DevvStream Holdings Inc. (“

DevvStream” or the

“

Company”) (CBOE: DESG) (OTCQB: DSTRF) (FSE: CQ0),

a leading carbon credit project co-development and generation firm

specializing in technology-based solutions, is pleased to provide a

progress update since the execution of its business combination

agreement (the “Business Combination Agreement”) for a business

combination (the “Transaction” or the “Business Combination”) with

Focus Impact Acquisition Corp. (“Focus Impact”) (NASDAQ: FIAC),

which is expected to result in the securities of DevvStream being

listed for trade on the Nasdaq Stock Market LLC (“Nasdaq”). The

Transaction values DevvStream at an implied enterprise value of

approximately $212.8 million, representing an equity value of

C$2.16 per DevvStream subordinate voting share prior to closing.

Since executing the Business Combination Agreement, DevvStream

has completed its preparation of required financial statements,

prepared in accordance with U.S. GAAP and audited in compliance

with Public Company Accounting Oversight Board requirements, for

inclusion in the Registration Statement on Form S-4 to be filed by

Focus Impact with the Securities and Exchange Commission (“SEC”) in

the coming weeks registering the securities being issued in

connection with the Business Combination (the “Registration

Statement”), which Registration Statement will also contain a proxy

statement for the purpose of soliciting votes from the Focus Impact

shareholders to approve the Business Combination. The Business

Combination is expected to be completed by early Q1 2024, subject

to the satisfaction of closing conditions under the Business

Combination Agreement.

Learn more about the Company’s progress by joining a live

webinar presented by DevvStream and Focus Impact on Thursday,

October 26th at 9:30am PT / 12:30pm ET. Please register by clicking

on the following link:

https://event.webinarjam.com/register/248/q32nmsn2.

“Since DevvStream and Focus Impact agreed to merge, the

transaction has proceeded smoothly and efficiently,” said Sunny

Trinh, CEO of DevvStream. “Not only are the two teams well-aligned

in terms of culture, strategy, and vision, but they also bring

highly complementary areas of expertise to the relationship, making

the process of combining our businesses effortless and natural.

DevvStream is excited to continue moving forward in its journey to

become the first and only carbon credit firm to be listed on

Nasdaq, which will strengthen our leadership position and market

presence, as well as enhance our ability to quickly and

cost-effectively help corporations and governments reach net zero

while generating ongoing streams of revenue.”

About DevvStream

Founded in 2021, DevvStream is a technology-based sustainability

company that advances the development and monetization of

environmental assets, with an initial focus on carbon markets.

DevvStream works with governments and corporations worldwide to

achieve their sustainability goals through the implementation of

curated green technology projects that generate renewable energy,

improve energy efficiencies, eliminate or reduce emissions, and

sequester carbon directly from the air—creating carbon credits in

the process.

About Focus Impact Acquisition Corp.

Focus Impact is a special purpose acquisition company formed for

the purpose of effecting a merger, share exchange, asset

acquisition, share purchase, reorganization or similar business

combination with one or more businesses. Focus Impact is sponsored

by Focus Impact Sponsor, LLC. Focus Impact intends to focus its

search on businesses that are, or seek to be positioned as, a

“Social-Forward Company,” which are companies that marry operating

excellence with the desire to create social good, with the benefit

of increasing attention and capital flows to such companies while

amplifying their social impact.

