FormFactor, Inc. (Nasdaq: FORM) today announced its financial

results for the fourth quarter of fiscal 2024 ended

December 28, 2024. Quarterly revenues were $189.5 million, a

decrease of 8.9% compared to $207.9 million in the third quarter of

fiscal 2024, and an increase of 12.7% from $168.2 million in the

fourth quarter of fiscal 2023. For fiscal 2024, FormFactor recorded

revenues of $764 million, up 15.2% from $663 million in fiscal

2023.

- High Bandwidth Memory grew fourfold in fiscal 2024 compared to

the prior year, driven by adoption of Generative AI, overcoming

persistent lackluster demand in important high-unit-volume markets

like PCs and mobile handsets.

- DRAM probe-card revenue during the fourth quarter set third

consecutive quarterly record.

- Continued focus on expanding and diversifying FormFactor’s

market position in enabling advanced packaging, through new

customer qualifications in client PCs and server applications and

new high-performance-compute applications.

- FICT acquisition with MBK Partners solidifies FormFactor’s

access to FICT’s technologies and products, which are an important

component of advanced probe cards.

“As expected, FormFactor reported sequentially

lower fourth-quarter revenue, gross margin, and non-GAAP earnings

per share, driven by the forecasted reduction in Foundry &

Logic probe-card revenue,” said Mike Slessor, CEO of FormFactor,

Inc. “This was partially offset by growth in DRAM probe-card

revenue, with HBM increasing to approximately half of DRAM

revenue.”

FormFactor also announced today that together

with MBK Partners (“MBKP”), the largest private equity firm in

North Asia, it is acquiring FICT Limited (“FICT”) from Advantage

Partners Inc. FICT, headquartered in Nagano, Japan, has been

providing the semiconductor test and high-performance computing

industries with complex multi-layer organic substrates, printed

circuit boards, and related leading-edge technologies and services

since its inception as a Fujitsu business unit in 1967. This

acquisition is designed to strengthen and grow FICT’s business, and

the FormFactor+MBKP consortium is committed to advancing FICT’s

mission to serve its entire customer base.

With this transaction, FormFactor invests

approximately US$60M into the consortium. FormFactor will hold a

minority, non-controlling stake of 20% and will be granted a seat

on the company’s board of directors. All required regulatory and

third-party approvals and conditions have been satisfied and the

transaction is expected to close within the current quarter. The

transaction is not expected to have a material impact on

FormFactor’s results of operations.

“The semiconductor industry’s rapidly

accelerating adoption of advanced packaging requires increased

investment and stronger collaboration across the test and assembly

supply chain,” said Mike Slessor, FormFactor’s CEO. “FormFactor’s

investment in FICT builds on our long-term collaboration with them

as a supplier of the industry-leading, high-performance components

we use in our advanced probe cards, and provides a platform for

accelerated development of tomorrow’s test and packaging

consumables.”

“We’ve built a partnership with MBKP, North

Asia’s leading private equity firm, with a shared vision to enhance

FICT’s long-term value by fully serving all of FICT’s existing and

potential customers,” Slessor concluded.

Fourth Quarter and Fiscal 2024

Highlights

On a GAAP basis, net income for the fourth

quarter of fiscal 2024 was $9.7 million, or $0.12 per fully-diluted

share, compared to net income for the third quarter of fiscal 2024

of $18.7 million, or $0.24 per fully-diluted share, and net income

for the fourth quarter of fiscal 2023 of $75.8 million, or $0.97

per fully-diluted share. Net income for fiscal 2024 was $69.6

million, or $0.89 per fully-diluted share, compared to net income

for fiscal 2023 of $82.4 million, or $1.05, per fully-diluted

share. Gross margin for the fourth quarter of 2024 was 38.8%,

compared with 40.7% in the third quarter of 2024, and 40.4% in the

fourth quarter of 2023. Gross margin for fiscal 2024 was 40.3%,

compared to 39.0% for fiscal 2023. The GAAP financial results for

the fourth quarter of 2023 and fiscal 2023 include a $73.0 million

gain from the sale of FRT that has been excluded from FormFactor's

fourth quarter and fiscal 2023 non-GAAP results. The GAAP financial

results for fiscal 2024 include a $20.3 million gain from the sale

of our China operations that has been excluded from FormFactor's

fiscal 2024 non-GAAP results.

