Cogint, Inc. (NASDAQ: COGT), a leading provider of information

and data-driven, performance marketing solutions, today announced

financial results for the quarter ended June 30, 2017.

“We delivered a very strong second quarter with revenues of $53

million, up 29% versus the second quarter of 2016, and Adjusted

EBITDA of $4.8 million, up 54%, driven by enterprise-wide adoption

of our products and solutions,” stated Derek Dubner, cogint’s CEO.

“Given our innovation-driven product roadmap and the increasing

momentum we experienced throughout the quarter, we are very

optimistic about the second half of 2017.”

Second Quarter 2017 Financial Highlights

For the three months ended June 30, 2017, as compared to the

three months ended June 30, 2016:

- Total revenue increased 29% to $53.0

million.

- Information Services revenue increased

39% to $18.6 million.

- Performance Marketing revenue increased

24% to $34.4 million.

- Gross profit margin increased 300 basis

points to 31%.

- Net loss was $20.4 million (inclusive

of non-recurring costs of $10.0 million and tax benefit of $0)

compared to $7.2 million (inclusive of non-recurring costs of $1.7

million and tax benefit of $3.5 million).

- Adjusted EBITDA grew 54% to $4.8

million.

Second Quarter 2017 and Recent Business Highlights

- Now over 50 customers spending in

excess of $1 million with us on an annualized basis.

- Integrated idiCORE™ with industry

leaders in the mobile and digital authentication space, serving as

a key ingredient in innovative, multi-factor identity

authentication solutions.

- After a successful launch of our Pay

Per Call ad format in fourth quarter 2016, continued adoption

across a range of verticals with Pay Per Call generating $1.5

million in second quarter 2017.

- Leveraging our Custom Audience Identity

Graph enables the communication with our audience on an even more

personalized level through addressable channels, such as email,

push notifications, SMS, contact centers and platforms like

Facebook messenger and Google.

- Nearly 90% of our audience data is

addressable to us in at least one marketing channel and more than

50% of our audience data is addressable in more than three.

Within our Information Services segment:

- Financial revenue increased to $3.0

million, up 78% year over year.

- Emerging revenue increased to $2.2

million, up 267% year over year.

- Digital revenue increased to $1.3

million, up 63% year over year.

Within our Performance Marketing segment:

- Consumer revenue increased to $8.6

million, up 93% year over year.

- Lifestyle revenue increased to $7.6

million, up 45% year over year.

- Financial revenue increased to $5.0

million, up 7% year over year.

Use of Non-GAAP Financial Measures

Management evaluates the financial performance of our business

on a variety of key indicators, including adjusted EBITDA. Adjusted

EBITDA is a non-GAAP financial measure equal to net loss, the most

directly comparable financial measure based on US GAAP, adding back

interest expense, income tax benefit, depreciation and

amortization, share-based payments, non-recurring legal and

litigation costs, acquisition and restructuring costs, write-off of

long-lived assets, and other adjustments.

Conference Call

Cogint, Inc. will host a conference call on Wednesday, August 9,

2017 at 4:30 PM ET to discuss its 2017 second quarter financial and

operating results. To listen to the conference call on your

telephone, please dial (866) 270-1533 for domestic callers or (412)

317-0797 for international callers. To access the live audio

webcast, visit the cogint website at www.cogint.com. Please login

at least 15 minutes prior to the start of the call to ensure

adequate time for any downloads that may be required. Following

completion of the earnings call, a recorded replay of the webcast

will be available for those unable to participate. To listen to the

telephone replay, please dial (877) 344-7529 or (412) 317-0088 with

the replay passcode 1011117. The replay will also be available for

one week on the cogint website at www.cogint.com.

About cogint™

At cogint, we believe that time is your most valuable asset.

Through powerful analytics, we transform data into intelligence, in

a fast and efficient manner, so that our clients can spend their

time on what matters most – running their organizations with

confidence. Through leading-edge, proprietary technology and a

massive data repository, our data and analytical solutions harness

the power of data fusion, uncovering the relevance of disparate

data points and converting them into comprehensive and insightful

views of people, businesses, assets and their interrelationships.

We empower clients across markets and industries to better execute

all aspects of their business, from managing risk, conducting

investigations, identifying fraud and abuse, and collecting debts,

to identifying and acquiring new customers. At cogint, we are

dedicated to making the world a safer place, to reducing the cost

of doing business, and to enhancing the consumer experience.

RELATED LINKS: http://www.cogint.com

FORWARD-LOOKING STATEMENTS

This press release contains "forward-looking statements," as

that term is defined under the Private Securities Litigation Reform

Act of 1995 (PSLRA), which statements may be identified by words

such as "expects," "plans," "projects," "will," "may,"

"anticipate," "believes," "should," "intends," "estimates," and

other words of similar meaning. Such forward looking statements are

subject to risks and uncertainties that are often difficult to

predict, are beyond our control and which may cause results to

differ materially from expectations, including whether given our

innovation-driven product roadmap and the increasing momentum we

experienced through the 2017 second quarter, we are very optimistic

about the second half of 2017. Readers are cautioned not to place

undue reliance on these forward-looking statements, which are based

on our expectations as of the date of this press release and speak

only as of the date of this press release and are advised to

consider the factors listed above together with the additional

factors under the heading "Forward-Looking Statements" and "Risk

Factors" in the Company's Annual Report on Form 10-K, as may be

supplemented or amended by the Company's Quarterly Reports on Form

10-Q and other SEC filings. We undertake no obligation to publicly

update or revise any forward-looking statement, whether as a result

of new information, future events or otherwise, except as required

by law.

