UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM

6-K

REPORT OF FOREIGN PRIVATE ISSUER

PURSUANT TO RULE 13a-16 OR 15d-16 UNDER

THE SECURITIES EXCHANGE ACT OF 1934

For the month of February 2024

Commission File Number: 001-33768

FANHUA

INC.

60/F, Pearl River Tower

No.15 West Zhujiang Road

Tianhe District, Guangzhou 510623

People’s Republic of China

(Address of principal executive offices)

Indicate by check mark whether the registrant files or will file annual

reports under cover of Form 20-F or Form 40-F.

Form

20-F ☒ Form 40-F ☐

SIGNATURE

Pursuant to the requirements of the Securities

Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto duly authorized.

| |

Fanhua Inc. |

| |

|

|

| |

By: |

/s/Yinan Hu |

| |

Name: |

Yinan Hu |

| |

Title: |

Chief Executive Officer |

Date: February 20, 2024

Exhibit Index

2

Exhibit 99.1

IR-387

FANHUA Announces Supplementary

Agreement to Strategic Framework Agreement with White Group and Board Changes

GUANGZHOU, China, February 21,

2024 (GLOBE NEWSWIRE) -- FANHUA Inc. (“FANHUA” or the “Company”) (Nasdaq: FANH), a leading independent financial

services provider in China, today announces the signing of the first supplementary agreement with Singapore White Group Pte. Ltd. (“White

Group”) to the framework strategic agreement previously disclosed on February 2, 2024. Pursuant to the agreement, both parties agree

to the following matters:

1. White Group will inject assets

into FANHUA aimed at assisting FANHUA in driving its artificial intelligence (“AI”) development and international expansion

by setting new offices in Singapore, Vietnam, Europe, the United States and Hong Kong.

2. White Group and its partnerships

will invest up to US$500 million in FANHUA.

3. The main objective of the

parties is to explore investments in the following high-quality assets:

An Asia-based telehealth solution

provider that had one of the largest number of patient consultations per day in the Asia-Pacific region in 2023, connecting approximately

approximately 2000 reputable doctors, 600 clinics, and over one million users across the Asia-Pacific region, with over 100,000 monthly

teleconsultations; and

An AI Humanoid hardware manufacturer

with multiple development facilities throughout the world, including China, Japan, the United States and Europe. It has world-leading,

medical-grade, AI Humanoid robots that can be applied in various fields such as medical research, home care, and elderly care.

Furthermore, with the approval

of the board of directors of FANHUA (the “Board”), Mr. Peh Chin Hua has been appointed to serve as the Chairman of FANHUA

with immediate effect. Meanwhile, Mr. Yinan Hu and Mr. Ben Lin have resigned as co-chairmen. Mr. Hu will assume the position of vice Chairman

and Chief Executive Officer of FANHUA while Mr. Lin will continue to serve as a director and chief strategy officer of FANHUA.

Mr. Peh Chin Hua, born in 1947,

is a Singaporean entrepreneur and former Member of Parliament for 13 years. With 29 years of active contributions to Singapore’s social

and political service, he received the National Day Public Service Medal. After retiring from politics in 2001, Mr. Peh earned an Executive

MBA from NUS. He was formerly Managing Director of Shinglee Book Holdings, the founder and executive Chairman of Dragonland Group, a listed

company in Singapore, and the vice Chairman of TFC Bank Holdings in the United States and Chairman of NTUC Seacare Holding Ltd.

IR-387

As the founder and executive

Chairman of Singapore White Group, Mr. Peh has led numerous large-scale projects in major Chinese cities, focusing on real estate. His

ventures aim to create affordable housing, develop ecological cities, and contribute to economic growth in China. Additionally, the Group

has been investing in artificial intelligence technology projects with international company across the USA, China, Europe and Asia Pacific.

Mr. Peh Chin Hua, Chairman of

FANHUA said, “I am glad to join FANHUA as the Chairman of the Board. I look forward to working with the rest of the Board members

and the management team to guide FANHUA through this journey to achieve the best results for shareholders as FANHUA seeks to explore growth

opportunities in China and international markets leveraging the power of AI technology.”

Commenting on the strategic

cooperation, Mr. Yinan Hu, founder, Vice Chairman and Chief Executive Officer of FANHUA said, “We are delighted to have Mr. Peh

as FANHUA’s Chairman. Mr. Peh is an outstanding leader with vast experience in various industries including real estate, artificial

intelligence, healthcare, and financial services. His wisdom will guide us through our strategic transformation as we embark on a new

stage of development driven by artificial intelligence technology.”

