Financial Measures” for description of items included in adjustments.

v3.25.0.1

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14a

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

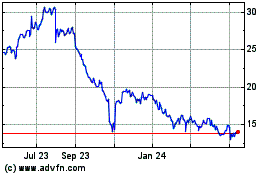

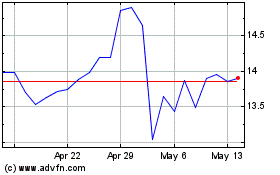

Energy Recovery (NASDAQ:ERII)

Historical Stock Chart

From Feb 2025 to Mar 2025

Energy Recovery (NASDAQ:ERII)

Historical Stock Chart

From Mar 2024 to Mar 2025