UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 6-K

REPORT OF FOREIGN PRIVATE ISSUER

PURSUANT TO RULE 13a-16 OR 15d-16

UNDER THE SECURITIES EXCHANGE ACT OF 1934

For the Month of November 2024

Commission File Number: 001-40850

Exscientia plc

(Translation of registrant’s name into

English)

The Schrödinger Building

Oxford Science Park

Oxford OX4 4GE

United Kingdom

(Address of principal executive office)

Indicate by check mark whether the registrant files or will file annual

reports under cover of Form 20-F or Form 40-F:

x Form 20-F

¨ Form 40-F

EXPLANATORY NOTE

Amendment to Transaction Agreement

As previously disclosed,

on August 8, 2024, Exscientia plc, a public limited company incorporated under the laws of England and Wales with registered number

13483814 (“Exscientia”) and Recursion Pharmaceuticals, Inc., a Delaware corporation (“Recursion”) entered

into a transaction agreement (the “Transaction Agreement”), pursuant to which, subject to the terms and conditions set forth

therein, including the requisite approval of each of Exscientia’s shareholders and Recursion’s stockholders, Recursion will

acquire the entire issued and to be issued share capital of Exscientia pursuant to a scheme of arrangement under Part 26 of the

United Kingdom Companies Act 2006 (the “Scheme of Arrangement” and such transaction, the “Transaction”).

On November 5, 2024,

the parties to the Transaction Agreement executed the First Amendment to the Transaction Agreement (the “Amendment”) to provide

that, (i) prior to the effective time of the Scheme of Arrangement (the “Effective Time”) and effective as of the Effective

Time, Recursion will appoint to its board of directors one (1) member of Exscientia’s board of directors selected by Exscientia,

subject to Recursion’s approval in compliance with the fiduciary duties of the Recursion board of directors, and (ii) prior

to (or as promptly as practicable following) the Effective Time, Recursion will appoint to its board of directors one (1) additional

individual if mutually agreed upon prior to the Effective Time by Exscientia and Recursion and subject to the fiduciary duties of the

Recursion board of directors, and subject in each case to such individual’s willingness and ability to serve on the Recursion board

of directors at the time of appointment.

The foregoing description

of the Amendment is subject to, and qualified in its entirety by, the Amendment, which will be filed by Recursion with the U.S. Securities

and Exchange Commission and a copy of which is attached hereto as Exhibit 99.1 and is incorporated herein by reference.

Supplemental Disclosures to Joint Proxy Statement

As of the date hereof, Recursion

filed the supplemental disclosures (the “Supplemental Disclosures”) to the joint proxy statement filed on October 10,

2024 by Exscientia and Recursion with the U.S. Securities and Exchange Commission (the “SEC”), which are attached

hereto as Exhibit 99.2.

Additional Information and Where to Find It

The proposed transaction between Exscientia and Recursion is the subject

of the definitive joint proxy statement filed on October 10, 2024 by Exscientia and Recursion with the SEC, as amended by the Supplemental

Disclosures (the “Joint Proxy Statement”). The Joint Proxy Statement provides full details of the proposed transaction

and the attendant benefits and risks, including the terms and conditions of the Scheme of Arrangement and the other information required

to be provided to Exscientia’s shareholders under the applicable provisions of the United Kingdom Companies Act 2006. This communication

is not a substitute for the Joint Proxy Statement or any other document that Exscientia or Recursion may file with the SEC or send to

their respective security holders in connection with the proposed transaction.

INVESTORS AND SECURITY HOLDERS ARE URGED TO READ THE JOINT PROXY STATEMENT

(WHICH INCLUDES AN EXPLANATORY STATEMENT IN RESPECT OF THE SCHEME OF ARRANGEMENT) AND ANY OTHER RELEVANT DOCUMENTS FILED OR THAT MAY BE

FILED WITH THE SEC OR SENT TO EXSCIENTIA’S SHAREHOLDERS OR RECURSION’S STOCKHOLDERS, AS WELL AS ANY AMENDMENTS OR SUPPLEMENTS

TO THESE DOCUMENTS, CAREFULLY AND IN THEIR ENTIRETY IF AND WHEN THEY BECOME AVAILABLE BECAUSE THEY CONTAIN OR WILL CONTAIN IMPORTANT

INFORMATION ABOUT THE PROPOSED TRANSACTION.

All documents, when filed, will be available free of charge at the

SEC’s website (www.sec.gov). You may also obtain these documents by contacting Exscientia’s Investor Relations department

at investors@exscientia.ai.

Participants in the Solicitation

Exscientia, Recursion, and their respective directors and executive

officers may be deemed to be participants in any solicitation of proxies in connection with the proposed transaction.

Information about Exscientia’s directors and executive officers

is available in Exscientia’s Annual Report on Form 20-F dated March 21, 2024. Information about Recursion’s directors

and executive officers is available in Recursion’s proxy statement dated April 23, 2024, for its 2024 Annual Meeting of Stockholders.

Other information regarding the participants in the proxy solicitation and a description of their direct and indirect interests, by security

holdings or otherwise, is available in the Joint Proxy Statement, as well as other relevant materials to be filed with the SEC regarding

the proposed transaction when they become available. Investors should read the Joint Proxy Statement carefully before making any voting

or investment decisions.

No Offer or Solicitation

This communication is not intended to and shall not constitute an

offer to buy or sell or the solicitation of an offer to buy or sell any securities, or a solicitation of any vote or approval, nor shall

there be any offer, solicitation or sale of securities in any jurisdiction in which such offer, solicitation or sale would be unlawful

prior to registration or qualification under the securities laws of any such jurisdiction. No offer of securities shall be made in the

United States absent registration under the U.S. Securities Act of 1933, as amended (“Securities Act”), or pursuant

to an exemption from, or in a transaction not subject to, such registration requirements. Recursion’s securities issued in the

proposed transaction are anticipated to be issued in reliance upon an available exemption from such registration requirements pursuant

to Section 3(a)(10) of the Securities Act.

Forward Looking Statements

Statements contained herein which are not historical facts may be

considered forward-looking statements under federal securities laws and may be identified by words such as “anticipates,”

“believes,” “estimates,” “expects,” “intends,” “plans,” “potential,”

“predicts,” “projects,” “seeks,” “should,” “will,” or words of similar meaning

and include, but are not limited to, statements regarding the proposed combination of Exscientia and Recursion and the outlook for Exscientia’s

or Recursion’s future businesses and financial performance such as delivering better treatments to patients, faster and at a lower

cost; the discovery and translation of higher quality medicines more efficiently and at a higher scale. Such forward-looking statements

are based on the current beliefs of Exscientia’s and Recursion’s respective management as well as assumptions made by and

information currently available to them, which are subject to inherent uncertainties, risks and changes in circumstances that are difficult

to predict. Actual outcomes and results may vary materially from these forward-looking statements based on a variety of risks and uncertainties

including: the occurrence of any event, change or other circumstances that could give rise to the termination of the Transaction Agreement;

the inability to obtain Recursion’s stockholder approval or Exscientia’s shareholder approval or the failure to satisfy other

conditions to completion of the proposed combination, including obtaining the sanction of the High Court of Justice of England and Wales

to the Scheme of Arrangement, on a timely basis or at all, and the receipt of required regulatory approvals; risks that the proposed

combination disrupts each company’s current plans and operations; the diversion of the attention of the respective management teams

of Exscientia and Recursion from their respective ongoing business operations; the ability of either Exscientia, Recursion or the combined

company to retain key personnel; the ability to realize the benefits of the proposed combination, including cost synergies; the ability

to successfully integrate Exscientia’s business with Recursion’s business, at all or in a timely manner; the outcome of any

legal proceedings that may be instituted against Exscientia, Recursion or others since the announcement of the proposed combination;

the amount of the costs, fees, expenses and charges related to the proposed combination; the effect of economic, market or business conditions,

including competition, regulatory approvals and commercializing drug candidates, or changes in such conditions, have on Exscientia’s,

Recursion’s and the combined company’s operations, revenue, cash flow, operating expenses, employee hiring and retention,

relationships with business partners, the development or launch of technology enabled drug discovery, and commercializing drug candidates;

and the risks of conducting Exscientia’s and Recursion’s business internationally.

