PROSPECTUS SUPPLEMENT

(To Prospectus dated November 30, 2022) |

|

Filed Pursuant to Rule 424(b)(5)

Registration No. 333-263315 |

EZGO Technologies

Ltd.

An Aggregate Offering Amount of $9,602,881.25

Ordinary Shares,

Warrants, and

Ordinary Shares Issuable Upon Exercise of Warrants

We are offering 8,498,125 ordinary shares, par value

of $0.001 per share (the “Ordinary Shares”), and accompanying 8,498,125 warrants (the “Common Warrants”) to purchase

8,498,125 Ordinary Shares (the “Warrant Shares”) and 33,992,500 warrants (the “Exchange Warrants,” together with

Common Warrants, the “Warrants”) to purchase 33,992,500 Warrant Shares in a registered direct offering to certain institutional

investors pursuant to that certain securities purchase agreement, dated as of September 11, 2023. The combined purchase price per Ordinary

Share and accompanying Common Warrant and four Exchange Warrants is $1.13. Each of the Warrants is exercisable for one Warrant Share at

an exercise price of $1.13 per share. Each Warrant may be exercised on a cashless basis. In addition, the Exchange Warrant may be exercised

on an alternative cashless basis. See the section entitled “Description of Securities We Are Offering – Warrants –

Cashless Exercise” in this prospectus supplement. The Warrants are immediately exercisable and may be exercised for a period

of three years following the issuance date. This offering also relates to the Warrant Shares issuable upon exercise of the Warrants sold

in this offering.

Aegis Capital Corp. is acting as the placement

agent for this offering. See “Plan of Distribution.” The net proceeds received by us from this offering will be used

for working capital and general business purposes.

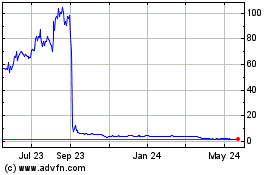

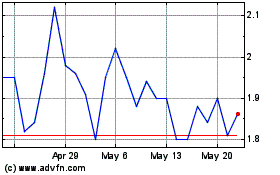

Our Ordinary Shares are listed on the Nasdaq Capital

Market (“Nasdaq”) under the symbol “EZGO.” On September 11, 2023, the last reported sales price of our Ordinary

Shares on Nasdaq was $0.315 per share.

We do not intend to apply to list the Warrants

being sold in this offering on any securities exchange. Accordingly, there is no established public trading market for the Warrants, and

we do not expect a market to develop. Without an active market, the liquidity of the Warrants will be limited.

We are an “emerging

growth company” as defined under applicable U.S. securities laws and are eligible for reduced public company reporting requirements.

Investing in

our securities involves a high degree of risk, including the risk of losing your entire investment. See “Risk Factors”

beginning on page S-25 and the “Risk Factors” in the accompanying prospectus to read about factors you should consider

before purchasing our securities.

INVESTORS

PURCHASING SECURITIES IN THIS OFFERING ARE PURCHASING SECURITIES OF EZGO Technologies Ltd., a British Virgin Islands business company

(“ezgo”), RATHER THAN SECURITIES OF its SUBSIDIARIES or THE VIE (AS DEFINED BELOW) THAT CONDUCT SUBSTANTIVE BUSINESS OPERATIONS

IN CHINA.

In this prospectus

supplement, “we,” “us,” “our,” “our company,” the “Company,” or similar terms

refer to EZGO Technologies Ltd. and/or its consolidated subsidiaries, other than Jiangsu EZGO Electronic Technologies, Co., Ltd. (formerly

known as Jiangsu Baozhe Electric Technologies, Co., Ltd.), a mainland China company (the “VIE”). EZGO conducts operations

in China through Changzhou EZGO Enterprise Management Co., Ltd. (the “WFOE”), the VIE and its subsidiaries in China, and

EZGO does not conduct any business on its own. The financial results of the VIE and its subsidiaries are consolidated into our financial

statements for accounting purposes, but we do not hold any equity interest in the VIE or any of its subsidiaries.

Investing

in EZGO’s securities is highly speculative and involves a significant degree of risk. EZGO is not an operating company

established in the People’s Republic of China (the “PRC”), but a holding company incorporated in the British

Virgin Islands. As a holding company with no material operations of its own, EZGO conducts the majority of its operations through

contractual arrangements with its operating entities established in the PRC, primarily the VIE, in which EZGO does not hold any

equity interest, and the VIE’s subsidiaries based in the PRC. This variable interest entity structure involves unique risks to

investors. The contractual arrangements with the VIE have not been tested in court. The variable interest entity structure is used

to provide investors with contractual exposure to foreign investment in China-based companies where Chinese law prohibits or

restricts direct foreign investment in the operating companies. Due to PRC legal restrictions on foreign ownership in internet-based

businesses, we do not have any equity ownership of the VIE; instead, we receive the economic benefits of the VIE’s business

operations through certain contractual arrangements. As a result of such series of contractual arrangements, EZGO and its

subsidiaries become the primary beneficiary of the VIE for accounting purposes and the VIE as a PRC consolidated entity under the

generally accepted accounting principles in the United States (the “U.S. GAAP”). We consolidate the financial results of

the VIE and its subsidiaries in our consolidated financial statements in accordance with U.S. GAAP. Neither we nor our investors own

any equity ownership in, direct foreign investment in, or control through such ownership/investment of the VIE. Investors may never

hold equity interests in the Chinese operating company. The securities offered in this prospectus supplement are securities of our

British Virgin Islands holding company that maintains contractual arrangements with the associated operation companies. The Chinese

regulatory authorities could disallow this variable interest entity structure, which would likely result in a material change in

EZGO’s operations primarily through the VIE and its subsidiaries in China and/or a material change in the value of the

securities EZGO is registering for sale, including that it could cause the value of its securities to significantly decline or

become worthless. For a description of our corporate structure and contractual arrangements with the VIE, see

“Item 3. Key Information — D. Risk Factors — Risks Related to Our Corporate Structure” on page 19

of our Annual Report on Form 20-F for the fiscal year ended September 30, 2022 (the “2022 Annual Report”), which is

incorporated herein by reference.

In

addition, as EZGO conducts substantially all of its operations in China through the WFOE, the VIE and its subsidiaries in China, it

is subject to legal and operational risks associated with having substantially all of its operations in China, which risks could

result in a material change in its operations and/or the value of the securities EZGO is registering for sale or could significantly

limit or completely hinder its ability to offer or continue to offer its securities to investors and cause the value of its

securities to significantly decline or be worthless. Recently, the PRC government initiated a series of regulatory actions and made

a number of public statements on the regulation of business operations in China with little advance notice, including cracking down

on illegal activities in the securities market, enhancing supervision over China-based companies listed overseas, adopting new

measures to extend the scope of cybersecurity reviews, and expanding efforts in anti-monopoly enforcement. Our PRC counsel, DeHeng

Law Offices (Shenzhen), is of the view that as of the date of this prospectus supplement, we are not directly subject to these

regulatory actions or statements, as we have not implemented any monopolistic behavior and EZGO’s business operations through

the WFOE, the VIE and its subsidiaries in China do not involve large-scale collection of user data, implicate cybersecurity, or

involve any other type of restricted industry. As further advised by our PRC counsel, as of the date of this prospectus supplement,

no relevant laws or regulations in the PRC explicitly require us to seek approval from the China Securities Regulatory Commission

(the “CSRC”) or any other PRC governmental authorities for our overseas listing or securities offering plans, nor has

our company, any of our subsidiaries, the VIE or any of its subsidiaries received any inquiry, notice, warning or sanctions

regarding our offering of securities from the CSRC or any other PRC governmental authorities. However, since these statements and

regulatory actions by the PRC government are newly published and official guidance and related implementation rules have not been

issued, it is highly uncertain what potential impact such modified or new laws and regulations will have on the VIE’s daily

business operations, or ability to accept foreign investments and list on a U.S. or other foreign exchange. The Standing Committee

of the National People’s Congress (the “SCNPC”) or other PRC regulatory authorities may in the future promulgate

laws, regulations or implementing rules that require our company, the WFOE, the VIE or any of its subsidiaries to obtain regulatory

approval from Chinese authorities before offering securities in the U.S. Any future Chinese, U.S., British Virgin Islands or other

rules and regulations that place restrictions on capital raising or other activities by companies with extensive operations in China

could adversely affect EZGO’s business through the WFOE, the VIE and its subsidiaries in China and results of

operations. See “Item 3. Key Information — D. Risk Factors — Risks Related to Doing Business in

China” beginning on page 17 of the 2022 Annual Report

for a detailed description of various risks related to doing business in China and other information that should be considered

before making a decision to purchase any of EZGO’s securities.

