20% Growth in Subscription Revenue

Record $41 Million in Operating Cash Flow

Raises 2024 Guidance for Revenue and Bottom

Line

Five9, Inc. (NASDAQ:FIVN), the Intelligent CX Platform provider,

today reported results for the third quarter ended September 30,

2024.

Third Quarter 2024 Financial Results

- Revenue for the third quarter of 2024 increased 15% to a record

$264.2 million, compared to $230.1 million for the third quarter of

2023.

- GAAP gross margin was 53.8% for the third quarter of 2024,

compared to 51.7% for the third quarter of 2023.

- Adjusted gross margin was 61.8% for the third quarter of 2024,

compared to 60.6% for the third quarter of 2023.

- GAAP net loss for the third quarter of 2024 was $(4.5) million,

or $(0.06) per basic share, and (1.7)% of revenue, compared to GAAP

net loss of $(20.4) million, or $(0.28) per basic share, and (8.9)%

of revenue, for the third quarter of 2023.

- Non-GAAP net income for the third quarter of 2024 was $50.5

million, or $0.67 per diluted share, and 19.1% of revenue, compared

to non-GAAP net income of $38.0 million, or $0.52 per diluted

share, and 16.5% of revenue, for the third quarter of 2023.

- Adjusted EBITDA for the third quarter of 2024 was $52.4

million, or 19.8% of revenue, compared to $41.3 million, or 17.9%

of revenue, for the third quarter of 2023.

- GAAP operating cash flow for the third quarter of 2024 was

$41.1 million, compared to GAAP operating cash flow of $37.0

million for the third quarter of 2023.

“We are very pleased to report strong third quarter results,

which exceeded our guidance across all key metrics. Subscription

revenue grew 20% year-over-year, and we achieved an adjusted EBITDA

margin of 20%, helping drive robust operating cash flow of $41

million. With the acceleration of AI, CX is at an inflection point.

We believe our AI-powered platform is at the forefront of enabling

a hyper-personalized experience, continuous engagement, and

seamless customer journeys, all while creating a pathway for

durable growth. We are energized by the momentum we are seeing with

our AI products and believe that the market opportunity ahead is

stronger than ever.”

- Mike Burkland, Chairman and CEO, Five9

Business Outlook

Five9 provides guidance based on current market conditions and

expectations. Five9 emphasizes that the guidance is subject to

various important cautionary factors referenced in the section

entitled "Forward-Looking Statements" below, including risks and

uncertainties associated with ongoing impact of macroeconomic

challenges.

- For the full year 2024, Five9 now expects to report:

- Revenue in the range of $1.030 to $1.031 billion.

- GAAP net loss per share in the range of $(0.30) to $(0.23),

assuming basic shares outstanding of approximately 74.5

million.

- Non-GAAP net income per share in the range of $2.36 to $2.38,

assuming diluted shares outstanding of approximately 75.0

million.

- For the fourth quarter of 2024, Five9 expects to report:

- Revenue in the range of $267.0 to $268.0 million.

- GAAP net income per share in the range of $0.03 to $0.08,

assuming diluted shares outstanding of approximately 88.6

million.

- Non-GAAP net income per share in the range of $0.69 to $0.71,

assuming diluted shares outstanding of approximately 76.0

million.

With respect to Five9’s guidance as provided above, please refer

to the “Reconciliation of GAAP Net Loss to Non-GAAP net income -

Guidance” table for more details, including important assumptions

upon which such guidance is based.

Conference Call Details

Five9 will discuss its third quarter 2024 results today,

November 7, 2024, via Zoom webinar at 4:30 p.m. Eastern Time. To

access the webinar, please register by clicking here. A copy of

this press release will be furnished to the Securities and Exchange

Commission on a Current Report on Form 8-K and will be posted to

our website, prior to the conference call.

A live webcast and a replay will be available on the Investor

Relations section of the Company’s web-site at

http://investors.five9.com/.

