0000765207false00007652072024-10-232024-10-23

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the

Securities Exchange Act of 1934

Date of report (Date of earliest event reported): October 23, 2024

THE FIRST BANCORP, INC.

(Exact name of Registrant as specified in charter)

Maine

(State or other jurisdiction of incorporation)

| | | | | |

| 0-26589 | 01-0404322 |

| (Commission file number) | (IRS employer identification no.) |

| | | | | | | | | | | |

| Main Street | Damariscotta | Maine | 04543 |

| (Address of principal executive offices) | (Zip Code) |

(207) 563-3195

(Registrant's telephone number, including area code)

Check the appropriate box below if the Form 8-K filing is

intended to simultaneously satisfy the filing obligations

of the registrant under any of the following provisions:

☐ Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

☐ Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

☐ Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

☐ Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4 (c))

Securities registered pursuit to Section 12(b) of the Exchange Act:

| | | | | | | | |

| Title of Each Class | Trading Symbol | Name of each exchange on which registered |

| Common Stock, par value $0.01 per share | FNLC | NASDAQ Global Select Market |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter). Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

TABLE OF CONTENTS

Item 2.02 Results of Operations and Financial Condition Page 1

Item 9.01 Financial Statements and Exhibits. Page 1

Signatures Page 2

Exhibit Index Page 3

Item 2.02 Results of Operations and Financial Condition.

On October 23, 2024, the Registrant issued the press release filed herewith as Exhibit 99.1 with information regarding the results of operations and financial condition of the First Bancorp, Inc. for the quarter ended September 30, 2024.

Item 9.01 Financial Statements and Exhibits.

(d) Exhibits.

--------

The following Exhibit is being furnished herewith:

99.1 Registrant's Press Release dated October 23, 2024

SIGNATURE

Pursuant to the requirements of the Securities Exchange Act of 1934, the Registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

THE FIRST BANCORP, INC.

By: /s/ Richard M. Elder

---------------------

Richard M. Elder

Executive Vice President & Chief Financial Officer

October 23, 2024

Exhibit Index

--------------

Exhibit Number Description of Exhibit

99.1 Registrant's Press Release dated October 23, 2024

Exhibit 99.1

The First Bancorp Announces Third Quarter Results

2024 Q3 Results Driven by Loan Growth, Net Interest Margin Expansion, and Continued Strong Asset Quality

DAMARISCOTTA, ME, October 23, 2024--(BUSINESS WIRE)--The First Bancorp (Nasdaq: FNLC), ("the Company", "we", "us", "our"), parent company of First National Bank, today reported unaudited net income of $7.6 million with diluted earnings per share of $0.68 for the quarter ended September 30, 2024. The Company also reported results for the nine months ended September 30, 2024. Net income year-to-date in 2024 was $19.8 million, with diluted earnings per share of $1.78.

Third Quarter Notable Items:

•Net Income growth of 22.7% from Q2; diluted EPS growth of 22.6%

•Net Interest Income at its highest level in six quarters

•Net Interest Margin increased by 11 basis points from Q2

•Total assets reached $3.14 billion, an increase of $57.6 million in Q3

•Loan balances grew in Q3 at an annualized rate of 10.6% to $2.31 billion

•Ratio of Non-Performing Assets to Total Assets of 0.08%

•Quarterly shareholder dividend of $0.36 per share

CEO COMMENTS

"I am pleased to report our results for the third quarter," commented Tony C. McKim, the Company's President and Chief Executive Officer. "Net income increased 22.7% from the second quarter of 2024 ("linked quarter"), and diluted earnings per share increased 22.6%.

"A definite bright note for the period was an expansion of 11 basis points in our net interest margin, attributable to rising asset yields and flat funding costs. Coupled with earning asset growth, the expanded margin led to a $1.3 million, or 8.8%, increase in net interest income from the linked quarter. While the Federal Reserve's action to lower short term rates by 0.50% in September had minimal effect on third quarter results, we expect to continue to see gradual margin improvement in coming quarters as pressures on funding costs ease."

Mr. McKim concluded, "Our balance sheet continues to grow in a responsible manner while also displaying strong asset quality, capital, and liquidity positions. Growth remains centered in the loan portfolio with over $129 million in new loans granted in the third quarter. We are proud to strongly support our customers and communities in the Bank's 160th year."