He continued, “Leveraging

Artificial Intelligence and globalization are the optimal paths for all companies to move towards the future. The collaboration with White

Group will accelerate our journey towards the AI era, presenting us with the opportunity to become a top player in the application of

AI technology in providing family services including insurance, wealth management, education, health and elderly care, as well as family

office management. We have full confidence that FANHUA can transform itself as a global leader in its pioneering innovation partnerships.”

About White Group

White Group was established

in 2005. It is a privately-owned boutique investment and development firm based in Singapore. It is focused on acquiring, investing

in, and managing businesses that develop solutions in real estate, technology, and healthcare, among others. Its primary interest

is in China and Southeast Asia. Its investments seek to create long-term economic value for its partners.

About FANHUA

Established in 1998, FANHUA

is a leading comprehensive financial services provider in China, driven by digital technology and professional expertise, with a focus

on delivering family asset allocation services throughout the entire lifecycle for individual clients, while also providing a one-stop

support platform for individual agents and sales organizations.

IR-387

As of September 30, 2023, the

Company’s offline sales service network spans 31 provinces in China, comprising 673 sales service outlets, 91,098 agents, and more

than 2,215 claims adjustors. Through proprietary technological tools such as “FA APP” (formerly known as Lan Zhanggui) , “FANHUA

Policy Custody System”, and “RONS DOP”, the Company is dedicated to supporting agents in providing convenient services

to clients through technological means.

With an integrated online and

offline approach, the Company has provided services to more than 12 million individual clients. For the nine months ended September 30,

2023, FANHUA facilitated US$1.7 billion gross written premiums, with its net revenues reaching US$335.7 million, net income attributable

to shareholders of US$42.2 million and total assets of US$549.0 million.

Forward-looking Statements

This press release contains

statements of a forward-looking nature. These statements, including the statements relating to the Company’s future financial and

operating results, are made under the “safe harbor” provisions of the U.S. Private Securities Litigation Reform Act of 1995.

You can identify these forward-looking statements by terminology such as “will”, “expects”, “believes”,

“anticipates”, “intends”, “estimates” and similar statements. Among other things, management’s quotations

contain forward-looking statements. These forward-looking statements involve known and unknown risks and uncertainties and are based on

current expectations, assumptions, estimates and projections about FANHUA and the industry. Potential risks and uncertainties include,

but are not limited to, those relating to its ability to attract and retain productive agents, especially entrepreneurial agents, its

ability to maintain existing and develop new business relationships with insurance companies, its ability to execute its growth strategy,

its ability to adapt to the evolving regulatory environment in the Chinese insurance industry, its ability to compete effectively against

its competitors, quarterly variations in its operating results caused by factors beyond its control and macroeconomic conditions in China

and their potential impact on the sales of insurance products. Except as otherwise indicated, all information provided in this press release

speaks as of the date hereof, and FANHUA undertakes no obligation to update any forward-looking statements to reflect subsequent occurring

events or circumstances, or changes in its expectations, except as may be required by law. Although FANHUA believes that the expectations

expressed in these forward-looking statements are reasonable, it cannot assure you that its expectations will turn out to be correct,

and investors are cautioned that actual results may differ materially from the anticipated results. Further information regarding risks

and uncertainties faced by FANHUA is included in FANHUA’s filings with the U.S. Securities and Exchange Commission, including its

annual report on Form 20-F.

IR-387

For more information, please

contact:

FANHUA Inc.

Investor Relations

Tel: +86 (20) 8388-3191

Email: ir@fanhgroup.com

Source: FANHUA

Inc.

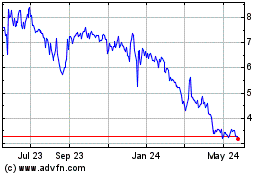

Fanhua (NASDAQ:FANH)

Historical Stock Chart

From Nov 2024 to Dec 2024

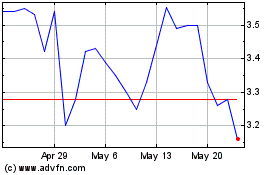

Fanhua (NASDAQ:FANH)

Historical Stock Chart

From Dec 2023 to Dec 2024