Non-GAAP Financial Measures

In addition to disclosing financial measures prepared in

accordance with U.S. generally accepted accounting principles

(GAAP), this press release and the accompanying tables contain

certain non-GAAP financial measures. We calculate adjusted gross

profit and adjusted gross margin by adding back the following items

to gross profit: depreciation, intangibles amortization,

stock-based compensation, exit costs related to the closure and

relocation of our Russian operations, acquisition and related

transaction costs and one-time integration costs, lease

amortization for finance leases and costs related to a reduction in

force plan. We calculate adjusted EBITDA by adding back or removing

the following items to or from GAAP net loss: depreciation and

amortization, stock-based compensation, interest expense, gain on

early extinguishment of debt, interest income and other, exit costs

related to closure and relocation of our Russian operations,

acquisition and related transaction costs and one-time integration

costs, lease amortization for finance leases, costs related to a

reduction in force plan and provision for income taxes. We

calculate non-GAAP operating income by adding back or removing the

following items to or from GAAP loss from operations: stock-based

compensation, intangibles amortization, exit costs related to the

closure and relocation of our Russian operations, and acquisition

related transaction costs and one-time integration costs, and costs

related to a reduction in force plan. We calculate non-GAAP net

income by adding back or removing the following items to or from

GAAP net loss: stock-based compensation, intangibles amortization,

amortization of discount and issuance costs on convertible senior

notes, exit costs related to the closure and relocation of our

Russian operations, acquisition and related transaction costs and

one-time integration costs, gain on early extinguishment of debt,

impairment charge of an equity investment, costs related to a

reduction in force plan, and tax benefit associated with an

acquired company. For the periods presented, these adjustments from

GAAP net loss to non-GAAP net income do not include any

presentation of the net tax effect of such adjustments given our

significant net operating loss carryforwards. Non-GAAP financial

measures do not have any standardized meaning and are therefore

unlikely to be comparable to similarly titled measures presented by

other companies. The Company considers these non-GAAP financial

measures to be important because they provide useful measures of

the operating performance of the Company, exclusive of factors that

do not directly affect what we consider to be our core operating

performance, as well as unusual events. The Company’s management

uses these measures to (i) illustrate underlying trends in the

Company’s business that could otherwise be masked by the effect of

income or expenses that are excluded from non-GAAP measures, and

(ii) establish budgets and operational goals for managing the

Company’s business and evaluating its performance. In addition,

investors often use similar measures to evaluate the operating

performance of a company. Non-GAAP financial measures are presented

only as supplemental information for purposes of understanding the

Company’s operating results. The non-GAAP financial measures should

not be considered a substitute for financial information presented

in accordance with GAAP. Please see the reconciliation of non-GAAP

financial measures set forth in this release.

Forward-Looking Statements

This news release contains certain forward-looking statements

within the meaning of the Private Securities Litigation Reform Act

of 1995, including the statements in the quote from our Chairman

and Chief Executive Officer, including statements regarding the

effect of AI on the CX market,

Five9’s AI platform and its market position and expected impact

on the Company's growth, Five9's market opportunity and ability to

capitalize on that opportunity, and the fourth quarter and full

year 2024 financial projections set forth under the caption

“Business Outlook,” that are based on our current expectations and

involve numerous risks and uncertainties that may cause these

forward-looking statements to be inaccurate. Risks that may cause

these forward-looking statements to be inaccurate include, among

others: (i) the impact of adverse economic conditions, including

the impact of macroeconomic challenges, including continued

inflation, increased interest rates, supply chain disruptions,

decreased economic output and fluctuations in currency rates, the

impact of the Russia-Ukraine conflict, the impact of the conflict

in the Middle East, and other factors, may continue to harm our

business; (ii) if we are unable to attract new clients or sell

additional services and functionality to our existing clients, our

revenue and revenue growth will be harmed; (iii) if our existing

clients terminate their subscriptions or reduce their subscriptions

and related usage, or fail to grow subscriptions at the rate they

have in the past or that we might expect, our revenues and gross

margins will be harmed and we will be required to spend more money

to grow our client base; (iv) because a significant percentage of

our revenue is derived from existing clients, downturns or upturns

in new sales will not be immediately reflected in our operating

results and may be difficult to discern; (v) if we fail to manage

our technical operations infrastructure, our existing clients may

experience service outages, our new clients may experience delays

in the deployment of our solution and we could be subject to, among

other things, claims for credits or damages; (vi) further

development of our AI solutions may not be successful and may

result in reputational harm and our future operating results could

be materially harmed; (vii) we have established, and are continuing

to increase, our network of technology solution distributors and

resellers to sell our solution; our failure to effectively develop,

manage, and maintain this network could materially harm our

revenues; (viii) our quarterly and annual results may fluctuate

significantly, including as a result of the timing and success of

new product and feature introductions by us, may not fully reflect

the underlying performance of our business and may result in

decreases in the price of our common stock; (ix) if we are unable

to attract and retain highly skilled leaders and other employees,

our business and results of operations may be adversely affected;

