UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

PURSUANT TO SECTION 13 OR 15(d) OF THE

SECURITIES EXCHANGE ACT OF 1934

Date of Report (Date of Earliest Event Reported): December 4, 2024

FREQUENCY ELECTRONICS, INC.

(Exact name of registrant as specified in its charter)

| Delaware | 1-8061 | 11-1986657 |

| (State or other jurisdiction | (Commission | (I.R.S. Employer |

| of incorporation) | File Number) | Identification No.) |

| 55 Charles Lindbergh Blvd., Mitchel Field, NY | 11553 |

| (Address of principal executive offices) | (Zip Code) |

(516) 794-4500

(Registrant's telephone number, including area code)

Not Applicable

(Former name or former address, if changed since last report)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (see General Instruction A.2. below):

☐ Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

☐ Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

☐ Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

☐ Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

Securities registered pursuant to Section 12(b) of the Act:

| Title of each class | Trading Symbol(s) | Name of each exchange on which registered |

| Common Stock (par value $1.00 per share) | FEIM | NASDAQ Global Market |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Item 5.02. Departure of Directors or Certain Officers; Election of Directors; Appointment of Certain Officers; Compensatory Arrangements of Certain Officers.

On December 4, 2024, the Board of Directors (the “Board”) of Frequency Electronics, Inc. (the “Company”) increased the size of the Board from four (4) to five (5) members and appointed Dr. Thomas McClelland, the Company’s Chief Executive Officer, to serve as a member of the Board, effective immediately. Dr. McClelland was not appointed to any committees of the Board.

There are no arrangements or understandings between Dr. McClelland and any other person pursuant to which he was appointed as a director, nor have there been any transactions in the past two years to which the Company or any of its subsidiaries was or is to be a party, in which he had or has an interest requiring disclosure under Item 404(a) of Regulation S-K of the Securities Exchange Act of 1934, as amended (the “Exchange Act”). As an executive officer of the Company, Dr. McClelland will not receive any additional compensation in connection with his service on the Board.

Item 7.01. Regulation FD Disclosure.

On December 5, 2024, the Company issued a press release announcing the appointment of Dr. McClelland to the Board. A copy of the press release is attached as Exhibit 99.1 to this Current Report on Form 8-K and incorporated into this Item 7.01 by reference.

In accordance with General Instruction B.2 of Form 8-K, the information in Item 7.01 of this Current Report on Form 8-K, including Exhibit 99.1 hereto, shall not be deemed “filed” for the purposes of Section 18 of the Exchange Act or otherwise subject to the liabilities of that section. The information in Item 7.01 of this Current Report on Form 8-K, including Exhibit 99.1 hereto, shall not be incorporated by reference into any filing or other document pursuant to the Securities Act of 1933, as amended, except as shall be expressly set forth by specific reference in such filing or document.

Item 9.01. Financial Statements and Exhibits.

(d) Exhibits.

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

|

|

FREQUENCY ELECTRONICS, INC.

|

|

|

|

|

|

|

|

|

|

|

|

|

|

By:

|

/s/ Steven Bernstein

|

|

|

|

|

Steven Bernstein

|

|

|

|

|

Chief Financial Officer, Secretary and Treasurer

|

|

Dated: December 5, 2024

false

0000039020

0000039020

2024-12-04

2024-12-04

Exhibit 99.1

PRESS RELEASE

Frequency Electronics, Inc. Announces Appointment of Tom McClelland to the Board of Directors

Mitchel Field, NY, December 5, 2024 – Frequency Electronics, Inc. (“FEI” or the “Company”) (NASDAQ-FEIM) today is pleased to announce the appointment of its Chief Executive Officer, Dr. Thomas McClelland, to the Company’s Board of Directors, effective immediately. Tom, a 40-year veteran of FEI, served as the Company’s Interim President and CEO from July 8, 2022 through January 17, 2023, and has served as permanent President and CEO since then. Prior to that, Tom served as FEI’s Chief Scientist and has led the Company’s research and scientific efforts for over 20 years. He is one of the foremost experts in precision timing and space-related applications. He has the highest level of security clearance with the U.S. government and holds a PhD in physics from Columbia University.

According to FEI Board Chair, General (ret) Lance W. Lord, “Tom has done an outstanding job leading FEI as its CEO for the past two years and we look forward to his continuing to do so. As we continue to position the Company to leverage its legacy market leadership in timing and space applications to take advantage of next-generation opportunities in quantum sensing, broadly proliferated small-satellite programs and alternate position, navigation and timing technologies, we believe that having Tom’s expertise at the board level will enable us to make the best long-term decisions to benefit our stockholders, customers and employees.”

