false

0000932781

0000932781

2024-11-05

2024-11-05

iso4217:USD

xbrli:shares

iso4217:USD

xbrli:shares

UNITED

STATES

SECURITIES

AND EXCHANGE COMMISSION

WASHINGTON,

D.C. 20549

FORM

8-K

CURRENT REPORT

PURSUANT TO

SECTION 13 OR 15(D) OF THE SECURITIES EXCHANGE ACT OF 1934

Date of Report

(Date of earliest event reported): November 5, 2024

First

Community Corporation

(Exact name

of registrant as specified in its charter)

South

Carolina

(State or other

jurisdiction of incorporation)

| 000-28344 |

57-1010751 |

| (Commission File Number) |

(IRS Employer Identification No.) |

| |

|

| 5455 Sunset Blvd, Lexington, South Carolina |

29072 |

| (Address of principal executive offices) |

(Zip Code) |

(803)

951-2265

(Registrant’s

telephone number, including area code)

Not

Applicable

(Former name

or former address, if changed since last report.)

Check the appropriate box below if

the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions

(see General Instruction A.2. below):

| ☐ |

Written communications pursuant

to Rule 425 under the Securities Act (17 CFR 230.425) |

| |

|

| ☐ |

Soliciting material pursuant to Rule 14a-12

under the Exchange Act (17 CFR 240.14a-12) |

| |

|

| ☐ |

Pre-commencement communications pursuant

to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| |

|

| ☐ |

Pre-commencement communications pursuant

to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

| |

|

Securities registered pursuant to

Section 12(b) of the Act:

| Title

of each class |

Trading

Symbol(s) |

Name

of exchange on which registered |

| Common

stock, par value $1.00 per share |

FCCO |

The

Nasdaq Stock Market |

Indicate by check mark whether the

registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter)

or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging

growth company ☐

If an emerging growth company, indicate

by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial

accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Item 7.01. Regulation FD Disclosure.

First Community Corporation (“First Community”) is furnishing

investor presentation materials as Exhibit 99.1 to this Form 8-K, which are to be used by First Community management in meetings with

investors on November 6-8, 2024 at the 2024 Hovde Group Financial Services Conference in Miami Beach, Florida.

The information in Items 7.01 and 9.01, including Exhibit 99.1, is furnished

to, and not filed with, the U.S. Securities and Exchange Commission.

Item 9.01. Financial Statements

and Exhibits.

(d) Exhibits

SIGNATURES

Pursuant

to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf

by the undersigned hereunto duly authorized.

| |

FIRST COMMUNITY CORPORATION |

| |

|

|

| |

By: |

/s/ D. Shawn Jordan |

| |

Name: |

D. Shawn Jordan |

| |

Title: |

Chief Financial Officer |

| |

|

|

| Dated: November 5, 2024 |

|

|

The Bank Behind Your Business November 2024

OUTLINE 2 I. Overview 3 II. 3Q24 Highlights / Topics of Interest 9 » Earning Assets 10 » Funding 15 » Net Interest Margin (NIM) 19 » Risk Management 24 » Capital 29 » Non - Interest Income Highlights 33 » Revenue 38 » Non - Interest Expense 41 » Net Income 44 Impacting Lives for Success and Significance

OVERVIEW Impacting Lives for Success and Significance

6 4

OUR IDENTITY 5

» Began in 1995 » Focused on Organic Growth, Augmented with Opportunistic Acquisitions ▪ 2004 – Newberry Federal ▪ 2006 – Bank of Camden ▪ 2008 – EAH Financial Planning Practice ▪ 2011 – Palmetto South Mortgage Corp. ▪ 2014 – Savannah River Financial Corp. ▪ 2017 – Cornerstone National Bank » Executive Leadership Team stability with leadership transition plan designed to be seamless » September 30, 2024 ▪ $1.9 billion total assets ▪ Twenty - one (21) banking offices ▪ Largest community bank in SC Midlands ▪ Fourth largest bank in SC » Dividends ▪ 91 Consecutive Quarters ▪ Current Yield – 2.53% 1 OVERVIEW Highlights 1 Based on 10/31/24 closing pricing of $23.74. 6

» Columbia (Midlands of SC) ▪ State Capitol ▪ University of SC ▪ Fort Jackson ▪ Quality Public Schools ▪ Lake Murray ▪ Riverbanks Zoo » Greenville (Upstate of SC) ▪ Great Pure Business Market ▪ Attractive to Millennials » Augusta (CSRA) ▪ Cybersecurity x Fort Gordon x Private Sector ▪ Augusta University ▪ Excellent Medical Community ▪ The Masters Tournament » Rock Hill (Piedmont) ▪ Winthrop University ▪ Lake Wylie ▪ Included in the Charlotte MSA ▪ Home of Sports & Event Center, as well as “Come - See - Me” & Christmasville Festivals Geographically Diverse and Growing Markets OVERVIEW 7