(x) our historical growth may not be indicative of our future

growth, and even if we continue to grow rapidly, we may fail to

manage our growth effectively; (xi) failure to adequately retain

and expand our sales force will impede our growth; (xii) the AI

technology and features incorporated into our solution include new

and evolving technologies that may present both legal and business

risks; (xiii) the use of AI by our workforce may present risks to

our business; (xiv) the contact center software solutions market is

subject to rapid technological change, and we must develop and sell

incremental and new solutions in order to maintain and grow our

business; (xv) our growth depends in part on the success of our

strategic relationships with third parties and our failure to

successfully maintain, grow and manage these relationships could

harm our business; (xvi) the markets in which we participate

involve a high number of competitors that is continuing to

increase, and if we do not compete effectively, our operating

results could be harmed; (xvii) we continue to expand our

international operations, which exposes us to significant

macroeconomic and other risks; (xviii) security breaches and

improper access to, use of, or disclosure of our data or our

clients’ data, or other cyber attacks on our systems, could result

in litigation and regulatory risk, harm our reputation, our

business or financial results; (xix) we may acquire other

companies, or technologies, or be the target of strategic

transactions, or be impacted by transactions by other companies,

which could divert our management’s attention, result in additional

dilution to our stockholders or use a significant amount of our

cash resources and otherwise disrupt our operations and harm our

operating results; (xx) we sell our solution to larger

organizations that require longer sales and implementation cycles

and often demand more configuration and integration services or

customized features and functions that we may not offer, any of

which could delay or prevent these sales and harm our growth rates,

business and operating results; (xxi) we rely on third-party

telecommunications and internet service providers to provide our

clients and their customers with telecommunication services and

connectivity to our cloud contact center software and any failure

by these service providers to provide reliable services could cause

us to lose clients and subject us to claims for credits or damages,

among other things; (xxii) we have a history of losses and we may

be unable to achieve or sustain profitability; (xxiii) our stock

price has been volatile, may continue to be volatile and may

decline, including due to factors beyond our control; (xxiv) we may

not be able to secure additional financing on favorable terms, or

at all, to meet our future capital needs; (xxv) failure to comply

with laws and regulations could harm our business and our

reputation; (xxvi) we may not have sufficient cash to service our

convertible senior notes and repay such notes, if required, and

other risks attendant to our convertible senior notes and increased

debt levels; and (xxvii) the other risks detailed from time-to-time

under the caption “Risk Factors” and elsewhere in our Securities

and Exchange Commission filings and reports, including, but not

limited to, our most recent annual report on Form 10-K and

quarterly reports on Form 10-Q. Such forward-looking statements

speak only as of the date hereof and readers should not unduly rely

on such statements. We undertake no obligation to update the

information contained in this press release, including in any

forward-looking statements.

About Five9

The Five9 Intelligent CX Platform provides a comprehensive suite

of solutions for orchestrating fluid customer experiences. Our

cloud-native, multi-tenant, scalable, reliable, and secure platform

includes contact center; omni-channel engagement; Workforce

Engagement Management; extensibility through more than 1,000

partners; and innovative, practical AI, automation and journey

analytics that are embedded as part of the platform. Five9 brings

the power of people, technology, and partners to more than 3,000

organizations worldwide. For more information, visit www.five9.com.

FIVE9, INC.

CONDENSED CONSOLIDATED BALANCE

SHEETS

(In thousands)

(Unaudited)

September 30, 2024

December 31, 2023

ASSETS

Current assets:

Cash and cash equivalents

$

290,959

$

143,201

Marketable investments

675,704

587,096

Accounts receivable, net

116,430

97,424

Prepaid expenses and other current

assets

48,640

34,622

Deferred contract acquisition costs,

net

72,534

61,711

Total current assets

1,204,267

924,054

Property and equipment, net

136,052

108,572

Operating lease right-of-use assets

43,480

38,873

Finance lease right-of-use assets

21,262

4,564

Intangible assets, net

69,731

38,323

Goodwill

365,450

227,412

Other assets

17,765

16,199

Deferred contract acquisition costs, net —

less current portion

149,885

136,571

Total assets

$

2,007,892

$

1,494,568

LIABILITIES AND STOCKHOLDERS’