FINANCIAL RESULTS FOR THE QUARTER ENDED SEPTEMBER 30, 2024

Net income was $7.6 million, or $0.68 per diluted share, for the three months ended September 30, 2024. On a Pre-Tax, Pre-Provision ("PTPP") basis, earnings for the quarter were $8.5 million. Results compare favorably to the linked quarter for which net income was $6.2 million, diluted earnings per share were $0.55, and PTPP earnings were $8.0 million. The drivers of third quarter results are discussed in the following sections:

Net Interest Income

Net interest income was $16.4 million for the three months ended September 30, 2024, an increase of $1.3 million or 8.8% from the second quarter of 2024, and the best three-month period since the first quarter of 2023. Net interest margin improved by 11 basis points to 2.32% for the third quarter of 2024, up from 2.21% in the second quarter. The average tax equivalent yield on earning assets increased 6 basis points in the third quarter to 5.28%, while the cost of total liabilities was unchanged at an average of 3.48% for the quarter.

Provision for Credit Losses

A reverse provision for credit losses on loans of $580,000 was recorded in the third quarter of 2024, compared with a provision expense of $539,000 in the second quarter. Models implemented in the third quarter introduced post-pandemic experience into the Bank's discounted cash flow based estimates, a period of strong asset quality for the Bank. This change, coupled with a refresh of peer groups used in our analysis, led to the modest reversal for the period. For the three months ended September 30, 2024 net charge-offs were $113,000; net charge-offs year-to-date in 2024 totaled $89,000, or an annualized 0.005% of total loans. A provision for credit losses on held- to-maturity securities was made in the amount of $76,000 and a reverse provision for off-balance sheet exposures of $134,000 was also recorded.

Non-Interest Income

Total non-interest income was $4.1 million for the three months ended September 30, 2024, level with the linked quarter, and in line with management's expectations. The Bank recorded a

quarterly gain of 2.4% in Debit Card income, while revenues from Wealth Management and Service Charges on Deposit Accounts each had small decreases from the prior period.

Non-Interest Expense

Total non-interest expense for the three months ended September 30, 2024 was $12.0 million, an increase of $750,000, or 6.7%, from the three months ended June 30, 2024. The period-to-period change is mostly attributable to employee salaries and benefits, resulting from a decrease in loan-related salary deferrals, seasonal hiring activity and incentive compensation accruals. The Company's efficiency ratio for the third quarter was 56.37%, essentially unchanged from the linked quarter ratio of 56.35%.

Loans, Total Assets & Funding

Total assets at September 30, 2024, were $3.14 billion, up $57.6 million in the third quarter and up $198.4 million from a year ago. Earning assets increased $54.8 million during the quarter comprised primarily of an increase in loans of $59.6 million. Earning assets have increased by $199.6 million since September 30, 2023, centered in loan growth of $227.4 million.

Loan growth in the third quarter was led by commercial credit. Commercial and industrial balances increased $37.9 million and multifamily loan balances increased $4.8 million; commercial real estate balances fell by $1.6 million. The residential term and home equity segments also contributed to loan portfolio growth, up $12.1 million and $4.8 million, respectively, in the quarter.

Total deposits at September 30, 2024 were $2.70 billion, up $124.6 million during the period, and up $102.8 million, or 4.0%, from September 30, 2023. The Bank typically sees a lift in local deposits in the third quarter attributable to seasonal factors. Non-maturity deposits led with an increase of $111.1 million while time deposits increased $13.6 million. The increase in deposit levels allowed for a $79.6 million decrease in borrowings during the period, including the full redemption of a $25 million Bank Term Funding Program advance which was due to mature in the first quarter of 2025. Uninsured deposits as of September 30, 2024, were estimated at 17% of total deposits, and 73% of uninsured deposits were fully collateralized. Available day-one liquidity was $703 million, sufficient to cover 149% of estimated uninsured deposits.

ASSET QUALITY

Asset quality continues to be very strong. As of September 30, 2024, the ratio of non-performing assets to total assets was 0.08%, down slightly from the 0.09% of total assets reported as of June 30, 2024 and September 30, 2023. The ratio of non-performing loans to total loans was 0.11% as of September 30, 2024, consistent with the 0.11% and 0.12% reported as of June 30, 2024

and September 30, 2023, respectively. Past due loans remain low at 0.14% of total loans as of September 30, 2024, a slight decrease from 0.15% of total loans as of June 30, 2024 and a slight increase from 0.10% of total loans as of September 30, 2023.