On a non-GAAP basis, net income for the fourth

quarter of fiscal 2024 was $21.3 million, or $0.27 per

fully-diluted share, compared to net income for the third quarter

of fiscal 2024 of $27.2 million, or $0.35 per fully-diluted share,

and net income for the fourth quarter of fiscal 2023 of $15.7

million, or $0.20 per fully-diluted share. Non-GAAP net income for

fiscal 2024 was $90.2 million, or $1.15 per fully-diluted share,

compared to net income of $56.8 million, or $0.73 per fully-diluted

share for fiscal 2023. On a non-GAAP basis, gross margin for the

fourth quarter of 2024 was 40.2%, compared with 42.2% in the third

quarter of 2024, and 42.1% in the fourth quarter of 2023. Non-GAAP

gross margin for fiscal 2024 was 41.7%, compared to 40.7% for

fiscal 2023.

A reconciliation of GAAP to non-GAAP measures is

provided in the schedules included below.

GAAP net cash provided by operating activities

for the fourth quarter of fiscal 2024 was $35.9 million, compared

to $26.7 million for the third quarter of fiscal 2024, and $9.3

million for the fourth quarter of fiscal 2023. Free cash flow for

the fourth quarter of fiscal 2024 was $28.8 million, compared to

free cash flow for the third quarter of fiscal 2024 of $20.0

million, and free cash flow for the fourth quarter of 2023 of

negative $0.3 million. GAAP net cash provided by operating

activities for fiscal 2024 was $117.5 million, compared to $64.6

million for fiscal 2023. Free cash flow for fiscal 2024 and fiscal

2023 was $82.8 million and $11.4 million, respectively. A

reconciliation of net cash provided by operating activities to

non-GAAP free cash flow is provided in the schedules included

below.

Outlook

Dr. Slessor added, “We continue to see slow

demand in important high-unit-volume markets, like client PCs and

mobile handsets, through the first quarter, with anticipated

sequential reductions in demand for both non-HBM DRAM probe cards

and Systems. That notwithstanding, as we move through 2025, we

expect an overall increase in demand for FormFactor’s

products.”

For the first quarter ending March 29,

2025, FormFactor is providing the following outlook*:

|

|

|

GAAP |

|

Reconciling Items** |

|

Non-GAAP |

|

Revenue |

|

$170 million +/- $5 million |

|

— |

|

$170 million +/- $5 million |

|

Gross Margin |

|

36.5% +/- 1.5% |

|

$3 million |

|

38% +/- 1.5% |

|

Net income per diluted share |

|

$0.07 +/- $0.04 |

|

$0.12 |

|

$0.19 +/- $0.04 |

*This outlook assumes

consistent foreign currency rates.**Reconciling items are

stock-based compensation, amortization of intangible assets and

fixed asset fair value adjustments due to acquisitions, and

restructuring charges, net of applicable income tax impacts.

We posted our revenue breakdown by geographic

region, by market segment and with customers with greater than 10%

of total revenue on the Investor Relations section of our website

at www.formfactor.com. We will conduct a conference call at

1:25 p.m. PT, or 4:25 p.m. ET, today.

The public is invited to listen to a live

webcast of FormFactor’s conference call on the Investor Relations

section of our website at www.formfactor.com. A telephone replay of

the conference call will be available approximately two hours after

the conclusion of the call. The replay will be available on the

Investor Relations section of our website, www.formfactor.com.

Use of Non-GAAP Financial Information:

To supplement our condensed consolidated

financial results prepared under generally accepted accounting

principles, or GAAP, we disclose certain non-GAAP measures of

non-GAAP net income, non-GAAP net income per basic and diluted

share, non-GAAP gross profit, non-GAAP gross margin, non-GAAP

operating expenses, non-GAAP operating income and free cash flow,

that are adjusted from the nearest GAAP financial measure to

exclude certain costs, expenses, gains and losses. Reconciliations

of the adjustments to GAAP results for the three and twelve months

ended months ended December 28, 2024, and for outlook provided

before, as well as for the comparable periods of fiscal 2023, are

provided below, and on the Investor Relations section of our

website at www.formfactor.com. Information regarding the ways in

which management uses non-GAAP financial information to evaluate

its business, management's reasons for using this non-GAAP

financial information, and limitations associated with the use of

non-GAAP financial information, is included under “About our

Non-GAAP Financial Measures” following the tables below.

About FormFactor:

FormFactor, Inc. (NASDAQ: FORM), is a leading

provider of essential test and measurement technologies along the

full semiconductor product life cycle - from characterization,

modeling, reliability, and design de-bug, to qualification and

production test. Semiconductor companies rely upon FormFactor’s

products and services to accelerate profitability by optimizing

device performance and advancing yield knowledge. The Company

serves customers through its network of facilities in Asia, Europe,

and North America. For more information, visit the Company’s

website at www.formfactor.com.