Other important factors and information are contained in the Joint

Proxy Statement, including the risks summarized in the section entitled “Risk Factors” thereof, and Exscientia’s other

periodic filings with the SEC, which can be accessed at http://investors.exscientia.ai, or www.sec.gov. All forward-looking statements

are qualified by these cautionary statements and apply only as of the date they are made. Exscientia does not undertake any obligation

to update any forward-looking statement, whether as a result of new information, future events or otherwise.

EXHIBIT INDEX

* * *

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934,

the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| |

EXSCIENTIA PLC |

| |

|

|

| |

By: |

/s/ Ben Taylor |

| |

Name: |

Ben Taylor |

| |

Title: |

Chief Financial Officer |

Date:

November 6, 2024

Exhibit 99.1

EXECUTION VERSION

FIRST AMENDMENT TO TRANSACTION AGREEMENT

This

first Amendment TO THE TRANSACTION AGREEMENT (this “Amendment”), dated as of November 5, 2024, is by and

between Recursion Pharmaceuticals, Inc., a Delaware corporation (“Parent”), and Exscientia plc, a public limited

company incorporated in England and Wales with registered number 13483814 (the “Company”).

WHEREAS, Parent and the Company

are parties to that certain Transaction Agreement, dated as of August 8, 2024 (the “Agreement”). Capitalized

terms used but not defined in this Amendment shall have the respective meanings given to them in the Agreement.

WHEREAS, Parent and the Company

desire to amend the Agreement as set forth herein pursuant to Section 11.03(a) of the Agreement; and

WHEREAS, the Parent Board

and the Company Board have each approved and declared advisable this Amendment.

NOW, THEREFORE, in consideration

of the agreements contained herein and other good and valuable consideration, the receipt and sufficiency of which are hereby acknowledged,

the parties hereto, intending to be legally bound, hereby agree as follows:

1. Amendment

to the Agreement.

1.1 Section 2.05(d) of

the Agreement is hereby amended and restated in its entirety to read as follows:

“(i) Prior to the Effective Time and

effective as of the Effective Time, Parent shall appoint to the Parent Board one (1) member of the Company Board, as of the date

hereof, selected by the Company and subject to Parent’s approval in compliance with the fiduciary duties under Applicable Law of

the Parent Board and (ii) prior to (or as promptly as practicable following) the Effective Time, Parent shall appoint to the Parent

Board one (1) additional individual if mutually agreed upon prior to the Effective Time by the Company and Parent and subject to

the fiduciary duties under Applicable Law of the Parent Board, and subject in each case to the continued willingness and ability of such

individual to serve on the Parent Board at the time of appointment.”

2. Effect

on the Agreement. Except as explicitly amended and/or superseded by this Amendment, all of the terms and conditions of the Agreement

remain, and shall remain, in full force and effect, unmodified hereby. This Amendment shall not constitute an amendment or waiver of

any provision of the Agreement not expressly amended or waived herein and shall not be construed as an amendment, waiver or consent to

any action that would require an amendment, waiver or consent, except as expressly set forth herein. Upon the execution and delivery

hereof, the Agreement shall thereupon be deemed to be amended and supplemented as hereinabove set forth as fully and with the same effect

as if the amendments and supplements made hereby were originally set forth in the Agreement. This Amendment and the Agreement shall each

henceforth be read, taken and construed as one and the same instrument, but such amendments and supplements shall not operate so as to

render invalid or improper any action heretofore taken under the Agreement. If and to the extent there are any inconsistencies between

the Agreement and this Amendment with respect to the matters set forth herein, the terms of this Amendment shall control. On and after

the date hereof, each reference in the Agreement to “this Agreement,” “hereunder,” “herein” or words

of like import shall mean and be a reference to the Agreement as amended by this Amendment, provided that references in the Agreement

to “the date hereof” or “the date of this Agreement” or words of like import shall continue to refer to the date

of August 8, 2024. Nothing contained herein invalidates or shall release or impair any covenant, condition, agreement or stipulation

in the Agreement.

EXECUTION VERSION

3. Counterparts.

This Amendment may be executed in counterparts, including by facsimile, by email with .pdf attachments, or by other electronic transmission

(including DocuSign and AdobeSign), each of which shall be deemed an original, but all of which shall constitute the same instrument.

4. Application

of Certain Sections of the Agreement. Section 11.05(b) (Assignment), Section 11.06 (Governing Law),

Section 11.07 (Jurisdiction; Venue), Section 11.10 (Entire Agreement), Section 11.11 (Severability),

and Section 11.13 (Interpretation) of the Agreement shall apply mutatis mutandis to this Amendment as if set forth

in full herein.

[Signature Page Follows]

IN WITNESS WHEREOF, the parties hereto have duly

executed this Amendment as of the date first written above.

| |

RECURSION PHARMACEUTICALS, INC. |

| |

|

| |

By: |

/s/ Christopher Gibson |

| |

Name: |

Christopher Gibson |

| |

Title: |

Chief Executive Officer |

| |

EXSCIENTIA PLC |

| |

|

| |

By: |

/s/ David Hallett |

| |

Name: |

David Hallett |

| |

Title: |

Interim Chief Executive Officer |

[Signature Page to First Amendment to

Transaction Agreement]

Exhibit 99.2

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13

OR 15(d) of The Securities Exchange Act of 1934

November 6, 2024 (November 5, 2024)

Date of Report (date of earliest event reported)

RECURSION

PHARMACEUTICALS, INC.

(Exact name of registrant as specified in its

charter)

| Delaware |

001-40323 |

46-4099738 |

|

(State or other jurisdiction of

incorporation or organization) |

(Commission

File Number) |

(I.R.S. Employer

Identification No.) |

41 S Rio Grande Street

Salt

Lake City, UT 84101

(Address of principal executive offices)

(Zip Code)

(385) 269- 0203

(Registrant’s telephone number, including

area code)

Not Applicable

(Former name or former address, if changed since

last report)

Check the appropriate box below if the Form 8-K filing is intended

to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (see General Instruction A.2.

below):

| ¨ |

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| |

|

| ¨ |

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| |

|

| ¨ |

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| |

|

| ¨ |

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities registered pursuant to Section 12(b) of the Act:

| Title of each class |

|

Trading

Symbol(s) |

|

Name of each exchange

on which registered |

| Class A Common Stock, par value $0.00001 per share |

|

RXRX |

|

Nasdaq Global Select Market |

Indicate by check mark whether the registrant

is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2

of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ¨

If an emerging growth company, indicate by check

mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting

standards provided pursuant to Section 13(a) of the Exchange Act. ¨

| Item 1.01 | Entry into a Material Definitive Agreement |

Amendment to Transaction Agreement

As previously disclosed, on

August 8, 2024, Recursion Pharmaceuticals, Inc., a Delaware corporation (“Recursion”), and Exscientia plc, a public

limited company incorporated under the laws of England and Wales with registered number 13483814 (“Exscientia”), entered into

a transaction agreement (the “Transaction Agreement”), pursuant to which, subject to the terms and conditions set forth therein,

including the requisite approval of each of Recursion’s stockholders and Exscientia’s shareholders, Recursion will acquire

the entire issued and to be issued share capital of Exscientia pursuant to a scheme of arrangement under Part 26 of the United Kingdom

Companies Act 2006 (the “Scheme of Arrangement” and such transaction, the “Transaction”).