The Allowance for Credit Losses (ACL) on Loans stood at 1.04% of total loans as of September 30, 2024, as compared to an ACL of 1.10% and 1.12% of total loans as of June 30, 2024, and September 30, 2023, respectively. The loan portfolio continues to be well-diversified with Commercial Real Estate exposures comfortably below regulatory guidance limits, and with very limited exposure in sectors considered to pose potential risks for the industry, such as office space.

CAPITAL

The Company’s regulatory capital position remained strong as of September 30, 2024. The Leverage Capital ratio was an estimated 8.53% as of September 30, 2024, as compared to the 8.58% and 8.65% reported as of June 30, 2024, and as of September 30, 2023, respectively, with period-to-period changes attributable primarily to earning asset growth. The estimated Total Risk-Based Capital ratio was 13.11% as of September 30, 2024, as compared to the 13.24% and 13.76% reported as of June 30, 2024, and as of September 30, 2023, respectively. The Company's tangible book value per share was $20.27 as of September 30, 2024, up from $19.20 as of June 30, 2024 and up from $17.66 as of September 30, 2023. Earning asset growth during the quarter, coupled with a smaller unrealized loss position on available-for-sale securities, produced a Tangible Common Equity ratio of 7.26% as of September 30, 2024, as compared to 7.00% as of June 30, 2024 and 6.72% as of September 30, 2023.

DIVIDEND

On September 26, 2024, the Company's Board of Directors declared a third quarter dividend of $0.36 per share. The dividend was paid on October 18, 2024, to shareholders of record as of October 8, 2024.

ABOUT THE FIRST BANCORP

The First Bancorp, the parent company of First National Bank, is based in Damariscotta, Maine. Founded in 1864, First National Bank is a full-service community bank with $3.11 billion in assets. The Bank provides a complete array of commercial and retail banking services through eighteen locations in mid-coast and eastern Maine. First National Wealth Management, a division of the Bank, provides investment management and trust services to individuals, businesses, and municipalities. More information about The First Bancorp, First National Bank and First National Wealth Management may be found at www.thefirst.com.

| | | | | | | | | | | |

| The First Bancorp |

| Consolidated Balance Sheets (Unaudited) |

|

| In thousands of dollars, except per share data | September 30, 2024 | December 31, 2023 | September 30, 2023 |

| Assets | | | |

| Cash and due from banks | $ | 35,136 | | $ | 31,942 | | $ | 29,894 | |

| Interest-bearing deposits in other banks | 17,199 | | 3,488 | | 38,366 | |

| Securities available-for-sale | 285,021 | | 282,053 | | 284,972 | |

| Securities held-to-maturity | 377,635 | | 385,235 | | 387,374 | |

| Restricted equity securities, at cost | 6,420 | | 3,385 | | 3,860 | |

| Loans held for sale | — | | — | | 268 | |

| Loans | 2,307,253 | | 2,129,454 | | 2,079,860 | |

| Less allowance for credit losses | 23,999 | | 24,030 | | 23,322 | |

| Net loans | 2,283,254 | | 2,105,424 | | 2,056,538 | |

| Accrued interest receivable | 14,600 | | 11,894 | | 12,038 | |

| Premises and equipment | 27,449 | | 28,684 | | 28,868 | |

| Other real estate owned | 173 | | — | | — | |

| Goodwill | 30,646 | | 30,646 | | 30,646 | |

| Other assets | 65,030 | | 63,947 | | 71,315 | |

| Total assets | $ | 3,142,563 | | $ | 2,946,698 | | $ | 2,944,139 | |

| Liabilities | | | |

| Demand deposits | $ | 312,956 | | $ | 289,104 | | $ | 323,375 | |

| NOW deposits | 651,242 | | 634,543 | | 683,180 | |

| Money market deposits | 344,102 | | 305,931 | | 271,056 | |

| Savings deposits | 269,092 | | 299,837 | | 313,160 | |

| Certificates of deposit | 693,948 | | 646,818 | | 641,429 | |

| Certificates $100,000 to $250,000 | 251,910 | | 251,192 | | 234,962 | |

| Certificates $250,000 and over | 179,468 | | 172,237 | | 132,775 | |

| Total deposits | 2,702,718 | | 2,599,662 | | 2,599,937 | |

| Borrowed funds | 151,027 | | 69,652 | | 82,993 | |

| Other liabilities | 32,035 | | 34,305 | | 34,544 | |

| Total Liabilities | 2,885,780 | | 2,703,619 | | 2,717,474 | |

| Shareholders' equity | | | |

| | | |

| Common stock | 111 | | 111 | | 111 | |

| Additional paid-in capital | 71,389 | | 70,071 | | 69,649 | |

| Retained earnings | 219,559 | | 211,925 | | 209,132 | |

| Net unrealized loss on securities available-for-sale | (34,394) | | (39,575) | | (53,852) | |