Forward-looking Statements:

This press release contains forward-looking

statements within the meaning of the “safe harbor” provisions of

the federal securities laws, including with respect to the

Company’s future financial and operating results, and the Company’s

plans, strategies and objectives for future operations. These

statements are based on management’s current expectations and

beliefs as of the date of this release, and are subject to a number

of risks and uncertainties, many of which are beyond the Company’s

control, that could cause actual results to differ materially from

those described in the forward-looking statements. These

forward-looking statements include, but are not limited to,

statements regarding future financial and operating results,

including under the heading “Outlook” above, customer demand,

conditions in the semiconductor industry, the timing of completion

of the FICT acquisition, the expected benefit thereof and other

statements regarding the Company’s business. Forward-looking

statements may contain words such as “may,” “might,” “will,”

“expect,” “plan,” “anticipate,” “forecast,” and “continue,” the

negative or plural of these words and similar expressions, and

include the assumptions that underlie such statements. The

following factors, among others, could cause actual results to

differ materially from those described in the forward-looking

statements: changes in demand for the Company’s products;

customer-specific demand; market opportunity; anticipated industry

trends; delays in the consummation of the FICT acquisition; the

potential impact on the business of FormFactor and FICT due to

uncertainties in connection with the acquisition; the retention of

employees of FICT following acquisition; the ability of FormFactor

to achieve expected benefits from the FICT acquisition; the

availability, benefits, and speed of customer acceptance or

implementation of new products and technologies; manufacturing,

processing, and design capacity, goals, expansion, volumes, and

progress; difficulties or delays in research and development;

industry seasonality; risks to the Company’s realization of

benefits from acquisitions, investments in capacity and investments

in new electronic data systems and information technology; reliance

on customers or third parties (including suppliers); changes in

macro-economic environments; events affecting global and regional

economic and market conditions and stability such as military

conflicts, political volatility, infectious diseases and pandemics,

and similar factors, operating separately or in combination; and

other factors, including those set forth in the Company’s most

current annual report on Form 10-K, quarterly reports on Form 10-Q

and other filings by the Company with the U.S. Securities and

Exchange Commission. In addition, there are varying barriers to

international trade, including restrictive trade and export

regulations such as the US-China restrictions, dynamic tariffs,

trade disputes between the U.S. and other countries, and national

security developments or tensions, that may substantially restrict

or condition our sales to or in certain countries, increase the

cost of doing business internationally, and disrupt our supply

chain. No assurances can be given that any of the events

anticipated by the forward-looking statements within this press

release will transpire or occur, or if any of them do so, what

impact they will have on the results of operations or financial

condition of the Company. Unless required by law, the Company is

under no obligation (and expressly disclaims any such obligation)

to update or revise its forward-looking statements whether as a

result of new information, future events, or otherwise.

| |

|

FORMFACTOR, INC. CONDENSED

CONSOLIDATED STATEMENTS OF INCOME(In thousands,

except per share amounts)