On November 5, 2024, the parties

to the Transaction Agreement executed the First Amendment to the Transaction Agreement (the “Amendment”) to provide that,

(i) prior to the effective time of the Scheme of Arrangement (the “Effective Time”) and effective as of the Effective Time,

Recursion will appoint to its board of directors one (1) member of Exscientia’s board of directors selected by Exscientia, subject

to Recursion’s approval in compliance with the fiduciary duties of the Recursion board of directors, and (ii) prior to (or as promptly

as practicable following) the Effective Time, Recursion will appoint to its board of directors one (1) additional individual if mutually

agreed upon, prior to the Effective Time by Exscientia and Recursion and subject to the fiduciary duties of the Recursion board of directors,

and subject in each case to such individual’s willingness and ability to serve on the Recursion board of directors at the time of

appointment.

The foregoing description

of the Amendment is subject to, and qualified in its entirety by, the Amendment, which will be filed by Recursion with the U.S. Securities

and Exchange Commission and a copy of which is attached hereto as Exhibit 2.1 and is incorporated herein by reference.

Supplemental Disclosures to Joint Proxy

Statement

The following supplemental

disclosures (the “Supplemental Disclosures”) should be read in conjunction with the definitive joint proxy statement, dated

October 10, 2024 (as it may be amended or supplemented from time to time, the “joint proxy statement”), filed by Recursion

and Exscientia with the U.S. Securities and Exchange Commission. The joint proxy statement relates to the Transaction Agreement and the

Transaction. If the Transaction is completed, each ordinary share of Exscientia (each an “Exscientia Share”) will automatically

be acquired by Recursion in exchange for 0.7729 shares of Recursion Class A Common Stock, par value of $0.00001 per share (the “Share

Deliverable”). Because each American Depositary Share in Exscientia represents a beneficial interest in one Exscientia Share (each,

an “Exscientia ADS”), each Exscientia ADS will also be exchanged for the Share Deliverable following the Effective Time.

The purpose of the Supplemental

Disclosures is to provide supplemental information concerning the Transaction, including the Amendment. Except as described in these Supplemental

Disclosures, the information provided in the joint proxy statement continues to apply. All paragraph headings and page references

used herein refer to the headings and pages in the joint proxy statement before any additions or deletions resulting from the Supplemental

Disclosures or any other amendments, and certain capitalized terms used below, unless otherwise defined, have the meanings set forth in

the joint proxy statement. The supplemental information is identified below by bold, underlined text. Stricken-through

text shows text being deleted from a referenced disclosure in the joint proxy statement. If information in the Supplemental Disclosures

differs from or updates information contained in the joint proxy statement, then the information in the Supplemental Disclosures is more

current and supersedes the different information contained in the joint proxy statement. THE SUPPLEMENTAL DISCLOSURES SHOULD BE READ

IN CONJUNCTION WITH THE JOINT PROXY STATEMENT AND THE JOINT PROXY STATEMENT SHOULD BE READ IN ITS ENTIRETY.

The

following bolded and underlined language is added to page 26 of the joint proxy statement in the section with the heading “Board

of Directors of Recursion Following Completion of the Transaction (page 113).”

Pursuant to the

Transaction Agreement, Exscientia may designate onetwo

members of the Exscientia Board, subject to approval

of the Recursion Board in compliance with fiduciary duties under applicable law, to serve as a members

of the Recursion Board following the consummation of the Transaction. In addition, prior to (or as promptly as practicable

following) the Effective Time, Recursion will appoint to the Recursion Board one additional individual if mutually agreed upon prior

to the Effective Time by Exscientia and Recursion and subject to fiduciary duties under applicable law.

The following bolded and

underlined language is added to page 52 of the joint proxy statement in the section with the heading “5. The Exscientia Directors

and the Effect of the Scheme of Arrangement on their Interests.”

Pursuant to the Transaction

Agreement, Exscientia may designate onetwo

members of the Exscientia Board, subject to approval of

the Recursion Board in compliance with fiduciary duties under applicable law, to serve as a members of

the Recursion Board following the consummation of the Transaction.

The following bolded and

underlined language is added to page 70 of the joint proxy statement in the section with the heading “Background of the Transaction.”

On October 26, 2022,

Chris Gibson, Recursion’s chief executive officer, met with Andrew Hopkins, Exscientia’s then-current chief executive officer

in Oxford, England, at Dr. Gibson’s invitation, to discuss Recursion’s and Exscientia’s respective businesses and

the industry in which they operate. As part of this discussion, Dr. Gibson and Dr. Hopkins discussed, for the first time

and on an exploratory basis, a potential combination of Recursion and Exscientia, with Dr. Hopkins expressing preliminary

interest in a “merger of equals” transaction with Recursion. Ultimately, Dr. Gibson and Dr. Hopkins proposed (1) to

continue these discussions and (2) for Recursion and Exscientia to enter into a mutual confidentiality agreement to facilitate these

discussions and a related exchange of information regarding Recursion’s and Exscientia’s respective businesses.

On November 5, 2022,

Exscientia and Recursion entered into a mutual confidentiality agreement, which contained customary mutual “standstill” provisions

but did not contain “don’t ask, don’t waive” provisions and did not restrict either party from making

confidential proposals that would otherwise be restricted by the standstill provisions to the board of directors of the other party.

The following bolded and

underlined language is added to pages 70-71 of the joint proxy statement in the section with the heading “Background of the

Transaction.”

On November 21, 2022,

the Recursion Board met, with representatives of Wilson Sonsini Goodrich & Rosati, P.C., Recursion’s outside legal counsel

(“Wilson Sonsini”) and Allen & Company in attendance. Dr. Gibson provided the Recursion Board with an update

on discussions with Exscientia and certain related due diligence matters. Allen & Company discussed with the Recursion Board,

on a preliminary basis and based on publicly available information and other information provided by Recursion management, certain (1) business

information relating to Exscientia and the potential combination of Recursion and Exscientia and (2) historical trading and public

market perspectives on Exscientia and Recursion, including implied financial metrics based on illustrative pro forma ownership levels.

Following discussion, the Recursion Board approved the submission of a non-binding proposal to acquire Exscientia in an all-stock transaction

in which Exscientia’s shareholders would own up to 35% of the pro forma common shares of the combined company following the transaction.

The Recursion Board also met in executive session (without Dr. Gibson in attendance) to discuss these matters. The Recursion

Board regularly meets in executive session without management in attendance as a matter of ordinary practice. In executive session,

the Recursion Board discussed the potential leadership of the combined company; it was the consensus of the Recursion Board that Dr. Gibson

would continue to serve as chief executive officer of the combined company, and that Recursion should propose that Dr. Hopkins join

the Recursion Board as vice chair.

The following bolded and

underlined language is added to page 74 of the joint proxy statement in the section with the heading “Background of the Transaction.”

On June 27, 2024, Exscientia

and Recursion entered into an updated mutual confidentiality agreement to facilitate continued discussions, which contained customary

mutual “standstill” provisions but did not contain “don’t ask, don’t waive” provisions and did

not restrict either party from making confidential proposals that would otherwise be restricted by the standstill provisions to the board

of directors of the other party.

The following bolded and

underlined language is added to page 74 of the joint proxy statement in the section with the heading “Background of the Transaction.”

On July 17, 2024, the Recursion Board established

a committee of the Recursion Board (the “Recursion Transaction Committee”), composed of Dr. Hershberg, the current chair

of the Recursion Board, and Zavain Dar, to oversee Recursion’s exploration, evaluation, consideration, review and negotiation of

a potential strategic transaction involving Exscientia and, as appropriate, make recommendations to the Recursion Board with respect thereto.

The members of the Recursion Transaction Committee were not paid additional compensation in connection with their service on the

Recursion Transaction Committee. The Recursion Transaction Committee was formed in light of the benefits, convenience,

and efficiency of having a subset of directors oversee Recursion’s consideration and negotiation of a potential transaction with

Exscientia in the context of (1) the potentially significant workload that could be involved with respect to these matters; and (2) the

possibility that Recursion management and Recursion’s advisors would require feedback and direction on relatively short notice.