| Net unrealized loss on securities transferred from available-for-sale to held-to-maturity | (49) | | (56) | | (58) | |

| Net unrealized (loss) gain on cash flow hedging derivative instruments | (136) | | 300 | | 1,410 | |

| Net unrealized gain on postretirement costs | 303 | | 303 | | 273 | |

| Total shareholders' equity | 256,783 | | 243,079 | | 226,665 | |

| Total liabilities & shareholders' equity | $ | 3,142,563 | | $ | 2,946,698 | | $ | 2,944,139 | |

| Common Stock | | | |

| Number of shares authorized | 18,000,000 | | 18,000,000 | | 18,000,000 | |

| Number of shares issued and outstanding | 11,148,066 | | 11,098,057 | | 11,089,290 | |

| Book value per common share | $ | 23.03 | | $ | 21.90 | | $ | 20.44 | |

| Tangible book value per common share | $ | 20.27 | | $ | 19.12 | | $ | 17.66 | |

| | | | | | | | | | | | | | | | | |

| The First Bancorp |

| Consolidated Statements of Income (Unaudited) |

| | | | |

| In thousands of dollars, except per share data | For the nine months ended | For the quarter ended |

| September 30, 2024 | September 30, 2023 | September 30, 2024 | June 30, 2024 | September 30, 2023 |

| Interest income | | | | | |

| Interest and fees on loans | $ | 95,541 | | $ | 78,860 | | $ | 33,498 | | $ | 31,839 | | $ | 28,329 | |

| Interest on deposits with other banks | 190 | | 300 | | 56 | | 56 | | 211 | |

| Interest and dividends on investments | 14,102 | | 14,192 | | 4,733 | | 4,663 | | 4,714 | |

| Total interest income | 109,833 | | 93,352 | | 38,287 | | 36,558 | | 33,254 | |

| Interest expense | | | | | |

| Interest on deposits | 59,111 | | 42,384 | | 20,118 | | 19,816 | | 16,992 | |

| Interest on borrowed funds | 4,365 | | 1,614 | | 1,767 | | 1,667 | | 308 | |

| Total interest expense | 63,476 | | 43,998 | | 21,885 | | 21,483 | | 17,300 | |

| Net interest income | 46,357 | | 49,354 | | 16,402 | | 15,075 | | 15,954 | |

| Credit loss (reduction) expense | (639) | | 501 | | (638) | | 512 | | (200) | |

| Net interest income after provision for credit losses | 46,996 | | 48,853 | | 17,040 | | 14,563 | | 16,154 | |

| Non-interest income | | | | | |

| Investment management and fiduciary income | 3,689 | | 3,515 | | 1,232 | | 1,269 | | 1,160 | |

| Service charges on deposit accounts | 1,552 | | 1,399 | | 511 | | 542 | | 465 | |

| | | | | |

| Mortgage origination and servicing income | 512 | | 611 | | 193 | | 189 | | 224 | |

| Debit card income | 3,884 | | 3,843 | | 1,365 | | 1,333 | | 1,367 | |

| Other operating income | 2,282 | | 1,962 | | 821 | | 824 | | 675 | |

| Total non-interest income | 11,919 | | 11,330 | | 4,122 | | 4,157 | | 3,891 | |

| Non-interest expense | | | | | |

| Salaries and employee benefits | 17,768 | | 16,420 | | 6,126 | | 5,585 | | 5,523 | |

| Occupancy expense | 2,532 | | 2,494 | | 823 | | 843 | | 784 | |

| Furniture and equipment expense | 4,182 | | 4,009 | | 1,416 | | 1,377 | | 1,403 | |

| FDIC insurance premiums | 1,762 | | 1,429 | | 636 | | 562 | | 551 | |

| Amortization of identified intangibles | 20 | | 20 | | 7 | | 6 | | 7 | |

| Other operating expense | 8,747 | | 8,199 | | 2,992 | | 2,877 | | 2,738 | |

| Total non-interest expense | 35,011 | | 32,571 | | 12,000 | | 11,250 | | 11,006 | |