EQUITY

Current liabilities:

Accounts payable

$

33,876

$

24,399

Accrued and other current liabilities

84,297

62,131

Operating lease liabilities

11,446

10,731

Finance lease liabilities

7,695

1,767

Deferred revenue

80,000

68,187

Convertible senior notes

432,927

—

Total current liabilities

650,241

167,215

Convertible senior notes — less current

portion

730,932

742,125

Operating lease liabilities — less current

portion

39,976

36,378

Finance lease liabilities — less current

portion

13,716

2,877

Other long-term liabilities

7,441

7,888

Total liabilities

1,442,306

956,483

Stockholders’ equity:

Common stock

75

73

Additional paid-in capital

992,905

942,280

Accumulated other comprehensive income

1,828

582

Accumulated deficit

(429,222

)

(404,850

)

Total stockholders’ equity

565,586

538,085

Total liabilities and stockholders’

equity

$

2,007,892

$

1,494,568

FIVE9, INC.

CONDENSED CONSOLIDATED

STATEMENTS OF OPERATIONS

(In thousands, except per share

data)

(Unaudited)

Three Months Ended

Nine Months Ended

September 30, 2024

September 30, 2023

September 30, 2024

September 30, 2023

Revenue

$

264,182

$

230,105

$

763,278

$

671,426

Cost of revenue

121,933

111,080

354,877

320,197

Gross profit

142,249

119,025

408,401

351,229

Operating expenses:

Research and development

42,482

40,391

124,717

117,709

Sales and marketing

78,615

73,366

238,056

223,757

General and administrative

36,575

31,006

101,111

89,741

Total operating expenses

157,672

144,763

463,884

431,207

Loss from operations

(15,423

)

(25,738

)

(55,483

)

(79,978

)

Other income (expense), net:

Interest expense

(4,068

)

(1,972

)

(10,541

)

(5,683

)

Gain on early extinguishment of debt

—

—

6,615

—

Interest income and other

11,144

8,233

35,503

18,477

Total other income (expense), net

7,076

6,261

31,577

12,794

Loss before income taxes

(8,347

)

(19,477

)

(23,906

)

(67,184

)

(Benefit from) provision for income

taxes

(3,868

)

942

466

2,222

Net loss

$

(4,479

)

$

(20,419

)

$

(24,372

)

$

(69,406

)

Net loss per share:

Basic and diluted

$

(0.06

)

$

(0.28

)

$

(0.33

)

$

(0.97

)

Shares used in computing net loss per

share:

Basic and diluted

74,876

72,356

74,192

71,751

FIVE9, INC.

CONDENSED CONSOLIDATED

STATEMENTS OF CASH FLOWS

(In thousands)

(Unaudited)

Nine Months Ended

September 30, 2024

September 30, 2023

Cash flows from operating

activities:

Net loss

$

(24,372

)

$

(69,406

)

Adjustments to reconcile net loss to net

cash provided by operating activities:

Depreciation and amortization

38,265

35,553

Amortization of operating lease

right-of-use assets

10,631

9,234

Amortization of deferred contract

acquisition costs

52,152

40,088

Accretion of discount on marketable

investments

(16,833

)

(7,684

)

Provision for credit losses

806

795

Stock-based compensation

127,872

156,721

Amortization of discount and issuance

costs on convertible senior notes

3,991

2,793

Gain on early extinguishment of debt

(6,615

)

—

Impairment charge of an equity

investment

1,250

—

Interest on finance lease obligations

258

77

Deferred taxes

441

438

Tax benefit of valuation allowance

associated with an acquisition

(4,831

)

—

Other

(145

)

592

Changes in operating assets and

liabilities:

Accounts receivable

(15,559

)

(6,661

)

Prepaid expenses and other current

assets

(9,562

)

(6,537

)

Deferred contract acquisition costs

(76,288

)

(68,410

)

Other assets

(1,452

)

(4,892

)

Accounts payable

8,651

5,562

Accrued and other current liabilities

5,380

(1,149

)

Deferred revenue

184

1,544

Other liabilities

(871

)

3,636

Net cash provided by operating

activities

93,353

92,294

Cash flows from investing

activities:

Purchases of marketable investments

(993,483

)

(544,713

)

Proceeds from sales of marketable

investments

93,995

971

Proceeds from maturities of marketable

investments

829,122

415,117

Purchases of property and equipment

(33,097

)

(19,941

)

Capitalization of software development

costs

(14,211

)

(5,820

)

Cash paid to acquire Acqueon Inc.