The Recursion Transaction Committee was not formed to address any actual or perceived conflict of interest of any director or officer

of Recursion. The Recursion Board did not condition the execution by Recursion of a transaction with Exscientia on the affirmative

recommendation of the Recursion Transaction Committee. It was the expectation that the Recursion Board would continue to be actively

involved in overseeing Recursion’s exploration, evaluation, consideration, review and negotiation of a potential transaction with

Exscientia, and the Recursion Board retained the authority to approve any definitive agreements with respect to a transaction with Exscientia.

The Recursion Transaction Committee has not been disbanded as of the date of this joint proxy statement.

The following bolded and

underlined language is added to page 91 of the joint proxy statement in the section with the heading “Opinion of Recursion’s

Financial Advisor.”

No company, business or transaction

reviewed is identical or directly comparable to Recursion or Exscientia, their respective businesses or the Transaction nor, except

as otherwise disclosed, were individual enterprise or transaction values derived from the selected public companies or selected precedent

transactions, as applicable, independently determinative of the results of such analyses, and an evaluation of these analyses

is not entirely mathematical; rather, the analyses involve complex considerations and judgments concerning financial and operating characteristics

and other factors that could affect the public trading, acquisition or other values of the companies, businesses or transactions reviewed.

The following bolded and

underlined language is added to page 92 of the joint proxy statement in the section with the heading “Opinion of Recursion’s

Financial Advisor – Financial Analysis – Exscientia Selected Public Companies Analysis.”

Allen & Company selected

a range of estimated enterprise values derived from the selected companies of $124 million to $719 million for Exscientia (with

particular focus, based on Allen & Company’s professional judgment, on the 25th percentile and the 75th

percentile of the estimated enterprise values observed for the selected companies).

The following bolded and

underlined language is added to page 92 of the joint proxy statement in the section with the heading “Opinion of Recursion’s

Financial Advisor – Financial Analysis – Selected Precedent Transactions Analysis.”

Allen & Company selected a range of estimated transaction values

derived from the selected transactions of $458 million to $1.011 billion for Exscientia (with particular focus, based on Allen

& Company’s professional judgment, on the 25th percentile and the 75th percentile of the estimated transaction

values observed for the selected transactions).

The following bolded and

underlined language is added to page 92 of the joint proxy statement in the section with the heading “Opinion of Recursion’s

Financial Advisor – Financial Analysis – Discounted Cash Flow Analysis.”

Allen & Company

performed a discounted cash flow analysis of Exscientia, both before and after giving effect to potential cost savings

expected by the management of Recursion to result from the Transaction, by calculating the estimated present value of the standalone

unlevered, after-tax free cash flows that Exscientia was forecasted to generate during the last two quarters of the fiscal year

ending December 31, 2024 through the full fiscal year ending December 31, 2049 based on financial forecasts and estimates

relating to Exscientia provided to or discussed with Allen & Company by the management of Recursion. For purposes of this

analysis, stock-based compensation was treated as a cash expense. Allen & Company calculated implied terminal values for

Exscientia by applying to the unlevered, after-tax free cash flows that Exscientia was forecasted to generate from its future

pipeline programs (net of corporate expenses) during the fiscal year ending December 31, 2049 a selected range

of perpetuity growth rates of 2.75% to 3.25% selected based on Allen & Company’s professional judgment.

The present values (as of June 30, 2024) of the cash flows and terminal values were then calculated using a selected range of

discount rates of 13.25% to 15.75% derived from a weighted average cost of capital calculation for Exscientia.

The following bolded and

underlined language is added to the second bullet on page 93 of the joint proxy statement in the section with the heading “Opinion

of Recursion’s Financial Advisor – Financial Analysis – Certain Additional Information.”

| · | publicly available Wall Street research analysts’ price targets for Exscientia ADSs (consisting

of three such price targets) and Recursion Class A Common Stock (consisting of seven such price targets), which

indicated an overall low to high target price range for Exscientia ADSs of $7.00 to $9.00 per ADS (with a median of $8.00 per ADS) and

an overall low to high target price range for Recursion Class A Common Stock of $8.00 to $17.00 per share (with a median of $11.00

per share); and |

The following bolded and

underlined language is added to pages 97 of the joint proxy statement in the section with the heading “Opinion of Exscientia’s

Financial Advisor – Summary of Centerview’s Financial Analysis – Discounted Cash Flow Analysis.”

In performing the discounted

cash flow analysis of Exscientia, Centerview calculated the estimated present value of the standalone unlevered free cash flows that

Exscientia was forecasted to generate during the three months ended December 31, 2024, through the year ending December 31,

2049, in the Exscientia-Prepared Risk Adjusted Forecasts for Exscientia. For the purposes of the discounted cash flow analysis, Centerview

calculated unlevered free cash flow as follows: earnings before interest and taxes (EBIT), less tax expenses, less capital expenditures,

plus depreciation and amortization and less change in net working capital. The implied terminal value was estimated based on unlevered

proprietary and partnered asset cash flows declining in perpetuity after December 31, 2049, at a rate of free cash flow decline

of 60% year-over-year, and unlevered future pipeline and overhead cash flows continuing in perpetuity after December 31, 2049, at

a flat rate of free cash flow of 0%, as directed by Exscientia management. The cash flows were then discounted to September 30,

2024, using mid-year convention at discount rates ranging from 14.5% to 17.0% (based on Centerview’s analysis of Exscientia’s

weighted average cost of capital). Based on its discounted cash flow analysis, Centerview then calculated a range of implied equity values

of Exscientia. When calculating this range, Centerview added Exscientia’s estimated cash balance of $319 million and subtracted

outstanding debt of €300,000 as of September 30, 2024, each as set forth in the Exscientia-Prepared Risk Adjusted Forecasts

for Exscientia and included the benefit of tax savings of $259 million from the usage of Exscientia’s federal net operating losses

as of December 31, 2023, estimated future losses and U.K. R&D tax credits, each as set forth in the Exscientia Internal Data.

Centerview then calculated a range of implied equity values per Exscientia Share (a) by dividing the result of the foregoing calculations

by the implied number of fully-diluted outstanding Exscientia Shares (determined

using the treasury stock method and taking into account outstanding Exscientia Options, Exscientia RSUscalculated

based on approximately 129.3 million Exscientia Ordinary Shares Outstanding and the dilutive impact under the treasury stock method of

approximately 9.1 million Exscientia Options outstanding (including approximately 8.4 million share options and approximately 0.8 million

share options subject to achievement of target performance) and approximately 1.5 million Exscientia RSUs outstanding (whether

subject to time-based vesting conditions, performance-based vesting conditions, or a combination thereof) (excluding Exscientia RSUs

issued to a terminated employee, as instructed by Exscientia’s senior management)and Exscientis RSUs) as of August 6,

2024, and as set forth in the Exscientia Internal Data and (b) taking into account the impact of the assumed equity raises, as set

forth in the Exscientia Internal Data and as instructed by Exscientia management. This resulted in an implied per Exscientia Share equity

value range for the Exscientia Shares of approximately $3.90 to $6.60, rounded to the nearest $0.05.

The following bolded

and underlined language is added to page 98 of the joint proxy statement in the section with the heading “Opinion of

Exscientia’s Financial Advisor – Summary of Centerview’s Financial Analysis – Discounted Cash Flow

Analysis.”