| Income before income taxes | 23,904 | | 27,612 | | 9,162 | | 7,470 | | 9,039 | |

| Applicable income taxes | 4,141 | | 4,773 | | 1,591 | | 1,299 | | 1,565 | |

| Net Income | $ | 19,763 | | $ | 22,839 | | $ | 7,571 | | $ | 6,171 | | $ | 7,474 | |

| Basic earnings per share | $ | 1.79 | | $ | 2.08 | | $ | 0.69 | | $ | 0.56 | | $ | 0.68 | |

| Diluted earnings per share | $ | 1.78 | | $ | 2.06 | | $ | 0.68 | | $ | 0.55 | | $ | 0.67 | |

| | | | | | | | | | | | | | | | | |

| The First Bancorp |

| Selected Financial Data (Unaudited) |

| | | | | | |

| Dollars in thousands, except for per share amounts | As of and for the nine months ended | As of and for the quarter ended |

| September 30, 2024 | September 30, 2023 | September 30, 2024 | June 30, 2024 | September 30, 2023 |

| | | | | |

| Summary of Operations | | | | | |

| Interest Income | $ | 109,833 | | $ | 93,352 | | $ | 38,287 | | $ | 36,558 | | $ | 33,254 | |

| Interest Expense | 63,476 | | 43,998 | | 21,885 | | 21,483 | | 17,300 | |

| Net Interest Income | 46,357 | | 49,354 | | 16,402 | | 15,075 | | 15,954 | |

| Credit loss (reduction) expense | (639) | | 501 | | (638) | | 512 | | (200) | |

| Non-Interest Income | 11,919 | | 11,330 | | 4,122 | | 4,157 | | 3,891 | |

| Non-Interest Expense | 35,011 | | 32,571 | | 12,000 | | 11,250 | | 11,006 | |

| Net Income | 19,763 | | 22,839 | | 7,571 | | 6,171 | | 7,474 | |

| Per Common Share Data | | | | | |

| Basic Earnings per Share | $ | 1.789 | | $ | 2.078 | | $ | 0.685 | | $ | 0.559 | | $ | 0.679 | |

| Diluted Earnings per Share | 1.775 | | 2.062 | | 0.679 | | 0.554 | | 0.674 | |

| Cash Dividends Declared | 1.070 | | 1.040 | | 0.360 | | 0.360 | | 0.350 | |

| Book Value per Common Share | 23.03 | | 20.44 | | 23.03 | | 21.96 | | 20.44 | |

| Tangible Book Value per Common Share | 20.27 | | 17.66 | | 20.27 | | 19.20 | | 17.66 | |

| Market Value | 26.32 | | 23.50 | | 26.32 | | 24.85 | | 23.50 | |

| Financial Ratios | | | | | |

Return on Average Equity1 | 10.67 | % | 13.00 | % | 11.86 | % | 10.16 | % | 12.67 | % |

Return on Average Tangible Common Equity1 | 12.19 | % | 14.97 | % | 13.50 | % | 11.63 | % | 14.59 | % |

Return on Average Assets1 | 0.87 | % | 1.08 | % | 0.98 | % | 0.82 | % | 1.02 | % |

| Average Equity to Average Assets | 8.20 | % | 8.27 | % | 8.24 | % | 8.10 | % | 8.07 | % |

| Average Tangible Equity to Average Assets | 7.18 | % | 7.18 | % | 7.24 | % | 7.08 | % | 7.01 | % |

Net Interest Margin Tax-Equivalent1 | 2.25 | % | 2.54 | % | 2.32 | % | 2.21 | % | 2.40 | % |

| Dividend Payout Ratio | 59.81 | % | 50.00 | % | 52.55 | % | 64.40 | % | 51.47 | % |

| Allowance for Credit Losses/Total Loans | 1.04 | % | 1.12 | % | 1.04 | % | 1.10 | % | 1.12 | % |

| Non-Performing Loans to Total Loans | 0.11 | % | 0.12 | % | 0.11 | % | 0.11 | % | 0.12 | % |

| Non-Performing Assets to Total Assets | 0.08 | % | 0.09 | % | 0.08 | % | 0.09 | % | 0.09 | % |