Three Lines of Business OVERVIEW 8

3Q24 HIGHLIGHTS / TOPICS OF INTEREST Impacting Lives for Success and Significance

EARNING ASSETS Impacting Lives for Success and Significance

Yield 4.36% 4.29% 4.43% 5.32% 5.73% Loan Portfolio LTM Growth = 9.6% 2 1 Includes PPP and related LOC to SBA partner. 2 Excludes PPP and related LOC to SBA partner. CRE as a % of RBC = 304.3% (4 th Quarter for 2020 - 2023 and 3 rd Quarter for 2024) $980.9 $1,134.0 $844.2 11 EARNING ASSETS $1,196.7 Composition 9/30/24 Millions $863.7

» 3Q24 $7.5 million 2.5% annualized growth rate » YTD 2024 $62.6 million 7.4% annualized growth rate Notes: » Percent of Growth : 3Q24 YTD24 ▪ CRE (57%) 30% ▪ C&I 20% 11% ▪ Residential Mortgage 128% 56% ▪ Other 9% 3% » Interest Rate Sensitivity (9/30/24) : ▪ Principal cash flows, including prepayment estimates 1 • 10/01/24 – 12/31/24 = $88.6 1 million at a weighted average rate of 5.63% • 2025 = $282.4 1 million at a weighted average rate of 5.39% 12 1 Excluding prepayments, 10/01/24 – 12/31/24 = $49.6 million and 2025 = $166.8 million. Loan Portfolio Growth EARNING ASSETS

Investment Portfolio Yield 1.98% 1.56% 2.78% 3.59% 3.53% AOCI/(AOCL) 1 $11.3 $3.3 ($32.4) ($28.2) ($23.2) (4 th Quarter for 2020 - 2023, and 3 rd Quarter for 2024) Average Life: 5.3 years Effective Duration: 3.4 Composition 9/30/24 $361.9 $564.8 $506.2 EARNING ASSETS Millions $486.8 13 $566.6 1 AOCI is accumulated other comprehensive income and (AOCL) is accumulated other comprehensive loss.

Notes: Mix (3Q24) : » Floating 32% » Fixed 68% Principal Cash Flows : » 10/01/24 – 12/31/24 $10.6 million » FY2025 $56.6 million 14 Investment Portfolio EARNING ASSETS

FUNDING Impacting Lives for Success and Significance

Total Deposit Cost 0.20% 0.11% 0.25% 1.69% 2.03% Non - Interest Bearing 32% 33% 33% 29% 27% Millions $1,230.3 $1,415.5 $1,454.1 $1,573.9 (4 th Quarter for 2020 - 2023 & 3 rd Quarter for 2024) 16 High Quality Deposit Franchise $1,711.0 FUNDING 12/31/2020 12/31/2021 12/31/2022 12/31/2023 09/30/2 024

3Q24 Notes: » 37.5% Cumulative Cycle Beta 1 – Cost of Deposits » 40.2% Cumulative Cycle Beta 1 – Cost of Funds » Uninsured deposits of $492.5 million (30.0% of total), of which $88.3 million (5.4% of total) are public funds that are secured or collateralized ▪ Average balance of customer deposits accounts - $24,281 ▪ Total remaining credit availability in excess of $505.0 million 2 17 High Quality Deposit Franchise FUNDING 1 Trough to peak. 2 Subject to collateral requirements.

18 YTD 2024 » Sources of funds (Millions) Customer Deposits $ 158.8 Customer Cash Management 4.1 Investment Portfolio 19.4 Capital 12.3 Other 7.1 Total $ 201.7 » Uses of funds Loans (includes held held - for - sale) $ 62.1 Short - Term Investments & CDs 77.6 Brokered CDs 25.7 FHLB Borrowings / FFP 36.3 Total $ 201.7 Summary: During 2024, we utilized customer deposit growth to fund loan growth , reduce wholesale funding and enhance our overnight liquidity . Sources and Uses FUNDING

NET INTEREST MARGIN Impacting Lives for Success and Significance

20 NET INTEREST MARGIN (NIM)

21 NET INTEREST MARGIN (NIM)

22 NET INTEREST MARGIN (NIM)

23 Notes: » NIM Inflection began 2Q24 » $12.0 Million Brokered CD • All - in cost of 5.15% • Called on October 31, 2024 » Effective May 5, 2023, entered into a pay - fixed /receive floating interest rate • Notional amount: $150 million • Synthetically converts approximately 13% of the Loan Portfolio from fixed to floating • Pay a fixed rate of 3.58% • Receive a floating rate of overnight SOFR • Matures on May 5, 2026 • 3Q24 Impact ▪ Interest Income $681 thousand ▪ Loan Portfolio Yield 23 bps ▪ Net Interest Margin 15 bps NET INTEREST MARGIN (NIM)