Furthermore,

as more stringent criteria have been imposed by the Securities and Exchange Commission (the “SEC”) and the Public Company

Accounting Oversight Board (the “PCAOB”) recently, EZGO’s securities may be prohibited from trading if our auditor

cannot be fully inspected. On December 16, 2021, the PCAOB issued its determination that the PCAOB is unable to inspect or investigate

completely PCAOB-registered public accounting firms headquartered in mainland China and in Hong Kong, because of positions taken by PRC

authorities in those jurisdictions, and the PCAOB included in the report of its determination a list of the accounting firms that are

headquartered in mainland China or Hong Kong. This list does not include our former auditors, Marcum Asia CPAs LLP (formerly known as

Marcum Bernstein & Pinchuk LLP) (“MarcumAsia”) and Briggs & Veselka Co., LLP (“Briggs & Veselka”),

or our current auditor, Wei, Wei & Co., LLP (“WWC”). On August 26, 2022, the PCAOB announced that it had signed a Statement

of Protocol (the “Statement of Protocol”) with the CSRC and the Ministry of Finance of China (“MOF”). The terms

of the Statement of Protocol would grant the PCAOB complete access to audit work papers and other information so that it may inspect

and investigate PCAOB-registered accounting firms headquartered in mainland China and Hong Kong. On December 15, 2022, the PCAOB announced

that it had secured complete access to inspect and investigate registered public accounting firms headquartered in mainland China and

Hong Kong and voted to vacate the previous 2021 determination report to the contrary. Our current auditor, WWC, as an auditor of companies

that are traded publicly in the United States and a firm registered with the PCAOB, is subject to laws in the United States pursuant

to which the PCAOB conducts regular inspections to assess its compliance with the applicable professional standards. Notwithstanding

the foregoing, in the future, if there is any regulatory change or step taken by PRC regulators that does not permit our auditor to provide

audit documentations located in China to the PCAOB for inspection or investigation, investors may be deprived of the benefits of such

inspection. Any audit reports not issued by auditors that are completely inspected by the PCAOB, or a lack of PCAOB inspections of audit

work undertaken in China that prevents the PCAOB from regularly evaluating our auditors’ audits and their quality control procedures,

could result in a lack of assurance that our financial statements and disclosures are adequate and accurate, then such lack of inspection

could cause EZGO’s securities to be delisted from the stock exchange. See risks disclosed under “Risk Factors

— Risks Related to Doing Business in China — EZGO’s Ordinary Shares may be delisted under the HFCA Act if the PCAOB

is unable to adequately inspect audit documentation located in China. The delisting of EZGO’s Ordinary Shares, or the threat of

their being delisted, may materially and adversely affect EZGO’s Ordinary Shares. Additionally, the inability of the PCAOB to conduct

adequate inspections deprives our shareholders of the benefits of such inspections. Furthermore, the Accelerating Holding Foreign Companies

Accountable Act amends the HFCA Act and requires the SEC to prohibit an issuer’s securities from trading on any U.S. stock exchanges

if its auditor is not subject to PCAOB inspections for two consecutive years instead of three” on page S-42 of this prospectus

supplement.

On December 2,

2021, the SEC adopted final amendments to its rules implementing the Holding Foreign Companies Accountable Act (the “HFCA Act”).

Such final rules establish procedures that the SEC will follow in (i) determining whether a registrant is a “Commission-Identified

Issuer” (a registrant identified by the SEC as having filed an annual report with an audit report issued by a registered public

accounting firm that is located in a foreign jurisdiction and that the PCAOB is unable to inspect or investigate completely because of

a position taken by an authority in that jurisdiction) and (ii) prohibiting the trading of an issuer that is a Commission-Identified

Issuer for three consecutive years under the HFCA Act. The SEC began identifying Commission-Identified Issuers for the fiscal years beginning

after December 18, 2020. A Commission-Identified Issuer is required to comply with the submission and disclosure requirements in the

annual report for each year in which it was identified. Since we were not identified as a Commission-Identified Issuer for the fiscal

year ended September 30, 2022, we were not required to comply with the submission or disclosure requirements in the 2022 Annual Report.

As of the date of this prospectus supplement, we have not been, and do not expect to be identified by the SEC under the HFCA Act. As

disclosed earlier, on December 15, 2022, the PCAOB announced that it had secured complete access to inspect and investigate registered

public accounting firms headquartered in mainland China and Hong Kong and voted to vacate the previous 2021 determination report to the

contrary. However, whether the PCAOB will continue to conduct inspections and investigations completely to its satisfaction of PCAOB-registered

public accounting firms headquartered in mainland China and Hong Kong is subject to uncertainty and depends on a number of factors out

of our, and our auditor’s control, including positions taken by authorities of the PRC. The PCAOB is required under the HFCA Act

to make its determination on an annual basis with regards to its ability to inspect and investigate completely accounting firms based

in the mainland China and Hong Kong. The possibility of being a “Commission-Identified Issuer” and risk of delisting could

continue to adversely affect the trading price of our securities. Should the PCAOB again encounter impediments to inspections and investigations

in mainland China or Hong Kong as a result of positions taken by any authority in either jurisdiction, the PCAOB will make determinations

under the HFCA Act as and when appropriate. On June 22, 2021, the U.S. Senate passed the Accelerating Holding Foreign Companies Accountable

Act (the “AHFCA Act”), which amends the HFCA Act and requires the SEC to prohibit an issuer’s securities from trading

on any U.S. stock exchanges if its auditor is not subject to PCAOB inspections for two consecutive years instead of three, and thus,

would reduce the time before EZGO’s securities may be prohibited from trading or delisted. On December 29, 2022, the AHFCA Act

was signed into law.

On February 17,

2023, the CSRC issued the Trial Measures for the Administration of Overseas Issuance and Listing of Securities by Domestic Enterprises

and five supporting guidelines, which became effective on March 31, 2023 (the “Overseas Listing Regulations”). The Overseas

Listing Regulations are applicable to overseas securities offerings and/or listings conducted by issuers who are (i) companies incorporated

in the PRC (“PRC domestic companies”) and (ii) companies incorporated overseas with substantial operations in the PRC. The

Overseas Listing Regulations stipulate that such issuer shall fulfill the filing procedures within three working days after it makes

an application for initial public offering and listing in an overseas stock market. Among other things, if an overseas listed issuer

intends to effect any follow-on offering in an overseas stock market, it should, through its major operating entity incorporated in the

PRC, submit filing materials to the CSRC within three working days after the completion of the offering. The required filing materials

shall include, but not be limited to, (1) filing report and relevant commitment letter and (2) domestic legal opinions. The Overseas

Listing Regulations may subject us to additional compliance requirements in the future, and we cannot assure you that we will be able

to get the clearance of filing procedures under the Overseas Listing Regulations on a timely basis, or at all. Any failure of us to fully

comply with new regulatory requirements may significantly limit or completely hinder our ability to offer or continue to offer our securities,

cause significant disruption to our business operations, and severely damage our reputation, which would materially and adversely affect

our financial condition and results of operations and cause our securities to significantly decline in value or become worthless.

On February 24, 2023, the CSRC, together with

the MOF, National Administration of State Secrets Protection and National Archives Administration of China, revised the Provisions on

Strengthening Confidentiality and Archives Administration for Overseas Securities Offering and Listing, which were issued by the CSRC

and National Administration of State Secrets Protection and National Archives Administration of China in 2009 (the “Provisions”).

The revised Provisions were issued under the title the “Provisions on Strengthening Confidentiality and Archives Administration

of Overseas Securities Offering and Listing by Domestic Companies,” and came into effect on March 31, 2023, together with the Overseas

Listing Regulations. One of the major revisions to the revised Provisions is expanding their application to cover indirect overseas offering

and listing, as is consistent with the Overseas Listing Regulations. The revised Provisions require that, among other things, (a) a PRC

domestic company that plans to, either directly or indirectly through its overseas listed entity, publicly disclose or provide to relevant

individuals or entities including securities companies, securities service providers and overseas regulators, any documents and materials

that contain state secrets or working secrets of government agencies, shall first obtain approval from competent authorities according

to law, and file with the secrecy administrative department at the same level; and (b) a PRC domestic company that plans to, either directly

or indirectly through its overseas listed entity, publicly disclose or provide to relevant individuals and entities including securities

companies, securities service providers and overseas regulators, any other documents and materials that, if leaked, will be detrimental

to national security or public interest, shall strictly fulfill relevant procedures stipulated by applicable national regulations. Any

failure or perceived failure by our Company or our PRC subsidiaries to comply with the above confidentiality and archives administration

requirements under the revised Provisions and other PRC laws and regulations may result in the relevant entities being held legally liable

by competent authorities and referred to the judicial organ to be investigated for criminal liability if suspected of committing a crime.