Centerview reviewed stock

price targets for Exscientia Shares in Wall Street research analyst reports publicly available as of August 7, 2024 (consisting

of three such price targets), which indicated the latest available low and high stock price targets for Exscientia Shares ranged

from $7.00 to $9.00 per share. Centerview also reviewed stock price targets for Recursion Shares in Wall Street research analyst reports

publicly available as of August 7, 2024 (consisting of seven such price targets), which indicated the latest available

low and high stock price targets for Recursion Shares ranged from $8.00 to $17.00 per share. Centerview then calculated the ratio of such

low stock price target for Exscientia Shares to such high stock price target for Recursion Shares and the ratio of such high stock price

target for Exscientia Shares to such low stock price target for Recursion Shares to derive an implied exchange ratio range of 0.4118x

to 1.1250x. Centerview then compared these implied exchange ratios to the Exchange Ratio of 0.7729x and observed that the Exchange Ratio

was within such implied exchange ratio range.

The following bolded and

underlined language is added to pages 104-105 of the joint proxy statement in the section with the heading “Certain Unaudited

Financial Forecasts – The Exscientia-Prepared Forecasts.”

The following table presents a summary of the Exscientia-Prepared

Risk Adjusted Forecasts for Exscientia (USD in millions):

| |

2024E |

2025E |

2026E |

2027E |

2028E |

2029E |

2030E |

2031E |

2032E |

2033E |

2034E |

2035E |

2036E |

2037E |

2038E |

2039E |

2040E |

2041E |

2042E |

2043E |

2044E |

2045E |

2046E |

2047E |

2048E |

2049E |

| Net Revenue(1) |

$ 18 |

$ 50 |

$ 65 |

$ 72 |

$ 67 |

$ 68 |

$ 79 |

$ 57 |

$ 52 |

$ 82 |

$ 224 |

$ 479 |

$ 836 |

$ 1,264 |

$ 1,683 |

$ 1,987 |

$ 2,203 |

$ 2,383 |

$ 2,429 |

$ 2,323 |

$ 2,007 |

$ 1,661 |

$ 1,191 |

$ 873 |

$ 710 |

$ 659 |

| Gross Profit(2) |

$ 18 |

$ 50 |

$ 65 |

$ 72 |

$ 67 |

$ 68 |

$ 79 |

$ 57 |

$ 50 |

$ 76 |

$ 206 |

$ 429 |

$ 741 |

$ 1,121 |

$ 1,494 |

$ 1,763 |

$ 1,957 |

$ 2,122 |

$ 2,174 |

$ 2,078 |

$ 1,801 |

$ 1,487 |

$ 1,078 |

$ 791 |

$ 640 |

$ 593 |

| EBIT(3) |

$ (213) |

$ (179) |

$ (145) |

$ (156) |

$ (183) |

$ (177) |

$ (154) |

$ (116) |

$ (122) |

$ (94) |

$ 11 |

$ 211 |

$ 461 |

$ 796 |

$ 1,103 |

$ 1,328 |

$ 1,498 |

$ 1,638 |

$ 1,685 |

$ 1,589 |

$ 1,374 |

$ 1,131 |

$ 799 |

$ 571 |

$ 443 |

$ 406 |

| Tax Expense (if profitable) |

- |

- |

- |

- |

- |

- |

- |

- |

- |

- |

$

(1) |

$

(26) |

$

(58) |

$

(99) |

$

(138) |

$

(166) |

$

(187) |

$

(205) |

$

(211) |

$

(199) |

$

(172) |

$

(141) |

$

(100) |

$

(71) |

$

(55) |

$

(51) |

| Capital Expenditures |

$

(6) |

$

(5) |

$

(5) |

$

(5) |

$

(4) |

$

(4) |

$

(4) |

$

(4) |

$

(4) |

$

(4) |

$

(4) |

$

(4) |

$

(4) |

$

(4) |

$

(4) |

$

(4) |

$

(4) |

$

(4) |

$

(4) |

$

(3) |

$

(3) |

$

(3) |

$

(3) |

$

(3) |

$

(3) |

$

(3) |

| Depreciation &

Amortization |

$

24 |

$

21 |

$

17 |

$

13 |

$

9 |

$

5 |

$

4 |

$

4 |

$

4 |

$

4 |

$

4 |

$

4 |

$

4 |

$

4 |

$

4 |

$

4 |

$

4 |

$

4 |

$

4 |

$

4 |

$

4 |

$

3 |

$

3 |

$

3 |

$

3 |

$

3 |

| Change in Net Working

Capital |

- |

- |

- |

- |

- |

- |

$

(0) |

$

(0) |

$

(1) |

$

(4) |

$

(11) |

$

(24) |

$

(35) |

$

(40) |

$

(39) |

$

(29) |

$

(20) |

$

(15) |

$

(9) |

$

10 |

$

26 |

$

32 |

$

45 |

$

30 |

$

12 |

$

5 |

| Unlevered Free Cash Flow(4) |

$ (195)(5) |

$ (163) |

$ (133) |

$ (148) |

$ (179) |

$ (177) |

$ (154) |

$ (116) |

$ (123) |

$ (97) |

$ (1) |

$ 161 |

$ 368 |

$ 657 |

$ 927 |

$ 1,133 |

$ 1,291 |

$ 1,419 |

$ 1,466 |

$ 1,400 |

$ 1,229 |

$ 1,022 |

$ 745 |

$ 530 |

$ 400 |

$ 360 |

| (1) | Represents cash inflows from collaborations and commercialized product sales in each year as

opposed to any amounts derived from the application of a GAAP accounting treatment. |

| (2) | Represents the cost of manufactured commercialized products and potential future outbound royalty payments

only, while all other costs related to new and ongoing programs are recorded within separately under R&D expenses. |

| (3) | EBIT in this context is a non-IFRS and non-GAAP financial measure defined as earnings before interest

expenses and taxes recognized on a cash rather than accounting basis. |

| (4) | Unlevered Free Cash Flow refers to EBIT, less tax expenses (assuming 12.5% tax rate per Exscientia

management, excluding the impact of net operating losses and UK R&D tax credits), capital expenditures and changes in net working

capital, plus depreciation and amortization. |

| (5) | Forecasted Unlevered Free

Cash Flow for the three-month period ending December 31, 2024 was negative $49 million. |

The following table presents a summary of the Exscientia-Prepared

Forecasts for Recursion (USD in millions):