| Efficiency Ratio | 57.88 | % | 51.88 | % | 56.37 | % | 56.35 | % | 53.49 | % |

| At Period End | | | | | |

| Total Assets | $ | 3,142,563 | | $ | 2,944,139 | | $ | 3,142,563 | | $ | 3,084,944 | | $ | 2,944,139 | |

| Total Loans | 2,307,253 | | 2,079,860 | | 2,307,253 | | 2,247,670 | | 2,079,860 | |

| Total Investment Securities | 669,076 | | 676,206 | | 669,076 | | 658,133 | | 676,206 | |

| Total Deposits | 2,702,718 | | 2,599,937 | | 2,702,718 | | 2,578,080 | | 2,599,937 | |

| Total Shareholders' Equity | 256,783 | | 226,665 | | 256,783 | | 244,668 | | 226,665 | |

1Annualized using a 366-day basis for 2024 and a 365-day basis for 2023. |

Use of Non-GAAP Financial Measures

Certain information in this release contains financial information determined by methods other than in accordance with accounting principles generally accepted in the United States of America (“GAAP”). Management uses these “non-GAAP” measures in its analysis of the Company's performance (including for purposes of determining the compensation of certain executive officers and other Company employees) and believes that these non-GAAP financial measures provide a greater understanding of ongoing operations and enhance comparability of results with prior periods and with other financial institutions, as well as demonstrating the effects of significant gains and charges in the current period, in light of the disclosure practices employed by many other publicly-traded financial institutions. The Company believes that a meaningful analysis of its financial performance requires an understanding of the factors underlying that performance. Management believes that investors may use these non-GAAP financial measures to analyze financial performance without the impact of unusual items that may obscure trends in the Company's underlying performance. These disclosures should not be viewed as a substitute for operating results determined in accordance with GAAP, nor are they necessarily comparable to non-GAAP performance measures that may be presented by other companies.

In several places net interest income is calculated on a fully tax-equivalent basis. Specifically included in interest income was tax-exempt interest income from certain investment securities and loans. An amount equal to the tax benefit derived from this tax-exempt income has been added back to the interest income total which, as adjusted, increased net interest income accordingly. Management believes the disclosure of tax-equivalent net interest income information improves the clarity of financial analysis, and is particularly useful to investors in understanding and evaluating the changes and trends in the Company's results of operations. Other financial institutions commonly present net interest income on a tax-equivalent basis. This adjustment is considered helpful in the comparison of one financial institution's net interest income to that of another institution, as each will have a different proportion of tax-exempt interest from its earning assets. Moreover, net interest income is a component of a second financial measure commonly used by financial institutions, net interest margin, which is the ratio of net interest income to average earning assets. For purposes of this measure as well, other financial institutions generally use tax-equivalent net interest income to provide a better basis of comparison from institution to institution. The Company follows these practices.

The following table provides a reconciliation of tax-equivalent financial information to the Company's consolidated financial statements, which have been prepared in accordance with GAAP. A 21.0% tax rate was used in both 2024 and 2023.

| | | | | | | | | | | | | | | | | |

| | For the nine months ended | For the quarters ended |

| In thousands of dollars | September 30, 2024 | September 30, 2023 | September 30, 2024 | June 30, 2024 | September 30, 2023 |

| Net interest income as presented | $ | 46,357 | | $ | 49,354 | | $ | 16,402 | | $ | 15,075 | | $ | 15,954 | |

| Effect of tax-exempt income | 2,072 | | 1,965 | | 717 | | $ | 686 | | 685 | |

| Net interest income, tax equivalent | $ | 48,429 | | $ | 51,319 | | $ | 17,119 | | $ | 15,761 | | $ | 16,639 | |

The Company presents its efficiency ratio using non-GAAP information which is most commonly used by financial institutions. The GAAP-based efficiency ratio is non-interest expenses divided by net interest income plus non-interest income from the Consolidated Statements of Income. The non-GAAP efficiency ratio excludes securities losses and provision for credit losses on securities from non-interest expenses, excludes securities gains from non-interest income, and adds the tax-

equivalent adjustment to net interest income. The following table provides a reconciliation between the GAAP and non-GAAP efficiency ratio:

| | | | | | | | | | | | | | | | | |

| | For the nine months ended | For the quarters ended |

| In thousands of dollars | September 30, 2024 | September 30, 2023 | September 30, 2024 | June 30, 2024 | September 30, 2023 |

| Non-interest expense, as presented | $ | 35,011 | | $ | 32,571 | | $ | 12,000 | | $ | 11,250 | | $ | 11,006 | |

