Financial Institutions, Inc. Announces Sale of the Assets of SDN Insurance Agency to NFP

01 April 2024 - 11:55PM

Financial Institutions, Inc. (NASDAQ: FISI) (the "Company," "we" or

"us"), a diversified financial services company and parent company

of Five Star Bank (the “Bank”) and Courier Capital, LLC (“Courier

Capital”), today announced and closed the sale of the assets of its

wholly-owned subsidiary SDN Insurance Agency, LLC (“SDN”) to NFP

Property & Casualty Services, Inc. (“NFP”), a subsidiary of NFP

Corp. and leading property and casualty broker and benefits

consultant. As part of the transaction, the SDN team joins NFP,

including President William E. Gallagher.

“In the nearly 10 years since we entered the insurance space, it

has proven to be a valuable line of business that supported revenue

diversification. This transaction allows us to capture strong value

premium in this business at an important time, strengthen our

capital position and support our continued focus on driving

earnings in our core banking business,” said Martin K. Birmingham,

President and Chief Executive Officer of the Company and the Bank.

“Since 2014, we enhanced SDN’s capabilities and scale through two

additional in-market acquisitions and as a result, it has grown

into a leading insurance agency in our Western New York market with

national reach. We are extremely confident in NFP as the right

company to steward SDN’s continued growth for the benefit of its

employees and our shared customers.”

Established in 1999, NFP’s more than 8,000 colleagues in the US,

Canada, UK and Ireland serve a diversity of clients, industries and

communities through its global capabilities, specialized expertise

and customized solutions across property and casualty insurance,

benefits, and more.

SDN is a full-service insurance agency serving business and

personal insurance customers. In addition to traditional business

insurance policies, its team has grown in recent years to

specialize in the areas of property and casualty coverage, surety

bonding and employee benefits.

“In its 100-year history, SDN has established itself as a

well-respected partner to commercial and personal insurance

customers throughout Western New York,” said Mr. Gallagher. “We are

excited to partner with NFP’s global network of insurance and

employee benefits professionals and benefit from its robust and

sophisticated solutions. We also look forward to continuing to

partner with Five Star Bank, which we have found to be an

exceptional and supportive partner in our decade of shared

history.”

Piper Sandler & Co. acted as exclusive financial advisor and

Luse Gorman, PC acted as legal counsel to Financial Institutions,

Inc. Davis+Gilbert LLP acted as legal counsel to NFP Corp.

Additional details on the transaction are available in the Form

8-K filed by the Company on April 1, 2024, with the Securities and

Exchange Commission, and in an accompanying investor presentation,

which includes non-GAAP reconciliations, published on its investor

relations website, www.FISI-Investors.com.

About Financial Institutions, Inc.Financial

Institutions, Inc. (NASDAQ: FISI) is an innovative financial

holding company with approximately $6.2 billion in assets as of

December 31, 2023, offering banking and wealth management products

and services. Its Five Star Bank subsidiary provides consumer and

commercial banking and lending services to individuals,

municipalities and businesses through banking locations spanning

Western and Central New York and a commercial loan production

office serving the Mid-Atlantic region. Courier Capital, LLC offers

customized investment management, financial planning and consulting

services to individuals and families, businesses, institutions,

non-profits and retirement plans. Learn more at Five-StarBank.com

and FISI-Investors.com.

Safe Harbor Statement This press release

contains forward-looking statements within the meaning of the

Private Securities Litigation Reform Act of 1995. Such

forward-looking statements include, but are not limited to,

statements concerning the proposed transaction and the Company’s

business plans and prospects. These statements are not historical

facts or guarantees of future performance, events or results. There

are risks, uncertainties and other factors that could cause the

actual results of the Company or the effects of the proposed

transaction to differ materially from the results expressed or

implied by such statements. Factors that may cause actual results

to differ materially from those contemplated by such

forward-looking statements include competitive pressures among

financial services companies, interest rate trends, general

economic conditions, deposit flows and the cost of funds, demand

for loan products, changes in legislation or regulatory

requirements, our effectiveness at achieving stated goals and

strategies, and difficulties in achieving operating efficiencies.

Certain risks and uncertainties are more fully described in the

Company’s Annual and Quarterly Reports filed with the Securities

and Exchange Commission. Forward-looking statements speak only as

of the date they are made. The Company undertakes no obligation to

publicly update or revise forward-looking information, whether as a

result of new, updated information, future events or otherwise,

except as may be required by applicable law or regulation.

For additional information contact:Kate

CroftDirector of Investor and External Relations (716)

817-5159klcroft@five-starbank.com

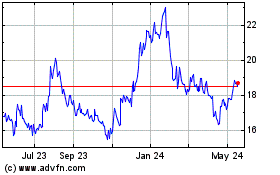

Financial Institutions (NASDAQ:FISI)

Historical Stock Chart

From Nov 2024 to Dec 2024

Financial Institutions (NASDAQ:FISI)

Historical Stock Chart

From Dec 2023 to Dec 2024