COGINT, INC.

CONDENSED CONSOLIDATED BALANCE

SHEETS

(Amounts in thousands, except share

data)

(unaudited) June 30, 2017 December 31,

2016

ASSETS:

Current assets: Cash and cash equivalents $ 19,248 $ 10,089

Accounts receivable, net of allowance for

doubtful accounts of $1,091 and $790 at June 30, 2017 and December

31, 2016, respectively

32,417 30,958 Prepaid expenses and other current assets

2,963 2,053 Total current assets 54,628 43,100 Property and

equipment, net 1,415 1,350 Intangible assets, net 92,814 98,531

Goodwill 166,256 166,256 Other non-current assets 2,581

2,674

Total assets $ 317,694 $

311,911

LIABILITIES AND

SHAREHOLDERS’ EQUITY:

Current liabilities: Trade accounts payable $ 15,173 $ 14,725

Accrued expenses and other current liabilities 14,771 6,981

Deferred revenue 1,108 318 Current portion of long-term debt

2,750 4,135 Total current liabilities 33,802 26,159

Promissory notes payable to certain shareholders, net 10,253 10,748

Long-term debt, net 49,910 35,130 Acquisition consideration payable

in stock 10,225 10,225 Other non-current liabilities 500

-

Total liabilities 104,690

82,262 Shareholders' equity:

Series A preferred stock—$0.0001 par

value, 10,000,000 shares authorized; 0 share issued and outstanding

at June 30, 2017 and December 31, 2016

- -

Series B preferred stock—$0.0001 par

value, 10,000,000 shares authorized; 0 share issued and outstanding

at June 30, 2017 and December 31, 2016

- -

Common stock—$0.0005 par value,

200,000,000 shares authorized; 55,528,094 and 53,717,996 shares

issued at June 30, 2017 and December 31, 2016, respectively; and

55,180,092 and 53,557,761 shares outstanding at June 30, 2017 and

December 31, 2016, respectively

28 27

Treasury stock, at cost, 348,002 and

160,235 shares at June 30, 2017 and December 31, 2016,

respectively

(1,254 ) (531 ) Additional paid-in capital 361,595 344,384

Accumulated deficit (147,365 ) (114,231 )

Total

shareholders’ equity 213,004 229,649

Total

liabilities and shareholders’ equity $ 317,694

$ 311,911

COGINT, INC.

CONDENSED CONSOLIDATED STATEMENTS OF

OPERATIONS AND COMPREHENSIVE LOSS

(Amounts in thousands, except share

data)

(unaudited)

Three Months Ended June 30, Six Months Ended June

30, 2017 2016 2017

2016 Revenue $ 53,024 $ 41,043 $ 103,790 $ 80,467

Cost of revenues (exclusive of

depreciation and amortization)

36,624 29,557 71,822 58,051

Gross

profit 16,400 11,486 31,968 22,416

Operating expenses: Sales and marketing expenses 5,843 3,179

10,356 6,305 General and administrative expenses 25,067 13,167

39,573 26,534 Depreciation and amortization 3,454 2,996 6,875 5,605

Write-off of long-lived assets - - 3,626

-

Total operating expenses 34,364

19,342 60,430 38,444

Loss from operations (17,964 ) (7,856

) (28,462 ) (16,028 ) Other

income (expense): Interest expense, net (2,445 ) (1,856 )

(4,672 ) (3,681 ) Other expenses, net - (976 )

- (1,273 )

Total other expense (2,445

) (2,832 ) (4,672

) (4,954 ) Loss before income

taxes (20,409 ) (10,688 )

(33,134 ) (20,982 ) Income taxes

- (3,504 ) -

(7,026 ) Net loss $

(20,409 ) $ (7,184 ) $

(33,134 ) $ (13,956 ) Loss

per share: Basic and diluted $ (0.37 ) $ (0.15 ) $ (0.61 ) $

(0.37 )

Weighted average number of shares outstanding: Basic

and diluted 54,778,046 48,084,608 54,297,536

37,776,411

Comprehensive loss: Net comprehensive

loss $ (20,409 ) $ (7,184

) $ (33,134 ) $ (13,956

)

COGINT, INC.