| |

2024E |

2025E |

2026E |

2027E |

2028E |

2029E |

2030E |

2031E |

2032E |

2033E |

2034E |

2035E |

2036E |

2037E |

2038E |

2039E |

2040E |

2041E |

2042E |

2043E |

2044E |

2045E |

2046E |

2047E |

2048E |

2049E |

| Net Revenue(1) |

$ 30 |

$ 48 |

$ 51 |

$ 238 |

$ 511 |

$ 1,062 |

$ 1,825 |

$ 2,342 |

$ 2,809 |

$ 2,942 |

$ 3,022 |

$ 2,591 |

$ 1,714 |

$ 1,415 |

$ 1,348 |

$ 1,376 |

$ 1,042 |

$ 950 |

$ 719 |

$ 667 |

$ 664 |

$ 656 |

$ 642 |

$ 627 |

$ 627 |

$ 627 |

| Gross Profit(2) |

$ 30 |

$ 48 |

$ 51 |

$ 226 |

$ 463 |

$ 948 |

$ 1,614 |

$ 2,071 |

$ 2,485 |

$ 2,603 |

$ 2,676 |

$ 2,303 |

$ 1,531 |

$ 1,269 |

$ 1,212 |

$ 1,239 |

$ 943 |

$ 861 |

$ 653 |

$ 606 |

$ 602 |

$ 594 |

$ 580 |

$ 565 |

$ 565 |

$ 565 |

| EBIT(3) |

$ (373) |

$ (410) |

$ (545) |

$ (406) |

$ (33) |

$ 537 |

$ 1,148 |

$ 1,529 |

$ 1,859 |

$ 1,949 |

$ 2,009 |

$ 1,720 |

$ 1,139 |

$ 943 |

$ 901 |

$ 924 |

$ 701 |

$ 639 |

$ 479 |

$ 441 |

$ 442 |

$ 437 |

$ 424 |

$ 410 |

$ 410 |

$ 410 |

| Tax Expense (if profitable) |

- |

- |

- |

- |

- |

$

(134) |

$

(287) |

$

(382) |

$

(465) |

$

(487) |

$

(502) |

$

(430) |

$

(285) |

$

(236) |

$

(225) |

$

(231) |

$

(175) |

$

(160) |

$

(120) |

$

(110) |

$

(110) |

$

(109) |

$

(106) |

$

(102) |

$

(103) |

$

(103) |

| Capital Expenditures |

$

(15) |

$

(15) |

$

(5) |

$

(5) |

$

(5) |

$

(4) |

$

(4) |

$

(4) |

$

(4) |

$

(4) |

$

(4) |

$

(4) |

$

(4) |

$

(3) |

$

(3) |

$

(3) |

$

(3) |

$

(3) |

$

(3) |

$

(3) |

$

(3) |

$

(2) |

$

(2) |

$

(2) |

$

(2) |

$

(2) |

| Depreciation &

Amortization |

$

26 |

$

24 |

$

19 |

$

15 |

$

11 |

$

7 |

$

5 |

$

4 |

$

4 |

$

4 |

$

4 |

$

4 |

$

4 |

$

4 |

$

4 |

$

3 |

$

3 |

$

3 |

$

3 |

$

3 |

$

3 |

$

3 |

$

3 |

$

2 |

$

2 |

$

2 |

| Change in Net Working

Capital |

- |

- |

- |

$

(12) |

$

(29) |

$

(60) |

$

(79) |

$

(52) |

$

(46) |

$

(14) |

$

(7) |

$

45 |

$

88 |

$

31 |

$

7 |

$

(2) |

$

34 |

$

9 |

$

22 |

$

4 |

$

(1) |

$

(0) |

$

(0) |

$

(0) |

$

(0) |

$

(0) |

| Unlevered Free Cash Flow(4) |

$ (362) |

$ (401) |

$ (530) |

$ (408) |

$ (56) |

$ 345 |

$ 782 |

$ 1,095 |

$ 1,349 |

$ 1,449 |

$ 1,500 |

$ 1,335 |

$ 943 |

$ 738 |

$ 683 |

$ 692 |

$ 560 |

$ 488 |

$ 381 |

$ 335 |

$ 331 |

$ 327 |

$ 318 |

$ 307 |

$ 308 |

$ 308 |

| (1) | Represents cash inflows from collaborations and commercialized product sales in each year as

opposed to any amounts derived from the application of a GAAP accounting treatment. |

| (2) | Represents the cost of manufactured commercialized products and potential future outbound royalty payments

only, while all other costs related to new and ongoing programs are recorded within separately under R&D expenses. |

| (3) | EBIT in this context is a non-IFRS and non-GAAP financial measure defined as earnings before interest

expenses and taxes recognized on a cash rather than accounting basis. |

| (4) | Unlevered Free Cash Flow refers to EBIT, less tax expenses (assuming 25% tax rate per Exscientia

management, excluding the impact of net operating losses), capital expenditures and changes in net working capital, plus depreciation

and amortization. |

The following table presents

a summary of the Exscientia-Prepared Non-Risk Adjusted Forecasts for Exscientia shared by Exscientia with Recursion (USD in millions).

Exscientia management prepared Exscientia-Prepared Non-Risk Adjusted Forecasts for Exscientia assuming that all of Exscientia’s

existing drug product candidates as well as future pipeline programs are successfully developed and commercialized. As is customary in

the biotechnology industry, Exscientia management prepared the Exscientia-Prepared Risk Adjusted Forecasts for Exscientia and Recursion

management prepared the Recursion-Prepared Risk Adjusted Forecasts for Exscientia by applying risk weightings and other adjustments to

the Exscientia-Prepared Non-Risk Adjusted Forecasts for Exscientia to account for the estimated likelihood of successfully developing

and commercializing Exscientia’s drug product candidates and to reflect other assumptions described above. None of Exscientia, Recursion

or any of their respective directors, officers, employees, affiliates, advisors or representatives believed that the Exscientia-Prepared

Non-Risk Adjusted Forecasts for Exscientia summarized below were achievable by Exscientia. The Exscientia-Prepared Non-Risk Adjusted

Forecasts for Exscientia provided to Recursion did not include forecasts of Unlevered Free Cash Flow. The Exscientia-Prepared

Non-Risk Adjusted Forecasts for Exscientia were not relied upon or used by Centerview in connection with rendering its opinion to the

Exscientia Board and performing the related financial analyses as described in the section entitled “The Transaction — Opinion

of Exscientia’s Financial Advisor” of this joint proxy statement.

The following bolded and

underlined language is added to page 106 of the joint proxy statement in the section with the heading “Certain Unaudited Financial

Forecasts – The Recursion-Prepared Forecasts.”

Recursion does not, as a

matter of course, publicly disclose financial forecasts or projections as to future revenues or other results of its operations

given, among other reasons, the uncertainty, unpredictability and subjectivity of the underlying assumptions and estimates.

Recursion management did not prepare, and neither the Recursion Board nor Allen & Company received or reviewed, forecasts

for Recursion’s future financial or operating performance of Recursion or of combined company following

the Transaction (other than the Cost Savings) in connection with Recursion’s evaluation of the Transaction.

The following bolded and

underlined language is added to page 107 of the joint proxy statement in the section with the heading “Certain Unaudited Financial

Forecasts – The Recursion-Prepared Forecasts.”