RISK MANAGEMENT Impacting Lives for Success and Significance

25 Credit Quality RISK MANAGEMENT NPA / Assets Net Charge - Offs (Recoveries)

26 Provision for (Release of) Credit Losses (000s omitted) Credit Quality RISK MANAGEMENT Allowance for Credit Losses on Loans to Loans

3Q24 Notes: » Key Loan Portfolio Sectors 27 • There are only four loans secured by office buildings in excess of 50,000 square feet of rentable space. These four represent $10.7 million in loans outstanding and have a 33% weighted average loan - to - value. Credit Quality RISK MANAGEMENT

28 RISK MANAGEMENT

CAPITAL Impacting Lives for Success and Significance

30 Leverage Ratio (Bank) Total Capital Ratio (Bank) CAPITAL *On 5/14/24, announced a plan to utilize up to $7.1 million of capital to repurchase shares of FCCO’s common stock (5.3% of total shareholders’ equity at the time of the announcement).

31 Tangible Book Value CAPITAL Tangible Common Equity

Dividend 32 CAPITAL

NON - INTEREST INCOME HIGHLIGHTS Impacting Lives for Success and Significance

Financial Planning / Investment Advisory Services AUM (millions) 34 NON - INTEREST INCOME HIGHLIGHTS

Financial Planning / Investment Advisory Services Revenue and Pre - Tax Income (thousands) 35 Pre - tax Profit Margin 29.7% 30.5% 33.9% 31.0% 32.8% NON - INTEREST INCOME HIGHLIGHTS

36 Residential Mortgage Banking Production (millions) NON - INTEREST INCOME HIGHLIGHTS $123.7 $107.2 $135.7

Pre - tax Profit Margin 31.6% 11.9% 3.6% 34.3% 59.4% Residential Mortgage Banking Revenue and Pre - Tax Income (000’s omitted) 37 $7,294.7 $ 5,327.8 $6,708.6 1 $3,763.8 1 $5,201.3 1 Note: Pre - tax net income does not include fund transfer pricing or ACL allocations. 1 Includes mortgage late charges and other mortgage revenue. NON - INTEREST INCOME HIGHLIGHTS

REVENUE Impacting Lives for Success and Significance

39 (Millions) $53.1 $56.2 $60.6 $59.5 Total Revenue 1, 2 Strength in Diversity of Revenue REVENUE 1 Adjusted for PPP deferred fees. 2 Adjusted for Securities Gains/Losses. 2 1 $48.6

40 (Thousands) $15,216 $16,982 $15,261 Total Revenue 1 Strength in Diversity of Revenue 1 Adjusted for Securities Gains/Losses. 1 $15,226 REVENUE $16,336

NON - INTEREST EXPENSE Impacting Lives for Success and Significance

NON - INTEREST EXPENSE 42 Non - interest Expense (Millions) $37.5 $39.2 $35.6 Notes: 2022 Opened new office – Rock Hill. $41.3 $43.1

NON - INTEREST EXPENSE 43 Non - interest Expense (Millions) $11.3 $12.0 NOTE: Closed downtown banking office at 771 Broad Street, Augusta, GA, as of June 27, 2024. Cost savings are estimated to be $327,000 annually going forward. $10.7 $11.8 $11.8

NET INCOME Impacting Lives for Success and Significance

1 Core net income and EPS exclude gains (losses) on sale of securities and bank premises, write - downs on bank premises held - for - sa le, non - recurring BOLI income, gains on insurance proceeds, and collection of summary judgements on two loans charged off at an FCCO acquired bank. S ee non - GAAP reconciliation on pages 48 and 49. 2 Includes $738 thousand in non - recurring PPP - related fee income. 3 Includes $2.955 million in non - recurring PPP - related fee income. 4 Includes $46 thousand in non - recurring PPP - related fee income. 5 This compares to YTD results of $9,423 thousand in Core Net Income and $1.23 in Core EPS. 6 This compares to YTD results of $11,623 thousand in pre - tax pre - provision earnings. Thousands Core Net Income 1 / Core EPS 1 / Pre - Tax Pre - Provision Earnings 45 NET INCOME 2 3 2 3 4 4 5 6