(167,166

)

—

Cash paid to acquire Aceyus, Inc.

99

(80,588

)

Net cash used in investing activities

(284,741

)

(234,974

)

Cash flows from financing

activities:

Proceeds from issuance of 2029 convertible

senior notes, net of issuance costs

728,843

—

Payments for capped call transactions

associated with the 2029 convertible senior notes

(93,438

)

—

Repurchase of a portion of 2025

convertible senior notes, net of costs

(304,485

)

—

Repayment of outstanding 2023 convertible

senior notes at maturity

—

(169

)

Cash received from the settlement at

maturity of the outstanding capped calls associated with the 2023

convertible senior notes

—

74,453

Cash received from partial termination of

capped calls associated with the 2025 convertible senior notes

539

—

Proceeds from exercise of common stock

options

423

8,315

Proceeds from sale of common stock under

ESPP

9,522

9,444

Payment of holdback related to an

acquisition

—

(500

)

Payment of finance lease liabilities

(2,006

)

(496

)

Net cash provided by financing

activities

339,398

91,047

Net increase (decrease) in cash, cash

equivalents and restricted cash

148,010

(51,633

)

Cash, cash equivalents and restricted

cash:

Beginning of period

144,842

180,987

End of period

$

292,852

$

129,354

FIVE9, INC.

RECONCILIATION OF GAAP GROSS

PROFIT TO ADJUSTED GROSS PROFIT

(In thousands, except

percentages)

(Unaudited)

Three Months Ended

Nine Months Ended

September 30, 2024

September 30, 2023

September 30, 2024

September 30, 2023

GAAP gross profit

$

142,249

$

119,025

$

408,401

$

351,229

GAAP gross margin

53.8

%

51.7

%

53.5

%

52.3

%

Non-GAAP adjustments:

Depreciation

7,218

6,893

21,956

19,378

Intangibles amortization

3,196

3,182

8,492

8,873

Stock-based compensation

7,512

9,856

22,904

29,077

Exit costs related to closure and

relocation of Russian operations

—

18

—

93

Acquisition and related transaction costs

and one-time integration costs

94

—

219

34

Lease amortization for finance leases

895

492

1,807

492

Costs related to a reduction in force

plan

2,115

—

2,115

—

Adjusted gross profit

$

163,279

$

139,466

$

465,894

$

409,176

Adjusted gross margin

61.8

%

60.6

%

61.0

%

60.9

%

FIVE9, INC.

RECONCILIATION OF GAAP NET

LOSS TO ADJUSTED EBITDA

(In thousands, except

percentages)

(Unaudited)

Three Months Ended

Nine Months Ended

September 30, 2024

September 30, 2023

September 30, 2024

September 30, 2023

GAAP net loss

$

(4,479

)

$

(20,419

)

$

(24,372

)

$

(69,406

)

Non-GAAP adjustments:

Depreciation and amortization

13,144

12,482

38,265

35,553

Stock-based compensation

39,556

52,611

127,872

156,721

Interest expense

4,068

1,972

10,541

5,683

Gain on early extinguishment of debt

—

—

(6,615

)

—

Interest income and other

(11,144

)

(8,233

)

(35,503

)

(18,477

)

Exit costs related to closure and

relocation of Russian operations (1)

21

659

78

2,070

Acquisition and related transaction costs

and one-time integration costs

4,486

778

9,506

3,110

Lease amortization for finance leases

951

492

1,863

492

Costs related to a reduction in force

plan

9,625

—

9,625

—

(Benefit from) provision for income

taxes

(3,868

)

942

466

2,222

Adjusted EBITDA

$

52,360

$

41,284

$

131,726

$

117,968

Adjusted EBITDA as % of revenue

19.8

%

17.9

%

17.3

%

17.6

%

(1) Exit costs related to the closure and relocation of our

Russian operations were $0.2 million during both the three and nine

months ended September 30, 2024. The $0.0 million and $0.1 million

adjustments presented above were net of $0.2 million and $0.1

million included in “Interest income and other.” Exit costs related

to the closure and relocation of our Russian operations was $0.9

million and $2.7 million during the three and nine months ended

September 30, 2023. The $0.7 million and $2.1 million adjustments

presented above were net of $0.2 million and $0.6 million included

in “Interest income and other.”