| (dollars

in millions) |

2024E |

2025E |

2026E |

2027E |

2028E |

2029E |

2030E |

2031E |

2032E |

2033E |

2034E |

2035E |

2036E |

2037E |

2038E |

2039E |

2040E |

2041E |

2042E |

2043E |

2044E |

2045E |

2046E |

2047E |

2048E |

2049E |

| Net Revenue (1) |

$ 18 |

$ 75 |

$ 79 |

$ 118 |

$ 94 |

$ 73 |

$ 30 |

$ 161 |

$ 128 |

$ 98 |

$ 225 |

$ 412 |

$ 685 |

$ 1,097 |

$ 1,570 |

$ 1,999 |

$ 2,318 |

$ 2,556 |

$ 2,609 |

$ 2,597 |

$ 2,363 |

$ 2,062 |

$ 1,772 |

$ 1,322 |

$ 1,080 |

$ 976 |

| Gross Profit |

$ 18 |

$ 75 |

$ 79 |

$ 118 |

$ 94 |

$ 73 |

$ 30 |

$ 161 |

$ 127 |

$ 92 |

$ 206 |

$ 370 |

$ 610 |

$ 979 |

$ 1,404 |

$ 1,787 |

$ 2,072 |

$ 2,288 |

$ 2,338 |

$ 2,331 |

$ 2,118 |

$ 1,847 |

$ 1,591 |

$ 1,191 |

$ 972 |

$ 878 |

| EBITDA (2) |

$ (155) |

$ (77) |

$ (84) |

$ (68) |

$ (123) |

$ (159) |

$ (181) |

$ (69) |

$ (101) |

$ (115) |

$ (23) |

$ 115 |

$ 319 |

$ 622 |

$ 962 |

$ 1,279 |

$ 1,529 |

$ 1,703 |

$ 1,734 |

$ 1,738 |

$ 1,553 |

$ 1,319 |

$ 1,096 |

$ 750 |

$ 539 |

$ 439 |

| Tax

Expense (if profitable) |

-- |

-- |

-- |

-- |

-- |

-- |

-- |

-- |

-- |

-- |

-- |

$

(24) |

$

(75) |

$

(150) |

$

(235) |

$

(314) |

$

(377) |

$

(420) |

$

(427) |

$

(428) |

$

(382) |

$

(323) |

$

(267) |

$

(180) |

$

(127) |

$

(102) |

| Capital

Expenditures |

$

(20) |

$

(20) |

$

(21) |

$

(21) |

$

(22) |

$

(22) |

$

(23) |

$

(23) |

$

(23) |

$

(24) |

$

(24) |

$

(25) |

$

(25) |

$

(26) |

$

(26) |

$

(27) |

$

(27) |

$

(28) |

$

(29) |

$

(29) |

$

(30) |

$

(30) |

$

(31) |

$

(32) |

$

(32) |

$

(33) |

| Change

in Net Working Capital |

$

1 |

$

(6) |

$

(0) |

$

(4) |

$

2 |

$

2 |

$

4 |

$

(13) |

$

3 |

$

3 |

$

(13) |

$

(19) |

$

(27) |

$

(41) |

$

(47) |

$

(43) |

$

(32) |

$

(24) |

$

(5) |

$

1 |

$

23 |

$

30 |

$

29 |

$

45 |

$

24 |

$

10 |

| Unlevered

Free Cash Flow (3)(4) |

$ (174) |

$ (104) |

$ (105) |

$ (93) |

$ (142) |

$ (179) |

$ (199) |

$ (105) |

$ (122) |

$ (135) |

$ (60) |

$ 47 |

$ 191 |

$ 404 |

$ 653 |

$ 895 |

$ 1,093 |

$ 1,231 |

$ 1,273 |

$ 1,282 |

$ 1,165 |

$ 996 |

$ 827 |

$ 583 |

$ 404 |

$ 315 |

| (1) | Represents cash inflows from collaborations and commercialized product sales in each year as opposed to

any amounts derived from the application of a GAAP accounting treatment. |

| (2) | EBITDA in this context is a non-IFRS and non-GAAP financial measure defined as earnings before interest

and taxes recognized on a cash rather than accounting basis (EBIT), plus depreciation and amortization. |

| (3) | Unlevered Free Cash Flow refers to EBIT, less tax expenses (assuming 25% tax rate per Recursion management),

capital expenditures, and changes in net working capital plus depreciation and amortization. |

| (4) | Forecasted Unlevered Free Cash Flow for the last two quarters of the fiscal year ending December

31, 2024 was negative $87 million. |

The following bolded and

underlined language is added to page 108 of the joint proxy statement in the section with the heading “Interests of Recursion’s

Directors and Executive Officers in the Transaction.”

Following

the completion of the Transaction, the current members of the Recursion Board are expected to continue as members of the Recursion Board.

In addition, pursuant to the Transaction Agreement, Recursion will appoint onetwo members

of the Exscientia Board to the Recursion Board. Dr. Gibson, Recursion’s current chief executive officer, is expected to continue

as chief executive officer of Recursion following the completion of the Transaction. Certain non-binding proposals submitted by

Recursion to Exscientia regarding a potential combination, as described in the section entitled “The Transaction — Background

of the Transaction” of this joint proxy statement, indicated that Dr. Gibson would continue to serve as Recursion’s

chief executive officer following a transaction.

The following bolded and

underlined language is added to page 109 of the joint proxy statement in the section with the heading “Arrangements with Recursion.”

Pursuant to the

Transaction Agreement, Exscientia may designate onetwo members

of the Exscientia Board, subject to approval of the Recursion Board in compliance with fiduciary duties under applicable law, to

serve as a members of the Recursion Board following the consummation of the Transaction. In

addition, prior to (or as promptly as practicable following) the Effective Time, Recursion will appoint to the Recursion Board one

additional individual if mutually agreed upon prior to the Effective Time by Exscientia and Recursion and subject to fiduciary

duties under applicable law.

The following bolded and

underlined language is added to page 111 of the joint proxy statement as a new section.

Litigation Related to the Transaction

On October 22,

2024, a purported stockholder of Recursion filed a complaint in New York state court against Recursion and members of the Recursion Board,

captioned Elliot v. Recursion Pharmaceuticals, Inc. et al., Case No. 655585/2024 (the “Elliot Complaint”).

On October 23, 2024, a purported stockholder of Recursion filed a complaint in New York state court against Recursion and members

of the Recursion Board, captioned Kent v. Recursion Pharmaceuticals, Inc. et al., Case No. 655606/2024 (the “Kent

Complaint,” and together with the Elliot Complaint, the “Complaints”). The Complaints assert claims against the Recursion

Board under New York law for negligent misrepresentation and concealment and for negligence with respect to allegedly false and misleading

statements of facts and omissions of material facts. The Complaints seek, among other relief, to enjoin Recursion from proceeding with

the Transaction unless and until Recursion cures certain alleged disclosure deficiencies in the joint proxy statement, actual and punitive

damages, and an award of attorneys’ fees and costs.

Recursion believes

that these lawsuits are without merit, but there can be no assurance that Recursion will ultimately prevail in these or other lawsuits. Additional

lawsuits may be filed before the Recursion special meeting, the Exscientia shareholder meetings or the consummation of the Transaction.

The following bolded and

underlined language is added to page 113 of the joint proxy statement in the section with the heading “Board of Directors of

Recursion Following Completion of the Transaction.”

Pursuant to the

Transaction Agreement, Exscientia may designate onetwo members of the Exscientia

Board, subject to approval of the Recursion Board in compliance with fiduciary duties under applicable law, to serve as a

members of the Recursion Board following the

consummation of the Transaction. In addition, prior to (or as promptly as practicable following) the Effective Time, Recursion

will appoint to the Recursion Board one additional individual if mutually agreed upon prior to the Effective Time by Exscientia and

Recursion and subject to fiduciary duties under applicable law.

* * *

Additional Information

and Where to Find It

The Transaction between Recursion and Exscientia

is the subject of the definitive joint proxy statement filed on October 10, 2024 by Recursion and Exscientia with the SEC, as amended

by the Supplemental Disclosures (the “Joint Proxy Statement”). The Joint Proxy Statement provides full details of the

Transaction and the attendant benefits and risks, including the terms and conditions of the Scheme of Arrangement and the other information

required to be provided to Recursion’s stockholders under the applicable provisions of the United Kingdom Companies Act 2006. This

communication is not a substitute for the Joint Proxy Statement or any other document that Recursion or Exscientia may file with the SEC

or send to their respective security holders in connection with the Transaction.

INVESTORS AND SECURITY HOLDERS

ARE URGED TO READ THE JOINT PROXY STATEMENT (WHICH INCLUDES AN EXPLANATORY STATEMENT IN RESPECT OF THE SCHEME OF ARRANGEMENT AND ANY OTHER

RELEVANT DOCUMENTS FILED OR THAT MAY BE FILED WITH THE SEC OR SENT TO RECURSION’S STOCKHOLDERS OR EXSCIENTIA’S SHAREHOLDERS,

AS WELL AS ANY AMENDMENTS OR SUPPLEMENTS TO THESE DOCUMENTS, CAREFULLY AND IN THEIR ENTIRETY IF AND WHEN THEY BECOME AVAILABLE BECAUSE

THEY CONTAIN OR WILL CONTAIN IMPORTANT INFORMATION ABOUT THE TRANSACTION.

No Offer or Solicitation

This communication is not

intended to and shall not constitute an offer to buy or sell or the solicitation of an offer to buy or sell any securities, or a solicitation

of any vote or approval, nor shall there be any offer, solicitation or sale of securities in any jurisdiction in which such offer, solicitation

or sale would be unlawful prior to registration or qualification under the securities laws of any such jurisdiction. No offer of securities

shall be made in the United States absent registration under the U.S. Securities Act of 1933, as amended (Securities Act), or pursuant

to an exemption from, or in a transaction not subject to, such registration requirements. Recursion securities issued in the Transaction

are anticipated to be issued in reliance upon an available exemption from such registration requirements pursuant to Section 3(a)(10) of

the Securities Act.