FORWARD - LOOKING STATEMENTS 46 SAFE HARBOR STATEMENT – In this presentation, unless the context suggests otherwise, references to the “Company” or “FCCO” refer to First Community Corporation and references to “we,” “us,” and “our” mean the combined business of the Company, First Community Bank (or FCB) and its wholly - owned subsidiaries . This presentation and other written reports and statements made by us and our management from time to time may contain forward - looking statements . These statements include, without limitation, statements regarding our operating philosophy, growth plans and opportunities, strategies and financial performance, industry and economic trends and estimates and assumptions underlying accounting policies . Words such as “believe,” “expect,” “anticipate,” “intend,” “target,” “estimate,” “focus,” “continue,” “positions,” “plan,” “predict,” “project,” “forecast,” “guidance,” “goal,” “objective,” “prospects,” “possible” or “potential,” by future conditional verbs such as “assume,” “will,” “would,” “should,” “could” or “may,” or by variations of such words or by similar expressions are intended to identify such forward - looking statements . These forward - looking statements are subject to numerous assumptions, risks and uncertainties, which change over time, are difficult to predict and are generally beyond our control . Although we believe that the assumptions underlying the forward - looking statements are reasonable, any of the assumptions could prove to be inaccurate . Therefore, we can give no assurance that the results contemplated in the forward - looking statements will be realized . The inclusion of this forward - looking information should not be construed as a representation by the Company or any other person that such future events, plans, or expectations will occur or be achieved . In addition to factors previously disclosed in the reports filed by us with the US Securities and Exchange Commission (the “SEC”), additional risks and uncertainties may include, but are not limited to : ( 1 ) competitive pressures among depository and other financial institutions may increase significantly and have an effect on pricing, spending, third - party relationships and revenues ; ( 2 ) the strength of the US economy in general and the strength of the local economies in which we conduct operations may be different than expected, including unemployment levels, supply chain disruptions, higher inflation, and slowdowns in economic growth ; ( 3 ) the rate of delinquencies and amounts of charge - offs, the level of allowance for credit loss, the rates of loan growth, or adverse changes in asset quality in our loan portfolio, which may result in increased credit risk - related losses and expenses ; ( 4 ) changes in legislation, regulation, policies, or administrative practices, whether by judicial, governmental, or legislative action ; ( 5 ) adverse conditions in the stock market, the public debt markets and other capital markets (including changes in interest rate conditions) could have a negative impact on the Company ; ( 6 ) technology and cybersecurity risks, including potential business disruptions, reputational risks, and financial losses, associated with potential attacks on or failures by our computer systems and computer systems of our vendors and other third parties ; ( 7 ) inflation and changes in the interest rate environment that reduce our margins or reduce the fair value of financial instruments ; and ( 8 ) the ultimate ramifications, if any, of the 2023 and 2024 bank failures with respect to increased regulatory supervision and any increases in the costs of doing business . Additional factors that could cause results to differ materially from those described in the forward - looking statements can be found in our reports (such as the annual report on Form 10 - K, quarterly reports on Form 10 - Q and current reports on Form 8 - K) filed with the SEC and available at the SEC’s internet site (http : //www . sec . gov) . All subsequent written and oral forward - looking statements by us or any person acting on our behalf is expressly qualified in its entirety by the cautionary statements above . The foregoing review of important factors should not be construed as exhaustive and should be read in conjunction with other cautionary statements that are included herein . We undertake no obligation to update or revise any forward - looking statement, whether as a result of new information, future events or otherwise, except as required by law .

NON - GAAP FINANCIAL MEASURES The Bank Behind Your Business 47 NON - GAAP FINANCIAL MEASURES – This presentation contains certain non - GAAP financial measures that are not in accordance with US generally accepted accounting principles (GAAP) . We use certain non - GAAP financial measures to provide meaningful, supplemental information regarding our operational results and to enhance investors’ overall understanding of our financial performance . The limitations associated with non - GAAP financial measures include the risk that persons might disagree as to the appropriateness of items comprising these measures and that different companies might calculate these measures differently . These disclosures should not be considered an alternative to our GAAP results . See the end of this presentation for a non - GAAP financial measures reconciliation to the most directly comparable GAAP financial measure .

NON - GAAP RECONCILIATION 48 The tables below provide a reconciliation of non - GAAP measures to GAAP for each of the periods indicated:

NON - GAAP RECONCILIATION 49 1 Excludes gains (losses) on sale of securities and bank premises, write - downs on bank premises held - for - sale, non - recurring BOLI income, gains on insuranc e proceeds, and collection of summary judgements on loans charged off at an FCCO acquired bank. The tables below provide a reconciliation of non - GAAP measures to GAAP for each of the periods indicated:

v3.24.3

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14a

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

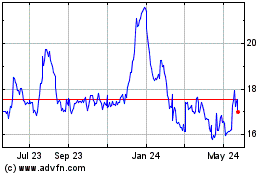

First Community (NASDAQ:FCCO)

Historical Stock Chart

From Nov 2024 to Dec 2024

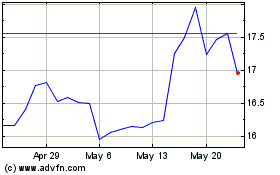

First Community (NASDAQ:FCCO)

Historical Stock Chart

From Dec 2023 to Dec 2024