(Unaudited) |

| |

| |

Three Months Ended |

|

Twelve Months Ended |

| |

December 28,2024 |

|

September 28,2024 |

|

December 30,2023 |

|

December 28,2024 |

|

December 30,2023 |

|

Revenues |

$ |

189,483 |

|

|

$ |

207,917 |

|

|

$ |

168,163 |

|

|

$ |

763,599 |

|

|

$ |

663,102 |

|

| Cost of revenues |

|

115,903 |

|

|

|

123,212 |

|

|

|

100,229 |

|

|

|

455,676 |

|

|

|

404,522 |

|

| Gross profit |

|

73,580 |

|

|

|

84,705 |

|

|

|

67,934 |

|

|

|

307,923 |

|

|

|

258,580 |

|

| Operating expenses: |

|

|

|

|

|

|

|

|

|

|

Research and development |

|

30,504 |

|

|

|

31,243 |

|

|

|

28,166 |

|

|

|

121,938 |

|

|

|

115,765 |

|

|

Selling, general and administrative |

|

35,226 |

|

|

|

35,607 |

|

|

|

31,451 |

|

|

|

141,786 |

|

|

|

133,012 |

|

| Total operating expenses |

|

65,730 |

|

|

|

66,850 |

|

|

|

59,617 |

|

|

|

263,724 |

|

|

|

248,777 |

|

| Gain on sale of business |

|

— |

|

|

|

— |

|

|

|

72,953 |

|

|

|

20,581 |

|

|

|

72,953 |

|

| Operating income |

|

7,850 |

|

|

|

17,855 |

|

|

|

81,270 |

|

|

|

64,780 |

|

|

|

82,756 |

|

| Interest income, net |

|

3,472 |

|

|

|

3,650 |

|

|

|

2,376 |

|

|

|

13,693 |

|

|

|

6,796 |

|

| Other income (expense),

net |

|

617 |

|

|

|

(558 |

) |

|

|

(1,546 |

) |

|

|

939 |

|

|

|

(285 |

) |

| Income before income

taxes |

|

11,939 |

|

|

|

20,947 |

|

|

|

82,100 |

|

|

|

79,412 |

|

|

|

89,267 |

|

| Provision for income

taxes |

|

2,234 |

|

|

|

2,211 |

|

|

|

6,254 |

|

|

|

9,798 |

|

|

|

6,880 |

|

| Net income |

$ |

9,705 |

|

|

$ |

18,736 |

|

|

$ |

75,846 |

|

|

$ |

69,614 |

|

|

$ |

82,387 |

|

| Net income per share: |

|

|

|

|

|

|

|

|

|

|

Basic |

$ |

0.13 |

|

|

$ |

0.24 |

|

|

$ |

0.98 |

|

|

$ |

0.90 |

|

|

$ |

1.06 |

|

|

Diluted |

$ |

0.12 |

|

|

$ |

0.24 |

|

|

$ |

0.97 |

|

|

$ |

0.89 |

|

|

$ |

1.05 |

|

| Weighted-average

number of shares used in per share calculations: |

|

|

|

|

|

|

|

|

|

Basic |

|

77,267 |

|

|

|

77,406 |

|

|

|

77,684 |

|

|

|

77,340 |

|

|

|

77,370 |

|

|

Diluted |

|

77,982 |

|

|

|

78,439 |

|

|

|

78,410 |

|

|

|

78,437 |

|

|

|

78,159 |

|

| |

|

FORMFACTOR, INC. NON-GAAP

FINANCIAL MEASURE RECONCILIATIONS(In thousands,

except per share amounts)(Unaudited) |

| |

| |

Three Months Ended |

|

Twelve Months Ended |

| |

December 28,2024 |

|

September 28,2024 |

|

December 30,2023 |

|

December 28,2024 |

|

December 30,2023 |

|

GAAP Gross Profit |

$ |

73,580 |

|

|

$ |

84,705 |

|

|

$ |

67,934 |

|

|

$ |

307,923 |

|

|

$ |

258,580 |

|

| Adjustments: |

|

|

|

|

|

|

|

|

|

|

Amortization of intangibles, inventory and fixed asset fair value

adjustments due to acquisitions |

|

555 |

|

|

|

530 |

|

|

|

756 |

|

|

|

2,216 |

|

|

|

4,336 |

|

|

Stock-based compensation |

|

1,944 |

|

|

|

1,934 |

|

|

|

2,053 |

|

|

|

7,738 |

|

|

|

6,854 |

|

|

Restructuring charges |

|

32 |

|

|

|

524 |

|

|

|

— |

|

|

|

639 |

|

|

|

357 |

|

| Non-GAAP Gross

Profit |

$ |

76,111 |

|

|

$ |

87,693 |

|

|

$ |

70,743 |

|

|

$ |

318,516 |

|

|

$ |

270,127 |

|

| |

|

|

|

|

|

|

|

|

|

| GAAP Gross

Margin |

|

38.8 |

% |

|

|

40.7 |

% |

|

|

40.4 |

% |

|

|

40.3 |

% |

|

|

39.0 |

% |

| Adjustments: |

|

|

|

|

|

|

|

|

|

|

Amortization of intangibles, inventory and fixed asset fair value

adjustments due to acquisitions |

|

0.4 |

% |

|

|

0.3 |

% |

|

|

0.5 |

% |

|

|

0.3 |

% |

|

|

0.6 |

% |

|

Stock-based compensation |

|

1.0 |

% |