Forward Looking Statements

Statements contained herein

which are not historical facts may be considered forward-looking statements under federal securities laws and may be identified by words

such as “anticipates,” “believes,” “estimates,” “expects,” “intends,” “plans,”

“potential,” “predicts,” “projects,” “seeks,” “should,” “will,”

or words of similar meaning and include, but are not limited to, statements regarding the Transaction by and between Recursion and Exscientia

and the outlook for Recursion’s or Exscientia’s future business and financial performance. Such forward-looking statements

are based on the current beliefs of Recursion’s and Exscientia’s respective management as well as assumptions made by and

information currently available to them, which are subject to inherent uncertainties, risks and changes in circumstances that are difficult

to predict. Actual outcomes and results may vary materially from these forward-looking statements based on a variety of risks and uncertainties

including: the occurrence of any event, change or other circumstances that could give rise to the termination of the Transaction Agreement;

the inability to obtain Recursion’s stockholder approval or Exscientia’s shareholder approval or the failure to satisfy other

conditions to completion of the Transaction, including obtaining the sanction of the High Court of Justice of England and Wales to the

Scheme of Arrangement, on a timely basis or at all, and the receipt of required regulatory approvals; risks that the Transaction disrupts

each company’s current plans and operations; the diversion of the attention of the respective management teams of Recursion and

Exscientia from their respective ongoing business operations; the ability of either Recursion, Exscientia or the combined company to retain

key personnel; the ability to realize the benefits of the proposed combination, including cost synergies; the ability to successfully

integrate Exscientia's business with Recursion’s business, at all or in a timely manner; the outcome of any legal proceedings that

may be instituted against Recursion, Exscientia or others following announcement of the proposed combination; the amount of the costs,

fees, expenses and charges related to the proposed combination; the effect of economic, market or business conditions, including competition,

regulatory approvals and commercializing drug candidates, or changes in such conditions, have on Recursion’s, Exscientia’s

and the combined company’s operations, revenue, cash flow, operating expenses, employee hiring and retention, relationships with

business partners, the development or launch of technology enabled drug discovery, and commercializing drug candidates; the risks of conducting

Recursion’s and Exscientia’s business internationally; the impact of changes in interest rates by the Federal Reserve and

other central banks; the impact of potential inflation, volatility in foreign currency exchange rates and supply chain disruptions; the

ability to maintain technology-enabled drug discovery in the biopharma industry; and risks relating to the market value of Recursion’s

common stock to be issued in the Transaction.

Other important factors and

information are contained in the Joint Proxy Statement, including the risks summarized in the section entitled “Risk Factors”

thereof, and Recursion’s other periodic filings with the SEC, which can be accessed at https://ir.recursion.com or www.sec.gov.

All forward-looking statements are qualified by these cautionary statements and apply only as of the date they are made. Recursion does

not undertake any obligation to update any forward-looking statement, whether as a result of new information, future events or otherwise.

Item 9.01. Financial Statements and Exhibits.

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934,

the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized on November 6,

2024.

| |

RECURSION PHARMACEUTICALS, INC. |

| |

|

|

| |

By: |

/s/ Michael Secora |

| |

|

Michael Secora |

| |

|

Chief Financial Officer |

Exhibit 2.1

EXECUTION VERSION

FIRST AMENDMENT TO TRANSACTION AGREEMENT

This

first Amendment TO THE TRANSACTION AGREEMENT (this “Amendment”), dated as of November 5, 2024, is by and between

Recursion Pharmaceuticals, Inc., a Delaware corporation (“Parent”), and Exscientia plc, a public limited company incorporated

in England and Wales with registered number 13483814 (the “Company”).

WHEREAS, Parent and the Company

are parties to that certain Transaction Agreement, dated as of August 8, 2024 (the “Agreement”). Capitalized terms

used but not defined in this Amendment shall have the respective meanings given to them in the Agreement.

WHEREAS, Parent and the Company

desire to amend the Agreement as set forth herein pursuant to Section 11.03(a) of the Agreement; and

WHEREAS, the Parent Board

and the Company Board have each approved and declared advisable this Amendment.

NOW, THEREFORE, in consideration

of the agreements contained herein and other good and valuable consideration, the receipt and sufficiency of which are hereby acknowledged,

the parties hereto, intending to be legally bound, hereby agree as follows:

1. Amendment to the Agreement.

1.1 Section 2.05(d) of the Agreement is hereby amended and restated in its entirety to read as follows:

“(i) Prior to the Effective

Time and effective as of the Effective Time, Parent shall appoint to the Parent Board one (1) member of the Company Board, as of the date

hereof, selected by the Company and subject to Parent’s approval in compliance with the fiduciary duties under Applicable Law of

the Parent Board and (ii) prior to (or as promptly as practicable following) the Effective Time, Parent shall appoint to the Parent Board

one (1) additional individual if mutually agreed upon prior to the Effective Time by the Company and Parent and subject to the fiduciary

duties under Applicable Law of the Parent Board, and subject in each case to the continued willingness and ability of such individual

to serve on the Parent Board at the time of appointment.”

2. Effect on the Agreement. Except as explicitly amended and/or superseded by this Amendment, all of the terms and conditions

of the Agreement remain, and shall remain, in full force and effect, unmodified hereby. This Amendment shall not constitute an amendment

or waiver of any provision of the Agreement not expressly amended or waived herein and shall not be construed as an amendment, waiver

or consent to any action that would require an amendment, waiver or consent, except as expressly set forth herein. Upon the execution

and delivery hereof, the Agreement shall thereupon be deemed to be amended and supplemented as hereinabove set forth as fully and with

the same effect as if the amendments and supplements made hereby were originally set forth in the Agreement. This Amendment and the Agreement

shall each henceforth be read, taken and construed as one and the same instrument, but such amendments and supplements shall not operate

so as to render invalid or improper any action heretofore taken under the Agreement. If and to the extent there are any inconsistencies

between the Agreement and this Amendment with respect to the matters set forth herein, the terms of this Amendment shall control. On and

after the date hereof, each reference in the Agreement to “this Agreement,” “hereunder,” “herein”

or words of like import shall mean and be a reference to the Agreement as amended by this Amendment, provided that references in the Agreement

to “the date hereof” or “the date of this Agreement” or words of like import shall continue to refer to the date

of August 8, 2024. Nothing contained herein invalidates or shall release or impair any covenant, condition, agreement or stipulation in

the Agreement.

EXECUTION VERSION

3. Counterparts. This Amendment may be executed in counterparts, including by facsimile, by email with .pdf attachments,

or by other electronic transmission (including DocuSign and AdobeSign), each of which shall be deemed an original, but all of which shall

constitute the same instrument.

4. Application of Certain Sections of the Agreement. Section 11.05(b) (Assignment), Section 11.06 (Governing

Law), Section 11.07 (Jurisdiction; Venue), Section 11.10 (Entire Agreement), Section 11.11 (Severability), and

Section 11.13 (Interpretation) of the Agreement shall apply mutatis mutandis to this Amendment as if set forth in full herein.

[Signature Page Follows]

IN WITNESS WHEREOF, the parties hereto have duly

executed this Amendment as of the date first written above.

| |

RECURSION

PHARMACEUTICALS, INC. |

| |

|

| |

|

| |

By: |

/s/ Christopher Gibson |

| |

Name: Christopher Gibson |

| |

Title: Chief Executive Officer |

| |

|

| |

|

| |

EXSCIENTIA PLC |

| |

|

| |

|

| |

By: |

/s/ David Hallett |

| |

Name: David Hallett |

| |

Title: Interim Chief

Executive Officer |

[Signature Page to First Amendment to Transaction

Agreement]

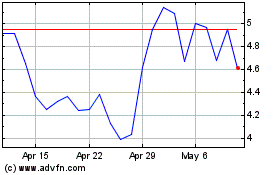

Exscientia (NASDAQ:EXAI)

Historical Stock Chart

From Dec 2024 to Jan 2025

Exscientia (NASDAQ:EXAI)

Historical Stock Chart

From Jan 2024 to Jan 2025