Neither the Securities and Exchange Commission

nor any state securities commission has approved or disapproved of these securities or determined if this prospectus supplement or the

accompanying prospectus is truthful or complete. Any representation to the contrary is a criminal offense.

We have engaged Aegis Capital Corp. (the “placement

agent”) as the sole placement agent in connection with this offering. The placement agent has no obligation to buy any of the securities

from us or to arrange for the purchase or sale of any specific number or dollar amount of securities. See the section entitled “Plan

of Distribution” beginning on page S-49 of this prospectus supplement for more information regarding these arrangements.

| | |

Per Share and Accompanying Warrants | | |

Total | |

| Offering price | |

$ | 1.13 | | |

$ | 9,602,881.25 | |

| Placement agent fees(1) | |

$ | 0.08 | | |

$ | 700,000.00 | |

| Proceeds, before expenses, to us(2) | |

$ | 1.05 | | |

$ | 8,902,881.25 | |

| (1) |

In addition, we have agreed to reimburse certain expenses of the placement in connection with this offering. See the section entitled “Plan of Distribution” beginning on page S-49 for more information regarding the placement agent’s compensation. |

| (2) |

The amount of the offering proceeds to us presented in this table does not give effect to the sale or exercise, if any, of the Warrants being issued in connection with this offering. |

Delivery of the securities being offered pursuant

to this prospectus supplement and the accompanying prospectus is expected to be made on or about September 13, 2023.

Placement Agent

Aegis Capital Corp.

Prospectus Supplement dated September 11, 2023

TABLE

OF CONTENTS

PROSPECTUS

SUPPLEMENT

PROSPECTUS

ABOUT

THIS PROSPECTUS SUPPLEMENT

This document is

in two parts. The first part is the prospectus supplement, which describes the specific terms of this offering of securities and also

adds to and updates information contained in the accompanying prospectus and the documents incorporated by reference into this prospectus

supplement and the accompanying prospectus. The second part is the accompanying prospectus dated November 30, 2022, included in the registration

statement on Form F-3 (Registration No. 333-263315), including the documents incorporated by reference therein, which provides more general

information, some of which may not be applicable to this offering.

This prospectus supplement provides specific terms

of this offering of our Ordinary Shares, Warrants and Warrant Shares, and other matters relating to us and our financial condition. If

the description of the offering varies between this prospectus supplement and the accompanying prospectus, you should rely on the information

in this prospectus supplement.

You should rely

only on the information contained or incorporated by reference in this prospectus supplement and the accompanying prospectus or any free

writing prospectus provided in connection with this offering. We have not authorized any other person to provide you with different information.

If anyone provides you with different or inconsistent information, you should not rely on it. You should assume that the information

appearing in this prospectus supplement, the accompanying prospectus and the documents incorporated by reference is accurate only as

of their respective dates, regardless of the time of delivery of this prospectus supplement, the accompanying prospectus or any other

offering materials, or any sale of the securities. Our business, financial condition, results of operations and prospects may have changed

since those dates. We are not making an offer to sell these securities in any jurisdiction where the offer or sale is not permitted.

Neither this prospectus supplement nor the accompanying prospectus constitutes an offer, or an invitation on behalf of us to subscribe

for and purchase, any of the securities and may not be used for or in connection with an offer or solicitation by anyone, in any jurisdiction

in which such an offer or solicitation is not authorized or to any person to whom it is unlawful to make such an offer or solicitation.

It is important

for you to read and consider all the information contained or incorporated by reference in this prospectus supplement and the accompanying

prospectus in making your investment decision.

In this prospectus

supplement and the accompanying prospectus, unless otherwise indicated or unless the context otherwise requires, references to:

| |

● |

“BVI”

refers to British Virgin Islands; |

| |

|

|

| |

● |

“CAC”

refers to the Cyberspace Administration of China; |

| |

|

|

| |

● |

“Changzhou

EZGO” or “WFOE” refers to EZGO HK’s wholly-owned subsidiary and wholly foreign owned enterprise, Changzhou

EZGO Enterprise Management Co., Ltd. (formerly known as Changzhou Jiekai New Energy Technology Company), a PRC company; |

| |

|

|

| |

● |

“Changzhou

Sixun” refers to Changzhou Sixun Technology Co., Ltd., a PRC company, and a wholly-owned subsidiary of Jiangsu EZGO New Energy

Technologies Co., Ltd., a PRC company, and an indirect wholly-owned subsidiary of EZGO; |

| |

|

|

| |

● |

“China”

or the “PRC”, in each case, refers to the People’s Republic of China, including Hong Kong and Macau. The term “Chinese”

has a correlative meaning for the purpose of this prospectus supplement and the accompanying prospectus; |

| |

● |

“CSRC”

refers to the China Securities Regulatory Commission; |

| |

● |

“Exchange

Act” refers to the Securities Exchange Act of 1934, as amended; |

| |

● |

“EZGO”

refers to EZGO Technologies Ltd., a British Virgin Islands business company, and “we,” “us,” “our company,”

the “Company,” “our,” or similar terms used in this prospectus supplement and the accompanying prospectus

refer to EZGO Technologies Ltd. and/or its consolidated subsidiaries, other than the variable interest entity, Jiangsu EZGO Electronic

Technologies, Co., Ltd., unless the context otherwise indicates; |

| |

● |

“EZGO

HK” refers to EZGO’s wholly-owned subsidiary, China EZGO Group Ltd. (formerly known as Hong Kong JKC Group Co., Limited),

a Hong Kong company; |

| |

● |

“FINRA”

refers to the Financial Industry Regulatory Authority, Inc.; |

| |

● |

“Hengmao

Power Battery” refers to Changzhou Hengmao Power Battery Technology Co., Ltd., a PRC company of which 80.87% of the equity

interest is owned by the VIE; |

| |

● |

“Hong

Kong” refers to the Hong Kong Special Administrative Region of the PRC; |

| |

● |

“initial

public offering” refers to our initial public offering, in which we offered and sold an aggregate of 3,038,500 Ordinary Shares

at an offering price of US$4.00 per share, including a partial exercise of the underwriters’ over-allotment; |

| |

|

|

| |

● |

“Jiangsu

Cenbird” refers to Jiangsu Cenbird E-Motorcycle Technologies Co., Ltd., a PRC company of which 51% of the equity interest is

owned by the VIE; |

| |

● |

“JOBS

Act” refers to the Jumpstart Our Business Startups Act, enacted in April 2012; |

| |

|

|

| |

● |

“MOFCOM”

refers to China’s Ministry of Commerce; |

| |

● |

“Ordinary

Shares” refers to EZGO’s Ordinary Shares, par value US$0.001 per share; |

| |

● |

“PCAOB”

refers to the Public Company Accounting Oversight Board of the United States; |

| |

● |

“RMB”

or “Renminbi” refer to the legal currency of the People’s Republic of China; |

| |

● |

“SAFE”

refers to China’s State Administration of Foreign Exchange; |

| |

● |

“SAT”

refers to China’s State Administration of Taxation; |

| |

● |

“SEC”

refers to the United States Securities and Exchange Commission; |

| |

● |

“Securities

Act” refers to the Securities Act of 1933, as amended; |

| |

● |

“share

capital” or similar expressions include a reference to shares in a company that does not have a share capital under its governing

law, but which is authorized to issue a maximum or unlimited number of shares; |

| |

● |

“US$,”

“$,” “dollars,” “USD” or “U.S. dollars” refer to the legal currency of the United

States; |

| |

● |

“U.S.

GAAP” refers to the generally accepted accounting principles in the United States; |

| |

● |

“VIE”

refers to the variable interest entity, Jiangsu EZGO Electronic Technologies, Co., Ltd. (formerly known as Jiangsu Baozhe Electric

Technologies, Co., Ltd.), a PRC company; and |

| |

|

|

| |

● |

“Yizhiying

IoT” refers to Changzhou Yizhiying IoT Technologies Co., Ltd., a PRC company and a wholly-owned subsidiary of the VIE. |

All discrepancies in any table between

the amounts identified as total amounts and the sum of the amounts listed therein are due to rounding.

PROSPECTUS

SUPPLEMENT SUMMARY

Investors in

EZGO’s securities are not purchasing an equity interest in our operating entities in China but instead are purchasing an equity

interest in a BVI holding company.

This prospectus

supplement summary highlights selected information that is presented in greater detail elsewhere, or incorporated by reference, in this

prospectus supplement and the accompanying prospectus. It does not contain all of the information that may be important to you and your

investment decision. Before investing in the securities that we are offering, you should carefully read this entire prospectus supplement

and the accompanying prospectus, including the matters set forth under the section of this prospectus supplement and the accompanying

prospectus captioned “Risk Factors” and the financial statements and related notes and other information that we incorporate

by reference herein, including, but not limited to, our 2022 Annual Report and our other SEC reports.