CONDENSED CONSOLIDATED STATEMENTS OF

CASH FLOWS

(Amounts in thousands, except share

data)

(unaudited)

Six Months Ended June 30, 2017

2016 CASH FLOWS FROM OPERATING ACTIVITIES: Net loss $

(33,134 ) $ (13,956 ) Adjustments to reconcile net loss to net cash

provided by operating activities: Depreciation and amortization

6,875 5,605 Non-cash interest expenses and related amortization

1,497 1,202 Share-based payments 16,631 14,623 Non-cash loss on

exchange of warrants - 1,273 Write-off of long-lived assets 3,626 -

Provision for bad debts 1,039 195 Deferred income tax benefit -

(7,039 ) Changes in assets and liabilities: Accounts receivable

(2,498 ) 869 Prepaid expenses and other current assets (910 ) 968

Other non-current assets 93 (706 ) Trade accounts payable 448 (174

) Accrued expenses and other current liabilities 7,790 (1,227 )

Deferred revenue 790 (491 ) Other non-current liabilities

500 - Net cash provided by operating activities 2,747

1,142 CASH FLOWS FROM INVESTING ACTIVITIES: Purchase of

property and equipment (437 ) (577 ) Capitalized costs included in

intangible assets (3,831 ) (5,902 ) Acquisition, net of cash

acquired - (50 ) Net cash used in investing

activities (4,268 ) (6,529 ) CASH FLOWS FROM

FINANCING ACTIVITIES: Proceeds from issuance of shares, net of

issuance costs - 4,664 Proceeds for debt obligations, net of debt

costs 14,039 (381 ) Repayments of long-term debt (2,636 ) (1,125 )

Taxes paid related to net share settlement of vesting of restricted

stock units (723 ) - Net cash provided by financing

activities 10,680 3,158

Net increase (decrease) in

cash and cash equivalents $ 9,159 $

(2,229 ) Cash and cash equivalents at beginning of

period 10,089 13,462

Cash and cash equivalents at

end of period $ 19,248 $ 11,233

SUPPLEMENTAL DISCLOSURE INFORMATION Cash paid for interest $ 3,195

$ 2,510 Cash paid for income taxes $ - $ - Share-based compensation

expenses capitalized in intangible assets $ 581 $ 499 Issuance of

common stock to a vendor for services rendered $ - $ 131 Fair value

of acquisition consideration $ - $ 21,206

Use and Reconciliation of Non-GAAP Financial Measures

Management evaluates the financial performance of our business

on a variety of key indicators, including adjusted EBITDA. Adjusted

EBITDA is a non-GAAP financial measure equal to net loss, the most

directly comparable financial measure based on US GAAP, adding back

interest expense, income tax benefit, depreciation and

amortization, share-based payments, non-recurring legal and

litigation costs, acquisition and restructuring costs, write-off of

long-lived assets, and other adjustments, as noted in the tables

below.

Three Months Ended June 30, Six Months

Ended June 30, (In thousands) 2017

2016 2017 2016 Net loss $

(20,409 ) $ (7,184 ) $

(33,134 ) $ (13,956 ) Interest

expense, net 2,445 1,856 4,672 3,681 Income tax benefit - (3,504 )

- (7,026 ) Depreciation and amortization 3,454 2,996 6,875 5,605

Share-based payments 9,319 7,245 16,631 14,623 Non-recurring legal

and litigation costs 8,325 191 8,830 714 Acquisition and

restructuring costs 1,650 525 2,318 577 Write-off of long-lived

assets - - 3,626 - Non-cash loss on exchange of warrants -

976 - 1,273

Adjusted EBITDA $

4,784 $ 3,101 $ 9,818 $

5,491

We present adjusted EBITDA as a supplemental measure of our

operating performance because we believe it provides useful

information to our investors as it eliminates the impact of certain

items that we do not consider indicative of our cash operations and

ongoing operating performance. In addition, we use it as an

integral part of our internal reporting to measure the performance

of our reportable segments, evaluate the performance of our senior

management and measure the operating strength of our business.

Adjusted EBITDA is a measure frequently used by securities

analysts, investors and other interested parties in their

evaluation of the operating performance of companies similar to

ours and is an indicator of the operational strength of our

business. Adjusted EBITDA eliminates the uneven effect across all

reportable segments of considerable amounts of non-cash

depreciation and amortization, share-based payments and write-off

of long-lived assets.

Adjusted EBITDA is not intended to be a performance measure that

should be regarded as an alternative to, or more meaningful than,

either operating income or net income as indicators of operating

performance or to cash flows from operating activities as a measure

of liquidity. The way we measure adjusted EBITDA may not be

comparable to similarly titled measures presented by other

companies, and may not be identical to corresponding measures used

in our various agreements.

View source

version on businesswire.com: http://www.businesswire.com/news/home/20170809006052/en/

Cogint, Inc.Media and Investor Relations Contact:Jordyn Kopin,

646-356-8469Director, Investor RelationsJKopin@cogint.com

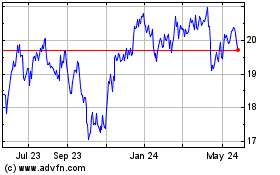

First Trust Latin Americ... (NASDAQ:FLN)

Historical Stock Chart

From Jan 2025 to Feb 2025

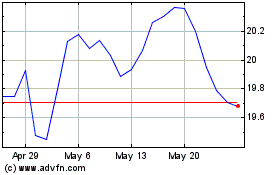

First Trust Latin Americ... (NASDAQ:FLN)

Historical Stock Chart

From Feb 2024 to Feb 2025