DevvStream Media Contacts

DevvStream@icrinc.com and info@fcir.ca

Phone: (332) 242-4316

Disclaimers

Certain statements in this new release may be considered

forward-looking statements. Forward-looking statements that are

statements that are not historical facts and generally relate to

future events or Focus Impact’s or DevvStream’s future financial or

other performance metrics. In some cases, you can identify

forward-looking statements by terminology such as “may”, “should”,

“expect”, “intend”, “will”, “estimate”, “anticipate”, “believe”,

“predict”, “potential” or “continue”, or the negatives of these

terms or variations of them or similar terminology. These

forward-looking statements, including, without limitation, Focus

Impact’s, DevvStream’s and the combined company’s expectations with

respect to future performance and anticipated financial impacts of

the proposed transactions, the satisfaction of the closing

conditions to the proposed transactions and the timing of the

completion of the proposed transactions, are subject to risks and

uncertainties, which could cause actual results to differ

materially from those expressed or implied by such forward-looking

statements. These forward-looking statements are based upon

estimates and assumptions that, while considered reasonable by

Focus Impact and its management, and Devvstream and its management,

as the case may be, are inherently uncertain and subject to

material change. New risks and uncertainties may emerge from time

to time, and it is not possible to predict all risks and

uncertainties. certain other risks are identified and discussed in.

Factors that may cause actual results to differ materially from

current expectations include, but are not limited to: (1) the

occurrence of any event, change or other circumstances that could

give rise to the termination of negotiations and any subsequent

definitive agreements with respect to the proposed transactions;

(2) the outcome of any legal proceedings that may be instituted

against Focus Impact, DevvStream, the combined company or others;

(3) the inability to complete the proposed transactions due to the

failure to obtain approval of the stockholders of Focus Impact and

DevvStream or to satisfy other conditions to closing; (4) changes

to the proposed structure of the proposed transactions that may be

required or appropriate as a result of applicable laws or

regulations; (5) the ability to meet Nasdaq’s or another stock

exchange’s listing standards following the consummation of the

proposed transactions; (6) the risk that the proposed transactions

disrupts current plans and operations of Focus Impact or DevvStream

as a result of the announcement and consummation of the proposed

transactions; (7) the ability to recognize the anticipated benefits

of the proposed transactions, which may be affected by, among other

things, competition, the ability of the combined company to grow

and manage growth profitably, maintain relationships with customers

and retain its management and key employees; (8) costs related to

the proposed transactions; (9) changes in applicable laws or

regulations; (10) the possibility that Focus Impact, DevvStream or

the combined company may be adversely affected by other economic,

business, and/or competitive factors; (11) Focus Impact’s estimates

of expenses and profitability and underlying assumptions with

respect to stockholder redemptions and purchase price and other

adjustments; (12) various factors beyond management’s control,

including general economic conditions and other risks,

uncertainties and factors set forth in the section entitled “Risk

Factors” and “Cautionary Note Regarding Forward-Looking Statements”

in Focus Impact’s final prospectus relating to its initial public

offering, filed with the SEC on October 27, 2021, and other filings

with the SEC, including the Registration Statement and (13) certain

other risks identified and discussed in DevvStream’s Annual

Information Form for the year ended July 31, 2022, and DevvStream’s

other public filings with Canadian securities regulatory

authorities, available on DevvStream’s profile on SEDAR at

www.sedarplus.ca.

These forward-looking statements are expressed in good faith,

and Focus Impact, DevvStream and the combined company believe there

is a reasonable basis for them. However, there can be no assurance

that the events, results or trends identified in these

forward-looking statements will occur or be achieved.

Forward-looking statements speak only as of the date they are made,

and none of Focus Impact, DevvStream or the combined company is

under any obligation, and expressly disclaim any obligation, to

update, alter or otherwise revise any forward-looking statement,

whether as a result of new information, future events or otherwise,

except as required by law. Readers should carefully review the

statements set forth in the reports, which Focus Impact has filed

or will file from time to time with the SEC and DevvStream’s public

filings with Canadian securities regulatory authorities. This news

release is not intended to be all-inclusive or to contain all the

information that a person may desire in considering an investment

in Focus Impact or DevvStream and is not intended to form the basis

of an investment decision in Focus Impact or DevvStream. All

subsequent written and oral forward-looking statements concerning

Focus Impact and DevvStream, the proposed transaction or other

matters and attributable to Focus Impact and DevvStream or any

person acting on their behalf are expressly qualified in their

entirety by the cautionary statements above.