Overview

EZGO

is a holding company incorporated in the BVI with operating subsidiaries, the VIE, in which EZGO does not hold any equity interest, and

VIE’s subsidiaries, and with substantially all of its operations and assets in China. As a holding company with no material operations

of its own, EZGO conducts its business in China through the WFOE, the VIE and its subsidiaries. Through the WFOE, the VIE and its subsidiaries

in China, EZGO’s vision is to be a leading short-distance transportation solutions provider in China. Leveraging its Internet of

Things (“IoT”) product and service platform, EZGO has preliminarily established a business model centered on the sale of

e-bicycles and battery and cells, complemented by sale of battery packs and its charging pile business through the WFOE, the VIE and

its subsidiaries in China. Currently, EZGO (i) designs, manufactures, rents and sells e-bicycles and e-tricycles; (ii) rents

and sells lithium batteries; and (iii) sells, franchises, and operates smart charging piles for e-bicycles and other electronic

devices primarily through the VIE and its subsidiaries in China, and sells battery packs partially through the WFOE.

The

e-bicycles are models under the PRC Safety Technical Specification for Electric Bicycles (GB 17761-2018) (also referred to generally

as the “New National Standards for Electric Bicycles” and referred to herein as the “New National Standards”)

(“new standards e-bicycles”) and there are no domestic laws or regulations related to urban e-tricycles. In addition, the

two-wheel electric vehicle models that do not comply with the new standards e-bicycles that are manufactured under the New National Standards

(“non-new standards e-bicycles”) are manufactured under the PRC National Standard General Specification for Electric Motorcycle

and Electric Mopeds (GB/T24158-2018) (“General Specification Standard”), which came into effect on April 1, 2019. None of

EZGO, the WFOE, the VIE and its subsidiaries in China produces any non-new standards e-bicycles. As of March 31, 2023 and September 30,

2022, we did not have any non-new standards e-bicycles as our property, plants and equipment and no impairment was recognized for the

fiscal years ended September 30, 2020, 2021 and 2022 or for the six months ended March 31, 2023.

To date, EZGO,

through the WFOE, the VIE and its subsidiaries in China, has engaged in the business of battery packs sales, which accounted for approximately

21%, 18% and 40% of its total revenues for the fiscal years ended September 30, 2020, 2021 and 2022, respectively, and 58% for the six

months ended March 31, 2023. The revenue from e-bicycles sales accounted for approximately 73%, 78% and 54% of its total revenues for

the fiscal years ended September 30, 2020, 2021 and 2022, respectively, and 34% for the six months ended March 31, 2023. For the fiscal

years ended September 30, 2020, 2021 and 2022, and for the six months ended March 31, 2023, as the self-developed smart charging piles

for e-bicycles and other electronic devices have not yet entered into large-scale production and sales, the revenue from this business

accounted for a small proportion of EZGO’s total revenues. For the fiscal year ended September 30, 2022 and the six months ended

March 31, 2023, the revenue from our smart charging piles business accounted for 3% and 8%, respectively, of EZGO’s total revenues.

EZGO, through the

WFOE, the VIE and its subsidiaries in China, is committed to providing cost-effective and convenient solutions for short distance travelers

through the design, manufacture, rental and sale of high-quality e-bicycles, with lightweight and high endurance lithium batteries, to

meet different levels of consumer demand, and through the operation of smart charging piles in communities. EZGO, through the WFOE, the

VIE and its subsidiaries in China, also plans to launch its online 4S (which stands for Sale, Spare-part supply, after-sale Service and

Survey) services to enhance its sales capacity by combining its online sales portals and offline service and support channels.

Contractual

Arrangements and Corporate Structure

EZGO

was incorporated in the BVI on January 24, 2019. EZGO’s wholly owned subsidiary, EZGO HK, formerly known as Hong Kong JKC Group

Co., Limited, was incorporated in Hong Kong on February 13, 2019. EZGO HK, in turn, holds all of the capital stock of Changzhou EZGO,

formerly known as Changzhou Jiekai New Energy Technology Company, which was incorporated in China on June 12, 2019 and Changzhou Langyi

Electronic Technologies Co., Ltd. (“Changzhou Langyi”), which was incorporated in China on August 6, 2021. Changzhou EZGO

has obtained the contractual rights to determine the most significant economic activities of the VIE and also receives the majority of

the economic benefits of the VIE, through a series of contractual arrangements (the “VIE Agreements”). EZGO conducts its

business in the PRC primarily through the VIE and its subsidiaries, Changzhou Hengmao Power Battery Technology Co., Ltd. (“Hengmao

Power Battery”), Jiangsu Cenbird E-Motorcycle Technologies Co., Ltd. (“Jiangsu Cenbird”) and Changzhou Yizhiying IoT

Technologies Co., Ltd., (“Yizhiying IoT”) since EZGO, through contractual arrangements with the VIE, obtained the rights

to determine the most significant economic activities and also receives the majority of the economic benefits of the VIE beginning in

November 2019.

On

January 25, 2023, EZGO and Jiangsu EZGO New Energy Technologies Co., Ltd. entered into an equity transfer agreement, pursuant to which

Changzhou Sixun was acquired and became a wholly-owned subsidiary of Jiangsu EZGO New Energy Technologies Co., Ltd., an indirect wholly

owned subsidiary of EZGO. EZGO issued an aggregate of 7,667,943 Ordinary Shares to the sellers of Changzhou Sixun (the “Sellers”),

which had an aggregate value of RMB54,400,000 (approximately US$8,080,448 on January 25, 2023) and on February 22, 2023, EZGO paid

the sellers of Changzhou Sixun RMB5,000,000 (approximately US$726,238 on February 22, 2023) in cash in consideration for such purchase.

For more information on the acquisition of Changzhou Sixun, see our Reports of Foreign Private Issuer on Form 6-K furnished with the

SEC on January 26, 2023 and February 22, 2023, respectively, both of which are incorporated herein by reference. In order to address

an issue relating to corporate authorization of the issuance of the 7,667,943 Ordinary Shares to the Sellers under BVI law, the holders

of such Ordinary Shares surrendered their shares for no consideration on May 13, 2023 and resubscribed for 7,667,943 Ordinary Shares

on May 15, 2023. Changzhou Higgs Intelligent Technology Co., Ltd., the 60% subsidiary of Changzhou Sixun, is a national high-tech enterprise

focusing on the research and development, production and sales of programmable core components of controller, providing stable and reliable

electronic control system for automation equipment. On April 10, 2023, the VIE sold 100% of equity interest in Tianjin Jiahao Bicycle

Co., Ltd., a former wholly-owned subsidiary of the VIE, for an aggregate cash consideration of RMB 44 million (approximately US$6,454,831),

which payments are made in installments until May 10, 2025. On April 11, 2023, Yizhiying IoT sold 80% of equity interest of Tianjin Dilang

Technologies Co., Ltd., a PRC company of which Yizhiying IoT previously owned 80% of the equity interest, for an aggregate of cash consideration

of RMB 2,240,000 (approximately US$325,667).

As

a result of such series of contractual arrangements, EZGO and its subsidiaries become the primary beneficiary of the VIE for accounting

purposes and the VIE as a PRC consolidated entity under U.S. GAAP. We consolidate the financial results of the VIE and its subsidiaries

in our consolidated financial statements in accordance with U.S. GAAP. Neither we nor EZGO’s investors own any equity ownership

in, direct foreign investment in, or control through such ownership/investment of the VIE. These contractual arrangements have not been

tested in a court of law in the PRC. As a result, investors in EZGO’s Ordinary Shares are not purchasing an equity interest in

the VIE or its subsidiaries but instead are purchasing an equity interest in EZGO, the BVI holding company.

The

diagram below shows our corporate structure as of the date of this prospectus supplement, including the VIE and its subsidiaries. However,

investors are cautioned that the enforceability of such VIE Agreements has not been tested in a court of law. EZGO conducts operations

in China primarily through the VIE and its subsidiaries in China, and EZGO does not conduct any business on its own. The VIE structure

is used to provide investors with contractual exposure to foreign investment in China-based companies where Chinese law prohibits or

restricts direct foreign investment in the operating companies. Due to PRC legal restrictions on foreign ownership in internet-based

businesses, we do not have any equity ownership of the VIE, instead we receive the economic benefits of the VIE’s business operations

through certain contractual arrangements. As a result of such series of contractual arrangements, EZGO and its subsidiaries become the

primary beneficiary of the VIE for accounting purposes and the VIE as a PRC consolidated entity under U.S. GAAP. We consolidate the financial

results of the VIE and its subsidiaries in our consolidated financial statements in accordance with U.S. GAAP. Neither we nor EZGO’s

investors own any equity ownership in, direct foreign investment in, or control through such ownership/investment of the VIE. Investors

are purchasing an interest in EZGO, the BVI holding company.