|

|

0.9 |

% |

|

|

1.2 |

% |

|

|

1.0 |

% |

|

|

1.0 |

% |

|

Restructuring charges |

|

— |

% |

|

|

0.3 |

% |

|

|

— |

% |

|

|

0.1 |

% |

|

|

0.1 |

% |

| Non-GAAP Gross

Margin |

|

40.2 |

% |

|

|

42.2 |

% |

|

|

42.1 |

% |

|

|

41.7 |

% |

|

|

40.7 |

% |

| |

|

|

|

|

|

|

|

|

|

| GAAP operating

expenses |

$ |

65,730 |

|

|

$ |

66,850 |

|

|

$ |

59,617 |

|

|

$ |

263,724 |

|

|

$ |

248,777 |

|

| Adjustments: |

|

|

|

|

|

|

|

|

|

|

Amortization of intangibles and other |

|

(191 |

) |

|

|

(191 |

) |

|

|

(518 |

) |

|

|

(764 |

) |

|

|

(4,081 |

) |

|

Stock-based compensation |

|

(8,269 |

) |

|

|

(7,002 |

) |

|

|

(7,230 |

) |

|

|

(32,025 |

) |

|

|

(31,762 |

) |

|

Restructuring charges |

|

(371 |

) |

|

|

(298 |

) |

|

|

— |

|

|

|

(767 |

) |

|

|

(1,183 |

) |

|

Costs related to sale and acquisition of businesses |

|

(1,689 |

) |

|

|

(13 |

) |

|

|

(268 |

) |

|

|

(2,391 |

) |

|

|

(2,407 |

) |

| Non-GAAP operating

expenses |

$ |

55,210 |

|

|

$ |

59,346 |

|

|

$ |

51,601 |

|

|

$ |

227,777 |

|

|

$ |

209,344 |

|

| |

|

|

|

|

|

|

|

|

|

| GAAP operating

income |

$ |

7,850 |

|

|

$ |

17,855 |

|

|

$ |

81,270 |

|

|

$ |

64,780 |

|

|

$ |

82,756 |

|

| Adjustments: |

|

|

|

|

|

|

|

|

|

|

Amortization of intangibles, inventory and fixed asset fair value

adjustments due to acquisitions, and other |

|

746 |

|

|

|

721 |

|

|

|

1,274 |

|

|

|

2,980 |

|

|

|

8,417 |

|

|

Stock-based compensation |

|

10,213 |

|

|

|

8,936 |

|

|

|

9,283 |

|

|

|

39,763 |

|

|

|

38,616 |

|

|

Restructuring charges |

|

403 |

|

|

|

822 |

|

|

|

— |

|

|

|

1,406 |

|

|

|

1,540 |

|

|

Gain on sale of business, net of cost related to sale and

acquisition of businesses |

|

1,689 |

|

|

|

13 |

|

|

|

(72,685 |

) |

|

|

(18,190 |

) |

|

|

(70,546 |

) |

| Non-GAAP operating

income |

$ |

20,901 |

|

|

$ |

28,347 |

|

|

$ |

19,142 |

|

|

$ |

90,739 |

|

|

$ |

60,783 |

|

| |

|

FORMFACTOR, INC. NON-GAAP

FINANCIAL MEASURE RECONCILIATIONS(In thousands,

except per share amounts)(Unaudited) |

| |

| |

Three Months Ended |

|

Twelve Months Ended |

| |

December 28,2024 |

|

September 28,2024 |

|

December 30,2023 |

|

December 28,2024 |

|

December 30,2023 |

|

GAAP net income |

$ |

9,705 |

|

|

$ |

18,736 |

|

|

$ |

75,846 |

|

|

$ |

69,614 |

|

|

$ |

82,387 |

|

| Adjustments: |

|

|

|

|

|

|

|

|

|

|

Amortization of intangibles, inventory and fixed asset fair value

adjustments due to acquisitions, and other |

|

746 |

|

|

|

721 |

|

|

|

1,274 |

|

|

|

2,980 |

|

|

|

8,417 |

|

|

Stock-based compensation |

|

10,213 |

|

|

|

8,936 |

|

|

|

9,283 |

|

|

|

39,763 |

|

|

|

38,616 |

|

|

Restructuring charges |

|

415 |

|

|

|

822 |

|

|

|

— |

|

|

|

1,418 |

|

|

|

1,540 |

|

|

Gain on sale of business, net of cost related to sale and

acquisition of businesses |

|

1,689 |

|

|

|

13 |

|

|

|

(72,685 |

) |

|

|

(18,190 |

) |

|

|

(70,546 |

) |

|

Income tax effect of non-GAAP adjustments |

|

(1,445 |

) |

|

|

(2,002 |

) |

|

|

2,026 |

|

|

|

(5,368 |

) |

|

|

(3,624 |

) |

| Non-GAAP net

income |

$ |

21,323 |

|

|

$ |

27,226 |

|

|

$ |

15,744 |

|

|

$ |

90,217 |

|

|

$ |

56,790 |

|

| |

|

|

|

|

|

|

|

|

|

| GAAP net income per

share: |

|

|

|

|

|

|

|

|

|

|

Basic |

$ |

0.13 |

|

|

$ |

0.24 |

|

|

$ |

0.98 |

|

|

$ |

0.90 |

|

|

$ |

1.06 |

|

|

Diluted |

$ |

0.12 |

|

|

$ |

0.24 |

|

|

$ |

0.97 |

|

|

$ |

0.89 |

|

|

$ |

1.05 |

|

| |