FIVE9, INC.

RECONCILIATION OF GAAP

OPERATING LOSS TO NON-GAAP OPERATING INCOME

(In thousands)

(Unaudited)

Three Months Ended

Nine Months Ended

September 30, 2024

September 30, 2023

September 30, 2024

September 30, 2023

Loss from operations

$

(15,423

)

$

(25,738

)

$

(55,483

)

$

(79,978

)

Non-GAAP adjustments:

Stock-based compensation

39,556

52,611

127,872

156,721

Intangibles amortization

3,196

3,182

8,492

8,873

Exit costs related to closure and

relocation of Russian operations

21

659

78

2,070

Acquisition and related transaction costs

and one-time integration costs

4,486

778

9,506

3,110

Costs related to a reduction in force

plan

9,625

—

9,625

—

Non-GAAP operating income

$

41,461

$

31,492

$

100,090

$

90,796

FIVE9, INC.

RECONCILIATION OF GAAP NET

LOSS TO NON-GAAP NET INCOME

(In thousands, except per share

data)

(Unaudited)

Three Months Ended

Nine Months Ended

September 30, 2024

September 30, 2023

September 30, 2024

September 30, 2023

GAAP net loss

$

(4,479

)

$

(20,419

)

$

(24,372

)

$

(69,406

)

Non-GAAP adjustments:

Stock-based compensation

39,556

52,611

127,872

156,721

Intangibles amortization

3,196

3,182

8,492

8,873

Amortization of discount and issuance

costs on convertible senior notes

1,482

954

3,991

2,793

Gain on early extinguishment of debt

—

—

(6,615

)

—

Exit costs related to closure and

relocation of Russian operations

176

854

156

2,705

Acquisition and related transaction costs

and one-time integration costs

4,486

778

9,506

3,110

Impairment charge of an equity

investment

1,250

—

1,250

—

Costs related to a reduction in force

plan

9,625

—

9,625

—

Tax benefit associated with an acquired

company

(4,831

)

—

(4,831

)

—

Income tax expense effects (1)

—

—

—

—

Non-GAAP net income

$

50,461

$

37,960

$

125,074

$

104,796

GAAP net loss per share:

Basic and diluted

$

(0.06

)

$

(0.28

)

$

(0.33

)

$

(0.97

)

Non-GAAP net income per share:

Basic

$

0.67

$

0.52

$

1.69

$

1.46

Diluted

$

0.67

$

0.52

$

1.68

$

1.44

Shares used in computing GAAP net loss per

share:

Basic and diluted

74,876

72,356

74,192

71,751

Shares used in computing non-GAAP net

income per share:

Basic

74,876

72,356

74,192

71,751

Diluted

75,137

73,426

74,653

72,790

- Non-GAAP adjustments do not have a material impact on our

worldwide income tax provision due to the tax treatment of the

non-GAAP adjustments reported, and the Company’s domestic valuation

allowance position.

FIVE9, INC.

SUMMARY OF STOCK-BASED

COMPENSATION, DEPRECIATION AND INTANGIBLES AMORTIZATION

(In thousands)

(Unaudited)

Three Months Ended

September 30, 2024

September 30, 2023

Stock-Based

Compensation

Depreciation

Intangibles

Amortization

Stock-Based

Compensation

Depreciation

Intangibles

Amortization

Cost of revenue

$

7,512

$

7,218

$

3,196

$

9,856

$

6,893

$

3,182

Research and development

8,244

721

—

12,980

831

—

Sales and marketing

12,490

32

—

16,404

36

—

General and administrative

11,310

1,977

—

13,371

1,540

—

Total

$

39,556

$

9,948

$

3,196

$

52,611

$

9,300

$

3,182

Nine Months Ended

September 30, 2024

September 30, 2023

Stock-Based

Compensation

Depreciation

Intangibles

Amortization

Stock-Based

Compensation

Depreciation

Intangibles

Amortization

Cost of revenue

$

22,904

$

21,956

$

8,492

$

29,077

$

19,378

$

8,873

Research and development

29,001

2,352

—

38,375

2,571

—

Sales and marketing

40,334

85

—

50,840

38

—

General and administrative

35,633

5,380

—

38,429

4,693

—

Total

$

127,872

$

29,773

$

8,492

$

156,721

$

26,680

$

8,873

FIVE9, INC.