Contractual

Arrangements with the VIE and Its Shareholders

Due

to PRC legal restrictions on foreign ownership in internet-based businesses, neither we nor our subsidiaries own any equity interest

in the VIE. Instead, we receive the economic benefits of the VIE’s business operations through the VIE Agreements. Changzhou EZGO,

the VIE and its equity holders entered into the VIE Agreements on November 8, 2019. The VIE Agreements are designed to provide Changzhou

EZGO with contractual rights, and obligations, including certain control rights and the rights in the assets, property and revenue of

the VIE, to (i) determine the most significant economic activities of the VIE, (ii) receive the majority of the economic benefits of

the VIE, most importantly the ability to consolidate the financial statements of the VIE with the financial statements of our holding

company, EZGO under U.S. GAAP, for which we are the primary beneficiary of the VIE for accounting purposes, and (iii) have an exclusive

option to purchase or designate any third party to purchase all or part of the equity interests in and assets of the VIE when and to

the extent permitted by PRC law. However, The VIE Agreements may not be as effective as direct ownership in providing us with control

over the VIE and its subsidiaries, and the enforceability of the VIE Agreements has not been tested in a court of law, and the PRC government

may take actions to exert more oversight and control over offerings by China based issuers conducted overseas and/or foreign investment

in such companies, or could disallow the VIE Agreements, which would likely result in a material change in EZGO’s operations primarily

through the VIE and its subsidiaries in China and/or a material change in the value of the securities we have registered for sale, including

that it could cause the value of EZGO’s securities could to significantly decline or become worthless. Specifically, the legal

environment in the PRC is not as developed as in other jurisdictions, such as the United States. As a result, uncertainties in the PRC

legal system could limit our ability, as a BVI holding company, to enforce these contractual arrangements and doing so may be quite costly.

There are also substantial uncertainties regarding the interpretation and application of current and future PRC laws, regulations and

rules regarding the status of the rights of Changzhou EZGO with respect to its contractual arrangements with the VIE and its shareholders.

It is uncertain whether any new PRC laws or regulations relating to variable interest entity structure will be adopted or if adopted,

what they would provide. If we or the VIE are found to be in violation of any existing or future PRC laws or regulations, or fail to

obtain or maintain any of the required permits or approvals, the relevant PRC regulatory authorities would have broad discretion to take

action in dealing with such violations or failures. In addition, the enforceability of the various contracts described above by our company

against the VIE is dependent upon the shareholders of the VIE. If the shareholders of the VIE fail to perform their obligations under

the contractual arrangements, we could be unable to enforce the contractual arrangements that enable us to consolidate the VIE’s

operations and financial results in our financial statements in accordance with U.S. GAAP as the primary beneficiary. If this happens,

we would need to deconsolidate the VIE. The majority of our assets, including the necessary licenses to conduct business in China are

held by the VIE and its subsidiaries and a significant part of our revenues are generated by the VIE and its subsidiaries. An event that

results in the deconsolidation of the VIE would have a material effect on EZGO’s operations primarily through the VIE and its subsidiaries

in China and result in the value of its securities diminishing substantially or even become worthless. For a detailed description of

the risks associated with our corporate structure, please refer to risks disclosed under “Item 3. Key Information—D. Risk

Factors—Risks Related to Our Corporate Structure” on

page 45 of the 2022 Annual Report.

As

a result of our direct ownership in Changzhou EZGO and the contractual arrangements with the VIE, we are regarded as the primary beneficiary

of Jiangsu EZGO, and we treat the VIE as our consolidated variable interest entity under U.S. GAAP, which generally refers to an entity

in which we do not have any equity interests but whose financial results are consolidated into our consolidated financial statements

in accordance with U.S. GAAP because we have a controlling financial interest in, and thus are the primary beneficiary of, that entity.

We have consolidated the financial results of the VIE and its subsidiaries in our consolidated financial statements in accordance with

U.S. GAAP.

Each

of the VIE Agreements is described in detail below and each of which is currently in full force and effect:

Exclusive

Management Consulting and Technical Service Agreement

Pursuant

to the Exclusive Management Consulting and Technical Service Agreement, dated November 8, 2019, between Changzhou EZGO and the VIE (the

“VIE Exclusive Management Agreement”), the VIE agrees to engage Changzhou EZGO as its exclusive provider of management consulting,

technical support, intellectual property license and relevant services, including all services within the VIE’s business scope

and decided by Changzhou EZGO from time to time as necessary. The VIE pays to Changzhou EZGO service fees within three months after each

fiscal year end. The service fees are set at 95% (or a percentage adjusted by Changzhou EZGO in its sole discretion) of the after-tax

profit after the deficit of the prior fiscal year is covered and the statutory common reserve is extracted. Changzhou EZGO exclusively

owns any intellectual property arising from the performance of the VIE Exclusive Management Agreement. The VIE Exclusive Management Agreement

is effective for twenty years unless earlier terminated as set forth in the agreement or other written agreements entered into by the

parties thereto. The VIE Exclusive Management Agreement shall be extended automatically at the end of its term, until Changzhou EZGO’s

business term or the VIE’s business term expires, unless otherwise notified by Changzhou EZGO in writing. During the term of the

VIE Exclusive Management Agreement, the VIE may not terminate the VIE Exclusive Management Agreement except in the case of Changzhou

EZGO’s gross negligence or fraud, or VIE Exclusive Management Agreement or applicable PRC laws provide otherwise. Changzhou EZGO

may terminate the VIE Exclusive Management Agreement by 30-day written notice to the VIE at any time.

Equity

Pledge Agreement

Pursuant

to the Equity Pledge Agreement, dated November 8, 2019, among Changzhou EZGO, the VIE and the equity holders of the VIE (the “VIE

Equity Pledge Agreement”), the equity holders of the VIE have pledged 100% of their equity interests in the VIE to Changzhou EZGO

to guarantee performance of all obligations under the VIE Exclusive Management Agreement, the VIE Loan Agreement (defined hereafter),

the VIE Exclusive Call Option Agreement (defined hereafter) and the VIE Proxy Agreement (defined hereafter). If any event of default

as provided for therein occurs, Changzhou EZGO, as the pledgee, will be entitled to dispose of the pledged equity interests according

to applicable PRC laws. On November 28, 2019, Changzhou EZGO, the VIE and all its equity holders completed the registration of the equity

pledge with the relevant office of State Administration of Market Regulation (“SAMR”, formerly known as State Administration

for Industry and Commerce, or the SAIC) in accordance with the PRC Property Rights Law.

Exclusive

Call Option Agreement

Pursuant

to the Exclusive Call Option Agreement, dated November 8, 2019, among Changzhou EZGO, the VIE and the equity holders of the VIE (the

“VIE Exclusive Call Option Agreement”), each of the equity holders of the VIE has irrevocably granted Changzhou EZGO an exclusive

option to purchase, or to designate other persons to purchase, to the extent permitted by applicable PRC laws, rules and regulations,

all of the equity interests and assets in the VIE from its equity holders. The equity holders of the VIE agree that, without the prior

written consent of Changzhou EZGO, they will not dispose of their equity interests in the VIE or create or allow any encumbrance on their

equity interests. The purchase price for the equity interest is to be the minimum price permitted by applicable PRC laws, rules and regulations,

or the amount that the equity holders actually pay to the VIE regarding the equity, whichever is lower. The purchase price for the assets

is to be the minimum price permitted by applicable PRC laws, rules and regulations, or the net book value of the assets, whichever is

lower. The VIE Exclusive Call Option Agreement expires when all the equity interests or all the assets are transferred pursuant to the

agreement.

Proxy

Agreement

Pursuant

to the Proxy Agreement, dated November 8, 2019, among Changzhou EZGO, the VIE and each of equity holders of the VIE (the “VIE Proxy

Agreement”), each of the equity holders irrevocably authorizes Changzhou EZGO to exercise his or her rights as an equity holder

of the VIE, including the right to attend equity holders meetings, to exercise voting rights and to transfer all or a part of his or

her equity interests therein pursuant to the VIE Exclusive Call Option Agreement. During the term of the VIE Proxy Agreement, the VIE

and all its equity holders may not terminate the VIE Proxy Agreement except when the VIE Proxy Agreement or applicable PRC laws provide

otherwise.

Loan

Agreement

Pursuant

to the Loan Agreement, dated November 8, 2019 (the “VIE Loan Agreement”), Changzhou EZGO agrees to provide the VIE with loans

of different amounts at an annual interest rate of 24% according to the VIE’s needs from time to time. The term of each loan is

20 years, which can be extended with the written consent of both parties. During the term of the loan or the extended term of the loan,

the VIE may not prepay any loan without the written consent of Changzhou EZGO while in case of certain circumstances, the VIE must repay

the loan in advance upon Changzhou EZGO’s written request.