|

|

|

|

|

|

|

|

|

| Non-GAAP net income

per share: |

|

|

|

|

|

|

|

|

|

|

Basic |

$ |

0.28 |

|

|

$ |

0.35 |

|

|

$ |

0.20 |

|

|

$ |

1.17 |

|

|

$ |

0.73 |

|

|

Diluted |

$ |

0.27 |

|

|

$ |

0.35 |

|

|

$ |

0.20 |

|

|

$ |

1.15 |

|

|

$ |

0.73 |

|

| |

|

FORMFACTOR, INC. CONDENSED

CONSOLIDATED STATEMENTS OF CASH FLOWS(In

thousands)(Unaudited) |

| |

| |

Twelve Months Ended |

| |

December 28,2024 |

|

December 30,2023 |

| Cash flows from operating

activities: |

|

|

|

|

Net income |

$ |

69,614 |

|

|

$ |

82,387 |

|

|

Selected adjustments to reconcile net income to net cash provided

by operating activities: |

|

|

|

|

Depreciation |

|

30,321 |

|

|

|

30,603 |

|

|

Amortization |

|

2,582 |

|

|

|

6,850 |

|

|

Stock-based compensation expense |

|

39,763 |

|

|

|

38,616 |

|

|

Provision for excess and obsolete inventories |

|

12,342 |

|

|

|

15,003 |

|

|

Gain on sale of business |

|

(20,581 |

) |

|

|

(72,953 |

) |

|

Non-cash restructuring charges |

|

428 |

|

|

|

— |

|

|

Other activity impacting operating cash flows |

|

(16,507 |

) |

|

|

(35,904 |

) |

|

Net cash provided by operating activities |

|

117,534 |

|

|

|

64,602 |

|

| Cash flows from investing

activities: |

|

|

|

|

Acquisition of property, plant and equipment |

|

(38,436 |

) |

|

|

(56,027 |

) |

|

Proceeds from sale of business |

|

21,585 |

|

|

|

101,785 |

|

|

Purchases of marketable securities, net |

|

(15,129 |

) |

|

|

(16,709 |

) |

|

Purchase of promissory note receivable |

|

(1,500 |

) |

|

|

— |

|

|

Net cash provided by (used in) investing activities |

|

(33,480 |

) |

|

|

29,049 |

|

| Cash flows from financing

activities: |

|

|

|

|

Purchase of common stock through stock repurchase program |

|

(53,302 |

) |

|

|

(19,801 |

) |

|

Proceeds from issuances of common stock |

|

9,748 |

|

|

|

8,822 |

|

|

Principal repayments on term loans |

|

(1,075 |

) |

|

|

(1,045 |

) |

|

Tax withholdings related to net share settlements of equity

awards |

|

(19,983 |

) |

|

|

(10,687 |

) |

|

Net cash used in financing activities |

|

(64,612 |

) |

|

|

(22,711 |

) |

| Effect of exchange rate

changes on cash, cash equivalents and restricted cash |

|

(3,509 |

) |

|

|

(2,649 |

) |

| Net increase in cash, cash

equivalents and restricted cash |

|

15,933 |

|

|

|

68,291 |

|

| Cash, cash equivalents and

restricted cash, beginning of period |

|

181,273 |

|

|

|

112,982 |

|

| Cash, cash equivalents and

restricted cash, end of period |

$ |

197,206 |

|

|

$ |

181,273 |

|

| |

|

FORMFACTOR, INC. RECONCILIATION

OF CASH PROVIDED BY OPERATING ACTIVITIES TO NON-GAAP FREE CASH

FLOW(In

thousands)(Unaudited) |

| |

| |

Three Months Ended |

|

Twelve Months Ended |

| |

December 28,2024 |

|

September 28,2024 |

|

December 30,2023 |

|

December 28,2024 |

|

December 30,2023 |

|

Net cash provided by operating activities |

$ |

35,913 |

|

|

$ |

26,731 |

|

|

$ |

9,250 |

|

|

$ |

117,534 |

|

|

$ |

64,602 |

|

| Adjustments: |

|

|

|

|

|

|

|

|

|

|

Sale of business and acquisition related payments in working

capital |

|

506 |

|

|

|

2,134 |

|

|

|

268 |

|

|

|

3,317 |

|

|

|

2,407 |

|

|

Cash paid for interest |

|

93 |

|

|

|

97 |

|

|

|

105 |

|

|

|

391 |

|

|

|

422 |

|

|

Capital expenditures |

|

(7,663 |

) |

|

|

(8,939 |

) |

|

|

(9,933 |

) |

|

|

(38,436 |

) |

|

|

(56,027 |

) |

| Free cash flow |

$ |

28,849 |

|

|

$ |

20,023 |

|

|

$ |

(310 |

) |

|

$ |

82,806 |

|

|

$ |

11,404 |

|

| |

|

FORMFACTOR, INC.CONDENSED

CONSOLIDATED BALANCE SHEETS(In thousands)