Added Dr. McClelland, “I appreciate the Board’s appointment of me to the Board of Directors. The Board established the plan that moved FEI towards more consistent growth in revenue, profitability and cash generation, while still investing in next-generation programs that I believe position the Company for much continued success, and I look forward to working with the rest of the Board to build upon those efforts. FEI’s strategic importance in precision timing, space and secured communications is growing and I look forward to helping the Board make the best strategic decisions for the future of the Company.”

About Frequency Electronics

Frequency Electronics, Inc. (FEI) is a world leader in the design, development and manufacture of high precision timing, frequency generation and RF control products for space and terrestrial applications. FEI’s products are used in satellite payloads and in other commercial, government and military systems including C4ISR and electronic warfare, missiles, UAVs, aircraft, GPS, secure communications, energy exploration and wireline and wireless networks. FEI-Zyfer provides GPS and secure timing capabilities for critical military and commercial applications; FEI-Elcom Tech provides Electronic Warfare (“EW”) sub-systems and state-of-the-art RF and microwave products. FEI has received over 100 awards of excellence for achievements in providing high performance electronic assemblies for over 150 space and DOD programs. The Company invests significant resources in research and development to expand its capabilities and markets.

www.frequencyelectronics.com

FEI’s Mission Statement: “Our mission is to transform discoveries and demonstrations made in research laboratories into practical, real-world products. We are proud of a legacy which has delivered precision time and frequency generation products, for space and other world-changing applications that are unavailable from any other source. We aim to continue that legacy while adapting our products and expertise to the needs of the future. With a relentless emphasis on excellence in everything we do, we aim, in these ways, to create value for our customers, employees, and stockholders.”

Forward-Looking Statements

The statements in this press release regarding future earnings and operations and other statements relating to the future constitute “forward-looking statements” pursuant to the safe harbor provisions of the Private Securities Litigation Reform Act of 1995. Forward-looking statements inherently involve risks and uncertainties that could cause actual results to differ materially from the forward-looking statements. Factors that would cause or contribute to such differences include, but are not limited to, our inability to integrate operations and personnel, actions by significant customers or competitors, general domestic and international economic conditions, reliance on key customers, including the U.S. government, continued acceptance of the Company’s products in the marketplace, competitive factors, new products and technological changes, product prices and raw material costs, dependence upon third-party vendors, other supply chain related issues, increasing costs for materials, operating related expenses, competitive developments, changes in manufacturing and transportation costs, the availability of capital, the outcome of any litigation and arbitration proceedings, and failure to maintain an effective system of internal controls over financial reporting. The factors listed above are not exhaustive and should be read in conjunction with the other cautionary statements that are included in this release and in our filings with the Securities and Exchange Commission. The Company’s Annual Report on Form 10-K for the fiscal year ended April 30, 2024, filed on August 2, 2024 with the Securities and Exchange Commission includes additional factors that could materially and adversely impact the Company’s business, financial condition and results of operations, as such factors are updated from time to time in our periodic filings with the Securities and Exchange Commission, which are accessible on the Securities and Exchange Commission’s website at www.sec.gov. Moreover, the Company operates in a very competitive and rapidly changing environment. New factors emerge from time to time and it is not possible for management to predict the impact of all these factors on the Company’s business, financial condition or results of operations or the extent to which any factor, or combination of factors, may cause actual results to differ materially from those contained in any forward-looking statements. Given these risks and uncertainties, investors should not rely on forward-looking statements as a prediction of actual results. Any or all of the forward-looking statements contained in this press release and any other public statement made by the Company or its management may turn out to be incorrect. The Company expressly disclaims any obligation to update or revise any forward-looking statements, whether as a result of new information, future events or otherwise, except as required by law.

Contact information: Dr. Thomas McClelland, President and Chief Executive Officer;

Steven Bernstein, Chief Financial Officer;

TELEPHONE: (516) 794-4500 ext.5000 WEBSITE: www.freqelec.com

v3.24.3

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14a

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

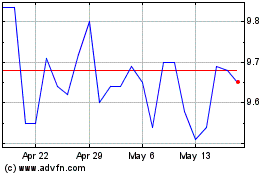

Frequency Electronics (NASDAQ:FEIM)

Historical Stock Chart

From Dec 2024 to Jan 2025

Frequency Electronics (NASDAQ:FEIM)

Historical Stock Chart

From Jan 2024 to Jan 2025