Spousal

Consent Letter

The

spouses of individual equity holders of the VIE have each signed a spousal consent letter. Under the spousal consent letter, the signing

spouse unconditionally and irrevocably has agreed to the execution by his or her spouse of the VIE Equity Pledge Agreement, the VIE Exclusive

Call Option Agreement and the VIE Proxy Agreement, and that his or her spouse may perform, amend or terminate such agreements without

his or her consent. In addition, in the event that the spouse obtains any equity interest in the VIE held by his or her spouse for any

reason, he or she agrees to be bound by and sign any legal documents substantially similar to the contractual arrangements entered into

by his or her spouse, as may be amended from time to time.

Through

the current contractual arrangements, we have established a contractual relationship with all equity holders of the VIE. Pursuant to

these agreements, all equity holders of the VIE have irrevocably authorized Changzhou EZGO to exercise voting rights and all other rights

as the equity holder and pledged all of his or her equity interests in the VIE to Changzhou EZGO as collateral to secure performance

of all of his or her obligations under these agreements. However, the equity holders of the VIE may have potential conflicts of interest

with us and may breach, or cause the VIE to breach, or refuse to renew, the existing contractual arrangements we have with them and the

VIE. Any failure by the VIE or equity holders of the VIE to perform his or her obligations under our contractual arrangements with them

would have a material adverse effect on EZGO’s business primarily through the VIE and its subsidiaries in China and financial condition.

See “Item 3. Key Information — D. Risk Factors — Risks Related to Our Corporate Structure”

on page 45 of the 2022 Annual Report.

Based

on the advice of our PRC counsel, DeHeng Law Offices (Shenzhen), that:

| ● | the

ownership structure of the VIE and Changzhou EZGO in China does not violate any applicable

PRC laws or regulations currently in effect; and |

| ● | the

contractual arrangements among Changzhou EZGO, the VIE and the VIE’s shareholders governed

by PRC law are valid, binding and enforceable in accordance with their terms and applicable

PRC laws or regulations currently in effect and do not and will not violate any applicable

PRC laws or regulations currently in effect. |

However,

there are substantial uncertainties regarding the interpretation and application of current and future PRC laws, regulations and rules,

and the VIE Agreements have not been tested in a court of law. Accordingly, we may incur substantial costs to enforce the terms of the

VIE Agreements, and the PRC regulatory authorities may in the future take a view that is contrary to or otherwise different from the

above opinion of our PRC legal counsel.

VIE

Financial Information

Set forth below is selected consolidated statements

of operations and cash flows for the six months ended March 31, 2023 and the fiscal years ended September 30, 2020, 2021 and 2022, and

selected balance sheet information as of March 31, 2023 and September 30, 2020, 2021 and 2022 showing financial information for the parent,

non-VIE subsidiaries, the WFOE, the VIE and VIE’s subsidiaries, eliminating entries and consolidated information (dollars in thousands).

In the tables below, the column headings correspond to the following entities in the organizational diagram on page S-3. See also VIE

and consolidated financial information in Note 1 of our financial statements.

| |

● |

“parent” refers to EZGO Technologies Ltd., a BVI business company; |

| |

● |

“non-VIE subsidiaries” refer to China EZGO Group Ltd.,

our wholly owned Hong Kong subsidiary, and its wholly-owned subsidiaries: (i) Changzhou Langyi Electronic Technology Co., Ltd. and (ii)

Jiangsu Langyi Import and Export Trading Co., Ltd, a wholly-owned PRC subsidiary; |

| |

● |

“WFOE and its subsidiaries” refers to Changzhou EZGO Enterprise Management Co., Ltd., our wholly owned PRC subsidiary, and its wholly owned subsidiaries, including: (i) Jiangsu EZGO Energy Supply Chain Technology Co., Ltd., (ii) Jiangsu EZGO New Energy Technologies Co., Ltd., (iii) Sichuan EZGO Energy Technologies Co., Ltd., (iv) Tianjin EZGO Electric Technologies Co., Ltd., (v) Changzhou Youdi Electric Bicycle Co., Ltd., (vi) Changzhou Sixun Technology Co., Ltd. and (vii) Changzhou Higgs Intelligent Technology Co., Ltd.; |

| |

● |

“VIE and its subsidiaries” refer to the sum of (i) Jiangsu EZGO Electronic Technologies, Co., Ltd., (ii) Changzhou Hengmao Power Battery Technology Co., Ltd., (iii) Changzhou Yizhiying IoT Technologies Co., Ltd., (iv) Jiangsu Cenbird E-Motorcycle Technologies Co., Ltd. and (v) Tianjin Dilang Technologies Co., Ltd., which was disposed in April 2023; and |

| ● | “VIE”

refers to Jiangsu EZGO Electronic Technologies, Co., Ltd. |

Consolidated

Statements of Operations Information

| | |

Six Months Ended March 31, 2023 | |

| | |

Parent | | |

Non-VIE

Subsidiaries | | |

WFOE and its Subsidiaries | | |

VIE and its

Subsidiaries | | |

Eliminations | | |

Consolidated | |

| | |

| | |

| | |

| | |

| | |

| | |

| |

| Revenue | |

$ | - | | |

$ | - | | |

$ | 1,181,439 | | |

$ | 3,980,259 | | |

$ | - | | |

$ | 5,161,698 | |

| Cost of revenue | |

| - | | |

| - | | |

| (988,612 | ) | |

| (3,991,073 | ) | |

| - | | |

| (4,979,685 | ) |

| Gross profit (loss) | |

| - | | |

| - | | |

| 192,827 | | |

| (10,814 | ) | |

| - | | |

| 182,013 | |

| Operating expenses | |

| (974,478 | ) | |

| (1,163 | ) | |

| (562,608 | ) | |

| (1,130,722 | ) | |

| - | | |

| (2,668,971 | ) |

| Loss from operations | |

| (974,478 | ) | |

| (1,163 | ) | |

| (369,781 | ) | |

| (1,141,536 | ) | |

| - | | |

| (2,486,958 | ) |

| Share of loss from subsidiaries | |

| (968 | ) | |

| (71,473 | ) | |

| - | | |

| - | | |

| 72,441 | | |

| - | |

| Other income (expense), net | |

| 3 | | |

| 3 | | |

| 257,223 | | |

| (2,399,975 | ) | |

| (407,061 | ) | |

| (2,549,807 | ) |

| Loss before income tax expenses (benefit) | |

| (975,443 | ) | |

| (72,633 | ) | |

| (112,558 | ) | |

| (3,541,511 | ) | |

| (334,620 | ) | |

| (5,036,765 | ) |

| Net loss | |

| (974,475 | ) | |

| (968 | ) | |

| (71,473 | ) | |

| (3,613,822 | ) | |

| (334,620 | ) | |

| (4,995,358 | ) |

| Less: net loss attributable to non-controlling interests | |

| - | | |

| - | | |

| - | | |

| (201,048 | ) | |

| - | | |

| (201,048 | ) |

| Net loss attributable to EZGO’s shareholders | |

| (974,475 | ) | |

| (968 | ) | |

| (71,473 | ) | |

| (3,412,774 | ) | |

| (334,620 | ) | |

| (4,794,310 | ) |

| | |

Fiscal

Year Ended September 30, 2022 | |

| | |

Parent | | |

Non-VIE

Subsidiaries | | |

WFOE

and its Subsidiaries | | |

VIE

and its

Subsidiaries | | |

Eliminations | | |

Consolidated | |

| | |

| | |

| | |

| | |

| | |

| | |

| |

| Revenue | |

$ | | | |

$ | 176,027 | | |

| 4,407,284 | | |

$ | 12,805,906 | | |

$ | | | |

$ | 17,389,217 | |

| Cost

of revenue | |

| | | |

| (170,454 | ) | |

| (4,042,002 | ) | |

| (12,957,722 | ) | |

| - | | |

| (17,170,178 | ) |

| Gross

profit | |

| | | |

| 5,573 | | |

| 365,282 | | |

| (151,816 | ) | |

| - | | |

| 219,039 | |

| Operating

expenses | |

| (1,449,339 | ) | |

| (14,993 | ) | |

| (1,095,508 | ) | |

| (4,121,806 | ) | |

| - | | |

| (6,681,646 | ) |

| Loss

from operations | |

| (1,449,339 | ) | |

| (9,420 | ) | |

| (730,226 | ) | |

| (4,273,622 | ) | |

| - | | |

| (6,462,607 | ) |

| Share

of loss from subsidiaries | |

| (157,105 | ) | |

| (149,440 | ) | |

| - | | |

| - | | |

| 306,545 | | |

| - | |

| Other

income (expense), net | |

| 327 | | |

| (265 | ) | |

| 533,977 | | |

| (931,538 | ) | |

| - | | |

| (397,499 | ) |

| Loss

before income tax expenses (benefit) | |

| (1,606,117 | ) | |

| (159,124 | ) | |

| (196,249 | ) | |

| (5,205,160 | ) | |

| 306,545 | | |

| (6,860,106 | ) |

| Net

loss | |

| (1,606,117 | ) | |

| (157,105 | ) | |

| (149,440 | ) | |

| (5,862,713 | ) | |

| 306,545 | | |

| (7,468,830 | ) |

Less:

net loss attributable to

non-controlling interests | |

| - | | |

| - | | |

| - | | |

| (1,005,032 | ) | |

| - | | |

| (1,005,032 | ) |

| Net

loss attributable to EZGO’s shareholders | |

| (1,606,117 | ) | |

| (157,105 | ) | |

| (149,440 | ) | |

| (4,857,681 | ) | |

| 306,545 | | |

| (6,463,798 | ) |

| | |

Fiscal

Year Ended September 30, 2021 | |

| | |

Parent | | |

Non-VIE

Subsidiaries | | |

WFOE

and its Subsidiaries | | |

VIE

and its

Subsidiaries | | |

Eliminations | | |

Consolidated | |

| | |

| | |

| | |

| | |

| | |

| | |

| |

| Revenue | |

$ | - | | |

$ | - | | |

| 3,793,146 | | |

$ | 19,628,860 | | |

$ | - | | |

$ | 23,422,006 | |

| Cost of revenue | |

| - | | |

| - | | |

| (3,604,878 | ) | |

| (19,434,650 | ) | |

| - | | |

| (23,039,528 | ) |

| Gross profit | |

| - | | |

| - | | |

| 188,268 | | |

| 194,210 | | |

| - | | |

| 382,478 | |

| Operating expenses | |

| (495,835 | ) | |

| (1,964 | ) | |

| (70,278 | ) | |

| (3,691,820 | ) | |

| - | | |

| (4,259,897 | ) |

| (Loss) income from operations | |

| (495,835 | ) | |

| (1,964 | ) | |

| 117,990 | | |

| (3,497,610 | ) | |

| - | | |

| (3,877,419 | ) |

| Share of loss from subsidiaries | |

| (203,744 | ) | |

| (205,707 | ) | |

| - | | |

| - | | |

| 409,451 | | |

| - | |

| Other income (expense),

net | |

| 279 | | |

| - | | |

| 156,368 | | |

| (75,873 | ) | |

| - | | |

| 80,774 | |

| Loss before income tax expenses

(benefit) | |

| (699,300 | ) | |

| (207,671 | ) | |

| 274,358 | | |

| (3,573,483 | ) | |

| 409,451 | | |

| (3,796,645 | ) |

| Net loss | |

| (699,300 | ) | |

| (203,744 | ) | |

| (205,707 | ) | |

| (2,714,344 | | |

| 409,451 | | |

| (3,413,644 | ) |

Less: net loss attributable

to

non-controlling interests | |

| - | | |

| - | | |

| - | | |

| (434,971 | ) | |

| - | | |

| (434,971 | ) |

| Net loss attributable to

EZGO’s shareholders | |

| (699,300 | ) | |

| (203,744 | ) | |

| (205,707 | ) | |

| (2,279,373 | ) | |

| 409,451 | | |

| (2,978,673 | ) |

| | |

Fiscal

Year Ended September 30, 2020 | |

| | |

Parent | | |

Non-VIE

Subsidiaries | | |

WFOE and its Subsidiaries | | |

VIE

and its

Subsidiaries | | |

Eliminations | | |

Consolidated | |

| | |

| | |

| | |

| | |

| | |

| | |

| |

| Third-party revenues | |

$ | - | | |

$ | - | | |

| - | | |

$ | 15,243,282 | | |

$ | - | | |

$ | 15,243,282 | |

| Inter-company consulting and services

revenues | |

| - | | |

| - | | |

| 116,190 | | |

| - | | |

| (116,190 | ) | |

| - | |

| Third-party costs of Revenue | |

| - | | |

| - | | |

| - | | |

| (13,704,248 | ) | |

| - | | |

| (13,704,248 | ) |

| Inter-company consulting and services

costs | |

| - | | |

| - | | |

| - | | |

| (116,190 | ) | |

| 116,190 | | |

| - | |

| Gross profit | |

| - | | |

| - | | |

| 116,190 | | |

| 1,422,844 | | |

| - | | |

| 1,539,034 | |

| Operating expenses | |

| - | | |

| - | | |

| - | | |

| (1,467,068 | ) | |

| - | | |

| (1,467,068 | ) |

| Income from operations | |

| - | | |

| - | | |

| 116,190 | | |

| (44,224 | ) | |

| - | | |

| 71,966 | |

| Share of income from subsidiaries | |

| 116,190 | | |

| 116,190 | | |

| - | | |

| - | | |

| (232,380 | ) | |

| - | |

| Other income, net | |

| - | | |

| - | | |

| - | | |

| 378,395 | | |

| - | | |

| 378,395 | |

| Income before income tax expenses | |

| 116,190 | | |

| 116,190 | | |

| 116,190 | | |

| 334,171 | | |

| (232,380 | ) | |

| 450,361 | |

| Net income | |

| 116,190 | | |

| 116,190 | | |

| 116,190 | | |

| 160,732 | | |

| (232,380 | ) | |

| 276,922 | |

Less: net income attributable to

non-controlling interests | |

| - | | |

| - | | |

| - | | |

| 129,748 | | |

| - | | |

| 129,748 | |

| Net income attributable to EZGO’s

shareholders | |

| 116,190 | | |

| 116,190 | | |

| 116,190 | | |

| 30,984 | | |

| (232,380 | ) | |

| 147,174 | |

Consolidated

Balance Sheets Information

| | |

As of March 31, 2023 | |

| | |

Parent | | |

Non-VIE

Subsidiaries | | |

WFOE and its Subsidiaries | | |

VIE and its

Subsidiaries | | |

Eliminations | | |

Consolidated | |

| | |

| | |

| | |

| | |

| | |

| | |

| |

| Amounts due from subsidiary of EZGO | |

$ | 16,161,400 | | |

$ | - | | |

$ | - | | |

$ | - | | |

$ | (16,161,400 | ) | |

$ | - | |

| Prepaid on behalf of VIE | |

| 2,947,954 | | |

| - | | |

| - | | |

| - | | |

| (2,947,954 | ) | |

| - | |

| Amount due from VIE and its subsidiaries | |

| - | | |

| - | | |

| 12,813,792 | | |

| - | | |

| (12,813,792 | ) | |

| - | |

| Service fee receivable from VIE | |

| - | | |

| - | | |

| 116,190 | | |

| - | | |

| (116,190 | ) | |

| - | |

| Amount due from non-VIE subsidiaries | |

| - | | |

| - | | |

| 1,238 | | |

| 746 | | |

| (1,984 | ) | |

| - | |

| Amount due from WFOE and its subsidiaries | |

| 22,400,000 | | |

| - | | |

| - | | |

| 13,407,132 | | |

| (35,807,132 | ) | |

| - | |

| Amount due from EZGO | |

| - | | |

| - | | |

| - | | |

| 857,692 | | |

| (857,692 | ) | |

| - | |

| Current assets | |

| 49,622,632 | | |

| 352 | | |

| 37,859,669 | | |

| 28,575,812 | | |

| (75,890,636 | ) | |

| 40,167,829 | |

| Amount due to VIE and its subsidiaries | |

| (857,692 | ) | |

| (746 | ) | |

| (13,407,132 | ) | |

| - | | |

| 14,265,570 | | |

| - | |

| Amount due to WFOE and its subsidiaries | |

| - | | |

| (1,238 | ) | |

| - | | |

| (12,813,792 | ) | |

| 12,815,030 | | |

| - | |

| Service fee payable to WFOE | |

| - | | |

| - | | |

| - | | |

| (116,190 | ) | |

| 116,190 | | |

| - | |

| Amount due to EZGO | |

| - | | |

| (16,161,400 | ) | |

| (22,400,000 | ) | |

| (2,947,954 | ) | |

| 41,509,354 | | |

| - | |

| Working capital | |

| 48,763,939 | | |

| (16,163,033 | ) | |

| (7,854,432 | ) | |

| 13,339,525 | | |

| (12,920,705 | ) | |

| 25,165,294 | |

| Investment in equity-owned subsidiaries | |

| - | | |

| 15,422,138 | | |

| - | | |

| - | | |

| (15,422,138 | ) | |

| - | |

| Assets | |

| 49,622,632 | | |

| 16,156,810 | | |

| 61,136,238 | | |

| 33,082,425 | | |

| (92,046,636 | ) | |

| 67,951,469 | |

| | |

As

of September 30, 2022 | |