| Net interest income, as presented | 46,357 | | 49,354 | | 16,402 | | 15,075 | | 15,954 | |

| Effect of tax-exempt interest income | 2,072 | | 1,965 | | 717 | | 686 | | 685 | |

| Non-interest income, as presented | 11,919 | | 11,330 | | 4,122 | | 4,157 | | 3,891 | |

| Effect of non-interest tax-exempt income | 136 | | 131 | | 45 | | 45 | | 44 | |

| | | | | |

| Adjusted net interest income plus non-interest income | $ | 60,484 | | $ | 62,780 | | $ | 21,286 | | $ | 19,963 | | $ | 20,574 | |

| Non-GAAP efficiency ratio | 57.88 | % | 51.88 | % | 56.37 | % | 56.35 | % | 53.49 | % |

| GAAP efficiency ratio | 60.08 | % | 53.67 | % | 58.47 | % | 58.50 | % | 55.46 | % |

The Company presents certain information based upon tangible common equity instead of total shareholders' equity. The difference between these two measures is the Company's intangible assets, specifically goodwill from prior acquisitions. Management, banking regulators and many stock analysts use the tangible common equity ratio and the tangible book value per common share in conjunction with more traditional bank capital ratios to compare the capital adequacy of banking organizations with significant amounts of goodwill or other intangible assets, typically stemming from the use of the purchase accounting method in accounting for mergers and acquisitions. The following table provides a reconciliation of average tangible common equity to the Company's consolidated financial statements, which have been prepared in accordance with U.S. GAAP:

| | | | | | | | | | | | | | | | | |

| | For the nine months ended | For the quarters ended |

| In thousands of dollars | September 30, 2024 | September 30, 2023 | September 30, 2024 | June 30, 2024 | September 30, 2023 |

| Average shareholders' equity as presented | $ | 247,463 | | $ | 234,832 | | $ | 253,911 | | $ | 244,321 | | $ | 234,024 | |

| | | | | |

| Less intangible assets | (30,820) | | (30,847) | | (30,827) | | (30,827) | | (30,853) | |

| Tangible average shareholders' equity | $ | 216,643 | | $ | 203,985 | | $ | 223,084 | | $ | 213,494 | | $ | 203,171 | |

To provide period-to-period comparison of operating results prior to consideration of credit loss provision and income taxes, the non-GAAP measure of PTPP Net Income is presented. The following table provides a reconciliation to Net Income:

| | | | | | | | | | | | | | | | | |

| For the nine months ended | For the quarters ended |

| In thousands of dollars | September 30, 2024 | September 30, 2023 | September 30, 2024 | June 30, 2024 | September 30, 2023 |

| Net Income, as presented | $ | 19,763 | | $ | 22,839 | | $ | 7,571 | | $ | 6,171 | | $ | 7,474 | |

| Add: credit loss (reduction) expense | (639) | | 501 | | (638) | | 512 | | (200) | |

| Add: income taxes | 4,141 | | 4,773 | | 1,591 | | 1,299 | | 1,565 | |

| Pre-Tax, pre-provision net income | $ | 23,265 | | $ | 28,113 | | $ | 8,524 | | $ | 7,982 | | $ | 8,839 | |

Forward-Looking and Cautionary Statements

Except for the historical information and discussions contained herein, statements contained in this release may constitute “forward-looking statements” within the meaning of the Private Securities Litigation Reform Act of 1995. These statements involve a number of risks, uncertainties and other factors that could cause actual results and events to differ materially, as discussed in the Company's filings with the Securities and Exchange Commission.

Category: Earnings

Source: The First Bancorp

The First Bancorp

Richard M. Elder, EVP, Chief Financial Officer

207-563-3195

rick.elder@thefirst.com

v3.24.3

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

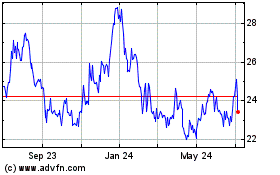

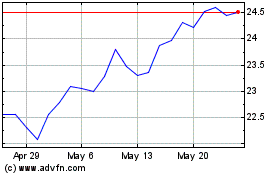

First Bancorp (NASDAQ:FNLC)

Historical Stock Chart

From Jan 2025 to Feb 2025

First Bancorp (NASDAQ:FNLC)

Historical Stock Chart

From Feb 2024 to Feb 2025