Additional Information and Where to Find It

In connection with the Business Combination, Focus Impact and

DevvStream intend to prepare, and Focus Impact intends to file a

Registration Statement containing a prospectus with respect to the

combined company’s securities to be issued in connection with the

Business Combination, a proxy statement with respect to the

stockholders’ meeting of Focus Impact to vote on the Business

Combination and certain other related documents. Investors,

securityholders and other interested persons are urged to read,

when available, the preliminary proxy statement/prospectus in

connection with Focus Impact’s solicitation of proxies for its

special meeting of stockholders to be held to approve the Business

Combination (and related matters) and general amendments thereto

and the definitive proxy statement/prospectus because the proxy

statement/prospectus will contain important information about Focus

Impact, DevvStream and the Business Combination. When available,

Focus Impact will mail the definitive proxy statement/prospectus

and other relevant documents to its stockholders as of a record

date to be established for voting on the Business Combination. This

communication is not a substitute for the Registration Statement,

the definitive proxy statement/prospectus or any other document

that Focus Impact will send to its stockholders in connection with

the Business Combination. Once the Registration Statement is

declared effective, copies of the Registration Statement, including

the definitive proxy statement/prospectus and other documents filed

by Focus Impact or DevvStream with the SEC, may be obtained, free

of charge, by directing a request to Focus Impact Acquisition

Corp., 250 Park Avenue, Suite 911, New York, New York 10177. The

preliminary and definitive proxy statement/prospectus to be

included in the Registration Statement, once available, can also be

obtained, without charge, at the SEC’s website (www.sec.gov).

Participants in the Solicitation

Focus Impact and its directors, executive officers, other

members of management, and employees, may be deemed to be

participants in the solicitation of proxies of Focus Impact's

stockholders in connection with the Business Combination under SEC

rules. Information regarding the persons who may, under SEC rules,

be deemed participants in the solicitation of Focus Impact's

stockholders in connection with the Business Combination will be in

the Registration Statement and the proxy statement/prospectus

included therein, when it is to be filed with the SEC. To the

extent that holdings of Focus Impact's securities have changed

since the amounts printed in Focus Impact's registration statement

on Form S-1 relating to its initial public offering, such changes

have been or will be reflected on Statements of Change in Ownership

on Form 4 filed with the SEC. Investors and security holders may

obtain more detailed information regarding the names and interests

in the Business Combination of Focus Impact's directors and

officers in Focus Impact's filings with the SEC and such

information will also be in the Registration Statement to be filed

with the SEC, which will include the proxy statement/prospectus of

Focus Impact for the Business Combination.

DevvStream and its directors and executive officers may also be

deemed to be participants in the solicitation of proxies from the

stockholders of Focus Impact in connection with the Business

Combination. A list of the names of such directors and executive

officers and information regarding their interests in the Business

Combination will be included in the proxy statement/prospectus of

Focus Impact for the Business Combination when available. You may

obtain free copies of these documents as described above.

No Offer or Solicitation

This news release is for informational purposes

only and does not constitute a solicitation of a proxy, consent or

authorization with respect to any securities or in respect of the

transactions described herein. This news release shall also not

constitute an offer to sell or the solicitation of an offer to buy

the securities of Focus Impact, DevvStream or the combined company

following consummation of the Business Combination, nor shall there

be any sale of securities in any states or jurisdictions in which

such offer, solicitation or sale would be unlawful prior to

registration or qualification under the securities laws of any such

jurisdiction. No offering of securities shall be made except by

means of a prospectus meeting the requirements of Section 10 of the

Securities Act of 1933, as amended, or an exemption therefrom.

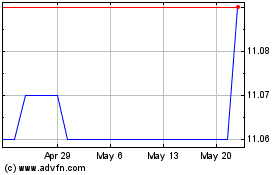

Focus Impact Acquisition (NASDAQ:FIAC)

Historical Stock Chart

From Oct 2024 to Nov 2024

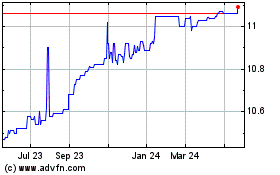

Focus Impact Acquisition (NASDAQ:FIAC)

Historical Stock Chart

From Nov 2023 to Nov 2024