| | |

Parent | | |

Non-VIE

Subsidiaries | | |

WFOE and its Subsidiaries | | |

VIE

and its

Subsidiaries | | |

Eliminations | | |

Consolidated | |

| | |

| | |

| | |

| | |

| | |

| | |

| |

| Amounts due from subsidiary

of EZGO | |

$ | 16,161,400 | | |

$ | - | | |

$ | - | | |

$ | - | | |

$ | (16,161,400 | ) | |

$ | - | |

| Prepaid on behalf of VIE | |

| 3,014,680 | | |

| - | | |

| - | | |

| - | | |

| (3,014,680 | ) | |

| - | |

| Amount due from VIE and its subsidiaries | |

| - | | |

| - | | |

| 12,370,844 | | |

| - | | |

| (12,370,844 | ) | |

| - | |

| Service fee receivable from VIE | |

| - | | |

| - | | |

| 116,190 | | |

| - | | |

| (116,190 | ) | |

| - | |

| Amount due from non-VIE subsidiaries | |

| - | | |

| - | | |

| 5,971,687 | | |

| 704 | | |

| (5,972,391 | ) | |

| - | |

| Loan from WFOE | |

| 8,000,000 | | |

| - | | |

| | | |

| 7,589,951 | | |

| (15,589,951 | ) | |

| - | |

| Amount due from EZGO | |

| - | | |

| - | | |

| - | | |

| 417,138 | | |

| (417,138 | ) | |

| - | |

| Current assets | |

| 27,278,299 | | |

| 5,789,274 | | |

| 30,210,861 | | |

| 17,434,133 | | |

| (47,558,531 | ) | |

| 33,154,036 | |

| Amount due to VIE and its subsidiaries | |

| (417,138 | ) | |

| (704 | ) | |

| (7,589,951 | ) | |

| - | | |

| 8,007,794 | | |

| - | |

| Amount due to WFOE | |

| - | | |

| (5,971,687 | ) | |

| - | | |

| (12,370,844 | ) | |

| 18,342,531 | | |

| - | |

| Service fee payable to WFOE | |

| - | | |

| - | | |

| - | | |

| (116,190 | ) | |

| 116,190 | | |

| - | |

| Amount due to EZGO | |

| - | | |

| (16,161,400 | ) | |

| (8,000,000 | ) | |

| (3,014,680 | ) | |

| 27,176,080 | | |

| - | |

| Working capital | |

| 26,773,478 | | |

| (16,904,159 | ) | |

| 14,651,312 | | |

| (5,334,798 | ) | |

| - | | |

| 19,185,833 | |

| Investment in equity-owned subsidiaries | |

| - | | |

| 15,604,043 | | |

| - | | |

| - | | |

| (15,604,043 | ) | |

| - | |

| Assets | |

| 27,278,299 | | |

| 21,803,156 | | |

| 27,446,730 | | |

| 31,327,603 | | |

| (93,502,243 | ) | |

| 14,353,546 | |

| | |

As

of September 30, 2021 | |

| | |

Parent | | |

Non-VIE

Subsidiaries | | |

WFOE and its Subsidiaries | | |

VIE

and its

Subsidiaries | | |

Eliminations | | |

Consolidated | |

| | |

| | |

| | |

| | |

| | |

| | |

| |

| Amounts due from subsidiary

of EZGO | |

$ | 15,853,200 | | |

$ | - | | |

| - | | |

$ | - | | |

$ | (15,853,200 | ) | |

$ | - | |

| Prepaid on behalf of VIE | |

| 3,017,337 | | |

| - | | |

| - | | |

| - | | |

| (3,017,337 | ) | |

| - | |

| Amount due from VIE | |

| - | | |

| - | | |

| 13,323,711 | | |

| | | |

| (13,323,711 | ) | |

| - | |

| Service fee receivable from VIE | |

| - | | |

| - | | |

| 116,190 | | |

| - | | |

| (116,190 | ) | |

| - | |

| Amount due from Non-VIE | |

| - | | |

| - | | |

| | | |

| 1,914,828 | | |

| (1,914,828 | ) | |

| - | |

| Amount due from EZGO | |

| - | | |

| - | | |

| | | |

| 316,524 | | |

| (316,524 | ) | |

| - | |

| Current assets | |

| 20,145,974 | | |

| 7,831 | | |

| 18,187,550 | | |

| 23,880,044 | | |

| (34,541,789 | ) | |

| 27,679,610 | |

| Amount due to VIE | |

| (316,524 | ) | |

| - | | |

| (1,914,828 | ) | |

| - | | |

| 2,231,352 | | |

| - | |

| Amount due to non-VIE | |

| - | | |

| - | | |

| | | |

| (13,323,711 | ) | |

| 13,323,711 | | |

| - | |

| Service fee payable to WFOE | |

| - | | |

| - | | |

| - | | |

| (116,190 | ) | |

| 116,190 | | |

| - | |

| Amount due to EZGO | |

| - | | |

| (15,853,200 | ) | |

| | | |

| (3,017,337 | ) | |

| 18,870,537 | | |

| - | |

| Working capital | |

| 19,781,865 | | |

| (15,844,963 | ) | |

| 16,188,763 | | |

| (1,921,225 | ) | |

| - | | |

| 18,204,440 | |

| Investment in equity-owned subsidiaries | |

| - | | |

| 15,753,483 | | |

| | | |

| - | | |

| (15,753,483 | ) | |

| - | |

| Assets | |

| 20,145,974 | | |

| 15,761,314 | | |

| 18,187,547 | | |

| 38,212,105 | | |

| (50,295,270 | ) | |

| 42,011,670 | |

| | |

As

of September 30, 2020 | |

| | |

Parent | | |

Non-VIE

Subsidiaries | | |

WFOE and its Subsidiaries | | |

VIE

and its

Subsidiaries | | |

Eliminations | | |

Consolidated | |

| | |

| | |

| | |

| | |

| | |

| | |

| |

| Service fee receivable

from VIE | |

| - | | |

| - | | |

| 116,190 | | |

| - | | |

| (116,190 | ) | |

| - | |

| Current assets | |

| - | | |

| - | | |

| | | |

| 16,316,861 | | |

| - | | |

| 16,316,861 | |

| Service fee payable to WFOE | |

| - | | |

| - | | |

| - | | |

| (116,190 | ) | |

| 116,190 | | |

| - | |

| Working capital | |

| - | | |

| - | | |

| 116,190 | | |

| 9,528,018 | | |

| - | | |

| 9,644,208 | |

| Investment in equity-owned subsidiaries | |

| 116,190 | | |

| 116,190 | | |

| | | |

| - | | |

| (232,380 | ) | |

| - | |

| Assets | |

| 116,190 | | |

| 116,190 | | |

| 116,190 | | |

| 19,817,798 | | |

| (348,570 | ) | |

| 19,817,798 | |

Consolidated

Cash Flows Information

| | |

Six Months Ended March 31, 2023 | |

| | |

Parent | | |

Non-VIE

Subsidiaries | | |

WFOE and its Subsidiaries | | |

VIE and its

Subsidiaries | | |

Eliminations | | |

Consolidated | |

| | |

| | |

| | |

| | |

| | |

| | |

| |

| Total cash (used in) provided by operating activities | |

$ | (830,011 | ) | |

$ | (1,133 | ) | |

$ | (11,482,770 | ) | |

$ | 4,126,838 | | |

$ | - | | |

$ | (8,187,076 | ) |

| Amounts due from EZGO | |

| - | | |

| - | | |

| - | | |

| (440,554 | ) | |

| 440,554 | | |

| - | |

| Amounts due from non-VIE subsidiaries | |

| - | | |

| - | | |

| 358 | | |

| - | | |

| (358 | ) | |

| - | |

| Loan to Changzhou EZGO | |

| (14,400,000 | ) | |

| - | | |

| - | | |

| (5,459,168 | ) | |

| 19,859,168 | | |

| - | |

| Net cash outflow due to acquisition of Changzhou Sixun | |

| - | | |

| - | | |

| (578,629 | ) | |

| - | | |

| - | | |

| (578,629 | ) |

| Net cash inflow from disposal of a subsidiary | |

| - | | |

| - | | |

| - | | |

| 2,579,717 | | |

| - | | |

| 2,579,717 | |

| Others(1) | |

| - | | |

| - | | |

| (10,241,453 | ) | |

| (54,904 | ) | |

| - | | |

| (10,296,357 | ) |