RECONCILIATION OF GAAP NET

LOSS TO NON-GAAP NET INCOME – GUIDANCE(1)

(In thousands, except per share

data)

(Unaudited)

Three Months Ending

Year Ending

December 31, 2024

December 31, 2024

Low

High

Low

High

GAAP net income (loss)

$

2,687

$

7,207

$

(22,000

)

$

(17,500

)

Non-GAAP adjustments:

Stock-based compensation(2)

43,479

41,479

171,351

169,351

Intangibles amortization

2,643

2,643

11,135

11,135

Amortization of discount and issuance

costs on convertible senior notes

1,485

1,485

5,476

5,476

Exit costs related to closure and

relocation of Russian operations

—

—

156

156

Acquisition and related transaction costs

and one-time integration costs(3)

2,146

1,146

11,652

10,652

Gain on early extinguishment of debt

—

—

(6,615

)

(6,615

)

Impairment charge of an equity

investment

—

—

1,250

1,250

Costs related to a reduction in force

plan

—

—

9,625

9,625

Tax benefit of valuation allowance

associated with an acquisition

—

—

(4,831

)

(4,831

)

Income tax expense effects(4)

—

—

—

—

Non-GAAP net income

$

52,440

$

53,960

$

177,199

$

178,699

GAAP net income (loss) per share:

Basic

$

0.04

$

0.10

$

(0.30

)

$

(0.23

)

Diluted

$

0.03

$

0.08

$

(0.30

)

$

(0.23

)

Non-GAAP net income per share:

Basic

$

0.69

$

0.71

$

2.38

$

2.40

Diluted

$

0.69

$

0.71

$

2.36

$

2.38

Shares used in computing GAAP net income

(loss) per share:

Basic

75,600

75,600

74,500

74,500

Diluted

88,600

88,600

74,500

74,500

Shares used in computing non-GAAP net

income per share:

Basic

75,600

75,600

74,500

74,500

Diluted

76,000

76,000

75,000

75,000

- Represents guidance discussed on November 7, 2024. Reader shall

not construe presentation of this information after November 7,

2024 as an update or reaffirmation of such guidance.

- Stock-based compensation expenses are based on a range of

probable significance, assuming market price for our common stock

that is approximately consistent with current levels.

- Acquisition and related transaction costs and one-time

integration costs are based on a range of probable significance for

completed acquisitions, and no new acquisitions assumed.

- Non-GAAP adjustments do not have a material impact on our

worldwide income tax provision due to the tax treatment of the

non-GAAP adjustments reported, and the Company’s domestic valuation

allowance position.

FIVE9, INC.

TAXES AND PURCHASES OF

PROPERTY AND EQUIPMENT – GUIDANCE(1)

(In thousands)

(Unaudited)

Three Months Ending

Year Ending

December 31, 2024

December 31, 2024

Low

High

Low

High

Taxes - Non-GAAP

$

2,500

$

2,700

$

7,797

$

7,997

Purchases of property and equipment

13,000

14,000

46,097

47,097

- Represents guidance discussed on November 7, 2024. Reader shall

not construe presentation of this information after November 7,

2024 as an update or reaffirmation of such guidance.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20241107022115/en/

Investor Relations Contacts:

Five9, Inc. Barry Zwarenstein Chief Financial Officer

925-201-2000 ext. 5959 IR@five9.com

The Blueshirt Group for Five9, Inc. Lisa Laukkanen 415-217-4967

Lisa@blueshirtgroup.com

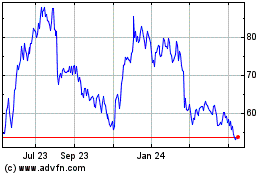

Five9 (NASDAQ:FIVN)

Historical Stock Chart

From Dec 2024 to Jan 2025

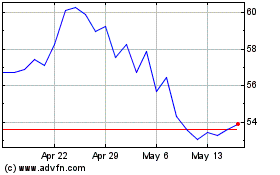

Five9 (NASDAQ:FIVN)

Historical Stock Chart

From Jan 2024 to Jan 2025