(Unaudited) |

| |

| |

|

December 28,2024 |

|

September 28,2024 |

|

December 30,2023 |

| ASSETS |

|

|

|

|

|

|

| Current assets: |

|

|

|

|

|

|

|

Cash and cash equivalents |

|

$ |

190,728 |

|

|

$ |

184,506 |

|

|

$ |

177,812 |

|

|

Marketable securities |

|

|

169,295 |

|

|

|

169,961 |

|

|

|

150,507 |

|

|

Accounts receivable, net of allowance for credit losses |

|

|

104,294 |

|

|

|

116,866 |

|

|

|

102,957 |

|

|

Inventories, net |

|

|

101,676 |

|

|

|

105,374 |

|

|

|

111,685 |

|

|

Restricted cash |

|

|

3,746 |

|

|

|

3,773 |

|

|

|

1,152 |

|

|

Prepaid expenses and other current assets |

|

|

35,389 |

|

|

|

34,302 |

|

|

|

29,667 |

|

|

Total current assets |

|

|

605,128 |

|

|

|

614,782 |

|

|

|

573,780 |

|

| Restricted cash |

|

|

2,732 |

|

|

|

2,210 |

|

|

|

2,309 |

|

| Operating lease,

right-of-use-assets |

|

|

22,579 |

|

|

|

25,034 |

|

|

|

30,519 |

|

| Property, plant and equipment,

net of accumulated depreciation |

|

|

210,230 |

|

|

|

204,108 |

|

|

|

204,399 |

|

| Goodwill |

|

|

199,171 |

|

|

|

200,137 |

|

|

|

201,090 |

|

| Intangibles, net |

|

|

10,355 |

|

|

|

11,017 |

|

|

|

12,938 |

|

| Deferred tax assets |

|

|

92,012 |

|

|

|

92,826 |

|

|

|

78,964 |

|

| Other assets |

|

|

4,008 |

|

|

|

3,669 |

|

|

|

2,795 |

|

|

Total assets |

|

$ |

1,146,215 |

|

|

$ |

1,153,783 |

|

|

$ |

1,106,794 |

|

| |

|

|

|

|

|

|

| LIABILITIES AND

STOCKHOLDERS’ EQUITY |

|

|

|

|

|

|

| Current liabilities: |

|

|

|

|

|

|

|

Accounts payable |

|

$ |

62,287 |

|

|

$ |

52,086 |

|

|

$ |

63,857 |

|

|

Accrued liabilities |

|

|

43,742 |

|

|

|

46,508 |

|

|

|

41,037 |

|

|

Current portion of term loan, net of unamortized issuance

costs |

|

|

1,106 |

|

|

|

1,098 |

|

|

|

1,075 |

|

|

Deferred revenue |

|

|

15,847 |

|

|

|

20,972 |

|

|

|

16,704 |

|

|

Operating lease liabilities |

|

|

8,363 |

|

|

|

8,512 |

|

|

|

8,422 |

|

|

Total current liabilities |

|

|

131,345 |

|

|

|

129,176 |

|

|

|

131,095 |

|

| Term loan, less current

portion, net of unamortized issuance costs |

|

|

12,208 |

|

|

|

12,488 |

|

|

|

13,314 |

|

| Long-term operating lease

liabilities |

|

|

17,550 |

|

|

|

19,731 |

|

|

|

25,334 |

|

| Deferred grant |

|

|

18,000 |

|

|

|

18,000 |

|

|

|

18,000 |

|

| Other liabilities |

|

|

19,344 |

|

|

|

19,378 |

|

|

|

10,247 |

|

|

Total liabilities |

|

|

198,447 |

|

|

|

198,773 |

|

|

|

197,990 |

|

| |

|

|

|

|

|

|

| Stockholders’ equity: |

|

|

|

|

|

|

|

Common stock |

|

|

77 |

|

|

|

77 |

|

|

|

77 |

|

|

Additional paid-in capital |

|

|

837,586 |

|

|

|

845,466 |

|

|

|

861,448 |

|

|

Accumulated other comprehensive loss |

|

|

(10,840 |

) |

|

|

(1,773 |

) |

|

|

(4,052 |

) |

|

Accumulated income |

|

|

120,945 |

|

|

|

111,240 |

|

|

|

51,331 |

|

|

Total stockholders’ equity |

|

|

947,768 |

|

|

|

955,010 |

|

|

|

908,804 |

|

|

Total liabilities and stockholders’ equity |

|

$ |

1,146,215 |

|

|

$ |

1,153,783 |

|

|

$ |

1,106,794 |

|

About our Non-GAAP Financial Measures:

We believe that the presentation of non-GAAP net

income, non-GAAP net income per basic and diluted share, non-GAAP

gross profit, non-GAAP gross margin, non-GAAP operating expenses,

non-GAAP operating income and free cash flow provides supplemental

information that is important to understanding financial and

business trends and other factors relating to our financial

condition and results of operations. Non-GAAP net income, non-GAAP

net income per basic and diluted share, non-GAAP gross profit,

non-GAAP gross margin, non-GAAP operating expenses, and non-GAAP

operating income are among the primary indicators used by

management as a basis for planning and forecasting future periods,

and by management and our board of directors to determine whether

our operating performance has met certain targets and thresholds.

Management uses non-GAAP net income, non-GAAP net income per basic

and diluted share, non-GAAP gross profit, non-GAAP gross margin,

non-GAAP operating expenses, and non-GAAP operating income when

evaluating operating performance because it believes that the

exclusion of the items indicated herein, for which the amounts or

timing may vary significantly depending upon our activities and

other factors, facilitates comparability of our operating

performance from period to period. We use free cash flow to conduct

and evaluate our business as an additional way of viewing our

liquidity that, when viewed with our GAAP results, provides a more

complete understanding of factors and trends affecting our cash

flows. Many investors also prefer to track free cash flow, as

opposed to only GAAP earnings. Free cash flow has limitations due

to the fact that it does not represent the residual cash flow

available for discretionary expenditures, and therefore it is

important to view free cash flow as a complement to our entire

consolidated statements of cash flows. We have chosen to provide

this non-GAAP information to investors so they can analyze our

operating results closer to the way that management does, and use

this information in their assessment of our business and the

valuation of our Company. We compute non-GAAP net income, non-GAAP

net income per basic and diluted share, non-GAAP gross profit,

non-GAAP gross margin, non-GAAP operating expenses, and non-GAAP

operating income, by adjusting GAAP net income, GAAP net income per

basic and diluted share, GAAP gross profit, GAAP gross margin, GAAP

operating expenses, and GAAP operating income to remove the impact

of certain items and the tax effect, if applicable, of those

adjustments. These non-GAAP measures are not in accordance with, or

an alternative to, GAAP, and may be materially different from other

non-GAAP measures, including similarly titled non-GAAP measures

used by other companies. The presentation of this additional

information should not be considered in isolation from, as a

substitute for, or superior to, net income, net income per basic

and diluted share, gross profit, gross margin, operating expenses,

or operating income in accordance with GAAP. Non-GAAP financial

measures have limitations in that they do not reflect certain items

that may have a material impact upon our reported financial

results. We may expect to continue to incur expenses of a nature

similar to the non-GAAP adjustments described above, and exclusion

of these items from our non-GAAP net income, non-GAAP net income

per basic and diluted share, non-GAAP gross profit, non-GAAP gross

margin, non-GAAP operating expenses, and non-GAAP operating income

should not be construed as an inference that these costs are

unusual, infrequent or non-recurring. For more information on the

non-GAAP adjustments, please see the table captioned “Non-GAAP

Financial Measure Reconciliations” and “Reconciliation of Cash

Provided by Operating Activities to non-GAAP Free Cash Flow”

included in this press release.

Source: FormFactor, Inc.FORM-F

Investor Contact:Stan FinkelsteinInvestor

Relations(925) 290-4273ir@formfactor.com

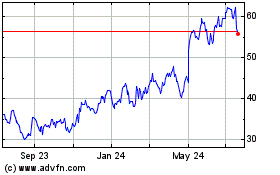

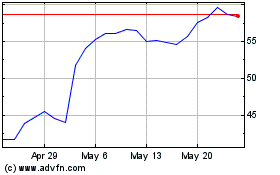

FormFactor (NASDAQ:FORM)

Historical Stock Chart

From Feb 2025 to Mar 2025

FormFactor (NASDAQ:FORM)

Historical Stock Chart

From Mar 2024 to Mar 2025